“Vision without action is merely a dream. Action without vision just passes the time. Vision with action can change the world.” - Joel A. Barker

Company Overview

In 1847, Philip Morris founded a small tobacco shop on Bond Street in London, England. At the turn of the 20th century, the company experienced several changes in control and ownership, eventually leading to Philip Morris International (PMI), an operating company of Philip Morris Companies. In 2003 Philip Morris Companies Inc rebranded to Altria. Several years later, in 2008, PMI was spun off so that it could gain greater operational flexibility and the ability to focus on emerging markets.

Philip Morris International has turned into a global behemoth:

Products sold in over 180 countries

More than 14 million points of sale

5 of the top 15 cigarette brands in the world, including the #1 Marlboro

And now, the company is growing into something even more remarkable.

Philip Morris International has a vision of delivering a smoke-free future.

For over a decade, the company has grown an impressive research team focused on developing new products that achieve a near-impossible task: deliver an exceptional customer experience while presenting substantially lower risks than combustible products. This pursuit, in which they’ve invested billions, has led to their truly innovative product, IQOS, the #1 heated tobacco product in the world.

The company has an ambitious goal of generating more than 50% of its total revenues from smoke-free products by 2025. To further accelerate a smoke-free future, the company has also acquired multiple pioneering pharmaceutical companies. And additionally, earlier this year, PMI announced a $16 billion cash tender offer to acquire Swedish Match, the Scandinavian company with an impressive portfolio of leading oral nicotine products.

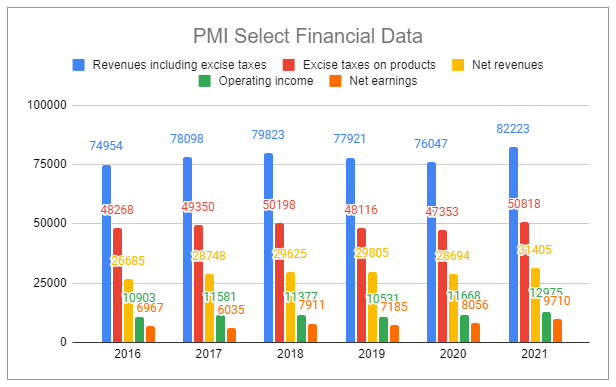

Now, while competitors continue to struggle to navigate a challenging environment, Philip Morris International is growing sales volumes, net revenue, and profitability. Furthermore, the low capital intensity of ongoing operations allows the company to remain committed to returning significant capital to shareholders in the form of dividends and buybacks.

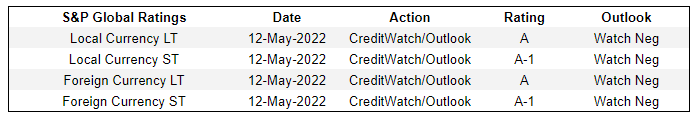

The company’s corporate headquarters are currently in New York City, New York, and operations are based out of Lausanne, Switzerland. The company’s shares trade on the NYSE under the ticker PM. Presently, the company holds the following credit ratings and outlooks:

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Investment Thesis

Philip Morris International is best positioned to capitalize on the fact that as long as humans exist, they are going to use nicotine. The company exhibits:

Leading products in legacy and new generation (RRP) categories

Superior economies of scale and global influence

Exceptional leadership and ability to navigate difficulties related to regulatory and geopolitical complexities

The company is wildly profitable and is set to create substantial long-term value while returning significant capital to shareholders in the form of dividends and buybacks.

Industry Overview

To claim that the global tobacco industry is complex would be an understatement. Humans have been enamored by the plant for thousands of years, and it has been monumentally influential in the shaping of our world. Interestingly, when European explorers first reached the Americas, they viewed smoking as a bizarre, savage act—something only the uncivilized would engage in. There was a lag time until they caved in, and then, from early pipes to snuff, cigars to the rise of the cigarette, tobacco spread across the world like wildfire. Back then, the small companies leading the way saw exponential growth, with many turning into multi-billion dollar operations today. But honestly, to even refer to it now as the tobacco industry is a bit of a misnomer. What we’re really talking about is the nicotine industry.

Present day, next to legacy products like cigarettes, cigars, pipes, and chew exist a variety of new products that promise to provide the nicotine users desire. And across all regions of the world, countries, and cultures, there are simultaneously unwavering societal norms and preferences pitted against changing consumer tastes, product allowances, bans, excise tax increases, decreases, surpluses, shortages, armed conflict, black markets, and more.

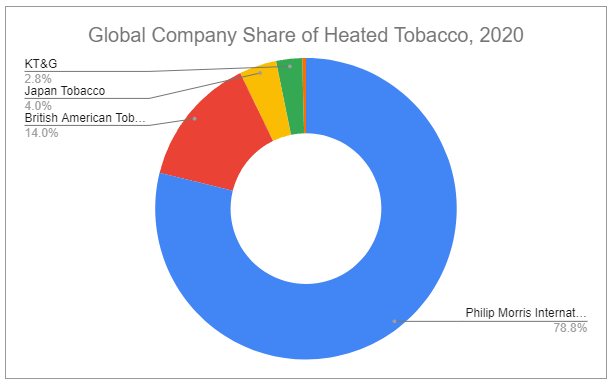

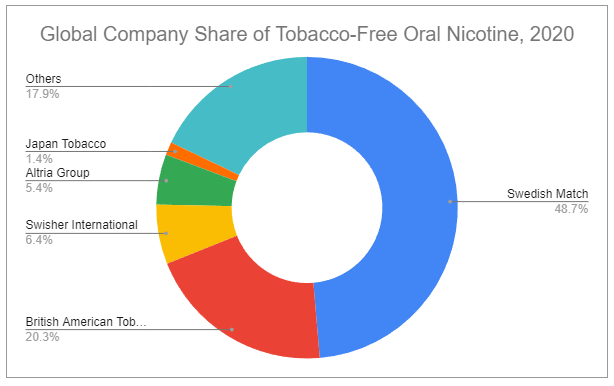

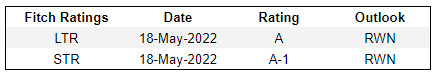

The absurdly high profitability of the industry would normally invite continuous competition, but staggeringly high brand loyalty reinforced by government regulators, who across the world have made it hard for new entrants to succeed, has largely protected incumbents. While there are local producers for various products in certain countries, these dynamics have led to the overall market becoming extremely concentrated (and ex-China, PMI is the largest player.)

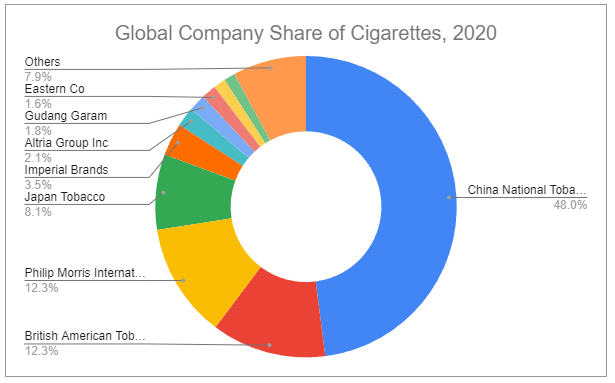

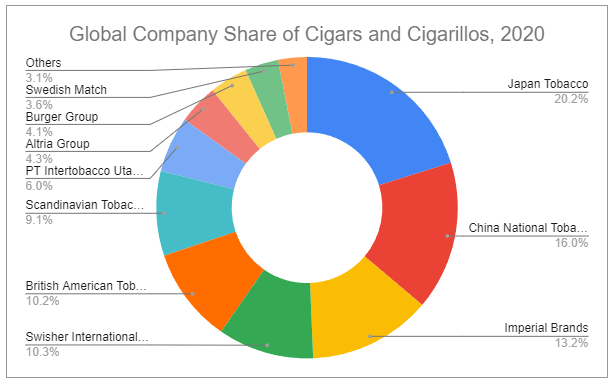

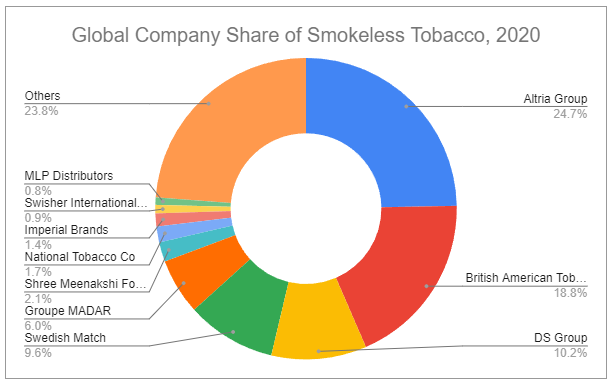

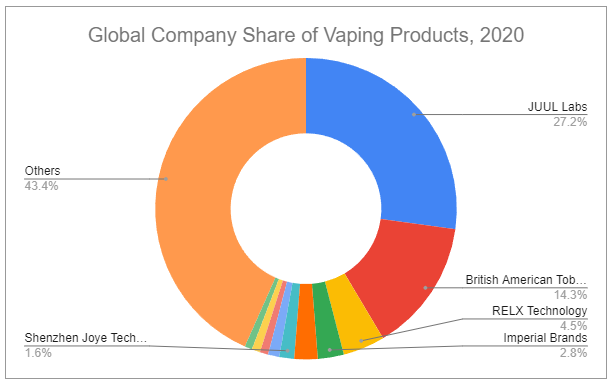

While there has been some shifting in certain categories, it’s useful to look at recent historical data to get a sense of the total market share across categories:

