“Secrecy is the enemy of efficiency, but don't let anyone know it.” - Ric Ocasek

Company Overview

In 2000, Jeffrey Sprecher had a vision.

The global energy markets were opaque, clunky, and inefficient.

He was going to build a solution.

Founding Intercontinental Exchange (ICE), Sprecher’s vision was not only supported by his strong engineering background but also by the backing of Goldman Sachs, Morgan Stanley, BP, Total, Shell, Deutsche Bank, and Société Générale. Over the last 22 years, ICE has boldly engaged in a large number of acquisitions and has become entrenched in the critical plumbing of global markets.

The company pushed hard into energy markets after the fall of Enron.

It charged into credit default swaps during the 2008 financial crisis.

And now, ICE is stepping on the accelerator in the mortgage ecosystem as rates continue to rise and real estate prices waver.

Currently, the company operates in 3 segments:

Exchanges & Clearing

Fixed Income & Data Services

Mortgage Technology

While ICE has taken on meaningful leverage to finance acquisitions, continued operations are extremely profitable and are of minimal capital intensity. The company continues to recognize meaningful synergies while also developing enhanced solutions on top of its existing offerings, compounding its network effects as well as returns for shareholders.

Intercontinental Exchange’s headquarters are in Atlanta, GA, United States. Its shares trade on the New York Stock Exchange (which ICE owns) under the ticker ICE. Earlier this year, the company increased its debt to help fund its announced agreement to acquire Black Knight, and as of May, it has been able to maintain its A- and A3 ratings from both S&P and Moody’s.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Investment Thesis

Founder-led with a fantastic track record

Multiple secular tailwinds

Extremely profitable

Low capital intensity of continued operations

Growing network effects

Shift from transactional to recurring revenues

Intercontinental Exchange’s talented team continues to leverage strategic acquisitions to facilitate growth and become further entrenched in global markets. The stock has recently sold off in tandem with broad market weakness and its announcement of its definitive agreement to acquire BKI. While current conditions may raise questions regarding the terms of the deal, current levels present a skewed risk/reward, and the company’s business model will create substantial value long-term while returning capital to shareholders.

Industry Overview

The conceptualization of commodity futures contracts dates back to Ancient Mesopotamia, ~1750 BC. The first modern futures exchange came in 1710, with the Dojima Rice Exchange in Osaka, Japan. Predating the Japanese exchange by 99 years, the Dutch East India Company became the first publicly traded company on the Amsterdam Stock Exchange.

But these were just the start.

Proliferation was inevitable.

The growing world population, global trade, and increasing financial complexity have led to exchanges becoming fundamentally necessary to the modern economy. Now, all around the world, nearly every nuanced aspect of the economy has been aggregated, disaggregated, mixed, chopped, and rebuilt, providing buyers and sellers, operators and speculators alike, the ability to transact in highly liquid markets.

From equities, credit, commodities, derivatives, data, ratings, and more, the large and growing modern industry has a suite of large and growing participants:

Nasdaq, Inc. (NasdaqGS:NDAQ)

CME Group Inc. (NasdaqGS:CME)

Cboe Global Markets, Inc. (BATS:CBOE)

S&P Global Inc. (NYSE:SPGI)

Moody's Corporation (NYSE:MCO)

Tradeweb Markets Inc. (NasdaqGS:TW)

MarketAxess Holdings Inc. (NasdaqGS:MKTX)

MSCI Inc. (NYSE:MSCI)

Deutsche Börse AG (XTRA:DB1)

Intercontinental Exchange, Inc. (NYSE:ICE)

TransUnion (NYSE:TRU)

FactSet Research Systems Inc. (NYSE:FDS)

Dun & Bradstreet Holdings, Inc. (NYSE:DNB)

CRISIL Limited (NSEI:CRISIL)

Bloomberg L.P. (Private)

Truthfully, this list merely scratches the surface. There is an insatiable need for efficient and accessible tools and products to navigate modern capital markets. From entirely new ways to access new markets to the digitization of old markets, there are substantial prospects for astute operators. I believe Intercontinental Exchange is one of those astute operators.

Operations and Segment Specifics

Intercontinental Exchange’s operations have an obscene amount of moving parts, but the business model, fundamentally, is very easy to understand:

Identify critically important asset classes riding on secular tailwinds that have distinct inefficiencies in their respective markets.

Iterate and optimize to improve efficiency in those markets to create value for all stakeholders.

To accelerate this, the company has engaged in a significant number of acquisitions over the years, including:

2001: International Petroleum Exchange (IPE)

2007: New York Board of Trade (NYBOT)

2007: Winnipeg Commodity Exchange (WCE)

2008: Creditex

2008: TSX Group's Natural Gas Exchange Partnership

2010: Climate Exchange

2013: NYSE Euronext

2014: SuperDerivatives Inc.

