“Have you ever noticed how they keep improving your laundry detergent, but they still can't get those blue flakes out? Why do we trust them to get our clothes clean? These guys can't even get the DETERGENT white!” - Jerry Seinfeld

Company Overview

In 1846, going against the conventional wisdom declaring to never get into business with family, John Dwight teamed up with his brother-in-law Austin Church. Humbly starting out of Dwight’s kitchen, they produced and sold sodium bicarbonate (baking soda). The duo’s flagship brand, ARM & HAMMER, showcasing a logo steadfastly promising quality, would go on to become not just a profit engine but a growth engine.

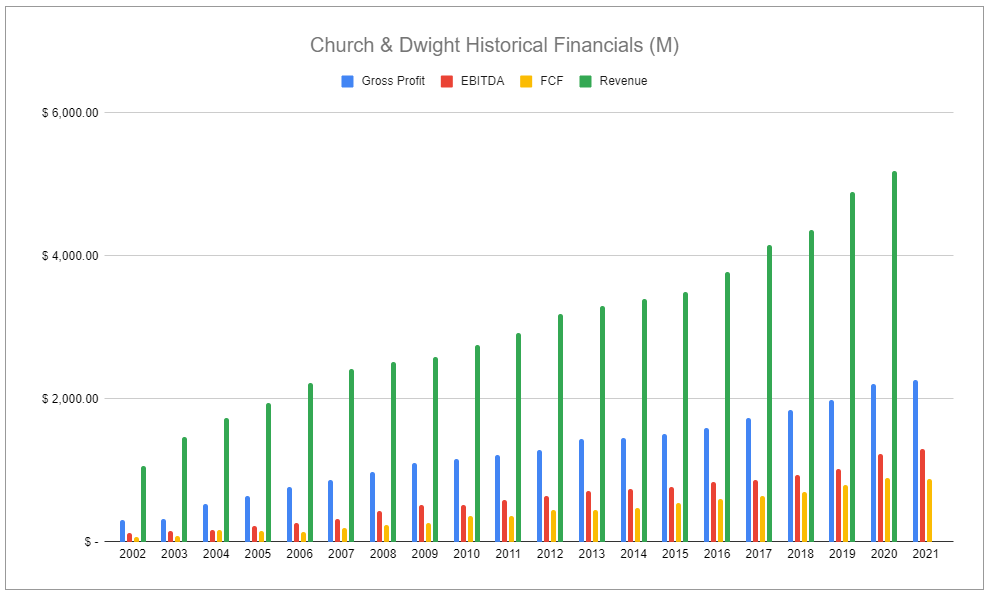

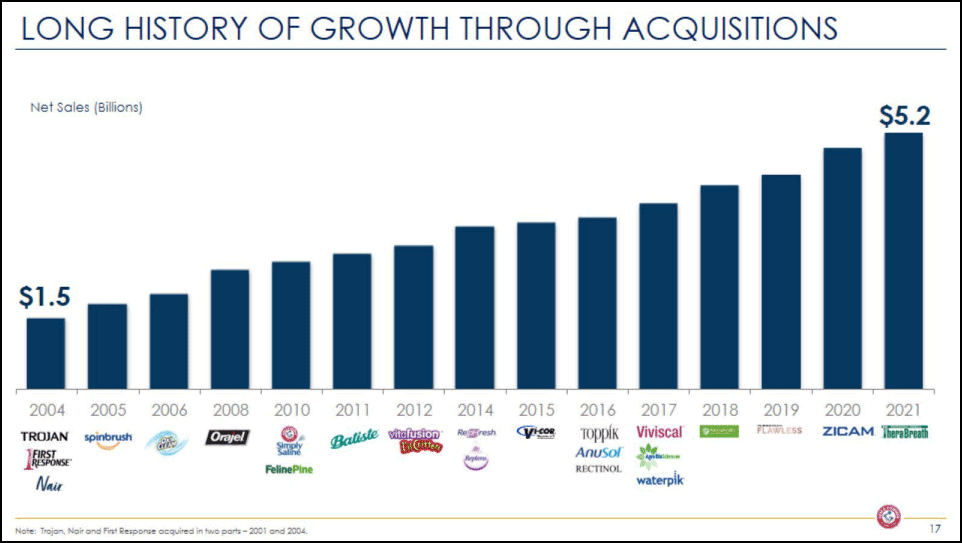

Over the years, the company has heavily reinvested into its business and through acquisitions, has built a remarkable portfolio of leading consumer packaged goods (CPG) brands.

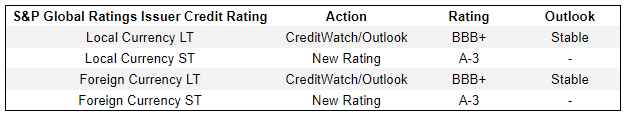

Church & Dwight has demonstrated its robustness, growing through thick and thin. While continuing to eye opportunities for future acquisitions, the company has shown a commitment to returning capital to shareholders by paying a dividend for 486 consecutive quarters. Operations are headquartered in Ewing, New Jersey. The company’s shares trade on the NYSE under the ticker CHD and the current credit ratings for the company are as follows:

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Investment Thesis

Church & Dwight has a 175-year+ track record demonstrating its remarkable staying power in the CPG space with its flagship ARM & HAMMER. The company is comfortably positioned to continue returning capital to shareholders, primarily in the form of dividends—a practice it has maintained for over 121 years. However, the company has become more aggressive in its acquisitions to drive growth, is facing greater macro headwinds, and is currently trading at a lofty premium. I remain cautious.