Industry Outlook

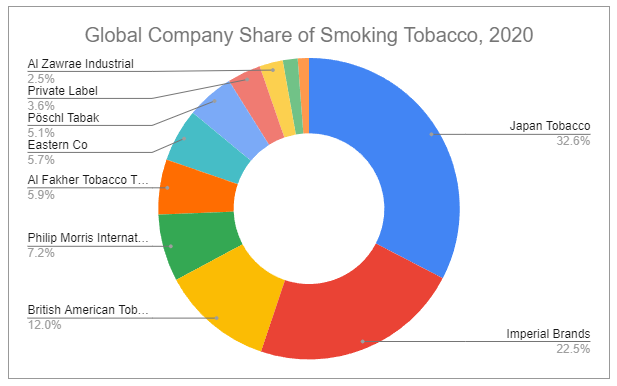

To gain context and a better understanding of the industry on a global scale, I strongly encourage you to read my previous article, The New Era of Nicotine. In doing so, a few critical points come to light:

Cigarettes make up the vast majority of retail value globally and aren’t disappearing anytime soon.

Reduced-risk products like HTPs and TFNPs are growing at high rates, albeit they are very small pieces of the pie.

Retail value for all categories has been steadily growing.

Towards the end of the piece, I engaged in some rough math to estimate what retail values could look like in the future. In it, I forecast total retail value experiencing a 2.75% CAGR into 2031 and RRPs (TFNP, HTP, and Vaping) experiencing a 13.13% CAGR in the same period.

Of course, all estimations are exactly that… estimations. How reality unfolds will largely be affected by the big boogeymen: government regulators.

Regulation

The backdrop

With tobacco, we’ve seen restrictions on allowable claims, limitations on advertising, rules on public use, higher purchasing age requirements, graphic warnings, banning of flavors, and especially banning of products. Governments around the world have taken a variety of approaches to treating tobacco and nicotine, and I would simply never finish this article if I were to detail every wordly nuance. To save you and myself time, here are some condensed thoughts:

It is inherently human to use substances that enhance/alter cognitive function, whether for individual reasons or spiritual, religious, or social rituals.

Historically, nicotine prohibition has failed. This includes attempts by TYRANTS threatening the punishment of DEATH.

Like with caffeine and alcohol, people are going to embrace nicotine.

Presented with these facts, what are regulators to do?

From my previous writing:

…it seems most practical to cheer for regulation that further thwarts underage access and usage of tobacco and nicotine while at the same time providing ample information, resources, and options for adult consumers to make informed choices.

Disappointingly, there seems to be a substantial amount of back-and-forth on this (I believe) sensible position. Nicotine’s longtime association with combustible tobacco persistently warps related social and political discourse. Opponents take stances, often either citing a preferred zero-tobacco/nicotine tolerance policy or clinging to their outrage that by society embracing reduce-risk products, tobacco companies would further profit.

We’ve seen this expressed in various ways:

In 2019, India banned all vaping, effectively losing control as a black market grew around the desired product.

During Covid, the government of South Africa instituted a 5-month total tobacco ban, which ultimately helped support a growing black market.

In 2021, New Zealand revealed a new policy that would incrementally increase the legal buying age of tobacco, theoretically preventing younger generations from accessing such products.

In June of 2022, The United States FDA issued MDOs to JUUL Labs, which would have stopped all sales, potentially would have forced JUUL Labs into bankruptcy, and likely would have resulted in some JUUL users reverting back to using cigarettes.

In countries such as Antigua and Barbuda, Argentina, Bhutan, Brazil, Colombia, Lebanon, Macau, Mexico, Panama, Sri Lanka, and Suriname, it is legal to use but illegal to sell vaping devices.

The World Health Organization takes a strict approach to tobacco use and is so vehemently opposed that it rejected Covid vaccine shots produced by a company partially owned by Philip Morris International.

The WHO also encourages countries to adopt their preferred focus of tax increases on tobacco products to reduce usage but also bizarrely recommends taxing RRPs such as HTPs at equal rates to cigarettes.

Transition to reason

Fortunately, some countries have refused to give in to the noise, and others are beginning to understand the importance of policies centered around tobacco harm reduction (THR). This allows them to foster a healthier population by reducing smoking-related illness while still raising critically needed revenues via excise taxes. Thankfully, supporting THR is an ever-growing coalition of scientists, political leaders, health workers, and consumer advocacy groups. To name just a few parts of the world leading the way forward:

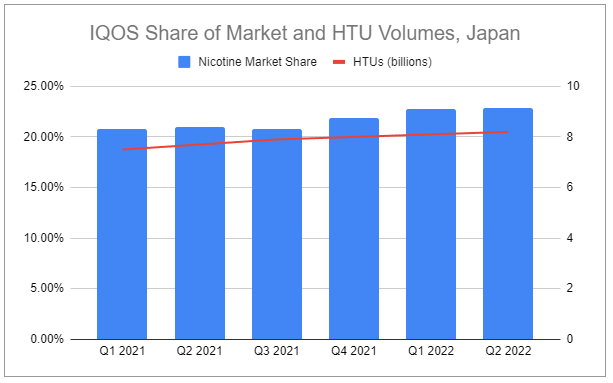

Japan has embraced HTPs at an unprecedented pace, accelerating the country’s decline in cigarette volumes, leading to a >50% drop since 2016.

The United Kingdom’s ASH (Action on Smoking and Health) has embraced THR policies to help reach its goal of becoming a smoke-free country by 2030.

The Czech Republic is leading the EU during its tenure as president of the Council of the European Union from July-December 2022. The country has positive views toward THR-focused policy and has stated that abstinence approaches have been inadequate. Watching how they influence future policy decisions for the EU will be critical.

Also, recently, Matt Holman, the director of the Office of Science at the United States Food and Drug Administrations Center for Tobacco Products (CTP), after working with the FDA for over 20 years, announced his departure and that he would soon begin working at Philip Morris International. Presumably, he was interested in working where he could make a real positive impact. As bureaucratic red tape continues to hamper progress on THR policies, it won’t be surprising to see others make similar moves in the future.

Taxation and Product Pricing

Tobacco taxation allows governments to reduce total tobacco consumption by making related products less affordable while raising critically important revenue earmarked for special programs. But this is no easy task. Country agencies must do this in a way that avoids negative second-order effects, such as causing related commerce to shift into black markets. Furthermore, while the majority of countries have an agency focused on tobacco control objectives, less than half have a team with multiple dedicated, full-time employees. The complexity of this is additionally compounded by the fact that each country has wildly different sociodemographic, socioeconomic, and cultural factors that make it impossible for an effective one-size-fits-all policy to exist.

Approaches to Taxation:

Specific Excise Taxes - a specific tax on a specific good for sale within a country or imported and sold in that country. The tax is collected from the manufacturer or at the point of entry by the importer in addition to import duties. Normally, for cigarettes, these types of taxes are at a rate of per stick, pack, or kilograms.

Ad Valorem Excise Taxes - These are very similar to specific excise taxes but generally occur between two separate entities during some point of the distribution chain, such as a % tax applied on transactions between manufacturers and retailers/wholesalers.

Import Duties - Taxes on specific goods upon entry into the country that will be consumed in that country (not just transported through). These can be specific or ad valorem. Specific import duties tax in a similar way to specific excise taxes, such as by volume or weight. Ad valorem import duties generally apply to cost, insurance, and freight (CIF) value.

