“One man's trash is another man's treasure” - Yotam Ottolenghi

The second-hand retail market is fragmented, recession-resilient, and is positioned to grow as consumers become more conscious regarding waste, leading to a growing stream of donated items, as well as growing purchase volumes—further driven by the value-oriented and younger generations seeking unique shopping experiences and vintage articles. Operators can also be spectacularly profitable, with no better example than Winmark Corporation.

Winmark Corporation

Winmark was founded in 1988 as Play It Again Sports Corporation. It was renamed Grow Biz International in 1993 - the year it went public under the ticker GBIZ. In 2001, the company was renamed Winmark (WINA), as the newly appointed CEO, John Morgan, worked fervently to save the nearly-bankrupt business. His efforts included replacing the entire management team and cutting corporate-owned stores in favor of improving the franchise model. It now operates five franchise-based retail companies, including:

Once Upon a Child (clothes + toys)

Style Encore (women’s clothing)

Plato’s Closet (teen and young adult clothing)

Play It Again Sports (sports equipment)

Music Go Round (musical instruments)

To answer a question of what had gone wrong, John Morgan answered:

They had sold franchises to anyone who could come up with the money. If there’s one thing that we’ve changed at this company, it’s not just if you have the money. We really screen the franchisees. We make them work hard to find the right real estate. And we don’t give them a second store until they’ve proven they can run the first.

The turnaround has been remarkable—so phenomenal that recent financials make it almost impossible to imagine this company was ever struggling.

Revenues have steadily increased, more than doubling since 2009.

The company’s revenues are resilient, though took an unmistakable hit in 2020 due to COVID-19 lockdowns. But far more impressive are the jaw-dropping margins the company commands.

Not only does Winmark sport a gross margin in the 90s, but its net income margin—currently 48.4%—is higher than the operating margin of most companies. This reflects the power of a well-oiled model that includes merchandise sales, collecting franchise opening fees, leasing, and (most importantly) ongoing royalties from each franchise based on gross sales.

Overall store count has increased steadily, from 841 in 2001 to 1295 in Q1 2023, with 57 additional franchises awarded but not yet opened. Winmark does not provide direct financing, and franchisees secure financing through third-party lending sources, with most using SBA loans (Small Business Association). Franchisees are also responsible for inventory and use an advanced POS system provided by Winmark Corp to purchase inventory directly from customers on-site (generally, there is an 8-12 week period for new stores to build up inventory before fully opening). This approach allows operators to be selective in what they purchase, how much they pay, and allows them to dynamically price. With franchisees fronting most costs and a disciplined approach to corporate overhead, Winmark’s capital outlay to facilitate growth is minimal. Revenues outpace expenses, leading to margins (which are already absurdly high) slowly expanding and the top line largely converting to cash. That cash has nowhere to go other than into the hands of shareholders, which has been done via share repurchases and dividends.

In 2000, Winmark’s market cap (then Grow Biz International) was $31 million. Today, the total equity is valued by the market at $1.18 billion.

Management’s compensation is structured to incentivize long-term value creation for shareholders. While specific components may be debated, I find management’s direct skin in the game a strong reflection of their alignment. According to the company’s latest proxy statement, approximately 11% of Winmark’s equity is owned by company insiders, including CEO Brett D. Heffes (4.3%), CFO Anthony D. Ishaug (3.5%), and COO Renae M. Gaudette (1.4%). The statement discloses further (emphasis added):

Your management team has significant ownership in Winmark – not due to a requirement but by their individual choice. These positions have been built up over a 20-, 14- and 28-year career by your Chairman and Chief Executive Officer, Chief Financial Officer and Chief Operating Officer, respectively. As of March 10, 2023, your Chairman and Chief Executive Officer, Chief Financial Officer and Chief Operating Officer own stock equal to 49 times, 32 times and 11 times their respective base salaries.