2015: Interactive Data Corporation (IDC)

2015: Trayport and subsequent divestment

2016: Standard & Poor’s Securities Evaluations (SPSE)

2017: TMX Atrium

2017: BofA Merrill Lynch Global Research Index Platform (BofAML)

2017: Euroclear

2017: Virtu BondPoint

2018: Chicago Stock Exchange (CHX)

2018: TMC Bonds LLC

2018: Merscorp Holding, Inc

2019: Simplifile, LC

2020: Ellie Mae

2021: risQ

Currently, Intercontinental Exchange operates in 3 segments:

Exchanges & Clearing

Fixed Income & Data Services

Mortgage Technology

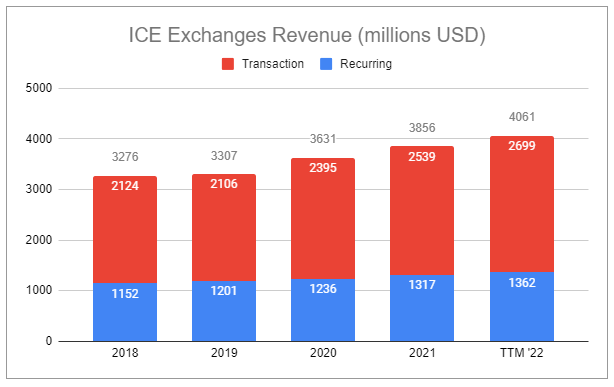

ICE revenues are split nearly 50/50 between transactional and recurring.

Intercontinental Exchange has grown impressively. From 2011-2021:

Revenue experienced an 18% CAGR

FCF experienced a 16% CAGR

Adj. EPS experienced a 14% CAGR

Every year since ICE became a publicly traded company in 2005, the company has meaningfully improved operations and grown earnings for equity holders. Impressively, neither the GFC nor Covid slowed the company down—quite the opposite. From ICE’s 2Q22 Earnings Call QA, Jeffrey Sprecher (emphasis added):

Because I'm a company founder, I get asked to speak to entrepreneurs from time to time. And I always tell them, the best time to start a business is when there's a downturn. And not that having us moved into this space, you wish a downturn on anybody. But it's very, very hard to get people in finance. And I say this broadly, whether it's trading, clearing, data acquisition, it's very, very hard to get people in finance to change their behavior when they're making a lot of money and when things are going well. And the best time to get people to think about making a change is when their businesses are under pressure.

Exchanges & Clearing

ICE operates an impressive portfolio of exchanges and clearing houses.

Exchanges include ICE Futures Europe, ICE Futures U.S., ICE Futures Singapore, ICE Futures Abu Dhabi, ICE Endex, Creditex, NYSE, ICE Swap Trade, ICE OTC Energy, and ICE NGX.

Clearing houses include ICE Clear Credit, ICE Clear Europe, ICE Clear Netherlands, ICE NGX, ICE Clear Singapore, and ICE Clear U.S.

Intercontinental Exchange’s exchanges & clearing houses provide efficient pricing, security, and transparency to users around the world and are further supported by solutions such as WebICE and ICE Connect, as well as products and proprietary data that deliver accessibility to diverse markets and robust risk management solutions. ICE products cover critical assets, including:

Transaction-based revenue model:

Global crude benchmark Brent

Global natural gas markets

Global environmentals

Global soft commodities such as sugar, cocoa, coffee, cotton, and canola

Largest market for EU & EK rates, including Euribor, SONIA, and Gilt

Equity index futures (including 90+ MSCI indices)

Bilateral energy markets allowing trading of physically-settled nat gas, power, and refined oil contracts

Cash equity and equity options trading at the NYSE

Recurring revenue model:

Listings (70% of S&P 500 listed on NYSE. ~75% of ETFs are listed on NYSE)

Proprietary real-time and historical pricing data

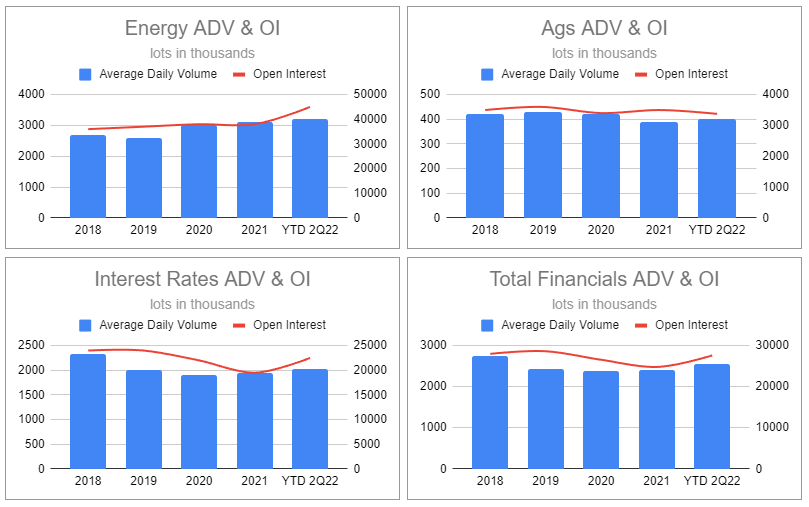

A clear macro trend is that there are simply more participants looking to do more things across ICE’s offerings. Open interest is at an all-time high across most of its platforms, which is the best indicator of long-term growth potential and is a general expression that people are hedging heavily. Whether it’s current volatility and future uncertainty, speculation, or protecting operations, these types of activities are continuing to become more prevalent. While the majority of this activity is marked as transactional revenue, the continued management of hedges is qualitatively more akin to recurring revenue.

Of course, the severity of macro shocks comes into question. However, for ICE, the effects so far this year have been a net positive. Interest rate revenue was up 80% (constant currency) y/y in 2Q22 and equity indices revenue was up 36% (CC) in the same period. While this is a y/y spike and should not be mistaken for normalized growth, there are multiple tailwinds for this segment:

Navigating rates = more risk management needs. Inflation and central bank policy will continue volume growth in related products for the foreseeable future.

Listings and Data & Connectivity Services boosted segment recurring revenue by 7% y/y and should continue to grow as market participants become more reliant on ICE’s platforms.

