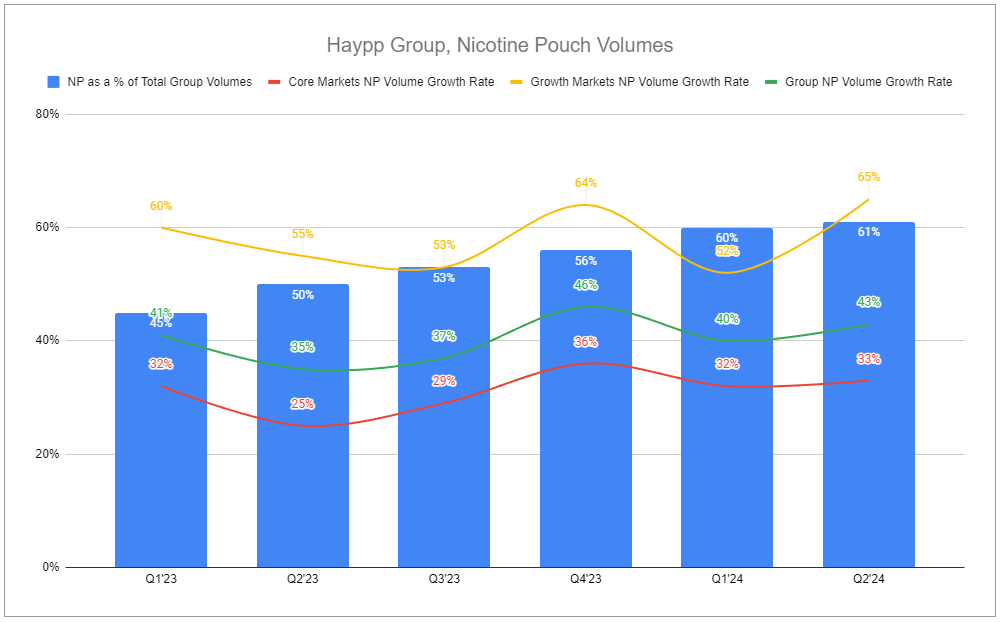

“Nicotine pouches now account for 61% of our total volume for the quarter, up 11 percentage points versus Q2 2023, and the robust trend continues. We’re particularly happy with the continued strong nicotine pouch performance in our Growth divisions, which grew 65% year-on-year after moving into profitability in Q1 and has continued expansion in margin in Q2.” – Gavin O’Dowd, Haypp Group CEO, Q2’24 Call

The recent acceleration of the already fast-growing nicotine pouch category has amplified opportunities and hindrances alike. It would not be unfounded to expect retailers to struggle with the rate of change, pincered by challenges from consumers, suppliers, and regulators. But Haypp Group, the largest online retailer, continues to set the pace for its channel. Management maintains discipline, balancing long-term thinking and nearer-term targets. Its presentations have no fluff or filler—only a concentrated effort to highlight the drivers that will ultimately move the needle. The pouch category still only represents a small fraction of total industry volumes, suggesting we are still in the early innings. As previously stated, the company is Ahead of the Nicotine Pouch Megatrend, and evidence continues to mount that it is further ahead of its competition.