Value Added Taxes (VAT) and Sales Taxes - VAT is a multi-stage tax on goods and services based on the taxes consumers pay for the product. While manufacturers and wholesale entities participate in paying taxes, they are reimbursed through a credit system. This way, the total tax paid falls onto the consumer. Countries that levy VAT normally do so predicated on excise tax and customs duty. Other countries, instead of using VAT, rely on sales tax instead. These occur at the point of retail sale.

Other Taxes - Various other taxes that do not exclusively fall under any other classification are used throughout the world. They usually apply to the quantity of tobacco or the value of the overall product in a transaction.

These overall dynamics lead to a gigantic spectrum of consumer prices. In Australia, a pack of Marlboro (the leading cigarette brand, owned by PMI) costs over $26 USD equivalent, whereas in Nigeria, a pack of Marlboro costs ~$0.97.

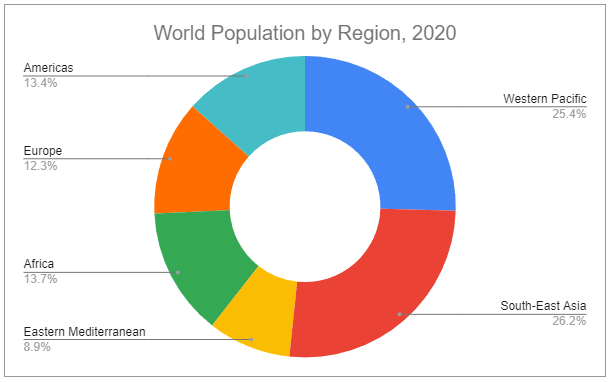

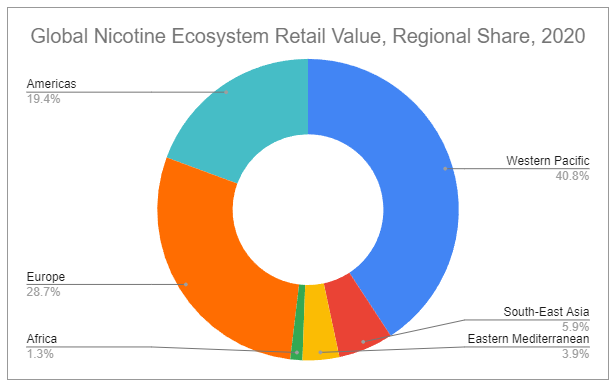

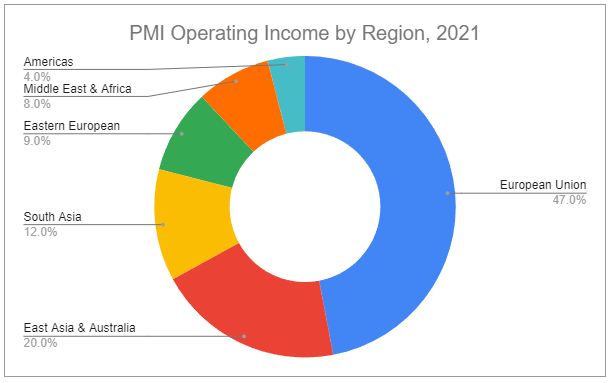

The following two charts showcase the massive differences between regional populations and their total contributions to tobacco retail sales.

And the following chart further illustrates the massive differences between high-income, middle-income, and low-income countries.

Increasing tax rates have been shown to decrease total the affordability of tobacco products and thus curb demand. Manufacturers raise prices to offset decelerating volumes, which further lowers demand. However, total pricing power has shown to more than offset the volume declines in terms of overall profitability. And, for cigarettes specifically, since the underlying product price is only generally ~50% of the retail price (with the other 50% being from taxes), the manufacturer’s price increases can be done incrementally and appear very minimal in the eyes of consumers, along with excise taxes simply passed on. The effectiveness of this pricing power is further exemplified when discounting is allowed, and in jurisdictions with minimum pricing laws, premium brands, such as Marlboro (PMI), stand to benefit the most. After all, when consumers are faced with choosing a discount brand or a premium brand, and the price point is the same, the choice process ends up being quite straightforward.

I believe taxation dynamics will end up being a major tailwind for reduced-risk products. When governments adopt tobacco harm reduction policies, they are likely to adopt taxation methods that tax RRPs at lower rates than combustibles to incentivize users to switch. As I stated in The New Era of Nicotine, these factors are likely to drive adoption, in addition to bolstering industry profitability.

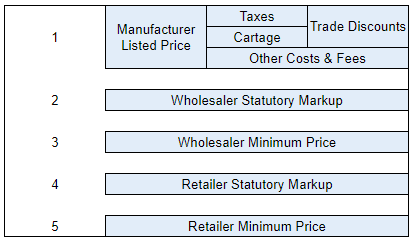

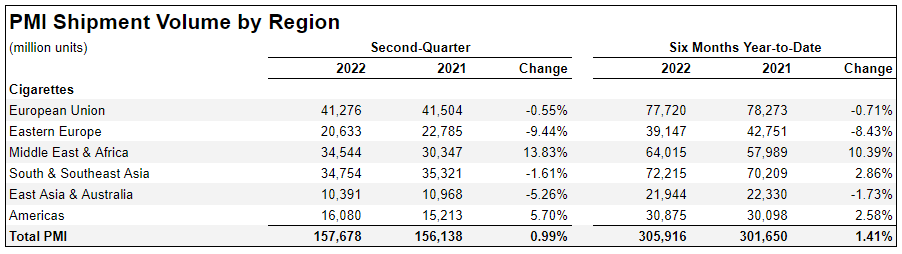

Philip Morris International Operations and Segment Specifics

Philip Morris International’s operations are primarily split into two segments, Cigarettes and Heated Tobacco, and span across the world, ex-U.S. and ex-China. The company is focused on building leading brands—across many regions and countries, PMI brands hold the #1 and/or #2 positions by market share. In early 2022, to compliment their leading portfolio of products, PMI created a new operating segment, Wellness and Healthcare.

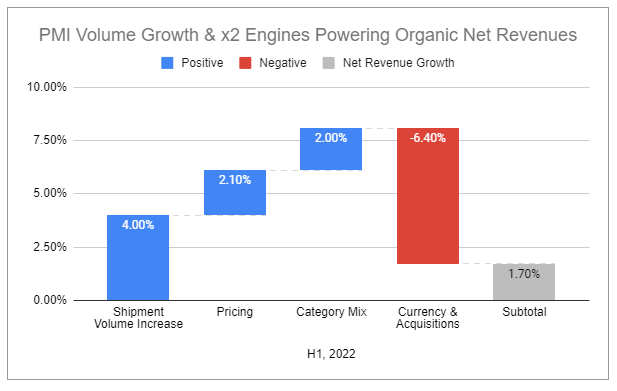

The company raised its full-year pro forma growth outlook, and while I think it’s often prudent to exercise caution around guidance, PMI management has a history of being responsibly conservative and quite accurate in their expectations. Narrowing from earlier in the year, the FY2022 expectations are as follows:

1.5-2.5% shipment volume growth

6-8% net revenue growth

0-50bps in adjusted operating margin expansion

10-12% adjusted diluted EPS growth

Adjusted diluted EPS in a range of $5.23-$5.34, which includes a -$0.80 impact from adverse currency impacts and excludes Russia and Ukraine ($5.90-$6.05 included).

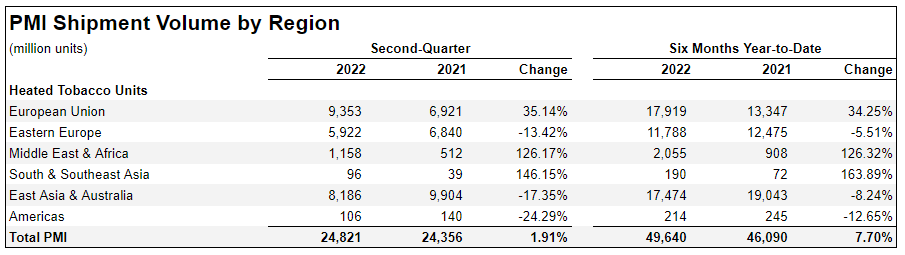

Heated tobacco unit shipment volumes in a range of 90-92 billion

The following subsections contain some data that includes Russian operations. PMI intends to include operations in Russia and Ukraine in its reporting for the remainder of 2022. Starting March 24th, 2022, PMI began to suspend certain investments and scale down manufacturing in Russia. The company plans to work on exiting the Russian market in an orderly manner as the complexities associated with operating there continue to grow. In 2021, Russia accounted for almost 10% of total shipment volumes and approximately 6% of net revenues for PMI. As of June 30, 2022, PMI’s assets located in Russia have an approximate value of $2.5 billion.