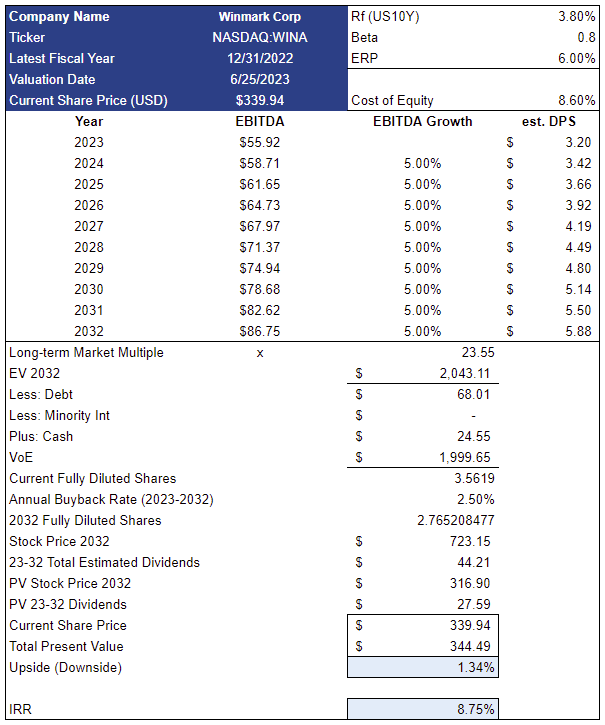

With aligned incentives and an exceptional track record, it is not unreasonable to expect strong continued execution. With low-single-digit franchise store growth and modest comparable store sales growth, plus strictly-managed corporate overhead, EBITDA could grow at a mid-single-digit rate for the foreseeable future, with a staggeringly high percentage (85-95%) converting to free cash flow (the past 4 full years have converted at 95.26%, 95.98%, 92.85%, and 80.51%, respectively). However, when plugging such assumptions into a crude model, it appears that Winmark is near fair value.

One could argue that the inputs above are too conservative, with secular tailwinds leading to growth above what is modeled. It could also be easily argued that management could (and perhaps will) wield debt to accelerate share repurchases, pushing ROE higher. I prefer to abstain from trying to paint an overly-rosy picture. Additionally, there is another critical consideration.

Despite being a small cap lacking analyst coverage, and the fact that the company does not provide quarterly investor calls and presentations, it appears that the market has woken up to this firm’s exceptional model and the envious tailwinds it’s positioned to capitalize on. This is reflected in the fact that the multiples it trades at have ballooned well past historical trends.

Does this company deserve to trade at its current multiples? Perhaps if the model’s assumptions prove to be terribly conservative—and this business appears only to be able to spit cash like a machine. However, a reversion to the 5-year average EV/EBITDA multiple would significantly affect shareholder returns. While the equity trading at a lower multiple would allow share repurchases to retire a greater percent of the outstanding, the forward IRR would be cut by 40-50%.

This may appear to be too simple of framing, but I am disinterested unless I can napkin math an attractive return with a wide margin of safety. Personally, it appears much more sensible to wait for multiples to compress or for fundamentals to radically accelerate—which means potentially sitting out indefinitely, and even missing out on exceptionally high returns. Such outcomes are no bother, as there are always opportunities elsewhere.

Is Savers Value Village such an opportunity?

Savers Value Village

Savers Value Village is one of the largest for-profit thrift operators in the world and is set to IPO on Thursday, June 29th, 2023, and will trade on the NYSE under the ticker SVV. The fact that it is a for-profit entity is surprising to many, and the company has been investigated for years regarding its marketing practices, with the Washington State Attorney General previously alleging that the company had created an impression it was a nonprofit, which the state Supreme Court recently rejected. Conversely, the company has settled other similar allegations, such as in Minnesota. There have also been other settlements, including a class action lawsuit in which Savers violated the Telephone Consumer Protection Act. Whoops.

The backdrop - a game of hot potato

SVV was initially established as Savers in 1954, with its first store located in an old movie theatre building in San Franciso, California. Over the last 70 years, the company has expanded organically, as well as through acquisitions, growing to 220 locations by 2008, and as of Q12023, 317 locations across the United States, Canada, and Australia. That growth has not been devoid of turmoil.

The company’s ownership has been a game of hot potato following the retirement of its founder, William (Bill) Ellison, in 2000—that same year private equity group Berkshire Partners purchased a 50% stake in the company. In 2006, private equity Freeman Spogli & Co became the majority owner via a secondary buyout estimated at $550 million and then a mere 6 years later, in 2012, was LBO’d by Leonard Green & Partners and TPG Capital—a deal placing Savers’ enterprise value at $1.72 billion, with a pro forma total debt to adjusted EBITDA multiple of x6.2. Then, in early 2019, Savers, highly indebted, went through a restructuring deal, making Crescent Capital Group LP a majority owner and Ares Management Corp. (NYSE: ARES) a significant minority owner. The two parties provided a much-needed $165 loan as a cash infusion to Savers and helped reduce Saver’s other debts by 40% by refinancing its $700 million first-lien loan and swapping $300 million of unsecured notes into a 7.5% stake, allowing them to assume the remaining 92.5%. This was followed by Ares acquiring Crescent Capital Group’s majority stake in March 2021.

