“The consumer demand continues to increase, and the volume of nicotine pouches has grown by 46% during the quarter relative to Q4 2022. This is 2 percentage points higher than the 44%, which we grew for the full year. And on the back of this, nicotine pouches accounted for 56% of the group volume during the fourth quarter. We have seen strong growth in both our number of orders, our average order value, and our active customers during the quarter also.” – Gavin O’Dowd, Haypp Group CEO, Q4’23 Call

Nicotine pouches are one of the world's most important consumer product categories. Small, discrete, convenient, and posing significantly lower risk relative to legacy tobacco products, these products are highly attractive to users of legacy tobacco products, leading to rapid growth and providing societies with a clear way to reduce tobacco-related harm as the global affinity for nicotine endures. This phenomenon is a secular megatrend that I believe is still in its infancy.

Most people have no idea the above is happening, and many of the specifics are still not well understood by those attempting to keep a pulse. Subsets of the investing world are aware of nicotine pouches, but there is an almost exclusive focus leaning towards the currently leading brands produced by major manufacturers: Philip Morris International’s ZYN, Altria’s on!, and British American Tobacco’s Velo. However, the rapid growth of the nicotine pouch category has led to a global influx of new manufacturers competing for share, with incremental improvements to product size, feel, flavor, nicotine delivery speed, and duration. Continued innovation and heightened competition bring into question manufacturers’ abilities to foster brand affinity, potentially curbing the formation of loyal customer bases and limiting the ability to exercise pricing power—a stark contrast to lucrative legacy tobacco products. Such concerns warrant consideration that other parts of the value chain may be primed to best take advantage of this burgeoning category.

Enter Haypp Group.

The origin story

In 2009, two 19-year-olds, Henrik Nordström and Linus Liljegren, both tobacco snus users, grew increasingly dissatisfied with the quality and breadth of offerings at local physical retailers. They formed the company Snusbolaget in Stockholm, Sweden, aiming to build a reputable online retailer. A slow start was followed by modest success, and the company has since undergone a major transformation.

In 2017, the company installed new expert leadership, concentrated its efforts on the nascent nicotine pouch category, and set its eyes on international expansion. These moves were very much a case of skating to where the puck was going. In the following year, the company acquired Snuslageret. In 2019, Snusbolaget merged with Northerner, making Haypp Group, the world’s largest snus and nicotine pouch retailer. In 2021, Haypp acquired NettoTobak of Sweden AB and Sweden Snus Gross AB, growing even larger. In October 2021, Haypp Group completed its initial public offering, becoming listed on Nasdaq First North Growth Market Sweden under the ticker HAYPP.

Investment thesis

Nicotine pouches are a relatively small product category, but the growth of the category is a strong secular trend. As markets grow, a greater percentage of sales shift to online channels, leading to e-commerce growth outpacing that of the category. Haypp Group is the unequivocal global leader in online sales of nicotine pouches, with a majority market share of e-commerce sales within the markets it operates. The company’s success is due to a mix of unique advantages that are difficult to replicate:

Across its platforms, Haypp offers the widest assortment of high-quality SKUs, the lowest prices, and fast shipping and also provides adult consumers with the most comprehensive product and category information.

Due to its size, Haypp generates significant data, allowing it to better refine its operations and provide data services to manufacturers, making it an integral partner.

Advertising of tobacco and nicotine is significantly limited. This extends to online, where major platforms restrict the advertising of addictive products. Haypp spends little on paid advertising and has instead focused on search engine optimization, resulting in it taking the lion’s share of organic search traffic with minimal added cost as the category grows.

Due to the strict nature in which Haypp operates and the types of products it sells, future legislative changes are far more likely to help than to hinder.

The above points act as a virtuous cycle, reinforcing the company’s position. The business sports low capital intensity and is set to recognize extreme operational leverage, fostering sustained organic growth and significant cash generation. Excess cash will be used for further growth opportunities or will be returned to shareholders.

Why does this opportunity exist?