Industry Overview

Church & Dwight operates in highly-competitive CPG segments, consisting primarily of personal care and household products. Not only are these segments highly-competitive, but they are also highly complex. Operators must address fluctuating demand paired with intricate global supply chains, as well as navigate changing consumer preferences. The recent pandemic exacerbated these challenges, and now, government responses have introduced another massive headwind: heightened inflation.

Successful operators must focus on several critical aspects, including:

Omnichannel sales - removing friction and enhancing the overall consumer experience.

Health and sustainability - ensuring product quality, consistency, and safety.

Personalization - providing consumers with ample choices to meet unique demands.

Attempting to balance all of this introduces the big question:

How does an operator optimally serve all stakeholders without rapidly, continuously eroding profitability?

It seems impossible. To reduce complexity and streamline operations, many producers and retailers have downsized their number of available SKUs, but to meet increasing personalization and multiple demand scenarios, SKU varieties need to be increased! The apparent solution is to embrace digitization actively and rethink organizational structure to avoid getting stuck in a reactive loop. Nonetheless, I believe most operators will struggle to increase profitability if current conditions persist. After all, there must be some degree of a tradeoff between efficiency and resiliency. This raises the point that now more than ever, robust infrastructure, with automation, advanced analytics, and strict inventory management, is necessary and that delicately balancing end-to-end solutions with strictly managed costs is the juggling act that takes center stage. This leads to a stark conclusion:

Leading brands that fail to adapt will no longer be leading brands.

This should provide astute operators the opportunity to take market share and will likely turn those stumbling into attractive acquisition targets. That happens to be exactly where Church & Dwight has excelled historically.

Church & Dwight Operations and Segment Specifics

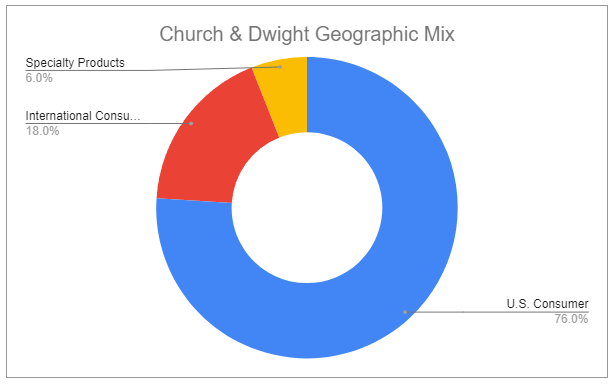

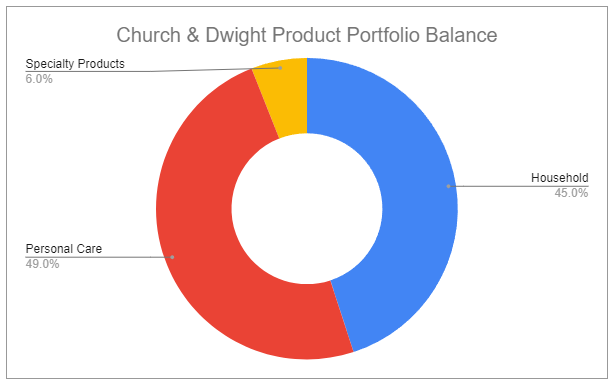

Church & Dwight operations are split into three primary segments: Consumer Domestic, Consumer International, and Specialty Products. CHD refers to its operational structure as an “evergreen model”, which aims for 3% organic net sales growth and 8% EPS growth. Organic topline growth is driven by a goal of 2% growth in the U.S., 6% international growth, and 5% growth in specialty products. Targeted EPS growth is further driven by incremental improvements to gross margin (+25 bps) and overhead costs (-25 bps) translating to continued improvement in operating margin (+50 bps).

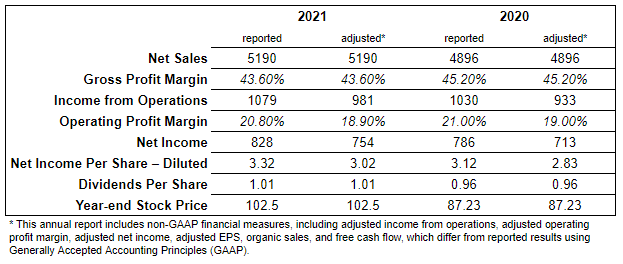

CHD states that aligning incentives and process within the evergreen model help to influence both short-term and long-term decision-making within the company. Since 2011, organic sales have grown at an average annual rate of 4.3%, above the evergreen goal of 3%. Likewise, adjusted EPS has grown by an average of 10.7% annually over the same period.

Consumer Domestic

~76% of sales

In the United States, Church & Dwight sells CPGs covering fabric care, health & well-being, home care, personal care, and more. The company’s CPG portfolio is diverse, consisting of ~60% premium and ~40% value offerings, with over 80 total brands total, including 14 “power brands”:

ARM & HAMMER - baking soda, cat litter, laundry detergent, carpet deodorizer, and other baking soda-based products. A&H products are in ~86% of U.S. households.

Batiste - #1 dry shampoo

OxiClean - stain removers, cleaning solutions, laundry detergents, and bleach alternatives. #1 laundry additive brand

Trojan - condoms, lubricants, and vibrators. #1 condom brand

XTRA - #1 extreme value laundry detergent

Nair - #1 depilatory brand

First Response - home pregnancy and ovulation test kits. #2 branded pregnancy kit

Spinbrush - #2 battery-powered toothbrush brand

Orajel - #1 oral care pain relief brand

VMS (Li’l Critters and Vitafusion) - #1 gummy dietary supplement brands for children and adults, respectively.

Water Pik - #1 power flosser and #1 replacement showerhead

FLAWLESS - beauty and body care products. #1 women’s electric hair removal system

Zicam - #1 adult cold shortening

TheraBreath - #2 alcohol-free mouthwash

These 14 power brands are responsible for >80% of total sales and profits. Of the 14 power brands, all 13 excluding ARM & HAMMER were acquired after 2001.

