“Smoking is the leading cause of statistics” – Fletcher Knebel

Company Overview

Initially known as Philip Morris and rebranded in 2003, Altria is a U.S.-based holding company with origins dating back to the mid-nineteenth century.

Al-tree-uh. Ale-trey-uh. All-tray-uh. It’s a name so marvelously unassuming you can tell a consulting firm thought it up.

In 2007, Altria spun off its majority stake in Kraft Foods to shareholders. That same year, it began to divest its stake in Philip Morris International (which was finalized in March 2008). Currently, the company trades on the NYSE under MO and oversees a leading portfolio of products for adult consumers in the U.S. market, all of which are manufactured and marketed by subsidiaries, including:

Philip Morris USA Inc. ("PM USA"), the maker of Marlboro cigarettes

U.S. Smokeless Tobacco Company LLC ("USSTC"), the maker of Copenhagen and Skoal moist smokeless tobacco products

John Middleton Co. ("JMC"), the maker of Black & Mild cigars

Helix Innovations LLC ("Helix"), the maker of on! oral nicotine pouches

The company also holds investments in:

Anheuser-Busch InBev SA/NV ("ABI"), the world's largest brewer

(9.96%, Public, NYSE: BUD) 197,457,354 shares

JUUL Labs, Inc. ("JUUL"), the nation's leading e-vapor company

(35%, Private)

Cronos Group Inc. ("Cronos"), a leading global cannabinoid company

(42%, Public, TSX:CRON, NASDAQ: CRON) 156,573,537 million shares

Additionally, on May 13, 2022, Altria announced a definitive agreement to purchase substantially all assets and properties of Poda Holdings, a Canadian company focused on heated tobacco product (HTP) technologies.

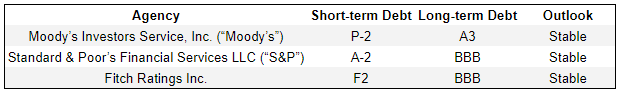

While the core business is in secular decline, operations as a whole are incredibly capital-light, allowing the company to prioritize returning capital to shareholders. The company has a long history of buying back shares while targeting an 80% payout ratio of adjusted diluted EPS and has increased and paid a dividend for more than fifty consecutive years. As of December 31, 2021, the credit ratings and outlook for Altria were the following:

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Investment Thesis

Altria is an unloved old-economy stalwart that is slowly reinventing itself as it continues to spit out mountains of cash.

Counter to common belief, regulation is a primary value driver for Altria.

Regulation has continued to insulate Altria from new competition.

Altria’s brands retain high market share and brand loyalty.

Lack of competition allows immense pricing power to offset the deceleration in legacy volumes while the company grows consumer affinity for new products.

Industry Overview - The Backdrop

At first glance, U.S. tobacco looks downright ugly.

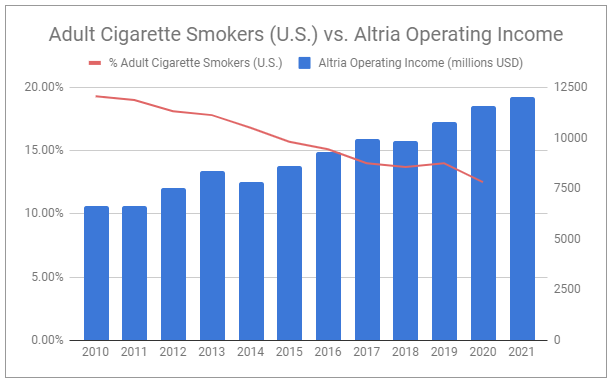

Tobacco companies have faced endless scrutiny and regulation while spending over half of the last century concealing the health risks of their products. Along with this, the percentage of U.S. adult smokers has steadily declined since it peaked in the 1950s.

The 1998 Master Settlement Agreement is the largest legal settlement ever executed in the United States. It unearthed internal tobacco industry documentation showcasing their deceptive tactics and created a path toward substantial federal regulation. A tobacco prevention foundation was formed, and several tobacco-industry initiatives were dismantled. Additionally, it required the offending Original Participating Manufacturers to make annual payments to the respective states in perpetuity and further restricted tobacco advertising, promotion, and marketing.

The Original Participating Manufacturers include:

Philip Morris Incorporated (now known as Philip Morris USA Inc.) ("Philip Morris")

R.J. Reynolds Tobacco Company ("R.J. Reynolds")

Brown & Williamson Tobacco Corporation ("Brown & Williamson")

Lorillard Tobacco Company ("Lorillard")

Yet, despite forced payment schedules, restrictions of agency, endless tax increases, and ever-extending government oversight that is all repeatedly hailed as a death sentence, the tobacco industry has always taken a long drag, puffed a smoke ring, and marched ahead.

Unexpectedly, the 1998 MSA's effects created a uniquely favorable environment.

The additional advertising, promotion, and marketing restrictions largely shielded incumbent brands from new competition. Drastic cuts to advertising budgets suddenly presented tobacco companies with piles of cash to redeploy. This allowed for the development of new products, strategic acquisitions, product discounts, vast amounts of capital returned to shareholders via dividends and buybacks, and consolidation within the space.

In 2014, Reynolds American bought Lorillard Tobacco Company for $27.4 billion. And then, in 2017, Reynolds agreed to be taken over by British American Tobacco, which already controlled Brown & Williamson within a subsidiary.

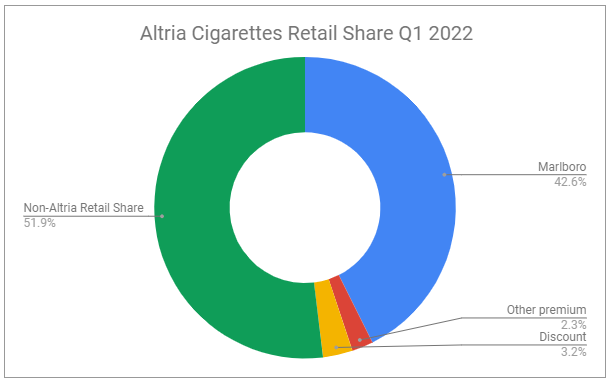

The U.S. Cigarette market has effectively become an oligopoly, with Altria's Philip Morris USA being the most dominant player. The U.S. nicotine market more broadly, while slightly more fragmented, is set to follow the same path, and Altria is well-positioned as it unfolds.

Regulation - Past and Present

While the Master Settlement Agreement is the most well-known and cited of tobacco regulations, it was not the first nor the last. The information I present to you is not exhaustive but does cover majorly impactful legislation. It is essential to understand these dynamics, as tobacco and regulation will forever be intertwined. More importantly, it highlights that as society embraces continued and increased tobacco and nicotine regulation, so should Altria shareholders.

Perspective on Regulatory Environment

Throughout history, humans have embraced mind-altering substances to achieve a variety of effects, for reasons ranging from medicinal, spiritual ritual, to social and communal.

Proponents of making cigarettes or nicotine illegal would best be served to study the 1920-1933 period of alcohol prohibition in the United States, or more recently, 2020 in South Africa, in which tobacco sales were banned during the COVID-19 lockdown, largely funneling sales to illicit sources and creating a windfall for the country’s black market. Or, we can look further into the past to see what true prohibition looked like. Think about this:

In early seventeenth-century Russia, smoking tobacco was banned because smoke was associated with evil spirits. As a result, if you were caught smoking, you’d experience a lovely punishment such as having your nostrils torn open, lips cut off, or a (usually) fatal flogging. Russia was not alone in its efforts. Executions were a common punishment in the Ottoman Empire and China as well. And Persia, going for style points, would pour molten lead down offenders’ throats. Japan, more humanely, would simply imprison smokers and confiscate all of their belongings.

If monarchs and dictators using the threat of death could not stop tobacco usage, what would make the progressive democracies and republics of today fair any better? Simply put, there is no way to put the genie back in the bottle. This is not to say that we should not regulate tobacco and nicotine or that all historical regulation has been right or wrong. Rather, it seems most practical to cheer for regulation that further thwarts underage access and usage of tobacco and nicotine while at the same time providing ample information, resources, and options for adult consumers to make informed choices.

Underage Access and Use

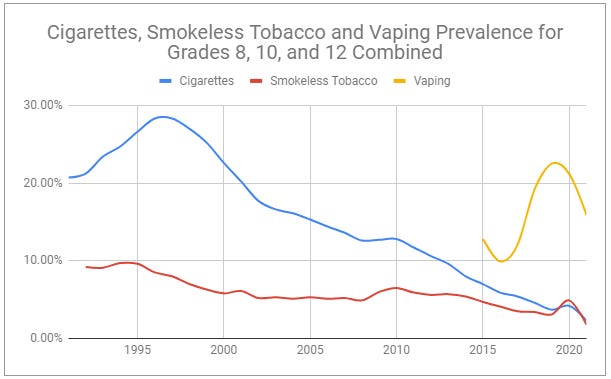

Underage cigarette use is at an all-time low. This can be largely attributed to:

Restrictions on advertising and marketing of products.

Increased prices through the raising of taxes.

Education and warnings about the harm effects of such products.

Technology and compliance initiatives designed to stop underage access.