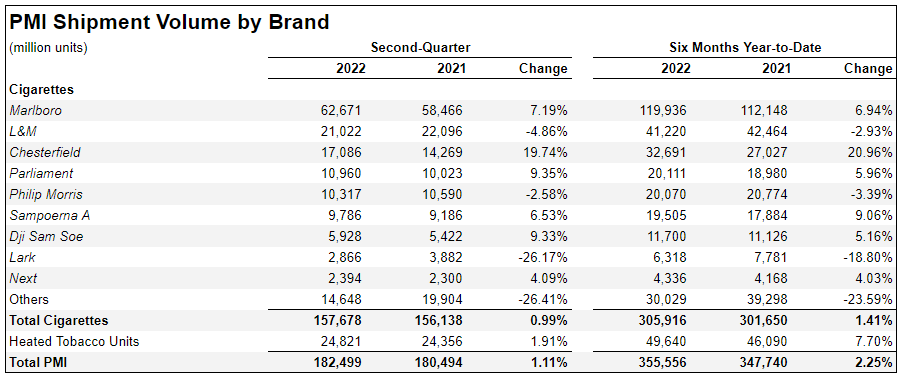

Cigarettes

With origins going back 175 years, Philip Morris International holds the most impressive portfolio of cigarette brands, with 5 of the 15 most popular in the world, including the top-ranked Marlboro. Other leading company brands include Parliament, Bond Street, Chesterfield, L&M, Lark, and Philip Morris.

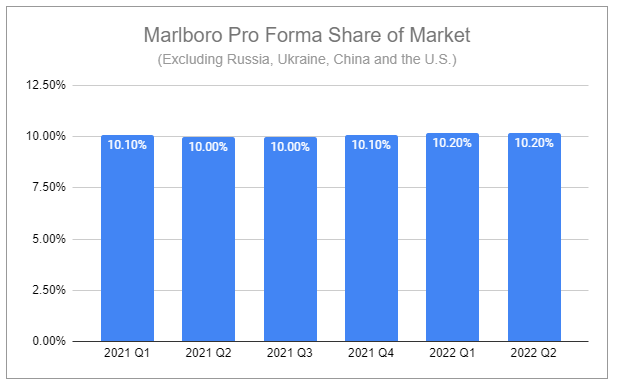

Marlboro has been the #1 cigarette in the world for 50 years, and Marlboro volume growth for Q2 2022 was an astounding 7.19% y/y, driven largely by reopenings leading to higher social occasions and purchase frequency. That type of growth is very a-typical, but the brand’s market share has remained extremely stable recently:

Heated Tobacco (IQOS)

IQOS is a golden goose.

Heated tobacco products aren’t entirely new. Other major manufacturers, such as R.J. Reynolds, attempted to market such products in the 1980s and 1990s, though all failed due to design and user experience flaws. Philip Morris (now Altria) began researching heated tobacco as an alternative to cigarettes in the 1990s and launched the Philip Morris Accord in 1997, but failed to succeed. As it turns out, creating a viable alternative to cigarettes is an exceedingly hard problem to solve:

The product must be affordable.

The product must deliver nicotine in a satisfactory way.

The overall customer experience must exceed that of cigarette use.

When Philip Morris International was spun off from Altria, PMI hit the ground running with substantial R&D investment. Between 2011 to 2014, PMI acquired patents and companies and developed partnerships focused on reduced-risk products. In 2013, PMI formed an agreement with Altria, in which PMI would sell Altria’s e-vapor technology outside of the United States, and Altria would gain exclusive rights to sell future heated tobacco products developed by PMI in the United States.

Heated tobacco device technology, while technically complex, is fundamentally straightforward:

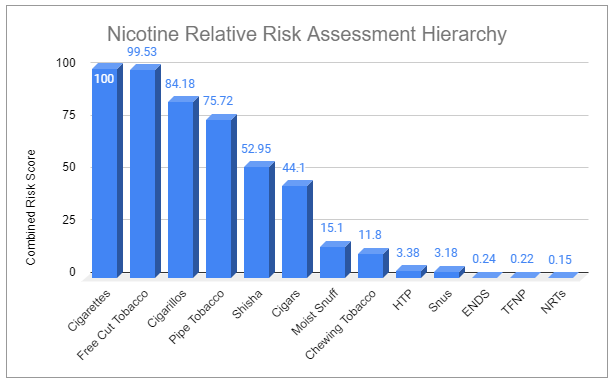

The electronic device heats, but does not burn, tobacco, releasing a nicotine-containing vapor. Research indicates that this results in a substantial reduction in exposure to Harmful and Potentially Harmful Constituents (HPHCs) relative to cigarette use.

The tobacco used is a uniquely formed heated tobacco unit (HTU), in which tobacco is ground and reformed into sheets (cast-leaf) and then turned into plugs.

Notably, further advancements in heating technology have been made:

IQOS versions such as IQOS 2.4+, 3 Multi, and 3.0 Duo use HEETS (or heatsticks). The devices use a unique blade technology that heats the tobacco sticks from the center.

The newest version, IQOS ILUMA, uses new induction technology to heat TEREA SMARTCORE STICKS.

These devices require their specific HTU to be used and can not be interchanged, including other HTUs competing in the market.

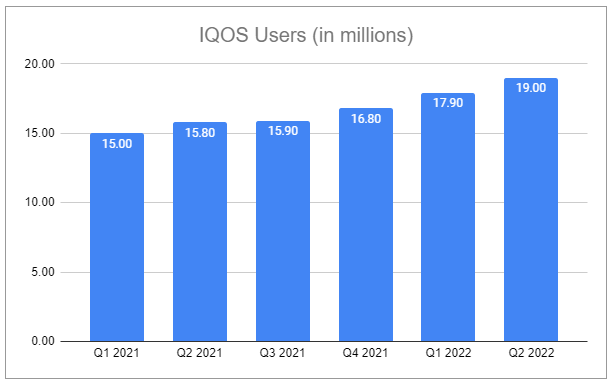

IQOS was first launched in Japan in 2016 and was introduced into the U.S. in 2019 and is presently the only HTP that has received both PMTA approval and an MRO, with the U.S. Food and Drug Administration citing that switching completely from cigarettes to IQOS would significantly reduce exposure to harmful or potentially harmful chemicals. As of June 30, 2022, Philip Morris International estimates that ~13.2 million adults have become IQOS users and have stopped smoking.

The complexities of IQOS development and product design are matched by the complexities relating to its profitability. The devices themselves are not cheap and require special inputs, including semiconductors—something that does not concern cigarettes. This has led the company to effectively subsidize device adoption, which compresses operating margins. This is especially true in the last few quarters, where the company has experienced elevated increases in the COGS and supply chain constraints, as well as both an acceleration of adoption as well as previous IQOS users upgrading their devices. This had led to the Total PMI OI Margin declining 90bps in H1, 2022 (down 110bps on a pro forma basis).

Management has stated they expect this trend in OI Margin to reverse as the ‘upgrade cycle’ subsides, but I am cautious about the rate at which this will occur. Currently, ILUMA is only in Japan, Sweden, Spain, and Greece, with more launches planned throughout the rest of the year.

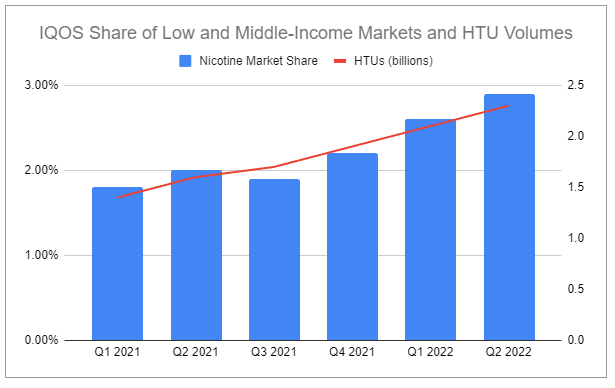

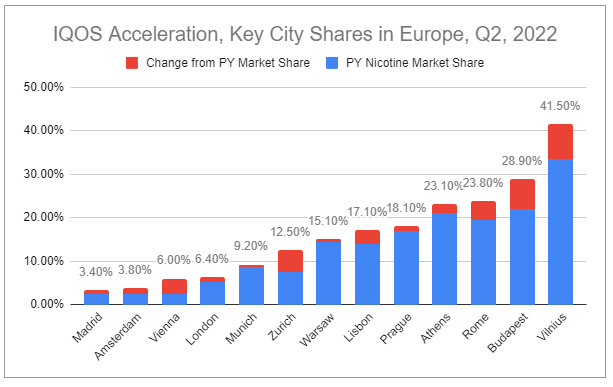

It’s important to note that the overall IQOS growth trend is across all geographies, with no country representing an abnormal source of growth. And it’s accelerating. Remember, in many lucrative markets, there are severe limitations in how tobacco and nicotine can be marketed and advertised. As IQOS enters more markets, it is used more socially and gains greater recognition, which should further extend sales growth.

