“I never smoke to excess - that is, I smoke in moderation, only one cigar at a time.” - Mark Twain

With fewer smokers, the total number of cigarettes sold continues to decline. But manufacturers offset those declines by exercising tremendous pricing power - a dance that has lasted decades. Those very same companies, in aggregate more profitable than ever, continue to invest in new types of nicotine products to reshape the world and reinforce their place in it. That is the heart of NEoN - The New Era of Nicotine:

Sitting at the forefront of this pivotal shift are 2 companies, Philip Morris International and British American Tobacco. Both reported their full-year 2022 results this past Thursday, 2/9/2023, and reactions were just as mixed as the numbers.

Let’s dig in.

Philip Morris International

Volumes volumes volumes

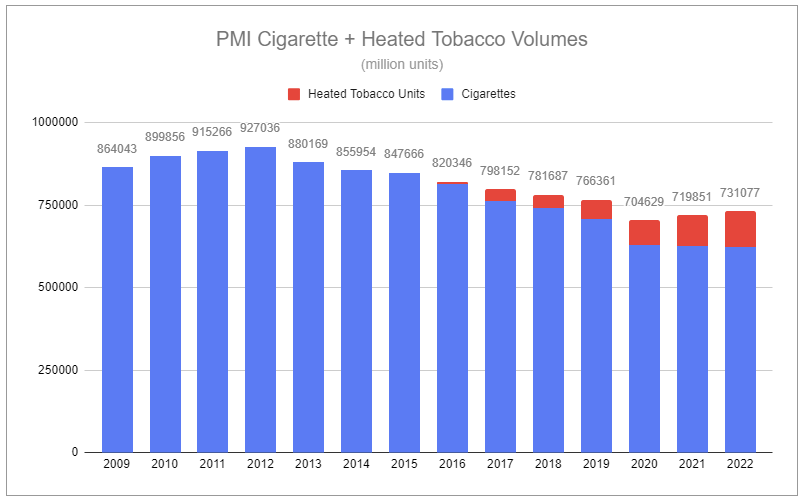

It was in 2012, a decade ago and only 4 years since being spun off from Altria, that Philip Morris International saw its cigarette volumes peak. In the years following, it remained uncertain how well RGM and pricing strategies would work, with certain international markets having different income dynamics compared to the West. This was compounded by the company investing in a first-of-its-kind heated tobacco product, IQOS. Not only were there serious doubts as to how receptive consumers would be, but the economics seemed questionable - especially when so many argued that a new product would quickly cannibalize the company’s immensely lucrative cigarette volumes.

It only took a few short years for IQOS to take the world by storm. While PMI’s cigarette volumes have been near flat for 3 years, HTU volumes have become a growth driver, leading to 2 consecutive years of total volume growth.

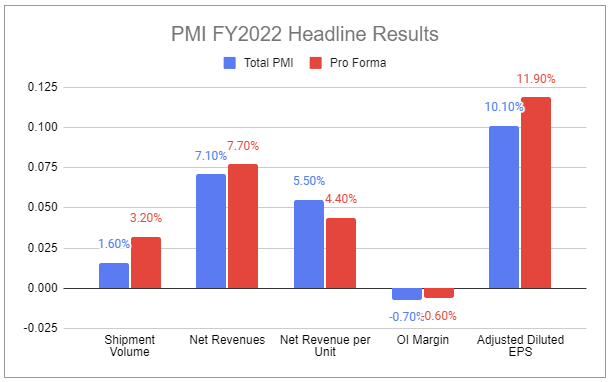

Throughout 2022, along with impaired operations in Russia and Ukraine, PMI continued to face input inflation, supply chain issues, and other unfavorable macro dynamics. Even so, PMI’s total cigarette volumes were down -2.75% in Q4 and just -.47% for the full year. The company’s flagship brand, Marlboro, saw volumes increase by nearly 2% for the year. In total, the company saw a favorable +4% to price/mix.

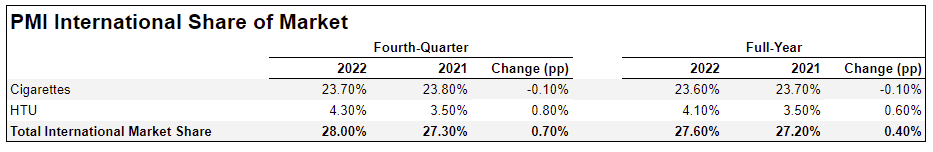

While cigarette volumes remained just shy of flat, heated tobacco units continued their growth streak. HTU volumes were up 26% in Q4 and 15% for the year. In total, PMI captured 40bps of the total international market in 2022.

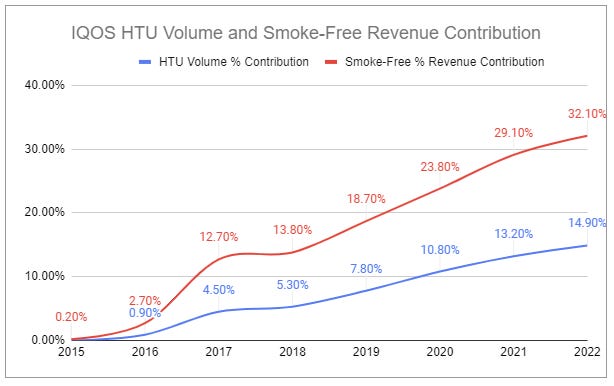

The shift to positive volume growth, while special, still understates the impact IQOS Heated Tobacco Units are having.