Tobacco and nicotine remain deeply unpopular with investors, and ESG mandates have further restricted interest and available capital. Haypp Group is a microcap with a market cap of SEK 1.88bn and an enterprise value of SEK 2.1bn. In USD terms at the time of publishing, this equates to a $183mn market cap and $205mn enterprise. The company is listed on a small Swedish exchange with little awareness, coverage, and limited liquidity. The company has only been public for a few years, with the profitability of its core business masked by higher reinvestment in new markets. The nature of the industry Haypp operates in and the shrouding regulatory overhang pose undeniable risks. However, taking sensible liberties when assessing potential futures suggests the opportunity weighs far heavier.

Shareholder concentration

Haypp Group’s limited liquidity is amplified because the majority of shares are held by the top ten shareholders.

Lots of inside money. Lots of private, deep pockets. One particular deserves special mention. In September of last year, I began to talk with the team at Hudson 215 Capital, a reputable family office, concerning the global evolution of tobacco and nicotine on both product and regulatory levels. During a subsequent meeting, they shared their interest in Haypp Group and their perspective on its fundamentals and encouraged me to investigate. It did not take long for me to reach similar conclusions. I have the highest respect for the Hirschman family, and, always eager to learn, I’m deeply appreciative of all they have shared. Jason has been kind enough to provide a touch of commentary:

Harping on the final P, People, it’s imperative to look at who is steering this company.

At the wheel

Haypp Group’s management consists of:

Gavin O’Dowd - CEO, Chief Executive Officer - At Haypp Group since September 2017

Svante Andersson - COO, Chief Operating Officer & Deputy CEO - At Haypp Group since September 2017. COO since May 2023

Peter Deli - CFO, Chief Financial Officer - At Haypp Group since October 2020. CFO since May 2023

Gabriel De Prado - Chief Commercial Officer (CCO) - At Haypp Group since January 2020. CCO since August 2023

Markus Lindblad - Head of Legal & External Affairs - At Haypp Group since August 2018

Janne Kalian - COO, Chief Operations Officer - At Haypp Group since September 2018

Johan Hansson - CPO, Chief Partnerships Officer - At Haypp Group since April 2018

Hans Strömblad van Eijk - CMO, Chief Marketing Officer - At Haypp Group since March 2021

This team has extensive experience, including four members previously holding critical roles at British American Tobacco and one at Swedish Match. Before becoming Haypp Group’s CEO in 2017, Gavin O’Dowd worked at British American Tobacco for over nine years, with his last two roles being Finance Director of BAT Iberia and General Manager for Norway and Sweden. While at BAT, Gavin was responsible for acquiring the company that produced the product that would become the leading nicotine pouch in Scandinavia, Velo. I have had the pleasure of speaking with Gavin. He is direct, his passion is immense, and his expertise is evident. The collective vision and execution he and his team demonstrate are most impressive.

Haypp Group Operations

Haypp Group is fundamentally straightforward. The company operates a portfolio of e-commerce websites across a number of geographies to best serve two sets of customers:

Adult consumers seeking reduced-risk nicotine products

Suppliers of reduced-risk nicotine products

Winning the adult consumer

Regarding adult consumers, and in true Invariant fashion, it’s worth stepping back and thinking about what never changes, and there is no quote more relevant than what Jeff Bezos said in 2012 (emphasis added):

I very frequently get the question: ‘What’s going to change in the next 10 years?’ And that is a very interesting question; it’s a very common one. I almost never get the question: ‘What’s not going to change in the next 10 years?’

And I submit to you that that second question is actually the more important of the two — because you can build a business strategy around the things that are stable in time … In our retail business, we know that customers want low prices, and I know that’s going to be true 10 years from now. They want fast delivery; they want vast selection.

It’s impossible to imagine a future 10 years from now where a customer comes up and says, ‘Jeff I love Amazon; I just wish the prices were a little higher,’ [or] ‘I love Amazon; I just wish you’d deliver a little more slowly.’ Impossible. […] When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.