On January 7, 2022, Savers - then operating as a Delaware limited liability company under the name S-Evergreen Holding LLC - was converted into a Delaware corporation, changed names to Savers Value Village, Inc, and all outstanding equity interest was converted into shares of common stock. On February 7, 2022, an S-1 was filed to take Savers Value Village public.

Savers initial public offering

Savers Value Village (SVV) filed an (amended) S-1/A on June 20, 2023. In it is the statement of Recent Developments, including December 2022 paying a dividend of $69.4 million to equity holders using cash and borrowings from the company’s revolving credit facility, as well as bonuses totaling $6.5 million to employees and directors who held equity interests which were not entitled to participate in the dividend, and February 2023 issuance of $550 million aggregate principal amount of 9.75% Senior Secured Notes due 2028—the proceeds of which went to prepay outstanding borrowings ($233.4 million), an additional dividend to equity holders ($262.2 million), and more one-time bonuses ($23.6 million).

While adding on extra debt to extract cash via dividends may appear fishy, such framing fails to recognize that the full mechanics of this deal only accelerate the would-be gains Ares stands to recognize. SVV plans to sell 18.75 million shares, priced at $15-$17. Using the midpoint and deducting assumed underwriting discounts and commissions, recognized proceeds are estimated to be ~$272.3 million. Immediately following the offering, Ares stands to retain control of 88.2% of the equity and voting power, though that could be reduced to 86.7% if underwriters exercise options to purchase additional shares in full. The amended S-1/A states the use of proceeds as follows:

The principal purposes of this offering are to increase our capitalization and financial flexibility and create a public market for our common stock. We intend to use the net proceeds of $272.3 million received by us from this offering and an estimated $8.2 million of cash on the balance sheet toward the repayment of indebtedness, including accrued and unpaid interest and premium under the Term Loan Facility and the Notes. We will not receive any proceeds from the sale of shares in this offering by the selling stockholders upon the sale of shares if the underwriters exercise their option to purchase additional shares. See “Use of Proceeds.”

You should naturally be skeptical when firms are taken public—especially with recent history providing a robust list of IPOs, SPACs, and direct listings which have largely been unprofitable garbage marketed to retail at suspiciously high prices. However, I’m not convinced Savers Value Village falls into that group.

SVV has a rather impressive business model, but there is a considerable amount of variable-rate debt on its balance sheet. With rates haven risen precipitously, this has had a ‘sub-optimal’ effect on equity earnings. All else aside, taking the company public can conceivably lead to better financing options, reducing the firm’s cost of capital. Ares has taken some chips off the proverbial table, yet with its reduced stake still is highly exposed to the future performance of the business.

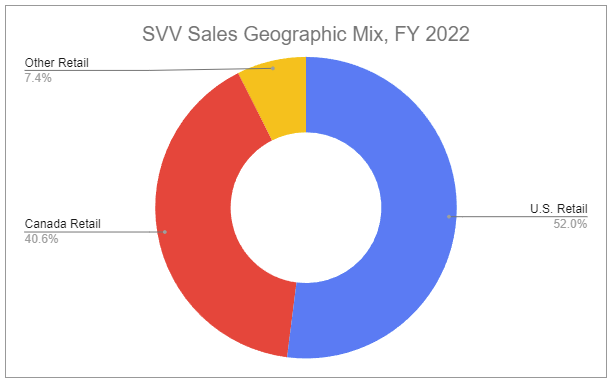

SVV’s FY2022 revenues were $1.44 billion, an increase of 19% from 2021. Net income for FY2022 was $84.7 million, up from $83.4 million in FY2021. Crudely mathing out the terms and expectations from the deal presents an implied P/E of ~x34 and an EV/EBITDA multiple of ~x12.

Again, I must stress that these are crude numbers—roughly based on presented expectations while excluding the possibilities such as underwriters exercising options. Reality is certain to unfold differently. Nonetheless, digging deeper into the specific operations of Saver Value Village provides much-needed granularity.

Savers Value Village operations

SVV’s business model, from an outside perspective, looks quite similar to Winmark Corporation. However, the actual operations are much different, with three especially critical considerations:

SVV operates all of its retail locations and does not rely on franchising. This means no stream of juicy ultra-high-margin royalties.