IQOS

IQOS HTUs, with recognized reduced-risk properties that will ultimately lead to higher CLV, are broadly taxed at lower rates than legacy combustible products. This leads to a substantially higher net revenue contribution on a per-unit basis.

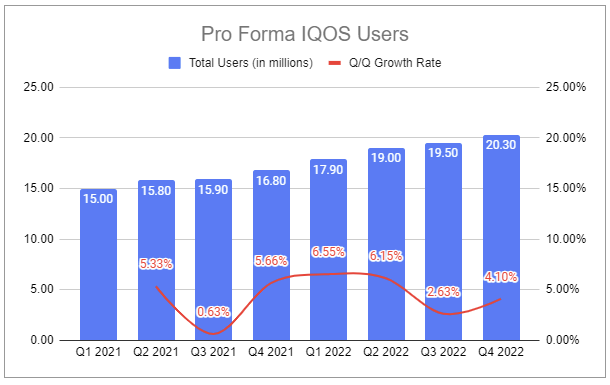

And the newest IQOS model continues to show strength with a higher conversion rate, leading to sustained growth in IQOS users:

Even in Japan, where HTP penetration is the highest of any market, ILUMA has reversed 5 quarters of decelerating growth:

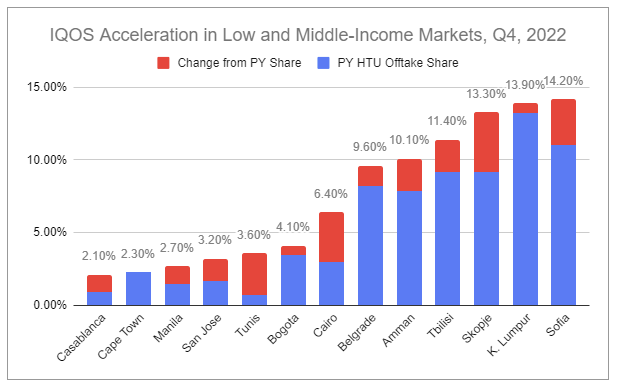

And even in low and middle-income markets, IQOS has continued to take meaningful share year over year:

Margins have faced pressure as IQOS users continue to upgrade to ILUMA and new users adopt the device. In H1, 2022 Total PMI OI Margin declined 90bps and was down 110bps on a pro forma basis. I wrote:

Management has stated they expect this trend in OI Margin to reverse as the ‘upgrade cycle’ subsides, but I am cautious about the rate at which this will occur. Currently, ILUMA is only in Japan, Sweden, Spain, and Greece, with more launches planned throughout the rest of the year.

For the full year, the ILUMA transition was, in fact, the greatest negative pressure on operating margin:

However, this continuation is absolutely welcomed. One of the greatest difficulties for new products in the nicotine space is convincing users to try them. With legacy products carrying tremendous loyalty, it can be painstakingly time intensive and costly to convert. As IQOS ILUMA continues to take share, it will automatically act as social proof, validating the platform for others. It’s important to note that the growing number of IQOS users is a lagging indicator for volumes since there is usually a ramp time between trial, adoption, and fully switching to the device. Today’s margin loss is tomorrow’s gain.

Swedish Match

When Philip Morris International made its tender offer for Swedish Match in May of last year, the deal seemed to make plenty of sense. But I expressed doubt, saying that the 90% threshold would be unmet. Even when the offer price was increased, I stated:

I remain very skeptical that the Swedish Match deal will successfully finalize, as even with the best and final price shaking out some holdouts attempting to arb the deal, it is unlikely to reach the required 90% acceptance threshold.

I’m thrilled to have been wrong.

Even when paying >x17 2023 consensus EBITDA (a >50% premium over the closing price prior to the initial offer), PMI would be gaining operations that had compounded sales at over 17% from 2018 to 2021, increased operating margin from 39.1% to 44.8% in the same period, and had cash from operating activities experience a CAGR of over 20% as well. And despite risks concerning the future regulation of tobacco-free nicotine pouches and increasing competition, several aspects made the deal even more compelling:

A distribution footprint that could be leveraged to accelerate IQOS’s reentry into the U.S. market (PMI plans to submit IQOS ILUMA to PMTA sometime in H2 2023.)

USD-based revenue to smooth FX.

PMI’s massive global infrastructure could be used to grow SWMA’s oral nicotine products in international markets - many of which currently have 0 presence of competition.

PMI’s financing would likely be done at attractive rates.

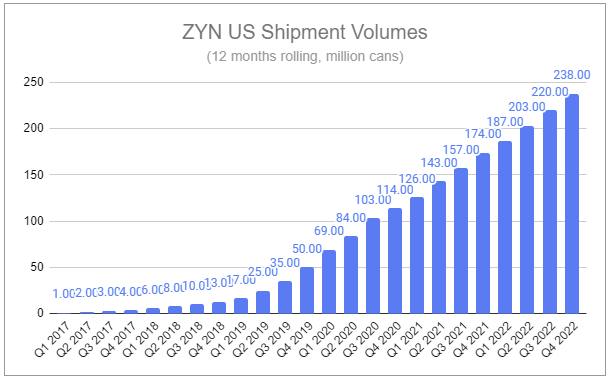

In mid-December, Swedish Match announced the compulsory redemption process had begun, and by the end of December, PMI’s PMHH had become the owner of 94.81% of the company. Swedish Match’s products add a new major growth driver for the company and should allow PMI to firmly surpass its 2025 goal of >50% of net revenues from smoke-free products. In Q4, ZYN shipments increased by 35%, and the pouch retained a 75.7% retail value share in the U.S.