Criteria for acquisitions are:

#1 or #2 in share brands

higher growth

higher margin

asset-light

able to leverage CHD manufacturing, logistics, and purchasing

able to deliver sustainable competitive advantage

Along with having brands that are either #1 or #2 in market position, CHD operates in categories that, in aggregate, are healthily growing. There are also established and emerging trends that should ultimately act as tailwinds for the company:

In oral care, TheraBreath only has ~10% of the total number of points of distribution Listerine has and is rapidly expanding. More broadly, oral care segment growth has accelerated notably since COVID, as I mentioned in previous writing. TheraBreath is a fast-growing premium brand, selling at a premium price, that is starting to steal quality shelving space in retailers.

The annual cold season has been notably lighter since COVID due to factors such as masking and social distancing. It is likely that over time, as these measures become less prevalent, the cold season returns to normalcy, driving higher sales for Zicam—a growth driver that CHD has not yet benefited from since acquiring the brand.

Products such as Baby hypoallergenic detergent are helping down-age the ARM & HAMMER brand. Children's vitamin gummies also promote earlier brand introduction and build customer preference.

Overall, products that focus on preventative medicine and wellness are incredibly well positioned for long-term growth as consumers continue to place greater importance on them. CHD has stated its commitment to anticipating and identifying consumer trends and capitalizing on them by routinely evaluating and adjusting its product offerings.

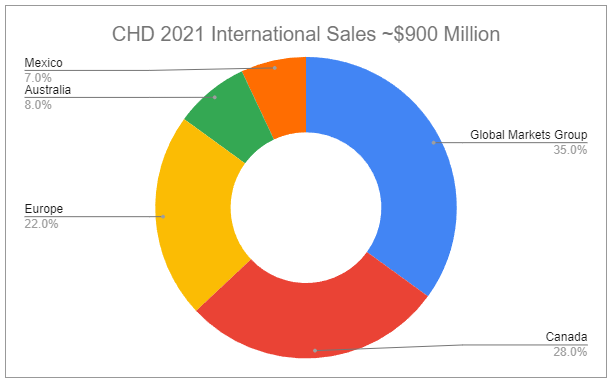

Consumer International

~18% of sales

Church & Dwight has its Global Markets Group which exports many of its CPG brands to over 130 countries and has fully operational subsidiaries in Canada, the U.K., France, Mexico, Brazil, Australia, and Germany. Historically, CHD has been able to deliver results far above its goal of 6% international organic sales growth, though 2021 was muted due to macro headwinds.

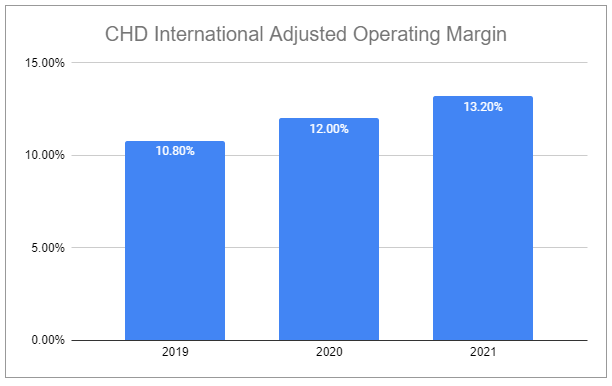

International net sales grew from ~$535 million in 2014 to ~$900 million in 2021. In 2021, subsidiary markets grew ~3%, while the Global Markets Group grew ~10.9%. International is heavily weighted to personal care and OTC categories. These impressive recent growth numbers are again, despite macro headwinds including COVID. As CHD continues to expand distribution, product offerings, and channels, this growth will persist. With scale, a focus on personal care, and leverage pricing, the company aims to expand its adjusted operating margin by +50 bps annually—a goal it has exceeded in the last several years.

Specialty Products

~6% of sales

CHD produces and sells a variety of products containing sodium bicarbonate and specialty inorganic chemics for industrial, institutional, medical, food, and specialty cleaning applications. Within the evergreen model, CHD aims to achieve 5% organic sales growth per annum for the segment. In 2021, segment net sales were ~$336 million, up 12% from the prior year.

In total, 70% of the segment is related to animal productivity. Related products fall into three different categories:

Prebiotics

Probiotics

Nutritional Supplements

This segment should continue to see increasing growth as consumers continue to move away from animal foods heavily reliant on antibiotics. Specifically, a large source of demand for CHD’s animal productivity products is the dairy industry, which is cyclical in nature. Non-dairy-related sales have grown considerably and are now >26% of this subsegment and are expected to grow >10% in FY 2022. While this is the smallest subsegment of sales, it perhaps has one of the clearest roadmaps for sustained long-term growth, with the company expanding its global reach and extending offerings to cover a variety of animals.

Management and Culture

Executive Leadership

Farrell, Matthew T., President and Chief Executive Officer

Bruno, Barry, Executive Vice President, Chief Marketing Officer and President – Consumer Domestic

Buchert, Brian, Executive Vice President of Strategy, M&A and Business Partnerships

de Maynadier, Patrick, Executive Vice President, General Counsel and Secretary

Dierker, Rick, Executive Vice President, Chief Financial Officer and Head of Business Operations

Gokey, Kevin, Senior Vice President, Global Chief Information Officer

Hemsey, René, Executive Vice President, Chief Human Resource Officer

Linares, Carlos, Executive Vice President, Chief Technology Officer & Global New Product Innovation

Pokhriyal, Surabhi, Chief Digital Growth Officer

Read, Michael, Executive Vice President, International

Spann, Rick, Executive Vice President, Chief Supply Chain Officer

Wood, Paul, Executive Vice President, Chief Commercial Officer

Leadership

Compensation

Management compensation structure is designed to be simple and straightforward. Bonuses are equally weighted on net revenue, gross margin expansion, EPS, and cash flow from operations. It is also worth noting that employee bonuses are heavily tied to gross margin, helping to align the incentives of all employees to a degree.

