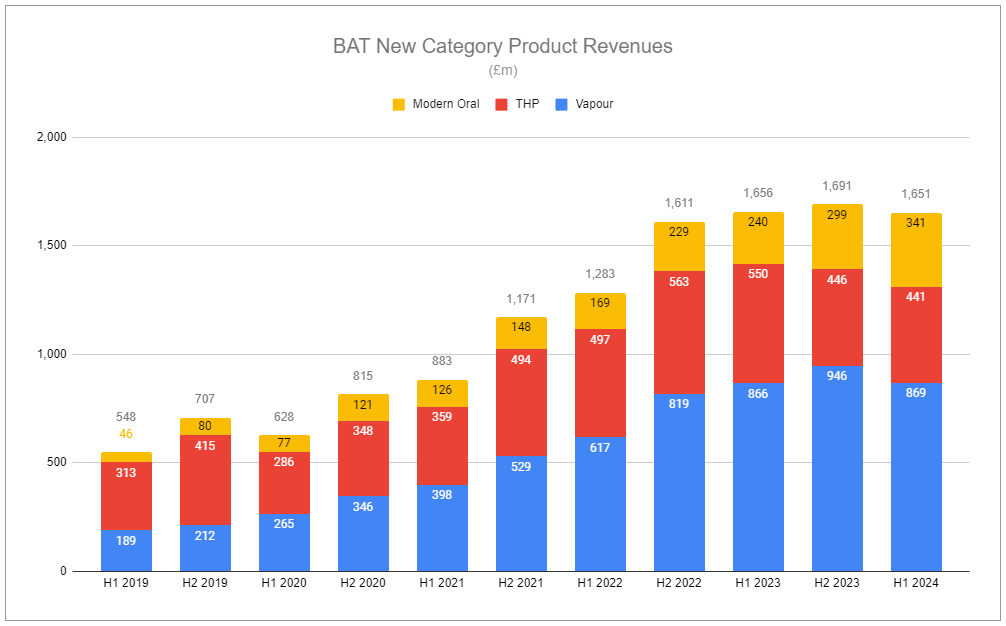

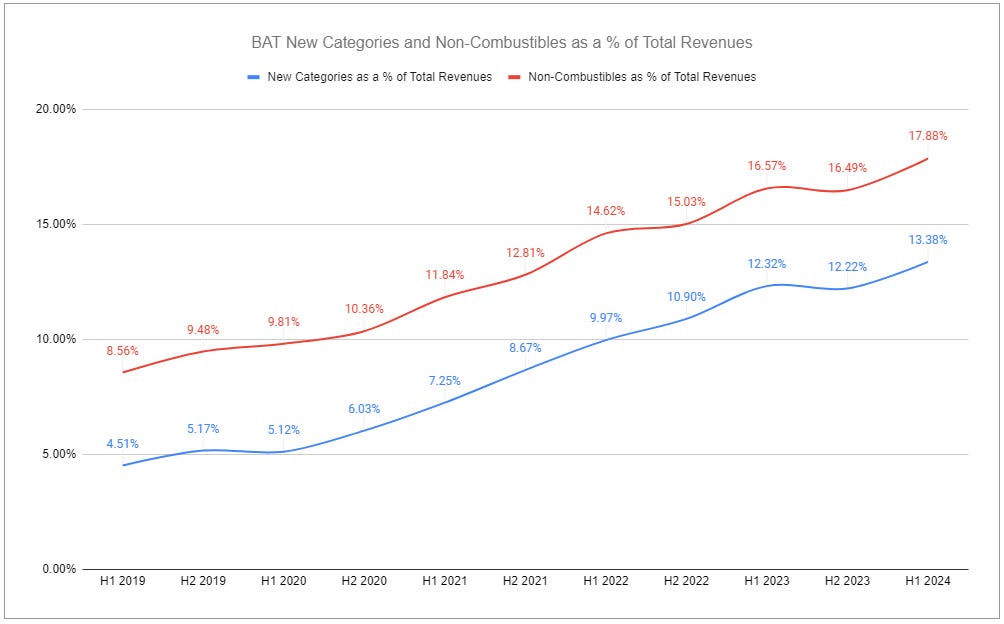

“One of my key priorities is to ensure that as we transform, we balance top and bottom line delivery. This is demonstrated with our new category contribution now driving our contribution margin up whilst we continue to invest for our future growth. New categories are now meaningfully contributing to group results as we benefit from increased scale and efficiencies. Building on this momentum, we expect to deliver a strong year-on-year improvement in new category profitability in 2024.” - Soraya Benchikh, BAT CFO

In mid-July, British American Tobacco received Marketing Granted Orders via the PMTA pathway for a slew of its vapor products, specifically the Vuse Alto device and six pods—two tobacco flavors at three different nicotine strengths each. The outcome is certainly better than receiving MDOs, which would be followed by a lengthy and costly legal challenge—the route taken by Alto’s menthol variants. Having products that are authorized sure has a nice ring to it, yet I can’t help but curb my enthusiasm and say, “So what?”