Haypp Group: Ahead of the Nicotine Pouch Megatrend

Mix on mix on mix

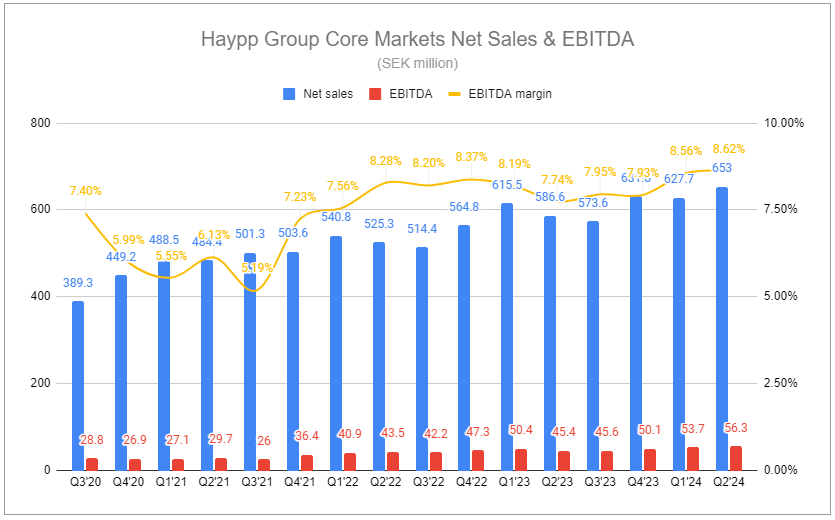

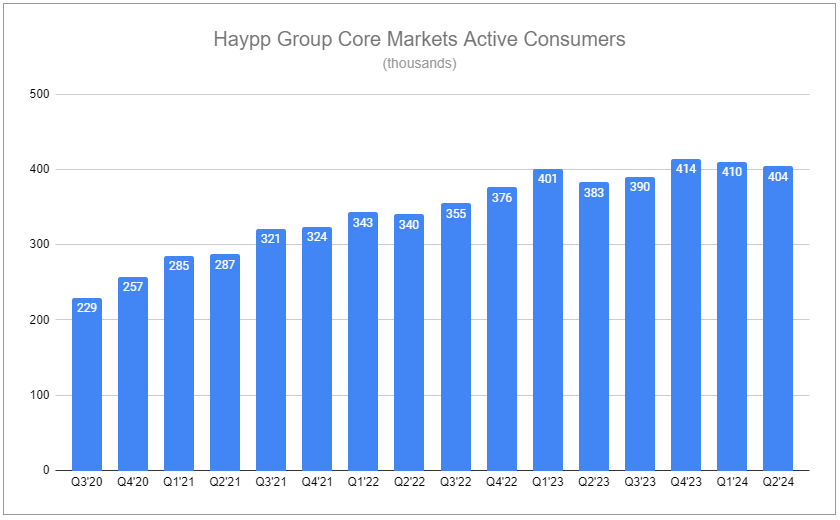

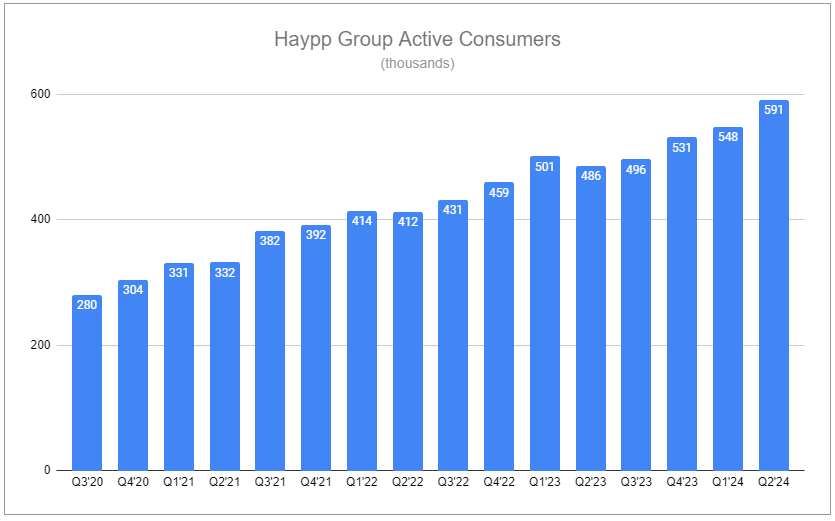

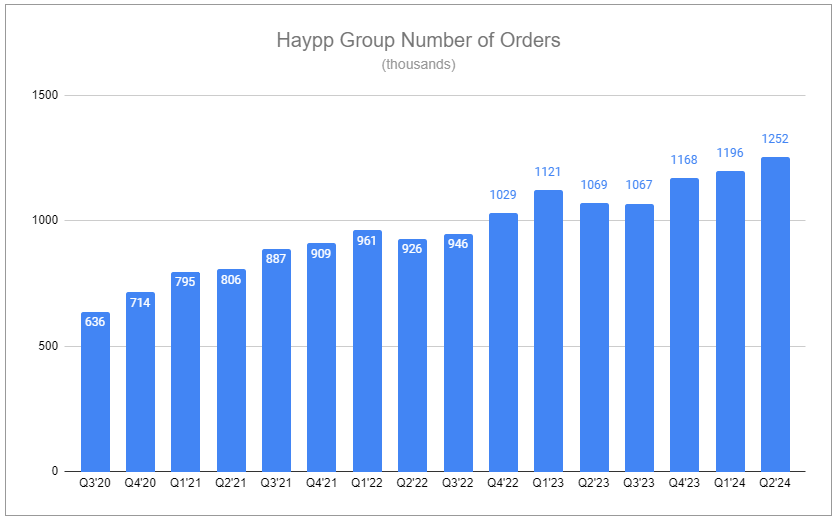

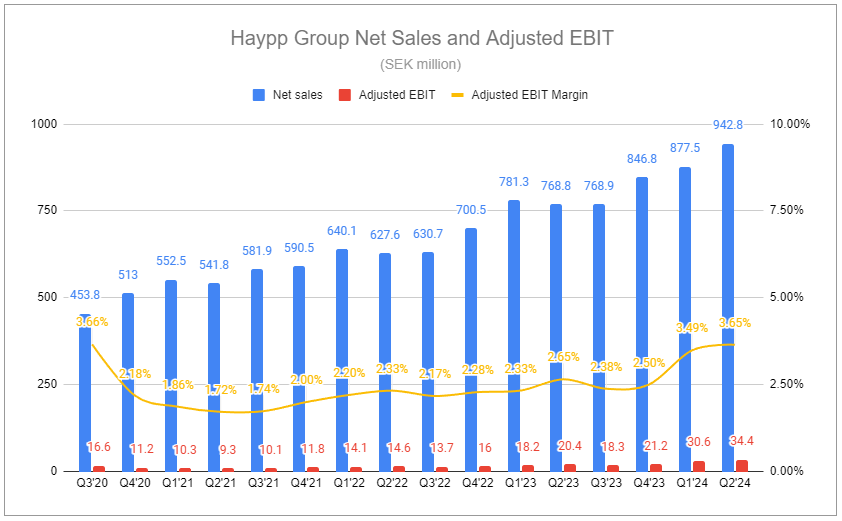

Several factors have masked Haypp Group’s long-term earnings potential. Continued reinvestment has suppressed margins, but even the topline's long-term growth trajectory remains partly disguised by multiple factors affecting sales mix across categories and geographies. Q2’24 net sales within the group’s Core Markets increased by 11% year over year. Nicotine pouch volumes within the segment increased by 33% in the period, while declines in snus continued to drag. Far higher than the 1.98% growth in topline for Q1’24, the longer-term trajectory is poised to be elevated, a function of NPs incrementally becoming a larger piece of segment volumes. Despite fervent competition in Core Markets, the group has retained share, and active consumer count has increased steadily. Margins also improved by a respectable 90bps, a function of mix shift and increased scale.