Nicotine pouches are essentially a perfect good for e-commerce: non-cyclical, small and uniformly sized, high value-to-size/weight, high purchase frequency, and low return frequency. They also happen to be surrounded by complex regulations. Due to its size, Haypp Group is able to offer the widest assortment of products at very low prices. Haypp’s prices are 20-40% cheaper than grocery stores and 30-50% cheaper than convenience stores, and while physical retailers have limited shelf space, Haypp is unencumbered. For nicotine pouches specifically, the company has more than 700 SKUs globally—roughly 7-20x more than the average physical retailer. The company can also get products into consumers' hands quickly. Haypp uses a mix of 3rd-party logistics warehouses, warehouses it owns, and warehouses it owns that have various forms of automation. As operations grow within geographies, the company invests to transition across these, with higher upfront costs for owned and even higher for automated. But at scale, this transition significantly drives down the warehouse cost as a % of order value and reduces the lead time until an order is packed. The company also partners with logistics and shipping companies across its respective operating geographies to ensure orders are delivered swiftly.

Equally important to price, assortment, and speed is a seamless user experience. This is also where Haypp excels. Its sites are intuitive, easy to navigate, and offer very little friction. Further considerations highlight just how serious this company is when it comes to quality and integrity:

The company employs a mix of age verification protocols through payment providers, online partners, and shipping partners. This has resulted in 100% of its transactions being age-verified.

Haypp shows extreme discretion over the suppliers it works with. All products seeking to be sold on its platforms must be sent to independent testing facilities to verify their quality—a cost eaten by the brand owner, not Haypp. Haypp also conducts background checks on companies wanting to have their products sold on its platforms to ensure appropriate expertise, capital, and strategy. Despite having the largest product assortment and being keen to increase it, Haypp actually rejects the majority of new companies. Haypp is critically protective of its reputation as a high-quality, responsible operator.

The high-quality experience and high-quality-low-cost products Haypp provides have built tremendous consumer affinity. ~40% of new consumers are recommended by friends, and the company boasts an outstanding 90% retention rate on second orders and beyond. Even more impressive is how the company attracts the rest of its consumers.

Online advertising opportunities are limited for the products Haypp sells, with platforms such as Google having terms of service greatly restricting the types of ads that can be run concerning addictive products. While Haypp does engage in paid advertising to a degree, it is a low amount, less than 1% of net sales in each of the last two years, which continues to shrink as a percentage as the company grows.

Nearly all of Haypp’s traffic is organic, most of which comes from organic search. Haypp has gained a significant advantage from its hyper-focus on search engine optimization (SEO), reflected in an ever-growing list of top-ranked search terms. The company receives ~65% share of clicks for positions 1-3 on Google’s search engine results pages. We can peek into the US market as an example:

The growth of the nicotine pouch category ensures more competition is coming. However, restrictions to paid online advertising mean that competitors can not simply brute-force their way to top visibility with deep pockets. Surely, competition can sink money into SEO efforts, but there is no guarantee of success, and building meaningful organic visibility takes time, often lots of time. Time is not something that many new competitors have—platforms such as Google have become increasingly good at identifying unsavory techniques companies use to artificially/temporarily boost rankings and have continually placed greater emphasis on all aspects of user experience rather than looking at a singular vector such as keywords. To ensure search results best match search intent, content, assortment, price, ease of use, and reputation are all factored in. Many previous competitors have entered the market and eventually folded shop because they faced a chicken or egg conundrum: How do you build material organic visibility without first investing significantly in the same breadth of offerings, competitive prices, and quick delivery, but how do you justify investing significantly in the same breadth of offerings, competitive prices, and quick delivery if you have no active consumer base and no material organic visibility to form one? Additionally, as a sub-scale operator, you offer no insights capabilities, you can’t source products at as favorable rates, and you likely need to outsource certain technical aspects of your infrastructure—all while navigating complex legal requirements. It’s a steep uphill battle.

Haypp has brought nearly all aspects in-house to best manage the technical infrastructure underpinning its organic online presence, leading to notable upfront costs and clear recurring costs to sustain the business. However, aside from having full control in reinforcing its position, the benefit is that a growing market results in growing traffic with zero added variable costs. The economics of this particular aspect are exceedingly favorable when, along with an absurdly high retention rate, its conversion rate on organic traffic is an astronomical 8% globally and even higher in markets where it has been operating longer term.

