“I believe that the tougher prioritization, discipline, and efficiency that we are driving across the organization will help us navigate the current environment and emerge an even stronger company.” - Mark Zuckerberg, Meta Q3 2022 Call

In 2018, following the Cambridge Analytica scandal, headlines declared Facebook finished. People predicted a mass exodus of users, giant government fines, and new regulations that would choke the business. The viability of the company’s model, and its profitability, would be further weakened by huge requisite spending on tech and infrastructure to protect user data, ensure privacy, and moderate content.

Those who believed this felt validated when the company released its Q2 2018 results - the first full quarter following the scandal:

User growth, while still positive, was slowing.

Revenue, while still up significantly y/y, missed analyst expectations.

The company was heavily investing in personnel and AI to moderate content.

The European Union’s General Data Protection Regulation (GDPR) had gone into effect on May 25th, regulating the way companies process, use, share, and move the personal data they collect from consumers online.

There was also a deep concern over Stories, the recently rolled-out product that appeared to be monetizing at a much lower rate relative to the incumbent media it sought to replace.

The company did not mince words when it explained the continuation of these dynamics would cause its operating margin to fall steeply.

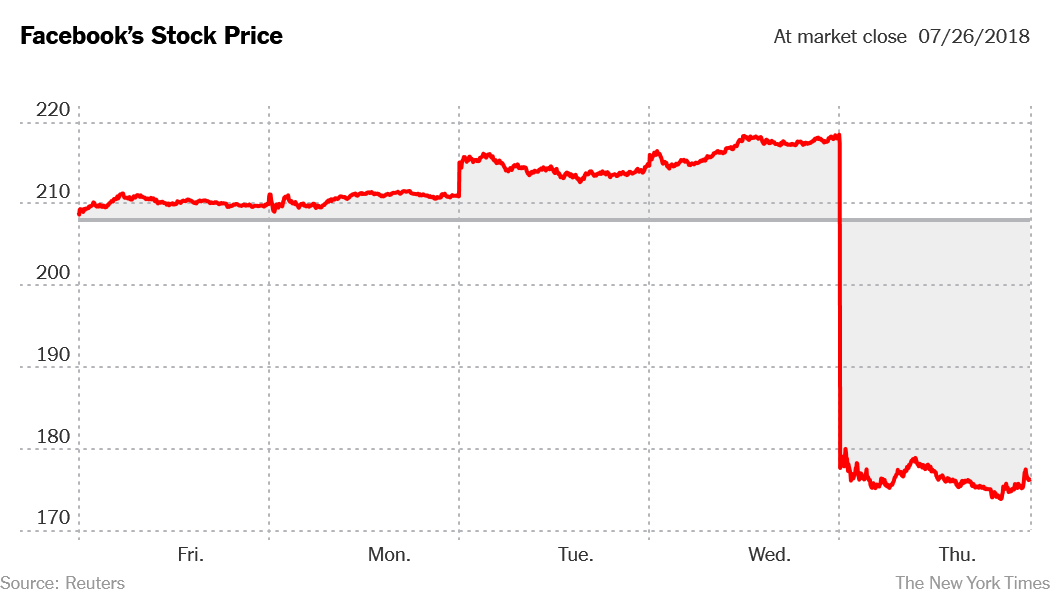

The stock tanked.

On July 25th, 2018, the stock closed at $217.50.

On July 26th, it rested at $176.26.

Nearly 19% of the company’s total market capitalization, $119 billion, poof, gone in a single day.

The narrative had been shattered.

What was once the darling of Wallstreet became its punching bag and the butt of every joke. Forget growth. Profitability was permanently impaired! Expenses would continue to balloon, and with the stock price tanking, stock-based compensation was kicked in the teeth and there would be an exodus of talent on pace to match the fleeing users. Or at least, that’s how it all looked to most at the time.

Without investor confidence, the stock continued to grind lower throughout the year, hitting $123.42 on December 24th - a 43% drop from its July high close.

That 2018 period was when I became very interested.

If you’ve read any of my previous work, you might find it odd that I would even look at such a company. I (mostly) explore and invest in things that are mature, old-economy, and not flashy in the slightest, like cigarettes, mouthwash, and elevators. I’ve also never (NEVER) had a personal Facebook or Instagram account. But I appreciate entrenched networks, and I’m especially drawn to assets that others have soured on. Meta (then Facebook) was viewed by most as rancid.

