Otis Worldwide $OTIS: Analysis and Valuation, 2022

“It is not the beauty of the building you should look at: it’s the construction of the foundation that will stand the test of time.” – David Allen Coe

Company Overview

Elevator-like machines have been around since the early 1800s to lift freight, but people back then were apprehensive to ride them. And who could blame them? Improper installation or a snap of a rope would be a death sentence.

Elisha Graves Otis remedied this.

In 1854, at the world’s fair in New York, Elisha cut the cable suspending a platform he himself was standing on. Shocking the audience, a custom-fit device sprung into action which stopped the platform’s free-fall. This ultimately helped usher in a new era—the rise (literally) of the skyscrapers.

Otis Worldwide is a U.S.-based corporation that develops, manufactures, and markets elevators, escalators, moving walkways, and related equipment.

Elisha founded the company in 1853, and after operating for over one hundred years independently, the company was acquired by United Technologies in 1976 and was eventually re-spun off as a separate entity in April 2020. Through discipline, invention, and acquisition, the company has maintained its position as the world’s leader in vertical transportation systems. Operations are split into two primary segments: New Equipment (product sales) and Service (maintenance, repair, and subscriptions).

Otis’s continued operations are surprisingly capital-light, allowing the company to target a 35-40% payout ratio for its dividend, engage in both bolt-on and strategic M&A, and return remaining free cash flow to shareholders through share buybacks. The company trades on the NYSE under the ticker OTIS, and currently holds the following credit ratings:

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Investment Thesis

The vertical transportation systems (VMS) space benefits from secular tailwinds including a growing global middle class and urbanization. Complexity, regulation, and safety concerns have created a formidable barrier to entry. Otis, as the largest and most dominant player in the industry, further benefits from:

Superior economies of scale and operational density.

Prioritization of the world’s largest portfolio of serviceable units.

Digitization and enhancing technologies.

These factors allow the company to sustainably increase operational efficiencies of a capital-light business and will create substantial value for equity holders.

Industry Overview

The vertical transportation systems (VMS) space is highly consolidated, with just a few major companies clearly leading in the public market:

Otis Worldwide Corp (NYSE: OTIS)

KONE Oyj (HLSE:KNEBV)

Schindler Holding AG (SWX:SCHN)

Presently, total global sales of the VMS market are approximately $80 billion, with around $35 billion in new equipment (NE) and $45 million in services sold last year. At the end of 2021, the top five industry leaders held a ~70% market share of the NE segment. With high fixed costs and safety concerns introducing complexity, no new original equipment manufacturers (OEMs) have taken a noticeable market share in the NE segment in decades. The service segment, however, is much more fragmented, with the top five only having around ~40% share. This discrepancy is even wider in emerging markets, where the top five have as low as ~25% of the service market share.

The industry experiences several secular tailwinds, including a growing global middle class and an increase in urban living.

Otis Operations and Segment Specifics

Otis Worldwide’s 2021 total sales came to ~$14.3 billion, and the company currently holds the largest portfolio of serviceable units, with over 2.1 million globally. Total revenue is split between new equipment, ~45%, and service, ~55%.

Since being spun off from United Technologies in 2020, Otis has been showing exceptional progress in improving its operational efficiency. Through a holistic lens, the company has tuned its operating model, captured global incentive credits, and simplified its legal structure. From 2019 to 2021, the company’s effective adjusted tax rate went from 34.1% to 28.5%. The company holds a full-year 2022 outlook of 27.5-28%, and a medium-term outlook of 25-27%.

