“Luck is a very thin wire between survival and disaster, and not many people can keep their balance on it.” - Hunter S. Thompson

A few years ago, I was introduced to a friend of a friend who goes by ‘N.’ They call him ‘N’ because his real name is far too long and far too Greek for most to pronounce without butchering. N is originally from Greece but has spent the last few decades mainly in New York City while frequently traveling back to his home country and bouncing around other parts of the world. He has a thick accent and a subtle but perpetual scowl. He is not a large man but has a certain intimidating aura. He dresses simply. Black shirt. Black jeans. Black jacket. If you were to meet him, you’d immediately get the sense that if there was ever any trouble, this was the guy who would crack some glass and start waiving the broken shards around. Fortunately for everyone, trouble never seems to find N. He’s kind, patient, and affable. At all times of the day, all he wants to do is to sip his coffee, talk your ear off, and smoke. And boy, does he smoke. N rolls his own cigarettes—thin and tight. No matter where he goes, he carries a big bag of fine-cut tobacco and a fat stack of papers. As soon as he lights up, he’s already rolling the next one. It never stops. If you ask N what his favorite brands are, they are all made by one company:

Karelia

In 1888, brothers George and Efstathios Karelias began selling small paper pouches of pipe tobacco in Kalamata, Greece. The product was a standardized portion and high-quality, sustaining demand as total consumption grew. As cigarettes began to rise in popularity at the turn of the century, the company steered into the category. The company’s foray into cigarette production benefitted from World War I when the vast majority of military personnel used tobacco, and consumption accelerated toward cigarettes. In 1916, the company invested in the first automatic cigarette-making machine in Greece, and the company was formally incorporated in 1925 as G. Karelia Bros. Co., as its brands continued to spread and win over Greek consumers.

World War II’s devastation did not spare Greece in the slightest. The Axis powers’ occupation led to severe economic strain and famine. Infrastructure was destroyed, agriculture obliterated, and by the end of the war, the country had lost a large portion of its population, and the value of its currency had tumbled. After the war’s end, Greece experienced continued upheaval in the form of a civil war, compounding the wreckage over several more years until a resolution in 1949.

The future looked bleak, but reality unfolded in the opposite direction. The Marshall Plan’s enactment provided Greece with significant loans to rebuild, and the country opted to devalue its currency further, incentivizing foreign investment, boosting exports, and ushering in a period of radical economic growth. Infrastructure was rebuilt, manufacturing was modernized, agriculture flourished, and tourism and other service industries thrived. The country’s economic growth from 1950 to 1973 was so rapid and well-sustained that it earned the moniker the “Greek economic miracle.”

Through modernization and cunning leadership throughout the economic boom, Karelia transformed from a small regional operator into one of the top national manufacturers. In 1976, the company went public as “Brothers Karelia” on the Athens Stock Exchange, where it still trades today under the ticker KARE. This was a pivotal moment. Earlier in the year, it had gained the rights to produce and distribute RJR’s Winston cigarettes in Greece, and the public offering raised capital needed to expand. Karelia’s growth was further boosted half a decade later when the company won the rights to contract manufacturer RJR’s Camel brand. At the same time, Karelia began establishing more brands of its own.

In 1991, the company assumed its current name, Karelia Tobacco Company Inc. Throughout the following decade, it engaged in expansion efforts beyond the borders of its home country, including opening an office in Bulgaria and establishing a subsidiary focused on international duty-free sales. In 1999, a shakeup occurred when RJR sold its non-US operations to Japan Tobacco, including the rights to use the brand names Winston and Camel outside of the United States. Following this sale, Karelia’s contract manufacturing agreement was nixed, and the company wholly focused on its owned brands. Investments were made to modernize production and increase capacity further, and subsidiaries were added to facilitate additional sales across Europe, Africa, the Middle East, and Asia.