However, with conservative napkin math, I saw something much more palatable. There was no evidence of a user exodus, and it seemed that even with slowing user growth there were plenty of levers to pull to create long-term value. And I didn’t have to be precise. I believed the massive drop in share price more than accounted for people’s fears. This was a company led by a hungry, young founder and was still very profitable, with no debt and lots of cash on the balance sheet. And most people still seemed fixated on the Facebook platform and gave Instagram too little focus. Whatsapp and the rest of the business weren’t part of the dialogue. But more important was a thought I couldn’t shake.

Regulation.

Everyone said it was going to crush the company. I had my doubts. After all, how many politicians are too out of touch to understand what exactly the company does, let alone regulate it? Also, mind you, through third parties, these are also the same people who rely on the company’s platforms for their reelection campaigns. I didn’t think they’d bite the hand that fed them.

But what if I was wrong? What if a tsunami of regulation was coming? That’s when I realized I was probably thinking about this entirely wrong. The world constantly debated if Facebook had any competitive advantages and if so, what they were. It seemed clear that regulation would become one.

Entering a market enveloped by stringent regulations is hard and expensive. Operating in an environment where regulation is being radically overhauled is often more so. For the majority of competitors, it looked like the costs of navigating new rules surrounding data security, privacy, as well as moderating content would become quite prohibitive. But for Facebook, with its size and profitability and seemingly endless resources at hand, it would mostly equate to speedbumps.

What’s happened since then?

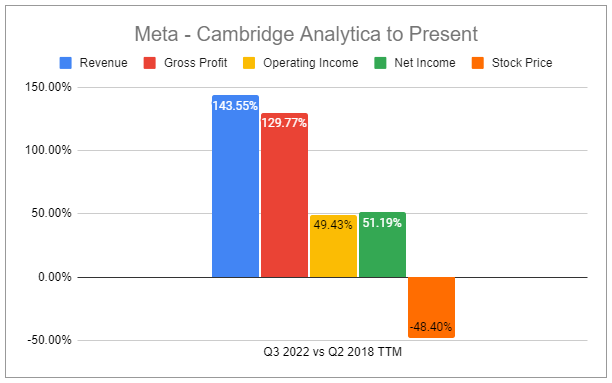

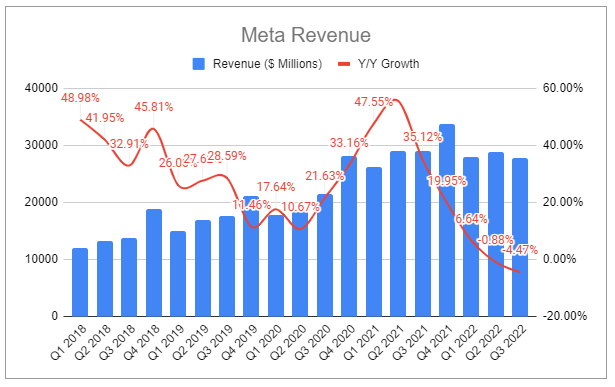

Perhaps partly responsible for the rebrand to Meta, the company has continued to face a litany of governmental inquiries, investigations, fines, countless new regulations, accusations, scandals, and awful headlines. Yet, revenue, gross profit, operating income, and net income are all up considerably. Along with this, the stock reached over $380 in September of last year before crashing; falling nearly 70% from its peak and 50% from the July 25th, 2018 close of $217.50 to $111.41 as of Friday.

For context, centered in the black box below is the Q2 2018 drop:

What a difference a few years makes.

To some, it may seem insane that a company can grow at such a rate and experience such a decline in stock price over the same period. To others, it’s clear that not only were lofty expectations previously baked in and unmet, but new threats have also emerged and the narrative has once again been broken. Further fanning the flames have been Meta’s buybacks.

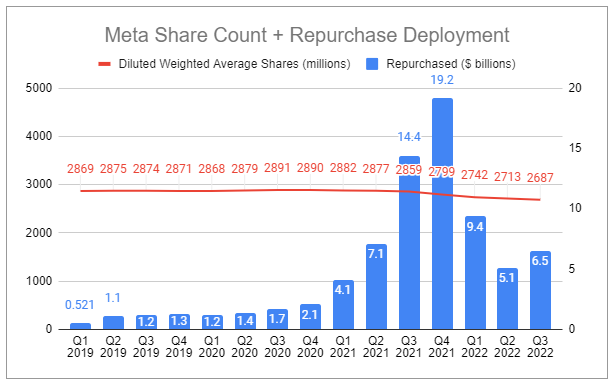

It was not all that long ago when cash on the balance sheet was growing at an astronomical rate, leading the company to ramp up its massive buyback program.