Instead of purchasing inventory on-site from individuals, SVV sources supply via a mix of sources, including donations, and also pays Non-profit Partners (NPPs).

While WINA has 1295 total franchised locations across 5 branded businesses throughout the United States, SVV has a mere 317 stores located throughout the United States, Canada, and Australia.

These factors guarantee SVV’s margin profile to be substantially lower than WINA's. However, there are distinct tradeoffs, and SVV has a considerable number of additional levers to pull to grow and increase efficiency. Its vertically-integrated business can be broken down into the following segments:

Supply & Processing

Retail

Wholesale

Supply & Processing

Supply

SVV sources merchandise via a three-pronged approach:

On-site donations (OSD). Items are donated to Non-Profit Partners (NPPs) at Community Donation Centers at SVV stores.

Delivered Supply. Items are donated to (or collected by) NPPs and delivered to SVV stores or Centralized Processing Centers (CPCs).

GreenDrop. Items are donated at branded GreenDrop buildings or parked trucks (parked at high-traffic locations), which then are transported to SVV stores or CPCs.

While the three methods of procurement appear similar, there are several key considerations. Firstly, SVV tracks supply via cost per pound, and On-Site Donations (OSD) carry a cost of approximately 1/3 of Delivered Supply. OSD volumes have grown at a 5% CAGR for the last 5 years, shifting from making up 48.6% of volume to 63%. Secondly, GreenDrop, which was part of SVV’s November 2021 acquisition of 2nd Ave. (purchase price consideration of $238.9 million in cash), allows mobility, setting up trucks in areas to optimize for higher-quality donations—a tradeoff on cost vs. resale value. As OSD and GreenDrop continue to become a larger percentage of supply, COGS drops on a relative basis.

Processing

Almost all SVV retail stores have space and staff dedicated to processing inventory, for which the company pays NPPs on a per-pound basis.

One of the most dramatic shifts in SVV operations is the implementation of Centralized Processing Centers (CPCs). CPCs are large facilities separate from retail stores that allow semi-automated inventory processing. SVV’s use of CPCs began in 2021, with the first being opened in Q3 2021, a second CPC opened in Q2 2022, and a third in Q1 2023.

CPCs represent a non-trivial cost to SVV, and there is a mix of risks associated with integration. The clearest risk is that any impairment to a CPC can negatively affect a large number of retail stores, whereas previously the majority of inventory movements were decentralized. A less obvious risk is that SVV contracts CPC-specific technologies from Valvan. There is an exclusivity agreement that, as of January 2023, extends exclusivity through December 22, 2025, for the United States and Canada, and through October 2024 for Australia. Additional purchases as CPCs expand would further extend this agreement, but there is no guarantee that occurs. Nonetheless, the benefits are unmistakable.

Inventory sorting velocity and accuracy can be significantly increased.

Improved pricing precision on inventory.

Processed volumes can be optimally allocated and delivered to stores based on stocking needs and sales trends.

Continued operational costs related to processing, namely costs associated with personnel, can be dramatically reduced.

New stores can be opened faster and more cheaply due to a lower required footprint, as there is less space needed to sort on-site.

Most notably, a CPC strategy requires scale. While still relatively nascent for SVV, this can be reinforced into a serious competitive advantage that thousands of standalone mom-and-pop resale and thrift stores can’t match.

Retail

Savers Value Village operates a total of 317 retail stores across brands Savers, Value Village, Village des Valeurs, Unique, and 2nd Ave.

Each store has ~28,000 square feet of retail space, which is utilized based on the importance of inventory. Inventory is classified into soft goods (womens, mens, kids, bed & bath, shoes) and hard goods (jewelry, housewares, furniture and other, and books). With hundreds of millions of pounds in merchandise processed and stocked quarterly, store inventory turns approximately every three weeks. This has the potential to incrementally improve, driven by CPCs and analytics, as well as the convenience of self-checkout, with kiosks deployed in 99% of stores as of April 2023.