Energy is showing remarkable promise, with environmentals growing at a rapid pace and TTF becoming the bellwether for global nat gas—similarly to the dominance of ICE’s Brent. The TTF business has averaged 43% annual growth over the last 5 years. Geopolitical uncertainty + growing energy demand = sustained volume growth in related products. Year-to-date alone, global gas volumes were up 31%.

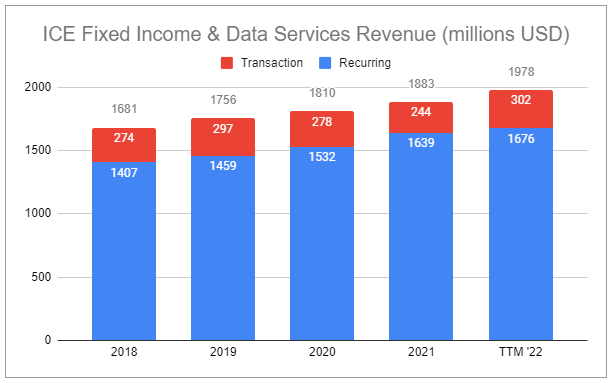

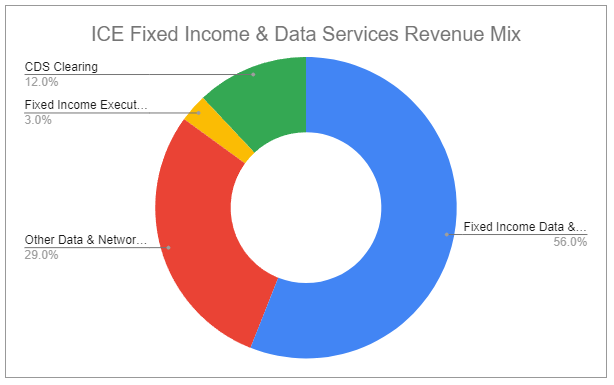

Fixed Income & Data Services

In 2016, Intercontinental Exchange introduced substantially expanded data services offerings, leveraging data from the NYSE as well as its 2014 acquisition of SuperDerivatives and 2015 acquisition of Interactive Data Corporation. ICE’s fixed income & data services allow clients to access critical information, analytics, valuations, and software.

Transaction-based revenue model:

ICE Bonds - providing markets for fixed income trading protocols

ICE Clear Credit - clears over 90% of global credit default swap (CDS) volume (gross notional).

Recurring revenue model:

Data & Analytics - End-of-day and real-time price evaluations on fixed income securities, Reference data, 2nd largest fixed income index provider in the world, Analytics and workflow tools, and ESG data and analytics

Data & Network Services - ICE Global Network offers a secure, low latency network that includes 150 trading venues, 750 third-party data sources, and consolidated feeds via API

Mortgage Technology

Jeffrey Sprecher at the 2022 Piper Sandler Global Exchange FinTech Conference (emphasis added):

…look at the demographics. We put these charts out in some of our appendices, the demographics of the millennial population now that is at their prime earnings, prime home buying age, starting families, not going to live in their parent's basement. We all read these stories in the US. Every house that gets built gets sold. I mean, there is a shortage of houses. It was exacerbated by this view that, oh, millennials don't ever want to own a home and they're not going to own a car. And da, da, da, da, da. Now they're at an age when that's ridiculous. And they aren't living at home with the kids. And so and secondly the supply chain that's been holding back homebuilding is slowly working its way through. And we just saw lumber prices come down last month. And anecdotally we're talking to people that things are starting to allow more homebuilding. So the total number of mortgages in the world is going (and in the United States is going) to be bigger. That's a really great thing to build a business into. And you can argue quarter to quarter but that trend, that macro trend, there are very few. If you put an analog to digital trend on top of a macro trend of housing needs, it's like a no brainer to me.

The mortgage industry is fraught with excessive labor and inefficient practices. Intercontinental Exchange’s mortgage technology unit aims to solve that by digitizing the U.S. residential mortgage process and streamlining processes. This operational segment was built upon ICE taking a majority equity interest in MERS in 2016, acquiring the rest in 2018, acquiring Simplifile in 2019, and Ellie Mae in 2020.

In 2Q22, this segment grew recurring revenue by 18% in constant currency. Related Data & Analytics revenue was up 37%. Overall segment revenue was down 13% y/y. However, I consider this to be incredibly impressive, as the industry experienced a ~40% decline in origination volumes.

Primarily transaction-based revenue model:

Closing Solutions - including eClose, eNotes, eRecording, and MERS registration connect lenders, title and settlement agents, and individual county recorders

Combination transaction and recurring revenue model:

Origination Technology - All-in-one SaaS-based mortgage origination system, Encompass, provides essential workflow management and vendor connectivity. ICE Mortage Technology connects customers to the mortgage supply chain and assists in the secure exchange of information between customers and a vast network of proprietary and third-party service providers

Data & Analytics - AIQ wields AI to assist in the entire load origination process, streamlining the process for customers

Other - Includes professional services fees and misc ancillary products

Equity Investments

Bakkt

On October 15, 2021, Bakkt Holdings, LLC completed its merger with VPC Impact Acquisition Holdings (VIH), a special purpose acquisition vehicle (SPAC). The new entity, Bakkt Holdings is listed on the NYSE under the ticker BKKT. Intercontinental Exchange owns a ~68% economic interest in the combined company. Following Q4 2021, ICE deconsolidated Bakkt and now reports its stake as an equity method investment for its financial statements.