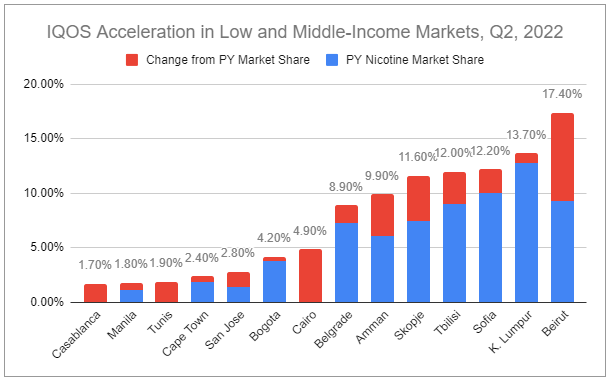

Continuing to focus qualitatively, it’s also essential to recognize that IQOS, especially ILUMA, has scored very favorably with consumers, which is reflected in higher conversions and increased customer loyalty. The following series of charts visualize just how much traction IQOS is experiencing:

It becomes readily apparent that even with headwinds, that IQOS growth is firing on all cylinders. But PMI is not yet satisfied—the company intends to launch a new HTP product in emerging markets in Q4 2022.

While devices make up only ~5% of IQOS sales, IQOS device sales mask the massive profitability of the related HTUs. I believe a large part of my IQOS bull thesis boils down to:

HTUs are often taxed at lower rates than combustibles.

On a per-unit basis, IQOS HTUs generate a substantially higher net revenue than combustible units.

IQOS is experiencing massive incremental economies of scale, with acquisition and retention costs falling yearly.

IQOS, being a reduced-risk product, should lead to longer, healthier lives for smokers who switch, and should increase CLV.

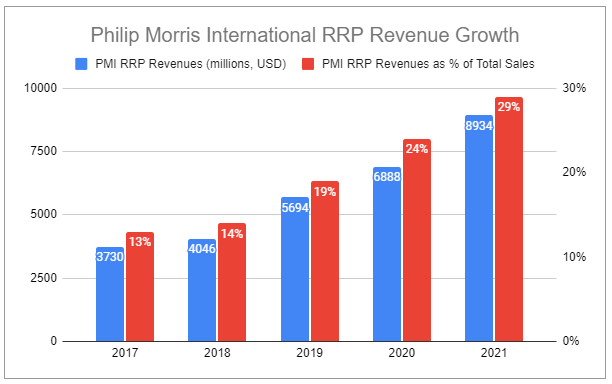

I believe these overall dynamics and the momentum showcased make IQOS one of the most impressive products on the market today. PMI’s RRPs, which consist nearly entirely of IQOS and its HTUs, are already nearly 1/3 of PMI’s net revenues on a pro forma basis, excluding Russia and Ukraine. And considering that RRPs are currently only a small fraction of the total global nicotine market retail value, I believe there is tremendous opportunity ahead.

Lastly, it’s worth remembering that IQOS’s impressive performance has been despite multiple headwinds and the fact that it has no presence in one of the most lucrative markets in the world—The United States of America. While Philip Morris International does not operate in the United States, it currently has an agreement with Altria, giving Altria the exclusive ability to sell and distribute IQOS in the United States through 2024. However, at the end of 2021, after an ITC ruling found IQOS infringing on multiple patents held by R.J. Reynolds, an injunction was issued, preventing IQOS from being imported into the United States. The ITC ruling was surprising, as similar legal contestations between the two companies have largely concluded in favor of PMI in many other countries.

It remains uncertain if PMI will renew its exclusive licensing deal with Altria, but the company has stated it expects to be able to reintroduce IQOS to the U.S. in H1 2023, though the overall plan is still being adapted. Part of PMI’s strategy will likely be pursuing manufacturing IQOS within the U.S., circumventing the import ban.

Other Products

Other products are not disaggregated in PMI’s financial reporting and generally represent non-material levels of revenue for PMI. Several are noted below.

IQOS VEEV

Launched in select markets in 2020, IQOS VEEV is an electronic nicotine delivery system that uses a mesh heating technology to heat pre-filled, pre-sealed pods that contain nicotine and flavors. The pods are manufactured in the company’s European production facilities. Using the device relies on puff-activated heating and a low-liquid detection system, which together provide consistency and quality in user experience.

In addition to IQOS VEEV, VEEBA, a sleek, disposable vaping device, has been launched in Canada.

SHIRO

Shiro was initially manufactured by AG Snus, one of the oldest tobacco companies in the world, which was acquired by PMI in May 2021. Shiro is a tobacco-free nicotine pouch, primarily consisting of a cellulose pouch that contains nicotine and flavoring agents.

Wellness and Healthcare

In the first third of 2021, Philip Morris International made several strategic acquisitions, including:

Fertin Pharma A/S, ($820 million)

Vectura Group plc., ($1.44 billion)

OtiTopic, (price undisclosed)

On March 31, 2022, PMI launched a new segment, Wellness and Healthcare, which consolidated the three acquisitions into Vectura Fertin Pharma. All aspects of operations and financial reporting for this segment are managed separately from the other segments.

In Q2 2022, PMI reported the Wellness and Healthcare segment generated $76 million in revenue and an operating loss of $34 million, which largely reflects the amortization of intangibles related to acquisitions as well as R&D. Excluding those factors, the segment recorded an adjusted operating loss of $16 with an adjusted operating loss margin of 21.1%.

PMI has substantial scientific expertise in areas such as preclinical safety, clinical development, regulatory affairs, and final product safety. The company will continue to invest in R&D, seeking to build end-to-end development of inhaled therapeutics and oral and intra-oral consumer health products. One of the company’s goals in its long-term efforts is to generate $1 billion in net revenues from ‘beyond nicotine’ products by 2025.

Of all of the IP gained from these acquisitions, one of the most interesting is ASPIRHALE, which is a patented, dry powder ASA inhalation delivery system designed to reduce the severity of heart attacks. It looks like it’s expected to move from clinical trials to filing with FDA for approval sometime this year. Along with that, a few other named products, and the ability to create other novel inhalation healthcare devices, the company will have the capabilities to design and produce compressed gums, extruded gums, lozenges, pouch powders, and other custom delivery systems focused on the following application areas:

Nicotine

Cannabinoids

Vitamins and dietary supplements

Oral care

Energy management

Pain management

Allergy

Cough and cold

Gastrointestinal

Sleep and relaxation

Overall, PMI hasn’t said much else (yet). I’m looking forward to when they do because it doesn’t take much creativity to think of interesting synergies and applications they seem well-suited to focus on. But maybe this segment becomes a perpetual black-box money pit, or perhaps it will turn into an incredibly profitable new segment. Either way, I’ll wait to speculate further.

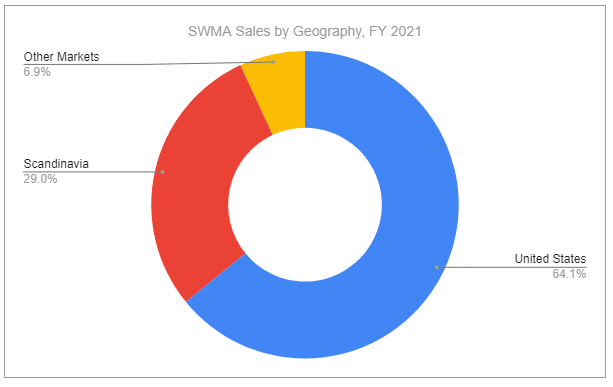

PMI’s Bid for Swedish Match

On May 11, 2022, Philip Morris International announced an agreement to buy Swedish Match AB (SWMA) by soliciting a cash tender offer to shareholders at 106 SEK per share, a ~40% premium to the prior share price, valuing the entirety of the deal at approximately 161.2 billion crowns ($16 billion). The board of Swedish Match has recommended that shareholders accept the offer. PMI suspended its buyback program upon the announcement and stated the following on the deal:

PMI and Swedish Match AB (Swedish Match) share a mutual vision of a world without cigarettes and a strong commitment to developing, scientifically substantiating, and responsibly commercializing smoke-free products that are less harmful than cigarettes. As PMI continues to evolve its business for the long term, it believes that the two companies are a perfect pairing of strategic vision, culture, and enterprise. Together, the companies can create a global, science-led smoke-free champion, combining expertise in heated tobacco and oral nicotine—including multiple MRTP authorizations—as well as PMI’s emerging presence in e-vapor products, to switch more adult smokers to better alternatives than the two could achieve as separate companies. Swedish Match would lead the combined company’s oral nicotine business.

