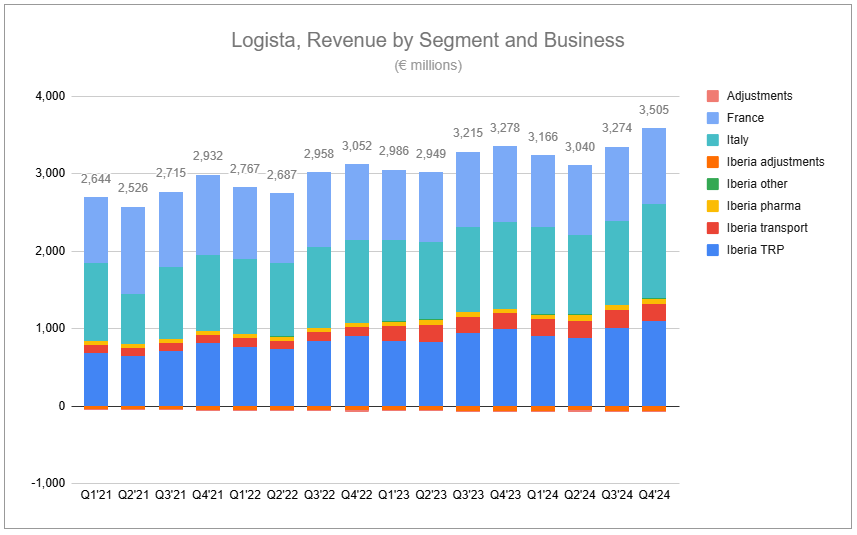

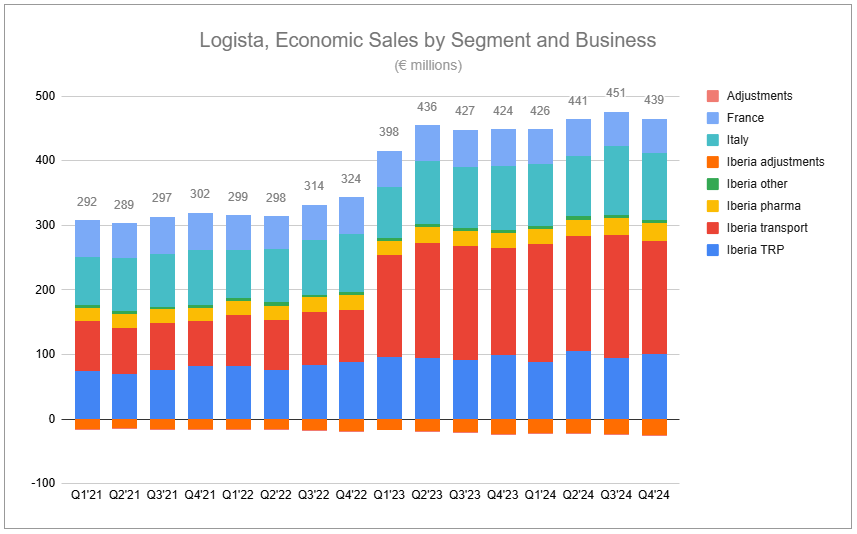

“During 2024, we have achieved a solid set of results, thanks to the growth of different business lines, the profit on inventory recorded for the period, and the evolution of interest rates. We have continued our progress in relation to our diversification strategy, maintaining the ratio of nontobacco related economic sales higher than 50%, and advancing with the integration of the acquisitions made.” - Íñigo Amusco, Logista CEO, FY’24 Results

The origins of Logista’s core business trace back nearly four centuries. New diversification avenues have added complexity, but tobacco still drives most of the profits. Concern that next-generation products are displacing the old are misplaced; the group moves the new products as well. Add an endless list of potential bolt-ons, tight controls on extra costs, and higher financial income, and a value-generating formula is set firmly in place. Public for just over ten years, the group’s respectable growth is made all the more impressive by maintaining hefty capital returns.

