“Notice the small things. The rewards are inversely proportional.” - Liz Vassey

Company Overview

United-Guardian is the smallest, most profitable company you've never heard of.

Founded in 1942, the company researches, produces, manufacturers, and markets a mix of products, including:

Cosmetic ingredients

Pharmaceuticals

Medical & health care products

Proprietary industrial products

United-Guardian (UG) has formed marketing and supply agreements with partners around the world, presenting unique opportunities for growth. This is further amplified by the company’s R&D efforts, which aim to not only formulate new products but identify new uses for their existing portfolio. Continued operations are extremely profitable while being very capital-light, allowing the company to generate substantial free cash flow it eagerly returns to shareholders.

The company’s corporate headquarters are in Hauppauge, New York, United States. Shares trade on the NASDAQ under the ticker UG. Presently, the company has a market cap of ~$57.3 million, has no debt, and as a microcap, seemingly has no current analyst coverage.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Investment Thesis

United-Guardian is a durable business run by extremely conservative management. The company has a fortress balance sheet and has reported positive net income every year since 1991. Furthermore, the company’s microcap status offers several contrasting dynamics:

The company is so small that it receives nearly zero coverage.

Its size, paired with its reliance on a small number of key customers, makes the company especially susceptible to fluctuations in macro conditions.

A key niche market the company operates in carries huge potential costs for new entrants, insulating UG from competition.

A series of events over the last decade may be masking the company’s long-term potential, and recently, the company’s equity has reached an extremely compressed multiple relative to history.

Management’s interests are heavily aligned with shareholders, with the CEO owning over 25% of outstanding shares, and while total growth prospects remain uncertain, continued operations are very capital-light, allowing nearly all generated cash to be returned to shareholders.

As an illiquid microcap, a mix of unique catalysts could present an exceptional opportunity to buy into this highly cash-generative business.

Industry Overview

Cosmetic ingredients, pharmaceuticals, medical & health care products, and proprietary industrial products are all highly-competitive spaces.

Major companies in cosmetic ingredients include BASE, Croda, Evonik, Clariant, Dow, Symrise, Lubrizol, Ashland, Schimmer & Schwarz, and Gattefossé.

Major companies in pharmaceuticals include Johnson & Johnson, Novo Nordisk, Roche, Novartis, Eli Lilly, Pfizer, GlaxoSmithKline, Merck, Bristol Myers Squibb, Sanofi, Bayer, and AstraZeneca.

Major companies in medical & health care products include Medtronic, Johnson & Johnson, Abbott, Philips, GE Healthcare, BD, Siemens Healthineers, Cardinal Health, Stryker, and Baxter.

All of the companies listed above are sharks, and relative to them, United-Guardian is a minnow.

In a different sense, United-Guardian is more of a remora - a fish that lives in symbiosis with otherwise would-be predators. In fact, UG’s largest marketing partner is Ashland (listed above), which is responsible for facilitating a substantial of the company’s cosmetic ingredient sales and providing substantial opportunities outside of the United States.

To continue with the oceanic analogies, I view United-Guardian’s size as a strength, not a weakness. Like a small fish, it’s able to dive into the cracks and crevices of niche markets for profit and protection alike and focuses on developing and producing products that fill unmet needs in the market, hold unique properties, and use proprietary technology. Additionally, even if caught by a predator, UG might be swallowed and not killed—there is a chance this company becomes a prime target for acquisition or activism.

Operations and Segment Specifics

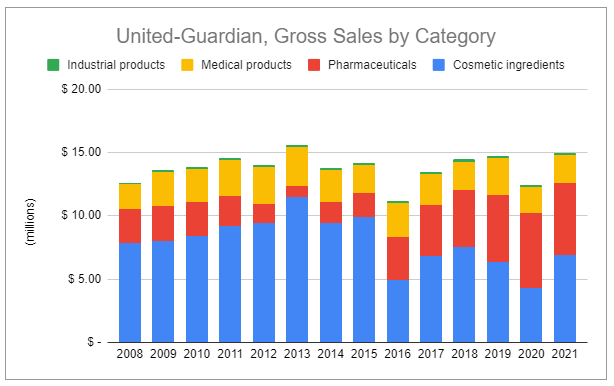

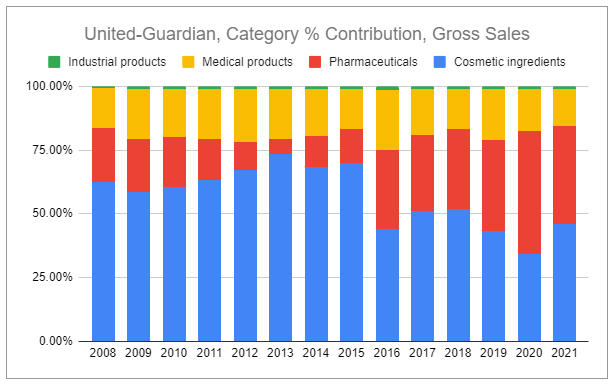

United-Guardian’s 50,000-square-foot facility in Hauppauge, New York serves as its principal office (30% of space), factory (60% of space), and research facility (10% of space). The facility is located on a 2.7-acre parcel that the company owns outright. UG’s products include cosmetic ingredients, pharmaceuticals, medical products, and specialty industrial products, however, the vast majority of sales and profits are generated from two product lines:

LUBRAJEL - (60% of 2021 gross sales) a key ingredient in cosmetics and medical products.

RENACIDIN - ( 34% of 2021 gross sales) the company’s leading pharmaceutical drug.

