Haypp Group: Land Grab

“Our commitment is to continually enhance the value we deliver to our consumers, which necessitates increasing the value we create for our business partners. By augmenting the value for media and insights product, we can consistently elevate our consumer offering in terms of both value and convenience while simultaneously improving our profit margins.” – Peter Deli, Haypp Group CFO, Q1’25 remarks

In 1783, at only twenty years old, John Jacob Astor immigrated to the United States following the American Revolutionary War. He knew the untapped vastness of the Americas represented unbound opportunity. Once in the United States, Astor engaged in several ventures, the first of which was as a modest retailer. Witnessing continued expansion West, he entered the fur trade, despite the many established competitors with significant backing. Astor traded various goods with Native Americans for furs at advantageous rates. He also struck deals for furs in Montreal, using creative shipping methods to circumvent trade restrictions.

Although only starting with a slight edge, Astor’s success compounded, leading him to take the major fur trading firms head-on by founding the American Fur Company in 1808. The Louisiana Purchase allowed for rapid expansion, and Astor created numerous partnerships. Those who did not partner were bought out. Over the coming decades, the AFC would become a near monopoly. Alongside the fur trade, Astor established meaningful opium trade routes between the Middle East and China by leveraging his existing distribution expertise and global relationships.

Despite the immense profitability of the AFC, problems arose. Astor exited the opium trade due to difficulty and associated risks. Then, in the 1830s, overhunting had greatly diminished the firm’s ability to source furs, and demand fell as fashion trends shifted in Europe. Identifying an irreversible path, Astor sold the entirety of his business.

John Jacob Astor had higher aspirations for his already enormous capital base, refocusing solely on real estate. Instead of looking for opportunities upon the expanse, he stayed East. Witnessing the rapid growth of New York, he began to purchase tracts of land on Manhattan. Rather than strictly hunting for the most pristine or established, he sought large, undeveloped lots. When the Panic of 1837 struck, he was not deterred, opting to add to his holdings on the island aggressively, at deeply depressed prices. Ultimately, he acquired a significant portion of what would become Times Square.

In his later years, despite amassing a fortune that made him the wealthiest man in America, John Jacob Astor expressed regret. He held conviction in America and had a vision for Manhattan. His timing was right, but he wished he had bought more land and parted with less.