At the end of 2020, Meta (then Facebook) ended the year with $62 billion in cash and marketable securities on its balance sheet and had repurchased $6.3 billion of Class A common stock over the full-year period. With $8.6 billion remaining on its previously authorized repurchase program, it then increased the sum by an additional $25 billion. This was despite the company referencing “significant uncertainty as we manage through a number of crosscurrents in 2021.” The ramp since then has been nothing short of astounding, ballooning to a peak in Q4 2021 and is still chugging along:

Meta's diluted weighted average shares outstanding peaked in Q3 2017 at 2956m. Since then, the total result of repurchases is a reduction in share count of 9.1%. The full effectiveness of the buybacks is obfuscated by the company’s stock-based compensation, which it has largely absorbed. There’s just one slight problem. Over its history, Meta’s average buyback price per share is $253.54, whereas the current share price is $112.05 as of Friday’s close. This was largely due to the massive ramp right before the stock price fell off a cliff.

Bad buybacks. Broken narrative. No confidence. It’s led to headlines like this:

The new narrative

The story now goes something like this:

TikTok is eating Meta’s lunch.

Meta is attempting (and failing) to copy TikTok.

Users are fleeing Facebook and Instagram.

Zuckerberg is panicked, neglecting the core business while chasing his dream dubbed ‘the metaverse’.

There are real risks and concerns for Meta here, but it seems that most headlines are nothing but sensationalist.

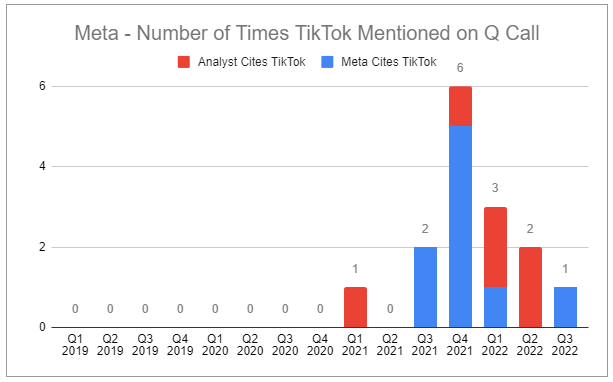

Bytedance launched the short-form video app Douyin in China in 2016. Only in 2018, following the acquisition of Musical.ly did its international version, TikTok, begin to spread across the world. The speed has been awing. In 2020, TikTok crossed 2 billion mobile downloads, and in 2021 surpassed Google to become the world’s most popular website. Unsurprisingly, it became a core focus for analysts considering the implications for platforms like Facebook and Instagram. Here are the number of times TikTok has been cited on Meta’s quarterly earnings calls:

But if we back up further, this notion that Meta is simply copying TikTok and was sleeping on video is somewhat silly. That idea falls apart when you look back further. In 2015, on the Q2 earnings call, before TikTok even existed, Mark Zuckerberg said the following (emphasis added):

So the reason why Facebook is excited in this space is -- I can give you 2 reasons for this. One is there's this continued progression of people getting richer and richer ways to share what's on their mind, right? If you go back 10 years, most of how people communicated and shared was text. We are going through a period where now it's mostly visual and photos.

We are entering into a period where that's going to increasingly be primarily video, and we're seeing huge growth there. But that's not the end of the line, right? I mean, there's always a richer way that people want to share and consume thoughts and ideas. And I think that immersive 3D content is the obvious next thing after video. So if you look at what the initial use cases are going to be around that, I think it's a lot of the stuff that you hear people are talking about.

Video, I think, will be huge, so just taking that to be 3D and immersive. Gaming will be huge, and those are both areas that Facebook has been involved with. Once you start to get more of a critical mass, I think you can start to get social applications, which is what we as a company are more interested in over the long term and think have a huge amount of potential in addition to the video and gaming stuff, which I just think is going to be awesome in the next few years as well.