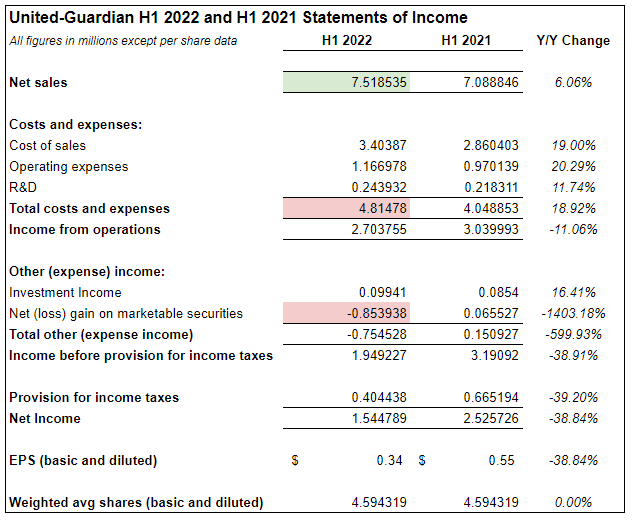

United-Guardian has shown very mixed results for H1 2022. Net income was significantly lower than a year prior—down a whopping 39%! This should raise eyebrows. However, there are several critical points to take into account:

A large part of the decrease in profitability was due to higher raw materials and shipping costs, but beginning in April, UG began to implement price increases across products to help offset these headwinds. While there is no clarity on when (or if) macro headwinds will ease, continued pricing should help offset some of the pressure. Looking from the demand side, sales were actually up 6% year over year, with pharmaceutical sales increasing ~8% and non-pharmaceutical medical product sales increasing ~55%.

Looking deeper, it becomes apparent that reported net income was not solely impacted by operating headwinds. United-Guardian holds a significant portfolio of marketable securities on its balance sheet. While the company recognized some realized losses from selling a portion of these positions, it also, in accordance with U.S. GAAP, recognized a substantial unrealized loss based on changes in fair value. Comprised of fixed income and equity mutual funds, the investment portfolio is unlikely to be materially impaired, and this recognition is undoubtedly a result of the selloff experienced by the broad markets.

United-Guardian has historically engaged in a number of government programs that include rebates and discount programs for its products. In October 2020, UG determined it was no longer profitable to participate in the Medicaid or 340B programs. On October 30, 2020, UG informed the Center for Medicare & Medicaid Services (CMS) and the HRSA that it intended to terminate its Medicaid Drug Rebate Agreement and its 340B Drug Pricing Agreement, effective at the end of 2020. The company stated it would continue to participate in other programs such as the Veterans Affairs FSS Program and Medicare Part D Coverage Gap Program (CGDP). This had a positive impact on FY 2021 results, and I expect this will continue to reduce sales growth but widen margins and ultimately increase profitability.

Looking simply at the topline indicates a choppy and possibly stagnating revenue base. However, I believe these may be masking the long-term potential of the business and will provide details in the following subsections.

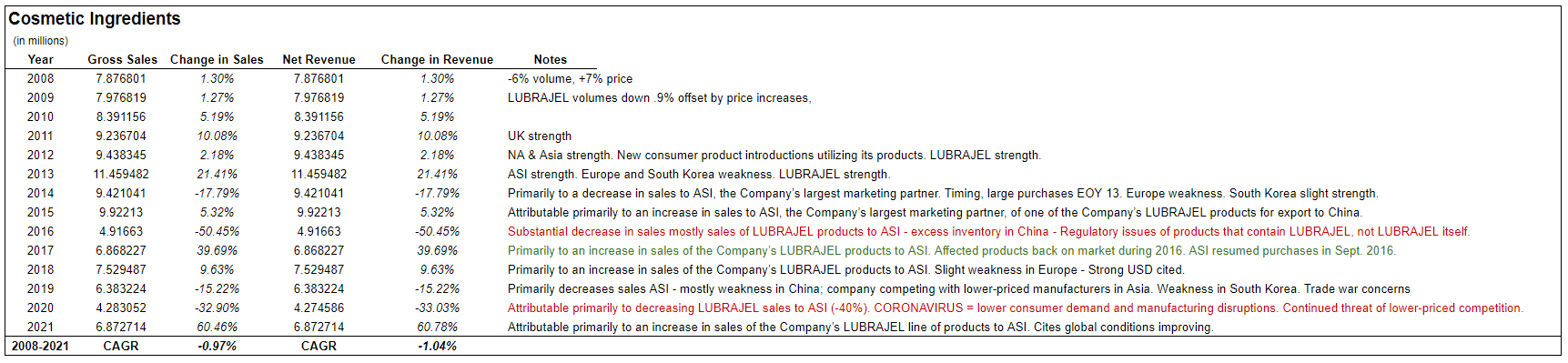

Cosmetic ingredients

(45.98% of 2021 gross sales)

The vast majority of the United-Guardian’s sales are of Lubrajel—its extensive line of water-based moisturizing and lubricating gel products. These are clinically proven to moisturize and additionally offer a wide range of textures and other qualities, leading to the Lubrajel line being used in creams, lotions, sun care products, hair gels, shaving gels, and other personal care products.

Hydrogel versions include Lubrajel CG, Lubrajel DV, Lubrajel XD, Lubrajel MS, Lubrajel NP, Lubrajel Oil, Lubrajel DV Free, Lubrajel XD Free, Lubrajel Lubrajel MS Free, Lubrajel NP Free, Lubrajel Oil Free, Lubrajel XD PF, Lubrajel MS PF, Lubrajel Oil PF, and Lubrajel PF. UG also offers a unique silicone hydrogel called Lubrasil II SB.

And more recently, further supporting the growing demand and consumer interest in natural products, UG has developed:

Lubrajel Marine

Lubrajel Natural

Lubrajel Oil Natural

Lubrajel Terra

UG’s cosmetic ingredients also include other natural products, such as:

B-122 - An additive to modify and enhance the binding properties of cosmetics such as eye shadows, rouges, cake powders, as well as tablets.

Orchid Complex OS - an oil soluble infusion based on orchid flower extract that enhances product spreadability, providing an enhanced silk smooth feel.

Recently, UG has stated that it has seen a substantial increase in product sample requests, indicating potential growth prospects. United-Guardian’s cosmetic ingredients are sold by its marketing partners to manufacturers that produce finished cosmetic and personal care products. UG ships all products Ex Works, and no sales are on a consignment basis, which results in all sales being final unless in rare cases such as product defectiveness. Partners include:

Ashland Specialty Ingredients (ASI) - U.S.

Sederma SAS - France

Azelis UK Ltd. - United Kingdom & Ireland

Azelis Deutschland Kosmetik GmbH - Switzerland

Safic-Alcan Italia S.p.A. - Italy

This is a double-edged sword.