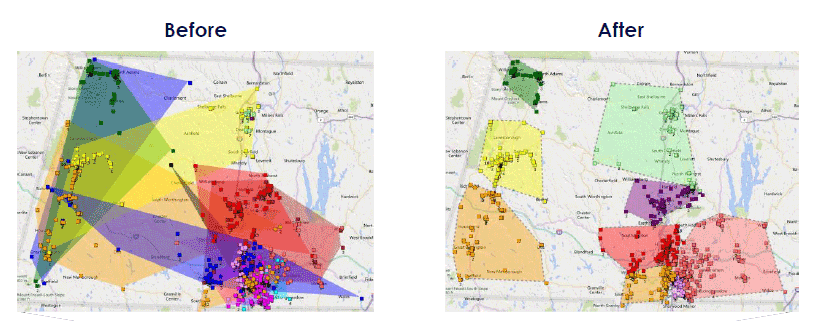

As the largest industry operator, Otis doesn’t just benefit from economies of scale, but also from operational density—which no other operator has been able to compete on. Operations are well-balanced globally, and service route optimization has become an essential focus. At the start of 2022, only 40 branches (with 9% of the portfolio units) had been route-optimized, leaving substantial room for improvement. The company aims to optimize an additional 300 branches by end of the year. For the context of what this results in, the company recently optimized routes for their Northeastern U.S. branch, reducing travel times by 30% and trimming the number of routes by 25%. This cuts all costs associated with travel, and dramatically improves response times and maintenance completion.

Otis’s SG&A expenses are in a stable state. By further leveraging its scale and global presence, the company is increasing its usage of shared service centers, analytics, and ERP to further reduce SG&A. As the company continues to grow, incremental costs will be driven down significantly.

While Otis is a leader in developing new products, it is prioritizing all levers that lead to increasing its service portfolio. And when you dive into the numbers, it’s not hard to understand why.

Service has ~x3 the operating margin as new equipment.

It’s a more stable form of revenue; especially subscriptions.

It’s less sensitive to input costs and other macroeconomic factors.

It provides additional opportunities to add value for all stakeholders.

There are four specifics Otis focuses on to accelerate growth in the service portfolio:

Grow new equipment share

Increase conversion

Improve retention

Recapture

The details of these dynamics will be explored throughout the following operations subsections.

New Equipment (product sales)

Total NE Revenues 2021: ~$6.4 billion.

Total NE Operating Profit Margin 2021: 7.1%

Presently, eight countries represent ~85% of the global VMS market. The global NE segment has experienced unit sales growth of ~1% for more than a decade and estimates indicate that this will continue for the foreseeable future, with the majority of growth generated from China.

Growing New Equipment Share

Otis’s NE market share fell from ~18% in 2010 to ~14% in 2012, before slowly recovering. From 2019 to 2021 Otis went from ~16% to ~18% NE share. For the same period, bid coverage increased by a staggering 10%. The company intends to continue this trend by growing its agent and distributor network and believes there is an opportunity to increase total coverage by an additional ~5%-10%.

Along with improving sales coverage and effectiveness, the company is focused on developing new products to meet changing customer needs.

The Gen2 PRIME™ unit is faster, larger, and substantially cheaper to install than legacy alternatives, and has allowed Otis to capture entry-level low-rise market share in emerging countries.

The Gen360™ is the first elevator unit to use drive-by-wire technology—a switch from mechanical to electronic architecture. The new electronic architecture allows for faster diagnostics and provides the potential to fix issues remotely. This unit is optimally designed to decrease pit depth and provides increased design flexibility and reduced construction costs, which should lead to a higher NE share.

While new equipment sales are a smaller segment and have lower margins, they are an essential piece of the puzzle. Paired with increased coverage and conversion rates, growing NE sales ensure an ever-growing portfolio of serviceable units.

Service (maintenance, repair, and subscriptions)

Total Service Revenues 2021: ~$7.9 billion.

Total Service Operating Profit Margin 2021: 22.4%

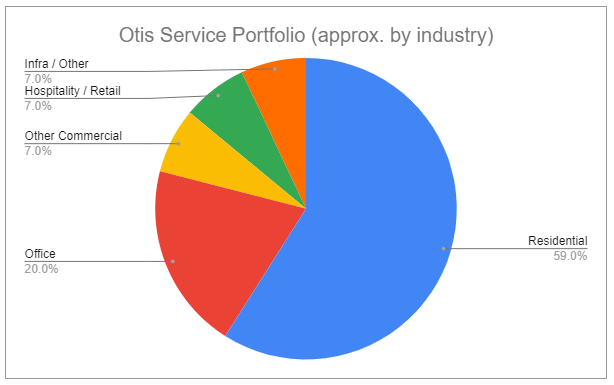

Otis Worldwide has the largest service portfolio in the industry, growing units by 3% in 2021 and now with over 2.1 million units total. Not only is Otis’s service portfolio geographically diverse, but it is also well-protected from trends regarding remote work and WFH, as well as economic weakness, with nearly 60% of its portfolio being multi-family residential. Maintenance and repair revenue from these units totaled around $6.5 billion in 2021.

