“The powerful trajectory of our smoke-free business gives us confidence in a strong full-year performance with excellent operating income growth. Outstanding momentum continues for IQOS and ZYN, the world-leading heat-not-burn and oral nicotine brands. And we have exciting plans to further grow oral nicotine pouches in the U.S. and internationally, along with the U.S. commercialization of IQOS next year.” - Emmanuel Babeau, PMI CFO, Q2 2023 call

Philip Morris International’s Q2 2023 results show a continuance of exceptional execution. Improvements to volumes, market share, and margins all mix together to paint an arrow going up and to the right. But there are several points - both good and bad - that are deserving of more attention.

Let’s break it down.

Volumes and pricing

IQOS

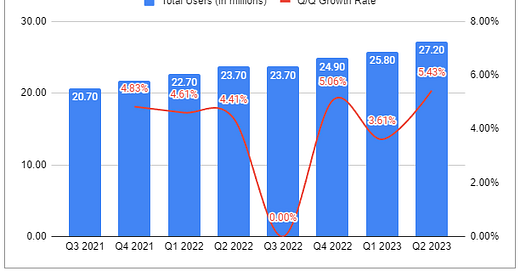

In Q2 2023, the number of IQOS users grew by 1.4 million, up 14.7% y/y and 5.43% sequentially. I continue to believe this is one of the most important metrics to look at, as users transitioning from trial, adoption, poly-usage, and eventually exclusive IQOS usage results in growing associated HTU volumes. The noticeable pickup in user growth showcases IQOS ILUMA’s continued strength, which was highlighted well by a specific exchange during the quarterly Q&A (emphasis added):

Owen Bennett, Analyst (Jefferies):

So related to [ heated ] competitive dynamics. So all 3 of your major tobacco peers now appear to be in a better spot at least versus the past with regard to product offerings at least and money they invest into this. I was just wondering if you could comment on IQOS trends in some of the more competitive heated markets where all 3 of your major peers now have a presence. So would like to [indiscernible], for example. So how is IQOS shareholding or if ILUMA having less traction in these markets in August? Are you seeing trial of other brands and consumers coming back to IQOS?

Emmanuel Babeau, PMI CFO:

Sure. Well, actually, you may have seen that our share of the category has remained stable in Q2 at around 75%. So it shows that indeed, there is an increased competition, but the quality of IQOS and notably ILUMA, but not just ILUMA, the overall IQOS proposition is allowing us to -- even if we are more premium to maintain our share of the category which is very good news here. I'm talking about volume. You can imagine in terms of value that is even higher.

Now let's be clear, since the beginning, we knew and I can say we were hoping for the whole industry to embrace heat-not-burn as the category of the future for inhalable nicotine product. And it's great to see a growing commitment from all the player behind that.

So no doubt that they will come with innovation ourselves, as you can imagine a way going to continue to innovate as well. And we will see certainly innovation and maybe new things coming in the future. Now after 6, 7, almost 8 years of launch of IQOS, I think, in terms of franchise, in terms of impact, in terms of strength, in terms of brand power, I think we are really second to none. And we made a clear gap and differential. And I think that this is exactly what we did with Marlboro in the past, which Marlboro was a superior product and recognized for the blend that was unique.

But on top of that, we managed to create unique brand that was extremely appealing. And I think with IQOS, that's what we are repeating today. So IQOS product are clearly better, recognized as such. It's a different customer experience. But then the IQOS brand is also iconic and people are seeing that as part of lifestyle and product they want to associate themselves with, which is a recipe for long-term success.

Further dispelling doubts about IQOS’s continued momentum is HTU volumes, which came in at 31.4 billion for the quarter, up 26.6% from last year. This is partly attributed to estimated distributor and wholesaler inventory movements. Adjusting for those impacts, sales volumes are estimated to have grown by 16% y/y. For H1 2023, HTU volumes totaled 58.82 billion, up 18.5% from H1 2022. HTU volumes in Q3 are estimated to be 31-33 billion. To reach the reaffirmed full-year outlook of 125-130 billion units, Q4 will require a pronounced jump to 33.18-40.18 billion.

Cigarettes

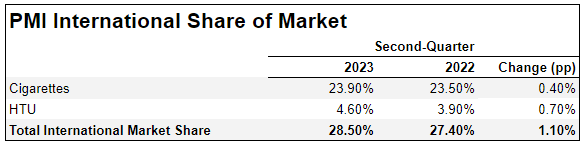

Q2 2023 cigarette volumes came in at 157 billion units, a y/y decline of -0.4%. This is a remarkable shift from the 3.1% decline seen in Q1 and makes it all the more likely that 2023 becomes the third consecutive year of aggregate volume growth.

Though growing volumes may be alluring, they are only one part of the equation. More impressive is that strong volume performances have come on top of continued aggressive pricing. In Q1, cigarettes saw price take of 7.4% y/y, more than double the year prior. In Q2, combustibles saw price take of over 9% y/y, and with HTUs, aggregate price take was ~6% y/y. To add, this level of pricing would lead one to expect a decrease in share of market, and yet, exactly the opposite happened for both categories.