Debt

In August 2022, I wrote:

The majority of Philip Morris International’s bonds were issued at incredibly favorable rates and are easily serviceable. However, with the announcement of PMI’s bid for SWMA, credit rating agencies have placed PMI on watch for a possible downgrade, contingent on the specifics of the deal closing. Even if that were to occur, PMI’s rating would fall a single notch, and I do not see that impacting the company to any material extent. The likely result of successfully acquiring SWMA would be for PMI to keep its share repurchase program suspended, as well as refrain from additional M&A until ~2025 as the company de-leverages. With strong brands, geopolitically diverse operations, and exceptional capital allocation, I expect PMI management’s use of debt to continue to bode well for the firm.

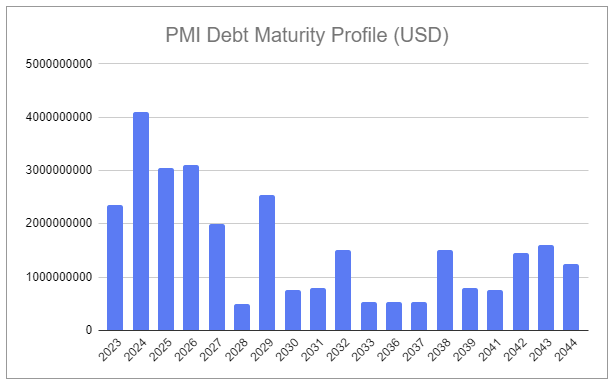

Philip Morris International currently has ~$43.1 billion in long-term debt, ~$3.2 billion in cash, and holds:

an interest coverage ratio of 23.47

a total debt/adjusted EBITDA ratio of 3.12

a net-debt/adjusted EBITDA ratio of 2.89

However, management has highlighted that FY 2022 only includes 50 days of consolidated performance from Swedish Match. Accounting for what would be a full-year contribution, the net-debt/adjusted EBITDA ratio falls to under 2.75. Nonetheless, with higher rates and several billion USD of debt maturing in each of the next several calendar years, we can expect share repurchases to remain halted while the company focuses its debt burden. There no longer appears to be a reasonable possibility of a rating downgrade.

Wellness and Healthcare

Early in 2021, Philip Morris International made several strategic acquisitions, including Fertin Pharma A/S, Vectura Group plc., and OtiTopic, for a total of several billion USD. Shortly after, PMI launched its Wellness and Healthcare segment, consolidating the 3 into Vectura Fertin Pharma. FY2022 segment revenues came in at $271 million, with an operating loss of $258. For 2023, PMI had guided to approximately $300 million in revenue and $150 in adjusted operating losses for the segment, primarily driven by investments in R&D.

Other developments

KT&G

On January 30, 2023, PMI announced a long-term collaboration with South Korea’s leading tobacco and nicotine manufacturer, KT&G, to continue to commercialize KT&G’s smoke-free devices and consumables on an exclusive, worldwide basis (sans South Korea). The agreement extends 15 years, with performance-review cycles and associated volume commitments during each 3-year period. KT&G reported FY2022 results last week, with sales up 12% and net income rising 3% y/y, largely due to the success of their heated tobacco products.

FDA desertion

Covering PMI, I previously mentioned that many countries are transitioning to tobacco harm reduction (THR) policies. Some individuals, fed up with bureaucratic red tape and ineffective policies that are tantamount to prohibition, have left the government to make a real difference in the private sector (emphasis added):

Also, recently, Matt Holman, the director of the Office of Science at the United States Food and Drug Administrations Center for Tobacco Products (CTP), after working with the FDA for over 20 years, announced his departure and that he would soon begin working at Philip Morris International. Presumably, he was interested in working where he could make a real positive impact. As the bureaucratic red tape continues to hamper progress on THR policies, it won’t be surprising to see others make similar moves in the future.

While not an immediate departure, Dr. Badrul Chowdhury left the FDA in April 2018 to work in the private sector, and in September 2022, was hired to be the Chief Life Science Officer of Smoke-Free Products for Philip Morris International. This continues the trend of PMI picking up high-caliber experts that hold FDA experience to further help navigate the growing complexities of the regulatory environment.

New regional structure

Beginning Q1 2023, PMI will report financial results encompassing 4 regions, down from 6. Management has rationalized the move by saying it will support growing the smoke-free business and reinforce consumer centricity. I think it will reduce transparency and make it harder to keep track of changes in operations on a more granular level - one of my very few criticisms of the company.

Valuation

I updated my PMI 10-year exit model that backs out equity from an EV/EBITDA multiple and factors in forecasted dividends and share repurchases. Despite the fact that PMI has announced it will continue to keep Russia and Ukraine consolidated in its financial reporting, I have made the adjustment to exclude Russia’s and Ukraine’s EBITDA contributions. This all but guarantees actual results will differ from those below.