From a positional standpoint, being authorized does not suddenly aid the product whose PMTA was previously pending determination. In both conditions, the product exists in a challenging environment, competing against a growing hoard of illicit products. Earlier in the year, I covered developments concerning state-level regulations targeting illicit products, and now we have data from states such as Louisiana, whose Vapor Directory bill significantly reversed trends in illicits, resulting in a large benefit to Vuse Alto. Now, a dozen or so other states have either enacted or implemented similar registry bills, suggesting a similar reversal. However, that too is worth remaining guarded on since additional states could take more than a year to implement, enforcement may be less robust, and many other states have struck down proposed registries, curbing continued adoption. At the same time, Federal actions to clamp down on the illicit market continue to expand. Effective enforcement is far from easy, but each layered action supported by state-level actions can provide meaningful effect.

Though the spread of vapor across the US is prolific, it pales to the pace of growth experienced by the nicotine pouch category. In H1’24, BAT’s US modern oral volumes increased by 226%, resulting in revenue growth of 117% and volume share nearly doubling to 7.6%. Despite the sizable percentage figures, I again find myself saying, “So what?”

BAT’s management points to the ‘brand refresh’ applied to Velo in the United States as a primary cause. Unfortunately for BAT, I am not sure that they deserve all of the credit for this performance, and serious doubts remain about the product’s trajectory in the US. The brand refresh includes higher-quality printing on still sloppily placed stickers on top of cans made from only marginally less flimsy plastic. What is inside the cans is still the same: dry pouches, weak flavors that barely pass for what they claim to be, and, of course, excess loose powder. The delivery and enjoyability of the product are no better than before. I have previously highlighted and often repeated the inferiority of US Velo to its non-US counterpart. Allow me to take it a step further: US Velo isn't just inferior to its non-US version; it’s inferior to every other pouch I have analyzed.

Velo’s recent spike in growth in the United States coincides with the capacity constraints affecting Philip Morris International's ZYN—the company simply can’t keep up with fervent demand. It only makes sense that Velo was a major beneficiary, sporting a massive distribution network and production utilization nowhere near max capacity because volumes had been previously falling despite infrastructure geared for the opposite. Over the next two years, Velo in the United States will act as a useful case study showing the push/pull of product vs. distribution—plenty of inferior products have won markets across other industries due to superior distribution, and superior products can flounder due to a lack of proper distribution. However, in Velo’s case, I remain deeply skeptical that the current growth in the US will be sustained over the longer term with the current product iteration, and I am even willing to suggest the possibility that the recent brand refresh is net-negative for the company's category moving forward. If and when Velo 2.0 finally finds its way into the US, unless the company does some seriously heavy lifting to stress its true differentiation, many consumers will have been turned off by the brand by having previously trialed Velo 1.0, and many more will be in that boat due to the refresh.