While we can celebrate the continued decline of underage cigarette and smokeless tobacco use, it is readily apparent that the United States is still struggling to stop a youth vaping epidemic. Many ENDS devices are small, have high nicotine content, come in appealing flavors, and can be used discretely - all of which are appealing to underage users. While there is no denying that those factors have played a role, it is also evident that measures designed to reduce underage access have largely failed.

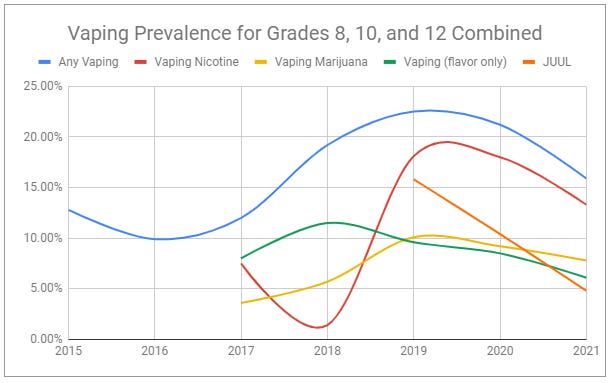

In December of 2018, Altria announced offering $12.8 billion for a 35% stake in Juul Labs. JUUL’s motivations for the deal largely stemmed from the fact they were facing immense pressures, and Altria would be able to help them navigate the legal and regulatory space. Since then, JUUL’s market share has shrunk from 72% in 2018 to an estimated 26% as of Q1 2022. With drastic changes to their marketing, flavors, branding, and a substantial increase in age verification efforts, underage JUUL use has fallen sharply, far exceeding the drop in underage vaping more broadly.

Age Validation Technology (AVT)

Age validation technology can be credited with substantially reducing underage use of tobacco products and appears to be one of the best tools to continue to eliminate underage use.

Along with immediate POS age verification, retailers are required to log all transactions and prepare audit-ready data for regulatory bodies. If retailers fail to use AVT or comply with the requirements, they are subject to losing their licenses to sell tobacco products. Furthermore, the majority of lenders and payment processors now require tobacco retailers to use third-party AVT.

As of April 2022, over 130,000 retail stores in the United States have AVT installed, with another 8,000 in progress. While this may seem impressive, there are an estimated 375,000 retailers in the United States that sell tobacco products. There should be support and expectation for future regulation and enforcement to ensure AVT is used by all tobacco retailers.

Along with drastically reducing underage access to tobacco products, AVT provides producers with major benefits:

Allows for real-time data-driven decision making, allowing for optimal use of resources.

Allows brands such as Marlboro to market directly to interested and verified adult consumers through retail-owned applications.

Data indicates that digital channels are now the most significant source of new tobacco product awareness.

With a dominant market share, a massive distribution network, leading premium products, and troves of internal data, I believe Altria is best positioned to leverage AVT. This should be observable through continued optimization of working capital, product offerings, and capital deployment, as well as reducing future legal liabilities. Notably, it will also allow for precision-like balancing between price adjustments across products and changes in volumes.

Historical Regulation

Tobacco regulation in the United States has a long history, including, but not limited to:

In 1965, President Johnson signed into law requiring all cigarette packaging to warn, “Caution: Cigarette smoking may be hazardous to your health.”

Effective 1971, cigarette advertisements on TV and radio were banned.

In 1979, smoking was restricted in all federal buildings in the United States.

In 1986, TV and radio advertisements for smokeless tobacco products were banned.

In 1990, smoking was banned on all U.S. commercial flights.

In 1994, Mississippi was the first state to sue the tobacco industry to recover costs associated with tobacco-related illnesses.

In 1995, California became the first state to ban smoking in the workplace.

In 2006, the courts prohibited the use of certain descriptors such as “low tar” and “light” for tobacco products.

Family Smoking Prevention and Tobacco Control Act

In June 2009, the Family Smoking Prevention and Tobacco Control Act (Tobacco Control Act/TCA) became law, providing the FDA additional authority to oversee tobacco product manufacturing, distribution, and marketing, and put specific measures in place to further reduce underage use of tobacco products. The act bans flavored cigarettes (except for menthol), requires tobacco companies to list ingredients and nicotine content, and requires smokeless tobacco products to showcase one of the following warnings:

WARNING: This product can cause mouth cancer.

WARNING: This product can cause gum disease and tooth loss.

WARNING: This product is not a safe alternative to cigarettes.

WARNING: Smokeless tobacco is addictive.

The TCA also ensures “modified risk” claims are supported by scientific evidence and requires disclosure of ingredients in tobacco products, all while preserving state, local, and tribal authority to regulate tobacco products. Notably, while other U.S. tobacco companies sued the FDA in federal court in response to the TCA, Altria supported the legislation, recognizing that the additional oversight would further prevent new competition.

Premarket Tobacco Product Applications (PMTA)

Any new tobacco product sought to be marketed in the United States must submit a Premarket Tobacco Product Application. A new product is defined as a product commercially marketed after February 15, 2007, or any modification of a tobacco product commercially marketed after February 15, 2007. Any applicants predicated on products existing prior to February 15, 2007, may apply using the Substantial Equivalence regulatory pathway.

The purpose of PMTAs is to determine:

The risks and benefits to the United States population as a whole, including both people who would use the product and nonusers.

If people who currently use any tobacco products would be more or less likely to stop using such products if the proposed new product was accessible.

The propensity individuals not currently using any tobacco products would have for using the proposed product.

PMTA requirements are designed to benefit the U.S. population but will also ultimately be a tailwind for major producers such as Altria.

The FDA estimates a single PMTA carries costs ranging between $117,486 and $466,563. This understates the total costs attached to research, development, and additional preparatory measures prior to submitting. The true total costs, as estimated by independent firms, are calculated to be in the millions. Additionally, a separate PMTA must be submitted for each individual SKU. That means substantial additional costs for each flavor, strength, and size of similar products. The total costs for small and independent producers aren’t just steep; they are an impossible hurdle to overcome. While major producers have submitted PMTAs for most of their product offerings, the majority of producers can’t even afford the process. It is likely that this will ultimately result in small and independent producers eventually ceding their market shares in segments such as ENDS to major producers such as Altria, providing approval of the major’s applications and FDA enforcement against noncompliance.

Modified Risk Tobacco Product Applications (MRTP)

MRTP applications are not mandatory like the PMTA and SE legal pathways. Any party may submit a Modified Risk Tobacco Product Application for a proposed MRTP seeking a modified risk order (MRO). Without an authorized MRO, tobacco products can not make claims such as “this is less harmful than smoking cigarettes.”

The subsequent review process allows the FDA to determine authorization based on:

The relative health risks to individuals of the tobacco product that the application is for.

If there would likely be an increase or decrease of current tobacco product users who would stop using said products and switch to the product covered by the application.

The likeliness of an increase or decrease in individuals who do not use tobacco products to start using the product covered by the application.

The risks and benefits to individuals from the use of the tobacco product covered by the application compared to other smoking cessation approved to treat nicotine dependence.

Comments, data, and information brought forth by persons of interest.

The difficulty in receiving a modified risk order means that the entire process is extremely costly and time-intensive. And MROs are not permanent, meaning companies are required to conduct continual post-market surveillance and provide comprehensive reports to the FDA. The FDA is able to revoke an MRO at any time if they determine certain conditions have not been fulfilled.

Currently, there are four tobacco and tobacco-related products that have been granted modified risk orders, and two under substantive review:

MRO Granted

Philip Morris International - IQOS 3 System Holder and Charger

Philip Morris International - IQOS Tobacco Heating System

22nd Century Group - VLN King, VLN Menthol King

Swedish Match USA - General Snus

Under Substantive Review

USSTC - Copenhagen Snuff Fine Cut

R.J. Reynolds - Camel Snus

Increased FDA Authority and PMTA Push

In Aug 2016, the FDA gained authority over all cigars, e-cigarettes, and ENDS products, and all related products on the market at the time were required to submit Premarket Tobacco Product Applications (PMTA). Since then, the agency has deferred enforcement of the PMTA requirements. Presently, the majority of ENDS products on the market are considered illegal and subject to possible enforcement. The rule also provided the FDA with the ability to act against manufacturers who sell and distribute products with unsubstantiated Modified Risk Tobacco Product (MRTP) claims.

Tobacco 21

In Dec 2019, President Trump signed into law an amendment to the Federal Food, Drug, and Cosmetic Act, raising the federal minimum age for the sale of tobacco products from 18 years to 21 years. Tobacco 21 (T21) applies to all products regulated under the FDA’s authority concerning tobacco, including ENDS and e-liquids. The amendment does not allow any state or municipal exemptions. All retailers in the United States are prohibited from selling tobacco products to individuals under the age of 21. With that said, there are gaps in the FDA’s enforcement protocols, and there appear to be high noncompliance rates in certain states.

Non-Tobacco Nicotine and Synthetic Nicotine

Effective April 14, 2022, the FDA gained the ability to regulate tobacco products containing nicotine from ANY source - bringing non-tobacco nicotine (NTN), such as synthetic nicotine, under their purview. All owner/operators engaged in the manufacturing, preparation, compounding or processing of NTN products must now register with the FDA. All manufacturers of NTN products who aimed to market their products were required to submit a Premarket Tobacco Product Application (PMTA), with a deadline of May 14, 2022. The FDA has also indicated that it will not be authorizing flavored products except for tobacco and menthol.