United-Guardian substantially reduces its own costs and leverages the expertise of large players (such as Ashland). However, this limits UG’s tactical control and also introduces substantial variance in reported sales due to partner order/inventory patterns. Additionally, this approach offers a way for UG to grow its international sales, though obviously exposes the company to greater global macro factors.

Ashland Specialty Ingredients (ASI, NYSE: ASH) is by far the largest partner of United-Guardian, accounting for roughly 35% of total sales in the second quarter of 2022. Critically, substantially all purchases by ASI are shipped to ASI’s warehouses located in the U.S., and all sales to ASI are reported as U.S. sales for United-Guardian’s financial reporting purposes. However, in Q2 2022 ~75% of ASI’s related sales were to foreign customers, which China representing 46%. Adjusting for this, it becomes apparent that UG is more reliant on foreign sales than first glance suggests.

The reliance on marketing partners, customer concentration, and exposure to global macro factors are evident in the category’s historical performance. While most years show steady growth, in 2016 a product that contained Lubrajel faced regulatory issues in China (unrelated to Lubrajel). This alone led to a ~50% drop in sales for the year. Likewise, in 2020, COVID led to a ~33% drop in sales due to low consumer demand for finished products as well as disruptions to manufacturing in Asia.

Despite these setbacks, global conditions have recently improved, boosting demand. Cosmetic sales in Q1 2022 saw a 27% increase y/y, and demand was relatively strong in Q2 2022.

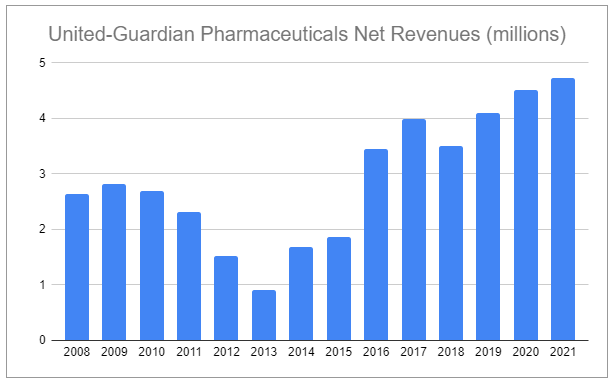

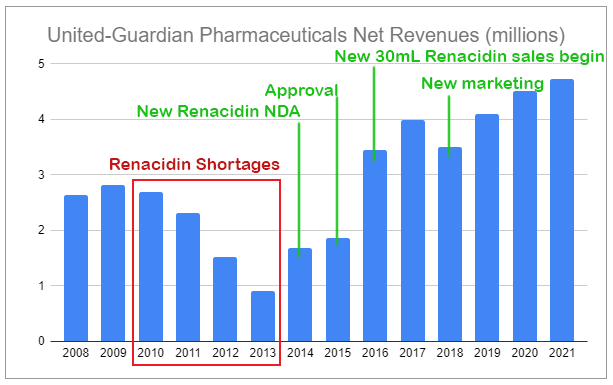

Pharmaceuticals

(38.46% of 2021 gross sales)

United-Guardian’s pharmaceuticals are manufactured by the company and are sold primarily to multiple full-line drug wholesalers who in turn sell those products to pharmacies, physicians, hospitals, long-term care providers, and other health care providers. UG covers shipping costs, and sales are final once shipped. Only in rare circumstances are products returnable, such as if they are damaged upon arrival, defective, or close to the expiration date.

The company has two pharmaceuticals, Clorpactin WCS90 and Renacidin.

Pharmaceutical product sales have been resilient, holding steady during the pandemic and increasing 6% in FY 2021 from the year prior. Sales did slightly decline in Q1 2022, but this was not due to a shortage of demand but rather a shortage of truck drivers and limited availability of shipping vessels, as significant portions of related product sales are to customers outside of the United States. Despite this recent softness, it is also worth noting that UG’s pharmaceutical sales grew not just during COVID but also through the duration of the GFC.

Clorpactin WCS90

Clorpactin is an antimicrobial used to treat infections in the urinary bladder, as well as in surgery for treating a wide range of localized infections in the peritoneum, the abdominal cavity, the eye, ear, nose and throat, and the sinuses.

Clorpactin made up approximately 4.8% of gross sales for FY 2021.

Renacidin Irrigation

Renacidin (Citric Acid, Glucono Delta-Lactone, and Magnesium Carbonate) is an irrigating solution that is used primarily to prevent and dissolve calcifications (stones) in catheters implanted in the urinary bladder. It is currently marketed as a ready-to-use sterile solution under the name RENACIDIN IRRIGATION. It currently has regulatory approval only in the United States.

Renacidin has quite the backstory, and it’s fascinating:

In the mid-1950s, Renacidin was developed by Dr. Alfred Globus, who founded United-Guardian, and beginning in the late 1950s, Renacidin was available in powder form that had to be reconstituted in a 10% solution and then sterilized prior to application. However, in the early 1960s, six deaths were reported due to a lack of standardized irrigation protocols. Following this, the U.S. FDA banned the practice of upper urinary tract stone dissolution using Renacidin. The FDA then acknowledged that it was inconsistencies in protocols and user mistakes that lead to the deaths, and not Renacidin. A few months later, the FDA approved Renacidin to “prevent formation of and to dissolve calcifications in catheters in the urinary bladder.” The ban on upper urinary tract usage remained in place until 1990 when Renacidin gained ‘Orphan Drug’ status for “treatment of renal and bladder calculi of the apatite or struvite variety (United-Guardian Inc., U.S. patent #4,962,208)”. That year, United-Guardian’s New Drug Approval was granted by the FDA for a ready-made sterile solution version of Renacidin which was sold in 500 mL glass bottles starting in 1991.

In 1971, a critical article was published on the adjuvant use of Renacidin through percutaneous nephrostomy tubes (PNT, flexible tubes placed into the kidney). This led to a rise in Renacidin usage supporting minimally invasive surgery and shockwave lithotripsy (SWL). SWL uses high-energy, short-duration shockwaves to break apart stones in the kidney and ureter, making them easier to pass. It also appears that Renacidin is a novel therapy for patients who are poor surgical candidates.

