“Opportunity often comes disguised in the form of misfortune, or temporary defeat.” - Napoleon Hill

Is it weird that the best investment of all time is now practically universally ignored?

A single dollar invested into tobacco companies at the turn of the 20th century would be worth over $7 million today—an annual compound return of over 14 percent for over a century. Nothing else comes close.

But now, with the rising influence of ESG, the amount of available capital willing to invest in the industry continues to shrink, and major financial institutions, controlling trillions of dollars, are leading the revolt. With new mandates to avoid sin stocks, they’ve sold billions of dollars worth of related equities, driving prices down to significantly lower multiples.

Along with abysmally low investor interest and sentiment, the public is very aware of the health consequences of combustible products, and governments have sprung into action with heavyhanded regulation. Headlines and pundits continually tout that the tobacco industry is doomed.

Are they correct?

I don’t think so, and I believe there is compelling data that explains why. In this article, I aim to clear up a few things:

Are cigarettes a thing of the past?

The new generation of nicotine products

The great re-nicotinization

Stakeholder perspectives

Future growth and profitability

Let’s dive in!

Are cigarettes a thing of the past?

Cigarettes are cheap, easy to make, high-margin, reliable, have a large total addressable market, and create loyal, repeat buyers. They’re nearly a perfect product. But there is an obvious flaw. The well-known health consequences of using combustible products aren’t just bad for users—for producers, there’s a clear downside in the fact that the most ardent customers, on average, live shorter lives and thus can’t keep purchasing the product.

So are cigarettes going away?

No.

Cigarettes will be a thing of the past, but not yet—volumes aren’t falling as fast as people think.

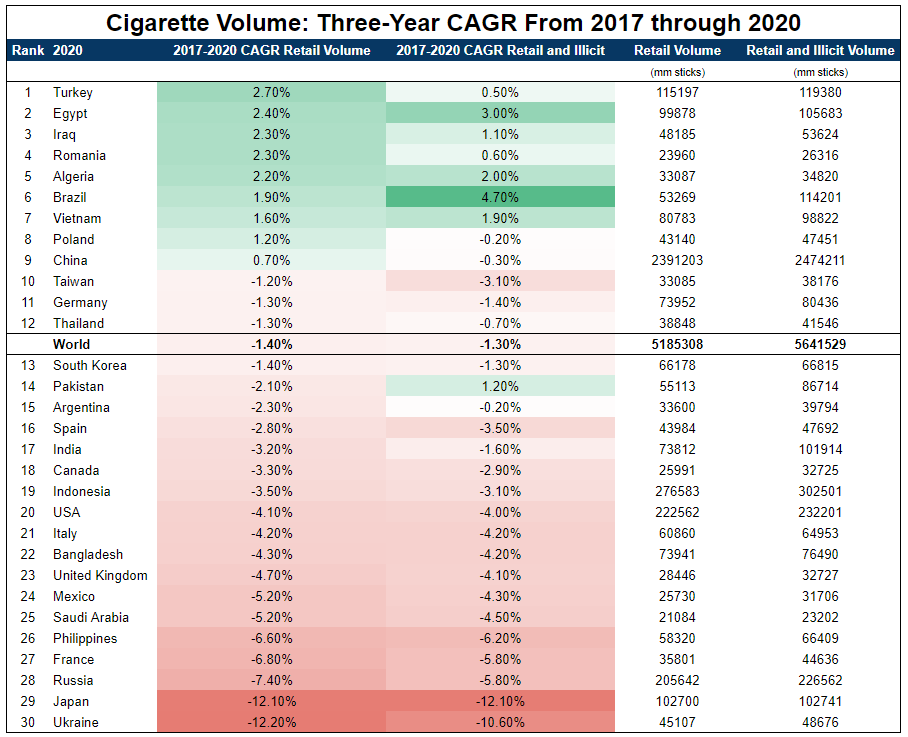

Retail sales do not capture illicit trade, nor do they cover locally manufactured or nonmachine–manufactured products such as bidis/beedis (India) and papirosy (Russia).

These numbers are for 2017-2020, and fluctuations are to be expected. For example, COVID lockdowns bolstered volumes for many countries, despite having experienced more substantial decreases prior, while other countries experience accelerated declines. Also, the first half of 2022 has been notably impactful for volumes in the U.S. (one of the most lucrative individual countries), with total volumes estimated to have dropped 7.5% year over year, thought to be primarily caused by higher gas prices leading to fewer purchasing trips.