Menthol Ban and Flavored Cigar Ban

FDA Document IDs: FDA-2021-N-1349-0001, FDA-2021-N-1309-0001

On May 10, 2022, the FDA proposed new rules that would ban the manufacturing and sales of menthol cigarettes and all flavored cigars. Through July 5th, the FDA is accepting public comments prior to moving forward with a decision. The motivations for the proposal are rooted in data highlighting a preference for menthol in underage users, with underage users perceiving menthol as less harsh.

While many groups support such measures, there is also notable resistance. 85% of menthol smokers are black, and organizations such as the American Civil Liberties Union (ACLU) have opposed a menthol ban, stating it would ultimately result in increasing negative interactions between communities of color and local law enforcement. The proposed legislation would exempt menthol e-cigarettes as the FDA evaluates separate rulings for related devices.

Graphic Imagery

In early 2020, the FDA finalized a new rule that would require cigarette packaging to include new health warnings along with color photorealistic images showcasing the negative health effects of cigarette smoking. Currently, the effective date for this new rule will be July 8, 2023.

Minimum Pricing Laws

Since the 1940s, over half of the U.S. states have enacted minimum pricing laws for cigarettes and other tobacco products. Initially designed to protect small retailers from the “loss-leading” practices of larger retailers, minimum pricing laws have become a partial tailwind for Altria. “Floor pricing” disproportionally affects discount brands, as lower pricing is their key advantage versus premium brands such as Marlboro. While discount cigarette companies like Liggett Group and Vector Tobacco fund opposition to such measures, Altria has recently been helping such types of legislation succeed.

State and Local Regulations

Smoking Restrictions

The majority of the U.S. has enacted various indoor smoking bans. Beyond the map below, certain cities and municipalities have enacted local 100% smoke-free air and/or other tobacco-related laws.

Vaping - Online Sales Bans

States with current or pending online sales bans include Arkansas, Maine, Oregon, South Dakota, New York, Utah, and Vermont.

Vaping - Flavor Bans

States with current or pending flavor bans include California, Hawaii, Massachusetts, New Jersey, New York, and Rhode Island. Multiple major cities have also passed flavor bans, including, but not limited to, Chicago, IL; San Diego, CA; Sacramento, CA; Oakland, CA; San Jose, CA; and Boulder, CO.

San Francisco, CA, has banned all vaping product sales.

EVALI

In 2019, the Centers for Disease Control and Prevention (CDC) initiated investigations into hospitalizations linked to vaping. Hospitalized patients suffered respiratory issues such as shortness of breath, cough, and chest pain. These occurrences became known as EVALI, or “e-cigarette, or vaping, product use associated lung injury.” In total, the condition is responsible for 68 deaths and over 2800 hospitalizations.

Regulators and the public wrongly blamed ENDS such as JUUL for these events. After a comprehensive analysis, the CDC concluded:

Illicit tetrahydrocannabinol (THC)-containing e-cigarette, or vaping, products, are linked to the majority of EVALI cases.

The EVALI outbreak is strongly linked to Vitamin E acetate.

Vitamin E acetate has not been found in the lung fluid of people that do not have EVALI.

There is not sufficient enough evidence to rule out other chemicals of concern contributing to EVALI cases in either THC or non-THC products.

From a practical manufacturing perspective, it is exceedingly unlikely ENDS devices played a role in the EVALI outbreak. Vitamin E acetate has been noted to be used as a ‘cutting agent’ in illicit vapes to dilute expensive THC oils while sustaining the required viscosity. Vitamin E acetate would never be added to nicotine e-liquids as it is not soluble in either propylene glycol or vegetable glycerin, the two base liquids used in ENDS. Despite the above data, perceptions of e-cigarettes as more harmful than cigarettes increased significantly between 2018 and 20201, which may somewhat curb the decline in traditional cigarette sales volumes.

Altria Operations and Segment Specifics

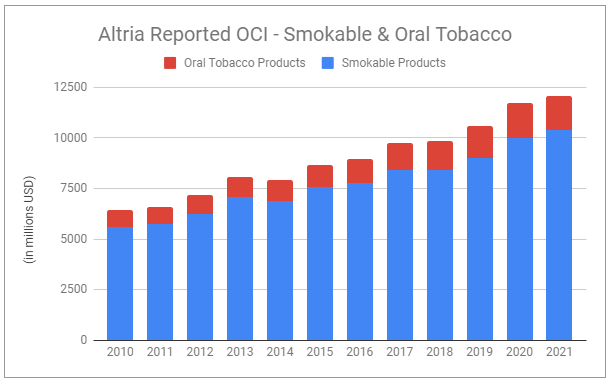

Altria’s operating companies can be placed into two major buckets, Smokable Products, including cigarettes and cigars, and Oral Tobacco Products (classified by Altria as “smokeless” prior to 2020), which includes categories such as moist smokeless tobacco and oral nicotine pouches.

While a majority of Altria’s revenues (and profits) are generated from cigarettes, the company is committed to Moving Beyond Smoking™ by promoting harm reduction and informed consumer choice to shift adult smokers away from traditional combustible products to less harmful options. I’m doubtful of the pace they’ll be able to achieve this, but nonetheless, leadership has laid their blueprint while prioritizing returning long-term value to shareholders.

Altria’s management includes operating companies income (OCI) in their financial reporting to help evaluate the continued underlying operations of each business segment. I have included data concerning reported OCI, that is, OCI that is unadjusted. Adjusted figures exclude income and expenses that management does not recognize as part of the underlying operations. It comes as no surprise that the adjusted figures are often much rosier looking than the reported figures. Exclusions include certain costs related to MSA payments, as well as certain obligations related to healthcare costs and litigation. While varying to different extents, these types of costs are very real and are all but guaranteed to be recuring and, in my opinion, should be considered costs of the underlying operations.

Smokable Product Operations

2021 Adjusted OCI of $10.4 billion. 2021 Adjusted OCI margins of 57.6%

Philip Morris USA

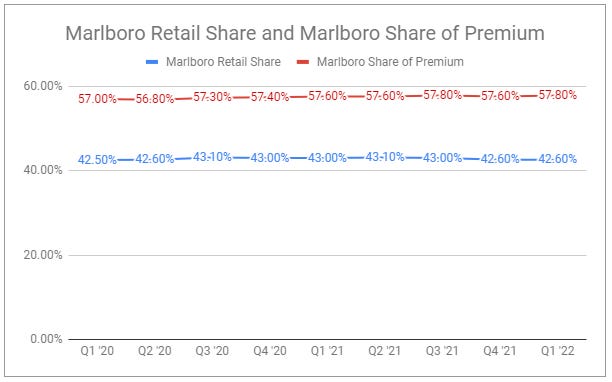

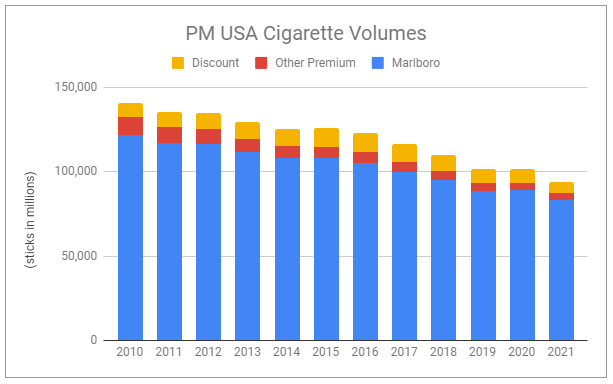

With origins dating back to 1847, Philip Morris USA has an exceptional track record of producing premium cigarettes. They have been the top manufacturer of cigarettes in the United States since 1983, and the strength of PM USA’s premium Marlboro is reflected in strong brand loyalty, optimal retail shelving space placement, and a lesser-felt impact from minimum pricing legislation relative to discount brands. Marlboro is the number one cigarette brand in each of the 50 states and is the top cigarette brand for men and women across all adult age demographics. Other PM USA brands include Parliament, Virginia Slims, L&M, Basic, Benson & Hedges, Cambridge, Chesterfield, Commander, Dave’s, Players, and Saratoga.

Continued cigarette production is the epitome of a capital-light business. Thanks to their addictive qualities, cigarettes have staggeringly high brand loyalty. This, paired with a lack of new competition, has allowed producers to increase prices steadily throughout all economic cycles. Even with a shrinking smoker base, these dynamics allow producers to earn a return on capital far above their cost of capital. As unit volumes decline, costs drop, and operating margins expand. Invariant of revenue remaining stable or falling slightly, the profitability of continued operations increases.

Skeptics question if this lucrative dance can continue, citing consumer price hike tolerance, future regulation, and demographic factors.

While research suggests cigarette prices have a negative and statistically significant effect on cigarette consumption, and many other unknowns remain, there are also counter-factors to consider:

Various factors could cause the smoking rate decline to slow or temporarily reverse, such as in 2020, when Altria's y/y cigarette volumes declined by far less than the average of the last decade.

Governmental bodies have become economic beneficiaries reliant on tobacco tax revenues.

Hastened excise tax increases may promote illicit activity centered around smuggling untaxed products.