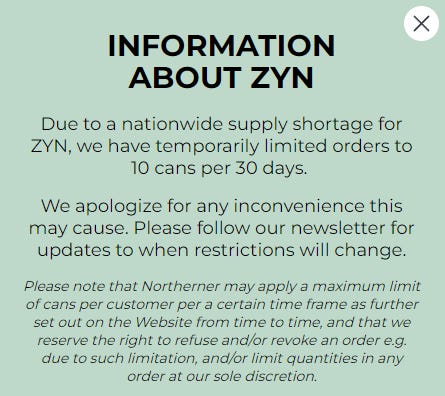

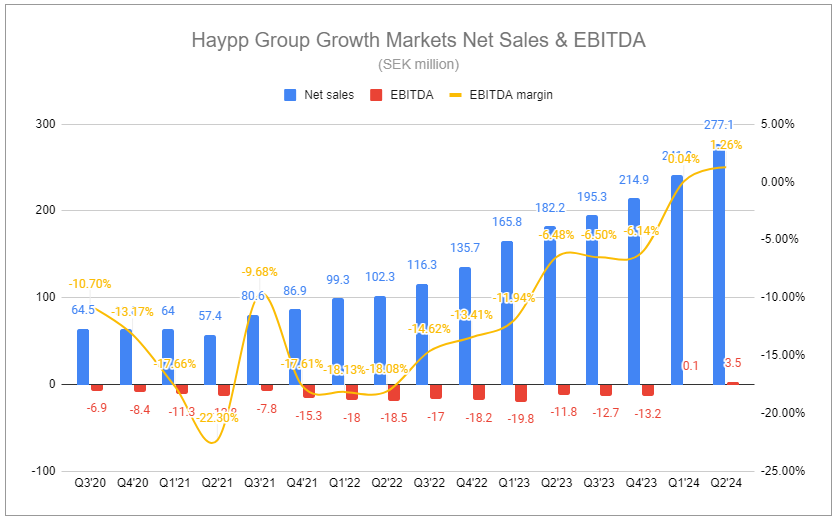

Haypp Group’s Growth Markets continue to experience a similar, though less pronounced, headwind against its top line. Access to the largest segment market by far, the United States, was provided with the acquisition of Northerner, whose portfolio of sites had previously placed greater emphasis on legacy oral tobacco brands. While Haypp prioritizes nicotine pouches, legacy products still make up a non-zero portion of volumes. Of the company’s top 10,000 ranked Google keywords, a number of top rankings are for varieties of Copenhagen, Skoal, Stokers, Red Man, General Snus, Grizzly, and so on. This partly explains the difference between the group’s Q2’24 net sales growth for the segment of 52% versus the segment’s volume growth rate in nicotine pouches of 65%. A more pronounced contributor was more acute, which is the manufacturing capacity constraints felt for ZYN, which is by far the largest brand in the NP category in the US, the implications of which are far less straightforward than should be assumed.

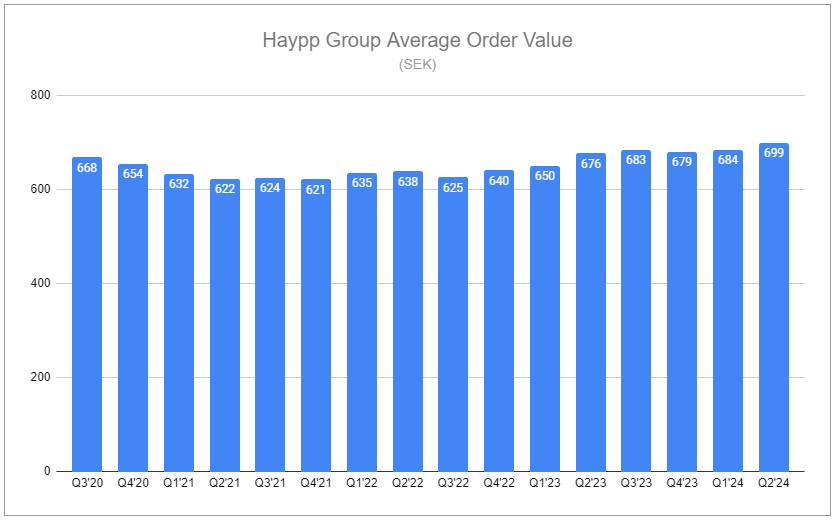

Traditionally, as a retailer, having to limit basket sizes of your best-selling product is a non-ideal situation. When that best-selling product is also the highest-priced of the category, pressures are doubled, which is precisely what has happened in Haypp’s case, with average order value being weighed down within the segment. Fortunately for Haypp, the circumstances are far from dire. While it is far too early to state the exact magnitude of the impact, it is difficult to conclude that the ramifications of the ZYN shortage are anything other than beneficial for the group over the longer term.

Place yourself in the position of an ardent ZYN user. The convenience store you regularly purchase at begins to be unable to keep up stock of your preferred flavor or strength, so you drive around town to a few other stores to find what you’re after. The rapid rise in demand for the product leads to limited availability or quantities too small to satiate your appetite. What are you to do? You head online to find a solution, likely finding yourself on one of Haypp’s sites. While the amount of ZYN you can purchase is capped, it is far cheaper than the physical stores you typically buy at, and you also discover several new brands you have never seen before because they do not have shelf space at your go-to store. You eagerly add a handful to your basket for good measure.