Key assumptions:

Combustible volumes will decline by ~1% per annum, offset by a price/mix variance of +4%. Share stable.

HTU volumes will materially accelerate in 2023, as guided by management to 125-130bn units before growth decelerates.

ZYN experiences a moderate deceleration in unit growth.

0 contribution from Wellness and Healthcare

~$1.075 billion D&A, ~$1.3 billion CapEx, and ~$650 million R&D run rates as a base mid-term outlook.

An effective tax rate of 22.5%.

Dividend increases by .04 in 2024, 2.6% in 2025, and 4% annually thereafter.

Buybacks resume in 2025 at a rate of .75% per annum.

The model’s output suggests PM’s equity is markedly underpriced.

There are easy points of criticism, such as potential FX headwinds, possible unfavorable regulation and tax treatment of RRPs materially impacting the growth and profitability of HTUs and ZYN, or the possibility that combustible volumes may deteriorate at a faster rate in-line with the broader market. However, I believe there are fair counter-points:

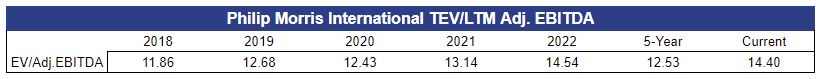

The model uses the 5-year average multiple of 12.53 as the exit multiple despite the higher quality business with a new, fast-growing smoke-free product and a higher % of net revenues from smoke-free sources.

PMI has the best-in-class ability to navigate regulatory dynamics.

PMI has the best-in-class brand and resources to navigate price/mix/share dynamics.

Along with completely excluding the contributions of Russia and Ukraine, the model notes no proceeds from a would-be sale.

Within this model is no inherent expression that IQOS will successfully be reintroduced into the United States or that Zyn will experience similar in new international markets.

In all, I don’t think the above scenario is farfetched in the slightest. PMI’s operations are durable and tested, are supernormally profitable, and those dynamics are continuing to improve. With excellent leadership, sustained execution could very well produce results above what is illustrated.

British American Tobacco

Ahead of schedule

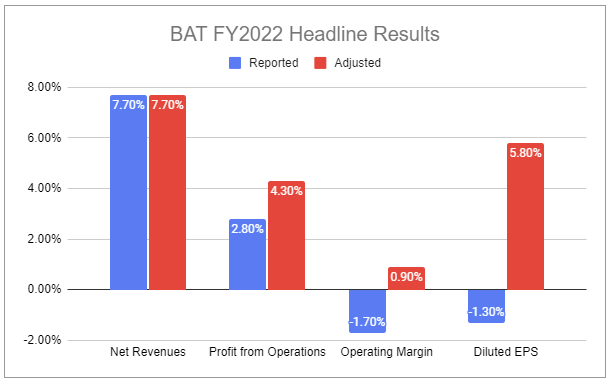

Throughout 2022, like PMI, British American Tobacco faced the macro pressures of input inflation, supply chain woes, and rising interest rates. Results, at first glance, look to be mixed, and if you focus on specific numbers, it may appear that the company is in dire straits:

BAT’s reported combustible volumes in the United States were down 15.5% for the year.

The company is reducing its reported regions from 4 to 3.

The company has halted further share repurchases.

Rising rates continue to increase the company’s interest expense.

Digging deeper, dare I say that these points are not terribly concerning?

On a global level, BTI cigarette volumes were down ~5%, in-line with recent historical performance and anticipated macro pressures. Value share was flat, as the company experienced an approximate +4.6% price/mix variance.

U.S. combustible volumes were not only affected by macro pressures such as inflation and high gas prices but also a partial inventory unwind from the year prior. In fact, reported combustible revenue in the United States was up +4.5% for the year, and the company’s U.S. combustible value share was up 10bps despite volume share being down 30bps. The partial inventory unwind stemmed from two sources. First is the rollout of the TaO system in H1 2022. Second is the broader spectrum of SKU rationalization, which has reduced combustible SKUs and related business units by nearly half since 2017. Along with supply chain optimization, automation, and digitization, these cost savings initiatives, dubbed Project Quantum, have translated into substantial annualized savings, totaling £1.9bn.

The company’s announcement to reduce its reported regions falls into the same cost savings classification. I am partly critical of this move, as it will add inherent opacity to the company’s reporting and make it more difficult to make accurate historical comparisons. However, focusing on creating simpler processes, enabling faster decision-making, and broadly becoming a more efficient operation is hard to knock - especially with the already proven savings generated, which have contributed heavily to FCF growth in recent years. CEO Jack Marie Henry Bowles elaborated on the additional organization restructuring to come on the FY2022 call (emphasis added):

Our new organizational design will be based on fewer larger business units, reducing the number of regions from 4 to 3 and business units from 16 to 12. This led to the senior management changes and realignment announced last week. And we are further optimizing our footprint. Phased over the next 2 years, we plan to exit around 30 smaller markets, where we don't see a near-term opportunity to execute our New Category strategy. When completed, this means we will be selling at least 20 billion fewer cigarettes annually with a limited impact on our P&L.

This will enable us to increase profit and unlock cash through resource allocation in two markets, which generates higher returns. Should the conditions and the opportunity for New Category products materially change then we will reconsider our presence in these markets. In addition, we have identified 6 different market archetypes to guide strategic sources and resource allocation.