Part of the decline in cigarette volumes can be attributed to cannibalization from other nicotine products.

It is also important to appreciate just how well-insulated Altria’s cigarette retail share is. Since 1999, several competitors have entered the market, but their entire aggregate retail share has never exceeded 2%.2

John Middleton Co

John Middleton became a wholly-owned subsidiary of Altria in 2007. The company has a 166-year history and is a leading producer of cigars and pipe tobacco. Cigar brands include Black & Mild, Middleton’s Cherry Blend, Gold & Mild, and Prince Albert. Pipe Tobacco brands include Apple, Black & Mild, Carter Hall, Middleton’s Cherry Blend, Gold & Mild, Kentucky Club, Prince Albert, Royal Comfort, Sugar Barrel, and Walnut.

While the below chart shows 2021 volumes to be nearly flat y/y, reported shipment volumes declined 9.6% y/y for Q1 2022. Additionally, in May of 2022, the FDA proposed new rules that would ban the manufacturing and sales of all flavored cigars. If this materializes, it would undoubtedly negatively impact JMC.

Oral Tobacco Product Operations

2021 Adjusted OCI of $1.7 billion. 2021 Adjusted OCI margins of 68.5%

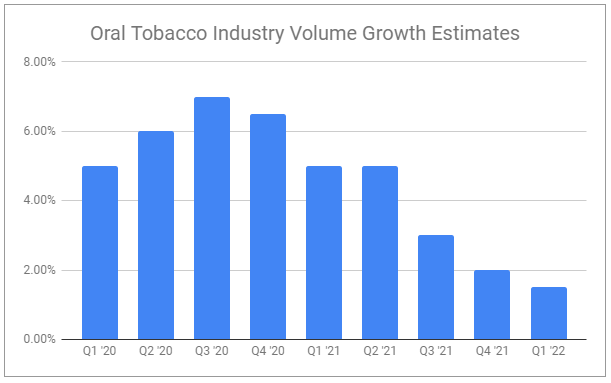

While total smokable volumes in the U.S. continue to decline, oral tobacco volumes continue to grow.

We expect to vigorously compete in the major smoke-free categories through our investments, licensing agreements and tobacco operating companies. We believe it’s important to have multiple products in these smoke-free categories to help smokers transition away from cigarettes.3

As of September 2020, internal research estimates as many as 12 million adult tobacco consumers in the United States, ages 21-54, are interested in switching from cigarettes to an alternative product. As of February 2022, 30% of adult smokers have tried smoke-free products, 11% continued to purchase smoke-free products after 5 weeks, and 7% continued to purchase smoke-free products after 18 weeks.4

U.S. Smokeless Tobacco Company

USSTC became a wholly-owned subsidiary of Altria in 2009. The company originated in 1822 and has since been the top producer of moist smokeless tobacco (MST), with brands including Copenhagen, Skoal, Red Seal, and Husky.

Copenhagen is currently the best-selling premium product in the U.S. MST category. USSTC submitted an MRTP application for Copenhagen Snuff in March 2018, which is still pending with the FDA. As of the end of 2021, it held a retail share of 29.4%, down from 31.8% at the end of 2020.

Skoal is currently the number two premium MST product in the U.S. It held a 12.6% retail share at the end of 2021, down from 13.9% in 2020.

Red Seal and Husky are discount brands marketed for price-sensitive consumers. Each contributes minimally to overall sales. In 2020, Altria began to include on! oral nicotine pouches in their “Other Oral Tobacco” segment reporting.

Like cigarettes, oral products such as MST are expected to continue to decline as users reduce usage, quit, or shift towards other products such as oral nicotine pouches, vaping, and heated tobacco products.

Helix Innovations

Helix Innovations was established in June 2019, when Altria announced it would pay $372 million for an 80% stake in Burger Söhne Holding AG, the Swiss producer of on! nicotine pouches. Transactions totaling $250 million were conducted in December 2020 and April 2021, allowing Altria to acquire the remaining 20%.

on! is an alternative to traditional tobacco products and is a tobacco leaf-free nicotine pouch consisting of tobacco-derived nicotine(TDN), water, flavorings, and plant-based fibers. The product comes in seven flavors, offers five different nicotine levels (1.5mg, 2mg, 3.5mg, 4mg, and 8mg), is packaged and sold in cans of 20 pouches, and is currently available in over 117,000 retail outlets. As of Q1 2022, Mint and Wintergreen make up a combined 56% of sales by flavor. The 8mg strength pouches contribute 42% of sales, indicating a consumer preference for higher-strength products.

The oral nicotine pouch (ONP) product category is fast-growing, and for obvious reasons:

From Altria Sciences, on Oral Tobacco-Derived Nicotine (OTDN) products:

Because OTDNs are smoke-free and tobacco leaf-free, most harmful and potentially harmful constituents (HPHCs) are not detectable or are lower compared to higher risk tobacco products. Completely transitioning to these products will significantly reduce exposure to the toxic constituents, except for nicotine, found in cigarette smoke and smokeless tobacco products.

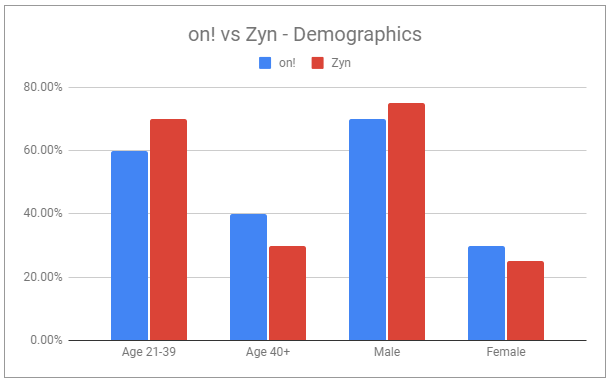

Altria has announced it intends to file an Modified Risk Tobacco Product Application for on!. We look forward to sharing the science supporting that application at upcoming conferences and in scientific publications, which we will also post on this site.

Additionally, unlike traditional dip, oral nicotine pouches do not require the user to spit, nor do they appear to stain teeth or have a scent. Available in a variety of strengths, they better aid users in satisfying cravings and can be used completely discretely. For these reasons, users have shifted from other tobacco products to oral nicotine pouches. Notably, while traditional oral tobacco products such as MST have a user base that is almost strictly male, oral nicotine pouches continue to gain considerable traction amongst women.

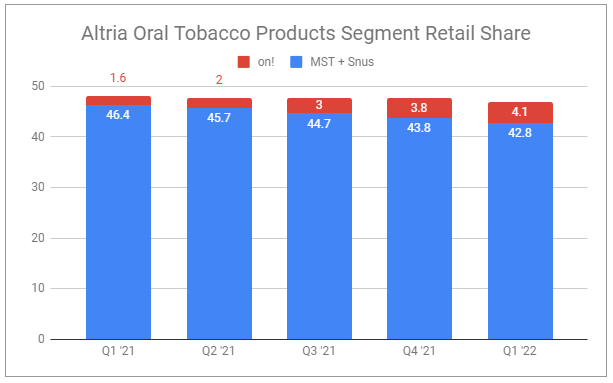

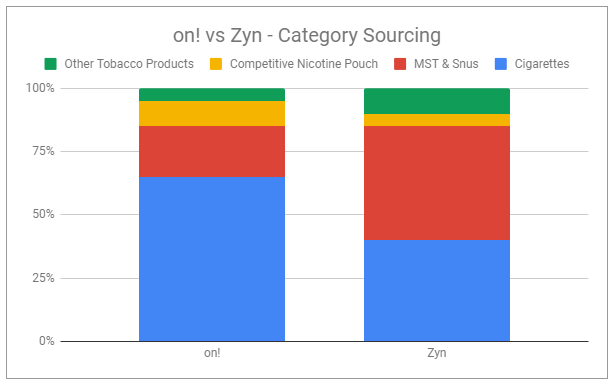

on!’s ONP retail share in the last quarter of 2020 was 10.8% and increased to 21.6% in Q4 2021. Despite the continued success of on!, Zyn is still the most dominant oral nicotine pouch in the United States. Zyn’s ONP retail share shrunk from 74.8% in 2020 to 65.3% in 2021.

One obvious criticism of on! is that Altria has largely focused on promoting sales using promotions such as steep discounts with the purchase of multiple cans, driving on!’s ASP 30-45% below Zyn. I believe that to be an appropriate tactic to gain retail share in a nascent category, especially since Altria can easily afford to effectively subsidize on! sales with price hikes on their legacy MST brands. Promoting the purchase of multiple cans has an additional overlooked benefit. Purchasers trying an oral nicotine pouch for the first time will tend to purchase different flavors, increasing the odds they find their preferred flavor from on! rather than bouncing between brands or writing off the segment entirely.

It remains to be seen how much retail share on! will cede if and when Altria halts promotions and even more uncertainty around their future ability to price hike on! as they do with other products. Additionally, there are looming concerns around future regulation and tax treatments for the category. Even with so many unknowns, aggregate data suggests Zyn and on! both are high-quality products. It appears the future TAM of oral nicotine pouches is underestimated, and multiple products can and will succeed.