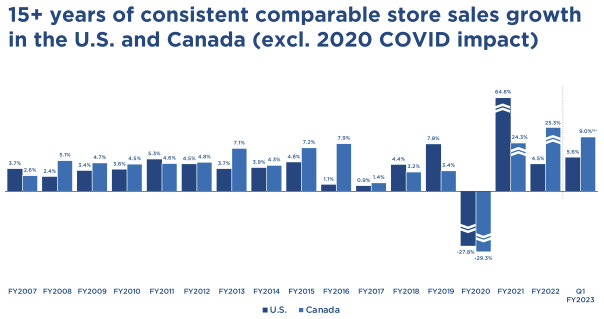

There is concern that newer online competition, such as unprofitable ThredUp and Poshmark, as well as platforms like Facebook Marketplace, will eat into the market. However, due to the fast-moving nature of products, immense inventory, and consumers actively enjoying hunting for bargain deals through the aisles (what SVV refers to as ‘treasure hunting’), the company has been able to consistently grow comparable store sales. Excluding 2020, in which lockdowns caused sales to fall steeply, Savers Value Village has experienced 15+ years of comparable store sales growth in the U.S. and Canada. Notably, comparable store sales grew during the entirety of the GFC. This can be attributed to the recession-resilient nature of the model in which the AUR (average unit retail) is less than $5—substantially lower than retail competitors.

Sales growth can be driven higher thanks to secular trends, with younger demographics purchasing more frequently from resale, as well as a widespread preference for donating used items quickly rather than taking the time to sell them (purely anecdotal, but 100% of my used household items are donated to Savers, as it’s conveniently close by, with a drive-thru that allows a quick pop-of-the-trunk and a seamless transaction that takes less than a minute). Sales growth is also aided by OSD becoming a greater percentage of supply, increasing inventory quality and therefore basket sizes. Additionally, customer retention and engagement continue to grow thanks to SVV’s loyalty program, Super Savers Club. As of April 2023, the company has over 4.7 million active members enrolled in Super Savers Club, up 9.3% from a year prior (4.3 million), and up 23% from October 2021 (3.8 million). The program incentivizes users by earning points and store credit, as well as coupons exclusively provided via email, and loyalty club members spend notably more per trip on average than non-members and shop more frequently.

Looking past comparable store sales growth, absolute sales are driven by new store openings. Year over year, total store count grew by 12 (4%) in 2021 and by 8 (2.6%) in 2022. SVV has guided to opening ~12 stores throughout 2023 and 20+ stores each year between 2024-2026—a rate of 4-6% per year.

Regarding reinvestment runway, SVV believes there to be the potential for 2,200 new stores. I’m not sure that I believe that—it does sound lofty. But what if it is? Even if that number were halved and new stores per year doubled from 2024 onward, you’d be looking at a multi-decade runway ahead—not that it’d make sense to expand that fast, or that the company could afford to, however. This would require a significant capital outlay—again, comparatively, WINA’s growth trajectory is tempered, with franchisees fronting most of the bill. Nonetheless, SVV’s payback period is fairly appealing, as per statements in the S-1/A (emphasis added):

Driven by our disciplined real estate selection approach, we expect to deliver attractive return on investment and store-level profitability. We target most of our new stores to achieve a payback period of approximately three years. Of the 21 new stores opened since 2019, six have already returned their initial investment despite the impacts of the pandemic. Our alternative store format is designed to capitalize on high real estate availability in in-fill markets through smaller formats.”

Moving forward, it will be most interesting to track new store openings alongside the expansion of CPCs, with the latter reducing the associated costs of the former, and potentially further increasing optimal location availability. Additionally, something curious that may be a headwind or tailwind, depending on your perspective, is the unsuspecting angle of NIMBY—I came across an article detailing a bloated and drawn-out fight over zoning for a thrift shop. While such contestations may be outliers, any growing sentiment may make organic expansion more difficult—potentially incentivizing a greater focus on inorganic growth via M&A.

Wholesale

Of all textile items received and processed, ~50% end up being sold to SVV thrift store shoppers. To prevent waste and recoup a portion of the costs, SVV sells most of its unsold inventory to wholesale buyers. Those buyers either ship inventories around the world for use and/or turn products into post-consumer fibers.

Insiders

Mark Walsh, CEO (since 2019). Prior to Savers, worked as a consultant focused on special situations and interim turnaround CEO services. Before that, long list of retail executive leadership positions, as well as positions at Deloitte and Pepsico.

Jay Stasz, CFO (since 2022). Prior to Savers was the CFO of Ollie’s Bargain Outlet.

Jubran Tanious, COO (since 2011). Prior to the COO role, was Vice President of Supply, responsible for changing the company’s supply strategy (presumably had a large influence on the shift to CPCs). Prior to Savers, worked at UnitedHealth Group.

Charles Hunsinger, CIO (since 2022). Prior to joining Savers, he was the CIO of Oriental Trading Company—a company owned by Berkshire Hathaway (6 years).