The concluding remarks from Gonzalez RD, Whiting BM, Canales BK, The History of Kidney Stone Dissolution Therapy: 50 Years of Optimism and Frustration With Renacidin. J Endourol:

The importance of Renacidin in the discovery and achievement of stone-free status for the infected stone patient cannot be overstated. Patients with complex struvite stone disease who are not cured by stone removal alone still exist. In these patients, it may be time to reconsider the role of Renacidin irrigation therapy.

Along with United-Guardian’s impressive Lubrajel line, Renacidin became a source of constant cash flow in the 1990s with the introduction of the ready-made sterile 10% solution. The previous powder version was discontinued in 1995 due to shrinking sales and the apparent superiority of the new version.

But recent history has been problematic.

Renacidin was being manufactured by a major U.S. company that in 2010 experienced regulatory issues unrelated to Renacidin. Despite no relation, this temporarily suspended Renacidin production. Issues were partly resolved in 2012, only for production to fall once again. These issues were finally resolved in 2014, and that same year, United-Guardian began to work with a new supplier and submitted a New Drug Application for a new version of the product which was smaller—a 30mL single-dose container.

Using Renacidin to dissolve kidney stones is not an indicated use for the new version of the product, as the process requires a greater volume of liquid than the new single-dose unit. The new version is used for catheter and bladder irrigation only. Relative to the previous version, it appears easier to use for patients, medical staff, and caregivers while also being more profitable on a volume basis for United-Guardian.

In 2018, United-Guardian launched a new separate website dedicated to Renacidin (www.renacidin.com). Paired with the hiring of a marketing consultant, this was the first step toward raising awareness of the product for patients and physicians alike. It’s critical to be mindful of the fact that, unlike direct-to-consumer sales, UG’s pharmaceutical business sees delayed results from these efforts. For example, patient and doctor awareness precedes a prescription, and then a pharmacy must order it from a wholesaler, and only when the drug wholesaler raises its purchase orders from UG would UG report an increase in sales.

Most important is what I consider the true moat of this portion of the business:

While the total sales and profits generated by Renacidin are impressive for United-Guardian, it is a drop in the bucket compared to the total of the pharmaceutical industry. There are competing products for certain indications, however, if potential entrants were interested in competing DIRECTLY against United-Guardian’s Renacidin brand, the associated costs and risks of doing so, especially the regulatory hurdles, are significantly greater than the potentially available profit pool.

Renacidin is unlikely to ever have a giant market share. But it doesn’t need one to contribute meaningful returns for United-Guardian’s shareholders. Increased awareness boosting sales paired with modest pricing can likely produce very impressive results. I believe that the success of the newest version of Renacidin continues to be overlooked by the market. This is a growing, highly-profitable, niche pharmaceutical that now makes up a significant chunk of sales for United-Guardian.

Again, to visualize the recent success:

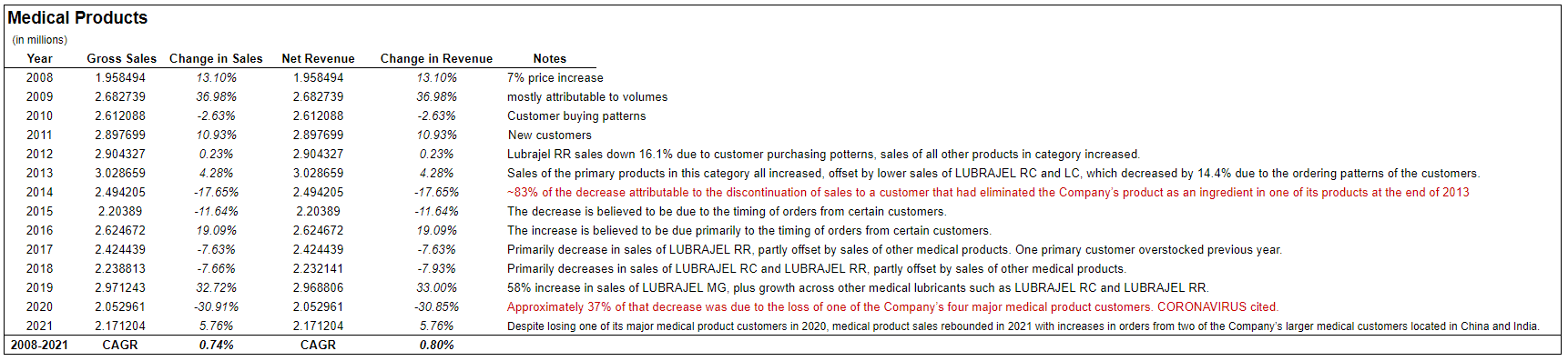

Medical & health care products

(14.56% of 2021 gross sales)

United-Guardian’s Lubrajel line also extends to medical and health care products, including:

Lubrajel Fluid

Lubrajel MG

Lubrajel MGL

Lubrajel RA

Lubrajel RC

Lubrajel RR

Lubrajel RR-CG

These offerings cover use cases such as standard medical lubricants, as well as more specialized focuses, such as radiation-resistant hydrogels and catheter lubrication. These products are sold directly by UG to marketers of finished products or to contract manufacturers used by those marketers.