Next Generation - Heated Tobacco Products (HTP)

Poda

On May 13, 2022, Poda Holdings, INC. announced its entering into a definitive agreement with Altria subsidiary ALCS in which they have agreed to sell ALCS substantially all assets and properties, including associated patents and certain licenses on those patents for an approximate sum of $100.5 million.

Poda develops, manufactures, and markets multisubstrate heated capsule technology. ‘Beyond Burn’ Poda Pods are tobacco-free and contain a mix of pelletized tea leaves infused with synthetic nicotine. The pods are inserted into a device that heats the contents without burning them, creating an aerosol, providing a sensory experience similar to traditional cigarettes but without smoke or ash. The capsules are propriety, single-use, biodegradable, and are designed to eliminate cross-contamination and cleaning requirements of the heating device (a common pain point expressed by users of other HTP products). The underlying technology is fully patented in Canada and is patent pending in over 60 other countries.

Currently, Altria has an exclusive license to sell and distribute in the United States through 2024 Philip Morris International’s IQOS, another heated tobacco product. IQOS, first launched in Japan in 2016, was introduced into the U.S. in 2019 and is presently the only HTP that has received both PMTA approval and an MRO, with the FDA citing that switching completely from cigarettes to IQOS would significantly reduce exposure to harmful or potentially harmful chemicals. However, after an ITC ruling at the end of 2021 that found IQOS infringing on multiple patents held by R.J. Reynolds, an injunction was issued, preventing IQOS imports. Legal pathways around the injunction are difficult, and PMI’s two primary options are to either redesign the product to avoid the infringed patents, or produce IQOS within the United States, avoiding the need to import entirely. PMI has stated they believe IQOS sales will resume as early as the second half of 2023. It also remains uncertain if they will renew their exclusive licensing deal with Altria.

It’s worth noting that Poda has said the Poda Pods could be designed to contain any proprietary blend, allowing the single device to support future changes to consumer needs and preferences and multiple use cases. Provided there are no surprises; it will likely take several years to see Poda and Poda Pods become commercially available in the United States.

Globally, the HTP (also called heat-not-burn or HNB) space is fast-growing and, like oral nicotine pouches, has an extremely long (multi-billion dollar) runway, despite raising a long list of questions around risks and regulation. The HTP space presents an interesting opportunity, but I feel the need to curb my enthusiasm. While HTP products have quickly been popularized in other parts of the world, it may be difficult to win over U.S. adult consumers as ENDS are already widely popular.

Altria Strategic Investment Specifics

Anheuser-Busch

(9.96%, Public, NYSE: BUD) 197,457,354 shares

Miller Brewing Company was founded in 1855 and was family-owned until being sold to W. R. Grace and Company in 1966. Three years later, Altria (then Philip Morris) outbid PepsiCo to acquire the company for $130 million. In 2002, South African Breweries (SAB) bought Miller from Philip Morris, using $2 billion in debt and $3.6 billion in stock, giving Philip Morris 24.99% voting rights and a 36% ownership stake in the new entity SABMiller. In 2015 Anheuser-Busch InBev finalized an agreement to acquire SABMiller for $107 billion. The deal necessitated the selling of their ex-U.S. MillerCoors interests to Molson Coors, leaving intact rights to all MillerCoors brand operations in the U.S. and Puerto Rico.

Anheuser-Busch InBev currently trades on the NYSE under the ticker BUD. Altria’s interest of 197,457,354 shares equates to approximately 9.96% of the total market cap and is worth close to $10.5 billion. The AB deal created a lockup period for Altria, which expired on Oct 10th, 2021. Altria has had a long history of receiving substantial dividends from its brewing investments, but the InBev-SABMiller merger saddled the new company with significant debt, forcing the company to cut its dividend multiple times to focus on balance sheet health, compounded by the macro impacts of COVID-19.

Despite the lockup period ending, Altria’s management has not indicated an interest in selling their ABI position, although they have stated they are keeping their options open. Selling isn’t straightforward as it would bring tax implications, but it does present Altria with additional financial flexibility. There is also the distinct possibility that when AB InBev stabilizes its finances that they reincrease the dividend, providing Altria with an additional steady stream of cash.

JUUL

(35%, Private)

In 2017, Juul Labs, Inc was spun out from Pax Labs. While vaping was already gaining traction in the United States, JUUL experienced a meteoric rise in popularity, leading to a dominant retail share. As mentioned in the regulatory section of this writeup, JUUL was facing significant pressures and looked to Altria to assist them in navigating their legal and regulatory challenges, especially regarding underage use.

In late 2018, Altria bought a 35% stake in Juul Labs for $12.8 billion. It was clear Altria was concerned with competition eating into the smokable segment. The deal required Altria to shutter its MarkTen brand, despite having a >10% vaping market share at the time. The FTC sued in 2020 to break up the deal with a suit citing anti-competitive laws, which was later dismissed by a federal judge.

Since Altria’s investment, JUUL use amongst the underaged has fallen considerably, outpacing underage use of ENDS broadly. Even after large fines and settlements, the company continues to face massive legal pressures, despite the fact that the company changed many of its business practices, including willfully removing the majority of its popular fruit flavors and stopping all broadcast and digital product advertising in the United States. Adoption outside of the U.S. has been a muted struggle, JUUL’s U.S. market share has been steadily declining, and the impact of future legal issues and additional regulations focused on ENDS remains uncertain.

Altria’s investment in JUUL has been brutal for shareholders. Since the initial time of investment, Altria has written down the value of its stake multiple times, falling from an initial $12.8 billion to a present $1.6 billion. It’s worth noting that if Altria’s JUUL investment falls below 10% of its initial value ($1.28 billion if you don’t have a calculator handy) or if JUUL is prohibited from selling e-cigarette products in the U.S. for at least a year, Altria is allowed to re-enter the vaping market with MarkTen or other owned brands. There is also a possibility that Altria will move to purchase the remaining 65% of JUUL in the future.

In July 2020, JUUL submitted PTMAs for its JUUL Device and four JUULpod SKUs, which are still pending with the FDA.

Cronos

(42%, Public, TSX:CRON, NASDAQ: CRON) 156,573,537 million shares

In 2019, Altria acquired a 45% equity stake in Cronos Group Inc, a Canadian cannabinoid company. The deal also provided Altria warrants to increase their ownership by another 10% over four years. Since its initial investment, Altria’s stake has been diluted to 42%.

From Altria’s website:

This investment positions Altria to participate in the emerging global cannabis sector, which we believe is poised for rapid growth over the next decade. It also creates a new growth opportunity in a category that is adjacent and complementary to our core tobacco businesses.

From the Cronos Group website:

Committed to building disruptive intellectual property by advancing cannabis research, technology and product development. With a passion to responsibly elevate the consumer experience, Cronos Group is building an iconic brand portfolio. Cronos Group’s diverse international brand portfolio includes Spinach®, PEACE NATURALS®, Lord Jones®, Happy Dance® and PEACE+™.

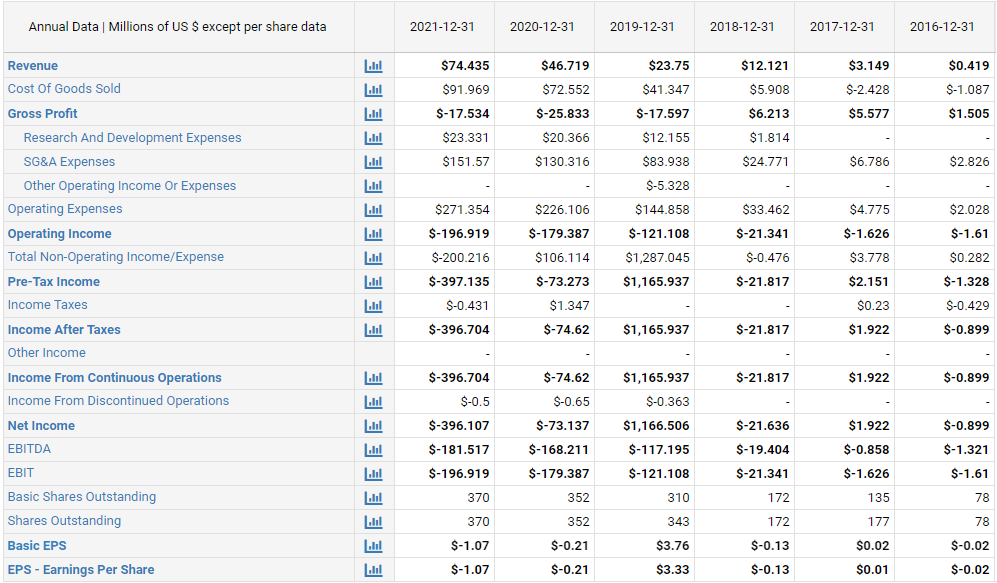

Cronos Group’s financials raise the question of how they will reach profitability, and is reflected in the drop in the value of Altria’s “strategic” investment, which has decreased from the initial $1.8 billion to approximately $427 million today.

Cannabis became legalized and regulated in Canada in 2018 but remains illegal on a Federal level in the United States. Altria remains somewhat secretive concerning its complete cannabis roadmap, but we are witnessing more unfold. Altria has been working with various lobbying groups for the last several years to raise support for federal legalization and also holds several patents concerning cannabis vaporization and use.