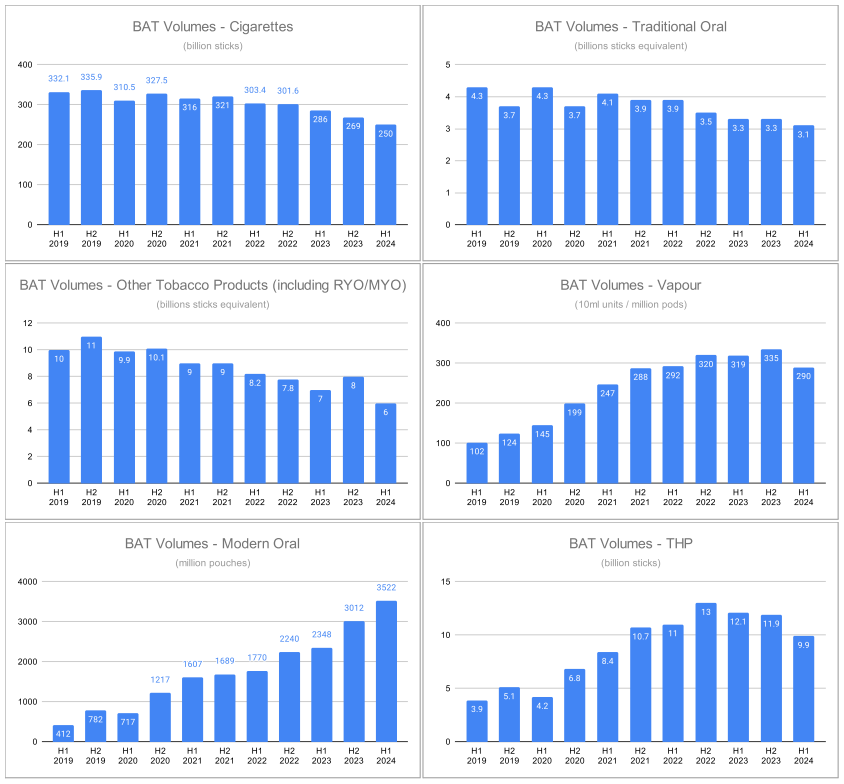

There are multiple caveats to the criticisms above, as well as additional points of concern. Despite the questionable sustainability of Velo’s US presence, the non-US version continues to gain traction, spreading across geographies. In H1’24, Modern Oral volumes in AME and APMEA increased by 46% and 32%, respectively, and respective revenues increased by 40% and 15%. APMEA vapor volumes and revenues increased by 40 and 41%, respectively, and although significant volume declines were experienced in AME and the US, revenues remained nearly unchanged. BAT’s heated tobacco product, Glo, is indeed struggling due to the relative product qualities highlighted in the FY’23 piece. Yet, even with HTP’s lagging performance, aggregate New Category Revenues remained essentially flat year over year. More importantly, despite flat-ish net revenues, contribution margin improved notably to ~8% in H1’24, resulting in New Categories producing an aggregate contribution of £129m.

The meat

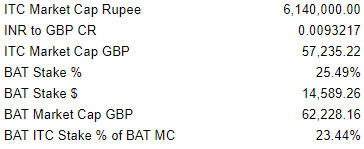

Cost controls, rationalization, and prudent capital management will lead to results on a per-share basis. The trimming of the group’s ITC stake netted proceeds totaling £1.67 billion—and the remaining stake is still sizable.

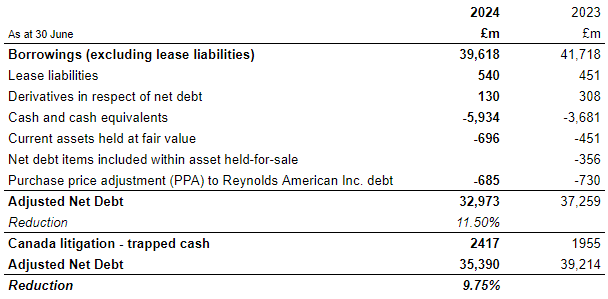

Deleveraging continues, and net financing will be quite a bit lighter for FY'24 than previously illustrated, pushing more earned dollars toward shareholders.

Operationally, while there are countless nuances and angles to consider when examining New Categories, the meat—the bulk of the group’s—continues to come from cigarettes. US volumes continue to decline at a rapid pace courtesy of the same pressures felt over the last two years, ultimately exacerbated by the same strain weighing on the group’s vapor performance: illicit volumes. To add, while the Natural American Spirit brand remains an ultra-premium pillar, Lucky Strike, fast-growing, is making a tradeoff on pack price for the sake of volume and market share—a buoy should consumers face sustained pressures, and a hinderance otherwise. Ex-US, combustibles volumes experienced elevated declines as well, with AME showing a substantial H1’24 drop courtesy of the sale of operations in Russia and Belarus in H2’23 and APMEA sporting a sizable drop due to illicit trade. Pricing has remained robust, and organic volumes on the continued front look far less gloomy, but FX pressures remain a constant threat.

One of the largest overhangs was the looming US federal-level menthol ban, which was set to disproportionally strain BAT’s business. After all, around half of the group’s significant writedown was related to Newport. Now, with an election around the corner and fear of losing voters, the energy to push the ban forward has magically exhausted. In the meantime, even though under considerable pressure, BAT’s US business will remain a cash cow with all its legs intact.