But even volume declines haven’t been disastrous. Price hikes have largely offset cigarette volume declines, allowing ongoing, often growing, profitability. I believe major operators will continue to produce impressive returns from their cigarette brands. But eventually, that parade will come to an end.

With that said, this is only part of the big picture.

The new generation of nicotine products

Over the last decade, we’ve seen RRPs (reduced-risk products) such as ENDS (electronic nicotine delivery systems, vapes), heated tobacco products (HTP, also known as HNB, or heat-not-burn), and tobacco-free nicotine pouches (TFNP, also known as MONP, modern oral nicotine pouches) enter the market.

ENDS are noncombustible battery-operated devices that heat a nicotine liquid (the base of which is normally propylene glycol or vegetable glycerin) to produce an aerosol, which is then inhaled.

HTPs are battery-powered systems that produce nicotine-containing emissions by heating tobacco. Critically, HTPs heat but do not burn tobacco, which is cited to expose users to fewer Harmful and Potentially Harmful Constituents (HPHCs) when compared to cigarettes.

TFNPs are small oral pouches normally made of plant-based fibers and contain tobacco-free nicotine, water, and flavorings. Unlike traditional dip, oral nicotine pouches do not require the user to spit, nor do they appear to stain teeth or have a scent, meaning they can be used completely discretely.

While research is never-ending, much of the scientific community and many governments are largely in agreement that these products are substantially safer than combustible products like cigarettes.

The great re-nicotinization

Someone beat me to the punch in coining the phrase re-nicotinization, but I am happy to embrace it. I first heard the term here. The thought process is simple and works along the lines of:

Humans, historically, embrace substances to enhance/alter how they think and feel.

Awareness of the negative health consequences of smoking paired with certain regulations is reducing smoking rates.

What would happen if people could easily access nicotine while avoiding many of the health concerns as well as social stigma?

If you conclude nicotine usage would increase, you are correct.

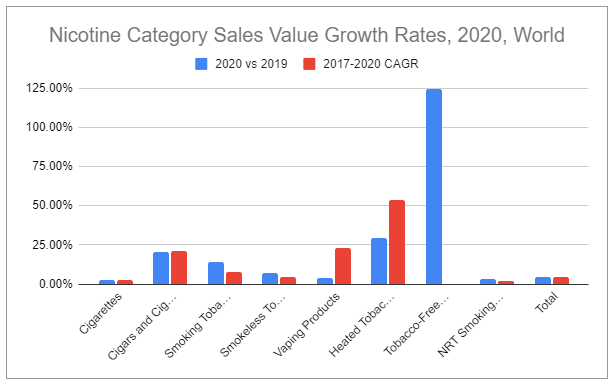

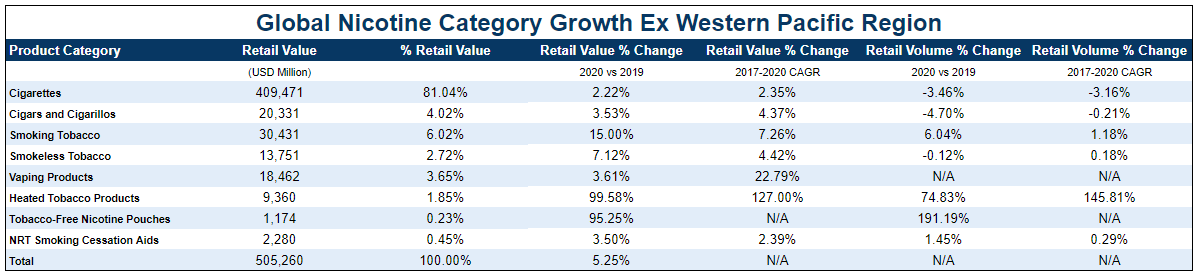

Looking at the above global data, two things should stand out:

While volumes of legacy products like cigarettes and smokeless tobacco (chew, snuff, etc) are shrinking, volumes of all other nicotine products are growing at varying degrees.

Every nicotine product segment has been growing in total $ retail value.