More recently published on their website:

We support a comprehensive federal framework for all cannabis products that is based on science and evidence, and we're hopeful that there will be a fully legalized and federally regulated THC cannabis market for adults 21 and over.

Public support for the federal legalization of cannabis is growing in the United States, but there are still substantial hurdles to overcome. I make no assumptions on if or when it will occur but have come to appreciate that Altria is well-positioned to take advantage if it does.

Management and Culture

Executive Leadership

Gifford Jr., William F, CEO & Director

Mancuso, Salvatore, Executive VP & CFO

Begley, Jody L., Executive VP & COO

Whitaker, Charles N., Senior VP, Chief Human Resources Officer & Chief Compliance Officer

Garnick, Murray R., Executive VP & General Counsel

Newman, Heather A., Senior VP & Chief Strategy and Growth Officer

Magness, Paige, Senior Vice President of Regulatory Affairs - Altria Client Services LLC

McCarter J.D., Bob, Senior VP & Associate General Counsel - Altria Client Services LLC

Leadership

“I try to invest in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.” - Warren Buffett

In early 2020, Altria announced CEO Howard Willard would be stepping down after spending 28 years with the company. There wasn’t much opposition after multiple billion-dollar writedowns on the JUUL investment and losses related to Cronos Group. He was replaced by William “Billy” F. Gifford Jr.

Billy, as then-CFO, must have had a hand in both investments that saddled the company with billions in extra debt and seemingly not much to show for it. This should be somewhat alarming to anyone with a pulse.

Everything is always so damned clear in hindsight. Or is it?

Billy worked his way up at the company since joining as an accountant in 1994. He’s loyal, committed, and understands the ins and outs of the business. And to play devil’s advocate (perhaps poorly), when the JUUL and Cronos investments were made, it looked like vaping was going to crush the cigarette market, and Canadian cannabis was red hot.

I don’t want to give anyone a pass. Regardless of the strategic merits of the investments or what they may grow into in the future, it’s clear that Altria overpaid. To take an alternate perspective, I think it speaks to the strength of the underlying business and balance sheet. While Altria’s total debt more than doubled, it’s been easily serviceable, and debt ratios have come down since. As of Q1 2022, Altria has an interest coverage ratio of 10.5x, an Altman Z Score of 3.75, and is nowhere near the most levered in the tobacco space.

Has leadership learned from the past? Their acquisition strategy seems to have shifted from homerun attempts to hitting singles, doubles, and the occasional steal, all while remaining committed to returning capital to shareholders.

Headcount

Excerpt from About Altria - At-a-Glance:

Our tobacco companies – which have been the undisputed market leaders in the U.S. tobacco industry for decades – include some of the most enduring names in American business.

Altria’s dominant market share does not change the fact that the core business is in a secular decline. Beyond price hikes, the company has battled decelerating legacy volumes by trimming headcount by 40% since 2009. For comparison, in the same timeframe, Philip Morris International has reduced its headcount by ~10%,

Surely, declining volumes allow for trimming one’s footprint, and improved operational efficiencies widen margins, but how sustainable is this? It should be cautioned that Altria may eventually reach a headcount floor, removing one of the many levers they use to maintain and increase profitability. Or, worse yet, they could continue to cut past the optimal floor, leading to operational inefficiencies or negative impacts on product quality.

Tobacco Taxation

Historically, the taxing of tobacco has been as popular as people using tobacco. Currently, the U.S. federal government taxes tobacco, as do all 50 states, the District of Columbia, and hundreds of different towns, counties, and municipalities.

Federal tobacco taxes have existed since the Civil War. Between the mid-19th century and the 1980s, the federal government taxed tobacco based on the fiscal needs of the government, with high fluctuations between war and peace times. The federal excise tax on tobacco has increased from $0.24 per pack in 1995 to $1.01 in 2009, where it has remained as of the time of this publishing.

State-level tobacco excise taxes vary significantly in rates and frequency of increases. Unsurprisingly, tobacco-producing states tend to have lower excise taxes than non-producing states.

In 2021, the average smoker paid $1.01 in federal excise tax, $1.91 in state excise tax, $0.66 in master settle costs, and $0.36 in average state sales tax, for a total of $3.94 per pack.5

Future Tax Increases

Tobacco Tax Equity Act

In 2021, the Tobacco Tax Equity Act was proposed, which aimed to raise funds to help cover the costs of a federal infrastructure bill. It would double the federal tax on cigarettes and increase taxes on pipe tobacco, roll-your-own tobacco, and dipping tobacco between 100% and 2000%. While ENDS products are not currently taxed at the federal level, the act proposes introductory taxes that would tax such products in line with cigarettes. Taxes on products with MRO authorization and deemed “appropriate for the protection of public health” would also see substantial tax increases ranging from 100%-2,892%. Talks on this proposal have largely stalled out, and concerns have been raised that such tax increases may shift users back towards traditional combustible products.

Other Proposed Taxes

Tobacco excise tax proceeds are earmarked for a variety of government projects and have sufficiently demonstrated their ability to curb underage use. Notwithstanding, there are concerns often cited:

Tobacco taxes are agued to be a regressive tax that disproportionally affects low-income demographics

Raising tobacco excise taxes at inappropriate rates may shift consumers towards illicit sources and promote black market activity.

While it is impossible to map out the rate at which tobacco excise taxes will increase, we should expect to see increases at the federal, state, and local levels over time. Altria, with a robust offering of premium products, will be best able to weather this with its best-in-class pricing power.

Other Risks & Considerations

Macro

We can add today’s unique environment to the list of countless tumultuous economic periods throughout history. Specific measures indicate an economic slowdown, but unemployment is remarkably low. Above-average inflation paired with extremely high gas prices is worrisome. Wage growth has not kept up with inflation broadly. Housing expenses are alarming. There are real concerns that have real impacts on real people.

But macroeconomic forecasting is laughably difficult.

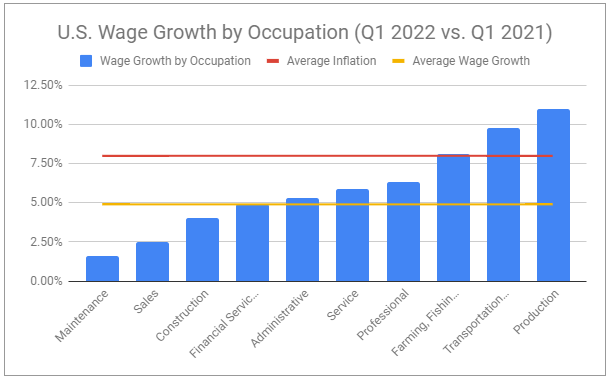

Fortunately, for Altria, that doesn’t seem to matter much. If you look at history, you will see that throughout all economic cycles, periods of heightened inflation, booms and busts, war, peace, and more, tobacco equities have been resilient. Inexpensively produced addictive products that have a loyal consumer base that is less sensitive to price increases are a de-facto hedge against inflation. There will always be an ebb and flow between premium and discount brands, but it’s worth remembering that when things get really ugly, people have an overall tendency to lean on their vices more, not less. Additionally, Altria cited in their most recent quarterly presentation that wage growth in occupations that have higher smoking rates is actually increasing in line or above broad inflation.

COVID-19 Impact

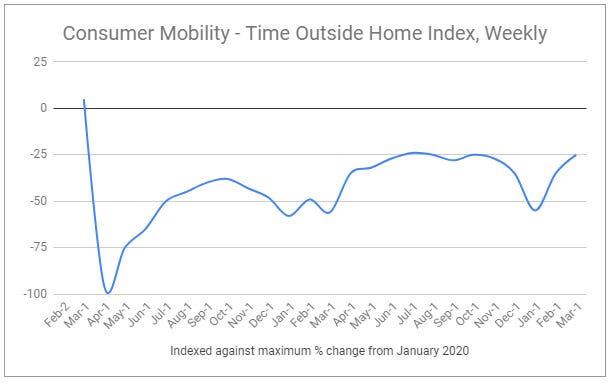

Adult tobacco consumers were not spared from feeling the economic impacts of COVID-19 and, as a result, changed their purchasing patterns. Consumers made shopping trips less frequently but began making larger purchases, with an increase in multi-pack and carton sales. There was also a noticeable uptick in adult users shifting from vaping back to traditional cigarettes. COVID-19, unsurprisingly, also significantly affected social behaviors, leading to a sharp decrease in social engagements amongst tobacco product users. This weakness has largely abated in the United States, though it is something to remain mindful of.

Overall, cigarette volumes became a net beneficiary during 2020, with declines being substantially less than in previous years.

Furthermore, a tailwind that continues to be underappreciated is the shift toward working from home. WFH policy prevalence skyrocketed during COVID-19 and will likely turn into a long-term secular trend. We are witnessing many companies shifting toward WFH or hybrid work policies, as well as an increasing willingness to hire remote workers. WFH and remote work increases tobacco product usage occasions and may promote polyuse across product categories.

Deglobalization and Supply Chain Constraints

COVID-19’s cascading effects threw global supply chains into turmoil. This, along with the horrors of the Russian invasions of Ukraine plus continued buffoonery in the geopolitical realm, has raised widespread speculation about potential deglobalization.