The threshold

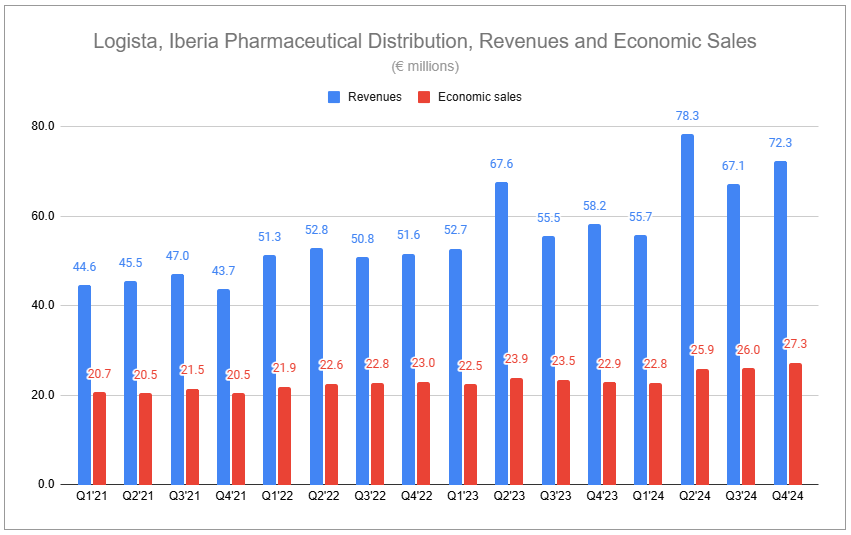

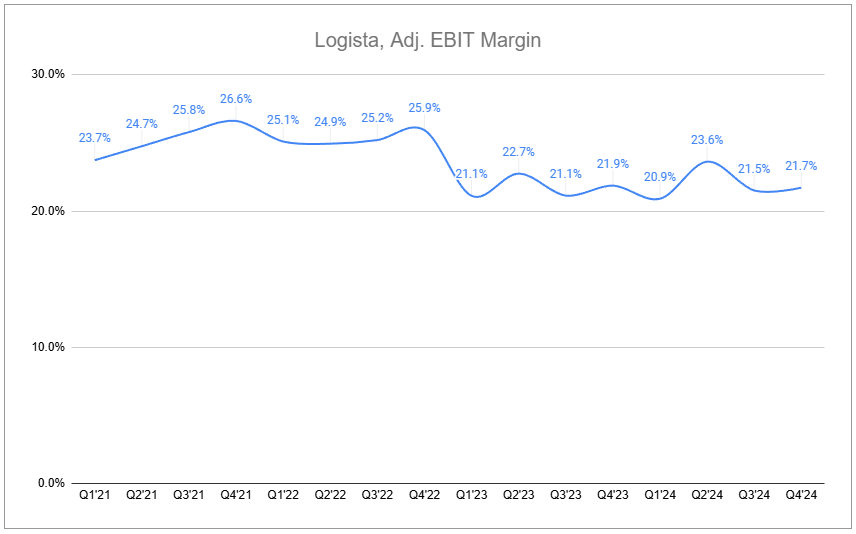

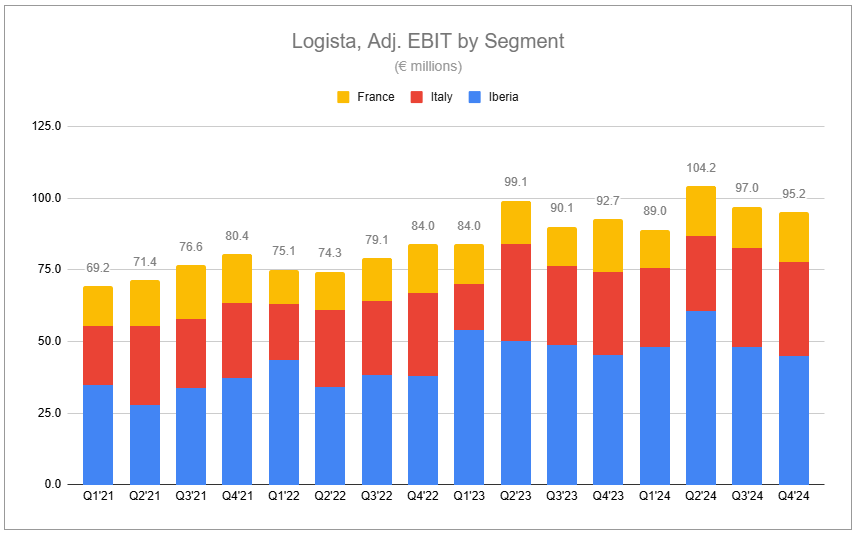

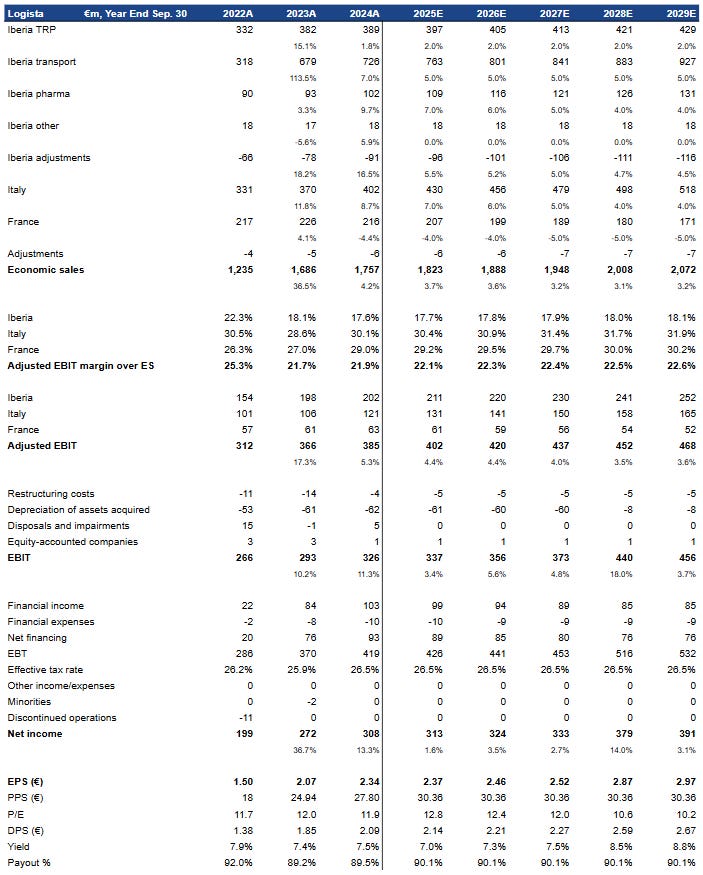

Logista has reached and maintained over 50% of its economic sales from non-tobacco businesses. While this is an achievement of sorts—and one that the group cheers—the longer-term implications on profits is one to ponder. Naturally, transportation, and even pharmaceutical distribution and specialty parcel services, are lower-margin than the tobacco business. That, in and of itself, is less of a concern, as recognition of synergies and no shortage of bolt-on targets provide a clear path for these businesses to grow at a rate above the group’s average. However, it is also clear that aside from specific activities, such as moving pharmaceuticals and foods, this also introduces a degree of cyclicality. Cycliality is also, in and of itself, less of a concern. However, as is often the case, the greatest M&A opportunities should be toward the bottom of cycles. This would also conceivably be when these new businesses produce the least in profits, limiting capital and flexibility. Fortunately, the group will likely remain nimble, courtesy of tobacco and related products, which are still driving the bulk (>70%) of profits.

