“Logista will continue to record sustained growth for the year 2024, estimating mid-single digit growth in Adjusted EBIT over that achieved in 2023. This expected growth excludes the effect of the inventory’s revaluation recorded for both years and any new acquisitions that may be made during the year.” - Logista Q3’24 Results

We have recently seen numerous operators, ranging from manufacturers to retailers across industries, struggle to address challenges that demand urgent care. As legacy tobacco products continue to be pressured, it would be easy to presume that Logista, whose distribution business is deeply rooted in the industry, would be forced to face the music: a dreary, sorrowful song telling of its end. Concerned that the notes would be all too piercing, the company has continued to invest and diversify away from tobacco, with operating contributions showcasing the merits of its initiatives. Yet, tobacco distribution profits remain robust, and, in the aggregate, the group demonstrates a straightforward value-creating formula for shareholders with results far heartier than its equity multiple continues to imply.

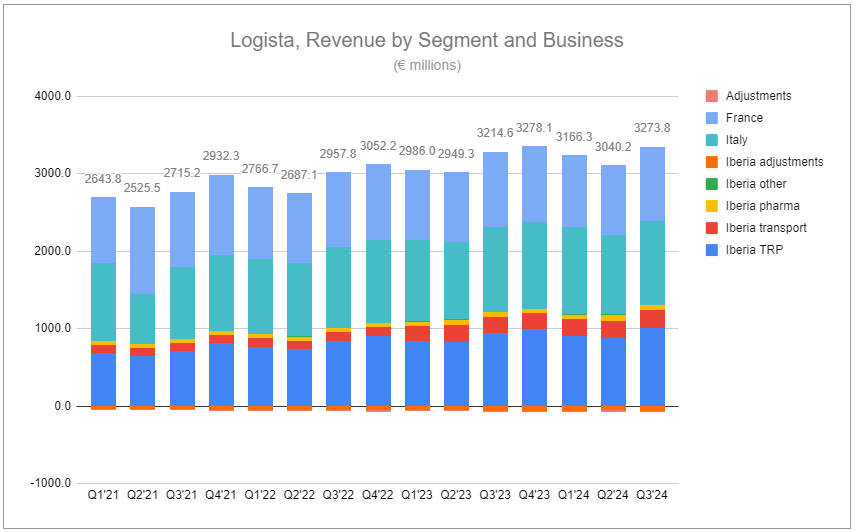

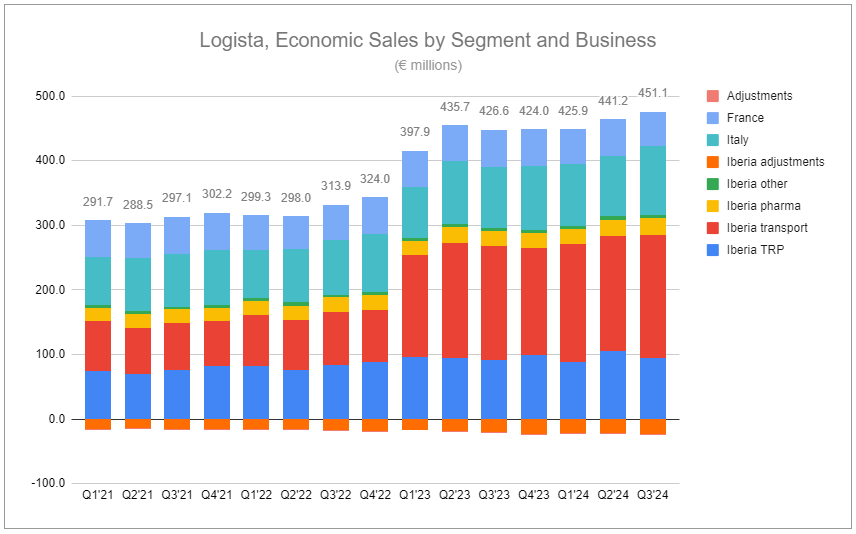

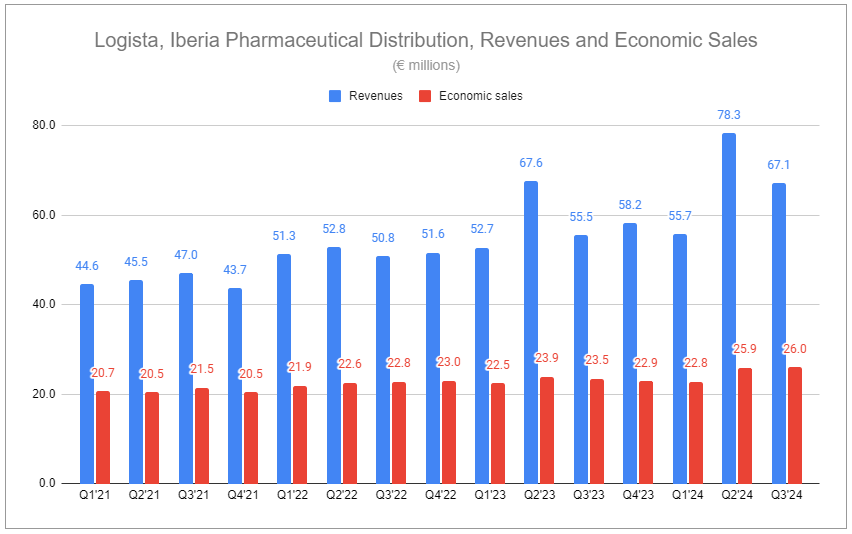

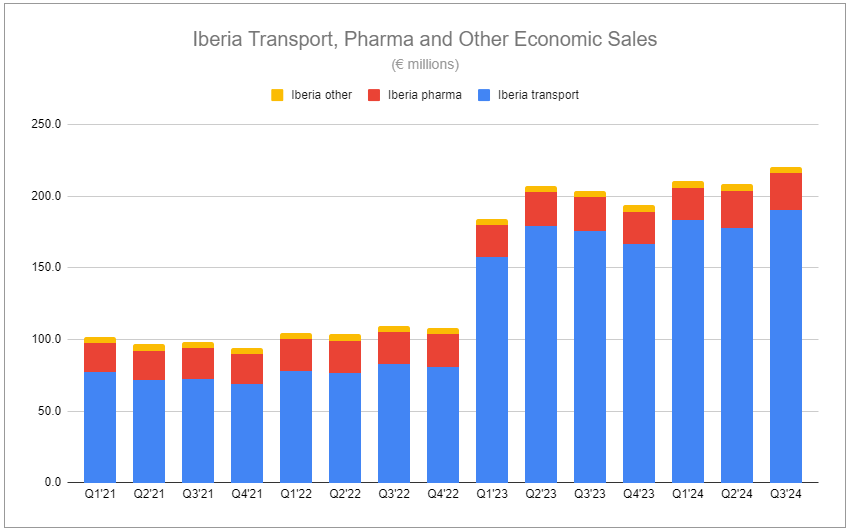

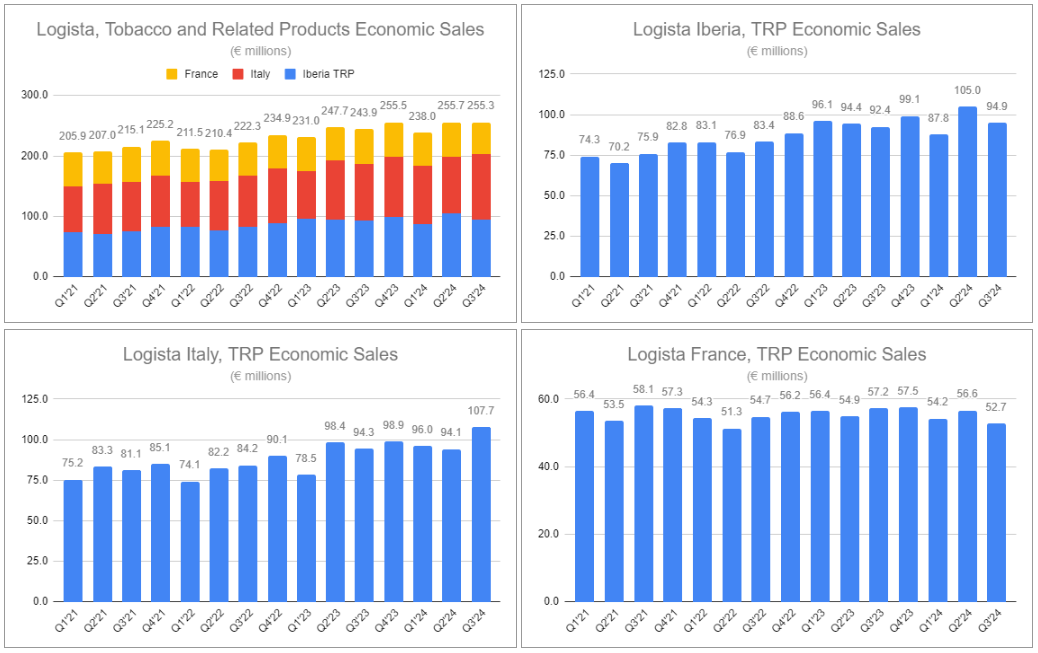

Logista’s revenues in Q3’24 were 1.84% higher than in Q3’23, although the first nine months of the year showed a stronger 3.61% rise. Economics Sales for Q3’24 and the first nine months were more substantial, up 5.74% and 4.6%, respectively. As highlighted in last quarter’s note, Pharmaceutical Distribution, while a small percentage of total revenues and economic sales, continues to grow rapidly.

Over the last several years, we have witnessed SGEL Libros, BPS, Gramma Farmaceutici, Carbó Collbatallé, and Logista Parcel integrations. Following Logista’s H1’24 results, the company acquired the remaining 30% stake in Speedlink, and following its posted Q3’24 results, it finalized acquiring the remaining 26.67% of El Mosca. It is not a far reach to envision the impacts of continued bolt-ons through M&A, presenting opportunities to rationalize costs while expanding geographic coverage and value-added services.

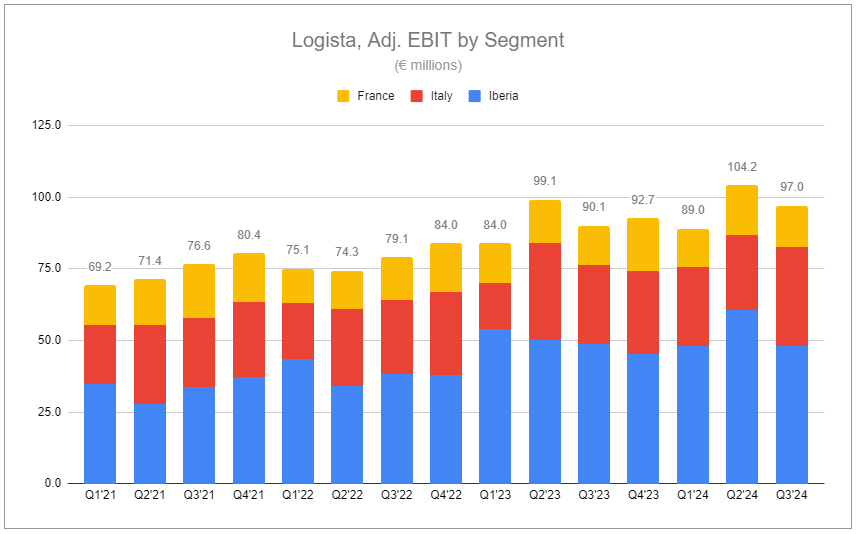

The M&A engine continues to contribute a growing contribution to the group. Still, the core Tobacco and Related Products business drives robust value despite pressures provided by secular decline rates in legacy categories.

Iberian TRP Economic Sales increased by 2.71% in Q3’24 and 1.7% for the first nine months of the year, with manufacturers’ price take leading to a €21 million profit on inventory recognition this year.

France’s TRP continues to be the weakest TRP segment. Revenues increased by 0.3% in the first nine months of 2024, but Economic Sales decreased by 3%, driven by volume declines of 10.9%. An increase in excise duty earlier in the year predictably led to manufacturers offsetting the increase with price take of their own, providing Logista with a profit on inventory recognition of €8.3 million.

Italy TRP remains the standout. Revenues and Economic Sales climbed by 2.6% and 9.8% in the first nine months, respectively. Excise duties were raised, but total aggregate volumes grew by 0.4%, driven by the growth of vapor and HTP exceeding legacy declines. This also led to a value in inventory change of €5.7 million.

