"I've often seen these people, these squares at the table, short stack and long odds against them. All their outs gone. One last card in the deck that can help them. I used to wonder how they could let themselves get into such bad shape, and how the hell they thought they could turn it around." - Mike McDermot, ‘Rounders’

I’ve loved poker ever since being swept up in the 2003-2006 boom when Texas hold‘em became all the rage. In the midst of it, my life-long best friend (who I’ve known since the age of four) and I built a professional-grade poker table from scratch. Fine felt, a leather handrail, the whole nine yards. It fit perfectly in his dimly-lit basement.

We started hosting a simple cash game—or at least it started that way.

It began with us playing on Friday nights but quickly became our whole weekend. Younger and with seemingly infinite energy, it somehow slipped into the rest of the week too.

All through each night, the ashtrays worked hard to keep up, and aside from quick runs to the fridge for drinks, there was never an empty seat. Pots and sides would occasionally grow massive, which was odd because none of us had any money back then. Of course, there’d end up being ‘bad beats’ and all kinds of trash talk, but honestly, up or down, it didn’t matter. That basement was our sanctuary.

We didn’t have many responsibilities or obligations back then, but we were all still in school. Inevitably, we began to either skip class or sleep right through it. I have no idea what lessons I missed. Does it matter? I undoubtedly learned more about myself and about life than I ever could have in a classroom. No textbook can ever replace sitting around a poker table, late at night, with close friends, making memories.

That kind of stuff is the real prize in life.

It should come as no surprise that there’s considerable overlap between the people interested in poker and investing. Yes, both activities, at times, get a bad rap and may look like degenerate gambling. But under the surface? It’s clear they’re games of skill.

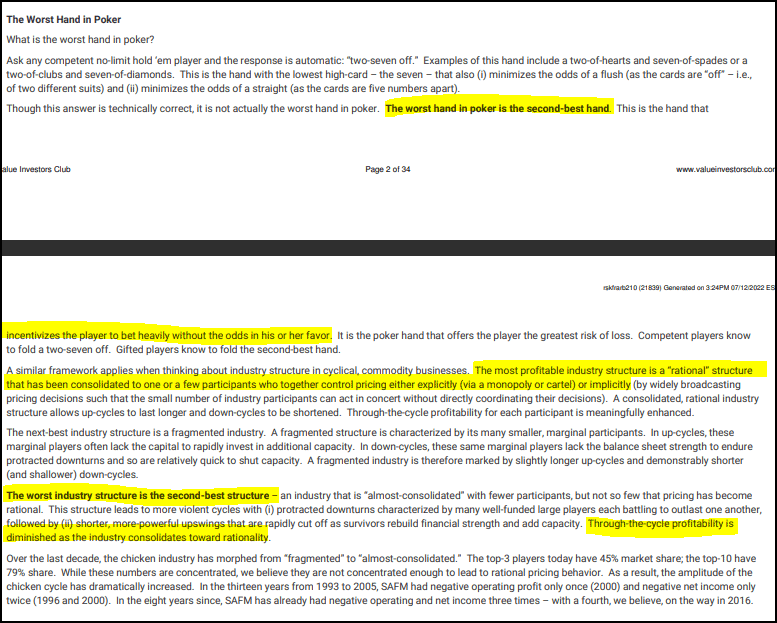

The single best thing I’ve read tying poker to investing is a short excerpt from an old thesis on Value Investors Club. It was recently re-shared on Twitter by fellow investor @rhunterh, who writes Lewis Enterprises (highlights are his emphasis):

“The worst hand in poker is the second-best hand.”

The underlying notion is something I’ve long subscribed to. However, focusing on ‘the best hands’ naturally leads to concentration, and this is where comparing poker to investing falls short—in fact, it presents something that’s difficult to reconcile:

It’s one thing if you’re in a poker tournament and you decide to play aggressively. Even in no-limit, you know your max-loss is your buy-in. But the real world is a 24/7 cash game, and there’s always a bigger fish with a bigger stack. You simply can’t play the same way if you appreciate having a shirt on your back.

Furthermore, while position sizing is absolutely paramount in both, your maximum return from a hand in poker is dictated by the maximum theoretical pot. In investing, this is not the case. My favorite illustration of this comes from Jeff Bezos’s 2015 Letter to Shareholders, which I was reminded of last year by Alex Morris in his TSOH Investment Research Service article AWS: “Scoring 1,000 Runs” (Alex’s emphasis is bolded):

One area where I think we are especially distinctive is failure. I believe we are the best place in the world to fail (we have plenty of practice!), and failure and invention are inseparable twins. To invent you have to experiment, and if you know in advance that it’s going to work, it’s not an experiment. Most large organizations embrace the idea of invention, but are not willing to suffer the string of failed experiments necessary to get there. Outsized returns often come from betting against conventional wisdom, and conventional wisdom is usually right. Given a ten percent chance of a 100 times payoff, you should take that bet every time. But you’re still going to be wrong nine times out of ten. We all know that if you swing for the fences, you’re going to strike out a lot, but you’re also going to hit some home runs. The difference between baseball and business, however, is that baseball has a truncated outcome distribution. When you swing, no matter how well you connect with the ball, the most runs you can get is four. In business, every once in a while, when you step up to the plate, you can score 1,000 runs. This long-tailed distribution of returns is why it’s important to be bold. Big winners pay for so many experiments.

- Jeff Bezos, 2015 Letter to Shareholders

Between actively avoiding ‘second-best hands’ and the potential asymmetry offered by investing, pivotal questions arise:

How much concentration is too much? How much is needed?

Pocket aces don’t come around too often in investing. It’s easy to convince yourself that it’s actually betting light that is the irresponsible thing to do. Plus, when you push all in on an asymmetric wager, there’s a chance you’ll go down in history as one of the all-time greats. That kind of fame and fortune can be alluring. But how many people chase and keep pushing all in only to lose everything? Pocket aces don’t always win, after all. Additionally, as Bezos noted, failure is valuable—but that’s only the case if you still have chips.

Size accordingly.

Thanks for Reading!

If you enjoyed this article, make sure you’re subscribed.

And please, if you’d like to help Invariant grow, be sure to share this article with a friend or somewhere on the internet. Thanks again!

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

“The worst hand in poker is the second-best hand," is an amazing quote, but, as you pointed, doesn't quite materialize the same way in the "real" world. I also really like Bezos' baseball analogy about how in business you can sometimes hit a ball that nabs you 1,000 runs. I do wonder how many people go broke swinging for those 1,000-run hits. Solid post, Devin. Thanks for writing.

Great post - and thanks for the shoutout to the AWS write-up!

Like yourself, I think much of my investment education came from early years at the poker table (and the same can be said for sports betting). Really helpful lessons for understanding the game.