Traditionally, all new equipment sold comes with a comprehensive 1-year warranty. Currently, Otis converts 62% of units to service contracts when their warranty ends, up 2% from just 3 years ago. The average service contract length is 4 years and includes adjustments for inflation. While a much smaller portion, subscription services have become an integral part of the business, as the added value and stickiness increase retention and conversion rates, while also providing incremental revenue.

As produced units become more advanced and digitization becomes more widespread, this further benefits OEMs in their efforts to convert from the warranty. Otis has several service-specific strategies to increase conversion, improve retention, and recapture old units.

Improving customer experience

Otis has been ensuring the customer experience continually improves, and the data supports their efforts. Comparing 2021 to 2019:

unplanned shutdowns decreased by 15%.

service response times improved by 20%.

retention rates increased from 93% to 94%.

I believe retention rates are one of the best measures of true customer satisfaction and loyalty, and Otis has the highest rate of any major operator in the industry. Retention and conversion rates should continue to see incremental improvement as Otis continues to prioritize new technologies and value-add services.

Otis ONE™ is the greatest driver for improved customer experience and has been cited by the company as the ultimate productivity and sales tool.

Traditionally with most companies, when an elevator experiences technical issues, the building operator has to contact a service provider to get a service technician on site. Oftentimes, the technician will arrive only knowing that a unit needs service, but won’t have diagnostics, and won’t know where the machine is located in the building. This inevitably leads to slower response times and higher maintenance costs.

Otis ONE™ fixes this by providing real-time monitoring and cloud-based analytics, and allows:

Otis to be immediately contacted by the unit when there is an issue.

Remote fixes and maintenance.

Immediate dispatch of technicians with complete diagnostics.

Direct facilitation of repair sales and contract orders.

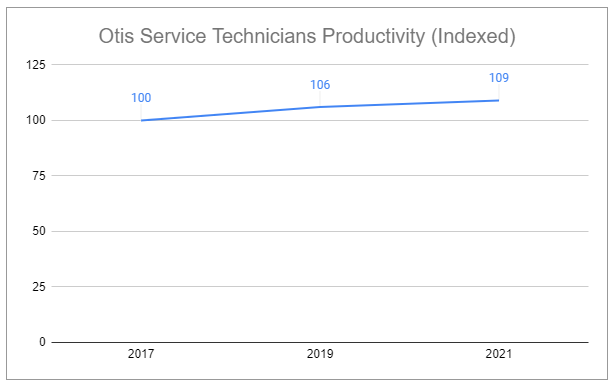

This reduces unplanned service calls and further improves response time, all while offering unmatched transparency to customers. It also makes it much easier for Otis to compete against independent service providers, which make up 60% of the total VMS service market. Otis ONE™ is so far only deployed with about 30% of portfolio units. The units utilizing it experience an average reduction in service hours of 10%. Importantly, Otis ONE™ allows service mechanics to optimize their time across more units. The company does not disclose revenue per service technician but has disclosed productivity per tech has increased by over 9% in the past few years.

Since the upfront costs for Otis ONE™ are minimal, Otis effectively uses it as a subsidy to increase sales of other digital products, which all contribute to increased retention and conversion.