Relative Efficiency

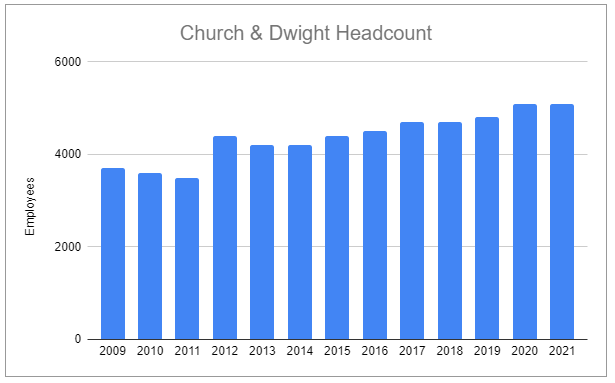

Church & Dwight’s headcount has remained relatively stable, with increases occurring in line with expansion and acquisitions, minus reductions related to recognizing synergies and redundancies.

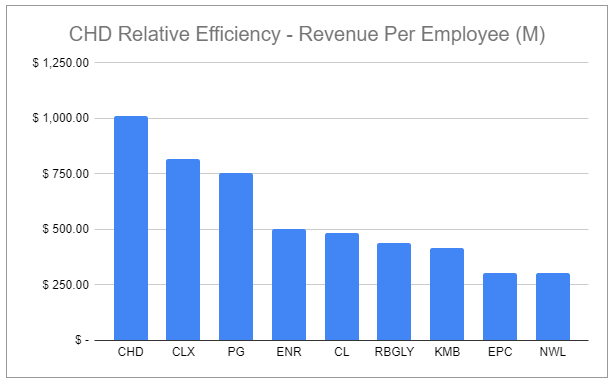

A stand-out point is how efficiently the company has grown its topline relative to headcount. CHD’s employee productivity stands far apart from its competition. Granted, this is only one comparative metric, but it is a critical one, and it is reasonable to expect this to improve as CHD continually prioritizes technologies that enhance productivity.

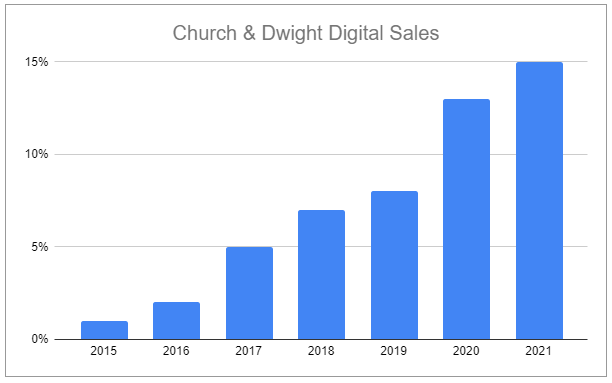

Additionally, the company has made a concentrated effort on digital sales. When Church & Dwight acquire Toppik in early 2016, company digital sales were ~1%, compared to Toppik’s ~30% digital sales. Capitalizing on the acquisition, CHD used Toppik’s playbook to further assist the company’s digital transformation. I believe there is still a long runway ahead for CHD to grow digital sales, with it eventually accounting for >30% of total sales.

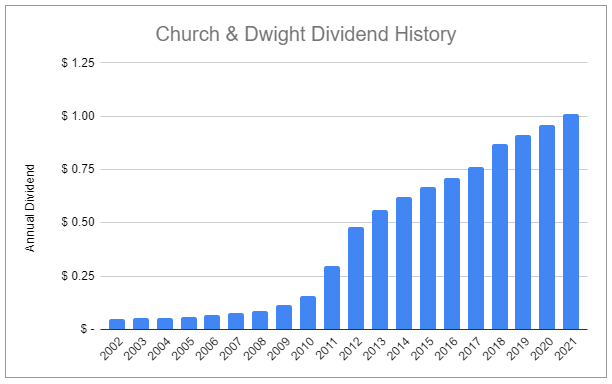

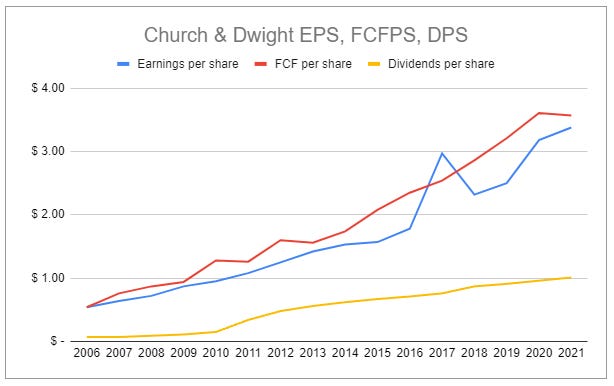

Dividend History and Buybacks

Leadership has remained committed to returning capital to shareholders, as evidenced by the fact Church & Dwight has paid a dividend for 486 consecutive quarters (121+ years). Over the last decade, the company has radically accelerated the rate at which it increases the annual dividend. This rate will likely decelerate as the company seeks to retain enough dry powder for continual acquisitions and reinvestment.