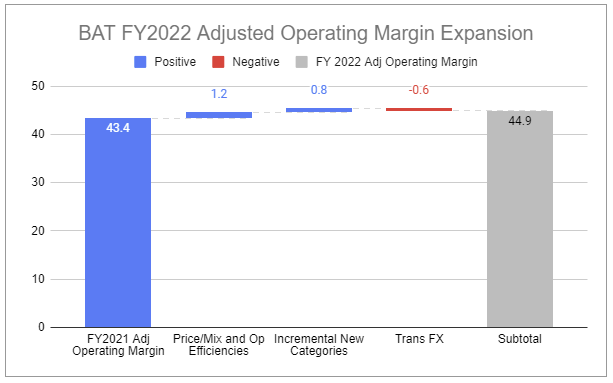

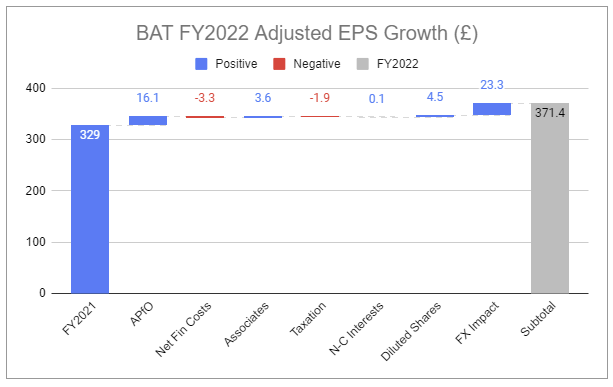

Full-year results look quite different when adjusting for one-off noncash items, such as the company’s recognized impairment of its business in Russia and Belarus, the provision for the DOJ and OFAC investigations, and a restructuring charge driven by Quantum. Adjusted profit from operations was up 4.3%, adjusted operating margin expanded 90bps, and adjusted diluted EPS increased 5.8%.

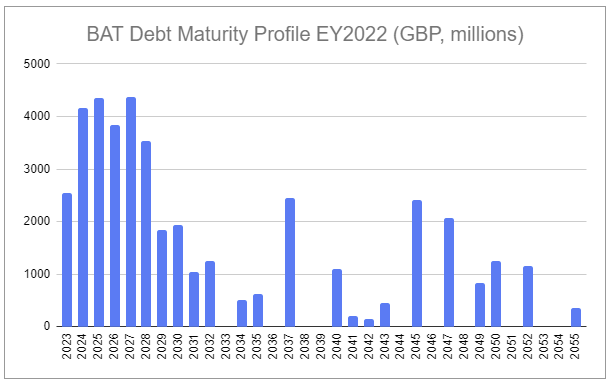

The greatest surprise was BAT’s announcement of halting further share repurchases. The company’s shares are trading at depressed multiples relative to history - an implicit expression that the broad market doubts the company’s trajectory. Considering how much the company had delevered in the last several years, paired with its robust cash generation, continuing repurchases seemed to be the obvious route. However, capital must be directed elsewhere. BAT has debt maturities of around £3-4 billion annually during each of the next 5 years:

Higher interest rates are bound to elevate net finance costs as debts are refinanced and rolled forward. Adjusted net debt to adjusted EBITDA is 2.89x, down from 2.99x at the end of 2021, within the 2-3x target range set by management. The company currently has £42.622b in debt and £3.448b in cash and holds an interest coverage ratio of 6.55.

The halting of repurchases may seem disappointing, as it goes against the investment thesis I published last year:

Since fully acquiring Reynolds American, British American Tobacco has steadily deleveraged while paying an increasing dividend while also engaging in significant R&D and M&A, and now, the company’s transformation is reaching a powerful inflection point.

Despite macro headwinds, BAT is seeing sustained and significant growth across New Categories, which are now contributing significantly to sales. Continued scaling will enhance operational leverage that will generate substantial long-term value. BAT is trading at a depressed multiple, and management has signaled its intentions to prioritize share repurchases to further drive shareholder returns.

I am not disappointed in this change in events. First, I have to commend management for being responsible stewards of capital and acting prudently to ensure future flexibility - so long as the broad market continues to remain sour on the sector, there will be plenty of opportunities to engage in buybacks in the future. Second, and more importantly, is that the servicing of debt isn’t the sole cause of pausing buybacks.

Much like when PMI’s IQOS was doubted, it was only a few years ago when BAT pushed its “A Better Tomorrow” strategy, doubling down on New Categories. The ambitious goals set by the company, including reaching aggregate New Category profitability in 2025, seemed far-fetched to many. However, last year, it seemed that things were lining up to reach that goal even sooner, and I modeled as such in my published valuation:

British American Tobacco invested more than £2bn into New Categories in 2022 and plans to increase related investments even further in 2023. The multi-category strategy is working exceedingly well. BAT CFO Tadeu Marroco confirmed this during the FY2022 earnings call (emphasis added):

In addition, our growing brand equity has enabled us to increase pricing on both device and consumables supported by insights from our digital tools. We have reached an inflection point in our New Category model. Having invested significantly in the base, we are now in a growth period, where we can invest more and deliver improved profitability. In 2023, we will capitalize on our momentum and further invest in our transformation to accelerate our innovation cadence and drive faster geographic expansion. And with that, we expect to continue to improve New Category contribution in 2023 and are confident in delivering our target of profitability ahead of plan in 2024.