I don’t exactly know where the world is heading, but I do know that Altria’s primary operations have limited exposure to factors outside of the United States. Of course, with such an interconnected world, no company is immune to exogenous shocks. Altria’s investment in AB InBev holds their greatest exposure. But overall, Altria should fair better than most. This is especially true when the U.S. dollar is showing incredible strength vs. other global currencies.

Competition

The next generation of nicotine products is still in its infancy and is a relatively small part of the overall tobacco profit pool, but its growth should continue to put pressure on legacy products. And while Altria has an exceptional track record of dominating legacy segments with premium brands, there is no guarantee that repeat success will be achieved with new products.

JUUL is losing market share to BAT’s products.

on! is growing using steep discounts but is still dwarfed by Zyn.

Altria may lose its exclusive U.S. IQOS deal, and Poda isn’t commercially available.

There is also a large looming threat from Philip Morris International, who in May 2022 announced a public cash offer to Swedish Match’s shareholders. If fully executed, the deal could accelerate PMI reentering the U.S. space with IQOS without Altria, as well as enhance the resources available to Swedish Match to continue to dominate with Zyn and possibly expand offerings in the United States.

Future Regulation

An opinion on tobacco, one way or another, is an opinion on regulation.

While I have presented multiple points highlighting that regulation has been a core value driver for Altria, there is no concrete rule saying that it must continue. The company has expertly waded through the legal and regulatory waters for decades, but maybe, just maybe, a monster wave will come.

What would it take to definitively crush Altria’s profitability? Immense restrictions on point-of-sale displays? The banning of branded packaging? Perhaps it will be the rule proposed by the Biden administration this weekend that would minimize allowable nicotine levels in cigarettes.

It’s incredibly difficult to assess the odds of any of these actually happening, as well as the complete impact if they were to occur. As a counter to these worries, look at what is currently unfolding in the regulatory space:

Brian King, who has over twelve years of experience working at the CDC, has been selected to become the new director of The Center for Tobacco Products (CTP). Previously, he led the CDC’s evaluation of EVALI and looks partly responsible for wrongly linking the outbreak to nicotine vaping. Publicly, he remains extremely critical of new forms of nicotine products. This is the man who will be responsible for overseeing ongoing reviews of Premarket Tobacco Product Applications (PMTAs).

Granted, regulatory bodies should exercise extreme caution in how they evaluate new products and propose new rules—any misstep risks losing public support and credibility. But that’s already happening. From being almost a decade late regulating ENDS and synthetic nicotine to banning the e-cig flavors adults say make it easier for them to quit traditional cigarettes, it isn’t hard to understand people’s criticism.

Historically, people underestimate how uncertain the looming regulatory environment for new products is and underappreciate the rigidity of regulation for legacy products. This point further champions the idea that Altria will more likely than not continue to weather the storm. Additionally, the FDA rulemaking process is not exactly fast:

Initiating events to consider rulemaking

Optional: Advance Notice of Proposed Rulemaking

Determination whether a rule is needed

Preparation of proposed rule (Timing undefined)

Office of Management & Budget (OMB) Review

Optional: Tobacco Products Scientific Advisory Committee Review

Publication of proposed rule

Public comments on proposed rule

Preparation of final rule

OMB Review

Publication of final rule (Mandatory 1 year delay for implementation period)

Legal challenges, if deemed appropriate

For most rulemaking, this adds up to a multi-year chain of events, and that’s prior to being challenged legally.

The Greatest Risk

“'Cause what you see you might not get

And we can bet, so don't you get souped yet

You're scheming on a thing that's a mirage

I'm trying to tell you now, it's sabotage”

-Beastie Boys. "Sabotage."

For more than half a century, tobacco companies have been keenly aware of the existential peril presented by declining volumes in their core business. But, as history has shown, the greatest risk to these companies is not the threat itself but rather how they attempt to overcome that threat. From Altria overpaying for stakes in JUUL and Cronos, British American Tobacco’s fervent diversification in the 1960s, to the theft-like actions at RJR Nabisco and the subsequent LBO, tobacco companies are experts at self-sabotage. You could argue that this is overly critical, as there have also been wonderfully accretive investments made by tobacco firms. Nonetheless, the risk remains. Any great business can become a terrible investment if management dreams big enough and has the willpower to follow through on a few half-baked ideas.

Valuation & Pricing

Intrinsic Valuation

A two-stage unlevered discounted cash flow model was used to value Altria.

Key assumptions:

PM USA cigarette market share will remain relatively stable as consumer spending narrowly fluctuates between premium and discount brands throughout economic cycles.

The trend in cigarette volume declines will persist.

Price hikes and cost savings will partially offset legacy volume declines.

Partial cannibalization will occur, pushing consumers to other products such as ENDS and oral nicotine pouches.

The above dynamics will cause operating margins to expand steadily.

These are expressed via the following inputs:

ROC and WACC will remain stable.

The company will continue minimal reinvestment to maintain low growth.

During the ten-year period, net revenue will grow at the 12-year average of 1.11%. It will drop to 1% in the terminal period.

EBIT Margin will expand by a relative .84% each year for ten years before contracting to 2020 levels in the terminal period.

The tax rate will be 25%, in line with management guidance.

These adjusted inputs reflect the uncertainty surrounding price, volume, product shifts, and related dynamics–especially EBIT margin, which should become increasingly harder to raise at the same rate over time.

The DCF model:

Reflects Altria's 2021 $1.2 billion sale of its subsidiary Ste. Michelle Wine Estates in operations and capital structure.

Applies zero value regarding marijuana, despite Altria's substantial investment in Cronos Group Inc., multiple patents concerning the use and vaporization of THC and CBD, and the company’s growing lobbying efforts to legalize recreational marijuana at the federal level.

Recognizes no material value in Altria’s JUUL investment and does not factor in potential future state-level actions against JUUL, a possible national settlement agreement, or related lawsuits.

Applies no specific values to potential or anticipated future regulation.

Assigns zero value to a possible continued agreement to distribute and sell Philip Morris’s IQOS in the United States and assigns no material operational impact from the acquisition of Poda.

Net revenues are defined as revenue minus excise taxes. Ex-U.S. revenues are excluded as they are immaterial.

This is a rather bare-bones unlevered DCF, with assumptions placed that are reasonable, practical, and paint a very undemanding scenario.

When you start going out of your way to add extra decimal places, line items, and premises, all you end up with is false precision. You also tend to start spending time focused on things that don’t move the needle and lose sight of what does. It’s far easier to paint with a conservative brush in an attempt to be directionally correct. If successful, the rest will be taken care of as the future unfolds.

Just how tame is this model?

EBIT growth and EBIT margin expansion rates for the next ten years are around half of what has been experienced over the last ten.

The substantial drop in EBIT margin in the terminal period is a proxied expression that—whether competition heats up, new products struggle, pricing and cost savings fail to offset excise tax increases, or something else—there will be hardships in the future.

Along with factoring in zero value to JUUL, IQOS, and Poda, Altria’s equity investments in BUD and CRON have been aggressively marked down by 30%.

There is no illiquidity discount, and no idiosyncratic risk discount was applied. While Altria operates in a unique space, it feels inappropriate to discount factors that have largely been a benefit to the company.

If you protest discounting by the 6.3% WACC and want to use a steeper hurdle rate of 9%, the implied value per share would still be above the current share price. With an implied value per share of more than 60% above the current share price, this model suggests a substantial margin of safety.

Relative Valuation

It’s worth assessing Altria relative to its peers. You could compare it to other low-beta consumer staples, but that would fail to account for the unique dynamics of the tobacco space. With the consolidated nature of the tobacco industry, there isn’t a terribly large dataset to compare. This is made more difficult by the fact that many of the publicly available tobacco names either have extremely small footprints or are more directly linked to tobacco as a commodity and not marketable consumer goods. For these reasons, the following companies were excluded from the analysis:

Vector Group Ltd. (NYSE:VGR)

Turning Point Brands, Inc. (NYSE:TPB)

Charlie's Holdings, Inc. (OTCPK:CHUC)

Healthier Choices Management Corp. (OTCPK:HCMC)

VPR Brands, LP (OTCPK:VPRB)

Universal Corporation (NYSE:UVV)