Swedish Match

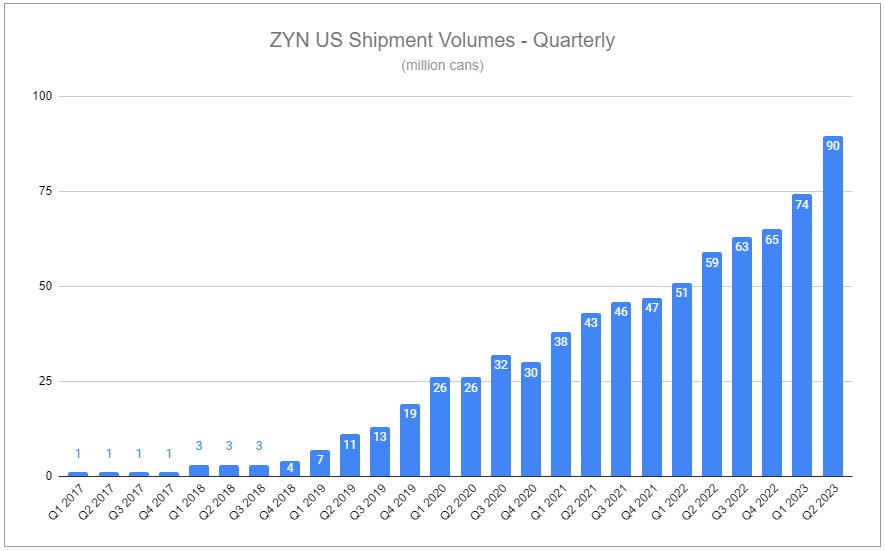

I’ve previously referred to IQOS as a golden goose. What does that make ZYN? A silver swallow? A platinum parakeet? I don’t know—something smaller that is capable of producing a ton of cash while continuing to grow at an alarming rate. Q1 volumes grew 47% y/y; ~30% when adjusted for inventory movements. I keep expecting growth to decelerate, and it certainly has to eventually, but Q2 showed not quite yet—in fact, it accelerated, with volumes up to 89.9 million cans, up from 58.7 million in Q2 2022, an increase of 53.1% y/y.

It’s only appropriate to remind you how wrong (and lucky?) I’ve been on Swedish Match. I had tracked it for years, watching an exceptional business grow and grow, and yet never bought it—any rationale completely escapes me. When PMI announced its bid, I found the terms compelling for PMI but doubted the deal would get done. I had no problem being wrong. Now, here I am, doubting that such remarkable results can continue—welcoming a future that continues to prove me overly conservative. Comically, I’m not the only one who has been surprised by ZYN’s recent performance, as per Emmanuel Babeau’s comment made during the DbAccess Global Consumer Conference in June:

First of all, I think I have to say that we are probably surprised on the upside by the speed at which ZYN is growing. So when we are comparing with when we were looking at Swedish Match more than a year ago and when the whole idea of combining the 2 businesses was being discussed, ZYN was not necessarily having the same dynamism or at least there was some question mark on whether that could carry on at the same speed.

So the first good news is that the U.S. potential seems to be enormous. Remember, today, we are in a situation where, yes, the western part of the country has started to be developed for ZYN. But clearly, there is both the potential for increased consumption in this western part. And actually, we see that in what we call the velocity in the sales point. So the number of [ cans bought ] every week is accelerating. And then there is a full extension, geographical extension that is providing a big upside potential.

Disaggregating the 12-month trailing data on ZYN volumes helps visualize how nuts the past 2 quarters have been.

The segment’s total oral product growth is less impressive, with pouch volumes growing 4.5% y/y in Scandinavia and snus volumes declining by 10.2%, resulting in total oral volume growth of 15.1% y/y. At the time same, Swedish Match’s cigar volumes declined by 6% but saw net revenue growth of 16% on the back of exceptional pricing.

Margin movements

Margin pressures have been deserving of heightened focus, which I highlighted last quarter, and concluded:

While I am not one to try calling shots with precision, it is far more likely that we are at, or within 1 quarter of, bottom of the trough gross margin. Though mind you, now with Swedish Match under the hood with IQOS, continued investment should not be protested, and operating margin recovery may be muted. Growth must be financed, and if recent performance is any indication, there is a long runway ahead.

Sure enough, Q2 saw a 120bp improvement in group gross margins, largely on the back of pricing and a shift to higher contribution products.

Additionally, SG&A, as illustrated, has shrunk.

These factors led to a 210bp jump in adjusted operating margin.

Expectations of further improvement throughout the rest of 2023 should be guarded, as the company plans to continue launching ILUMA in 27 additional markets and certain expenses have been pushed to H2. Nonetheless, looking longer-term, there are ample drivers to push the operating margin considerably higher.