Land grab

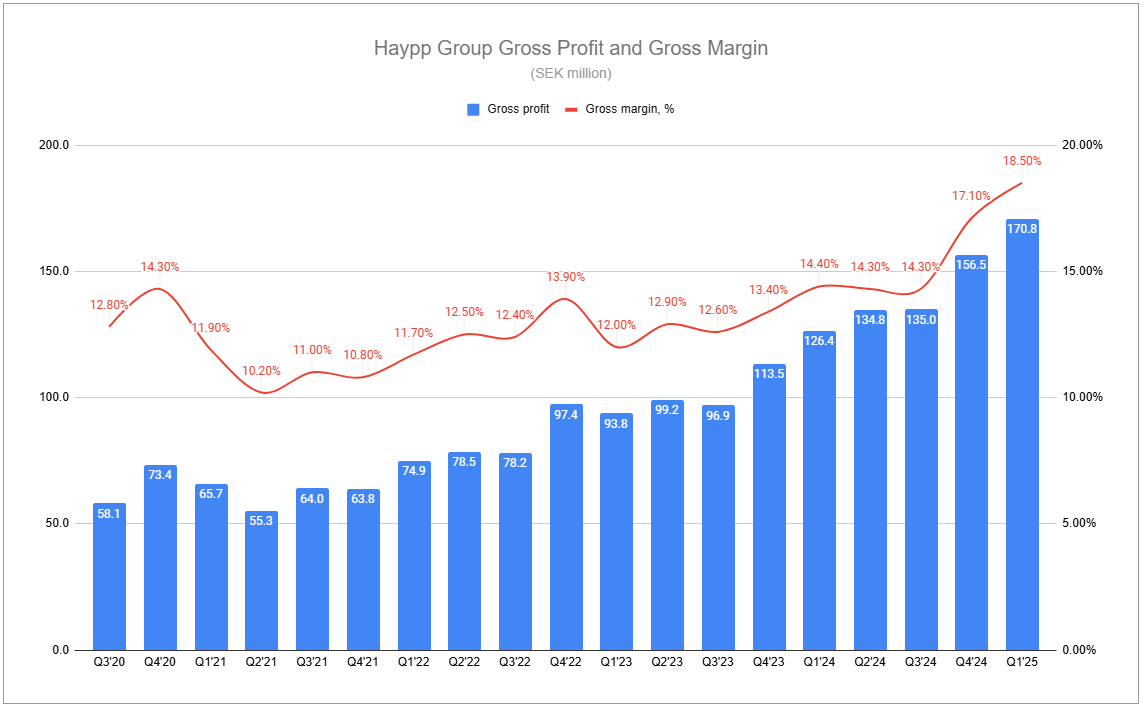

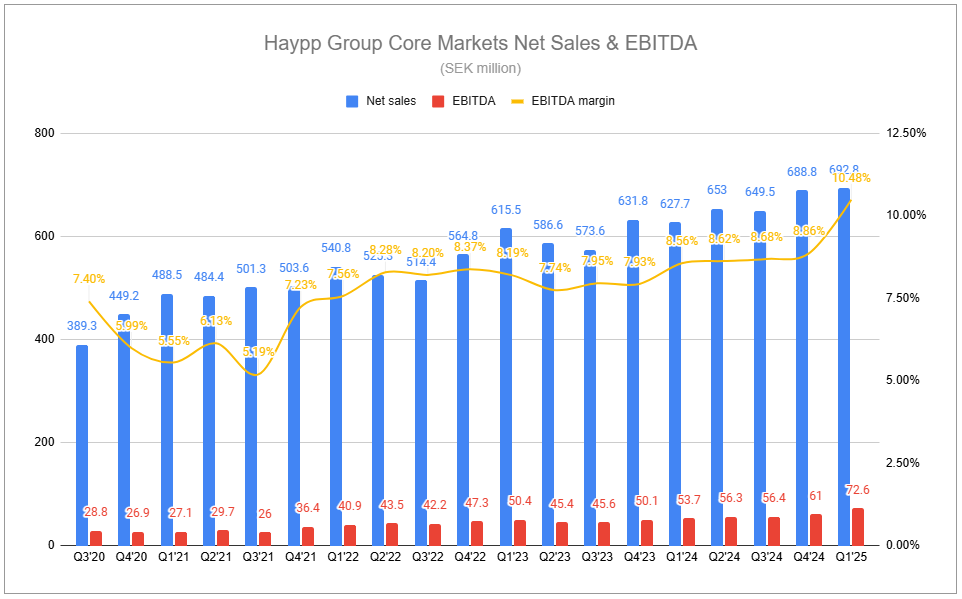

Haypp Group’s Q1’25 results showed a substantial improvement in profitability, including a stark jump at the gross level. While execution was strong across the board, the primary driver at the operating level was the Core Markets segment. We can expect group profitability to soften as we move through the year, as investments in the United States will be increased meaningfully.

Undoubtedly, some investors would prefer a different path. Steadied, reliable profits from the Core Markets could be paired with a tapering of investments in Growth and Emerging Markets, equating to a sizable amount of free cash returnable to shareholders. However, such a route does not fit management’s near-term ambitions. The United States represents a massive land grab opportunity.