Further, the company is currently refining its ERP system, integrating it, and upgrading the infrastructure of its websites. Clear benefits include making operations more streamlined, improving site speed, accelerating development, customizing sites to cater to specific demographics, and further optimizing SEO—things the company already does well. This overhaul will also allow the company to use its existing infrastructure to expand into additional product categories and new markets. But there is another distinct benefit. Most of the industry uses e-commerce solutions that charge fees as a percentage of gross sales. Even Haypp has several sites using such solutions. However, most of Haypp’s sites use a custom system that it licenses from a provider in which it instead pays an annual flat fee. Over time, more of its sites will likely migrate to the newest version of the custom system, which would benefit margins as total volumes grow.

Winning the product supplier

Product suppliers need retail partners that won’t jeopardize their brand by selling to underaged users. For newly launched products, they also need to work with someone who can get them in front of adult eyeballs and help them understand the market. To succeed, they must overcome these hurdles without spending an arm and a leg, and speed is a must. There is no better route than partnering with Haypp Group.

Haypp’s consumer base is valuable not only because it is large but because it is well-understood. The company holds a decade’s worth of data covering products, consumer behaviors, market trends, and so on. This allows the company to continually refine its operations and sell its knowledge to brand owners. The company developed an Insights business four years ago, offering broad market data and custom data solutions. Haypp is now the largest provider of nicotine pouch insights in the world, and its platforms are optimal for running product trials, raising brand awareness, launching commercially, and identifying market opportunities and even potential M&A candidates. Using Haypp as a route to market is faster and more efficient than traditional paths, providing brand owners with better outcomes yet lower costs. Even the largest manufacturers work with Haypp, such as Altria, which operates solely in the US but is eyeing international expansion with new smoke-free products—the evidence is tucked into the footnotes of the last few quarters of its investor presentations:

Haypp benefits further by being the ideal go-to-market partner. Due to the accelerated rate at which new products hit the market, users are increasingly inquisitive to explore new products rather than sticking with a single brand. New and exclusive launches on Haypp’s platforms ensure active consumers return time and time again. The continued innovation and competition occurring in the brand space may be a challenge for incumbent manufacturers, but it is a tailwind for Haypp.

In its reporting, Haypp Group splits its operations into two segments: Core Markets, consisting of Sweden and Norway, and Growth Markets, comprised of the US, UK, Germany, Austria, and Switzerland. The countries making up these two segments have noteworthy contrasts, but each still holds considerable promise and illustrates Haypp’s leading position.

Core Markets

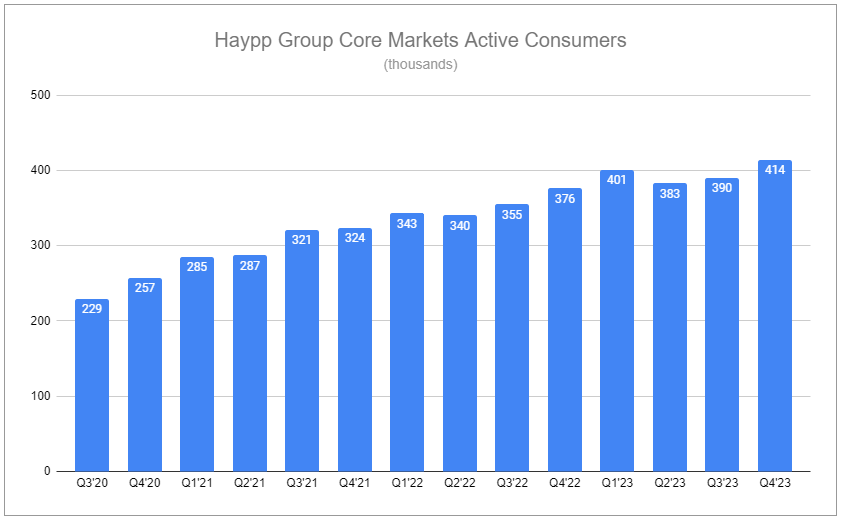

In Q4’23, Haypp’s nicotine pouch volumes in Core Markets grew by 36% year over year, net sales increased by 11.9%, and active consumers increased by 10%. For FY’23, nicotine pouch volumes increased 31% year over year, sales were up 12.2%, and active consumers increased by 15%.