Digital offerings increase recurring revenue

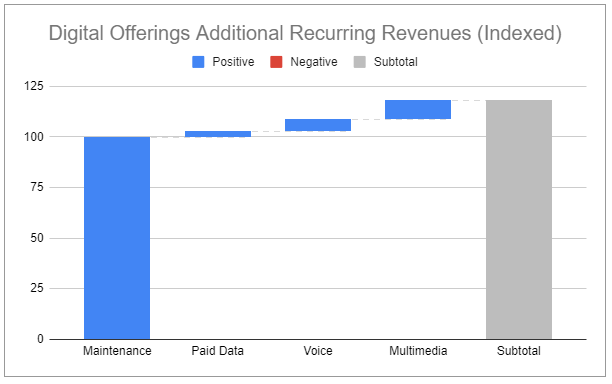

Otis’s digitization efforts don’t stop with Otis ONE™. The company has also seen massive success by launching:

Destination dispatching tool COMPASS 360™. The company lowered the cost by 20%, leading to an x4 increase in market opportunity. With a 99% retention rate, COMPASS 360™ has led to an over 30% increase in unit sales since 2019.

Otis eView Multimedia™. This screened device is installed within units, providing a stand-out experience for users. Content can be wide-ranging and customizable, creating entirely new subscription revenue streams for Otis.

Otis eCall™. This application makes it easy to hail an elevator from anywhere in the building, without needing to touch a button or wait in the hall.

Digital products provide predictable recurring incremental revenue and allow Otis to increase total revenue 15-20% above the regular service contract amount. And it’s a win-win situation for Otis customers, as it becomes easy to make buildings more appealing and differentiated from the competition.

Capitalizing on Modernization

The number of elevator units over 20 years old was 5.5m in 2019. This number increased to 6.5m in 2021 and is expected to grow to 8m in 2025. These units not only need more frequent maintenance but need to be retrofitted with solutions that enhance both efficiency and safety. Upgrades range from small changes, such as changing the interior wall of an elevator, to large projects, such as changing out the entire electrical system of a unit or outfitting with full IoT integrations.

Modernization is one of the smallest portions of Otis’s operations, but that doesn’t mean it isn’t important. Older units are prime candidates for additional digital products, and as the number of older units increases, modernizing them allows the entire service process to reset and extend well into the future. Otis estimates that there are ~3.5 million active Otis units globally, but only ~1.5 million of those are within Otis’s service portfolio. The remaining ~2 million units present a unique opportunity for Otis to recapture; and as the OEM, the company is uniquely positioned to best service and upgrade the units. Like the New Equipment segment, Modernization has experienced almost no new entrants in the past few decades. Otis is positioned to grow its modernization revenue at a mid-single-digit CAGR.

Management and Culture

Executive Leadership

Marks, Judith F., Chair, President & CEO

Ghai, Rahul, Executive VP & CFO*

Calleja, Bernardo, President, EMEA

Cramer, Jim, President, Americas

de Montivault, Stéphane, President, Asia Pacific

Glance, Todd, Executive Vice President of Operations

Green, Neil, Executive Vice President & Chief Digital Officer

Ryan, Michael Patrick, VP & Chief Accounting Officer

Leonard, Rina, VP & Global Chief Information Officer

LaFreniere, Nora E., Executive VP & Chief General Counsel

Tanguay, Randi, VP & Chief Communications Officer

Fiala, Robin, Vice President of Sales & Marketing

Luersman, Abbe, Executive VP & Chief People Officer

*Anurag Maheshwari, Executive VP & CFO, effective August 12, 2022

Leadership

On June 27, 2022, Otis Worldwide announced current CFO Rahul Ghai had accepted a position outside Otis. He will be replaced by Anurag Maheshwari as Executive Vice President & Chief Financial Officers, effective August 12, 2022. Anurag has held major roles serving finance, IT, and transformation for Otis in the Asia Pacific region.

Current Otis Worldwide Chair, President & CEO Judith F. Marks has held critical roles at firms such as IBM, Lockheed Martin, and Siemens AG during her 37-year career in the industry. She was serving as CEO of Siemens AG when appointed President of Otis in 2017 and led the successful spinoff in 2020.

Otis has seen countless changes in leadership, which is to be expected for existing for over 150 years. Despite all that has changed in the world, the company continues to cultivate an exceptional work environment and culture, focused on safety while empowering the talent of its over 70,000 employees.