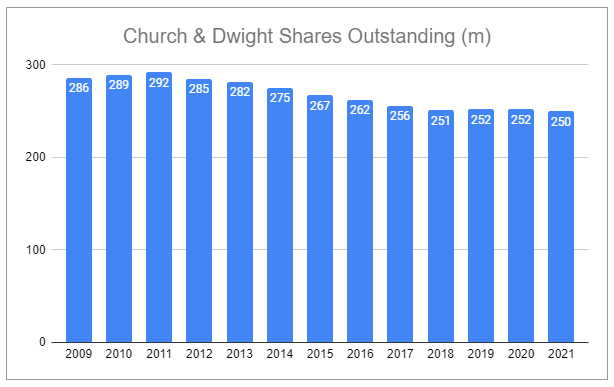

Supporting a long history of dividend payments is also CHD’s use of share repurchases to return capital to shareholders; doing far more than simply offsetting would-be dilution from SBC.

Risks and Considerations

I’ve spent a good portion of this article covering CHD in a positive light, and while I think the company has many strengths and advantages, I believe it is also worthy of a fair amount of criticism.

Simple Compensation = Simply bad?

As mentioned in the leadership subsection, Church & Dwight has a rather straightforward compensation system for management, focused on net revenue, gross margin expansion, EPS, and cash flow from operations. However, it’s hard to argue against the fact that this incentive structure, while simple, may motivate management to be overly aggressive in their acquisitions. Aggressive acquisitions can help hit short-term performance goals to qualify for bonuses but make no guarantee of creating long-term value.

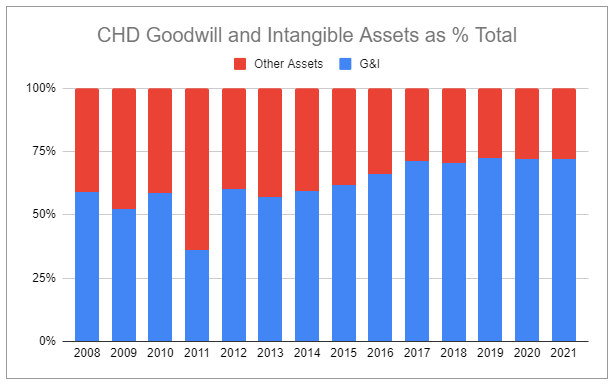

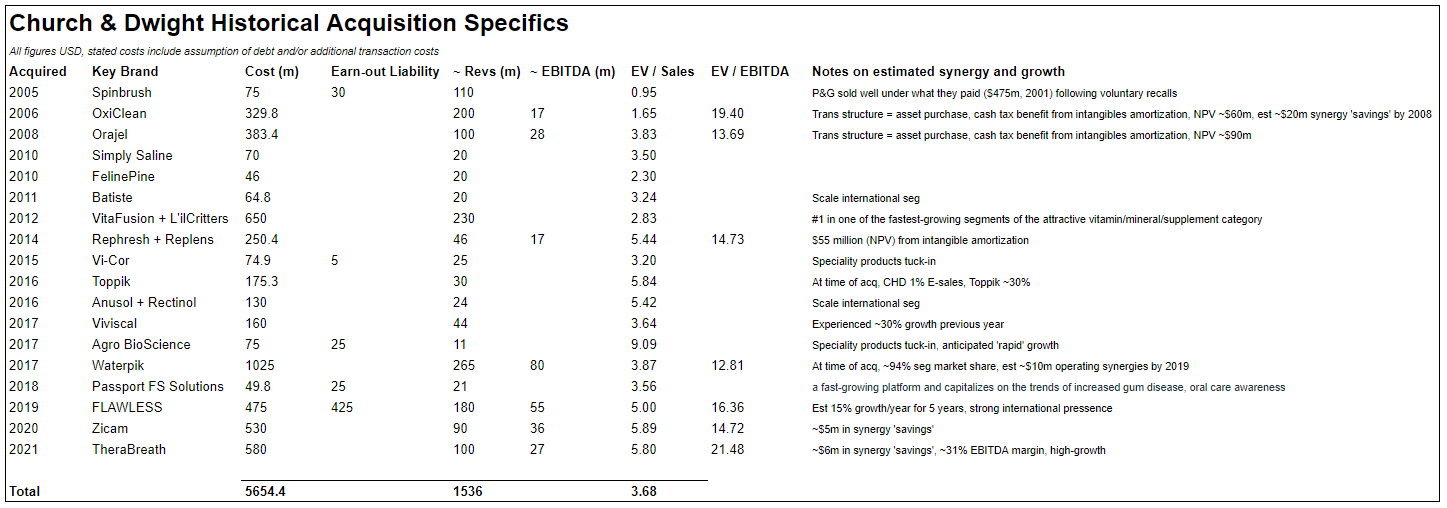

And acquisitions have definitely been aggressive. G&I has grown substantially, makes up a staggering % of recent deals, and is the majority of the company’s assets. Overpaying for acquisitions would inflate G&I, providing a greater tax deduction as its amortized over 15 years. There have been many different degrees of synergy across past acquisitions, but there have been considerable shortfalls as well. As the company makes more acquisitions, any substantial stumble could prove extremely value-destructive.

Transparency, Synergy, and Durability

An additional major criticism I have is that Church & Dwight is not the most transparent with the specifics of each acquisition and, in my opinion, offers unsatisfactory updates regarding the progress of integrations and recognition of synergies. For a company so focused on its acquisition engine, one would expect related information not only to be provided but easily accessible and for clearly laid out updates that don’t simply paint everything as sunshine and rainbows. It took a bit of hunting to aggregate the following table, illustrating the rough terms of each deal:

I have little concern over the long-term durability of ARM & HAMMER. Batiste has been a truly incredible growth story post-acquisition. I also believe Zicam and TheraBreath are very good acquisitions that will help contribute meaningfully to growth for the foreseeable future. But not all acquisitions have panned out well.

