“You don’t believe in me,” observed the Ghost.

“I don’t,” said Scrooge.

“What evidence would you have of my reality, beyond that of your senses?”

“I don’t know,” said Scrooge.

“Why do you doubt your senses?”

“Because,” said Scrooge, “a little thing affects them. A slight disorder of the stomach makes them cheats. You may be an undigested bit of beef, a blot of mustard, a crumb of cheese, a fragment of an underdone potato. There’s more of gravy than of grave about you, whatever you are!” - Charles Dickens, A Christmas Carol

British American Tobacco’s 2024 Pre-Close Statement provided ample material for ruminating. 2024 guidance was reaffirmed, but numerous concerns have brought indigestion. As Christmas fast approaches, it is hard to avoid channeling the inner Scrooge, who declares, “Bah humbug!” However, reality must be addressed, which begins with assessing the source of discomfort: the group’s mixed approach to product categories.

Modern Oral

My note covering BAT’s Capital Markets Day 2024 stated that the group’s approach to Modern Oral remains weirdly disjointed. Unsurprisingly, the Scandinavian version of Velo has continued to perform well: strong product, strong distribution, and strong contribution. The confusion stems from the group’s approach to the U.S. market.

Earlier in the year, BAT did a ‘brand refresh’ for Velo in the United States, and Pre-Close remarks stated a significant increase in share. But the U.S. version of Velo is not good. At all. The brand refresh may be growing share now, but how it leads to sustained repeat purchases is a mystery when the packaging is still low-quality, the pouches are rough, and it is difficult to tell how long the flavors supposedly last because they are so weak from the first second of use. Hearing me rant about the product, a friend recently purchased it to try for himself. Upon opening the can, he discovered one or two pouches had already split open, covering the remaining pouches generously with powder. He tossed the can into the trash rather than attempting to salvage them.

To make matters worse, BAT has touted the rollout of Grizzly Modern Oral pouches as further aiding the group’s growth in the United States. The rationale for using a strong legacy brand on a modern oral pouch is that the level of familiarity and brand equity better converts legacy oral tobacco users to the category. The issue? It’s the same product as the refreshed Velo with a different logo slapped on the can. Think of all the time, effort, and money spent to push this product, only to likely result in consumers willing to try out the modern oral category being turned off or inclined to jump to a competing brand.

The one saving grace for BAT’s modern oral presence in the United States is the recent rollout of Velo Plus. The handful of consumers and retailers I have talked to about the product have unanimously agreed it is indeed a radical improvement compared to Velo 1.0. Tadeu Marroco, BAT’s CEO, provided context on the rapid rollout occurring for the product during the call:

On the VELO Plus, our first launch that is happening now is addressing a number, we had in mind something close to 75,000 outlets, and we are reaching now close to 80,000 outlets by the end of the year. And we expect in the second phase that will be in the first quarter of next year to reach 110,000 outlets. So it’s a very reasonable presence and we’ll be scaling up from there quickly.

Despite the promising launch of Velo Plus, there remain several lingering questions:

Will the leading European version also be branded as Velo in the US? Will there be a future in which the company has a trove of Velo brands, all different, in the US market? Managing agreements for retail shelf space in such a scenario would be quite a task. Will the company sunset 1.0 if the + product gains meaningful traction? Will BAT sunset + if and when the leading European version gets into the market? There are costs and pains with doing so, and the potential for consumer confusion is further elevated by the Grizzly pouch rollout, in which a legacy brand name was willfully bestowed onto a new category. The company says it is becoming more discerning in its deployments, but it is hard to argue that these rollouts don’t look like a shotgun approach.

Heated Products

During BAT’s Capital Markets Day 2024, the group conceded that the glo Hyper Pro was struggling to compete within the premium HTP subsegment. The group’s 2024 Pre-Close Statement disclosed glo’s volume share improvement. Yet, this is expressed as a meaningful lightening of continued volume share decline relative to the full year 2023. The group also highlighted the nascent launch of the glo Hilo, claiming promise. Although data is extremely limited, early user reviews suggest BAT may be missing the mark again. The one promising area is non-tobacco heated sticks, such as Veo, which are gaining traction quickly.