Risks and Considerations

Safety and Regulation

Safety is the foremost focus of the VMS industry and has fortunately led to strict regulations concerning production, installation, and service standards. This prevents new entrants to the space but also makes it a challenge for existing operators. Unfortunately, with a massive portfolio of serviced units that billions of people use daily, it’s inevitable occasional accidents occur that Otis is liable for.

There have been notable occurrences in the past:

In 1992, an Otis trainee died after receiving orders to ignore workplace safety protocols.

In 1998, two Otis workers died in separate events in Mumbai.

In 2001, 8-year-old Tucker Smith was crushed to death by an outdated Otis unit.

In 2009, eight people were trapped for eight hours in an Otis unit in Toronto, Canada. While attempting to fix the unit, a service worker fell to his death.

In 2010, an Otis escalator in Shenzhen randomly reversed direction, in which a resulting stampede injured 25 people.

In 2011, an Otis escalator in Beijing spontaneously reversed direction, injuring 27 and killing 1.

In 2017, an Otis escalator in Hong Kong reversed, injuring 18 people.

In 2018, an Otis escalator in Stockholm reversed, causing minor injuries to a one-year-old.

Investigations occurred for each, and Otis has sought to rectify each occurrence. There is no excuse for these events, but it is worth noting that the occurrence rate for events such as these is less for Otis than other operators. Future incidents may result in fines and product recalls, and while unlikely, even Otis losing its ability to operate in certain jurisdictions. While these safety concerns represent a risk, it’s critical to recognize that they are also a primary barrier to entry.

Along with safety concerns, in 2007, the European Union fined Otis 225 million Euros for its role in a price-fixing cartel. Competitors were also fined for participating, including:

ThyssenKrupp

Schindler Group

KONE

Mitsubishi Elevator

Cash Repatriation

When Otis was spun off in 2020, it was left without large distributable reserves. As a majority of operating income comes from outside of the U.S., this has proven challenging for the company. In 2020, the company repatriated ~$500m of trapped cash, and in 2021, was able to move ~$1 billion. This is not overly concerning but is worth keeping an eye on.

Debt and Underfunded Pension

Spinning off from United Technologies also left Otis Worldwide with considerable debt and an underfunded pension. Increasing cash contributions towards the pension will negatively impact FCF. In recent years the company has addressed its debt level, with efforts including paying down a large chunk in 2021. Currently, the company holds:

an interest coverage ratio of 14.22, which is substantial.

an Altman-Z score of 2.99, which is reasonable.

a net-debt/EBITDA ratio of 2.02, in line with the company’s target ratio of 2.0.

Due to Otis’s market position, and the defensive, capital-light nature of the business, I believe Otis is well-positioned to further improve its balance sheet. While company executives have stated their belief the company will remain ‘strongly BBB’, it makes far more sense to continue to allow the numbers to do the talking.

Zardoya

In late 2021 Otis Worldwide announced a tender offer through one of its subsidiaries for all of the shares it did not then currently own of Spanish company Zardoya Otis, S.A. (Zardoya). Offering a premium of ~29%, the tender offer was successful and resulted in Otis acquiring an additional ~45.5% of Zardoya, which took their total stake to over 95%. Exercising a special provision allowed Otis to acquire the remaining interest and have Zardoya automatically delisted in early May. The total deal places an approximate value for Zardoya of ~$3.8 billion. In total, the transaction is expected to be $0.12 accretive to 2022 adjusted EPS.

Macro

Currently, 74% of all revenue Otis generates is in non-USD currencies, and ~90% of company cash resides outside of the United States. Current USD strength has been a headwind for the company, and continued strength will continue to weaken recognized earnings. Along with currency headwinds, the company has faced both elevated commodity and labor inflation, further dampening earnings power. If we see an extreme economic slowdown in China, this should dramatically decrease industry new equipment sales, though it is worth mentioning that in Q1 2022, industry new equipment sales in China fell by 5%, while Otis experienced a 3% increase in the same period. Lastly, Otis has stopped all additional new equipment orders and investments in Russia. The company is honoring existing contractual commitments but is not expecting to continue existing operations within the country past that. While these macro factors have recently been unfavorable, it is worth noting that despite them, Otis has impressively experienced 9 straight quarters of margin expansion. If these macro factors subside or reverse, Otis may begin to increase its earnings power substantially.