Sweden has been preparing to increase cigarette excise notably, with excise on snus being minorly reduced, and Haypp has launched a preliminary pilot to expand into vaping in the country. The country is a brutally competitive market for nicotine pouches, and yet Haypp holds ~30% share of the total market and ~85% of the online market. Snus volumes are being cannibalized as users switch to nicotine pouches. This has accelerated as launches of innovative nicotine pouch brands continue to be introduced into the country at a rapid pace and Swedish adult consumers show higher interest in exploring new offerings.

Sweden means nicotine pouches, it is the most competitive and toughest market. If we can win here, we can win anywhere. And we are. - Haypp Group CMD 2023 presentation

Norway is highly regulated. Snus and nicotine pouches sit behind opaque closed doors in physical retail stores; all products must be in plain packaging. For brand owners, it’s practically impossible to raise consumer awareness in such an environment, and consumers have no way of learning about the specific qualities of products. This is perfect for Haypp. Online, along with offering a wide assortment and low prices, Haypp is able to provide comprehensive information to consumers regarding products and can clearly showcase all the differentiating factors.

Growth Markets

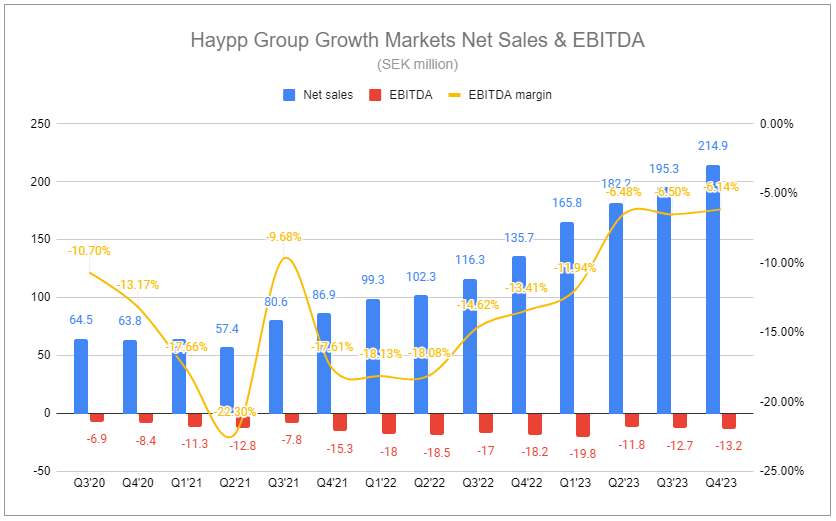

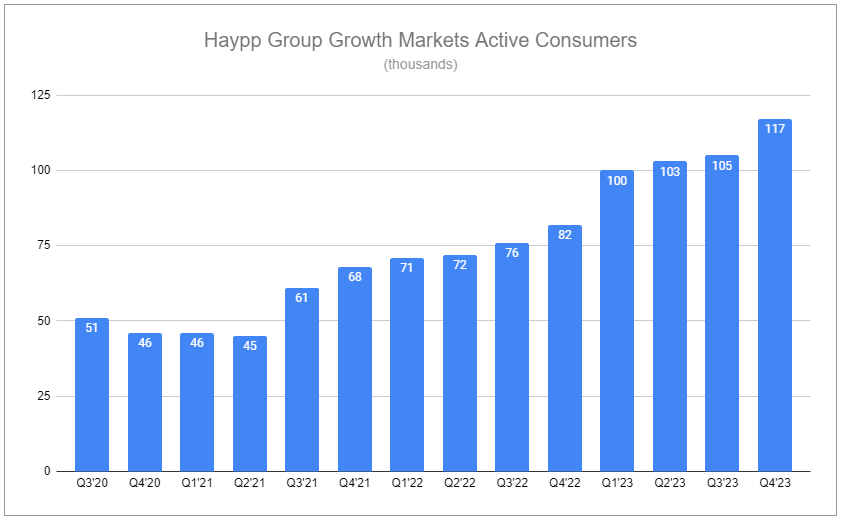

In Q4’23, Haypp’s nicotine pouch volumes in Growth Markets grew by 64% year over year, net sales increased by 58%, and active consumers increased by 42% y/y from Q4’22. For the full year, net sales were up 67%, and active consumers increased by 39%. Segment EBITDA has remained negative as the company has continually invested in scale. However, the company expects the segment to reach profitability in early 2024.