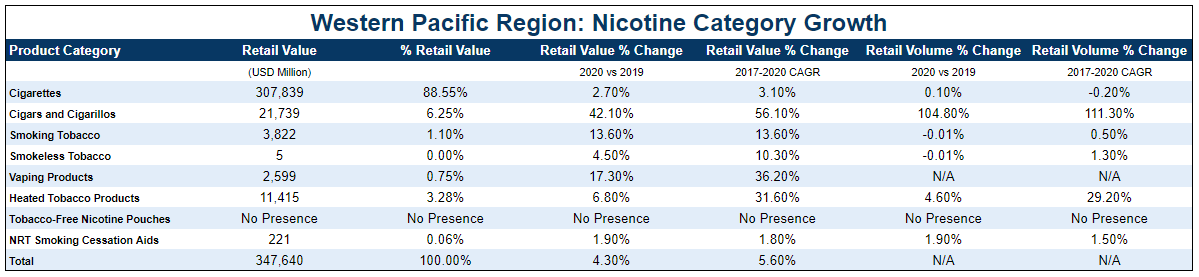

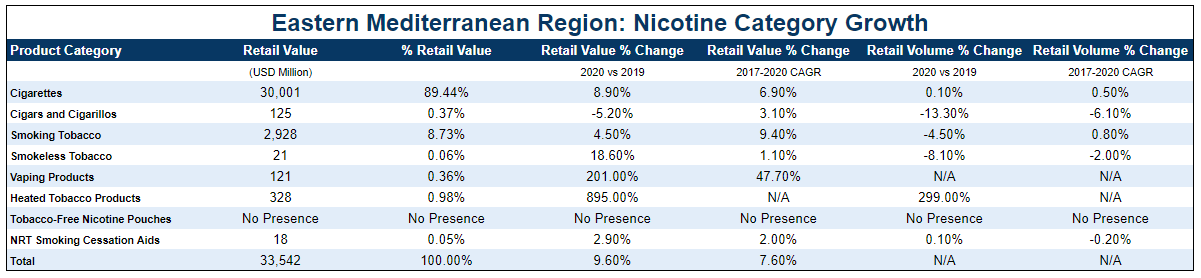

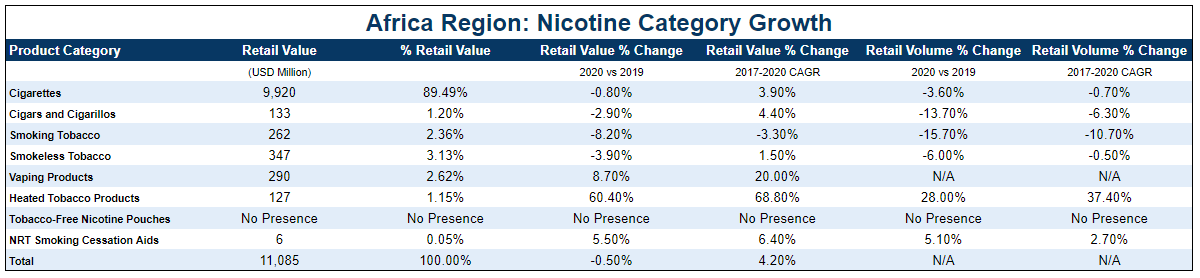

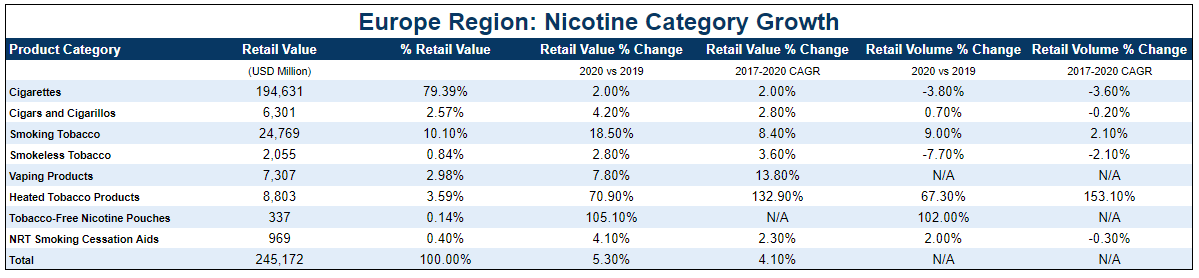

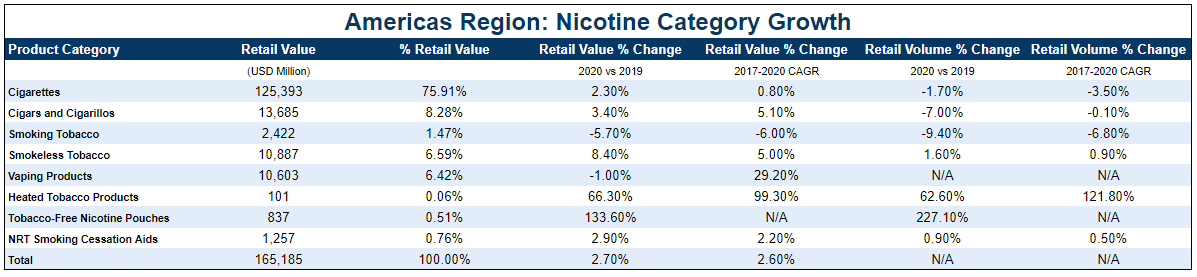

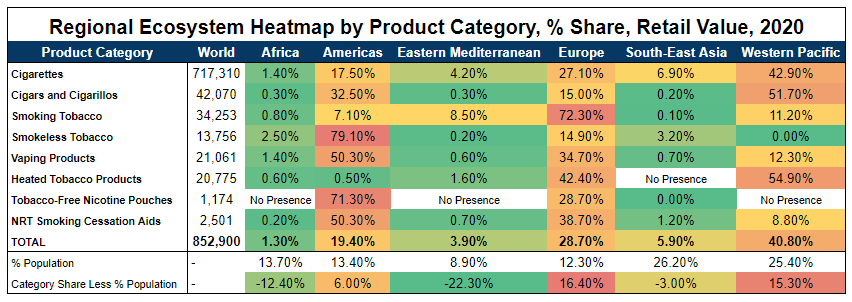

That’s astounding, but it’s worth digging deeper. Here’s a regional breakdown, with regions segmented based on the WHO classifications:

There are a few things to note:

The China National Tobacco Corporation (CNTC) is the world’s largest producer of cigarettes and predominantly serves the massive Chinese domestic market. China is also a disproportional driver of cigar demand, and CNTC is responsible for selling nearly half of all cigarettes in the world but is a state-majority-owned entity.

The Americas and Europe account for the highest value share in almost all categories.

Africa has a total population similar to the Americas and Europe but is by far the smallest region in terms of overall retail value, equating to just 1.3% of total retail sales value.

The data above includes factors such as the 2019 vaping ban in India, as well as the South African 5-month total ban on tobacco product sales that occurred in 2020 during Covid lockdowns.

Snus, an oral tobacco product, has been around for centuries. On a relative basis, research suggests it is less harmful than even HTPs but is grouped into smokeless tobacco, which includes other higher-risk legacy products.

Also, remember, as previously noted, overall retail sales data do not capture illicit trade or include locally manufactured, nonmachine–manufactured products such as bidis/beedis (India) or papirosy (Russia). Though, oddly, this data does include factory-made, hand-rolled kreteks, which are a major product category in Indonesia.