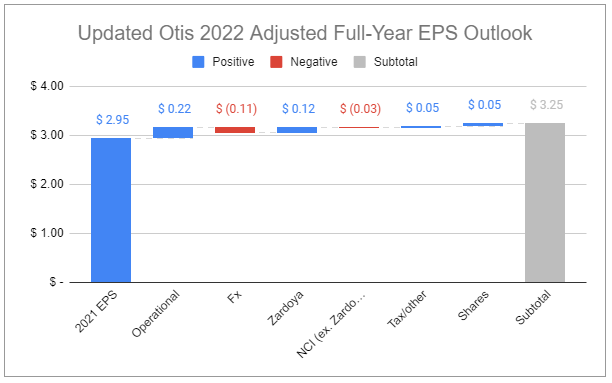

To further illustrate Otis’s operational strength, the below charts illustrate the impacts of recent events:

Two major drags:

2021 EPS decreased $0.06 when excluding operations in Russia.

Fx became an even larger headwind.

Countered with:

Finalizing the Zardoya deal early increased accretion.

Tax dynamics continued to evolve favorably

Buybacks were accelerated

Additionally, commodity and labor inflation were offset by volume, pricing, and productivity improvements. This left the net FY2022 adjusted EPS outlook in aggregate largely unchanged at $3.22-$3.27 and represents a 9%-11% increase Y/Y.

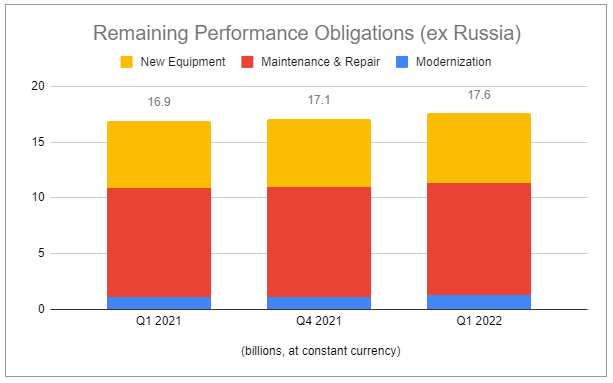

Backlog and Orders

Otis has seen its backlog of performance obligations increase over the last year. The increase is mostly in the NE segment, where sales have increased. Supply chain issues and macroeconomic considerations have led many customers to request delaying deliveries from 2022 to 2023. Further broad weakness may cause this backlog to continue to increase. On the flip side, that same weakness will likely drive input commodity prices down, offsetting some concerns.

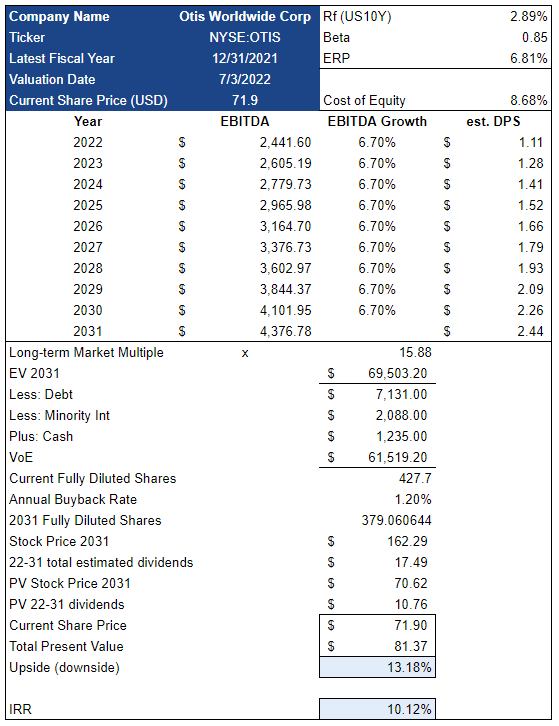

Valuation

I valued Otis using a 10-year exit based on backing out equity from an EV/EBITDA multiple and factoring in forecasted dividends and share repurchases.

Why EV/EBITDA?