Bakkt operates a technology platform focused on digital assets such as crypto. ICE’s 2022 Q2 10-Q states the carrying value of the company’s Bakkt investment to be $1.5 billion as of June 30, 2022. I remain suspicious regarding how much value Bakkt will actually be able to generate.

Options Clearing Corporation (OCC)

Intercontinental Exchange owns 40% of Options Clearing Corporation (OCC). OCC is a clearing house for securities options, security futures, commodity futures, and options on futures traded on multiple independent exchanges.

Management and Culture

Executive Leadership

Sprecher, Jeffrey, Chair & Chief Executive Officer, Intercontinental Exchange

Jackson, Benjamin, President, Intercontinental Exchange

Gardiner, Warren, Chief Financial Officer, Intercontinental Exchange

Martin, Lynn, President, NYSE Group & Chair, ICE Fixed Income & Data Services

Bland, Trabue, Senior Vice President, Futures Exchanges, Intercontinental Exchange

Edmonds, Christopher, Chief Development Officer, Intercontinental Exchange

Foley, Douglas, Senior Vice President, HR & Administration, Intercontinental Exchange

Ilkiw, Jennifer, President, ICE Futures U.S.

Hindlian, Amanda, President, Fixed Income & Data Services, Intercontinental Exchange

Ivanov, Stanislav, President, ICE Clear Credit

Kapani, Mayur, Chief Technology Officer, Intercontinental Exchange

King, Elizabeth, President, ESG & Chief Regulatory Officer, Intercontinental Exchange

McClear, Kevin, President, ICE Clear U.S.

McLaughlin, Brookly, Vice President, Corporate Affairs & Sustainability, Intercontinental Exchange

Rhodes, Christopher, President, ICE Futures Europe

Rowe, Joanne, Corporate Risk Officer, Intercontinental Exchange

Serafini, Hester, President, ICE Clear Europe

Spencer, Octavia, Vice President, Associate General Counsel & Corporate Secretary, Intercontinental Exchange

Surdykowski, Andrew, General Counsel, Intercontinental Exchange

Tyrrell, Joe, President, ICE Mortgage Technology

Underwood, David, Chief Audit Executive, Intercontinental Exchange

Wassersug, Mark, Chief Information Officer, Intercontinental Exchange

Williams, Stuart, Chief Operating Officer, Intercontinental Exchange

Leadership

There is the old adage advising to ‘bet on the jockey, not the horse’.

Intercontinental Exchange is a very good horse led by an exceptional jockey—founder Jeff Sprecher. Growing from a fledgling startup to a Fortune 500 with nearly 10,000 employees, the company has always appeared to be one step ahead, anticipating, building, and acquiring for the needs of market participants. But not all efforts to grow via acquisition have been successful or applauded. The company had an unsuccessful bid for the Chicago Board of Trade in 2007, and many critics have been outspoken towards many past acquisitions, despite the company continuing to execute well.

Perhaps most impressive beyond its long list of successful acquisitions is Intercontinental Exchange’s profitability. Alongside prioritizing growth, the company has a straightforward capital return policy. The company will grow the dividend as the company grows, and 100% of its FCF net of strategic M&A and dividends will be allocated to share repurchases.

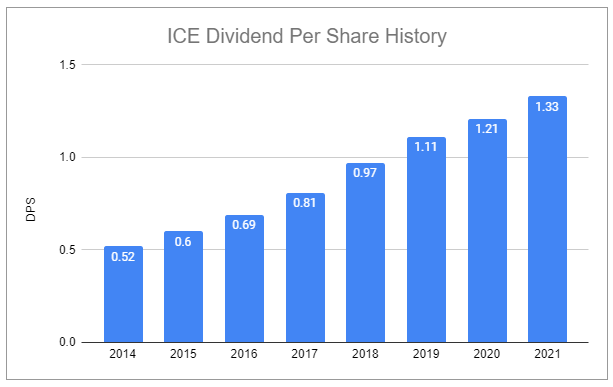

Since 2014, ICE’s dividend has experienced a 14.36% CAGR. Share count has declined by a mere .2% per year on average over the same period due to SBC and major acquisitions.

IDC was acquired in 2015

Ellie Mae was acquired in 2020

BKI deal announced in early 2022

Risks and Considerations

Black Knight

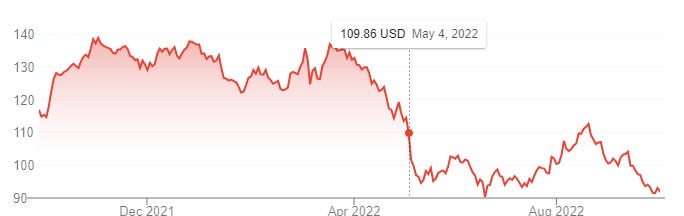

In May 2022, Intercontinental Exchange announced its entering into a definitive agreement to acquire Black Knight, Inc. The cash and stock deal values Black Knight (BKI) equity at $13.1 billion, its EV at ~$16 billion, and the deal is expected to close sometime in H1 2023 so long as there are no regulatory issues.

This is a very large transaction, and it is a very big deal for ICE. Black Knight’s EV of ~$16 billion is around 1/4 of ICE’s EV. ICE has stated the price represents ~15x fully synergized 2022 Black Knight adjusted EBITDA (adjusted = midpoint of BKI midpoint FY22 guidance of $786 million to $803 million, factoring SBC and adjusted for anticipated synergies of $325 million).