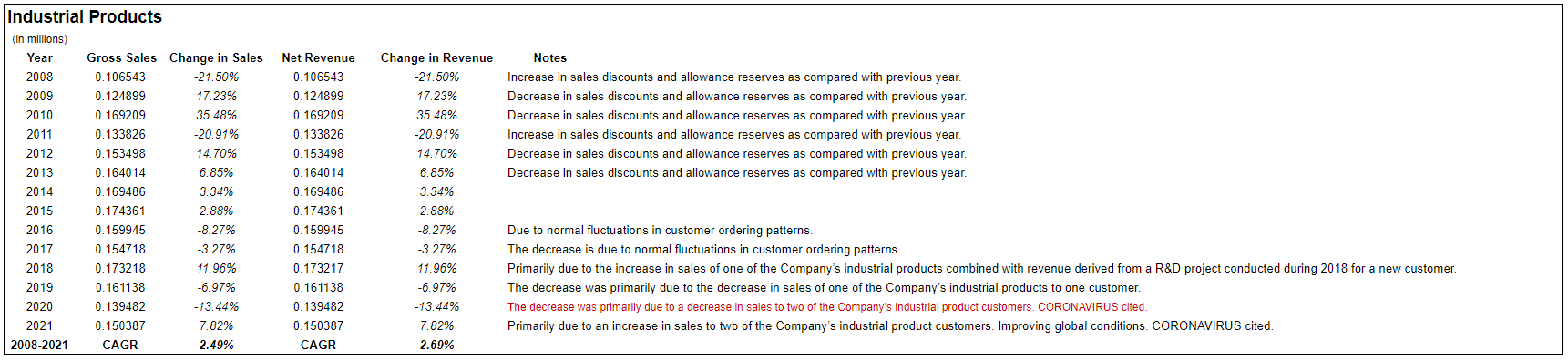

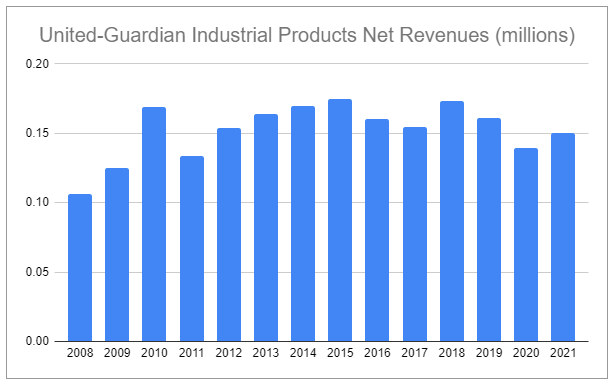

Proprietary industrial products

(1.01% of 2021 gross sales)

United-Guardian’s proprietary industrial products contribute the least in sales, by far. Despite being the smallest category and sales growth recently showing a degree of stagnation, it again demonstrates the company’s ability to create value in unique niches. Products include:

Deselex 50% - a replacement for phosphates in the manufacturing of detergents. This product is biodegradable yet does not stimulate algae growth like phosphate usage normally does, making it an ideal alternative for ecological considerations.

Polycomplex Q-2 - a surfactant used for oil dispersion, solubilization, and emulsification.

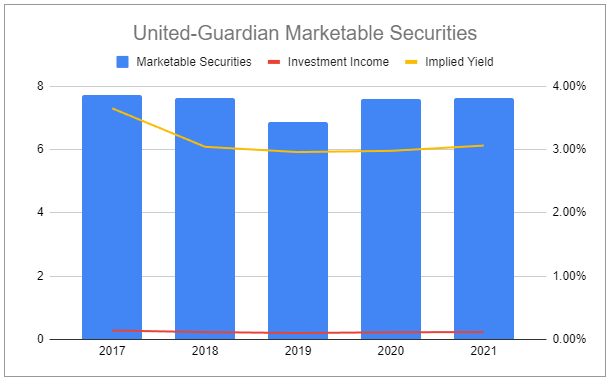

Marketable Securities

United-Guardian’s leadership has always been extremely conservative in managing its balance sheet. The earliest record I could find of the company holding marketable securities was in its 1998 annual report—$ 822,596 in total, and it has grown considerably since.

In 2020, UG began to change its investment strategy from lower-yielding U.S. Treasuries to short and intermediate-term bond funds that were yielding higher returns. In H1 2022 United-Guardian has marked a negative $853,938 change in fair value to its portfolio of marketable securities, made up of fixed income and equity mutual funds. This brings the current fair value to $6,410,082.

Why does this company have this portfolio of marketable securities? That’s a very good question. While I understand the conservative mentality of holding a rainy day fund, I am skeptical that this is actually prudent capital allocation.

Management and Culture

Executive Leadership & Inside Directors

Globus, Ken, President & Chief Executive Officer, Chairman of the Board of Directors, General Counsel

Young, Adrea, Chief Financial Officer & Controller, Treasurer, Secretary

Hiltunen, Peter A., Senior Vice President, Production Manager, Director of Plant Operations

Vigilante, Donna, Vice President, R&D Manager, Director of Technical Services

Nantista, Kristen, Quality Assurance Manager

Martino, Nicole, Quality Control Manager

Outside Directors

Dresner, Arthur M., Director; Counsel to the law firm of Duane Morris LLP, New York, NY

Maietta, Lawrence F., Director; Partner in the accounting firm of PKF O'Connor Davies, LLP, New York, NY

Boccone, Andrew A., Director; Independent Business Consultant, Former President of Kline & Company, Inc (business consulting firm), Little Falls, NJ

Papolulias, S. Ari, Director; Principal of ChemRise LLC (a business advisory firm providing advice to companies in the chemicals industry), Tarrytown, NY

Leadership

United-Guardian is very much the story of a tight-knit family-oriented business. The company was founded by Dr. Alfred R. Globus and is currently led by his nephew, Kenneth H. Globus, who has served as President since 1988 and chairman of the board since September 2009.

Reading through the last two decades worth of filings and shareholder letters has led me to conclude that this is a company that has always taken a cautious and measured approach to business—something very different from the ‘move fast and break stuff’ mentality that is so pervasive today. Always committed to identifying niche market opportunities and developing quality products to meet customer demands, this has seemingly served the company well.

But the company is not afraid of change either. United-Guardian sold its Eastern Chemicals division in 2007, which sold a mix of organic chemicals, research chemicals, intermediates, reagents, indicators, dyes, and stains. It was a small division and was objectively much less impressive than the rest of its operations.

The company currently employs 23 people, and it appears that instead of heavily reinvesting to facilitate growth, management is quite content to return the majority of excess capital to shareholders. The company has a 27-year history of exercising its flexible dividend policy, historically making two payments annually, paired with occasional special dividends.

Management’s decisions are not only conservative but should be aligned with shareholders, as the largest shareholder is the current president and CEO Kenneth Globus, who as of Q1 2022 owned 1,318,053 shares (~28.7%) of United-Guardian. Ken has announced he intends to retire by the end of the year. He will continue to lead while the company, working with executive recruiters, hunts for an ideal replacement. He will also continue to assist the company in a consulting role for as long as he is needed.

