“We are in the life safety business, and 2.3 billion people a day trust us. And you don't think twice about using our product. That's exactly the kind of company we want to be” - Judith Marks, Otis CEO, 2024 Investor Day

At lunch a few weeks ago, my uncle gifted me an old Harvard Business School printout from 1986 that he found while cleaning out boxes long forgotten in the back of one of his closets. It was a remnant from nearly forty years ago—research when he worked at a specialty manufacturer that provided power systems for several Otis unit types. Echoed in the words given by Judith Marks showcased at the beginning of this piece, the paper opens with a quote from Bob Smith, the company’s Chief Operating Officer at the time:

When elevators are running really well, people do not notice them. . . . Our objective is to go unnoticed.

The paper provides a comprehensive record of the company’s strategic imperatives and what has led to its distinct competitive advantage. In the late 1970s, microprocessors began to replace the mechanic control systems within elevators. New equipment was produced by several highly competitive companies, including Westinghouse, Dover, Montgomery, Schindler, Fujitec, and the largest, Otis. Otis was also the leader in the servicing of elevators. But, just as it is today, the service market was highly fragmented, with thousands of small independent service providers chasing steady, highly profitable repair and maintenance contracts. Often, the winner of a contract was based on responsiveness, quality, and price. Elevators with microprocessors introduced a new level of complexity, often attached to proprietary maintenance devices, which provided the original equipment manufacturers with a new edge.

Integrating microprocessors into elevators was not Otis's first leap into digitization. In 1965, the company’s North American Operations division installed its first computer, an IBM 1401, to automate maintenance billing. In the 1970s, this was extended to handle aspects of production control and accounting and then expanded to cover data entry for inventory control. While these initiatives did provide considerable benefit, Bob Smith, COO, quoted above, grew apprehensive of the continued development costs of these new additional systems. He implemented a massive cost-reduction initiative, suspending new development, which led to the laying off of more than sixty percent of the company’s programmers.

The company’s advancements in information systems resumed in 1982. Otis had been exploring the possibility of utilizing a centralized customer service department, aiming to drive higher customer satisfaction. In the summer of that year, a centralized program was successfully piloted, and plans were made to extend the program for all of North American Operations. The program was titled OTISLINE. In 1983, a new IBM 3083 was installed, and over the next two years, it was paired with a myriad of storage devices, tape drives, and telecom equipment—all cutting-edge at the time. By 1985, the NAO information services budget had ballooned to more than double what it was just a few years prior. Was it justified? Absolutely.

The company recognized that out-of-service elevators not only angered customers and negatively affected their businesses but also provided an openly visible, negative association with Otis itself. Unlike many of the commercial answering services competitors were using, the OTISLINE Service Center comprised an army of highly-trained, highly-skilled dispatchers. Prioritizing efficiency and effectiveness, the OTISLINE application allowed dispatchers to respond to customers in less than a second. The program also produced considerable data, which was stored on centralized systems, logging the quality of service provided and enhancing speed by driving down the time and resources required to diagnose and resolve problems. Critically, OTISLINE changed not just how customer service was done, but how all of North American Operations functioned. The massive data accumulated allowed the company to identify trends in component issues, leading to the program’s utilization in both engineering and service marketing. Redesigns and component improvements accelerated, and New Equipment Sales teams were armed with comprehensive information to best support negotiation processes and provide competitive but maximally profitable estimates. It was a constant, iterative, and ever-expanding effort, all in the name of going unnoticed.

Interestingly, the HBS paper outlined potential future uses of OTISLINE and further additions to the company’s information technology suite, including:

Remote Elevator Monitoring

In-Car Phones

Hand-Held Terminals replacing the pagers of service mechanics

Streamlining New Equipment ordering

Managing the company’s comprehensive portfolio of New Equipment and Service contracts

The paper concluded with a quote from Bob Smith in a 1985 North American Operations management letter:

The real significance of OTISLINE is its ability to collapse both distance and time, resulting in faster responses to customer problems, better maintenance procedures, and, ultimately more reliable elevators. . . . This can translate into real competitive advantage. We’re confident that it will, and we are investing accordingly.

Invest they did.

Fast-forward thirty-nine years from the time of that quote and here we are today. Think of how much the world has changed. The company certainly has. Yet, underneath it all, the same drivers propelling the company forward have remained firmly in place. All of those future potential use cases? The company is using them all to stay ahead of the pack, while, as intended, countless millions use Otis products every hour of every day, all around the globe, without a second thought.