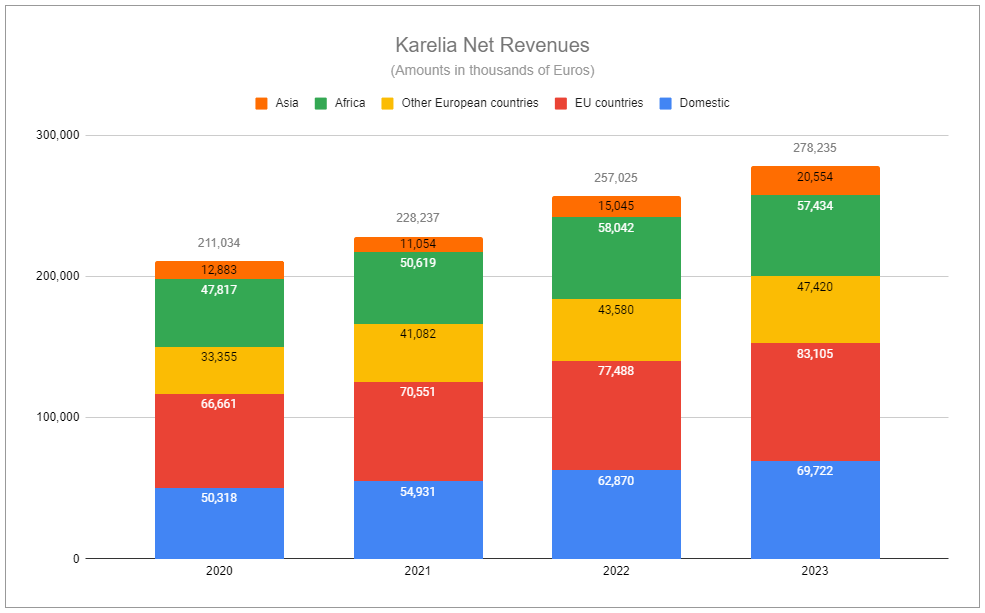

Fast-forward to the present day, and while things have been choppy from time to time, Karelia, as a whole, has executed remarkably. It has grown domestic sales in Greece considerably over the period. Yet, roughly 75% of the group’s net revenues (sales excluding excise and VAT) are now generated internationally across more than five dozen countries from its distinguished, premium product portfolio.

Karelia has endured through thick and thin. It has adapted. The company has high margins. It has expanded, grown volumes, taken pricing, and produced considerable earnings.

Karelia appears to hold many virtuous qualities. So why, at €342/share, does it trade at just over 3x EV/EBIT? Make no mistake about it: a multiple is not a valuation, despite how many times those terms are used interchangeably. A multiple is nothing more than a snapshot comprised of a numerator and denominator, and there is always more than meets the eye. Karelia is a most curious case that superbly demonstrates this.

For those familiar with the tobacco landscape, it is no secret the industry’s vilification and ESG-driven divestments have fostered considerable aversion. Karelia is only a fraction of the size of the tobacco majors. While it could be argued that the company has fewer resources in absolute terms, its track record suggests no issues navigating the markets it operates in. But, its small size, alongside its Greek listing, certainly further restricts access and interest. Further, the name is stupendously illiquid. Daily volume is frequently only 10-20 shares. On occasion, 250 or so will trade hands. Often, it’s as low as 0-5.

These factors play a role, but they are an incomplete explanation of why Karelia is optically cheap.

Karelia has 27.6 million shares outstanding, providing a market capitalization of €943 million. Trailing twelve-month net earnings places the equity at just over 9x. As of Q2’24, the company sported almost zero debt and held net cash, short-term investments, and securities of €617 million, representing roughly 65% of market capitalization. If that isn’t tantalizing enough, know there is insider ownership of gigantic proportions.

So what’s the rub?

That last point—insider ownership—is a true point of contention. Karelia forces us to consider whether there can be such a thing as too much insider ownership.

Andreas Karelias is the company’s Managing Director, and Efstathios is Vice chair. The George & Victoria Karelia Foundation was formed in 1993 by the late George Karelia, the previous company head, and his wife, Victoria, who is currently Chair of the BoD. Asimina Spyropouloy and Ioanna Karelia are the widow and daughter, respectively, of Kostas Karelias, who died in 2009. For the latter two, ‘insider’ ownership is a bit of a misnomer, as they have no direct involvement in operations.