As Ben Thompson of Stratechery recently noted in Meta Myths, some data suggests TikTok usage in the United States may be plateauing. Zuckerberg also provided positive context on the Q3 2022 call (emphasis added):

All right. Now I'd like to share some updates on the progress that we're seeing in these product areas. Our AI discovery engine is playing an increasingly important role across our products, especially as advances enable us to recommend more interesting content from across our networks and feeds that used to be primarily driven just by the people and accounts you follow. So this, of course, includes Reels, which continues to grow quickly across our apps, both in production and consumption. There are now more than 140 billion Reels plays across Facebook and Instagram each day.

That's a 50% increase from 6 months ago. Reels is incremental to time spent on our apps. The trends look good here, and we believe that we're gaining time spent share on competitors like TikTok.

This does not sound like Meta is failing. Meta recognized video was the future well before TikTok would have been seen as a viable threat. Did TikTok’s precipitous rise accelerate Meta’s rollout and push? Quite certainly. But this was the natural progression that was always going to happen.

To add to this are widespread calls to ban TikTok in the United States, the most lucrative market in the world. I think it’s unlikely that happens, mostly because it would be too sensible for the government, even though it’s clearly a national security threat. Nonetheless, even without that happening, TikTok is facing plenty of other headwinds of its own and has cut its 2022 ad revenue estimates.

So what’s really happening?

As many have noted, Meta, TikTok, and other advertising companies have been kneecapped by Apple’s App Tracking Transparency (ATT), which requires developers to attain an opt-in from users before accessing their IDFA, Identifier for Advertisers, a unique identifier assigned to each Apple user’s device.

Meta, at a surface look, was undoubtedly most impacted as the company had built a large part of its ad infrastructure around leveraging IDFA. Other DR and brand advertising platforms were seemingly less affected, but only because they had not developed ad offerings anywhere near as sophisticated and effective.

Eric Benjamin Seufert, author of Mobile Dev Memo, wrote in TikTok and ATT:

I’ve argued that the companies most impacted by ATT have downplayed its commercial impact because it represents a systemic, permanent drag on their businesses, instead blaming the vague apparition of “macro headwinds.”

Eric goes on to make the sensible argument that other large advertising companies which are less affected or unaffected by ATT continue to excel, such as The Trade Desk, which grew 31% y/y in the last quarter, and Publicis, which raised its outlook for the rest of the year.

This is further supported by looking at Alphabet’s recent numbers, in which core search, which is largely unaffected by ATT, saw slowing growth, and YouTube, which was significantly affected by ATT, put up much less impressive numbers relative to historical trends.

Has Meta gone overboard with spending?

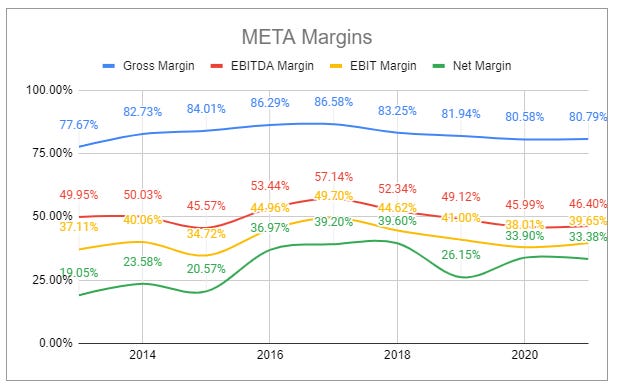

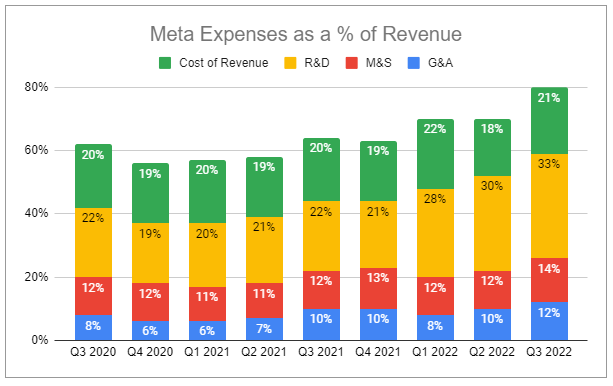

Meta’s spending has grown to astronomical levels - and even that may be an understatement. While the company’s gross margin has remained relatively stable, everything under that line has been trending downward:

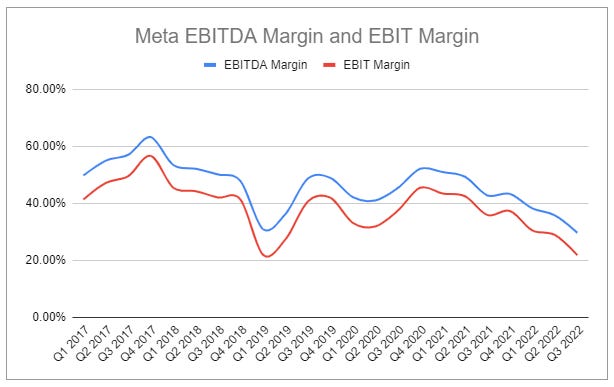

Looking at EBITDA and EBIT margin quarterly paints a much less smooth picture:

Breaking it down by more recent quarters better illustrates the trend:

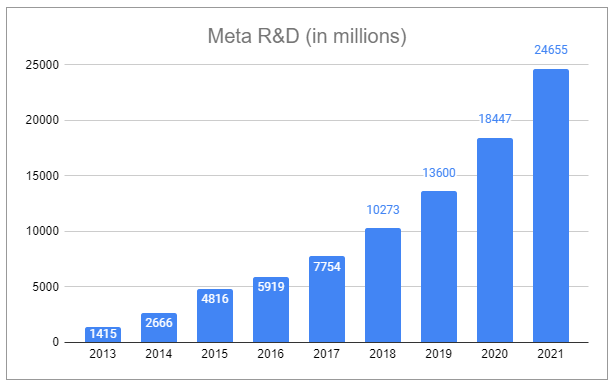

To illustrate the growing expenses:

This is not solely from reality labs. Even the core business, Family of Apps, has been under significant pressure:

And all of this increased spending is occurring as revenue growth has not only decelerated but has turned negative:

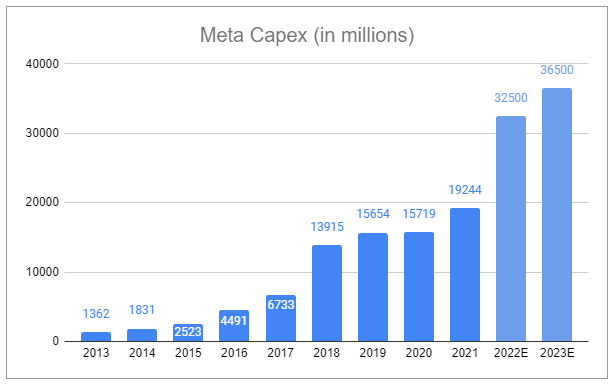

Usually, when costs are growing faster than your top line, you have a problem. But this case is far from usual. The company is spending (and losing) billions on Reality Labs and whatever currently exists on the path to the metaverse:

Not only that. But RL losses are expected to grow significantly in 2023 as well! This should be a concern to anyone looking at this company. However, there are two key points that must be taken into consideration:

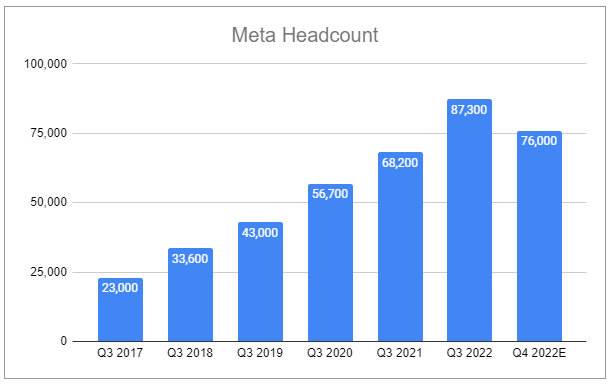

Zuckerberg’s supervoting shares provide him ~57% of voting rights with ~13% of shares outstanding, allowing him to solely determine the fate of Meta. Many have argued they he will continue to ramp up all forms of spending with complete disregard. However, Zuckerberg’s November 9th statement, in which he announced reducing Meta’s headcount by 11,000 (~13% of its workforce) and pursuing other cost-saving initiatives to become a “leaner and more efficient company” says otherwise. Whether it’s Reality Labs, specific avenues concerning FoA, or otherwise, I believe Zuckerberg is willing to cut back on spending when it is clearly in the best interest to do so.

The vast majority of spending is not related to the pursuit of the metaverse and is, rather, focused on the core business, the Family of Apps:

Rebuilding ad infrastructure post-ATT, creating probabilistic modeling to regain signal, both for ad targeting and attribution.