PMI provided further rationale for the offer:

Enhances robust top-line growth

Additional upside from U.S. & international expansion

Accretive to operating income margins and adjusted EPS (excluding deal-related costs and the amortization of acquired intangibles)

Accretive to cash flow and currency profile

Substantial expected mid-term and long-term shareholder value creation

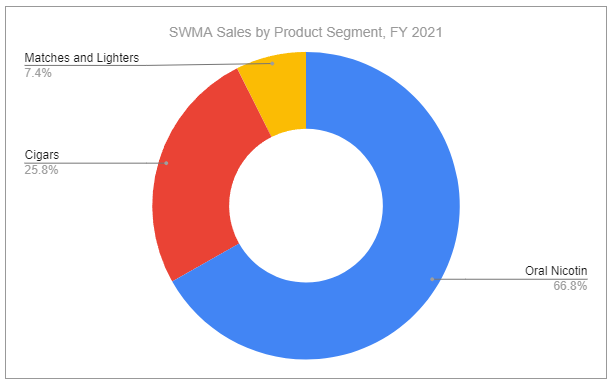

Swedish Match is the world leader in tobacco-free nicotine pouches and has other impressive products, such as moist snuff ‘snus’ and a lucrative cigar business. Notably, SWMA’s General Snus is one of only a few products with a Modified Risk Order from the United States FDA (with another being PMI’s IQOS). The company’s TFNP Zyn is the #1 in the category and made up ~64% of the category share in the U.S. in 2021. Importantly, on a global level, nicotine pouches experienced ~65% growth in 2021 and are expected to experience a 30-40% CAGR in retail value over the next 5 years. This will likely be driven by growth in Europe, as well as opportunities in low and middle-income markets.

The deal looks to give SWMA and enterprise value of ~$17.5 billion, which would come out to around x17 2023 consensus EBITDA.

The company’s sales from product segments held a 17% CAGR from 2018 to 2021.

SWMA’s operating margin from product segments experienced a +570bps expansion from 2018 to 2021, going from 39.1% to 44.8%.

The company’s cash from operating activities grew from $426 million to $738 million in the same period, representing a 20% CAGR.

I think the current deal, at the current price, is quite advantageous to PMI and PMI shareholders. There are several considerations I find most compelling:

SWMA’s footprint in the United States allows faster distribution and could expedite PMI’s plans to manufacture IQOS within the U.S., circumventing the ruling that stopped its import. It would also provide a ‘door’ for PMI to enter the U.S. market with other products.

PMI would gain USD-derived revenue, which would somewhat help counter adverse FX impacts.

PMI’s global footprint and vast resources would likely substantially accelerate SWMA’s oral nicotine product growth in markets, especially where it currently has zero presence. PMI would also be able to provide world-class guidance on navigating future regulatory challenges.

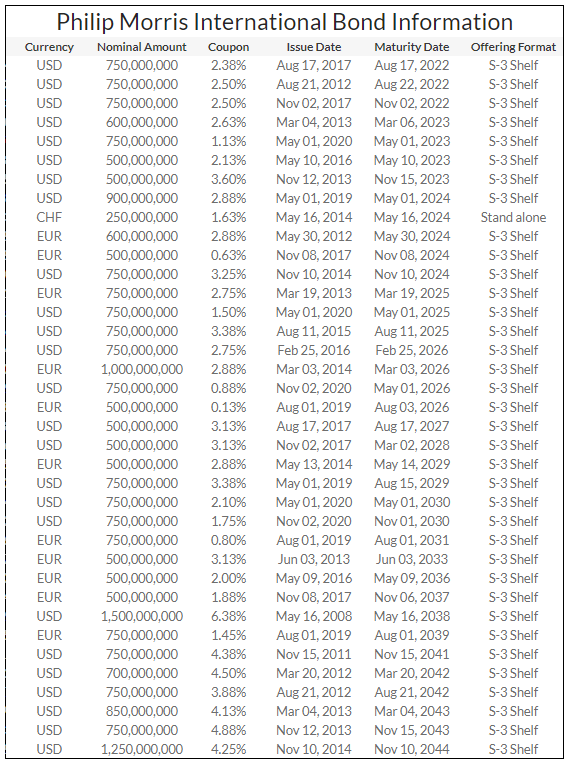

PMI will likely be financing the deal in its entirety with very attractively priced debt. With absurdly low borrowing costs and a strong coverage ratio, this should be especially welcomed by anyone holding a view that above-average inflation will persist.

But let’s be real. There are real risks and concerns:

Nicotine pouches, globally, will face plenty more tests with regulators. Adverse regulation could drastically curb growth prospects.

Competition is starting to increase. While SWMA’s Zyn is a market leader, there is no guarantee it will be able to hold its share as the market grows.

Competition is taking market share from SWMA for their legacy products in Scandinavia. There may also be future regulation that adversely impacts its cigar segment.

Credit rating agencies are on watch to potentially downgrade PMI contingent on the final terms of the deal, debt, and outlook.

Are any of these points why Swedish Match’s board seemed eager to recommend acceptance of the offer to their shareholders? It should make you take a step back and wonder if something is missing from the picture. And, anyways, not everyone is as excited about the deal. In fact, there is some striking opposition:

John Hempton, the co-founder of hedge fund Bronte Capital, based in Sydney, Australia, called the deal “unacceptable”. *Actually, he said a lot more than that and used some pretty colorful language to convey his frustration with the situation. His fund owns ~1% of SWMA.

Activist Elliott Management is said to be working to raise its stake in SWMA to 5%, supposedly in a plan to oppose the deal in its current form, although the firm has not commented much publicly.

The deal has largely received a green light from regulators, and Philip Morris International stated they expect the deal to close in Q4, 2022, subject to shareholder acceptance. But PMI needs to clear a 90% tender threshold, and with the current SWMA share price on the Stockholm exchange sitting above the 106 SEK offer price, it is looking less and less likely that the deal will go through in its current state. PMI could raise their bid and extend the duration to get the deal done, and due to the target’s size, there are unlikely to be any counter-bidders to compete with. Whether or not the deal would be value-creating at a higher final price remains to be seen.

Management and Culture

Executive Leadership

Calantzopoulos, André, Executive Chairman of the Board

Olczak, Jacek, Chief Executive Officer

Babeau, Emmanuel, Chief Financial Officer

Li, Bin, Chief Product Officer

Voegele, Michael, Chief Digital & Information Officer

Muenster, Silke, Chief Diversity Officer

Volpetti, Stefano, President, Smoke-free Products Category & Chief Consumer Officer

Insuasty, Jorge, President Vectura Fertin Pharma and Chief Life Sciences Officer

Kurali, Andreas, Deputy Chief Financial Officer & Head of Finance Transformation

Barth, Werner, President, Combustibles Category & Global Combustibles Marketing

Drago, Azinovic, President, Middle East, Africa, & PMI Duty-Free Regions

Mishra, Deepak, President, Americas Region

de Wilde, President, European Union Region

Mariotti, Marco, President, Eastern Europe Region

Masseroli, Mario, President, Latin America & Canada Region

Kennedy, Stacey, President, South & Southeast Asia Region

Riley, Paul, President, East Asia & Australia Region

Andolina, Massimo, Senior Vice President, Operations

Bendotti, Charles, Senior Vice President, People & Culture

Rich Folsom, Suzanne, Senior Vice President and General Counsel

Kunst, Michael, Senior Vice President, Commercialization

Salzman, Marian, Senior Vice President, Global Communications

Verdeaux, Gregoire, Senior Vice President, External Affairs

de Rooij, Frank, Vice President, Treasury and Corporate Finance

Leadership

In 2017 Philip Morris International established the Foundation for a Smoke-Free World, intending to extend supportive financing of over $1 billion over 12 years, citing the organization would:

…evaluate the impact that smoke-free alternatives can have on smokers and public health, assess the effect of reduced cigarette consumption on the industry value chain, and measure overall progress towards a smoke-free world.