Karelia’s manufacturing occurs in a single production center in Kalamata. It is modern and, by all measurable accounts, highly efficient. The site requires maintenance, as expected, but additional capital expenditures to benefit capacity or otherwise are modest and infrequent. The company produces a dividend of approximately 35% of net earnings after withholding a bit for its statutory reserves. What is done with the rest? It accumulates on the balance sheet.

Why hoard? Karelia is a dynastic company founded and led by a family for over a century. Although, by traditional measures, the company is woefully overcapitalized, the lack of debt and the significant cash pile reflects the family’s fiercely conservative nature, looking to weather any possible storm. They are all familiar with how quickly things can turn from good to bad. While the payout ratio is not lofty, the millions the family members receive support quite a comfortable lifestyle. There is also no doubt that they wish to preserve the company’s status in Greek culture and protect the legacy of George Karelia with the foundation. As for the small bucket of minority shareholders, the company provides but does not prioritize. Management appears to lack any interest in engaging with other shareholders or with curious outsiders.

What does the future hold for Karelia? Without access to a crystal ball, let us instead hastily illustrate one scenario and walk through its implications.

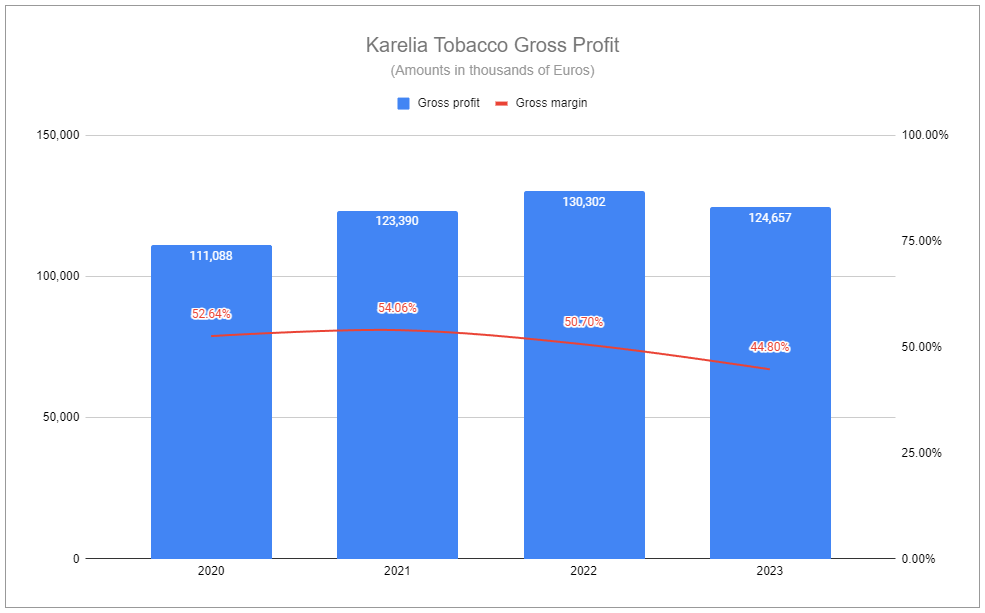

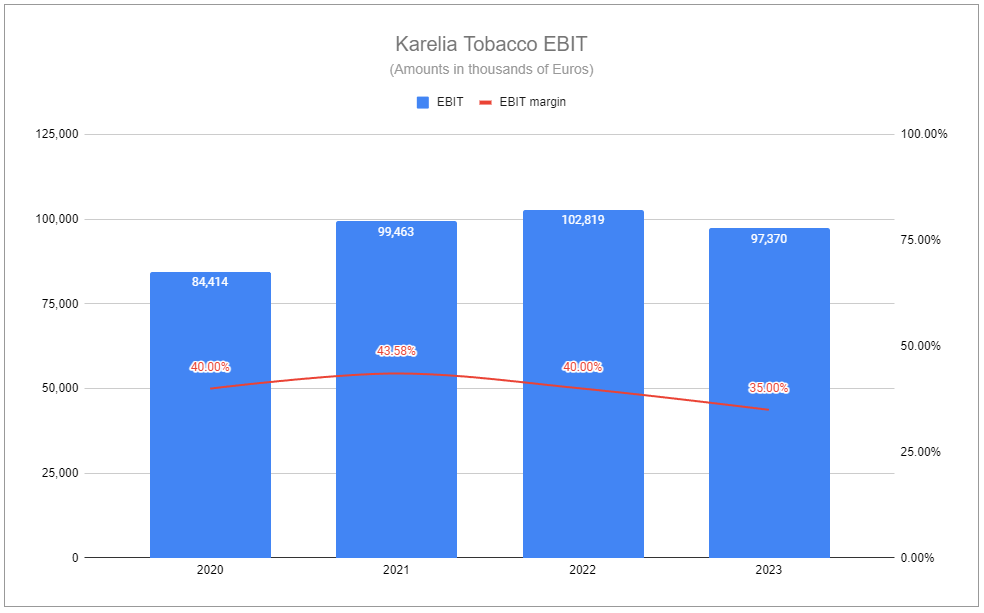

Net revenues reflect turnover excluding excise and VAT. For context, revenues and excise and VAT for 2022 and 2023, measured in thousands of EUR, were 1,265,734/1,008,709 and 1,324,157/1,045,922, respectively. In the illustration, net revenue growth rates have been chopped across the board, gross margin continues to contract far beyond the company’s historical average, and operating expenses steadily rise. These curbed expectations reflect lesser visibility into the company’s volume and pricing runway, show concern for foreign markets, and further assume difficulty in controlling costs. What is left is a rate of operating profit nearly flat.

Below the operating line, things aren’t quite so stagnant. Net income is illustrated slowly creeping North, reflecting a not-so-conservative assumption about the group’s financial income. Karelia continues to accumulate cash and shift its balance to investments. This shift, paired with rising rates, has benefited net financial income considerably.