With all that considered, there’s something exciting in the above data that is harder to see until it’s revisualized. Look below at the recent growth rates for heated tobacco products (HTP) and tobacco-free nicotine pouches (TFNP):

Granted, HTPs and TFNPs are still relatively nascent, so this growth is coming off small bases. With that said, the future runway appears enormous. And critically, major producers have spent years optimizing these new products, scaling production, working with regulators, and going through the painstaking logistical hoops of mapping distribution, getting retailers onboard, and raising consumer awareness. But it’s all starting to come together. For additional context, see the below chart. HTPs have almost zero presence outside of Europe and the Western Pacific. TFNPs have no presence outside of the Americas and Europe, and vaping is similar. So not only are these products growing quickly off of small bases, the majority of the world is a nearly untapped market.

Stakeholder perspectives

Let’s briefly step back into history and remember how unstoppable nicotine has been. As I stated in previous writing:

In early seventeenth-century Russia, smoking tobacco was banned because smoke was associated with evil spirits. As a result, if you were caught smoking, you’d experience a lovely punishment such as having your nostrils torn open, lips cut off, or a (usually) fatal flogging. Russia was not alone in its efforts. Executions were a common punishment in the Ottoman Empire and China as well. And Persia, going for style points, would pour molten lead down offenders’ throats. Japan, more humanely, would simply imprison smokers and confiscate all of their belongings.

