“In theory, there is no difference between theory and practice. In practice there is.” - Yogi Berra

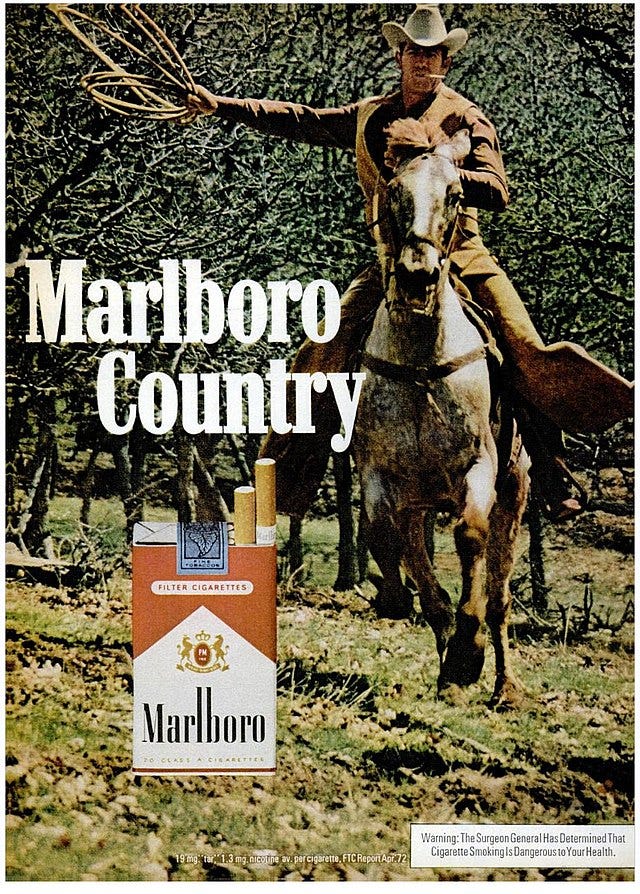

On April 2, 1993, Philip Morris sent shockwaves throughout the markets by announcing discounting for its flagship Marlboro cigarette, effectively slashing prices by 20% overnight. Caught completely off-guard by the company’s decision that seemingly made no sense, shares of the company sold off frantically, dropping 26%. The day would be remembered as Marlboro Friday.

At the time, Philip Morris faced pressure from a growing number of competitors; especially bargain brands. The company recognized it was ceding market share but also realized that it was in a much better financial position compared to its rivals. It knew that if it dropped its prices in one fell swoop, competitors would not be able to respond in kind. By partially closing the relative price gap, it all but guaranteed that consumers would eagerly select Marlboro.

It worked beautifully.

But it didn’t end there.

Several years later, the Master Settlement Agreement (MSA) was finalized, slamming tobacco companies with the largest legal settlement ever executed in the United States. Once again, headlines and the market reacted in a hopeless fashion, expecting the demise of the tobacco companies. As I’ve written before, that was simply wrong. The MSA brought forth new restrictions on the advertising, promotion, and marketing of tobacco products, largely cementing Marlboro’s market share. Now, the company (now Altria) continues to become more profitable than ever despite historic cigarette volume declines.

Marlboro Friday is often recited. Morgan Housel covered it. Gene Hoots wrote about it and discussed it with fellow tobacco enthusiast Lawrence Hamtil. It’s a favorite tale because it reminds us that what works in practice is sometimes different than what’s taught in theory. More importantly, and what I love most, is that it is also a prime illustration of one often-forgotten fact:

Maximizing long-term results often requires short-term pain.

(This is true in most aspects of life.)

In our current environment, there’s an even greater fixation on short-term movements in markets. Additionally, everyone seems permanently positioned at the edge of their seats, waiting for specific macro data to print. If everyone is focused on the short-term and the macro data, who’s paying attention to the long-term fundamentals of individual companies? This environment should be nearly ideal for such an approach.

Of course, rising rates are a simple explanation for greater long-term discounting. But that doesn’t account for everything. There are companies out there willfully taking on more pain, much to the dismay of the short-sighted. What they’re doing might not be as evident as Marlboro Friday, and it’s hard to identify them because they’re hidden between the over-levered, the perpetually unprofitable, and so on. But there is a big difference between those who choose to take on more pain vs. those who are forced. While the latter may struggle to survive, it’s often the former that builds the tolerance to thrive.

Thanks for reading.

Questions or thoughts to add? Comment here or message me on Twitter.

Ownership Disclaimer

I own positions in Altria and other tobacco companies such as British American Tobacco and Philip Morris International.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑

IMO Tesla has been doing the same with considerable price cuts which shook the whole EV industry and led others to further price cuts, even though other OEMs had actually negative net margins already prior to price cuts. Tesla, with positive FCF, strong margins vs peers & impressive operational leverage and manufacturing efficiencies can withstand the short-term pain for long-term gain through stronger market share, higher market penetration and more accessible price points..

Thomas Russo from Gardner Russo & Quinn likes companies that have the ability to suffer so you might like his work. I'm sure you would have some great insights into his holdings Nestle and Heineken (especially when Anheuser-Busch has done poorly recently) if you are looking for article ideas :)