Acquisitions like FLAWLESS concern me. The company was founded in 2017, a mere two years prior to being acquired for a substantial sum. With the earn-out liability, it is the second largest deal CHD has done, and I question why CHD was interested in the unproven brand in the first place. Furthermore, I question if some of the recent acquisitions, like FLAWLESS, are more of stand-alone bolt-ons rather than efficiently integrated operations that fully recognize potential synergy. FLAWLESS, acquired in 2019, is wholly managed by Ideavillage Products Corporation, the selling party, under a long-term service agreement.

Perhaps most concerning, and one of the greatest risks to the company is that some of its acquisitions have been for products that, while leading brands, aren’t areas the company has historically focused or been masterful in. This type of acquisition creep should be somewhat alarming, and future acquisitions, even if done at seemingly attractive valuations, could prove to be value destructive if execution falters.

Additionally, even older brands have faced secular challenges. Trojan, acquired in 2004, has a less certain future. While the brand has further expanded into products such as lubricants and sex toys, condom sales continue to disappoint as would-be purchasers shift to other forms of birth control. Could other CHD-owned brands begin to face negative secular headwinds?

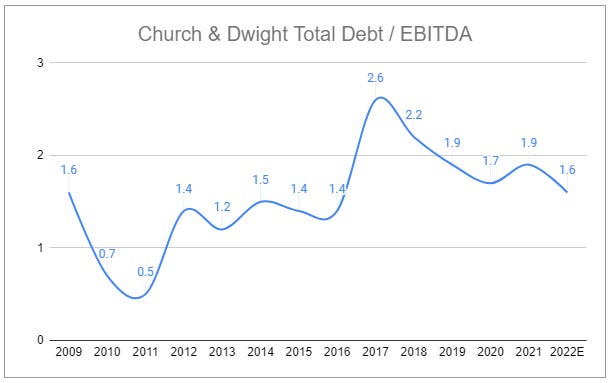

Leverage and Future Acquisitions

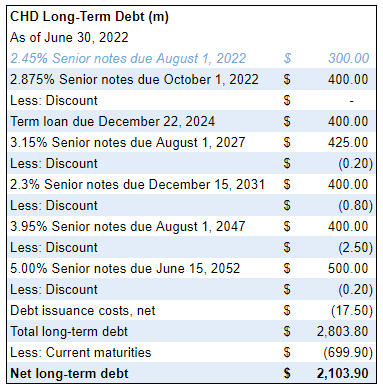

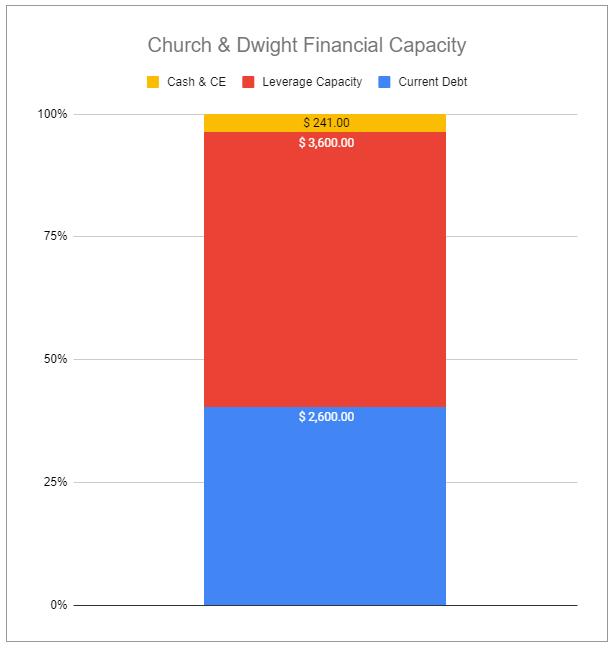

Church & Dwight has freely but strategically wielded debt to optimize capital structure and engage in continuous acquisitions. The company currently has ~$3 billion in total debt, $2.3b in net debt, and holds:

an interest coverage ratio of 15.7

a total debt/EBITDA ratio of 2.5

a net-debt/EBITDA ratio of 1.9

Church & Dwight has a long history of acquiring leading CPG brands and has continually restated its intent to pursue strategic targets. Management, due to the overall stability of cashflows, has stated that they believe they have the capacity to expand debt to ~3.75 EBITDA, and with TTM Bank EBITDA of $1.377 billion, they likely won’t face issues financing future deals.

Competition

As illustrated throughout this article, CHD faces fierce competition, including the behemoth Proctor & Gamble in all CPG segments it operates in. A wide variety of factors can lead to an ebb and flow between brands and fluctuations between premium and value-oriented labels. Additionally, 5 of the 17 categories CHD competes in have private label exposure:

Pregnancy test kits - ~37%

Baking soda - ~22%

Gummy vitamins - ~14%

Orejel equivalent - ~19%

Clumping cat litter - ~9%

While the strength of CHD’s brands has been showcased in its ability to retain market share, and total private label market share has been averaging a mere weighted 12%, it is likely that private labels continue to weigh against the company and must be tracked closely.