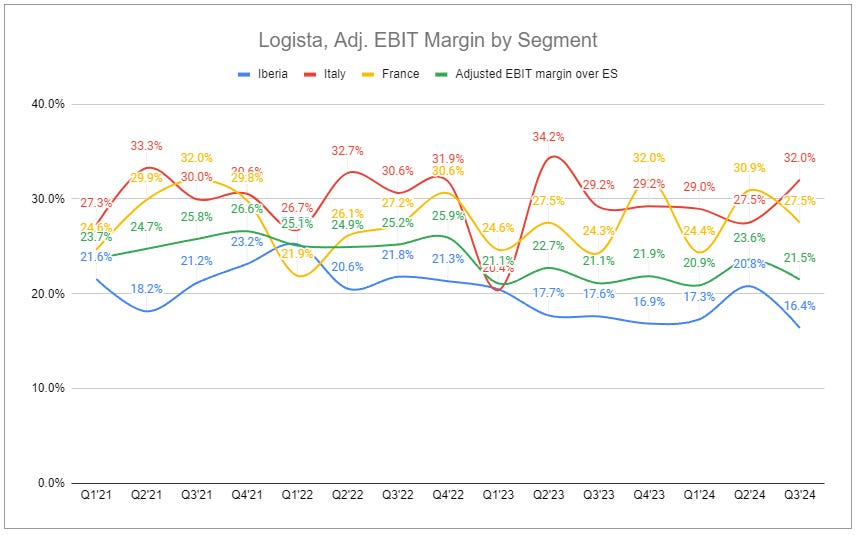

Although the group’s adjusted EBIT margin remains several percentage points below prior years, this is due to its diversification efforts into other distribution segments, which have lower margins. While EBIT margins can not fully revert, they can climb in the aggregate as integrations are finalized and non-TRP segments grow Economic Sales at an elevated rate.

Heartier

With TRP and other distribution segments all executing strongly, Logista’s path to producing increasing profits for shareholders remains clean. In the year's first nine months, group adjusted EBIT has risen by 6.2%. Full-year results will include a profit on disposal, and depreciation will be marginally higher. The complete acquisition of El Mosca will change minorities and shift equity-accounted companies. A significant driver of elevated earnings comes via financial income courtesy of the group’s credit agreement with major shareholder Imperial Brands.

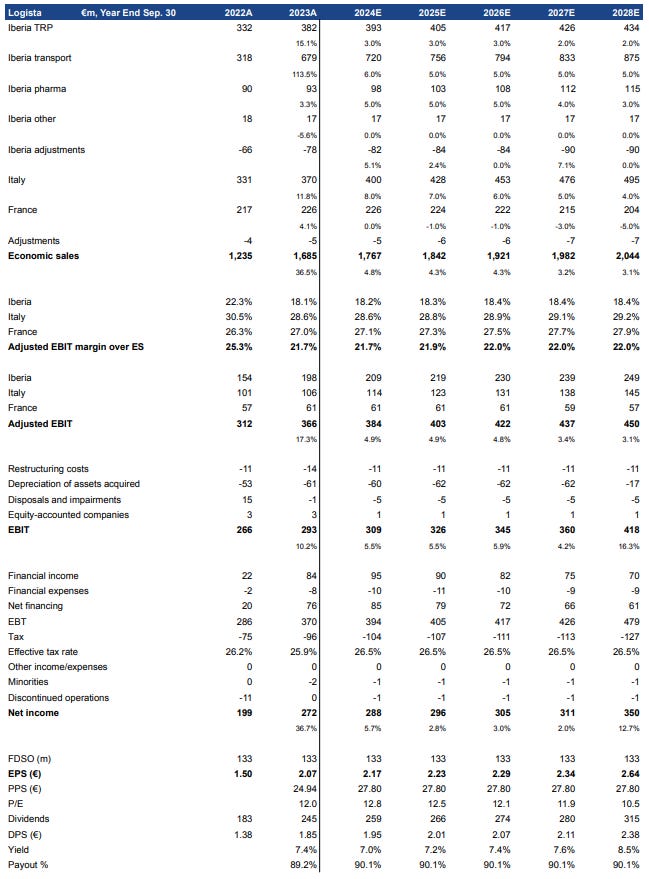

Below is a lightly revised model illustrating a potential path over the next handful of years. A brush of conservatism has been applied, with the rising contribution of Courier services leading to transportation ES growth under what can be achieved, Pharmaceutical Distribution curbed similarly, and restructuring and the ETR maintained at elevated levels. Net financing has been illustrated to evolve negatively, a proxied expression that interest rates may very well fall—an input that, if proven incorrect, would be of significant benefit. Management continues to expect mid-single-digit adjusted EBIT growth. While not flashy or alluring to most, such results would be most impressive, considering the lack of leverage and that Logista returns nearly all excess cash to shareholders via dividends.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own no direct position in Logista (Compañía de Distribución Integral Logista Holdings, S.A). I own an indirect stake in Logista via positions in Imperial Brands. I own positions in other tobacco companies such as Altria, Philip Morris International, British American Tobacco, and Scandinavian Tobacco Group. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

As someone who hasn't done much research into Logista, can you share whether there is much room for consolidation in the market in which it competes, or point me to a post of yours if you've already covered this topic?