The Flip

Non-Combustible Consumers includes both traditional oral products and New Categories.

In December 2017, the FDA filed for substantive scientific review of MRTP applications from R.J. Reynolds Tobacco Company for 6 of its traditional oral products. In October 2022, R.J. Reynolds Tobacco Company requested to withdraw the applications from review. For the full-year 2022, Traditional Oral saw units decline by 8.3%.

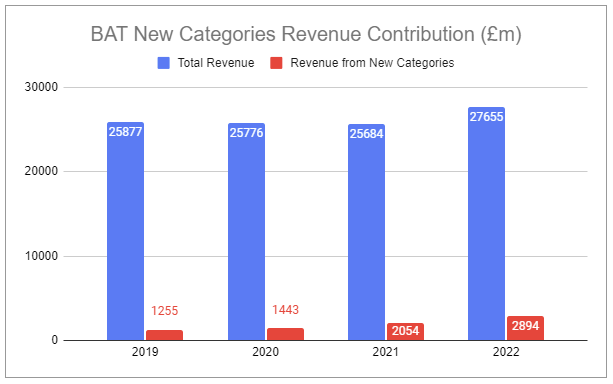

New Categories are a radically different story.

For the full-year 2022, New Categories reported +37% revenue growth.

New Category revenues continue to be dwarfed by legacy combustible volumes. But as New Categories continue to grow, the segment recognizes economies of scale, driving down COGS, all while BAT leverages analytics to optimize revenue growth management and marketing spend effectiveness. It’s also critical to note that, in the aggregate, New Categories are currently a drag on total profitability. Yet, even with increasing investment, the segment’s contributing loss is quickly shrinking:

Beyond the flip to profitability, now set for 2024, is particularly interesting. These products are fast-growing, and the margin profiles are particularly favorable, as reiterated by CFO Tadeu Marroco on the FY 2022 call (emphasis added):

Just to complement that in Japan, and it's not different in Europe, every single product we sell in THP has higher margins than our combustible products. So even the newly launched the Lucky Strike that we did to complement our range in the market has higher margins than the combustibles one. So for us, it’s a financial opportunity to strength our business in all those locations. We are very pleased with the -- to be honest, with the progress that we have made in all categories throughout 2022, margin-wise. We have read in THP on the consumables side margin that is higher than combustible.

The same is happening for modern oral.

And in vapor, we have reached worldwide, a 50% gross margin compared with the cigarettes, which is around 68%. And in the U.S. alone it’s even higher than that. So it's a big improvement. That's what is really driving the reduction in loss as well.

And we are really heading towards a very sustainable business where we're being different between you selling cigarettes or selling one of these products.

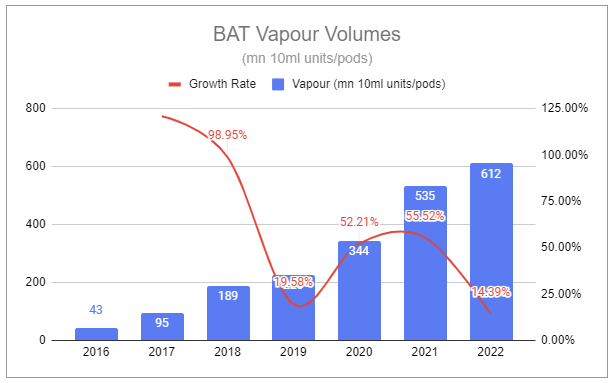

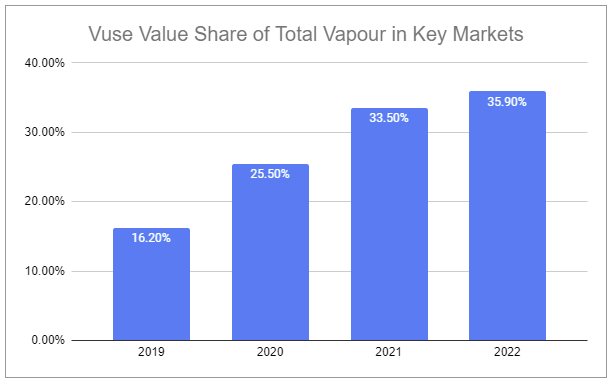

Vapour (Vaping, ENDS - Electronic Nicotine Delivery Systems) - Vuse

For FY 2022, vapour revenue was up 44% at constant currency, volumes increased by 14%, and category share increased to 35.9%. The massive differential between revenue and volumes was driven by BAT being able to exercise pricing, as well as Vuse Go, their newer premium disposable device. Vuse Go, with youth access prevention controls, is quickly taking share in key markets, with minimal cannibalization to BAT’s other lines. Additional geographic expansion is planned throughout the year.

Vuse in the United States market is particularly encouraging. While combustible volumes declined at an accelerated rate due to macro factors, Vuse experienced 840bps in vapour value share. Additionally, as a whole, New Category revenue grew 52% year over year in the United States.