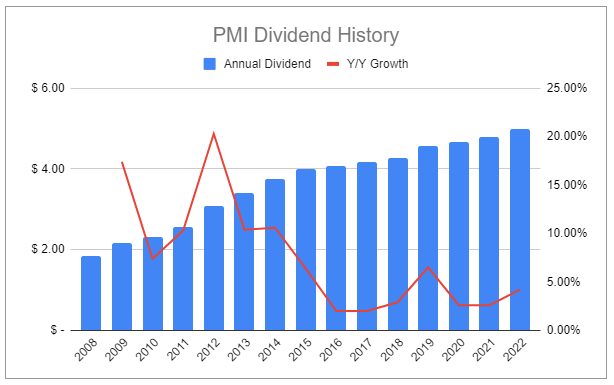

Along with visions of delivering a smoke-free future, PMI has continually stated its commitment to returning capital to shareholders. The company has increased and paid its dividend yearly since becoming public in 2008. Since its inception, the dividend has risen 171.7%, a CAGR of ~7.4%.

Risks & Considerations

Future Regulation and Taxation

As always, one of the most prominent risks to PMI is future regulation and tax treatment of tobacco and nicotine products. PMI has historically managed such complexities extremely well, but there will undoubtedly be jurisdictions that act in ways unfavorable to the future of the company.

There has been recent scrutiny of product flavors, including menthol, in key markets. PMI has stated its belief that limiting such flavors would have a negligible impact on the company as a whole. With a priority focus on IQOS, the greatest risks likely come from future regulation inhibiting RRPs and excessive taxation methods targeting RRPs.

Competition

In such a lucrative market, competition is to be expected. Versus other cigarettes, PMI’s leading brands, such as Marlboro, are well positioned. However, countless variables weigh in that could ultimately lead to a loss of market share or profitability—and the threat of new RRPs from rivals is prominent.

PMI was the first to enter the modern HTP market, but now every major competitor has its own device, and all are commercially available. It is argued that to take market share, competitors will be willing to aggressively discount devices, as well as their HTUs. While this competitive threat should not be entirely dismissed, I believe IQOS is a superior product compared to the rest of what is currently on the market and that adopters are unlikely to switch, although there is a possibility that the prevalence of HTPs causes an accelerated decline in total cigarette volumes, including PMI’s brands.

Cannibalization

Since the launch of IQOS, opponents have said the devices and overall strategy would cannibalize sales of Marlboro, driving profitability down. Cannibalization is occurring, but if you look at the volumes of PMI HTUs and cigarettes, you will notice that a great deal of growth is from IQOS stealing market share from other companies. And as mentioned prior, as PMI experiences increased economies of scale and exercises pricing power, the total profitability of the company is growing, along with unit volumes.

Illicit Trade

Despite international efforts to combat illicit trade, counterfeiting and cross-border sales continually evolve, which is a constant negative headwind for the industry. This results in billions of illegal cigarette units annually, along with the illegal sales of many other unregulated tobacco and nicotine products. The illicit market is particularly large in Montenegro, South Africa, Malaysia, and Libya.

Additional M&A

The company will have access to capital to engage in various M&A activities, although management has said that at this time, they are entirely focused on the deal with Swedish Match. If and when the SWMA finalizes, I would expect the most likely future M&A targets to be small, niche providers that could be rolled into Vectura Fertin Pharma under the Wellness and Healthcare segment. Though, this likely will not occur for several years until the company deleverages its balance sheet post-deal.

Currency Impacts and Inflation

One of the most obvious impacts on Philip Morris International’s real profitability is the headwinds caused by adverse currency exchange rates. PMI reports and recognizes earnings in USD but derives no revenue from the United States. The chart below illustrates the recent severity of this issue.

The U.S. dollar has been on a tear this year, to the dismay of many. It would not surprise me if it shows continued strength and continues to apply pressure on many global operators, PMI included. The company has also had to deal with other serious headwinds, such as a hyperinflationary environment in Turkey—a sizable market for the company. I will not pretend to be able to forecast global currency moves with any accuracy, but it’s likely that some of these pressures subside, and eventually, others will reverse and turn into tailwinds for PMI.

Supply Chains

Along with currency and inflation headwinds, there have been a myriad of supply chain issues for PMI. It remains to be seen how much inflation has been caused by supply imbalances and logistical issues, and perhaps it will remain unknown. I take a very different view on this. While these issues have undeniably been a headwind for PMI, they have seemingly been much rougher for competitors to navigate. This may ultimately help protect PMI’s market position and, in my mind, speaks to the quality of management.

Conflict

Russia’s invasion of Ukraine has been a troubling conflict for the company to navigate. Philip Morris International employs thousands located in the two countries and, prioritizing their safety, has expressed its commitment to continue to support them. The company also derives nearly 10% of total shipment volumes and 6% of net revenues from Russia, and the company’s total assets located in Russia total ~$2.5 billion. It remains uncertain how long it will take, but the company is actively working to exit Russia entirely and divest related interests.

Debt

Historically, Philip Morris International has been quite responsible with its use of debt. The company currently has ~$28 billion in total debt, ~$23 billion in net debt, and holds:

an interest coverage ratio of ~18.6, which is fantastic

a total debt/EBITDA ratio of 2.00

a net-debt/EBITDA ratio of 1.64

The majority of Philip Morris International’s bonds were issued at incredibly favorable rates and are easily serviceable. However, with the announcement of PMI’s bid for SWMA, credit rating agencies have placed PMI on watch for a possible downgrade, contingent on the specifics of the deal closing. Even if that were to occur, PMI’s rating would fall a single notch, and I do not see that impacting the company to any material extent. The likely result of successfully acquiring SWMA would be for PMI to keep its share repurchase program suspended, as well as refrain from additional M&A until ~2025 as the company de-leverages. With strong brands, geopolitically diverse operations, and exceptional capital allocation, I expect PMI management’s use of debt to continue to bode well for the firm.

Valuation & Pricing

Valuation

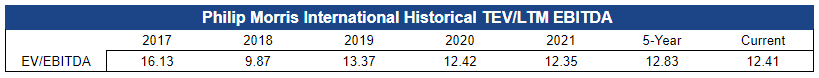

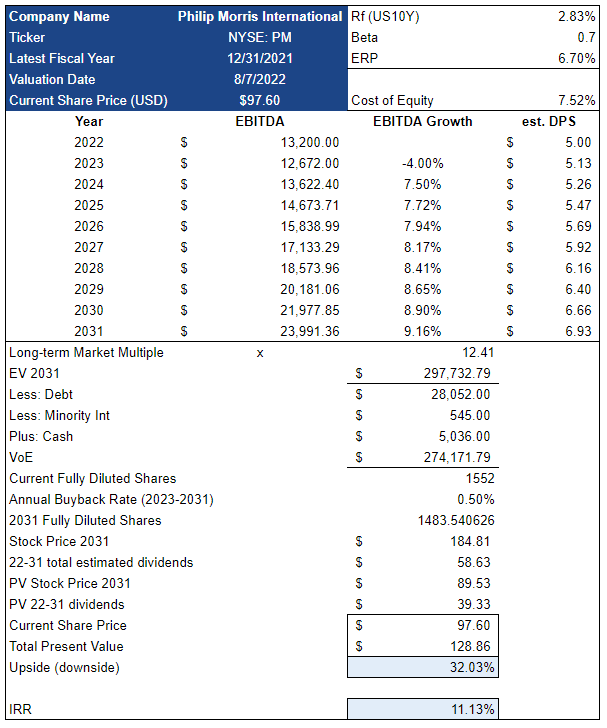

I valued Philip Morris International using a 10-year exit based on backing out equity from an EV/EBITDA multiple and factoring in forecasted dividends and share repurchases.

While the company has engaged in several recent acquisitions as well as placed an offer for SWMA, the continued operations of the core business are extremely capital light—though CapEx should be slightly elevated to support the continued growth and success of IQOS.

My methodology for accounting for the loss of Russian operations differs from the guided pro forma numbers. In my forecast, I am showcasing a substantial negative impact in 2022, as well as in 2023. This undoubtedly also looks different than the numbers others have publicly expressed as forecast and likely won’t align with how reality unfolds—that’s just fine by me. I believe it provides an additional level of caution to account for such complex uncertainties.

Key assumptions:

FY2022 and FY2023 will be massively impacted by the complete exiting of Russian operations and other significant macro factors.

Current FX rates will remain unchanged.

Marlboro's market share will remain stable. Other cigarette brands will fluctuate. All will decline in their share of the overall nicotine market.