If monarchs and dictators using the threat of death could not stop tobacco usage, what would make the progressive democracies and republics of today fair any better? Simply put, there is no way to put the genie back in the bottle. This is not to say that we should not regulate tobacco and nicotine or that all historical regulation has been right or wrong. Rather, it seems most practical to cheer for regulation that further thwarts underage access and usage of tobacco and nicotine while at the same time providing ample information, resources, and options for adult consumers to make informed choices.

Governments have largely shifted from prohibitionist tactics to health education and taxation methods to curb usage. In the process, they’ve inadvertently become addicted to the excise tax revenue that tobacco provides. With that in mind, let’s think about the primary stakeholders here:

Consumers

Governments

Producer companies

Everyone is likely to align:

Consumers should be able to access safer nicotine in various RRP forms.

As awareness of these products spread, they gain social acceptance.

Governments around the world are beginning to adopt harm reduction strategies, working to shift smokers to RRPs, *although there are notable exceptions to this, such as India banning all vaping in 2019 and the U.S. FDA, which claims to be focused on harm reduction but has recently taken actions that would likely push people back to cigarettes.

To incentivize smokers to switch to RRPs, governments are likely to overall tax such products at lower rates than cigarettes.

To ensure safety and efficacy, governments create steep regulatory hurdles for new nicotine products, costing significant time and money, which limits new entrants into the space.

A lack of significant competition paired with the differential between excise taxes on combustible products and RRPs can make RRPs cheaper for consumers and also potentially more profitable for producers.

Substituting cigarettes for effective RRPs should lead to longer, healthier lives for users and will ultimately increase CLV.

These points are exceedingly simple, which means that some government ineptitude will probably find ways to muck it up. Even currently, the World Health Organization seems to be on board with thwarting the proliferation of RRPs, stating that new products such as HTPs should be taxed in line with legacy combustible products, despite RRPs being an incredibly effective way to curb cigarette consumption. Though it’s worth remembering, any adverse policy targeting RRPs will likely reduce decelerations in cigarette volumes. That type of protective insulation is partly the driving force behind my Altria thesis.

Future growth and profitability

Overall trends have been minimally impacted since the referenced 2017-2020 global data concerning category growth rates was published last year. However, there are some additional considerations to weigh. To name a just few:

Changes in currency exchange rates.

Regulatory changes regarding product allowance, production, and importation in various jurisdictions.

Excise tax modifications.

Covid ‘reopening’.

Income disparities across the world impact consumers’ ability to purchase different products.

Different cultures may be more/less receptive to new products.

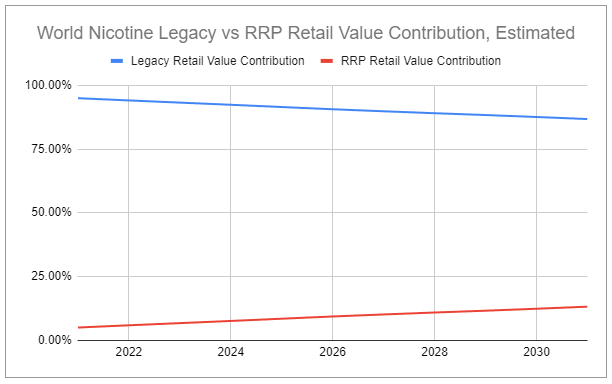

Attempting to factor in these considerations is difficult. Using global data, softening continued cigarette pricing power, and modeling persistent but decelerating growth across high-growth RRP categories results in something that looks like this:

The above charts showcase total retail value maintaining a 2.75% CAGR throughout 2031, and notably, a 13.13% CAGR for RRPs during that same period. But these charts only convey retail value, not profitability. Profitability, as mentioned prior, should steadily increase as RRPs take a greater share and are likely to be taxed at lower rates relative to cigarettes. This is especially true because of something else none of these charts fully capture: again, improved relative health should meaningfully increase CLV. If and when overall cigarette profitability begins to decline, RRPs will persist as a value-creating engine for the industry.

I’d prefer to avoid trying to get clever, but in an effort to reasonably estimate category growth from an investor’s perspective, it may make sense to look at global data with the Western Pacific region excluded. This removes China, a market that is largely dominated by a state-majority-owned company, as well as Japan, in which HTP already has > 30% share. This approach isn’t meant to pinpoint and predict the future but rather to present a (hopefully) more conservative estimation for the rest of the world. The chart below is exactly this and reflects obvious lower volumes and different growth dynamics, including a more substantial deceleration in cigarette volumes. However, one aspect is still the same: the retail value across all segments has been steadily increasing.