However, several considerations suggest that the illustration may be far too aggressive. The rate of incremental cash build is in no small part a function of the returns investments can generate. As rates lower, future financial income growth is likely to be dampened. Additionally, currency exchange differences have had a major impact in the past, both positive and negative, and the future is assuredly bound to look not quite as smooth. Lastly, even if we assume the balance sheet builds at the rate illustrated, a dollar (or, in this case, euro) is worth more in the right hands and less in the wrong hands. If only 35% is paid out to the equity, and there is no expectation of additional special returns, one must wonder how much the market will value the surplus. Even if we assume that each incremental euro per share is reflected in the share price 1:1, the aggressive rate of increase, paired with the modest dividend, still only results in a rather tame return rate.

This is brought further into question by the fact the regular dividend itself is far from guaranteed at a typical rate. Special occurrences, such as two major shareholders, Ioanna Karelia and Asimina Spyropouloy, requesting the postponement of Annual Meetings, have delayed previous payouts several times. Future delays aren’t exactly out of the question. Therefore, a view on Karelia’s forward returns not only requires a strong sense of operations and management but also requires long-reaching assumptions on interest rates and currency dynamics. If you believe you have special knowledge of those latter considerations, is Karelia the most efficient expression of your views? Unlikely.

None of this is to say that Karelia is not worth watching. Rather, I am keen to continue to track the firm’s development and patiently await an event in which the knowns triumph over the unknowns with considerable leeway for error. Karelia is perhaps more bond-like than any other tobacco firm, and there are plenty of potential events that could lead to a more attractive coupon. Struggles in specific geographies, issues at the company’s sole manufacturing center, spats between major shareholders, or simply its shares’ significant illiquidity are just a few such occurrences that could deliver.

Thanks for reading. Enjoy this piece? Hit “♡ like” on the site and share it.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

At the time of publishing, I own zero positions in Karelia Tobacco. I may initiate such positions in the future. I own positions in other tobacco companies such as Imperial Brands, Altria, Philip Morris International, British American Tobacco, and Scandinavian Tobacco Group. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

If H1'24 figures are anything to go by, the illustration is far far conservative for FY'24 figures. Nonetheless, it still does a good job illustrating some of the key points of consideration.

Thank you for this piece, very interesting case study. Tons of compliments on your writing, it's always engaging and fun to read your pieces thanks to how well you articulate yourself!