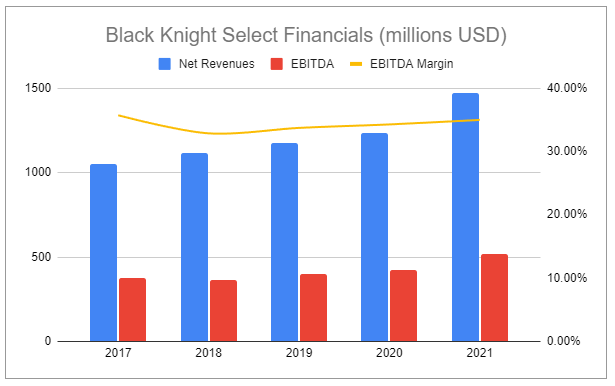

From 2017-2021, BKI revenues experienced an 8.84% CAGR, and EBITDA compounded at an 8.27% rate over the same period.

Why target Black Knight?

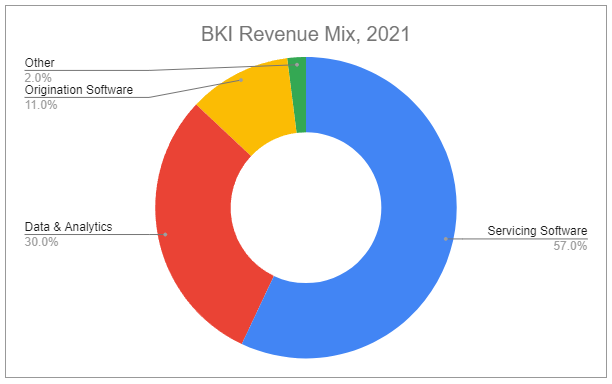

Black Knight is a software, data, and analytics company focused on real estate data, mortgage lending, servicing, and secondary markets.

This is an incredibly complimentary and synergistic move for ICE, and the company laid out its rationale simply. The acquisition would expand the mortgage tech TAM and further accelerate penetration by creating a ‘life-of-the-loan’ platform, including:

Home search

Lead generation & application

Processing, underwriting, & pre-closing

Closing & post-closing

Secondary & loan trading

Servicing & defaults

ICE has stated they expect the deal to be accretive to adjusted EPS in the first full year post-close and to net an IRR of 10%.

However, the deal has received substantial criticism. Firstly, x15 FY22 ‘adjusted’ EBITDA based on the immediate recognition of future key synergies is questionable. This is especially true for an acquisition that is ~25% the size of ICE’s own enterprise value. Secondly, many are quick to scoff at the deal when rates continue to rocket higher and RE prices waver. While there has been a broad selloff in equity markets, the consensus seems to lean into these points, as illustrated by ICE’s stock performance post-announcement.

These notions mischaracterize the business. Could this be where the opportunity lies? Yes, mortgage originations are cooling, but mortgage origination software is only a small part of BKI’s revenue. The company’s recent quarterly reports actually show its revenue becoming less sensitive to mortgage origination over time. This business is far less cyclical than many believe and would meaningfully add to ICE’s % of revenue from recurring sources by +7-8%.

More important, and yet underappreciated, is the potential of the ‘life-of-the-loan’ platform. ICE’s current mortgage technology primarily handles application, processing, underwriting, pre-closing, closing, and post-closing. BKI’s technology fills in every other gap in the workflow.

Why does that matter?

Operators want best-in-class solutions, which leads them to piece together different tools for each step of the process. This can be a total headache and can actually increase total associated costs. But that’s not the primary issue at hand. Ballooning mortgage industry costs have been primarily personnel-related and the mortgage process takes 30-60 days. Digitizing and automating the workflow would radically change that. ICE’s all-in-one solution could be cheaper for all stakeholders, provide better tools, be more efficient, and simply present a better user experience. This would be a very difficult value proposition to compete against. Additionally, as an end-to-end solution, this would provide ICE with more data that is of higher quality, allowing the company to wield its technological expertise to build additional offerings on top of this robust platform. Furthermore, that same data would drive growth in the data & analytics portion of the business, as well as assist in the pricing of MBS-linked asset valuations. The opportunities are immense.

If this deal goes through, ICE would be optimally positioned to further digitize a market that is still largely analog, continue to take market share, and create substantial value every step of the way.

“If.”

This is all contingent on regulatory approval. With BKI sitting at $64.73, well under the offer price, the market is clearly expressing doubt over the deal getting through.

But I am not terribly concerned either way:

If the deal goes through and the mortgage market continues to cool, investors could further sour on ICE, presenting an attractive level to enter or add to the name.

If the deal fails and the mortgage market continues to cool, ICE could engage in several smaller deals over the next 1-2 years at much lower valuations. While each would be likely less impactful than BKI, price paid matters, and ICE could generate impressive returns on said acquisitions.

And people have a tendency to get tunnel vision. So focused on a currently cooling origination market, they forget it will eventually heat up. Regardless of if this deal goes through or not, ICE’s mortgage technology business is already very well positioned to weather all cycles.

Competition

With a wide variety of high-level product offerings, ICE is fairly entrenched in its core operations via robust network effects. Participants want rich, deeply liquid markets, and new participants gravitate towards markets that are already established. This makes it exceedingly hard for would-be competitors to encroach on ICE’s key products. With that said, network effects work in reverse as well. Loss of momentum and inability to anticipate market needs or compete against the future offerings of competitors could cause the company to lose significant volumes or pricing power. This is something to watch, though I believe a more likely scenario is for larger operators to continue to consolidate share amongst key markets. ICE can succeed and even complement other would-be competitors across multiple markets experiencing secular tailwinds.