Such a scenario has played out thousands of times, supporting Haypp’s Growth Markets active consumer count surge by 68% in Q2’24, unquestionably further aided by Philip Morris International also temporarily halting sales on the standalone ZYN (dot) com website. For the period in the US, organic search traffic on Haypp’s sites grew by 101% year over year, and sales of non-ZYN pouch brands increased by 121%. With Philip Morris International’s efforts to increase ZYN capacity throughout 2024 and 2025, early signs show supply shortages easing, bringing into question to what extent Haypp retains the influx of new customers. It’s reasonable to expect a portion to return to their old habit of the local convenience store on the corner. But with a wider variety and far lower prices, it isn’t a stretch to think that many will convert to repeat purchasers on Haypp’s platforms.

The ZYN shortage has several positive implications for Haypp that are not immediately apparent or reflected in metrics centered on retail customers. The void provided by ZYN’s demand was set to be filled, one way or another, making Haypp’s proposition to suppliers all the more valuable. Not only is product placement and advertising on the group’s platforms more critical but its Insights business is bound to experience a step up. Currently, Insights generated from Core Markets are the vast majority. Still, with continued scale and fiercer competition in Growth Markets, Haypp’s relationship with suppliers should be reinforced. The incremental value produced by producing and selling Insights should help subsidize continued leadership of the lowest relative price, protecting the Pricing Gaps highlighted in the Q1’24 note.

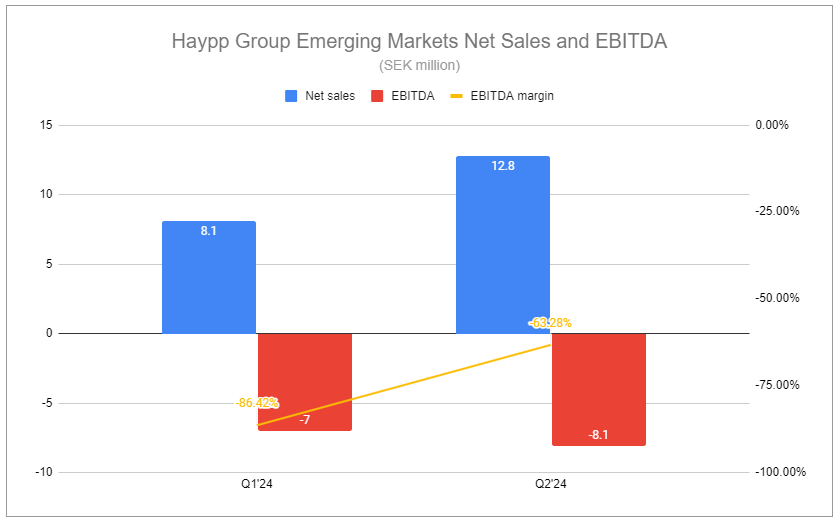

Improvement in profitability within Haypp Group’s Growth Markets is all the more impressive considering that many other online retailers have likely struggled amidst the ZYN shortage. Q1 marked a pivotal period, with the segment flipping to positive earnings contribution, and despite continued reinvestment, earnings have improved further. Alongside volumes leading to sales growth of 52% in Q2’24, scale benefits led to EBITDA margin expansion of 780bps year over year and 122bps sequentially.