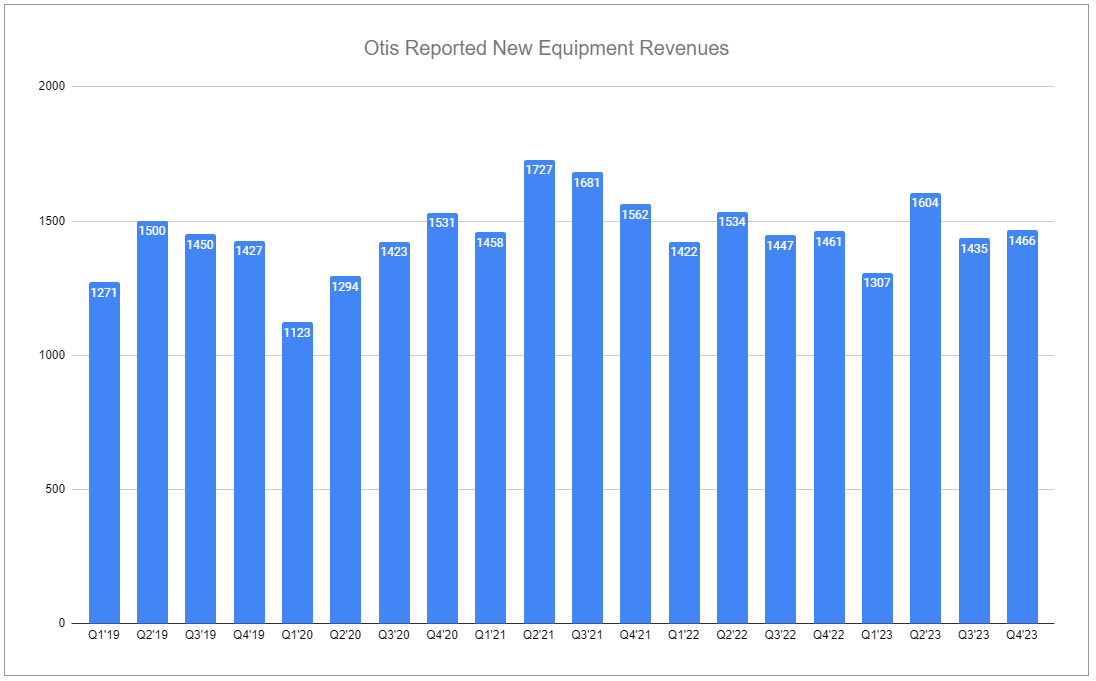

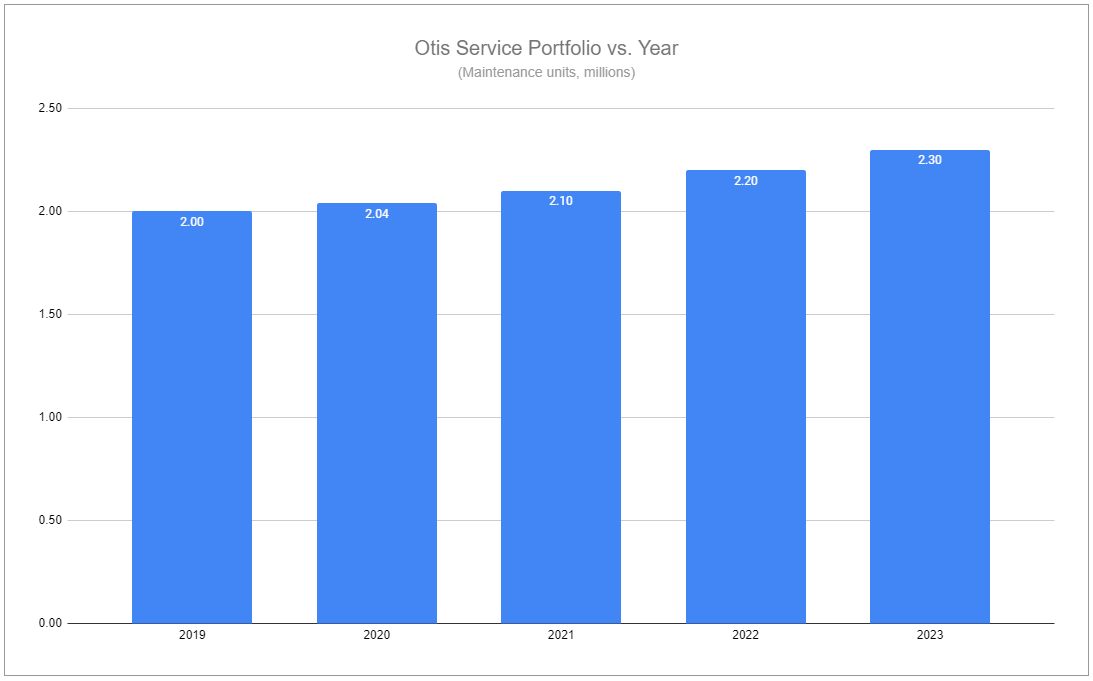

Considering all of the above, it is somewhat odd that there remains such a fixation on the current pressures facing Otis’s New Equipment segment, with China front and center. The cyclical nature guarantees ups and downs, but people refuse to take the good with the bad. Yet, the current environment can hardly be called bad, when, even in China, aggregate profits have still grown on the back of strong Service performance, as Judith Marks reminded us during the 2024 Investor Day, held in February:

Our China portfolio has been growing. Last year, we grew at 20%. We've doubled it since spin from a low base for the Service portfolio. The China New Equipment market is certainly coming down. What I like about the China mod market is different from Europe, different from mature Asia, different from North America. If you think about it, almost every elevator or escalator installed in China started early days 2000. They're all the same rough technology or vintage. Certainly from us, they're all similar Gen2s. So the ability to grow at scale in mod in China is easier because it's less bespoke or custom than anywhere else in the world. And that's why starting at a small base, that China mod -- our China mod business grew significantly, well over double digit last year.

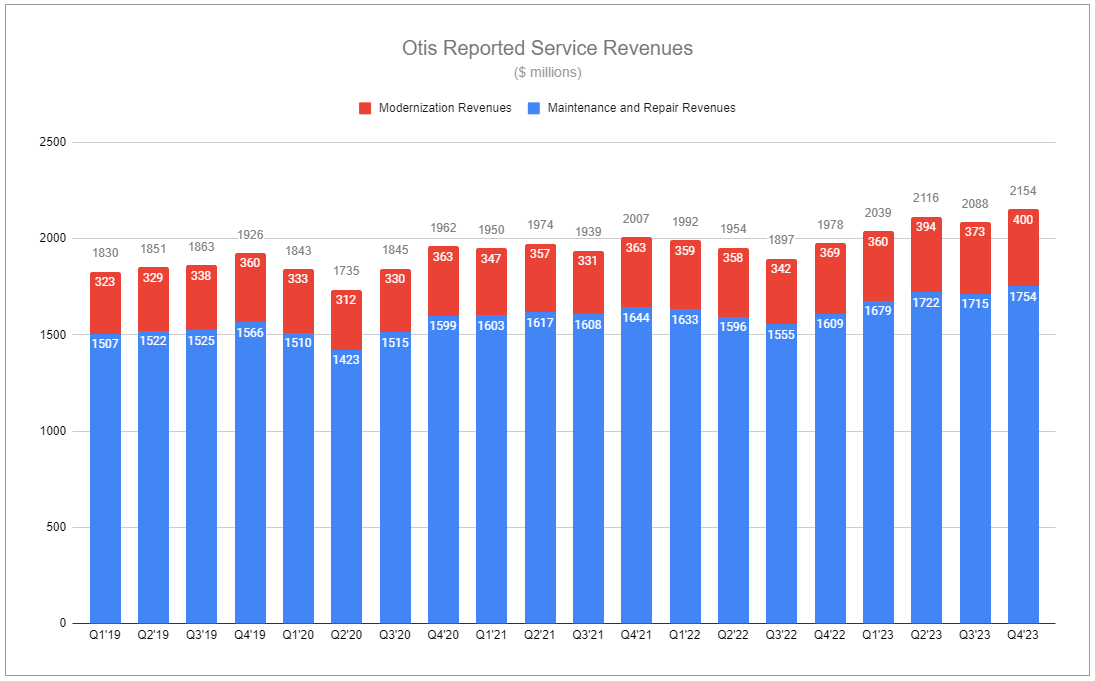

The growth of Mod continues to outpace Service, with its backlog growing by a massive 15% in 2023. The sustained outperformance in Mod continues to be driven by the very same cyclicality that people worry about in NE—previous macrocycles. Anurag Maheshwari highlighted prospects for Mod during Investor Day:

So the addressable modernization market, and addressable defined as New Equipment units installed in China 15 years ago and the rest of the world 20 years ago, in 2023 was about 0.5 million units. The actual units got sold were about 300,000 to 350,000 because the penetration is about 60% to 70%. If you look forward to the next 5 years, in 2028, this addressable market will grow from 0.5 million units to about 900,000, and that's because the big build that we saw in China in 2005, '10 time frame and the rest of the world. So it grows 2x. Even if we assume the penetration rates to be similar as of what it is today, modernization should grow about 2x. If penetration rates improve because of initiatives, regulations and other things, it could be between 2 to 3x.

So taking a step back. If you look at 2023, New Equipment plus mod was about 1.1 million units. And this 1.1 million units because of the mod growth can increase to 1.5 million to 1.8 million units, a mid- to high single-digit CAGR between the 2 put together. Now if the New Equipment markets continue to soften a little bit, let's say, they keep going down 2%, 3% every year, the 800,000 could become 700,000 by 2028. So the 1.5 million to 1.8 million becomes 1.4 million to 1.7 million, still a mid-single-digit CAGR growth between New Equipment and mod.

