Philip Morris International: IQOS Growth Is No Illusion

“Reality is merely an illusion, albeit a very persistent one.” - Albert Einstein

Dutch-born MC Escher was a masterful graphic artist who spent decades creating mathematically inspired illustrations and prints. His boundary-pushing works explore concepts such as infinity, impossible objects, symmetry, perspective, and geometry. They are peculiar, and if you stare at any of them long enough, like the one above, you will likely feel challenged, conflicted even, as your eyes study what looks to be oddly familiar yet distinctly foreign.

This past Thursday, Philip Morris International released its Q3 2022 results. Along with the reported numbers, growth rates were presented on an organic basis, reflecting currency-neutral adjusted results, excluding acquisitions and disposals. Additionally, adjusted results excluded amortization and impairment of acquired intangibles. Comparative figures were also presented on a pro forma basis, which excludes PMI’s operations in Russia and Ukraine. At first glance, some of the numbers differ so widely that it wouldn’t be unfair to describe the report in its entirety as Escheresque.

What’s to make of it all?

Let’s break it down.

Philip Morris International Q3 2022 Results

For the quarter, key reported numbers y/y were as follows:

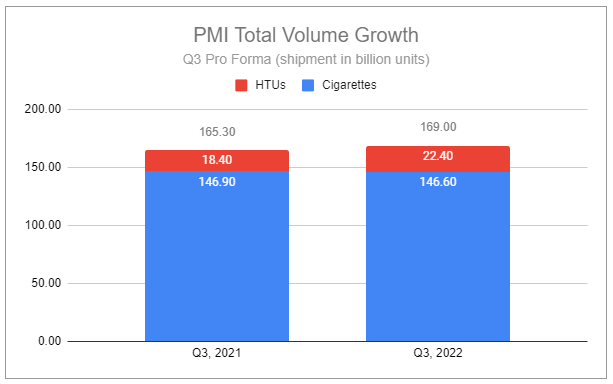

Total shipment volumes were up +0.6%

HTU (heated tobacco unit) shipment volumes were up +17.1%

Net revenue was down -1.1%

Operating income was down -14.1%

Operating income margin was down -5.5%

Diluted EPS was down -13.5% to $1.34

If some of these look ugly to you, that’s because they are.

Now let’s compare them to the pro forma numbers:

Total shipment volumes were up +2.3%

HTU (heated tobacco unit) shipment volumes were up +21.9%

Net revenue was up +6.9%

Adjusted operating income was up +4.4%

Adjusted operating income margin was down -1%

Adjusted Diluted EPS was $1.33, down from $1.44 the previous year. Excluding currency impact, adj. diluted EPS was up 8.3% to $1.53.

The differences between the two sets of figures are staggering. Of course, the reported numbers are grounded in reality and are, in fact, what the company achieved. But the pro forma numbers provide a wonderful context around how and why those exact results came about. It’s also worth remembering that none of this is a surprise.

Since being spun, it’s been readily apparent that PMI, a company reporting in USD but deriving zero revenues in USD, is particularly sensitive to foreign exchange fluctuations. With the U.S. dollar’s rampage so far this year, the headwind has been particularly damning. One bright spot regarding currency dynamics is that PMI’s debt profile is heavily denominated in EUR, helping lead to the company’s net debt being $1.5 billion lower vs. December 2021 and is now below 1.6x adjusted EBITDA.

The war in Ukraine has also been particularly impactful on PMI’s performance. The company derived almost 10% of its total net revenues from Russia and Ukraine in the quarter and ~8% for the year-to-date period. In February, PMI announced the temporary suspension of its operations in Ukraine. Since then, the company has resumed partial retail activity, though production in its Kharkiv factory remains halted. The company also continues to pay the salaries of and further support its 1,300+ employees in the country. In March, PMI announced planned suspensions of investments in Russia and plans to scale down manufacturing in the country, including discontinuing certain cigarette products, suspension of marketing, and cancellation of new product launches. The company employs over 3,200 people in Russia and will continue to pay their salaries and provide additional support. Further, PMI has reiterated it intends to exit the Russian market as the complexities of continued operations continue to grow. As of September 30, 2022, PMI’s Russian and Ukrainian operations have approximately $2.6 billion and $0.5 billion in total assets, respectively.

PMI’s FY 2022 pro forma outlook on July 21st included an adjusted operating income margin expansion of +0-50 bps. Their updated outlook now states a decrease of -50-0 bps. Along with global cost inflation and supply chain disruptions primarily from the war in Ukraine, the lower operating income margin reflects investment to further expand ILUMA to match demand and the higher initial costs of ILUMA devices and related HTUs. Once again, this shouldn’t be all too shocking. From my report published on August 7th:

Management has stated they expect this trend in OI Margin to reverse as the ‘upgrade cycle’ subsides, but I am cautious about the rate at which this will occur. Currently, ILUMA is only in Japan, Sweden, Spain, and Greece, with more launches planned throughout the rest of the year.