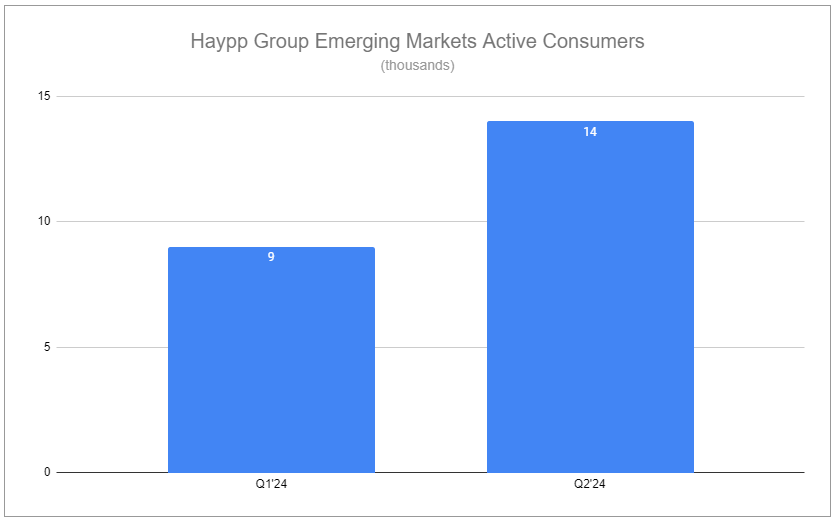

While reinvestment into Growth Markets has masked the profitability of Haypp’s underlying Core Markets for years, the newly segmented Emerging Markets are bound to have a similar yet less pronounced effect. EBITDA margin has improved sequentially, though remains deeply negative, reflecting continued investment. Sequential 58% growth in net sales shows a rapid trajectory underpinned by Active Consumers reaching 14,000 in the quarter. These numbers are relatively small compared to the Core Markets, but it is worth highlighting that the Active Consumers figure is roughly 25% of what Growth Markets had just under three years ago. Although regulatory headwinds are likely to shake up the exact trajectory of the segment, the products sold within ultimately have even higher margins, providing a potential timeline to reach profitability at an accelerated pace.

The layers

Within the valuation section of my initial thesis, several liberties were taken to illustrate a potential future, fully embracing my nature to act with an elevated degree of conservatism. It is worth revisiting a number of those layers and positing several questions.

Net sales

Over the forecast period in the illustrated model, Core Markets net sales growth decelerates from 12% to 8.5% per annum. If snus declines are masking segment NP growth of >30%, and NPs incrementally become a larger piece of the whole, would aggregate net sales growth decelerate? Is there a potential for the growth rate to remain stable or even increase?

Growth Markets net sales growth was illustrated to have decreased from 65% to 30% per annum. In the US, the online channel represents a low single-digit percentage of total retail sales versus >30% in Sweden. US usage occasions are also markedly lower than in established Core Markets. As consumers of the category establish stronger habitual use of the product, will higher usage frequency cause consumers to seek a wider variety of brands at the most affordable price? While the total NP category may experience a growth deceleration, is the online channel in Growth Markets more likely to evolve similarly to Core Markets? Even assuming online penetration rates never reach parity, what type of tailwind does that provide a retailer that holds a majority share of the channel?

Margins

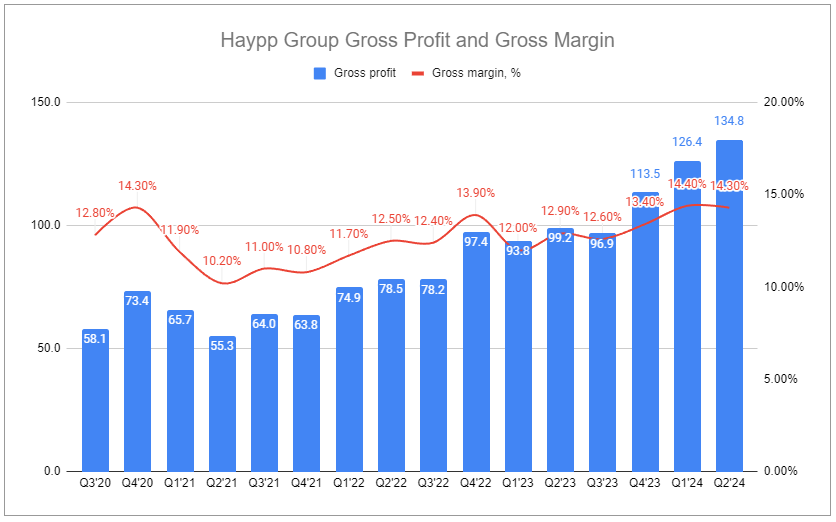

Nicotine pouches carry more favorable margin profiles than legacy products, and supplier agreements are based on calendar years, with rates referencing the previous year’s volumes. What degree of benefit is provided as NPs become a substantially more significant percentage of total sales and continue to scale in absolute terms? As illustrated within the forecast period, gross margin expands by 10bps-40bps per annum. For reference, Q1’24 and Q2’24 saw gross margin expansion of 240bps and 140bps, respectively.