Cigarette volumes and pricing mix dynamics will remain favorable.

HTUs will experience persistent, albeit decelerating unit sales growth.

HTU pricing is LSD positive, and the product category taxation dynamics currently experienced will persist.

IQOS CAC and retention costs continue to decrease y/y incrementally.

Current elevated COGS will normalize over the next 2 years.

Zero material EBITDA contribution from the Wellness and Health segment.

Assumption Swedish Match deal does not happen.

Assumption EV/EBITDA stays at the current ratio (under the 5-year average).

EBITDA margin should incrementally expand ~300bps over the next few years.

~$1 billion D&A, ~$1 billion CapEx, and ~$600 million R&D run rates as a base mid-term outlook.

Effective tax rate ~22.5%

I have modeled an incrementally increasing dividend with the payout ratio shifting to well-under management’s stated target of ~75%. Additionally, PMI suspended its share repurchase program upon the announcement of its offer for SWMA. I assume that the program is reinitiated in 2023.

The resulting output suggests that currently, shares of PMI are meaningfully underpriced. For a defensive name with operations that are growing, highly profitable, and geopolitically diversified, the implied IRR is compelling. However, there are plenty of considerations that widen the spectrum of potential outcomes.

Additional bearish considerations:

Unit price and volume mix may potentially end up considerably lower.

Currency headwinds could become even more severe.

Changes to regulations and taxation methods may especially curb the growth and profitability of RRPs.

The impact of macro factors, including the loss of Russian operations, could be a more pronounced headwind long term.

Supply chain issues and input availability/inflation may curb the success of IQOS.

The market could further sour on PMI and re-rate the company to a lower multiple.

Additional bullish considerations:

Unit pricing and volume mix shift could continually become more favorable.

IQOS growth could continue to accelerate.

Supply chain and inflationary pressures may subside faster than anticipated.

SWMA deal might be successfully finalized. *This would likely slow dividend increases and postpone the reinitiation of PMI’s share repurchase program for several more years, as well as postpone future M&A.

As RRPs grow and become a greater contributor to sales and profit, EBITDA margins will expand. Additionally, as RRPs begin to make up more of sales and profit, the market may re-rate the company at a higher multiple.

To be honest, I’m having a very hard time seeing how the company reaches its goal of deriving 50% of net revenues from smokeless by 2025 without the successful acquisition of Swedish Match. Nonetheless, I feel that my base case, while clearly bullish, is quite reasonable, and the additional bullish considerations largely outweigh the bearish.

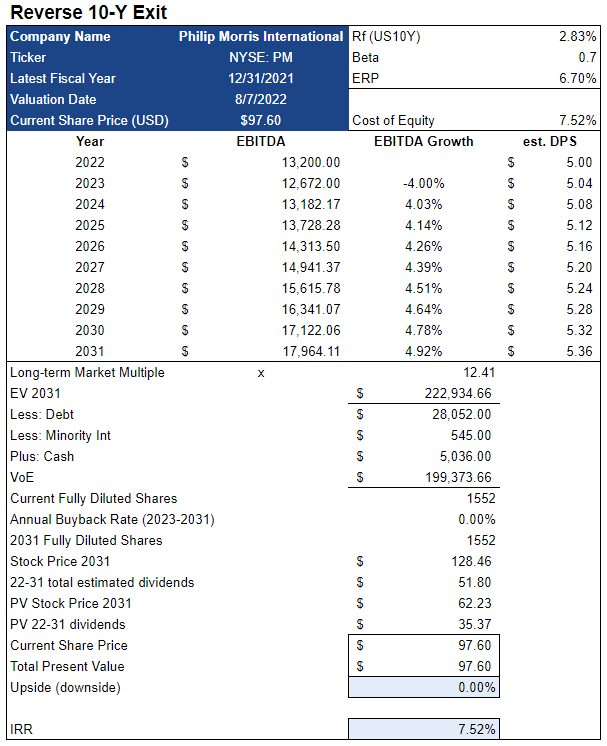

If you’re curious about what assumptions may be embedded in the current share price based on the methodology used, below is a reverse 10-year exit.

Big hits are still taken in FY2022 and FY2023

Multiple stays the same

Substantially reduced growth

Dividend increases by $0.04 annualized.

Zero buybacks

Just how demanding is this scenario? I’d say not very.

Simplified Pricing

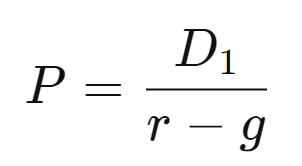

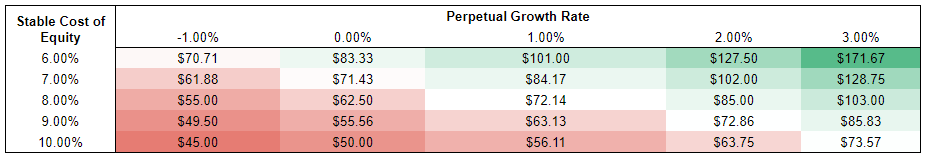

Gordon Growth Model (GGM)

g = Perpetual growth rate

r = Stable cost of equity (hurdle rate)

D1 = Value of next year’s dividends

P = Current stock price

Philip Morris International holds many distinct factors that will likely lead to it growing by more than a theoretically capped terminal rate of 3% for quite some time. Despite that, simply going through the motion of calculating the implied value using the current annualized dividend of $5.00 presents the following range:

PMI’s stable CoE could be narrowed to the 7-8% range, and perpetual growth will likely be in line with 3%, implying a fair price range of around $103-$128.75. I don’t think this is the most appropriate method to value shares of PMI, but this at least provides some additional context and consideration.

Closing Thoughts

Conclusion

I’ve held Philip Morris International for over a decade, and now, even with many headwinds, the company looks to be hitting its stride. IQOS might just be one of the single most exciting products in the world at the moment. Will PMI also acquire SWMA to further dominate the future of nicotine? It’s hard to say.

It seems likely that regardless of how the future unfolds, Philip Morris International will be there, evolving and returning capital to shareholders.

Thanks for reading!

If you enjoyed this article, please take a few seconds to share it on your favorite social platform or with a few friends.

And make sure you’re subscribed so you never miss my writing in the future.

Questions? Thoughts? Comment here or reach out on Twitter.

Ownership Disclaimer

I own positions in Philip Morris International, as well as other tobacco companies such as British American Tobacco and Altria.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: PM 0.00%↑ BTI 0.00%↑ MO 0.00%↑

Additional Resources:

Philip Morris International - public filings and investor presentations. Source

Harm Perceptions and Beliefs about Potential Modified Risk Tobacco Products. Source

How do minimum cigarette price laws affect cigarette prices at the retail level? Source

Preclinical Assessment of Tobacco-Free Nicotine Pouches Demonstrates Reduced In Vitro Toxicity Compared with Tobacco Snus and Combustible Cigarette Smoke. Source

FDA Authorizes Marketing of IQOS Tobacco Heating System with ‘Reduced Exposure’ Information. Source

Action on Smoking and Health. Source

Differential taxation and heated tobacco products: Do lower excise taxes guarantee higher profits? Source

Evolution of tobacco products: recent history and future directions. Source

Tobacco industry pricing strategies and price segmentation of the UK tobacco market. Source

WHO global report on trends in prevalence of tobacco use 2000-2025, third edition. Source

WHO technical manual on tobacco tax policy and administration. Source

WHO report on the global tobacco epidemic 2021: addressing new and emerging products. Source

WHO, FCTC, Framework Convention on Tobacco Control. Source

Global Trends in Nicotine Report December 2021. Source

Cigarette Smoking: An Assessment of Tobacco’s Global Environmental Footprint Across Its Entire Supply Chain. Source

The value of studying supply chains for tobacco control. Source

The unique contribution of e-cigarettes for tobacco harm reduction in supporting smoking relapse prevention. Source

Tobacco company agreements with tobacco retailers for price discounts and prime placement of products and advertising: a scoping review. Source

Heat-Not-Burn Tobacco Products Are Getting Hot in Italy. Source

Nicotine Products Relative Risk Assessment: A Systematic Review and Meta-analysis. Source

Associations of Flavored e-Cigarette Uptake With Subsequent Smoking Initiation and Cessation. Source

The e-cigarettes ban in India: an important public health decision. Source

Global and local perspectives on tobacco harm reduction: what are the issues and where do we go from here? Source

Great article Devin. You should jump on The Closingbell Show to discuss! We have 60,000+ in our community who'd love to learn from you. We recently had on Alex Morris, Brad Freeman, Ayesha Tariq and Tyler Okland :)