Executive officers stand to receive cash bonuses contingent on performance, with payouts ranging between 75-200% of base salary. Executives also receive stock options which are 40/60 time-vesting/performance-vesting, with time-vesting generally vesting in equal annual installments over 5 years, while performance-vesting occurs to the extent that private equity investors (Ares) receive a specified multiple on invested capital (MOIC)—1/3 if MOIC =/> 2.00; 1/3 if MOIC =/> 3.00; and 1/3 if MOIC =/> 3.75.

Looking for value

With all the levers illustrated, at what rate can SVV grow? Looking at revenue growth of recent years, as shown below, is misleading, as 2020 was uniquely depressed by COVID, and the following 2 years were a spring back from that, which overstates the would-be growth rate.

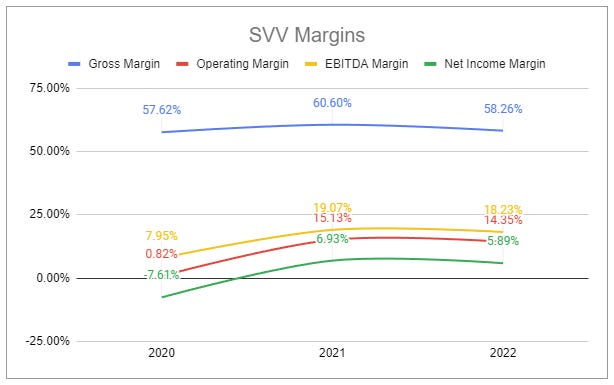

We know that comparable store sales have grown at low/mid-single-digits for 15+ years (excluding 2020). This may continue due to secular trends, an increase in OSD sourcing, growth in SVV’s loyalty program, and improvements to dynamic inventory pricing. OSD mix increase also would reduce COGS on a relative basis, increasing gross margin—from 2015 to 2022, gross margin expanded from 46.4% to 58.3%.

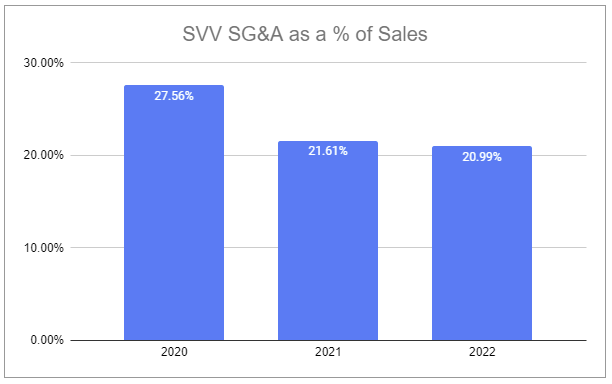

We also know that the company aims to increase store count by 4-6% per year for the foreseeable future, aiming for payback periods of ~3 years. Along with retail stores, the company will also be building out a number of CPCs. These investment activities prevent a good deal of gross proceeds from falling further down the line—for now. But if CPCs can further accelerate sales velocity, improve pricing, and reduce COGS, the longer-term effects would be undoubtedly positive on all levels. Continued scaling would also be reflected in SG&A becoming an incrementally smaller percentage of sales, further expanding margins.

It remains uncertain exactly how much capital outlays will increase during this ramp in reinvestment. However, SVV could continue to grow top-line by msd-hsd while incrementally expanding gross and operating margins. Should reinvestment peak or taper, a good deal of operating cash could fall to the balance sheet. The S-1/A stated there is no intent to issue a dividend in the foreseeable future. Excess cash will likely go to further reducing debt and possibly towards acquisitions.

Despite the durable model and clear mechanics to produce value, I have no interest in rushing to build a position in this name—I am much more inclined to let the IPO pass and patiently track the company’s progress as we are provided more granularity over time. Trading at a pro forma net debt/EBITDA ratio of x3.95 and an interest coverage ratio of x3.97, on top of variable-rate debt and other sensitivities, any misstep in execution or sudden shift in macro conditions could present a dislocated opportunity to acquire this thrifty retailer at a bargain price.

To support Invariant, hit “♡ like” and share this article with someone—they won’t mind reading it second-hand.

Questions or thoughts to add? Comment here or message me on Twitter.

Ownership Disclaimer

At the time of publishing this piece, I have no direct positions in Winmark or Savers Value Village. I may take such positions (long or short) in the future.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: $SVV WINA 0.00%↑ ARES 0.00%↑ TDUP 0.00%↑ POSH 0.00%↑

Great work Devin. Thanks for introducing us to Winmark!

Thank you. Interesting. You write very well)