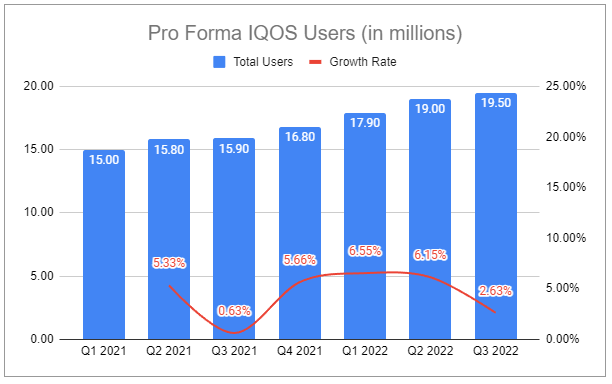

Weaker margins are never ideal, but the fact that acceleration in growth in a new product is partly to blame is something to cheer over, not cry about. In fact, this may be one of the clearest signals reinforcing the longer-term trend. See the pro forma number of IQOS users to appreciate the context of what is unfolding:

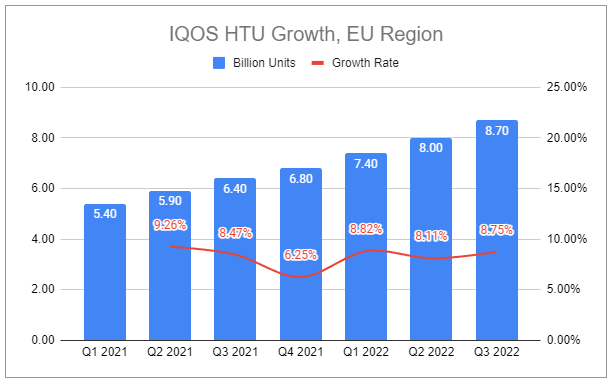

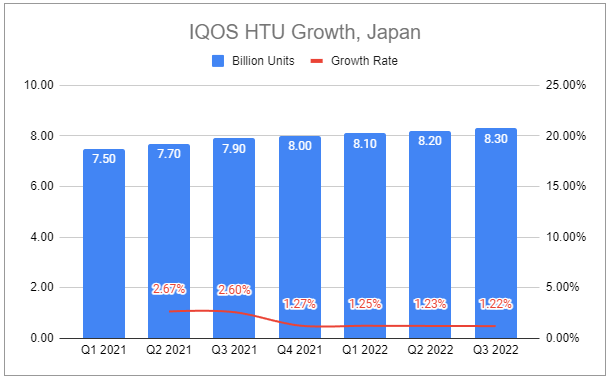

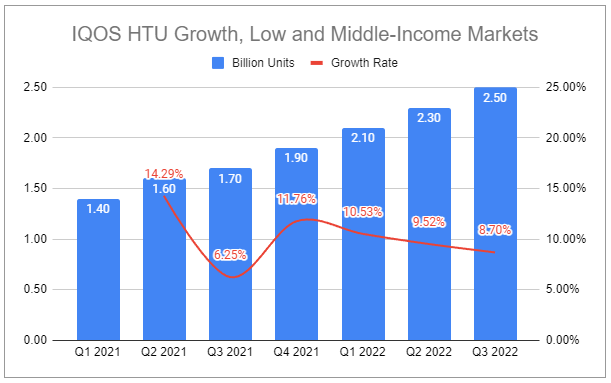

A growing base of users precedes sustained growth in HTU volumes:

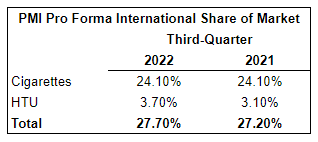

IQOS HTU volume growth has eclipsed declines in combustible shipments, leading to net shipment volume growth on both a reported and pro forma basis. This demonstrates that IQOS is not just cannibalizing PMI’s legacy volumes but the market as a whole. The company has also updated its FY pro forma outlook to include +2-3% shipment volume growth, up from its previous July outlook of +1.5-2.5%. Along with this, the company continues to exercise favorable pricing. In Q3 2022, combustible product pro forma adjusted net revenues increased by 4.1% on an organic basis due to pricing variance of +4.9%.