Speaking of competition, ICE’s management has pointed out that regulators are very focused on wanting greater competition amongst exchanges. The company believes competition should be focused between every buyer and seller of each transaction. While the company has shown an uncanny ability to navigate and operate across a number of highly regulated environments, future regulations may inhibit its ability to operate in the same capacity.

Macro

The complex and dynamic nature of our world is not necessarily a headwind for ICE. Clients rely on many of the products and services the company offers to support their continued operations and demand should continue to grow for financial information services largely irrespective of macro factors.

However:

Disruption and reversal of the globalization that has occurred over the last half-century would materially impact the prospects of the company. Unlikely, but nothing is off limits.

Changes in regulation and financial reform across markets can and will alter how ICE conducts business.

In 2021, ~17% of exchange revenues were billed in pounds sterling or euros, and ~10% of operating expenses were incurred in pounds sterling or euros over the same period. FX dynamics may impact these levels to varying degrees in the future.

While much of ICE’s continued operations can be seen as inflation-resistant, persistent heightened inflation will likely lead to slowing growth in early-stage companies, causing them to stay private longer and slowing the listing business.

Interest Rates and Volatility

Interest rates are a primary factor in mortgage loan production volumes, and rising rates are likely to act as a continued headwind for related operations. At the same time, uncertainty around future rates, paired with increased volatility, is a boon to the exchange and clearing segment, where increased volumes are heavily driven by participants’ hedging.

A Big Break

ICE has tremendous counterparty exposure, especially in regards to its clearing house operations, where it acts as a CCP (central counterparty), though the company maintains safeguards such as default insurance to protect against counterparty risks. As part of the critical plumbing of financial markets, perhaps the greatest risk to the company is the next big break - Lehman 2.0, systemic risk, a proliferating contagion - substantial defaults by clearing members and risks related to investing margin and guaranty funds would be substantially costly to the company.

It’s worth pointing out that ICE has been ahead of the curve and has excelled during the most difficult periods of the last 22 years. Having high visibility into the inner workings of key financial systems and with robust tools to mitigate risk, perhaps this (whatever we find ourselves in today) will inevitably be a tailwind for the company instead.

Goodwill

As a serial acquirer, ICE carries a tremendous amount of Goodwill on its balance sheet, north of $20 billion. Along with other intangibles stated at over $13 billion, the company could recognize substantial impairments in the future. Any significant impairment could materially impact future operating results.

Future Acquisitions

Intercontinental Exchange has a long track record of acquisitions. Some are small and more speculative, others larger and more measured. Its track record shows an impressive history of accretive moves while at the same time a willingness to dilute shareholders to reinforce its competitive position and network effects. This mix suggests any type of serious stumble in the future could prove doubly damaging to shareholder returns.

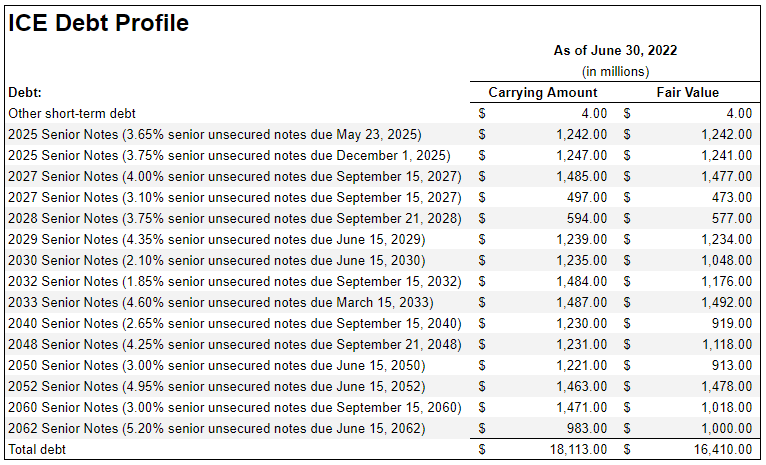

Leverage

Intercontinental Exchange has a long history of wielding debt to facilitate strategic acquisitions. While the company is more levered than your average name, the company seemingly has no issue sourcing debt relatively cheaply.

ICE currently has:

a current ratio of 9.6

a total debt/EBITDA ratio of 4.03

a net debt/EBITDA ratio of 3.85

ICE’s operational stability, profitability, and shift to recurring revenue leave little worry regarding its ability to service debt. It’s worth mentioning that ICE has already sorted financing for the BKI deal. If it goes through, it should be assumed that share repurchases remain depressed in the short term as the company deleverages. Management has stated that repurchases won’t be off the table but that their goal is to bring net leverage down to around x3 by the end of 2024, regardless of if/when the deal goes through. If it doesn’t go through, debt can be adjusted accordingly and the company will be materially less levered than current numbers show.

Valuation

Ponder a few questions:

Is the world going to continue being a rather complex and dynamic environment?

Will there be a demand for tools to navigate such an environment?

Would people prefer powerful digital tools or painfully archaic analog tools?

Do you think people will want to consume energy in the future?

Will people want to live in houses in the U.S. in the future?