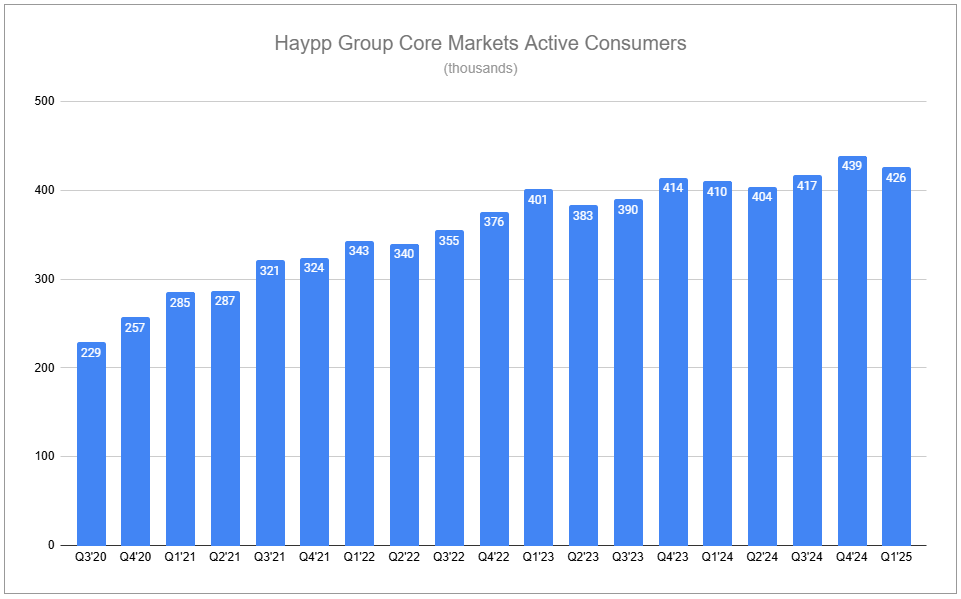

Haypp intends to not only defend its sizable portfolio of digital real estate but also add considerable acreage by growing the channel in absolute terms. Investments to accomplish the task can be broken down into three buckets, the first and most critical of which is forming a team wholly dedicated to the U.S. market. This is no small undertaking, and the talent necessary will not come cheap, but it is a prerequisite.

The second bucket, enhancing the convenience offered to adult consumers, is relatively straightforward. While multiple initiatives can and will be employed, the group is piloting one-day shipping in a select part of Texas. Depending on the results, the group would conceivably extend the radius at which its Texas warehouse could provide such a service. Additional hubs would be built down the line in high-density locations, likely near major urban areas. Competitors, restricted in their investment capabilities, are unlikely to match such an offering, lacking equivalent automation and processes, and many relying on 3PL for fulfilment. For reference, while recently testing a U.S. competitor’s ‘convenient’ shipping, receiving an order took over a week.

The third bucket is, on the surface, equally straightforward, but is the most difficult to assess in terms of quantifiable impact. Haypp will be trialing several methods of acquiring new consumers. This includes grandiose tactics such as sponsoring a NASCAR event. It also consists of a notable ramp in marketing dollars to communicate with adult consumers in other limited channels to raise awareness of Haypp’s U.S. sites and the online offer. We have an approximate percentage range of spend going toward such activities. Still, since the company has historically held marketing spending at extremely low levels, this is somewhat new territory, and management is likely uncertain as well and will be keen to adjust accordingly. While it will come down to the returns generated on spend, the latter appears to be a low hurdle to clear, considering the vast majority of adult nicotine pouch consumers in the U.S. have no idea that the online channel exists. As consumers become aware of the channel and its virtues, momentum can organically propel the group. Convenient and vast assortment at substantially lower prices will not be shied away from.

Alongside the uncertain return profiles of these activities, I suspect the group will receive objections in the form of being asked why this is being done now. The ZYN shortage, while being alleviated at physical retail, persists for Haypp. Is this the right time? A different framing is required to appreciate the group’s rationale.

Would you press the button?

An argument routinely made in the past was that Haypp wholly relied on ZYN for its success, and the product represented a specific concentration risk for the group in the United States. When last year’s ZYN shortage spread online, directly affecting Haypp, it was clear that the argument would be tested. At the time, I reasoned that while specific metrics would be negatively affected, the impact on profitability wasn’t as straightforward. This was especially true considering that the U.S. was set to be impacted not only by the ZYN shortage but also by Haypp pausing sales in several states, including California, and opting to wind down its sales of legacy oral tobacco products ahead of schedule. Although Q1’25 figures somewhat affirmed such a view, they are far from conclusive. Nonetheless, such figures, industry data, and Haypp’s articulation of their plans provide food for thought. I’ll throw in a question of my own for you to chew on.

Pretend there is a button that, when pushed, would magically undo the ZYN shortage. Set aside all implications for others, including PMI. Would you press the button if you were strictly concerned with maximizing Haypp’s position and long-term trajectory?

If I had to hazard a guess, I would expect most people to find the question preposterous. I also expect most would immediately answer yes, they would press the button. Please, feel free to call me foolish, but I am not sure I would.

Keep reading with a 7-day free trial

Subscribe to Invariant to keep reading this post and get 7 days of free access to the full post archives.