*From an investment perspective, it would also make sense to attempt isolating and excluding Russian volumes if you believe major tobacco companies will follow through with divesting their interests in the country.

And finally, it makes sense to mention the major nicotine companies of the world:

China National Tobacco Corp, British American Tobacco Plc, Philip Morris International Inc, Altria Group Inc, Japan Tobacco Inc, Swedish Match AB, Imperial Brands Plc, Gudang Garam Tbk PT, Eastern Co SAE, KT&G Corp, ITC Ltd, Swisher International Inc, Scandinavian Tobacco Group A/S, PT Intertobacco Utama Industry, Burger Group, The, Al Fakher Tobacco Trading LLC, Pöschl Tabak Gmbh & Co KG, Al Zawrae Industrial Co, DS Group, Groupe MADAR, Shree Meenakshi Food Products Pvt Ltd, National Tobacco Co, MLP Distributors CC, JUUL Labs Inc, RELX Technology Co Ltd, Shenzhen Joye Technology Co Ltd, Shenzhen IVPS Technology Co Ltd, Shenzhen Kanger Technology Co Ltd, Shenzhen Eigate Technology Co Ltd, Flavourart srl

It’s important to remember that while the future may look positive for the industry, not all companies will fair well. They each have unique management, legal and capital structures, different quality products and brands, different currency and market exposures, and different focuses on legacy and RRP products, along with countless other factors. I’ve already written at length about Altria, and while I won’t dive into the specifics of any name in this piece, I will be covering many more of these names individually in the future. Each piece will be unique, but together, they will highlight the fact that, as always, the world is changing, but nicotine isn’t going away, it’s merely evolving. We are witnessing a monumental shift and are entering a new era of nicotine—one where all stakeholders benefit.

Adults wanting to enjoy nicotine can access it in safer forms.

Governments still earn important excise tax revenues while empowering a healthier population.

TobaccoNicotine companies can engage in new, highly lucrative markets.

Thank you for reading!

If you enjoyed this article, be sure to subscribe and never miss my writing in the future.

And please, if you’d like to help Invariant grow, be sure to share this article with a few friends or on your favorite social platform. Thanks again!

Ownership Disclaimer

I own positions in tobacco companies such as Philip Morris International, British American Tobacco, and Altria.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑

Additional Resources:

Nicotine Products Relative Risk Assessment: A Systematic Review and Meta-analysis. Reference Source

WHO global report on trends in prevalence of tobacco use 2000-2025, third edition. Reference Source

World Health Organization: WHO Report on the Global Tobacco Epidemic. Geneva. 2019. Reference Source

Estimation of the global number of e-cigarette users in 2020. Reference Source

Nicotine Delivery and User Ratings of IQOS Heated Tobacco System Compared With Cigarettes, Juul, and Refillable E-Cigarettes. Reference Source

Understanding tobacco industry pricing strategy and whether it undermines tobacco tax policy: the example of the UK cigarette market. Reference Source

Preclinical Assessment of Tobacco-Free Nicotine Pouches Demonstrates Reduced In Vitro Toxicity Compared with Tobacco Snus and Combustible Cigarette Smoke. Reference Source

Global Trends in Nicotine Report December 2021. Reference Source

The Nicotine Market: An Attempt to Estimate the Nicotine Intake from Various Sources and the Total Nicotine Consumption in Some Countries. Reference Source

WHO on Tobacco. Reference Source

Altria - public filings and investor presentations. Reference Source

Philip Morris International - public filings and investor presentations. Reference Source

British American Tobacco - public filings and investor presentations. Reference Source

Swedish Match - public filings and investor presentations. Reference Source

Japan Tobacco - public filings and investor presentations. Reference Source

Imperial Brands - public filings and investor presentations. Reference Source

Price hikes have largely offset cigarette volume declines, allowing ongoing, often growing, profitability.

I hear that rather often and it implies to me that Tobacco doesn't price optimally. It looks it would be more profitable for them to sell at higher prices given that usually it is said that cigarette volume declines were offset or even more than that, by price hikes. But then I start thinking wouldn't be then logical to raise prices even without proceeding volume declines?

What do you think about Imperial Brands?