“Our Service-driven business model is working as we approach 2.3 million units in our portfolio by year-end, with the compounding lifetime value of each additional unit. Year-to-date results are indicative of the strength of our strategy as we continue to prioritize value creation for our shareholders for the remainder of 2023 and beyond.” - Judith Marks, Otis CEO, Q3‘23 Call

Pressures continue to weigh on Otis’s New Equipment segment, with Q3 NE orders decreasing by -10% y/y. For the period, despite pricing up globally and a 1% increase in organic sales, reported NE net sales declined by -0.8% and were up a mere 0.1% when adjusted, leading to a -6% move in segment operating profit (a 1% adjusted increase).

During the Q&A of the Q3 call, CEO Judith Marks shined a light on both concerning geographies (emphasis added):

We now believe the New Equipment market in the Americas is going to be down mid-teens, and we're really seeing that with the highest impact being the interest rates remaining high. It really is impacting new project starts.

We expect infrastructure to pick up as we go into '24.

What I do like about the Americas beyond their performance, and they really had a strong performance in terms of backlog conversion, is we still have strong mid-single-digit backlog on new equipment.

We'll wait and see what happens with interest rates. If this does become the new normal, we think people will adjust. Because housing demand is real. It's still there, so we have to wait and see where this equilibrium is going to come out with the developers and when they go ahead with projects. We're not seeing a decline in terms of interest or proposals.

In China, the New Equipment market does remain somewhat weak, and it's worse than we saw it a quarter ago, when we told you we didn't see that inflection point for book and ship. We're now saying it's really down. The China market itself is really down north of 10%. So we are continuing to focus on our pivot in China.

We have picked up share in China for the year. And so we will continue, even though the backlog is down, our team is continuing to fight for all units and execute our strategy, which has been in play, which is focusing on key accounts mainly state-owned enterprises, and continuing new product introduction and expansion on Otis ONE.

I think what you see with the results is despite China being down, our other 3 regions really picked it up nicely for us to be able to hold margins at 7% on New Equipment for the quarter and grow organically 1%, even with China down fairly significantly. So we'll wait and see what happens in terms of stimulus. Obviously, we've seen certain actions already in China in terms of easing monetary support, postponing property taxes, loosening credit policy for mortgages, but we really do are watching sentiment and liquidity. Those are the 2 items that we're watching.

Additionally, concerning cancellations, it was noted:

We're not seeing project cancellations at any level different than we have in the past. And we can say that everywhere in the globe. There are always a small amount of project cancellations that occur, in which we retain the deposit, the advanced deposit, but nothing unusual there.

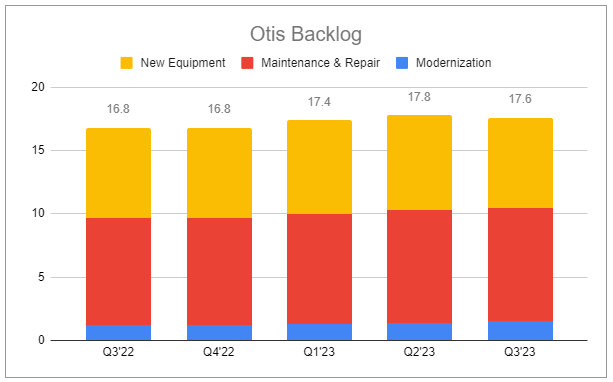

At the same time, the NE backlog increased by 2%, and Otis’s total backlog remains strong, providing clear visibility into the next 18-24 months.

While concerns about New Equipment remain elevated, this is ultimately a service-driven business, and in that regard, Otis continues to impress. Conversion rates, pricing, retention, and margins are all going up while the number of units within the Service portfolio continues to grow. With this in mind, it’s worth examining some of the core aspects driving performance.

Service-driven

Q3 Service adj. net sales measured $2.088 billion, a 10.3% increase y/y., while segment adj. operating profits increased by 14.6% to $518 million—an adj. operating margin of 24.81%. These increases, as a percentage, are less impressive considering the relatively easy comp to a weaker Q3’22. However, this also marked the 15th consecutive quarter with y/y adj. Service margin expansion.

Segment strength in Q3 was driven by an increase in organic sales of 8.4%, comprised of Maintenance & Repair up 8.6% and Mod up 7.6%. The trend in y/y margin expansion is unlikely to continue in Q4 due to mix shift, as Repair should come in near-flat while Mod—inherently lower-margin—is poised to continue to grow at double-digits.

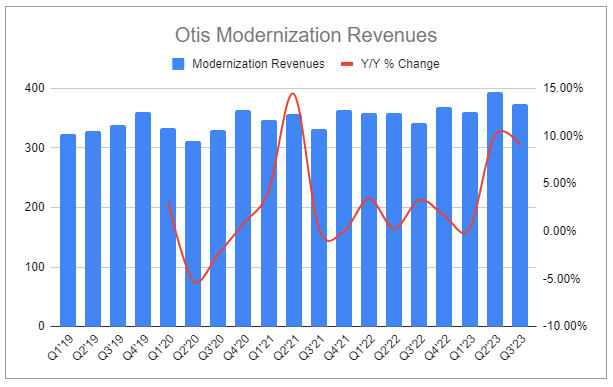

Despite being a relatively small percentage of total sales and carrying lower margins, I continue to believe that focusing on Mod is a priority.