Ken’s personal remarks from the last quarterly letter:

During my 39 years with the company I have done my best to continue the work that my uncle, Alfred R. Globus, started 80 years ago. I will always cherish the time I have spent here, working with so many dedicated and caring people, many of whom have spent most, if not all, of their working lives and careers here, and are like family to me. I have also been lucky enough over the years to get to know some of our stockholders, and I know that some of you have been stockholders of ours for decades. I would like to thank all of our stockholders for the confidence you have shown in me over the years, and for your loyalty to our company. I wish you all the best.

Other shareholders with > 5% ownership:

Parker, Betsee (7.7%)

In 2007, Dr. Betsee Parker inherited 556,339 shares representing ~12.1% of those outstanding in United-Guardian from the Last Will and Testament of Irwin Uran. She has sold shares over the period since and as of Q1 2022 holds 354,133 UG shares.

Gabelli, Mario (5.6%)

Billionaire Italian-American investor and financial analyst Mario Joseph Gabelli owns 256,811 shares of UG as of Q1 2022 via Gabelli Funds LLC.

Renaissance Technologies LLC (5.0%)

American Hedge Fund Renaissance Technologies, or RenTech, owns 230,263 shares of UG as of Q1 2022.

Risks and Considerations

Debt

United-Guardian holds 0 (ZERO) debt.

Trade Secrets vs. Patents

Over the course of its existence, United-Guardian has been granted over 32 patents. However, most of these are long expired. Focusing on niche products that have unique properties and/or are made using proprietary technologies, UG currently protects most of its new work as trade secrets rather than with patents. This is a cheaper route and also places no expiry like with patents, though it does not offer the same distinct protections that patents do.

(il)Liquidity

As of March 1, 2022, there are 385 holders of United-Guardian’s common equity.

United-Guardian has 4,594,319 shares outstanding and the average volume (10 days) is a mere 9,752 shares at the time of this writing. Historically, there have also been stretches where daily volume was only 1,500 to 3000 shares per day. Additionally, the order book is often very thin, resulting in the bid/ask spread routinely widening to 2-5%, and sometimes even greater.

This is another double-edged sword.

It could prove difficult to build a meaningful position in this name and could prove even more problematic if trying to unload a sizable position. This, however, could be advantageous, as any broad liquidity event could cause UG to become greatly mispriced.

Macro

United-Guardian is reliant on foreign demand for many of its key products, especially Lubrajel for cosmetics. While United-Guardian recognizes all sales in USD, foreign demand is greatly influenced by FX dynamics. Also, a great deal of this demand stems from China, which has grown meaningfully over time. In 2019, during the U.S.-China trade war, Lubrajel exports were set to face steep retaliatory tariffs from China. However, the products were fortunately removed from the list prior to implementation. Any future quarrels between the U.S. and China might materially impact UG.

Additionally, UG uses a wide variety of raw materials, such as common industrial organic and inorganic chemicals. Most of these materials are widely available from numerous sources. However, shortages and input inflation may be (and have been) materially impactful to the company. While UG has exercised pricing power to somewhat offset this, there is a question of how much pricing power can continue to be exercised if inflation were to remain persistent.

Lastly, UG is responsible for shipping costs related to many of the products it sells. In recent history, we’ve seen rising costs due to supply chain disruptions meaningfully impact the company’s performance. More critically is that there have even been periods in the past where shipping simply wasn’t possible.

Credit Concentration

In each category it sells products in, United-Guardian has a small and concentrated list of customers. Ashland Specialty Ingredients (ASI) makes up the bulk of sales (35% of the total as of late). UG has stated that if ASI were to stop marketing the company’s products, alternative arrangements could be made with another major global marketer. United-Guardian claims that this would allow a continued supply of products to customers currently using UG products without any significant interruption.

I am less certain.

I think that the concentration risk of customers and marketing partners is very real. Historically, various losses of single customers have led to 5-15% drops in sales for the respective categories. Perhaps on a more positive note, this also highlights how much potential opportunity there is for new product lines as United-Guardian continues to develop novel solutions. If a single customer loss can have a meaningful impact, a customer gain can certainly have a profound effect on the company as well.

Competition

United-Guardian is beginning to face heightened competition for many of its cosmetic ingredients. While the company undeniably produces high-quality ingredients, there has been a notable increase in Asian manufacturers aiming to offer low-price alternatives. UG has stated it is working to develop its own lower-priced lines. This may support volumes but will ultimately compress margins if successful. Aside from this, UG is also pursuing the development of natural and preservative-free products as well as products in low-competition niches. Historically, the company has proven to succeed with this strategy and is one I am much more supportive of.

Exploration of Strategic Alternatives

In early 2022, Untied-Guardian announced the board had launched a review process to explore ‘strategic alternatives’. This was aimed to ensure that value was being maximized for shareholders. This included evaluating strategic partnerships, joint ventures, and even the outright sale of the company.

On June 14, 2022, UG announced it had completed the review process, concluding there were no such current opportunities. The board stated it would focus on exploring opportunities to grow the core business while considering any future opportunities to maximize value for shareholders.

I think this is something to watch closely. With the inevitable retirement of Ken Globus, new leadership and the board could make some very interesting decisions. Additionally, as a small company, UG could become a prime acquisition target for a larger company or an opportunity for a PE firm.

Growth Prospects

While the growth trajectory for United-Guardian’s cosmetic ingredients is largely contingent on Asian demand, there are clearer tailwinds for the pharmaceutical and medical product segments.

There is a secular growth trend in catheter usage in the United States and should continue to grow as the geriatric population continues to increase. Products associated with care, such as medical catheter lubricants (Lubrajel) and incrustation prevention tools (Renacidin), serve critical roles.