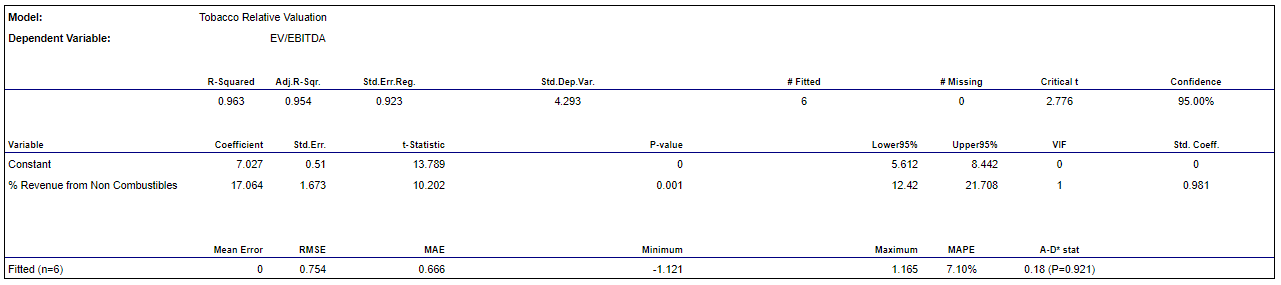

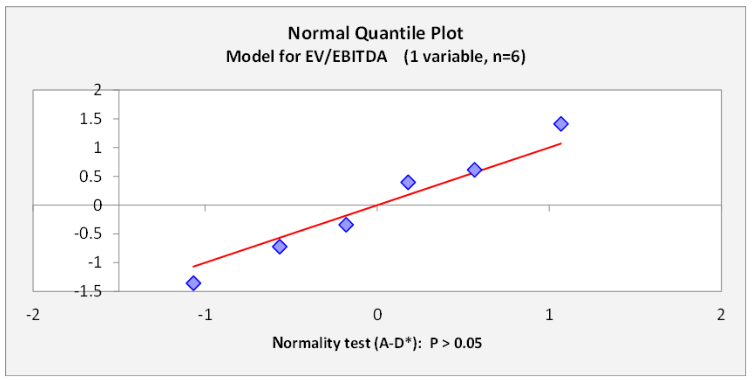

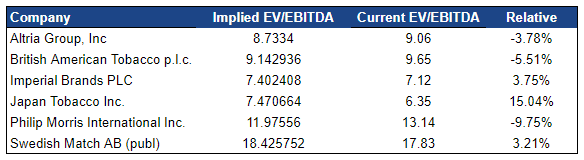

With only five companies remaining to compare to Altria directly, I decided to run a simple regression normalizing the current EV/EBITDA for each company relative to the percentage of their revenue derived from non-combustibles in 2021.

The resulting regression equation:

7.027 + 17.064 (% Rev from Non-Combustibles)

This gives Altria an implied EV/EBITDA of 8.7334 - not far off from the current multiple of 9.06.

It’s also worth noting that Swedish Match’s EV/EBITDA was approximately 13.77 prior to PMI’s cash offer to shareholders. And you have to keep in mind that, with a simple regression off such a small dataset, we aren’t going to get the full picture. It makes sense to evaluate a wide variety of operating statistics and identify what you find most important and not necessarily what the market currently values most.

Why are tobacco names nearly all at lower multiples relative to history? Along with the risks already covered in this write-up, the rise of ESG along with active management consciously rejecting exposure has led tobacco multiples to contract.

I find this of no concern.

The market must clear. For every seller, there must be a buyer. At the end of the day, someone is going to own shares of Altria. The question always remains, “at what price?'“

I have no interest in assuming Altria will experience multiple expansions and concede that continued multiple compression is a real possibility. If the underlying operations continue to succeed, there should be ample cash flows to pay an increasing dividend while also engaging in buybacks if management deems appropriate.

And although the tobacco sector may appear undervalued as a whole, I encourage you to dive deeper into each name to better understand them on both individual and relative bases. It’s also worth reiterating that if Philip Morris’s acquisition of Swedish Match finalizes, potential additional competitive pressures may change relative valuations significantly.

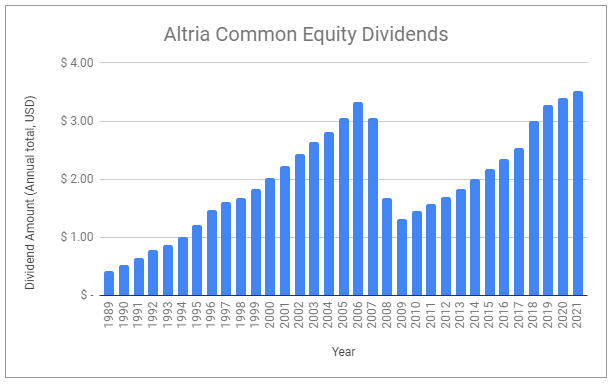

Simplified Approaches to Value and Pricing

Altria targets an 80% payout ratio of adjusted diluted EPS and has increased and paid a dividend for more than fifty consecutive years. The only ‘decreases’ in payout were in 2007 and 2008 when the company spun off its stake in Kraft and interest in Philip Morris International to shareholders. In fact, Altria’s FY2021 dividend of $3.52 was $.20 greater than the 2006 dividend before the divestments.

Between 2017-2021, Altria has grown its adjusted diluted EPS at a CAGR of ~7.9%. In a recent statement, the company reaffirmed full-year guidance:

We reaffirm our guidance to deliver 2022 full-year adjusted diluted EPS in a range of $4.79 to $4.93, representing a growth rate of 4% to 7% from an adjusted diluted EPS base of $4.61 in 2021.

Average Historical Yield Pricing

Since 2009, the year after the PMI spinoff was finalized, Altria has paid an average quarterly dividend yielding 1.44%, equating to an annual yield of 5.76%. At a current share price of $48.94 and a quarterly dividend payment of $.90, Altria’s current yield is 7.35%. If you were to argue that Altria’s prospects have remained unchanged and that Altria’s yield should be in line with the average, you would get a share price of $62.44.

This math is simple to do, and the result is simply worthless.

Altria’s prospects may look unchanged or even improved from gaining clarity with passing time since the TCA became law in 2009. But this does not change the fact that such a simple approach fails to account for fundamentally important factors such as debt, equity investments, the risk-free rate, or anything else for that matter. To focus strictly on yield is a fool’s errand, and playing pricing games in this context isn’t any more helpful.

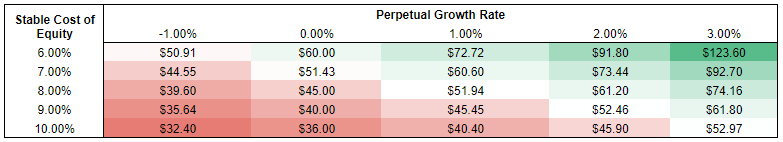

Gordon Growth Model (GGM)

The Gordon Growth Model approximates the value of a company’s shares by assuming constant growing dividend payments. While Altria’s dividend track record is impressive, it’s up to you to decide how likely future payments are.

g = Perpetual growth rate

r = Stable cost of equity (hurdle rate)

D1 = Value of next year’s dividends

P = Current stock price

Despite Altria continually growing adjusted earnings and its dividend higher than 4%, the perpetual growth rate of a business can never be higher than the growth rate of the economy. Therefore, perpetual growth should be theoretically capped at ~3%. Take your assumed growth rate and the current annual dividend rate of $3.60, grow it, and discount it by the denominator (hurdle rate), and your result will be somewhere in a wide range.

Lining up the DCF input assumptions with the GGM would narrow down the outputs to between a 7-9% stable cost of equity and a 2-3% perpetual growth rate, giving an implied share value between $52.46 and $92.70. Such a simple approach isn’t going to build substantial conviction, but it’s certainly better than only comparing to historical yield.

Closing Thoughts

Conclusion

It’s refreshing to reevaluate a business’s potential to remain wildly profitable at a time when much of the market seems fixated on other operations that may never become profitable at all.

I first purchased shares of Altria in 2010—a time when it was one of only a few companies I felt were attractively priced and whose operations and prospects I could understand. Despite all that has changed in the world since then, my core thesis has remained intact.

Regulation is a primary value driver for Altria—at least for now.

Thank you for reading

If you found this write-up valuable, I’d appreciate you sharing it with others.

And show your support by subscribing and never miss a future article.

If you found an error, believe I’ve omitted something critical, or have questions or feedback, please leave a comment below or reach out on Twitter @DevinLaSarre.

Ownership Disclaimer

I own positions in $MO, as well as other tobacco companies such as British American Tobacco and Philip Morris International.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Relative Harm Perceptions of E-Cigarettes Versus Cigarettes, U.S. Adults, 2018–2020, Priti Bandi PhD, Samuel Asare PhD, Anuja Majmundar PhD, MBA, NigarNargis PhD, AhmedinJemal DVM, PhDStacey A.Fedewa PhD

The US Cigarette Industry: An Economic and Marketing Perspective, 2020, David Levy, PhD, Frank Chaloupka, PhD, Eric N. Lindblom, JD, David T. Sweanor, J.D., Adjunct Professor, Richard J. O’Connor, PhD, Ce Shang, PhD, and Ron Borland, PhD, Nigel Gray Distinguished Fellow in Cancer Prevention

Altria CAGNY 2022 presentation, slide 23

Altria CAGNY 2022 presentation, slide 5

Analysis of Federal Proposal to Increase Tobacco and Nicotine Product Taxes, Tax Foundation

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑

Jesus christ, what a write-up, gonna share this on Sunday, thanks.

This is a great write-up; I largely agree with everything here. Only issue I worry about is management. You touched on it in risks, but it's a bigger concern than one paragraph. This is a company that's been run by the same group of insiders for decades. They're fantastic at running a cigarette company. There's no evidence that they have any clue how to do anything else. Every Altria bull-case relies on assuming that they'll be able to capitalize on their position. Which I agree is very strong. They *should* have an easy path to transition into the new product areas you talked about. But capitalizing requires making good decisions. So far, that hasn't happened. If they'd done one thing to indicate that they have a coherent forward-looking strategy beyond "fuck it, we've got 100 billion dollars, we'll figure it out" MO would be like 40% or more of my portfolio right now.

Basically, the question is whether Altria is Yahoo or Microsoft. Right now it looks ominously like Yahoo.