“I believe BAT is best positioned given the multi-category approach that we have taken since Day 1. Our portfolio of combustible and noncombustible brands is well-placed to meet consumers’ preference and are at a scale where we can drive additional value and efficiencies. Combustibles remain the solid cash-generative core of our business, despite global volumetric decline as consumers shift towards smokeless products.” - Tadeu Marroco, BAT CEO, Capital Markets Day 2024

On 16 October 2024, British American Tobacco held its Capital Markets Day event in Southampton, UK. The occasion included multiple hours of presentations and slide decks totaling more than 200 pages, highlighting the capabilities and talents within the group. If there was one talent truly showcased, it was that of the slide makers—should there ever be a competition for who can add more colors and more shapes, they have a good shot of winning gold. As for how well the presentations illustrated the case for BAT, many concerns still linger. However, other critical considerations have been rightly refocused.

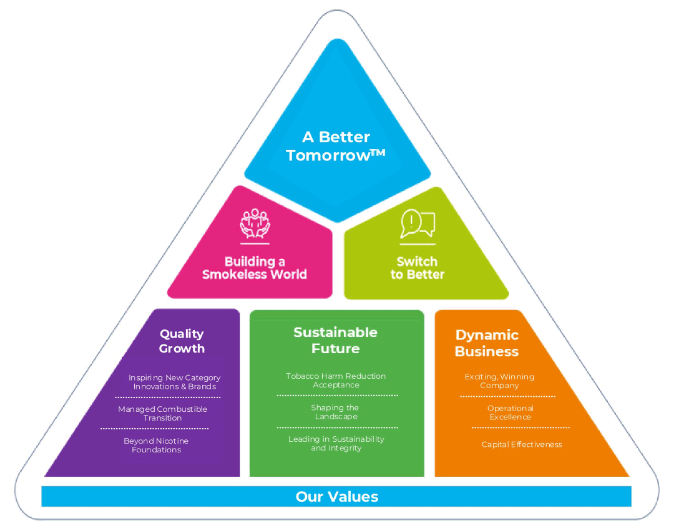

In theory, graphics within a presentation should, above all else, distill complex ideas into something instantaneously understood. This handy pyramid showcases the group’s values, but it does not do a great job of highlighting what is valuable about those values. It has been a while since I have played with a block set, but from what I recall, the bottom blocks act as a foundation to which you can add additional blocks on top. So when a bottom block, ‘Sustainable Future,’ is the future, a middle block references the future, and the top block is tomorrow (also the future), our understanding of how that future will be reached from nearer-term actions can become a bit fuzzy. I suppose these blocks merely convey that the company values existing in the future—generally a good desire and certainly a prerequisite for positive shareholder returns. As for ‘Quality Growth,’ the group is not just referring to topline growth but also to the quality of earnings growth, in which case the subpoints within ‘Dynamic Business’ directly play a role. Much of this could be cleaned up, and surely, a pyramid is unnecessary.

I fully recognize that these criticisms come off as pedantic. No one can expect the complex issues at hand to be well-distilled into one graphic. However, there are genuine concerns related to the company’s goals that need to be addressed. Presented at the CMD event were two ‘critical’ medium-term ambitions:

Fifty million consumers of new category products by 2030

A company that is a predominantly smokeless business in revenue terms by 2035

These, in a grander picture, are perfectly fine ambitions. But why should they be considered critical? There is a straightforward path to building from today’s twenty-six million new category consumers to fifty million by the end of the decade by cutting new category product prices by 95% and watching as droves of consumers pile in. Likewise, the company can just as quickly become predominantly smokeless in revenue by entirely neglecting its combustible business. Neither route is constructive.

Of course, these criticisms do not mean BAT’s efforts in new categories are unjustified. Many reasons explain the potential fruits, which I have routinely covered. However, there are plenty of additional concerns, too, when looking on a category-by-category basis.

Premium promised

BAT’s messaging on heated tobacco remains lacking. The group has questioned the category’s ability to continue its growth trajectory. A cynic might ask if this stems from the group’s recent struggles to compete in the category. Glo Hyper Pro had been touted as a significant upgrade compared to previous iterations, allowing BAT entry into the premium HTP subsegment. The quality and feature gaps between Hyper Pro and the newer iterations of IQOS are readily apparent, and I have never been shy in expressing my doubts about BAT’s framing. Now, BAT has conceded that the product is not premium, and new efforts to compete on the higher end will be met with glo Hilo. As the product is not yet on the market, the group remains quiet on the exact features it believes make the product so novel. Therefore, let us remain cautious about its prospects.

Weirdly disjointed

BAT trumpets Velo as a ‘Weirdly wonderful nicotine pouch.’ The product continues to lead outside the US by a meaningful margin, but the group’s approach in the US market appears weirdly disjointed—and now more than ever.

Keep reading with a 7-day free trial

Subscribe to Invariant to keep reading this post and get 7 days of free access to the full post archives.