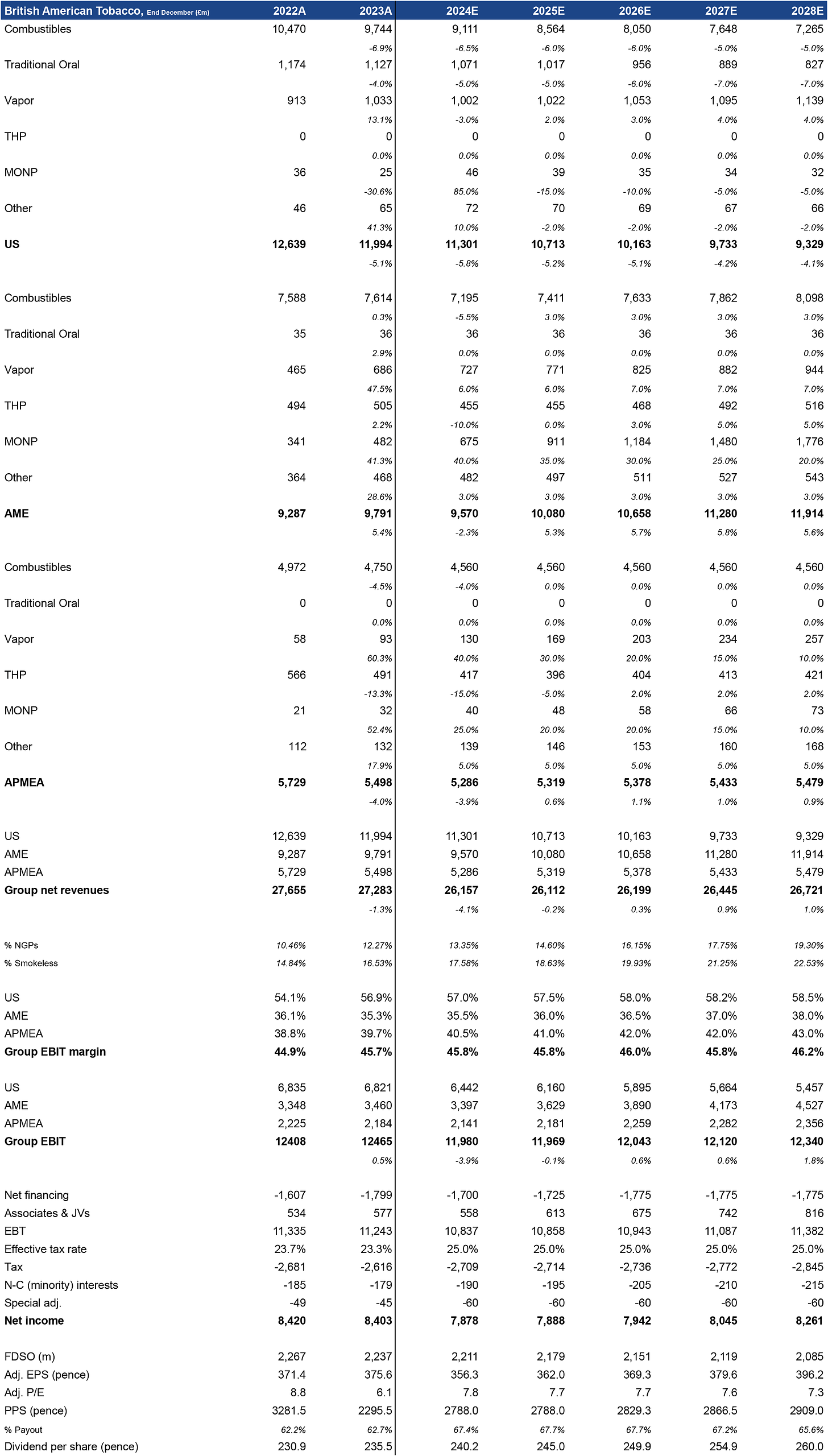

The model below illustrates a potential future escaping such a ban, as well as assumptions including:

Continued significant strain on US combustibles

Deceleration and reversal of US MONP segment, with zero inclusion of future potential Velo 2.0 impact

Accelerated decline of US Traditional Oral due to growing MONP market

Sustained growth of MONP in AME and APMEA

Lagging THP topline performance

Lower net financing cost

Lower contribution from associates & JVs, reflecting partial sale of ITC stake

ETR remaining at an elevated 25%

Reduced effect of repurchase program reflecting higher per-share price

Persistent, pronounced FX pressures weighing across the business

While these assumptions collectively are severe, the enormity of cash still produced by the group in such a future leads me to once again ask, “So what?”

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in British American Tobacco and other tobacco companies such as Altria, Philip Morris International, Scandinavian Tobacco Group, and Imperial Brands. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: BTI 0.00%↑ MO 0.00%↑ PM 0.00%↑

Additional Resources:

British American Tobacco - Reporting. Source

Good article as always.

Volume declines in Europe / Americas (ex US) were under 3% (ex the Russia, Belarus Exit).

Velo is the number one oral brand in most of Europe.

US Citizens have often a very limited worldview. Not meant negative, result of the big land territory.

What i don t understand why BAT can not bring the same quality of pouches to the USA? It can't be rocket science to produce a nicotine pouch.

I travelled to Italy through Austria this summer. Smoking cigarettes is still so common that i think for the cigarette companies (ex US) its a "so what". They will earn there marketcaps by cigarettes alone in the coming years. The USA has extreme low cigarette smoking rates compared to all other developed countries (maybe ex UK and Australia, New Zealand).

Greetings Ulrich

Hi Devin, thanks for the great writing as usual. As a long-term shareholder of BTI for one agree with the conclusion, BTI is cash cow and will likely remain one but on the other hand the equity holders will not shrug off a continued weakness in new catagories as well as decline in combustibles at these price levels. If BTI has an inferior product in each new catagory and PMI & MO are breathing down their neck how would you sustain it going forward?