Haypp Group’s continued expansion has been largely financed by its Core Markets segment. Although operationally present for less time, the company has commanded a significant share of the online market throughout the US, UK, and DACH. While all are lumped together in reported financials, each is unique.

In Germany, offline sales of nicotine pouches are prohibited, resulting in a prime position for Haypp as demand for the category continues to grow. In Austria and Switzerland, growth remains similarly robust. The UK represents a small percentage of overall group nicotine pouch sales, but there appears a fervent interest, with Haypp Group’s associated sales growth outpacing the rest of the world on a percentage basis. In both of these countries, Haypp has recently launched Vapeglobe sites focused on selling disposable vaping products alongside nicotine pouches directly to adult consumers. Recent headlines concerning the UK’s intent to ban disposable vaping products have brought into question Haypp’s interest in exploring such opportunities. However, investment has been minimal for the UK vapeglobe site, and there is no preexisting installed base of consumers it services, so there is little risk to Haypp for using opportunities such as this to learn—retail margins for disposable vapes are even higher than pouches, and the demand is clearly there. If countries were to ban products like disposable vapes, it would be an unquestionable benefit for nicotine pouches as adult consumers continue to seek reduced-risk nicotine products. Haypp stands to benefit even more in the UK—following Brexit, getting products into the country became much harder, and the company invested in 3PL and self-owned warehouses within the country, leading to a notable acceleration of volumes.

Representing an immense opportunity for Haypp, the United States is the world’s largest market for nicotine pouches by far and deserves additional focus. In November 2023, Gavin O’Dowd, Haypp Group CEO, stated (emphasis added):

We established ourselves in the U.S. in almost 4 years ago -- it's actually 4 years ago last month. Soon as we got going, and at that point in time, we were selling roughly 20,000 to 25,000 cans of nicotine patches a month going through, we've now crossed 1 million. So it's about 40x larger at this stage. But we were also very much in the belief at that stage that we were happy to just keep pouring money into the U.S. in order to get it to scale, knowing that our model works with scale that it would become profitable in itself. We have now lifted our gross margin in the U.S.—from odd points in time, it was minus 20% EBITDA to now being almost profitable. So we've managed to grow share while at the same point in time, reducing the amount of investment and bringing the market towards breakeven at this stage. So our basis for how we scale and how we grow in the U.S. was, first -- we kind of view it going through 3 stages. First, get ourselves established and up to critical mass. Second, once we get towards critical mass, bring the market into profitability. And then once we get into profitability, which is where we're going to now, we have the profitable long-term growth ahead of us. And let's be frank, since we are 85% of the online sales within the U.S., we effectively are the market. So our decision for the last phase to sharpen it up and bring it on to an economically sustainable model was probably one of the key factors why we didn't accelerate market share faster in the past. But I think we are very well positioned to -- once we get it into profitability, we are very well positioned to scale in a profitable way from there.

…this (the US) is, by far, the biggest nicotine market in the world. It is the most valuable cigarette market in the world. It is the most valuable vape market in the world. And as Gabriel earlier alluded to, it is by far the most valuable nicotine pouch market in the world. Just one in perspective as regards to how big it is and nicotine pouch is now rapidly -- it is now gone into growth, particularly in the last 6 months. The growth of nicotine pouches in the U.S. in the last 6 months is more than the entire nicotine pouch market in Europe, including Scandinavia.

Due the its size and growth rate, competition in the United States has ramped up considerably. Yet, data most recently disclosed by Haypp still shows the company holding an 85% share of online sales of nicotine pouches. Critically, this is only a 2.5% share of total category volumes in the country. There is a clear trend that as the nicotine pouch category develops in countries and adult consumers in those countries become better acquainted with understanding the category, a greater percentage of sales shift to online channels due to adult consumers wanting to learn even more, explore more brands, and importantly, become more interested in purchasing at more attractive prices as their usage frequency increases. Therefore, there appears a long runway for Haypp’s sales of nicotine pouches to grow at a rate that far outpaces the category. This is especially true as the company continues to improve its logistics infrastructure. Haypp has a higher share of the total US nicotine pouch market in states where it has funded its own warehouses rather than using 3PL, accelerating delivery and improving retention rates.

