“One of the most difficult matters in all of controversy is to distinguish disputes about words from disputes about facts.” - Bertrand Russell

The words above, first proclaimed in 1958, were a permanent fixture of my childhood. Pinned up in the kitchen of the house I grew up in, scribbled onto a piece of paper by my father, it is a quote I will never forget. Nor should you.

The trap

Traditional media continues to fall short. Headlines are designed to get clicks, as they should be, but fewer and fewer pieces provide the substantive insights so many of us crave, and the sheer volume of content produced is simply a sign of chasing the flavor of the day, hour, and minute. It is unnourishing, leaves a lingering sour taste, and is exactly what is driving dissatisfied readers toward independent media outlets. But even many of those independents fall into a classic trap—pursuing growth at all costs.

All too many exhaust themselves by setting out at an unsustainable pace. Others, believing they’ve found a cheat code, find that quickly growing an audience comes easy. They keep up with each current event and offer an opinion on everything. Speaking with certainty, no matter the abundance of complexity or absence of expertise, they form incendiary remarks to carelessly lob at the masses. Sparking tribalism, even occasionally setting their own tribes on fire, it is a game of getting eyeballs on themselves and doing whatever it takes to stay in the spotlight. Commit to this, and there is a good chance that you, too, can build a sizable audience. However, this approach is also bound to disappoint. Sizable audiences do not necessarily reflect the truthfulness, accuracy, or usefulness of work. Being quick and loud does not set you apart, and you are bound to become merely another of countless who end up mirroring the incumbent media they detest—and when that hollowness becomes apparent, eventually, you’re just yelling into a void. Without question, it is better to do the opposite.

Doing the opposite

I firmly believe the world needs more writing that embraces full curiosity and skepticism, created by those who favor sensible timeliness over fostering false urgency. This is exactly what I’ve aimed to achieve with Invariant. One piece is published each week, ranging from short musings on history and philosophy to deeply researched analyses. The tone of each may change, but the degree of effort to consistently distill value does not. A growing number of people find such an approach refreshing.

While subscriber growth holds steady, there has been a modest deceleration. I have welcomed this—a development appearing entirely natural, as most of the companies I cover are less favored, perspectives less common, and all framed within a future duration that far exceeds the holding periods of most. Without running any paid advertising, the growth of Invariant has been entirely organic, and with limited reach across social media, said growth, in addition to search, is largely a function of readers sharing my work with others as well as an increasing number of other authors recommending Invariant to their readers. Still, the total reader base has surpassed 5,100. It is still dwarfed by many other independent publications, but, as it was once framed to me, if one were able to fill an auditorium week after week, full of those eager to listen, that would be a remarkable feat. Here we are, and on a weekly basis, Invariant is eagerly read by thousands. Despite spending a good deal of my time collating numbers much larger, that figure is still hard to grasp. I am both grateful and awed.

Much like my investments, I am interested in the truly long-term, and as I shared in Writing for the Long Run, my ultimate goal is to build something that lasts. To achieve this, there are two other metrics I consider most critical:

Continuity: An archive of work that exhibits sensibility and authenticity and appropriately reflects an evolving understanding of our endlessly complex world through the lens of finance.

Deep Connections: The number of people who engage with the content and connect with me, including private individual investors, analysts, money managers, family offices, retired executives, operators within the industries I cover, and anyone else curious.

I could not be more pleased with how these are developing.

The growing archive provides a clear way to track ideas, research, and analysis throughout time. Beyond useful reference, it ensures honesty—not just to readers, but to myself and my investing process. As for deep connections, there has been a growing number of readers that have reached out, connecting through DM, email, phone, and video call—opportunities I am eager to take. Often discussing company-specific research, these exchanges offer valuable insights and criticisms alike, allowing me to further refine both my investing and writing abilities. This is an integral part of the engine that moves Invariant forward, as evidenced by the virtuous cycle meticulously illustrated below:

The idea that there is an opportunity to turn Invariant into something more significant has been fully validated. I pay to support a number of high-quality independent publications, rooting for their ongoing success, and I would like to join their ranks. After having published all content entirely free for nearly two years, Invariant will be transitioning to a semi-paid publication toward the second half of 2024. Before you get your pitchfork out, there are several things to note:

Most new pieces will still be entirely free.

Certain future analyses and other select works will be accessible only to paid subscribers.

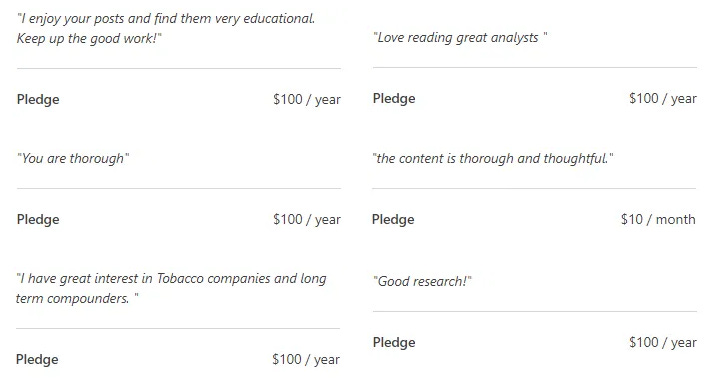

While the exact date for the transition is yet to be determined, anyone pledging a paid subscription prior to the switch will be grandfathered in at a rate of $10/mo or $100/yr.

Future paid signups will be at a rate of $12/mo or $120/yr.

The cadence of new releases will stay the same, but the overall resource commitment to the publication will increase. My goal is to earn your continued support through an unwavering commitment to providing thorough research, engaging writing, and unique specificity. This is the route that so many desire and I am thrilled that numerous have already pledged. Here is what a few of them have to say:

If you enjoy reading Invariant and share similar appreciation, I encourage you to consider pledging today. This work is incredibly fulfilling, and the prospect of being able to provide more time and resources to make it even more valuable is beyond exciting. Thank you for helping me reach this pivotal moment. I wish you an exceptional new year and beyond.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

I always appreciate the thoughtfulness of Devin’s on schedule weekly articles (whether totally refined or not 😊).

Reading your newsletter has been an enjoyable part of my Sunday routine for almost a year now. Devin, I wish you well in 2024.

A difference between independent publications such as yours and the legacy media is that you are writing to further your own understanding, not to convince me of something. As you say, “the world needs more writing that embraces full curiosity and skepticism.”

This is evident when you write about specific companies. The information and charts you provide are meant to answer questions like “is this a good investment?” and not simply to fill space. You often reach nuanced conclusions.

Your curiosity also shows through the kinds of articles you write — sometimes about specific companies, but sometimes about your investment process or the broader industry and regulatory environment.

I’m happy to hear that you’ve been able to get valuable feedback and make deep connections through your newsletter.