Still driving

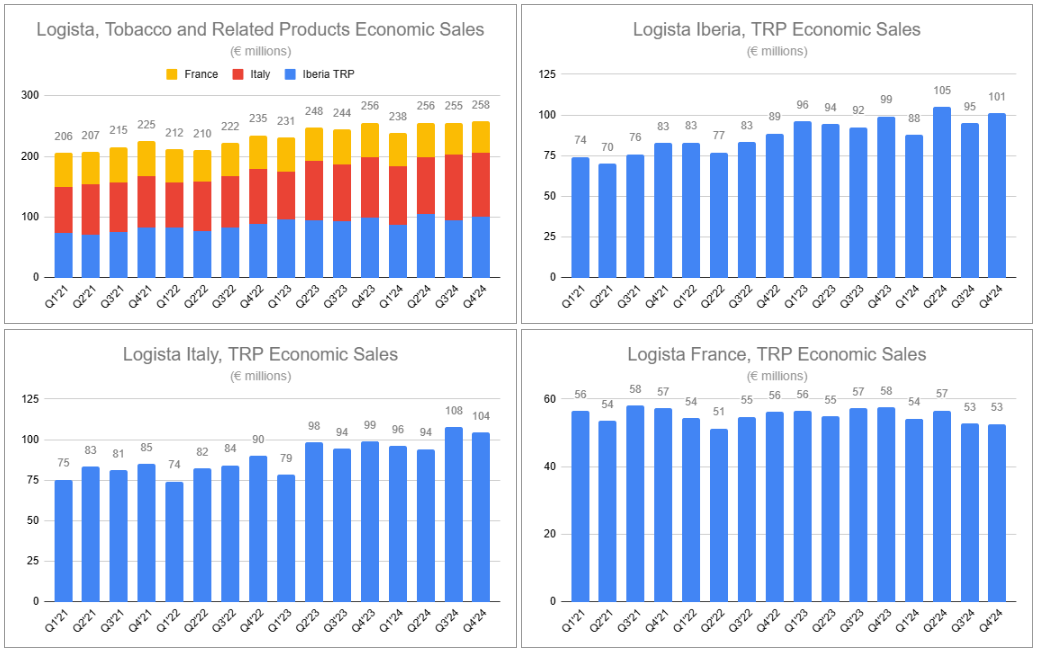

It cannot be escaped. The world remains pessimistic about tobacco’s prospective profitability, and even insiders, including at Logista, are keen to steer elsewhere. Yet, the money keeps rolling in. Volumes in Iberia and Italy grew by 0.4% and 1.1%, respectively, while volumes in France, the group’s smallest market, declined by 10.7%. Translated into related Economic Sales, growth in Iberia, Italy, and France measured 1.8%, 8.7%, and -4.4%, with aggregate performance reaching an all-time high. There was no excise increase in Italy during 2024, while increases were witnessed in Italy and France, and manufacturers took prices up across the board. RYO remained strong, courtesy of its relative affordability, and NGP growth sustained the group’s overall trajectory. Promising but providing minimal current contributions are new retail-facing services for the tobacco business, both in sales-related products and recycling initiatives for disposable vaping devices. Far more impactful was the profit on inventories the group recognized, with all three geographies providing a benefit in 2024.

There is, understandably, uneasiness related to the fact that the POI gains are a function of manufacturer’s discretion—an externality that Logista has no control over. However, the rationale explaining why such events are likely to continue is straightforward. Should legacy volumes decline organically or be additionally driven by excise increases, manufacturers are bound to continue to take price to partly offset the impact—more often than not resulting in future POIs. Likewise, should legacy decline rates be partly elevated by sustained growth in NGP categories, either more aggressive price take occurs, resulting in POIs, or, at a minimum, NGP growth offsets the volume dynamic.

Where next?

I previously contemplated that Logista might target additional bolt-on deals to expand its pharmaceutical distribution business. The subsegment is small but impressively growing, and while this still appears the likely path over the longer term, eyes may be looking elsewhere at the moment. Despite the POIs recognized in France, the organic trends in the market make it difficult, if not improbable, for Logista to stabilize its tobacco business in the country. With uncertain growth rates of NGPs, courtesy of future legislation, alternative measures are needed to maximize the group’s existing footprint. So while the group, when pressed on where it is eying M&A targets, states it is fairly agnostic in location, France is more likely than not the focus area, with a broader size and scope than targets in other countries.

Just over ten

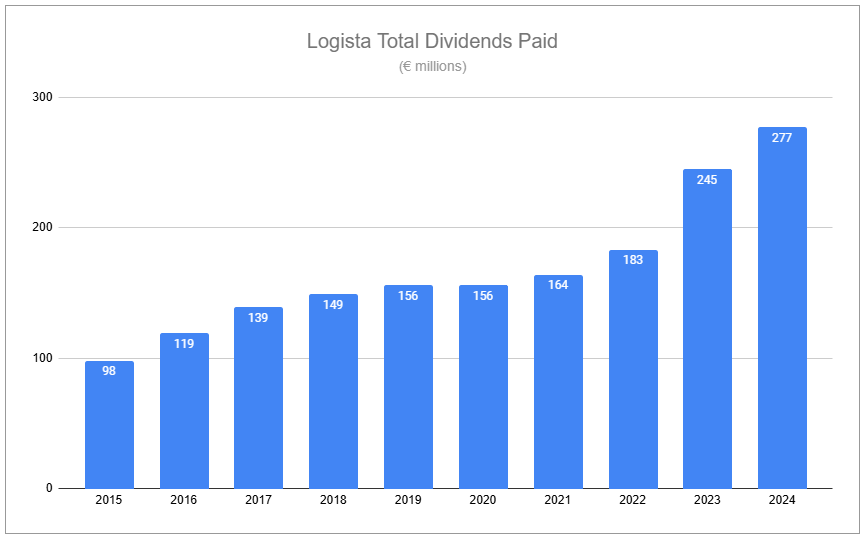

Just over ten years as a public entity, Logista has grown meaningfully larger despite returning roughly €1.7 billion to shareholders over the period in the form of dividends, roughly 90% of the group’s initial market capitalization. Revenues and economic sales continue to rise, while diversification efforts have decreased group margins. Still, operating profits steadily climb, and the group’s reciprocal credit agreement continues to aid the bottom line. Even with looming legislative and excise changes set to challenge the core business, profits are to be well-managed, and with other segments sporting attractive growth profiles, no stretches are needed to paint an attractive future. In my illustrated assumptions, France ES remains challenged, margin evolution is dampened, net financing softens, and the mildly elevated effective tax rate remains. This brings us to the lower end of 2025 guidance and excludes all assumptions concerning future M&A.

Thanks for reading. Enjoy this piece? Hit “♡ like” on the site and share it.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own no direct position in Logista (Compañía de Distribución Integral Logista Holdings, S.A). I own an indirect stake in Logista via positions in Imperial Brands. I own positions in other tobacco companies such as Altria, Philip Morris International, British American Tobacco, and Scandinavian Tobacco Group. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.