Altria: Drift

“Altria delivered strong third quarter and first 9 months financial performance. Adjusted diluted earnings per share increased 3.6% in the third quarter and by 5.9% for the first 9 months. In the smokeable products segment, adjusted operating company’s income grew by 0.7% to nearly $3 billion in the third quarter and by 2.5% to $8.4 billion for the first 9 months. Adjusted OCI margins expanded to 64.4% for the third quarter and first 9 months, representing impressive margin growth of 1.3 percentage points and 2.7 percentage points, respectively.” - Salvatore Mancuso, Altria CFO, Q3’25 remarks

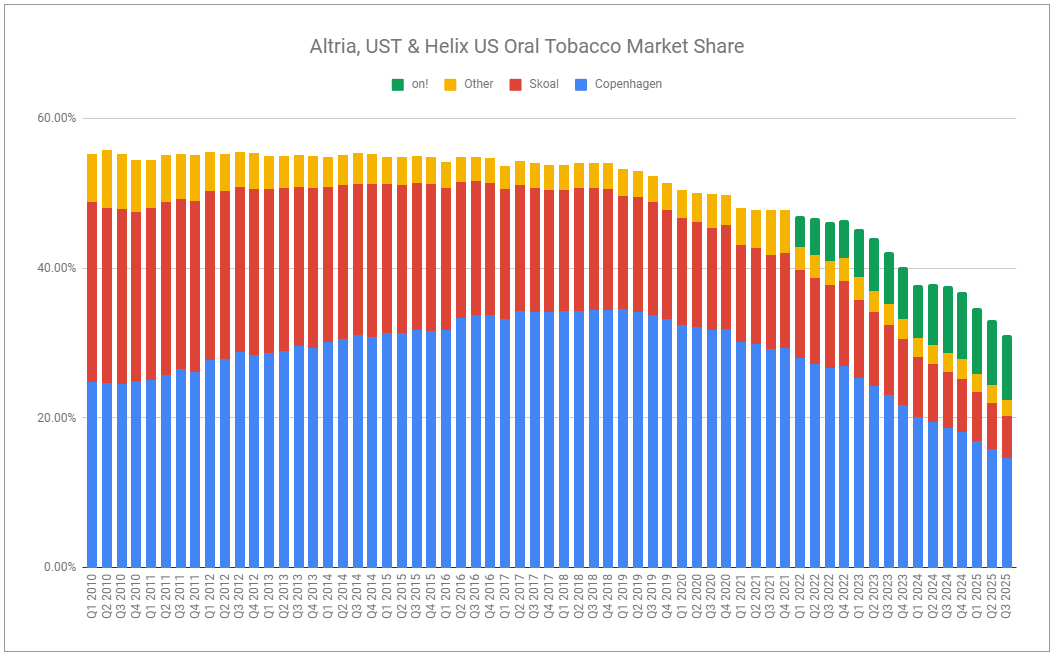

Altria continues to discuss its next-generation product efforts in detail; therefore, it is no surprise that investors’ minds wander in that direction. When it comes to on!, there are ample points to consider. As highlighted in last week’s piece concerning PMI, the US nicotine pouch market is facing heightened competition, and just as ZYN is feeling the pressure, so too is on!, albeit differently expressed. The loss of total oral share or total oral shipped volumes can easily be pointed to as a weakness that should be of grave concern. But those metrics have looked relatively weak for some time. By now, it should be evident that these metrics are less useful, as they do not capture the full scope of value creation of the segment. More importantly, we must consider operations as a whole so that our perspective does not drift from what truly matters.

Keep reading with a 7-day free trial

Subscribe to Invariant to keep reading this post and get 7 days of free access to the full post archives.