Valuation and Pricing

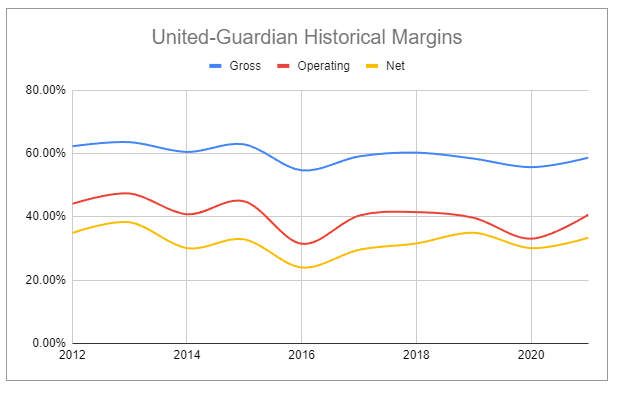

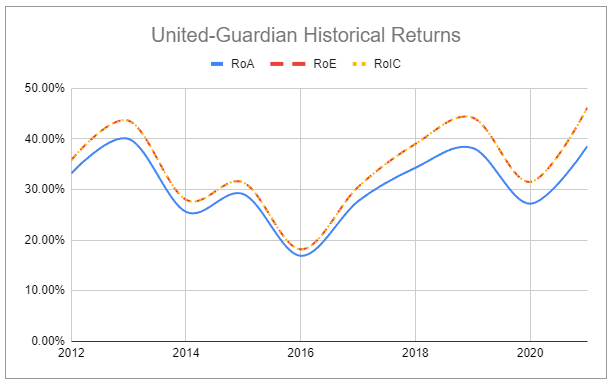

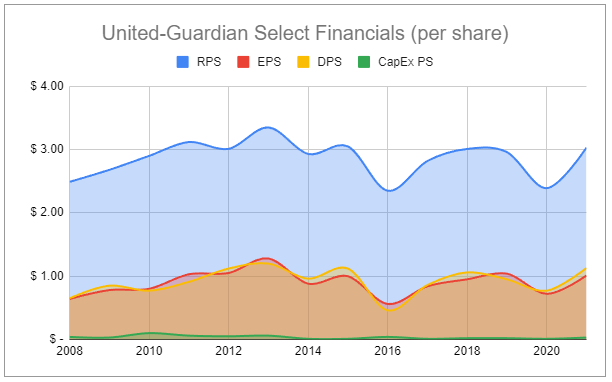

I valued United-Guardian using a variety of methods to account for the fact that there is undoubtedly a huge range in potential futures. Prior to diving into each method, it’s important to consider some of the very impressive metrics United-Guardian boasts:

Intrinsic Valuation - 2-Stage Unlevered DCF

Key assumptions:

EBIT margins continue to face pressure from input inflation but incrementally return to 40% over 4 years.

Any efficiencies or cost savings are offset by pharmaceuticals becoming a larger % of sales, which carry lower margins than Lubrajel.

Revenue growth incrementally increases based on category trends for the 10yP before dropping to 0 terminally.

Zero contribution from future product lines.

This is bare bones but paints a fairly straightforward picture. I’m sure there will be some choppy years in the future, and reality will certainly not unfold as smoothly. Nonetheless, if United-Guardian can continue to incrementally grow its existing product lines and recover margins, I would expect meaningful value to be created for shareholders. The break-even discount rate for this model is 9.28%.

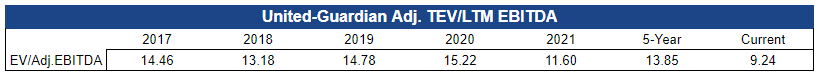

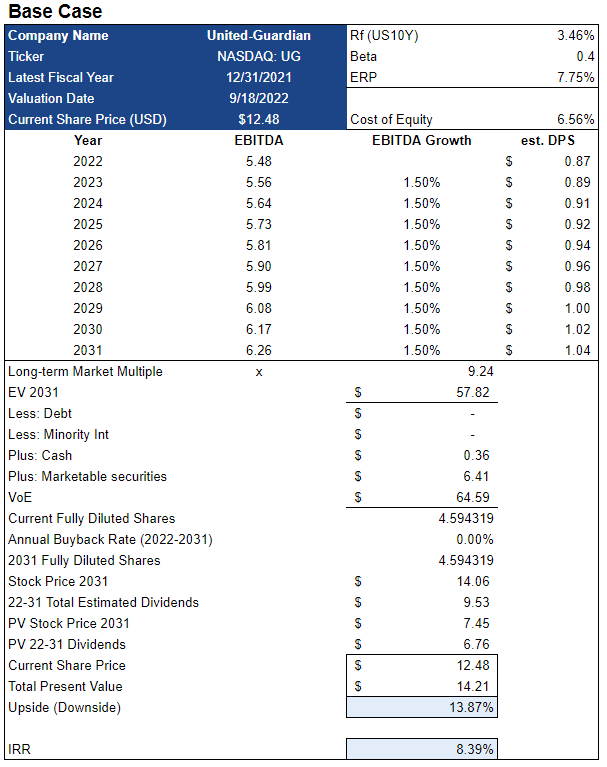

Relative Valuation - Exit Multiple

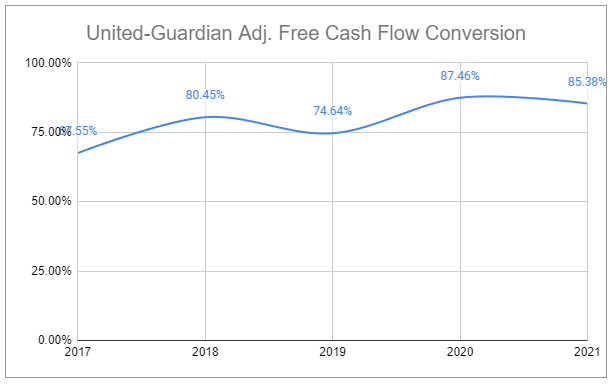

I also valued United-Guardian using a 10-year exit based on backing out equity from an EV/EBITDA multiple and factoring in forecasted dividends. As with most other names I’ve covered, continued operations are incredible capital-light, and total reinvestment costs are fairly stable and predictable.

Of course, the above chart understates United-Guardian’s true reinvestment rate, as R&D spending is reported as an operating expense. However, historically, neither UG’s R&D nor CapEx has fluctuated meaningfully, and in the past 5 reported years, they have averaged $474,560 and $77,340 respectively.

Adjusting United-Guardian’s EV/EBITDA by backing out its portfolio of marketable securities indicates it is currently trading at a substantial discount relative to the past 5 years:

For my base case, I made the following key assumptions:

EBITDA growth is tepid

Forecasted dividends work off a base of the 2006-2021 average payouts

L-T multiple stays at the current multiple

Implied IRR and upside aren’t terribly exciting, considering the looming risks. However, I could understand interest from value and income-oriented investors seeking returns less correlated to the broad market.