Wellness & Healthcare

In March of last year, PMI launched its newest segment, Wellness & Healthcare, by combining the acquisitions of Fertin Pharma, Vectura Group, and OtiTopic. The path seemed obvious: leverage PMI’s extensive experience and research of inhalable and oral products and its ability to navigate regulation to develop new pipelines of products to further diversify away from combustible tobacco products. I concluded at the time:

Overall, PMI hasn’t said much else (yet). I’m looking forward to when they do because it doesn’t take much creativity to think of interesting synergies and applications they seem well-suited to focus on. But maybe this segment becomes a perpetual black-box money pit, or perhaps it will turn into an incredibly profitable new segment. Either way, I’ll wait to speculate further.

While little has been disclosed, what has been shared has not been anywhere near as impressive as PMI’s other operations. The company’s inhalable aspirin product saw unsuccessful clinical trials, pointing to a drawn-out timeline and greater uncertainty regarding outcomes. Additionally, its contract development and manufacturing organization (CDMO) saw increasing costs and lagging demand. The company recognized a significant non-cash charge reflecting a lower determined carrying value for related assets and has postponed its segment goal of $1 billion of net revenues in 2025. While it’s still far too early to point to this as a perpetual black-box money pit, skepticism should be further heightened by recent news of the company planning to acquire Syqe Medical, an Israeli company whose key product is a cannabis-based inhaler focused on pain management. This follows PMI’s previous $20 million investment in the company in 2016. PMI will invest an additional $120 million to support the firm attaining U.S. approval for its product, and upon success will acquire the company for $650 million.

FX

Up until recently, PMI, reporting in USD, generated none of its net revenues in USD. In fact, 11 of the past 15 years have been adversely affected by FX dynamics, with the DXY having been on an absolute tear over the last decade. It is sensible to expect negative FX dynamics to persist, though, on a long enough timeline, they may very well reverse. Additionally, FX may be smoothed out with Swedish Match USD revenues and a future reintroduction of IQOS into the United States. It is critical to acknowledge these impacts, as well as limitations on forecasting future FX moves. While offensive to some, this is exactly why it makes sense to focus on constant-currency results—to track the performance of the things that can be grasped and understood, while refusing to pretend one has access to a crystal ball.

Leverage

Philip Morris International currently has ~$47.9 billion in total debt, ~$3.5 billion in cash, and holds:

an interest coverage ratio of x15.5

a total debt/adjusted EBITDA ratio of x3.5

a net-debt/adjusted EBITDA ratio of x3.24

Adjusting to factor in full-year contribution from SWMA leads to leverage ratios modestly lower. Not included is the remainder due to be paid to Altria for handing back the IQOS US rights.

Distilling the value engine

There are a number of interesting catalysts for Philip Morris International:

The reintroduction of IQOS in the US (start Q2 2024)

An international rollout of ZYN in the medium term

The potential breakout success of Wellness & Healthcare

Launches of e-vapor products

A potentially favorable ruling on the German tax surcharge

The likelihood and potential impact of each can all be debated, but what is most fantastic is that the company is not reliant on any of these to generate impressive returns. Still, little has changed since my last published model—net-net, only positives. The opportunity can be condensed intuitively:

Philip Morris International currently trades at x14.3 EV/EBITDA, a bit more than one turn over its 5-year average of x12.9. Combustibles share and volumes remain strong. IQOS and ZYN are rapidly growing and together now make up 35.4% of group net revenues, and also carry higher contribution margins. Even when viewing operations pro forma ex-Russia, taking price on top of growing aggregate volumes, paired with productivity and cost savings, can lead to mid to high-single-digit topline growth, incrementally higher margins, and higher free cash flow conversion. Despite increased reinvestment, Philip Morris International is still able to return considerable value to shareholders via capital returns. It is likely we see a mid-year increase to the dividend, which as of Friday’s closing price of $97.52, would put the forward yield around 5.25%. In all, forward IRRs can comfortably sit in the low-double-digit to mid-teen range. Should any of the catalysts listed above materially impact the business, or should the market gain confidence and re-price PM in line with other leading FMCG brands, forward returns could look radically higher.

If you enjoyed reading, hit “♡ like” and give this piece a share.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Philip Morris International and other tobacco companies such as Altria, British American Tobacco, and Scandinavian Tobacco Group.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: PM 0.00%↑ BTI 0.00%↑ MO 0.00%↑

Additional Resources:

Philip Morris International - Reports and filings. Source

Such in-depth quality. It's a pleasure to read.

Thank you Devin! As always your article is clear and enjoyable to read.

I need to give credit where credit is due: PMI managed to create a brand from scratch (IQOS). They could have piggybacked on Marlboro. Now IQOS doesn’t have any association to cigarettes, and PMI will be able to use the brand in the US.

Their M&A has been excellent, especially compared to Altria. They managed to buy Swedish Match for a very small premium, and as you point out ZYN’s growth in the US continues to be impressive. Plus they’ll presumably be able to use SM’s sales force and distribution network for IQOS. Their wellness M&A so far hasn’t panned out, but it’s a drop in the bucket compared to SM. So kudos to them!