Expanding huge amount of requisite compute to support short-form video (Reels).

Shifting from a social graph to an open graph, optimizing personally served content from a much deeper pool.

Mind you, these pursuits are all occurring within a challenging macro environment, and while they may be overplayed, softness in certain markets and the impact of FX headwinds are undeniable. And people are impatient and forget the fundamentals. Firstly, growth doesn’t ‘just happen’; it must be earned and paid for. Secondly, as Aswath Damodaran illustrates, R&D can provide long-lasting returns, and from a valuation perspective, it is reasonable to reclassify it from Opex to Capex, which would more accurately reflect total invested capital and would lessen the dramatic decrease in margins. Nonetheless, returns will not be immediate. Additionally, as the company navigates the post-ATT world, something to be mindful of is the lag in Reels. Just as with Stories in 2018, there will be a significant delay until there is a full yield of borne fruit. However, Mark Zuckerberg’s statements during the Q2 2022 call remind us the process is well underway (emphasis added):

Reels engagement is also growing quickly. I shared last quarter that Reels already made up 20% of the time that people spend on Instagram. This quarter, we saw a more than 30% increase in the time that people spent engaging with Reels across Facebook and Instagram. AI advances are driving a lot of these improvements. And one example is that after launching a new large AI model for recommendations, we saw a 15% increase in watch time in the Reels video player on Facebook alone.

So I think that there are many improvements like this that we're going to be able to continue to make.

As we are building out our discovery engine though, I want to be clear that we are still ultimately a social company focused on helping people connect. One social trend that we're seeing is that instead of people just interacting in comments in their feeds, most people find interesting content in their feeds then they message that content to friends and interact there. And this creates this flywheel of discovery and then social connection and then inspiring those people to create more content themselves.

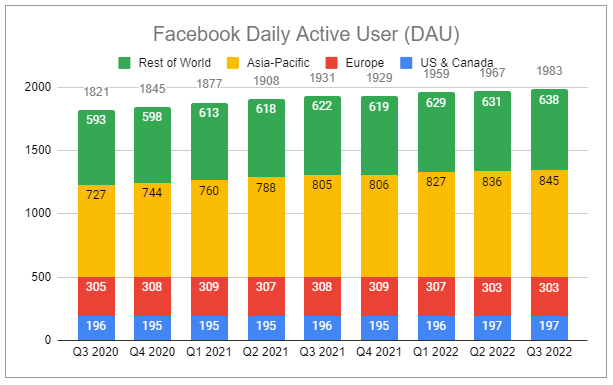

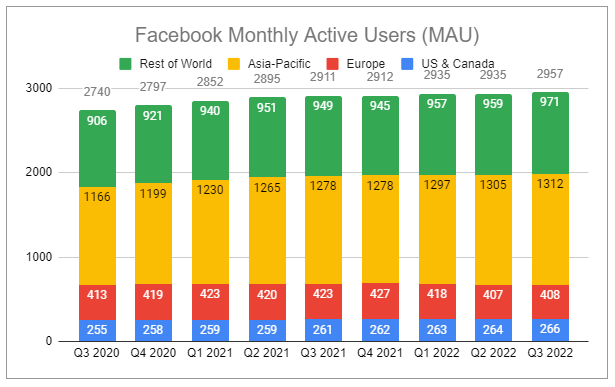

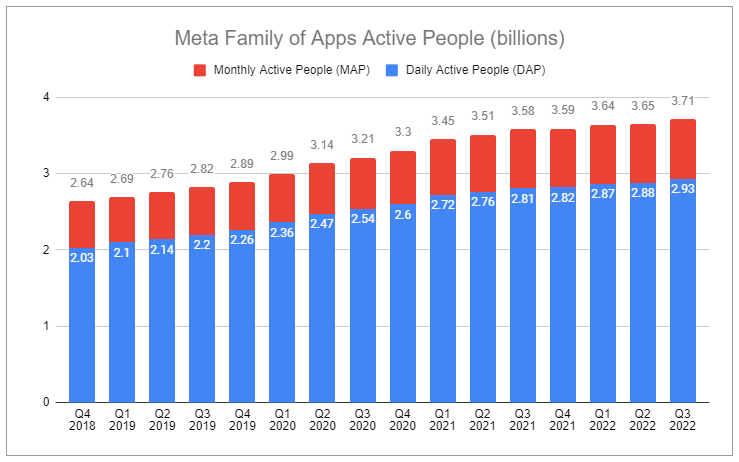

I also think it’s critical to step back and look at the actual number of people using Facebook and the Family of Apps as a whole:

Most people fail to grasp how much of the world uses FoA. The world population just crossed 8 billion. The number of people without internet in the world is estimated to be 2.9 billion, including 415 million in China, where Facebook et al are banned. Of the world population that could currently use Meta’s Family of Apps, ~70% use FoA daily, and ~90% use FoA monthly.