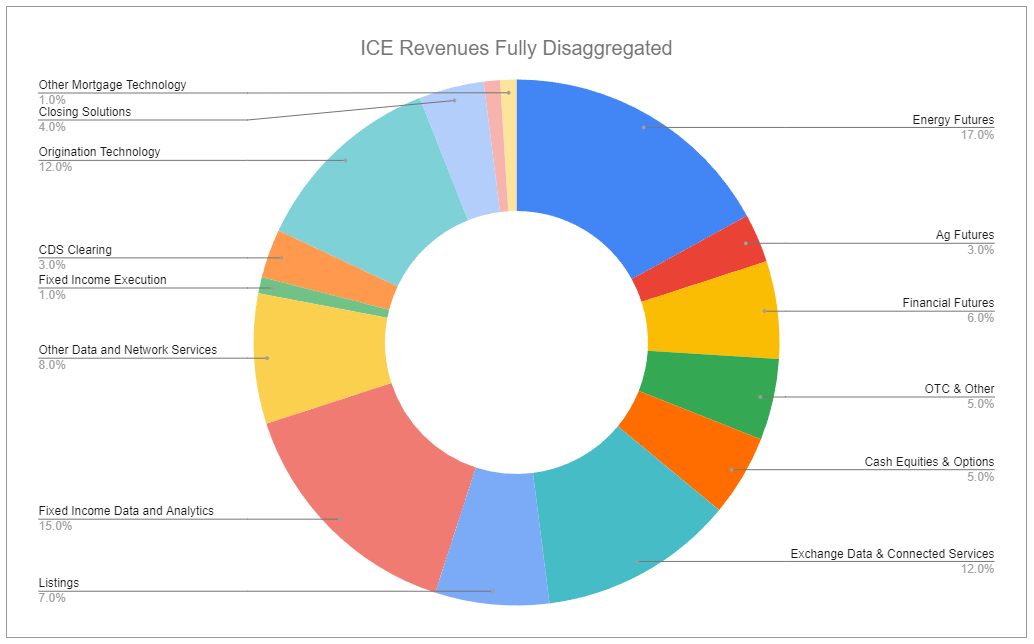

These might seem like very silly questions. They are. But they also paint Intercontinental Exchange’s enviable position. The company’s fully disaggregated revenues showcase just how wide a presence the company maintains:

And ICE’s presence isn’t just wide, it’s also deep:

The company dominates global energy trading, with key benchmarks for oil and gas

Handles the majority of the world’s CDS trading

Touches the majority of U.S. mortgages

Provides critical data, analytics, and connected services

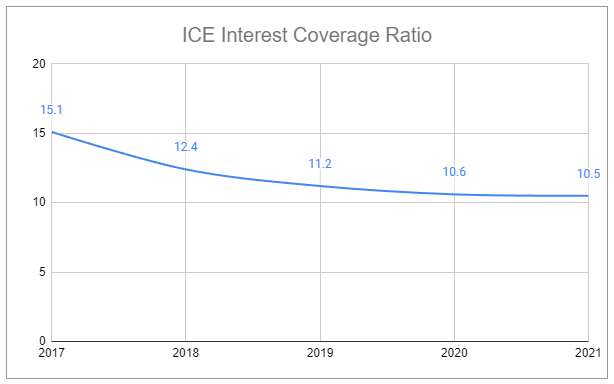

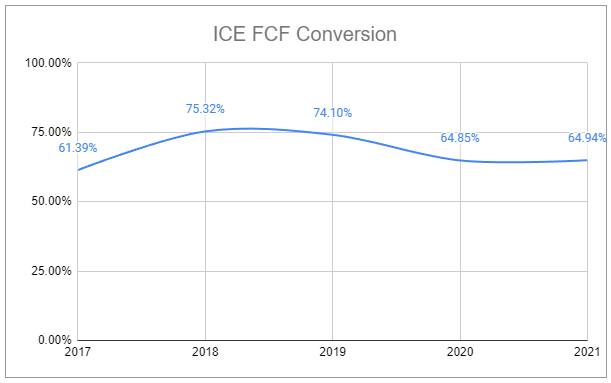

ICE operates as a pseudo-monopoly, and all of the markets it focuses on have tremendous long-term growth prospects. This dominant status allows the company to operate extremely profitably:

And the end results have been like clockwork:

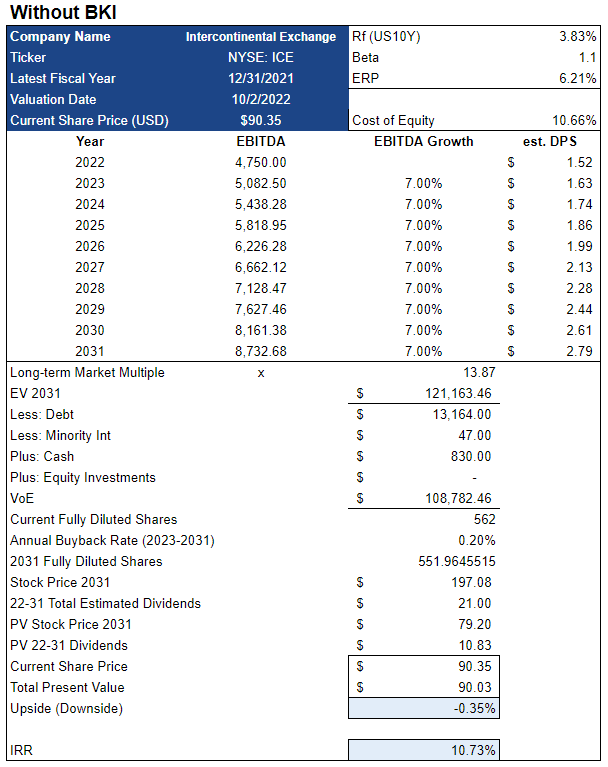

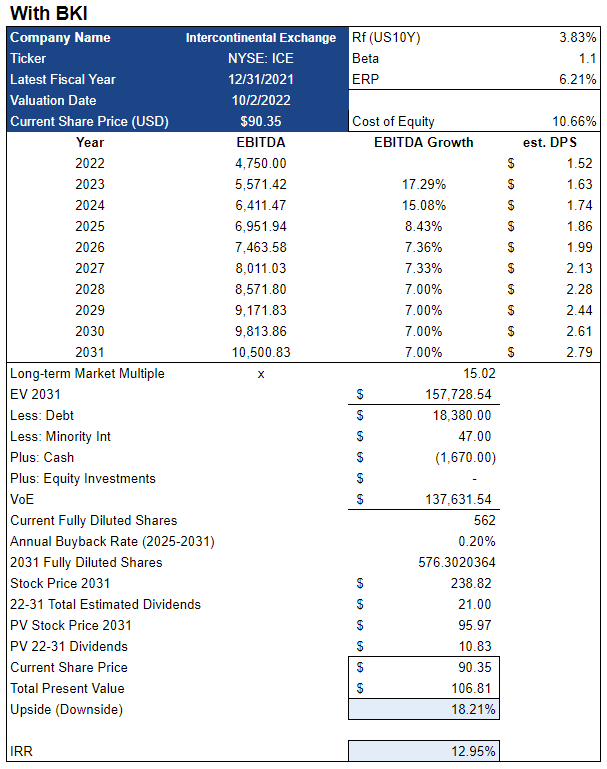

I valued Intercontinental Exchange using a 10-year exit based on backing out equity from an EV/EBITDA multiple and factoring in forecasted dividends and share repurchases. Two models were created - one with the BKI deal and one without.

WITHOUT BKI, Key assumptions:

Continued H1 2022 segment trends for FY 2022

Base ~61% EBITDA Margin and ~40% FCF Margin

EBITDA and DPS growth rates of 7%

Adjusted current debt down to reflect no BKI deal

Excluded value of equity investments

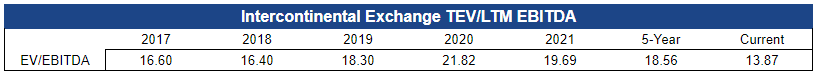

Maintains current adjusted EV/EBITDA multiple of x13.87

Share repurchases resume in 2023 with .2% of outstanding repurchased per annum

While the results indicate ICE is near fair value, we should reevaluate:

The lazily-input EBITDA growth rate of 7% is starkly lower than the 11.43% CAGR achieved over the last 5 years.

The dividend growth rate is less than half the achieved rate over the last five years.

The adjusted multiple of x13.87 is significantly lower than the avg x18.56 over the last five years

Additionally, rough math would suggest that only ~1/3 of theoretically available FCF would be used on dividends and buybacks, leaving ample capital available for inorganic growth via acquisitions and as well as additional share repurchases.

WITH BKI, the change in assumptions are as follows:

Maintains current EV/EBITDA multiple of x15.02

BKI deal finalizes in H1 2023

ICE fully recognizes anticipated post-acquisition y1-5 synergies

Factors in share dilution from the BKI deal (~$2.6b new equity)

Share repurchases resume in 2025 with .2% of outstanding repurchased per annum

The output suggests that with the BKI dealing happening, ICE is undervalued and could produce impressive returns. Though, we can knock this model for lazily netting out the cash consideration as part of the BKI deal. However, this model also uses the same lazy base 7% growth rate and simply overlays the impact of the initial acquisition and 5y synergies on top, without any forecast of increased growth thereafter. Additionally, this model uses the current x15.02 multiple, still considerably under the 5y average of x18.56. Even ballparking higher interest expense, additional deal costs, and deleveraging, there would be around half the theoretically generated FCF available for dividends, buybacks, and future acquisitions.

Neither of these models is close to precise, but neither demands all that much from a company that has historically been able to deliver much, much more.

Closing Thoughts

The world has gone crazy but Ice doesn’t look crazy to me. The company’s first-half performance this year is a testament to its durability and ability to navigate our complex world. Maybe, just maybe, it will leverage today’s crazy environment into its next major growth catalyst. It wouldn’t be the first time.

Thanks for reading!

Ownership Disclaimer

At the time of publishing this piece, I own positions in Intercontinental Exchange.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: ICE 0.00%↑ BKI 0.00%↑

Additional Resources:

Intercontinental Exchange - public filings and investor presentations. Source

Black Knight - public filings and investor presentations. Source

ICE Chair & CEO Jeffrey Sprecher to Present at the Piper Sandler Global Exchange & FinTech Conference. Source

ICE Chair & CEO Jeffrey Sprecher to Present at the 38th Annual Bernstein Strategic Decisions Conference. Source

ICE Chief Financial Officer Warren Gardiner and NYSE President Lynn Martin to Present at the 12th Annual Deutsche Bank Global Financial Services Conference. Source

ICE Chief Financial Officer Warren Gardiner to Present at the Raymond James 43rd Annual Institutional Investors Conference. Source

There's a big tail risk of Energy Futures volumes in the future (with the advent of green energy). Secondly, ICE roundtrip costs are exorbitantly high for some products ( Sugar, Cocoa, Cotton) vs for CME. Even after rebates, the costs are 2x that of CME group. Hence, there's a potential of fees (& hence revenues) reducing.

Excellent analysis, really very good.