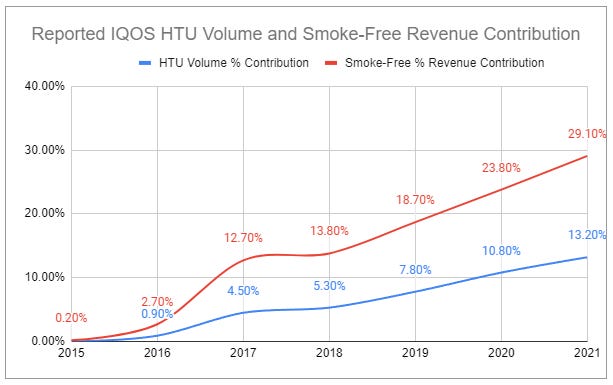

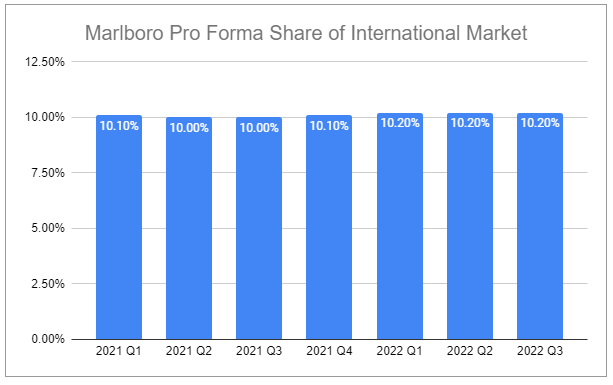

In Q3 2022 smoke-free products were 30.1% of net revenues and 29.2% on a pro forma adjusted basis, and market share of HTUs was up 1.3 pts to 7.7% on a pro forma adjusted basis. And while IQOS HTU volumes shined, Marlboro cigarettes continued to show relative strength:

This led PMI to capture additional total market share:

There were also two significant developments:

PMI reached an agreement with Altria to end the companies' commercial relationship regarding IQOS in the U.S. as of April 30, 2024. For this, PMI will be paying a total cash consideration of $2.7 billion - $1 billion upfront and the remaining by July 2023 at the latest. This is a hefty price but removes uncertainty around the companies’ relationship and options for U.S. IQOS. It also signals PMI’s confidence in their plans to move forward.

PMI increased its offer price for shares of Swedish Match to SEK 116 from the initial SEK 106, representing a 52.5% premium over the closing price prior to the announcement of the initial deal. The revised price accounts for the value relating to SWMA's cash flows generated in USD and the recent strength of the USD. PMI has stated that given global economic uncertainty and recent market weakness, the offer price should be attractive to SWMA shareholders. PMI has further stated that this is the best and final price, which per the Takeover Rules for Nasdaq Stockholm, means that the price can not be increased any further.

I remain very skeptical that the Swedish Match deal will successfully finalize, as even with the best and final price shaking out some holdouts attempting to arb the deal, it is unlikely to reach the required 90% acceptance threshold. Nonetheless, without a legacy combustible business, U.S. IQOS represents purely incremental growth with no cannibalization. PMI management believes the opportunity is immense (one would hope so, as the payment to Altria and the future costs associated with a U.S. presence are non-trivial). PMI is targeting ~10% volume share by 2030 and sees a fast path to profitability. The company has also stated that even if the SWMA deal does not finalize, plans are in place to get IQOS into the United States in 2024. However, there is also considerable doubt regarding HTP’s potential for success in the U.S. market, where ENDS are so widely favored and regulation can make entry exceedingly difficult.

Several points to note:

The company plans to submit a PMTA to the FDA in the second half of 2023 for IQOS ILUMA.

The ITC injunction issued against PMI only concerns the IQOS 3 series. ILUMA, relying on different heating technology, would be unaffected.

The SWMA deal and U.S. IQOS would both contribute meaningful USD revenues, somewhat helping reduce the impact of future changes in FX rates.

Without the SWMA deal finalizing, I find it unlikely that PMI will reach its 2025 goal of 50% smoke-free net revenues.

There isn’t much to say about the Healthcare and Wellness segment. For Q3, net revs were ~$275 million and its adj. op loss was ~$100 million. My stance on the segment has remained unchanged since earlier in the year:

…maybe this segment becomes a perpetual black-box money pit, or perhaps it will turn into an incredibly profitable new segment. Either way, I’ll wait to speculate further.

All in all, it was a very strong quarter for PMI. Management seems to agree. From the Q3 2022 report:

As a result of our strong year-to-date performance, we are raising the low end of our full-year pro forma growth outlook for adjusted net revenues, resulting in a range of 6.5% to 8% on an organic basis, and continue to expect full-year pro forma adjusted diluted EPS growth of 10% to 12%, excluding currency.

PMI is still facing plenty of headwinds, but taking a long-term view, it’s hard not to be positive between volumes, pricing, and high degrees of achievable operating leverage as IQOS grows. And if macro conditions begin to normalize? That’d be enough to make Escher’s head spin.

Thanks for reading.

Click here for the full analysis and valuation of Philip Morris International.

Ownership Disclaimer

I own positions in Philip Morris International and other tobacco companies such as British American Tobacco and Altria.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: PM 1.66%↑ BTI 2.43%↑ MO 1.05%↑

Additional Resources:

Philip Morris International - public filings and investor presentations. Source