It remains to be seen if the incremental improvement in net revenues and profits can justify a continual pursuit of competitiveness in the premium subsegment. Should British American Tobacco remain steadfast in its attempts? The category, relative to other NGPs, is unique in that it skews premium as a whole. Many budget-conscious consumers are looking for NGP alternatives. Why not focus on non-premium price points, where consumers can be directly met?

Vapor

British American Tobacco’s vapor portfolio is strong. Its value share remains over 40% in its top markets and more than 50% in tracked channels in the United States. Pre-Close remarks highlighted the trend of users first entering the vapor category via disposables but shifting to pod-based products over time due to the economic benefit of relative pod prices. This, naturally, also benefits retailers, who benefit from improved margins on pods relative to disposables. The company is also working to introduce premium vaping products next year, catering to a slightly more sophisticated consumer. With a drastic lead in value share, this appears less of an uphill battle than HTP, in which IQOS firmly has the high ground.

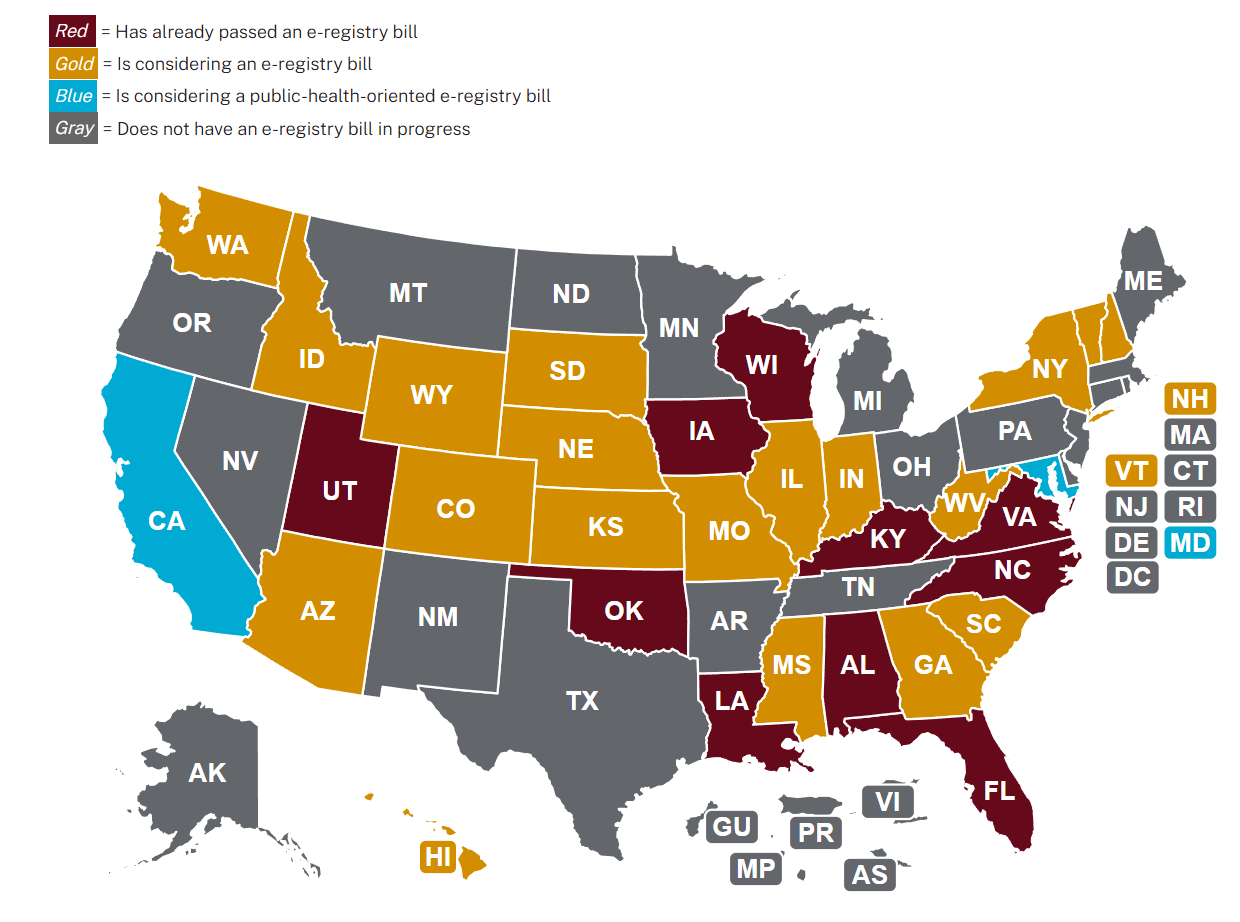

As strong as BAT’s vapor portfolio is, there are undeniable headwinds. Prior years’ estimates of illicit products in the United States market measured 40%, 50%, and 60%. Throughout 2024, we have seen increased government enforcement against illegal products, including actions taken by the Department of Justice and the U.S. Customs and Border Protection. Even so, BAT estimates illicits now make up more than 70% of United States volumes. This is also despite several states having passed and now enforcing registry bills, resulting in a significant drop in respective illicit volumes and a relative boon for BAT’s Vuse and legacy products. Many more states have recently passed similar bills or are considering doing so soon. However, the effects felt will surely take multiple years before meaningful aggregate benefit is realized.

Combustibles

There is no escaping that British American Tobacco’s NGP approach is a mixed bag. However, during the group’s Capital Markets Day 2024, the rightful refocusing on combustible products was highlighted. Commercial investments made earlier in the year are primed to bear fruit for H2, but, as always, there are caveats. For example, in the U.S., premium brands, such as American Spirits, continue to perform strongly, but a seemingly disproportionate focus remains on value brands, such as Lucky Strike. So, while volume share has been bolstered in the group’s top markets, value share has been driven downwards. The group has not expressed expectations of macro improvements in the U.S. market in 2025. Still, if and when consumer pressures are lessened, it remains to be seen how adequately BAT will fill in the gaps in its stretched pricing ladder relative to competition, potentially weighing on both volume and value share.