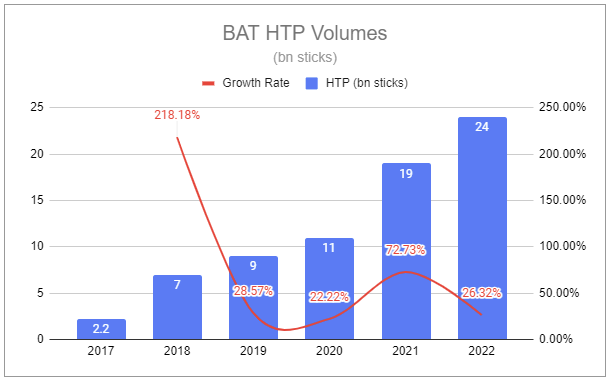

HTP (Heated Tobacco Products/Tobacco Heating Products) - glo

For FY 2022, HTP revenue was up 27% at constant currency, volumes increased by 26%, and category share increased to 19.4%. Growth during the year accelerated during the second half, driven by the success of glo Hyper X2.

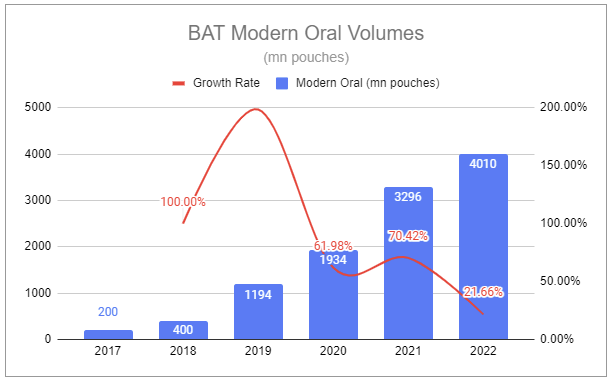

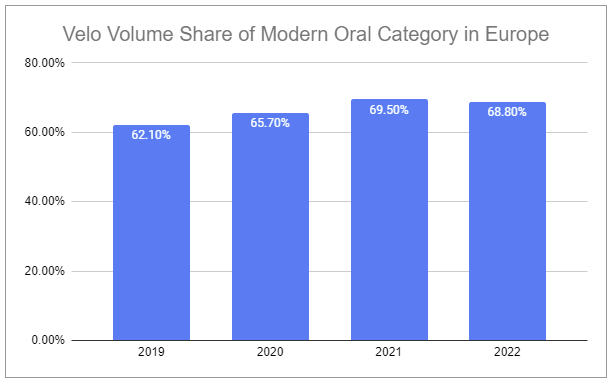

Modern Oral (TFNP - Tobacco-Free Nicotine Pouches) - Velo

For FY 2022, Modern Oral revenue was up 46% at constant currency, volumes increased by 22%, and category share increased to 30.4%.

While volume share in Europe declined for the first time in 4 years, the volume increase is exceptional considering the massive differential between volumes and revenue, showcasing exercisable pricing power for the modern oral product.

BATS has submitted a PMTA in the United States for a new Velo product - one that aligns with the superior European version. It remains unknown exactly when a ruling will be reached. In the meantime, there are significant expansion opportunities for Velo in emerging markets.

Other Developments

ITC

British American Tobacco’s interest in ITC decreased from 29.38% in 2021 to 29.19% in 2022 as a result of ITC’s SBC.

Organigram

BAT impaired its investment in Organigram by £59 million (net of tax), reflecting the decrease in that company’s share price.

Charlotte’s Web

In November 2022, BAT invested in Charlotte’s Web Holdings, Inc. via a convertible debenture of £48 million. Charlotte’s Web operates out of Colorado, USA, and is listed on the TSX in Canada. The company primarily focuses on hemp extract wellness products. The debenture stake can currently be converted into a 19.9% non-controlling equity stake.

Alto ruling

In September 2022, a jury found Reynolds Vapor’s, a BAT subsidiary, Vuse Alto infringed upon 3 patents owned by Altria. Past damages have been waived instead for a 5.25% royalty rate for Altria. Reynolds is currently working through the appeal process while exploring other legal avenues.

Russia and Belarus

British American Tobacco is in advanced talks to transfer its operations in Russia and Belarus to another party. BAT’s management has guided to 3-5% organic revenue growth (excluding Russia and Belarus), contingent on when the 2023 transfer of business in Russia and Belarus occurs. There is no information on what considerations are involved or if a buyback clause will be included.

FDA Marketing Denial Orders

The U.S. Food and Drug Administration issued two marketing denial orders (MDOs) to Reynolds for two menthol e-cigarette products. This was not entirely unexpected, as the FDA is looking to crack down on characterizing flavors, including Menthol. I found this exchange during the FY 2022 call during the Q&A particularly illustrative:

Gaurav Jain - Analyst, Barclays:

Sure. My second question is on the NGP breakeven guidance for FY'24. And a lot of people are concerned about the U.S. e-cigarette business because see, 30% of your NGP is U.S. e-cigarettes, where FDA has given two of Vuse Alto menthol variants and MDO.

And they also commented that Vuse was second ranked in the FY'22 Youth Prevalent Survey. So most likely Vuse Alto menthol will also get an MDO and maybe a tobacco product also gets an MDO. So with all this regulatory uncertainty, how certain are you that you will hit NGP breakeven, in FY'24?