While Haypp does not segment-out its Insights business, does the Insights business provide greater incremental returns if NP volumes grow at an elevated rate? Further, what are the implications of Haypp Group improving the infrastructure underpinning its portfolio of sites? During the Q2’24 remarks, Haypp’s CEO, Gavin O’Dowd, stated:

Our infrastructure transformation continues on track and now all of our Norwegian stores are migrated to V3. We will further add functionality to our storefront platform and then migrate the remaining European stores.

A Swedish firm provides the infrastructure underpinning the sites within the Core Markets. Rather than charging a percentage fee based on sales, a flat annual licensing fee is in place. Incremental volumes benefit margins greatly under such a dynamic. While Haypp has not announced plans to, it is not unreasonable to expect plans to migrate Growth Markets, namely the two large US sites, to the same infrastructure in the future. Considering the rapid growth rate of volumes, would following such a path not provide a meaningful step up in profitability?

Below ops

Adjusted EBIT growth and expansion of margin reflect Haypp’s advantage from scale. Underneath the operating line are several additional considerations. The first and clearest, from the illustrated model, is the net financing rate, which in 2023 included the effect of a translational adjustment to intercompany loans that were then (initially described as not sensible) extrapolated to repeat in all subsequent periods. Getting us closer to the question of what falls to the equity on a per-share basis is the impact of dilution, which was highlighted during the Q2’24 call:

Peter Deli, Haypp Group CFO:

We got some questions from Daniel in the presentation. Maybe we start Gavin from the bottom. First question was about the fully diluted number of shares, which increased around 4% year-on-year, and there has also been a new issue warrants for the management. Can you please give us an idea of the annual average growth in fully diluted shares in issue we can expect over the next few years?

Gavin O'Dowd, Haypp Group CEO:

And so I don't think I'm quite sort of on the same page when it comes to the 4% that we've seen year-on-year coming through on this one. But when it comes to looking forward, what we generally do is we issue roughly 3% of warrants for the management each year as it goes forward. And as you can see the details of -- in our AGM. These warrants are generally issued 30% out of the money. And at the time of maturity, three years later, they will generally results in being converted into an equivalent value of shares subject to earnings.

So for us to simplify this in and give some examples of what this could look like. So in a scenario where the share price grows roughly 30%, over those three years, there would be 0 dilution. In a scenario where the share price grows by roughly 100% over those three years, there would be roughly 1% dilution per annum coming through on this piece. So I hope that gives some sort of a context as regards to say, that is a linear equation from there as regards to plot the driving factors, which is the underlying share price itself and what the spectrum of implication of that could be.

In my initial model, I used a rather brainless approach of continuing a rate of 3% dilution for the sake of simplicity. Critically, the model ignores the future effect of reinvestment and contribution of Emerging Markets, which is far too early to make a strong case for. However, while using a standardized rate of 3% dilution, my conclusion included:

Again, results show multiples merely a few years out that are abysmally low for the qualities of the business. Applying an x13 earnings multiple five years out suggests an IRR of nearly 20%—which suggests a significant margin of safety for the current business.

There is a distinct push-and-pull effect between the success of the business, the reflection of that success in the share price, and the share price affecting the dilution rate. When my Haypp Group thesis was first published, shares traded at 63.2 SEK. Six months later, they are at 112.5 SEK, an increase of 78%. All else equal, this would point to a forward IRR substantially lower. However, two final questions remain. First, considering all of the above, will Haypp Group’s execution prove the initial assumptions illustrated as conservative? Second, even if those assumptions are proven closer to being in-line, would an x13 earnings multiple for a business growing its topline at >20% per annum, with room for considerable incremental expansion of margins, be appropriate? For now, I will abstain from attaching a revised illustration, leaving you, the reader, with room to exercise your creativity.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Haypp Group, as well as positions in tobacco companies such as Altria, Philip Morris International, British American Tobacco, Scandinavian Tobacco Group, and Imperial Brands.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

I've noticed lately that Google has been allowing ads for the search term "nicotine pouches". I just searched and there were four sponsored results before the first organic result, Onnicotine, Nicokick, Rogue Nicotine and Black Buffalo. Has there been a change in Google's stance on this search term or are these just getting through. Seems this could be a change in the thesis if it persists. Any thoughts?