Otis’s operations are incredibly capital-light. CapEx, on average, equals only ~1.5% of revenue, and other reinvestment needs are quite minimal. The company also boasts an FCF conversion rate >120%, which will come down over time but should remain exceedingly high (the medium-term outlook is 100-110%). Like any approach, this isn’t perfect. It’s an approximation.

Key assumptions:

Bid coverage will expand by an additional 5% in the medium term.

Small, incremental improvements to conversion and retention rates will occur.

Organic sales growth will be 3-4%, with low-single-digit growth in NE, and mid-single-digit growth in services.

Modernization and Recap will experience mid-single-digit growth.

We will see continued incremental improvements in productivity in both NE and service, as well as LSD pricing power.

Continued SG&A rationalization will occur.

Service route optimization will continue to be focused on.

Slight continued improvement in service tech productivity.

NE operating margins will expand by ~20 bps per annum.

Service operating margins will expand by ~30-50 bps per annum.

FX headwinds will persist.

Russia is excluded from continued operations.

The company’s tax rate will continue to favorably evolve towards 25-27%.

That’s a sizable number of levers to pull to create value.

Additionally, Otis has a $1 billion buyback program in effect, with a goal of retiring $500 million of shares by the end of 2022. At the time of this writing, that would equal ~1.64% of the total share count. I have assumed that the company will aim to retire ~1.2% of net shares outstanding per annum. The company also has a trailing dividend payout ratio of 32.67%, with the expressed goal of raising it to a 35-40% target. The dividend increases I forecast incrementally raise the payout ratio to ~38%.

The resulting total PV suggests Otis shares are undervalued by ~13%. While this may not be eye-popping, I believe it’s reasonable considering the defensive nature of the business. In regards to the company’s position and prospects, this model is rather tame in its assumptions and yet still produces an IRR >10%. Importantly, it excludes several additional considerations:

Firstly, service sales will grow x3-4 faster than NE sales, and while operating margins for both segments are expanding, service operating margins should continue to expand ~x2 as fast. Service, due to digitization, is becoming stickier, is less impacted by overall macro factors, and will continue to become a larger piece of the overall pie. This ultimately upgrades the quality of the business and, without assuming, it wouldn’t be unreasonable to see the market re-rate Otis based on this, leading to an expansion in multiples.

Secondarily, management has stated that excess cash will be deployed towards additional buybacks and M&A. The dividends and buybacks I forecasted are softer than what the company is guiding towards in the short term, and importantly, should leave a fair amount of free cash on the table. This means we could see a considerable increase over the $50-$100m in annual bolt-on M&A that management has guided to. With the number of value drivers Otis has access to, I don’t foresee there being a shortage of highly accretive targets; especially in the highly fragmented service space.

These factors should be compounded by the fact that management is targeting x2.0 net debt/EBITDA. As the business grows, debt financing will accelerate buybacks, M&A, and strategic investments. Depending on how things line up, it doesn’t take much creative legwork to see how shares could experience an IRR well above what is calculated.

Closing Thoughts

Conclusion

There is plenty of uncertainty regarding the macro outlook for the world, and it wouldn’t be farfetched to see extended softness mute Otis in the short term. It would also be unsurprising to see wall street sour on Otis if the company misses on 1-2 metrics that analysts have placed greater emphasis on.

However, Otis Worldwide is the epitome of durability. At nearly 170 years old, it’s the leader in an operation-critical, lindy industry, and is benefiting from several secular tailwinds. With shares currently trading at a 5.02% LTM FCF yield, ROC far above COC (and improving), a strengthening balance sheet, and a clear commitment to return excess capital to shareholders, I am content to patiently hold. I’ll look forward to any shocks or surprises as an opportunity to reevaluate.

Thank you for reading

Do you want to help me out?

If you found this write-up valuable, I’d appreciate you sharing it with others. And if you haven’t yet, consider showing your support by subscribing. You’ll never miss a future article, and it helps me connect with other curious people.

Questions? Thoughts? Comment here or reach out on Twitter @DevinLaSarre.

Ownership Disclaimer

I own positions in $OTIS.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tag: OTIS 0.00%↑