In Q3, Mod orders were up 13% at CC, Mod backlog increased 15%, and associated reported sales increased 9.06% y/y. This subsegment continues to carry meaningfully higher retention rates and allows Otis to more easily convert outside units into the company’s service portfolio. Higher retention is not only due to the nature of the customized solutions but is an expression of the value produced by including Otis ONE and other connectivity solutions—additionally driving smaller but higher margin recurring revenues. Further, for Mod broadly, margins are poised to widen as the company focuses on streamlining related processes at the factory level. This is even playing out in China, and Otis, while not disclosing specifics, has stated that Mod growth has remained at steady double-digit growth for the first nine months of 2023.

While comparative price take has remained robust, measuring +4pp y/y in Q3, inflation, namely in the form of wage inflation, remains a key concern for the Service segment. However, the company is poised to execute on both pricing and cost controls going into the first half of next year, as the majority of maintenance workers have been represented in finalized collective bargaining negotiations globally.

Compounding free cash flow

Otis’s updated full-year outlook pushed expected FCF conversion to the bottom of the previous 105-115% range and nominal FCF to $1.5 billion from the earlier 1.5-1.55. There was a stand-out exchange between RBC’s Nicholas Housden and Judith Marks, as it moved the conversation closer toward a long-term framing (emphasis added):

Nicholas Housden, Analyst, RBC

So yes, just on that free cash flow point, I mean, it looks like China are going to go back to that 650,000 unit mark. So I'm just wondering if that means that, over the medium term, there needs to be a permanent reset on the expectations for conversion from the current sort of 100% to 110% target that you've already got? That's the first one.

Judith Marks, Otis CEO

Well, I can take that one. The answer is no. No reset.

Nicholas Housden, Analyst, RBC

Okay.

Anurag Maheshwari, Otis CFO

Theres no reset because the 2 -- the new lower -- definitely lower orders, but also we're executing on high backlog. So all these will normalize. And the repair revenue will also kind of -- will start converting more into cash. So I don't think there's any reason for us to reset the target, yes.

Nicholas Housden, Analyst, RBC

Okay. Great. Very clear. Then just a second question on some of the competitive dynamics in modernization. So it sounds like when you guys or some of your European competitors modernize a unit, especially in China, it's almost always someone else's unit. And very often, it's one of the Asian competitors units that you're modernizing and then moving into your own portfolio. Are the Asian guys just not focused on modernization? Or why does it seem to be the case that you are kind of eating their lunch there?

Judith Marks, Otis CEO

Well, your hypothesis that most of our modernization is on non-Otis equipment in China is accurate. But remember, our China market share is -- our share of segment in Service is pretty low, because 75% of the -- all the units are maintained by ISPs. So I wouldn't specifically say it's -- some of the units we're getting back are Otis units that are not on portfolio, many are non-Otis units, but they're not necessarily Japanese or European. I can't comment on who they are. But what we've done a we've created very innovative packages to be able to put our hardware on non-Otis equipment to modernize it, to add new technology, and then to convert it into our portfolio.

The lower level of FCF conversion is a function of the timing aspects of the weakness of New Equipment and the strength of Service. On one hand, fewer upfront deposits for New Equipment are coming in, while on the other, repair work is billed upon completion. The final point made by Judith Marks reiterates what matters far more than a single quarter or single-year guide and what can drive free cash flow materially higher in the future: Continuing to execute a clear strategy to grow the Maintenance portfolio while remaining unwaveringly disciplined. In 2019, the Maintenance portfolio contained 2 million units, 2.1 million in 2020, 2.2 million presently, and it is likely to reach 2.3 million by the end of the year—all while keeping costs checked.

The enduring, consistent, and capital-light nature of the business continues to impress, and, following Q2, I concluded:

My valuation, last published in February, remains largely unchanged—an attempt to remain conservative by not adjusting to what I view as favorable developments. To distill simply, at Friday’s closing price of $83.73, the forward yield is 1.62%, the company will likely be able to retire >2% of shares outstanding per year, and free cash flow can grow at a rate of 5-7% per year. This durable asset—effectively a tax on human mobility—has the potential to compound near a ~10% rate.

At the present price of $79.81, shares trade at 21.7x FY’23 free cash flow. At a constant price and equal annual allocation to share repurchases, more than 2.4% of outstanding shares may be retired per year moving forward. Additionally, there remains no impact of the company’s new efficiency initiative ‘Uplift’, in which the company aims to recognize $150 million in annual savings. The process should begin in Q4 and continue throughout 2024, with related restructuring charges amounting to ~1:1. With management describing the goal as “absolutely achievable”, related charges may mute 2024 but the full impact should flow through to FCF starting mid-2025—further accelerating FCF per share. It’s also worth noting that this assumes a continued down market for New Equipment. Otis, with its 170-year history, has seen plenty of downs. The company would find itself in an envious position if that segment perks up.

If you enjoyed reading, hit “♡ like” and share this piece with someone.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Otis Worldwide.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: OTIS 0.00%↑