Macro

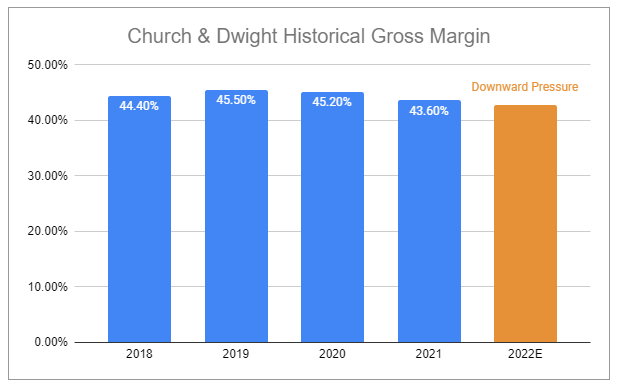

Church & Dwight has been notably impacted by broad-based inflation, including higher commodity costs for inputs such as resin & surfactants as well as higher transportation costs. The company has also struggled in dealing with supply chain shortages impacting labor, material, and higher co-packer costs. This should continue to apply downward pressure on margins, although the company has worked vigilantly the last few years to shorten and tariff-proof supply chains and expand local manufacturing in key markets—this includes moving portions of manufacturing out of China and into other parts of SEA.

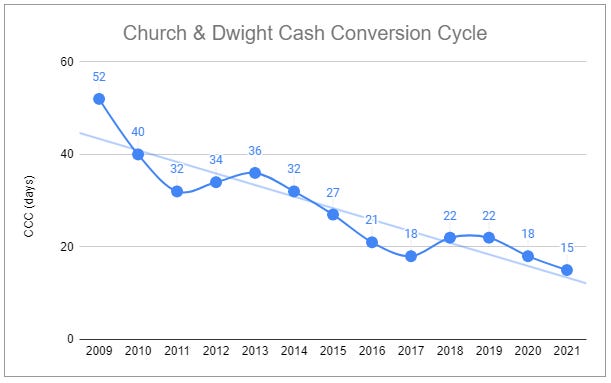

FCF conversion and WC optimization floor?

Church & Dwight has boasted a best-in-class FCF conversion rate. I believe that this is unlikely to improve in the near future and may, in fact, worsen.

CHD’s superior FCF conversion comes from its tight control of working capital. Through strict optimization, the company has reduced its cash conversion cycle substantially, as per the chart below. This will likely worsen throughout the rest of 2022 as inventories are rebuilt. Long-term, from an operations standpoint, it is hard to see how the company isn’t close to reaching a theoretical floor in this regard.

Marketing

Church & Dwight has continued to stress their commitment to improving operational efficiency. Part of this is to further rationalize and improve SG&A. With a growing portfolio of brands, especially from acquisitions, as well as continual new product offerings, it would be sensible to expect marketing spend to increase steadily. However, marketing spend in Q2 2022 decreased by ~12% y/y, and for H1 2022, spend decreased by ~5%. This, surely, can be partly attributed to the challenging macro environment in which many companies are scaling back, but this trend isn’t new: CHD’s total marketing expense for 2021 was lower than 2020. Perhaps certain synergies or efficiencies have provided degrees of savings, but I question if this overall is simply just cutting corners and will lead to them struggling to maintain market share across their brands.

Reinvestment

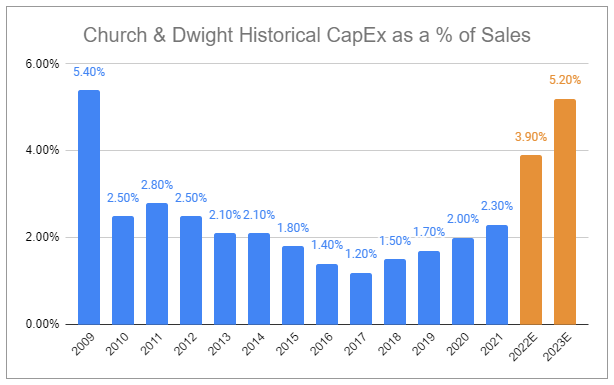

Historically, Church & Dwight has had incredibly capital-light operations, with CapEx averaging ~2% of net sales. However, this should more than double in the coming few years as the business expands its global capacity, mainly in vitamins, laundry, and litter. While total reinvestment spending is unlikely to expand percentage-wise past 2023, it raises a critical question:

Has CHD been underinvesting in the last decade?

For a company that brags about a historical average CapEx as a % of sales of ~2%, such a staggering jump would suggest their evergreen model has not led to the most prudent of reinvestment decisions. If you line up when CapEx dropped in 2009, you’ll see that right then is when the company began to ramp up its dividend payments. Will future dividend increases be muted due to reinvestment needs?

For the record, I am not against the increase in reinvestment, rather, I hold the belief that much of this expansion should have happened sooner—though I will concede it is easy for me to say that with the aid of hindsight.

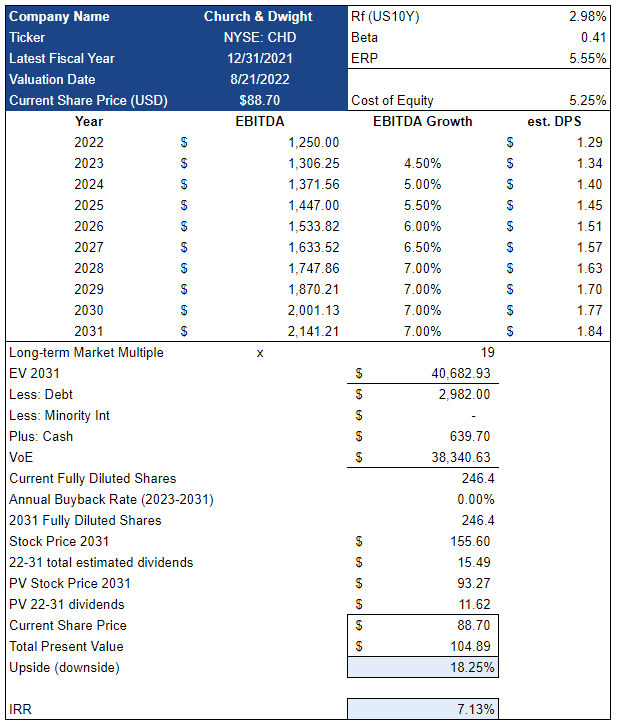

Valuation

I valued Church & Dwight using a 10-year exit based on backing out equity from an EV/EBITDA multiple and factoring in forecasted dividends. Operations are capital-light, with CapEx historically averaging ~2% of sales. I’m factoring in necessary expansion in reinvestment for the next several years, which should come down closer to the historical average over time. Sales are growing at a relatively stable rate, though considerable headwinds are continuing to impact margins.

