Tail-End Problems

“Every great story seems to begin with a snake.” - Nicolas Cage

The Cobra Effect is often used to describe any governmental policy that generates unintended and/or undesirable results. It was coined by economist Horst Siebert, citing a peculiar occurrence in India during British rule - a time when the country had too many cobras. To remedy the venomous problem, the government instituted a bounty for each one killed and delivered. Brave citizens, eager to earn as much money as possible, set out on the hunt, ultimately killing a great number of snakes. A terrific success.

But other clever residents took a different approach. They would breed cobras to kill and deliver. The costs of breeding were more than made up for by bounties, and it was safer and easier to do. Scaled scales. Brilliant - kind of.

The sudden influx of dead cobras being turned in raised suspicion amongst government officials and, upon discovering the clever scheme, scrapped the bounty program entirely. Breeders, left with no incentive to maintain their operations, simply released their cobras into the wild, substantially increasing the native population.

In 1902, a similar tale unfolded in Vietnam. Overwhelmed by a rat infestation, the government offered a bounty for each rat tail delivered. It didn’t take long for people to realize they could simply cut the rats’ tails off - leaving them to breed and create more lucrative tails. Whoops.

It’s easy to point the finger at politicians and criticize them - and there’s constantly plenty to be critical of. But even in finance, successfully identifying cause and effect, first/second/third order effects, and ultimate end results often remain elusive. Throughout history, legislation and regulations have created unique environments and outcomes that were unanticipated by most.

In 1998, the Master Settlement Agreement was executed in the United States. It was hailed as a death sentence for Big Tobacco, but it created an environment where those companies became more profitable than ever.

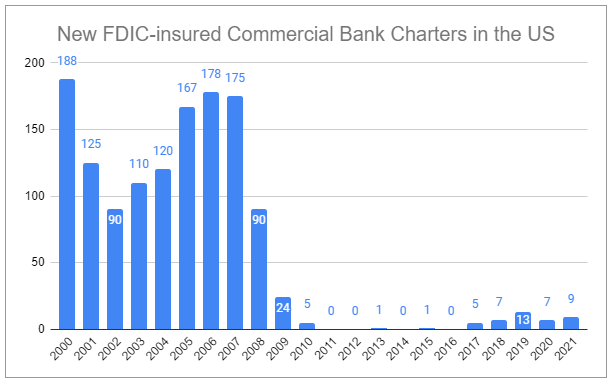

The Great Financial Crisis is another prime example. Ignoring the bailouts and the changes in capital requirements for financial institutions, the difficulty of acquiring a new bank charter increased tremendously. New competition for existing banks is almost nonexistent:

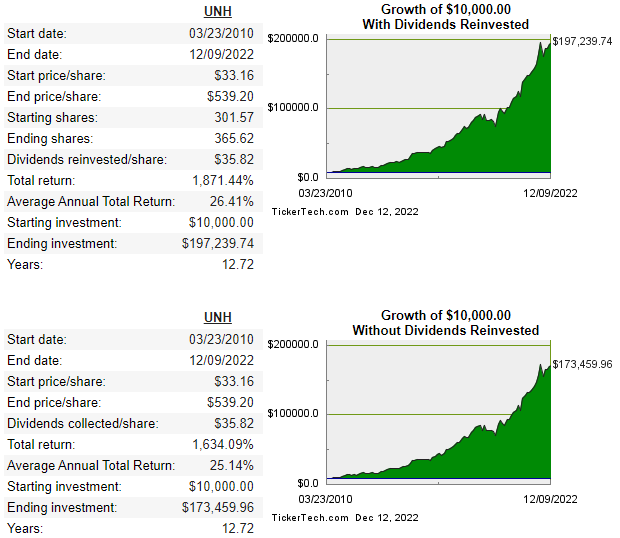

And I’d be remiss if I didn’t mention US Congress and President Barack Obama passing the Affordable Care Act (ACA) into law on March 23, 2010. Few foresaw the ACA turning UnitedHealth Group into a $500 billion enterprise.

From the day of the ACA passing to the present, an investment in UNH would have grown to 17.3x, or 19.7x with dividends reinvested:

I think of these examples every time I come across new headlines announcing that new regulations will forever alter and/or destroy a particular industry or company. Similar scenarios are playing out right now. I believe when we look back 10, 20, and 30 years from now, the story of nicotine will be very different than what most believe today. It’s almost impossible that the discussion around energy doesn’t change. There’s also a good chance that legislation focused on digital privacy ends up having certain effects nearly opposite of what some expect.

Few things in the world are truly simple. If you’re willing to look at things a bit differently and take unpopular bets, sometimes ridiculously skewed odds get thrown your way.

Questions or thoughts to add? Comment here or message me on Twitter.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

We are not as smart as we think :) True free markets protect us from this problem as multiple solutions are tried.

I would put ESG investing in this bucket. But I can’t figure out what the implications are that will unfold.