Critics would be quick to point out that if nearly the entire potential user base is already on FoA, it would be harder to grow. I think that’s a bit disingenuous. For one, along with low growth, plenty more can transition from Monthly Active People to Daily Active People. Secondly, this is only one part of the overall value equation, including time spent on platform, ad density, and ad value. As Meta continues to make incremental improvements to their infrastructure and core offerings, I expect the output of the value equation to increase meaningfully. This will be especially true as it builds in verticles, growing the number of transactions occurring wholly on-platform and generating substantial first-party data, which circumvents the need for users opting into ATT in order for the company to operate granularly.

It’s also important to keep in mind that while there are current macro challenges, there is still the long-term secular tailwind of legacy advertising shifting to digital. Meta’s FoA has the best suite of tools for advertisers and, based on individual and blended metrics, still provides the highest returns for DR and brand advertising and should continue to win a good chunk of that shift. This may become even more pronounced as more competitors fall further behind and into what

calls The Valley of Death. As he explains:“The magic of a proper tech company is the ability to scale costs linearly while scaling revenues exponentially. While this does lead to capital shortfalls as the business ramps, once escape velocity is reached, the nonlinear relationship between costs and revenue makes them wildly profitable.”

There may be seemingly exponential rewards to be had, but what if the competition can’t afford the costs? Most are already two (or more) steps behind, are nowhere near as profitable, and simply will never have deployable capital to match what Meta has built, let alone what it is building. Now, with rates increasing, the hurdle continues to grow taller, and just as in 2018, I expect it to be further increased by privacy-oriented regulations over time.

Ultimately, it’s very hard for me to envision in the long-term Zuckerberg continuing to invest massively in Reality Labs if seeing dismal returns. It’s also hard to picture a future in which Meta is unable to further regain and improve ad targeting and attribution. What isn’t hard for me to imagine is Capex shifting from a massive infrastructure buildout to maintenance, R&D growth slowing while incrementally improving the growth rate and profitability of the business, and Reels continuing to ramp up. Even without radical cost controls, the company could sport a normalized EBIT far above current levels and produce considerable FCF, and the operations as a whole may end up even better positioned relative to its peers. None of this will be immediate, but at current multiples, with a rock-solid balance sheet, I feel that there’s a considerable margin of safety for those willing to wait.

As I wrote in No Pain, No Gain, maximizing long-term results often requires short-term pain. There is a big difference between those who choose to take on more pain vs. those who are forced, and while the latter may struggle to survive, it’s often the former that builds the tolerance to thrive. Zuckerberg is no stranger to pain and historically has welcomed it when he thought it was in the interest of his company long-term. Along each step of the way, he has been met with endless criticism. Last week, a fake leak claiming Zuckerberg intended to step down was met with sweeping celebrations across the internet. If that isn’t a good sentiment check, I don’t know what is. And I’m fine staying on the other side of that.

Questions or thoughts to add? Comment here or message me on Twitter.

Ownership Disclaimer

I own positions in Meta and Alphabet.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: META 0.00%↑ GOOG 0.00%↑ PINS 0.00%↑ SNAP 0.00%↑ TTD 0.00%↑

Hi Devin,

Great work, a pleasure to read. I like your position on growth as more than DAU growth but vertical integration from current users.

Kind regards,

Dani

Spent $36B on Metaverse/Reality Labs since 2019 so I wouldn't say small :) $9B this year alone. It shows it isn't a sideproject but a shift in core focus an he mentions in past earnings calls also. Zuck should be investing in the Metaverse but not too this level IMHO as it could be a little too early. Next year if he scales it back Metaverse to a sideproject (still has this upside if market goes in this direction as groundwork is done) it would be a good entry point for me even as the price will pop 5-8% on this news but the moneypit downside will be limited. Love the article as people are way too negative towards Meta (I advertise on there and great) and I might be too greedy wanting a pivot also.