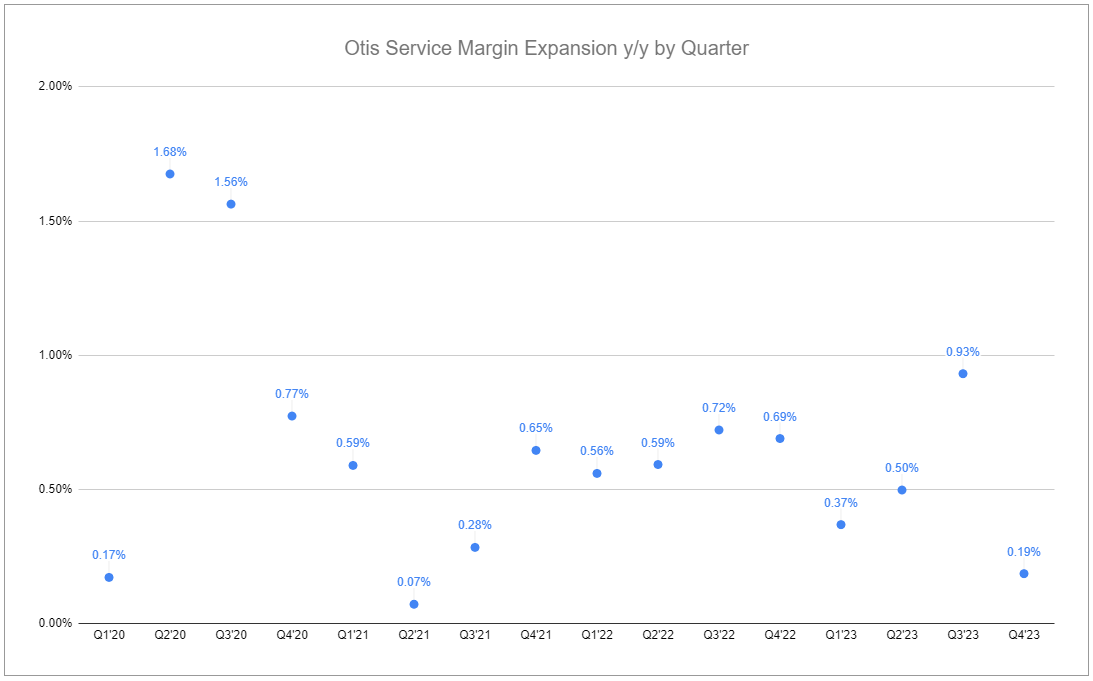

While there is undeniable softness in NE, it should also be noted that Otis has continually increased its share of the market, which should allow it to more than recover the segment’s contributing performance throughout cycles. At the same time, the long-term drivers that have allowed Service to excel have significantly improved how that translates into increased profitability. Since spin, the company’s Service margins, leverage ratios, and effective tax rates have all evolved favorably, and in material ways. Judith Marks distilled the clear opportunity ahead during the 2024 Investor Day (emphasis added):

We know how to do this. We've shown you we know how to do this. And we have an organic growth opportunity called modernization sitting right in front of us that will allow us to accelerate even more. That's what gives us the confidence that even in a flat New Equipment market, portfolio is going to grow, mod is going to contribute. And while New Equipment on the top line and bottom line, it will be flat to low single digit. It's our Service business. Customer-centric, Service-driven business model is our Service business that's going to be up mid-single digits plus, which is going to drive the double-digit EPS CAGR. We've done 13% EPS CAGR since spin through some really interesting years, through some interesting times. But looking forward, even with a flattish New Equipment market, even with challenges in the property markets no matter where you are in the world, this business model and this company will deliver double-digit CAGRs.

Looking forward

The financial outlook for 2024 includes flat NE sales and MSD Service sales. While NE margins are expected to be flat, Service margins are set to continue expanding at 40-50bps per year, with the Service portfolio increasing by >4% per year moving forward. Uplift restructuring costs, approximately 1:1 to savings, should provide run-rate savings of ~$80 million in 2024 and ~$150 in 2025. The ETR continues to evolve favorably, toward 25.5% in 2024 and toward 24% in the medium term. The company will maintain a 40% target payout ratio, $50-100m of FCF devoted to bolt-on M&A each year, and excess allocated toward share repurchases, with the aim of >$8 billion deployed 2024-2028 and share repurchases making up >$5 billion of that. Approximating these figures, while adding a touch of conservatism toward NE sales and margin, ETR evolution, Uplift benefit, and net financing, we can still reach an EPS CAGR of 10%.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Otis Worldwide.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: OTIS 0.00%↑

I love the personal anecdote and I hope you’re having a great Easter with your family.

Does the company discuss their labor costs? I’d be curious to know whether they’re facing challenges recruiting and training qualified technicians, especially in the US.