Jack Marie Henry Bowles - BAT CEO (emphasis added):

Yes. I mean, to be blunt, we would not say that we accelerate the profitability of NGP to 2024 if we would not have looked at all these things, but it's a very valid question. I think what you have to see is the consumers are increasingly coming to our portfolio and to our brands. And we have now 22.5 million consumers that are there, which only represents a small portion of the 80 million that are existing at the moment.

So we have a lot of space to grow and to grow against competitors.

The second thing is the FDA is, of course, doing all the regulatory work, but it has slowed down dramatically, because they have a lot of things to do, which I understand. So I think that the speed at which regulation and new regulation will come in and regulatation related to all this is going to be slow. And I think that we have adapted very well in the past to all the regulators. And we know that we have very strong brands. So we have space to grow, and we know that we have very strong brands.

So I'm confident in the way forward. These things are multiyear things with a lot of litigation, regulation, discussions and all this will take time. We have this kind of debate since now 5 years, and it's only starting to move slowly and there is not even a definitive view in terms of what is going to happen. So we'll take the time and we'll make sure that we do the right thing for the business. And we reiterate -- I reiterate the fact that we'll be profitable in New Categories by 2024.

I could even be profitable sooner, but I want to invest the money in order to make sure that we grow the base of the business. And that's what we're doing in the right way.

Valuation

Our business is highly cash generative; we achieved another year of excellent operating cash conversion, delivering 100%, well ahead of our 90% guidance and we expect as a Group to generate c.£40 billion of free cash flow before dividends over the next five years. - BAT 2022 FY Preliminary Results

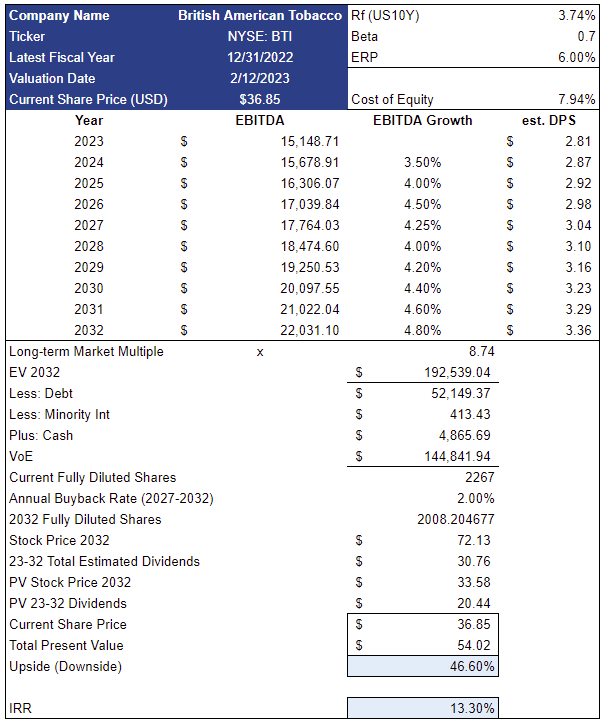

I updated my model using a 10-year exit based on backing out equity from an EV/EBITDA multiple and factoring in forecasted dividends and share repurchases.

Key Assumptions:

Cigarette volumes will maintain decline trend, offset by pricing power, resulting in retail value growing ~1% per annum.

BAT cigarette market share will remain relatively stable.

New Category will flip to net profitability in H1 2024 with favorable margin dynamics.

Cost savings initiatives will incrementally expand past £1.95bn per annum.

Effective tax rate ~25.25%.

0 contribution from Beyond Nicotine, ITC, or VST.

The dividend per share will increase by 2% per year, under half the 5Y average and 1/3 of the recent 6% increase.

No future M&A.

Buybacks will resume in 2027 at a 2% rate per year.

Model assumes no retirement of debt and instead approximately accounts for higher net financing costs and an incrementally lower leverage ratio as EBITDA grows.

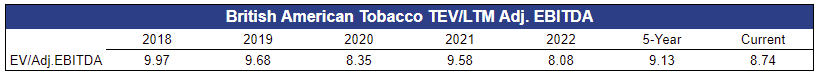

The output of the model suggests BAT’s equity is significantly underpriced.

Additional considerations:

The model is priced in USD, and actual results will differ materially based on prevailing transactional and translations FX dynamics.

The model uses the current paltry x8.74 multiple as the exit multiple.

The model crudely excludes operations in Russia and Belarus but accounts for no proceeds from the sale.

The exclusion of ITC and VST not only ignores material equity stakes but the associated dividends, totaling several hundred million $ annually.

Heightened competition in new categories could encourage promotional pricing and discounting, compressing margins and eroding share.

Significant changes to regulation in major markets such as the EU or the US could materially affect results.

5 months ago, I wrote that British American Tobacco had the widest spectrum of potential future outcomes relative to its peers. However, I also believed it heavily skewed to the upside. That view remains unchanged.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Philip Morris International, British American Tobacco, and other tobacco companies such as Altria.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: PM 0.00%↑ BTI 0.00%↑ MO 0.00%↑

Really great article, thank you for writing it. My hope is that BAT use excess FCF to pay off some of the near term debt rather than refinancing it at higher rates and then use the saved interest expense to buyback shares.

Good writeup. I feel like this industry offers relative safety in a very uncertain environment, and PMI's management in particular seems to always be a step ahead. Between a US rollout of iQOS and the Swedish Match acquisition there's a real under the radar growth story playing out here in an industry that many investors have written off.