“We reaffirm our guidance to deliver 2024 full-year adjusted diluted EPS in a range of $5.07 to $5.15, representing a growth rate of 2.5% to 4% from a base of $4.95 in 2023. Turning to our business results, the smokeable products segment continued to deliver on the strategy of maximizing profitability while appropriately balancing investments in Marlboro with funding the growth of smoke-free products.” - Salvatore Mancuso, Altria CFO, Q3 2024 Call

When I was seven years old, I was surprised to find that a playset had been swiftly assembled in our backyard. The structure had two swings, a slide, a climbing rope, and a two-story playhouse. I was ecstatic. My mother told me, under no uncertain terms, that I was NOT to jump off of the second story. What did I do the very next day? I followed my mother’s orders. I did not jump off of that second story. Instead, identifying a loophole in the rule, I climbed up onto the roof of the second-story and hurled myself off. Gravity took course. I hit the ground—badly. I didn’t know exactly what happened, but I did know I was in pain and couldn’t bear weight on my left foot. I had to crawl to the house. My mom was pissed. She thought my foot was fine. After a few days, she took me to the doctor, who confirmed that my foot was, in fact, broken.

What is it like when the shoe (or proverbial cast) is on the other foot? Look no further than Altria, the company few believe when it says it is not broken. The company is seen as old, slow, and hobbled, yet is told by so many that it must rush forward in new investments to compete effectively. Repeatedly, it is hailed that the company is running out of time. Yet, as the company continues to produce genuinely staggering piles of cash, the things running out are new explanations of why such a phenomenon can not continue.