2022 Outlook

5-8% reported sales growth

3-6% organic sales growth

+60-70 bps operating profit margin

4-8% adjusted EPS growth

Key Assumptions:

Incremental cost inflation will balloon to a total of ~$135 million for 2022. Rising costs will continue to apply pressure but will be somewhat offset but continued price increases.

Gross margin will slightly improve over time due to cost optimizations, enhanced productivity, supply chain optimization, new products, and modest acquisition synergies.

Markets shares remain relatively stable.

Continued organic sales growth of ~3%, driven by recent trend split between domestic, international, and specialty products.

Annual dividend increase of 4%, in line with the most recent increase, but under historical increases. The payout ratio will slowly stray from the current ~32%.

Zero net share repurchases.

The following variables are not directly mapped out in the model but are additional assumptions that will clearly affect true profitability and future capital allocation decisions:

The effective tax rate will increase ~3%, which will be a hard-felt headwind.

I’m expecting SG&A remain in line with current levels.

D&A will grow pseudo-linearly with CapEx and future acquisitions, respectively.

I am anticipating FCF conversion to stagnate, though as mentioned prior, I believe it could easily worsen.

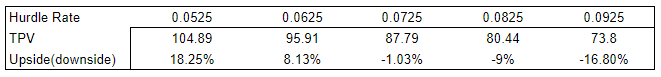

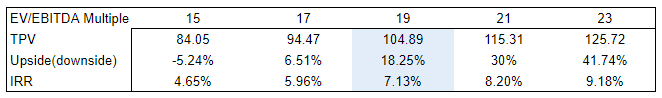

The resulting outputs suggest CHD shares are undervalued by ~18%. However, this is based on the company’s CoE, which is exceedingly low due to an absurdly low beta. Steepening the hurdle rate will quickly suggest that shares are fairly valued or overvalued.

While the company’s implied IRR might not be eye-popping, it’s perhaps attractive due to perceived stability. However, there are further critical considerations. Remember, the company’s evergreen model goals include 3% organic net sales growth, +25 bps gross margin, -25 bps SG&A, and ultimately 8% EPS growth. This has led to stellar total returns to shareholders:

2021: 17.9%

3-year: 17.4%

5-year: 20%

10-year: 18%

15-year: 17.9%

However, it must be recognized that a substantial driver in CHD’s continued stellar TSR has been substantial multiple expansion - an evident widespread willingness to pay up for the stock.

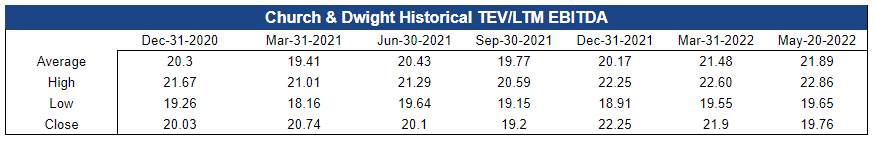

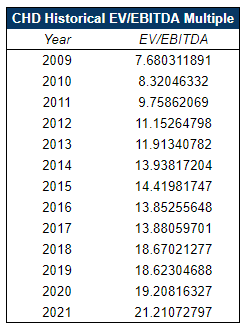

CHD’s EV/EBITDA is currently 19.07 and has remained in a fairly tight range in the last year and a half, but zooming out further, it becomes evident it’s expanded significantly. In hindsight, the 2009-2011 multiples were a complete steal, but the current range is undoubtedly elevated. Is that elevation rational? That’s a multi-billion dollar question, literally.

Any heightened underperformance could easily cause CHD to re-rate towards a mid-teens multiple. In such a scenario, shares may be fairly priced at best, and the company’s IRR could but cut dramatically.

Granted, the assumptions in this model (I believe) are very conservative. If any combination of improving macro conditions, accelerating topline, rapid recognition of synergies, and margin expansion occur, CHD should perform exceedingly well. But there are likely far better securities to focus on to express a specific view on the future of the macro environment, and due to the opacity around recent acquisitions and zero information about inevitable future acquisitions (we have no crystal ball, of course), I believe expectations for CHD should be curbed.

Closing Thoughts

Conclusion

I think Church & Dwight is an amazing story, but I can’t help but wonder if the durability of ARM & HAMMER is now somewhat shrouded by less durable brands. Even if that’s the case, there’s likely tremendous value in the company, but, as per the risks and considerations I highlight in this piece, I am much less excited about the stock at the current price.

Could I be wrong?

100%

Maybe CHD outperforms the wildest of expectations, as it has in the past, and I miss out. But that’s okay. In investing, discipline and restraint are critical. I simply can’t currently build conviction on the name, and I see better opportunities elsewhere. For now, I’ll be keeping an eye out to see if a re-rating occurs or if the fundamentals begin to outpace share price.

Thank you for reading

Do you want to help Invariant grow? If you enjoyed this article, please take a few seconds to share it on your favorite social platform or with a friend!

And immediately access future articles in your email inbox by subscribing.

Questions? Thoughts? Comment here or reach out on Twitter.

Ownership Disclaimer

I do not currently hold any direct position in Church & Dwight.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: CHD 0.00%↑

Impeccable work

Great work 👍