Several days ago, an alarm was sounded that the FDA requested the White House move forward with a previous plan to curb the level of nicotine in cigarettes significantly. Will this go anywhere? Not soon. And as I’ve written previously, it’s unlikely to materialize fully.

With a change in the White House and a notably skewed representation in Congress, one distinct (non)event is set to benefit BAT disproportionally. The proposed menthol ban, tabled, will remain in the shadows for at least the next few years. Had the ban gone forward, it would have been contested and drawn out for years before being enacted. As this was the largest threat to BAT’s profits in the medium term, the group has been provided generous breathing room to protect its U.S. profits.

And another one

The day after BAT’s Pre-Close Statement was released, creditors voted to approve the agreement concerning the CCAA. While the math is still cloudy, the group’s leverage will tick above the high end of its 2-2.5x range, with a goal of reaching the high point in 2026. Although some pressures have lessened, and the company retains uniquely valuable assets, such as its ITC stake, further doubt has been generated about how sustainable the proclaimed ‘sustainable share repurchases’ genuinely are.

Indeed, not all new product categories will succeed everywhere. Historical usage patterns, societal norms, affordability, and regulation will largely dictate trial and adoption. So, the multi-category focus is somewhat justified. But is the group’s approach trying too hard to be everything for everyone? One year of elevated investment becomes two, perhaps three, and four. And another one. And then another. If it has bitten off more than it can chew, at what point does the group show discipline to maximize value? Following last year’s Pre-Close Statement, I stated that BAT faced an identity crisis. Little has changed in terms of how external stakeholders perceive the company. The group must formulate better communication for its roadmap, turning new efforts into real, meaningful profits and providing a more concrete commitment to shareholder capital returns. Based on where the equity trades, it shouldn’t take much.

Thanks for reading. Enjoy this piece? Hit “♡ like” on the site and share it.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in British American Tobacco and other tobacco companies such as Altria, Philip Morris International, Scandinavian Tobacco Group, and Imperial Brands. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: BTI 0.00%↑ MO 0.00%↑ PM 0.00%↑

Your report has great candour and provides insightful analysis.

The sooner the European version of Velo gets to the states the better. Far superior and think possibly better than Zyn.