No two alike

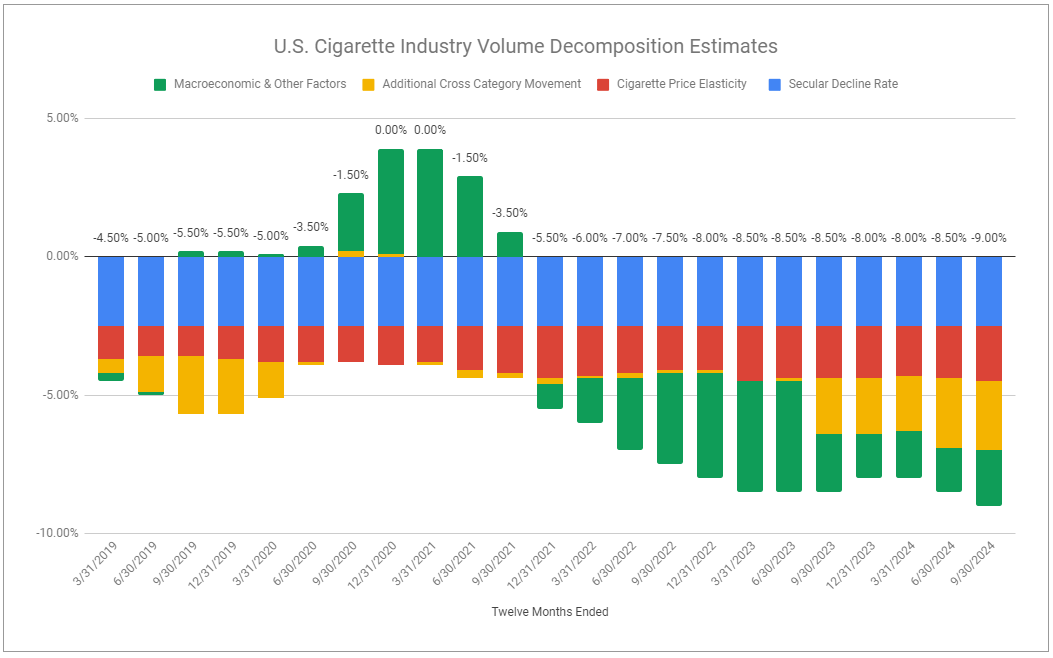

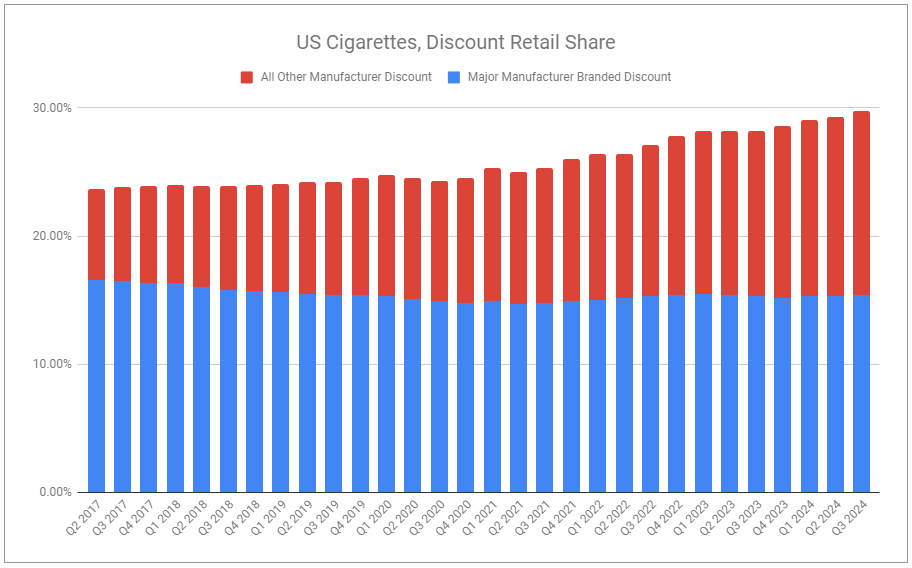

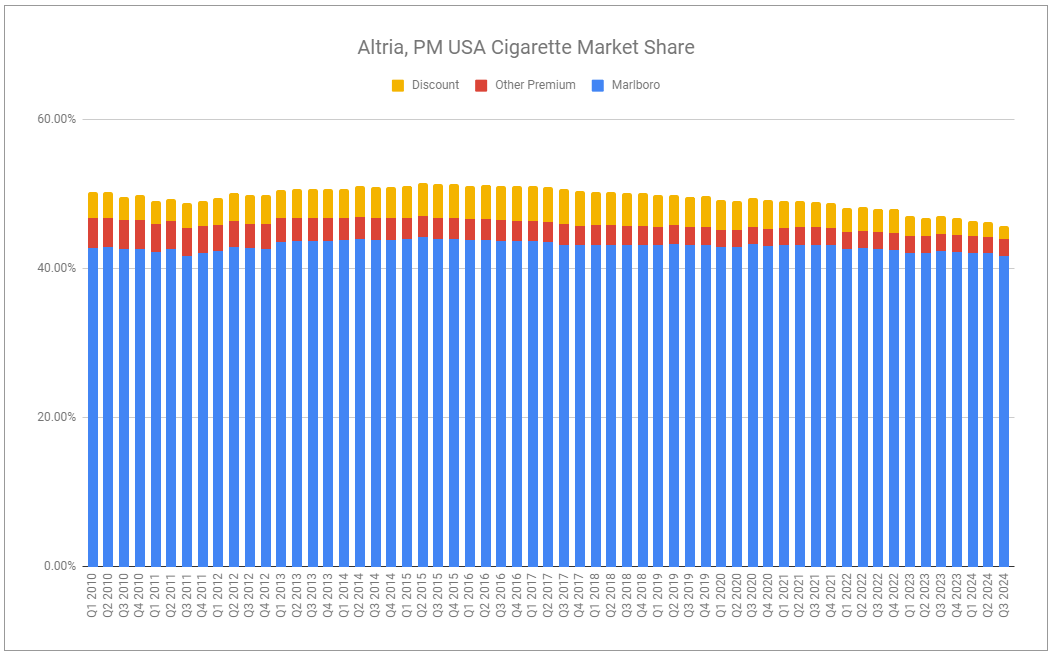

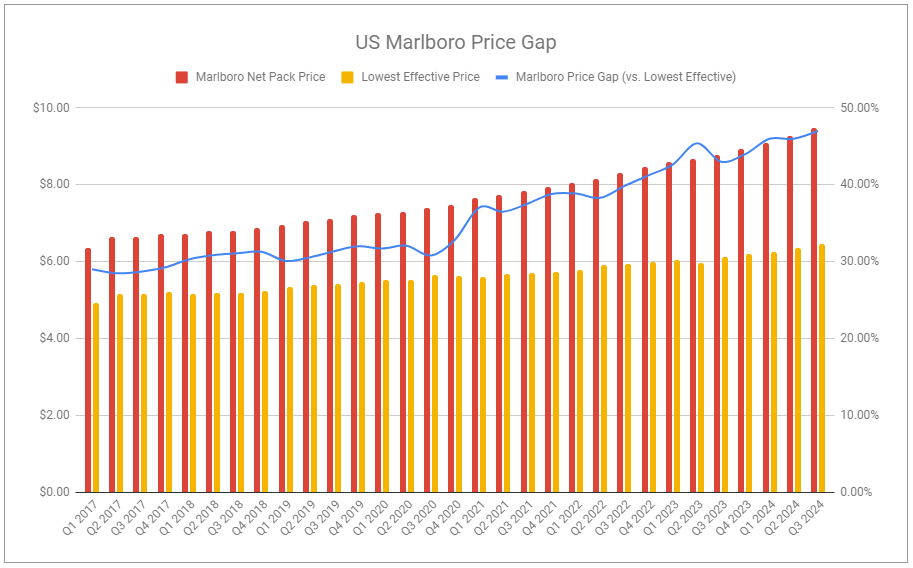

The elevated decline of Altria’s cigarette volumes continues. Despite growing enforcement efforts, illicit vaping is still rampant. The company is ceding share, too, as inflation continues to weigh on consumers, reducing purchasing—or rather, purchasing premium brands as they trade down to discount. To actively wind down lower-priced volumes—exactly what Altria is doing—while consumers are still trading down may appear foolish. However, it remains a terribly sensible route if you are concerned with dollars earned and not volumes shipped. Supporting this idea is my favorite excerpt from our recent interview with Rae Maile on the Preferred Shares Podcast (emphasis added):

In tobacco, there’s this fixation that all cigarettes are created equally, which is definitely not true. One time, we went to Russia with BAT—a long time ago now, I have to say—and they were explaining that on the pricing structures, the top end of the range was a brand Vogue Ephemere, which was a super slim, super long, extraordinarily branded cigarette. And it sold at a price. And they said to make the same gross margin as this one box, we have to sell 60 packets of a local brand. I’ll tell you what, 60:1, then you can do a lot of damage on volumes on that.

Talking once to Paul Adams when he was chief exec of BAT, and he got bored because there was a fixation with volume. He said, “You want volume? I can do you any volume you want. You have no concept of how much of Russia there is east of the Urals. I won’t make a single penny more. But if you want volume, yeah, fine. I can do that tomorrow.” And that’s what it comes down to. Volume is an easy number to track. But it’s not the answer.

It doesn’t matter if it’s Russia, the US, or anywhere else: company by company, brand by brand, country by country, profitability varies immensely. When it comes to cigarettes, there are no two alike.

Keep reading with a 7-day free trial

Subscribe to Invariant to keep reading this post and get 7 days of free access to the full post archives.