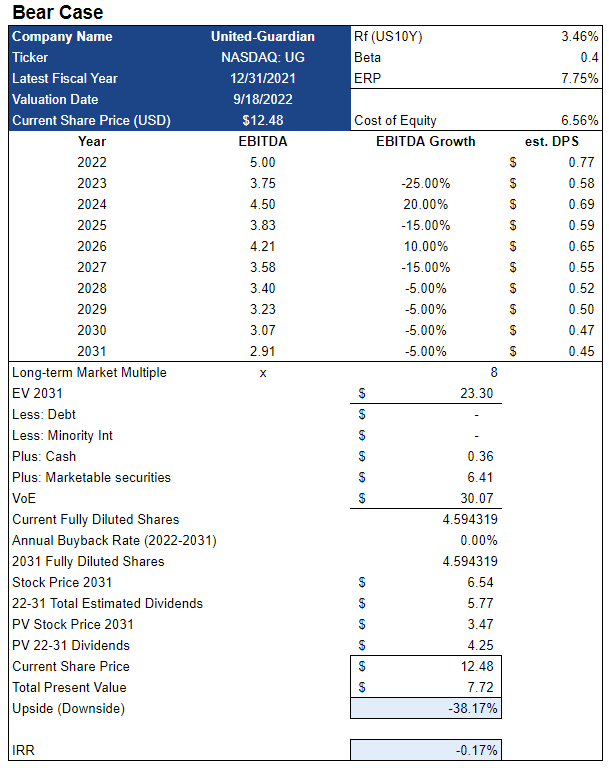

For my bear case, I made the following key assumptions:

Significant fluctuations in EBITDA resulting from the churning of major customers and an inability to fully replace lost sales

Reduced dividends in line with declines in EBITDA and a logical reduction in FCF conversion

L-T multiple contracts further to x8

The results of the bear case are ugly. There are plenty of scenarios where macro shocks, competition, or even simple losses of key customers throw UG onto its back foot, struggling to recover.

For my bull case, I made the following key assumptions:

Above trend, MSD EBITDA growth

Improving FCF conversion

Dividend payouts off of a higher base

L-T market multiple re-rates to the company’s 5-year average

An implied 70% upside and mid-teens IRR is something to take interest in. EBITDA growth isn’t outlandish, and the increased dividend payments are commensurate. A great deal of the excess return relative to the base case is the L-T re-rating, which I would never want to assume.

For many, this still may not be appetizing enough to consider a microcap such as United-Guardian, but there is still one additional major consideration:

This company, historically, has been very conservative. With the overall stability of a meaningful portion of cash flows, the company could take on significant debt ($10-15 million) and sit within a total debt/EBITDA ratio range of 2-3x. Along with selling its marketable securities, United-Guardian could retire a significant amount of outstanding shares, with my rough math showing a 20-40% reduction.

This would take time to do, as the stock is thinly traded, but is a meaningful way to strengthen returns to shareholders. While leverage can compound negative results as well, it’s not impossible to think a perfect storm could arise in which further weakness in the stock price could result in both an attractive entry point as well as amplifying the effects of a significant buyback.

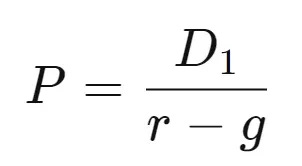

Pricing - Gordon Growth Model (GGM)

United-Guardian has a 27-year track record of paying a dividend. Its flexible dividend policy guarantees that future payments will not increase lock-stop, however, it may be worth taking a peek at a GGM model to see what type of assumptions may be baked in.

g = Perpetual growth rate

r = Stable cost of equity (hurdle rate)

D1 = Value of next year’s dividends

P = Current stock price

United-Guardian’s average annual dividend payment from 2006-2021 was $0.8725. To reflect more recent results, the average annual dividend payment from 2016-2021 was $1.038 and $0.996 when excluding special dividends. I decided to use the 2006-2021 average as the basis for this exercise. I also opted to focus the outputs on a hurdle rate higher than the company’s cost of equity.

Results indicate that shares are near fair value when using an 8% hurdle rate and assuming a 1% perpetual growth rate. Fun to look at, but worth taking with a big grain of salt.

Closing Thoughts

I’m intrigued by United-Guardian. It has a colorful history and many of the hallmarks that make a great business. However, it’s also been hit hard a number of times over the years, and while never out for the count, I’m not sure if it’s a fighter to bet on. UG’s ‘low capital intensity’ may be more of a bug than a feature and paying out nearly all FCF is more indicative that management has been unable to find effective new ways to reinvest in the business.

But at a certain price, I’m likely a buyer.

Markets have a tendency to get weird, and I can think of plenty of scenarios where I decide I need to pull the trigger:

a steeper selloff without degrading fundamentals

improving fundamentals with a stagnating share price

an activist investor or new management that I think could usher in a new wave of catalysts

There are almost no eyes on this company. That makes me think it’s worth it to keep watch.

Thank you for reading

Could you do me a favor? If you enjoyed reading this article, please take a moment to share it with a friend or online somewhere. It helps me connect with more curious minds.

And make sure you’re subscribed to get future articles sent straight to your inbox!

If you have questions or have something to add, don’t hesitate to comment on this piece or reach out on Twitter.

Ownership Disclaimer

At the time of publishing this piece, I have zero positions in United-Guardian. I may initiate such positions in the future.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: UG 0.00%↑ ASH 0.00%↑

Additional Resources:

United-Guardian - public filings. Source

United-Guardian - website. Source

Renacidin - NDC Drug Information. Source

The History of Kidney Stone Dissolution Therapy: 50 Years of Optimism and Frustration With Renacidin. Source

Case of the month from Lillebaelt hospital, University Hospital of South Denmark, Denmark: Renacidin® – still a useful adjunct to endoscopic surgery for complex renal struvite stone disease. Source

Minimally invasive treatment of infection staghorn stones with shock wave lithotripsy and chemolysis. Source

Renacidin(R) Irrigation Returns to the Market, Press Release. Source

Cost of Generic Drug Development and Approval. Source

Nice work. I wonder if the Chinese alternatives are 80% as good as LUBRAJEL?