Along with nicotine pouches, Haypp sells a variety of legacy oral tobacco products in the US. Since nicotine pouches are cannibalizing legacy oral tobacco volumes alongside cigarettes, it makes sense that Haypp’s legacy volumes still handily shrink. However, this is far from a bad thing in the absolute. Haypp can directly communicate with its active consumer base of legacy oral tobacco users and convey the value proposition of nicotine pouches, and nicotine pouches carry more favorable margin dynamics due to excise taxes.

A true concern is regulatory impact. While the FDA has issued prior statements regarding its intent to appropriately educate the public, stick to the science, and encourage users to switch to reduced-risk products, its actions have largely fallen short. I discussed many of its shortcomings in December’s Toxic State:

Further, there has been notable public concern raised over underage usage of nicotine pouches, although most alarmist rhetoric can be swiftly debunked, as explained in January’s piece, The ZYNpocalypse:

Nonetheless, a clear risk was noted in The Zynpocalpse subsection What can’t be ignored:

There is not a single nicotine pouch in the U.S. market that has received a Marketing Granted Order. For reference, a relatively similar product category, smokeless (oral) tobacco, has seen products such as Swedish Match’s General Snus SKUs receive PMTAs. Both General Snus and Altria’s Copenhagen have received Modified Risk Granted Orders via the MRTP process. These products pose far less risk than combustible products, but as they still contain tobacco, they carry greater risk than nicotine pouches. All other things being equal, it stands to reason that this would bode well for certain nicotine pouches to pass through the PMTA process and ultimately receive MGOs. However, it remains the case that ever since Brian King became director of the FDA CTP mid 2022, zero new products have received authorization through the PMTA process. Looking at other product types, recent denial orders for e-vapor include closed (disposable) systems, closed and open pod systems, and open tank systems. Even with many manufacturers receiving stays by legally contesting the MDOs, the FDA appears ardent in its roadblock position, and it remains unseen if the administration treats the pouch class any differently as it works through its backlog of PMTAs.

There is a potential future in which the FDA provides MGOs to a tiny set of nicotine pouches and denies all others. While this would not be catastrophic for Haypp, it would maintain the notably different environment relative to Core Markets where there is higher innovation and greater brand exploration amongst users, driving higher traffic and undoubtedly making Haypp’s Insights business much more valuable.

As a counterpoint, there is an opposite potential future, predicated on legal escalations following new products receiving Marketing Denial Orders, as covered in my most recent piece on Philip Morris International:

Counterintuitively, legal escalations do pose a separate threat from a competitive standpoint. ZYN, dominant in the United States, is largely so because it is the best of the first generation of dry pouches currently on the market. If the FDA concedes translating scientific substantiation of the product class’s reduced-risk profile into future modifications of its application process, it stands to reason that the door could potentially open wider for the hundreds of innovative products competing in Scandinavia. Although PMI has a pending PMTA for its moist pouch variant, heightened competition would challenge both the ability to retain market share as well as exercise price take.

Undoubtedly concerning for incumbents, such a future is ideal for Haypp. The rapid growth rate of nicotine pouches in the US has occurred despite all available brands being ‘version 1s’ of what exists elsewhere. What if the door not only opens wider but is entirely blown off of its hinges? Perhaps it is a far less likely scenario, but it would be one that creates a Cambrian explosion-like event. Category growth would accelerate, and demand for Haypp’s services from adult consumers and brand owners alike would follow.

Somewhere in the middle is a future in which the FDA begrudgingly concedes to scientifically substantiating the reduced-risk properties of nicotine pouches on a category level and provides MGOs to brands at a moderate pace. In this same future, certain states could take actions that include restricting flavors, increasing excise taxes, or prohibiting certain types of sales, including online. Ultimately, category growth will remain robust across most possibilities, and Haypp will fare far better than most due to its high integrity and 100% of its transactions being age-verified—a reputation that will bode well as other markets build more comprehensive regulatory frameworks around new product categories.

New Categories and Emerging Markets

Lapping the majority of its higher investment in its current Core and Growth Markets business, Haypp is aiming to pursue the following order:

New RRP categories in existing European markets

Nicotine pouches in new European markets

New RRP categories in new European markets

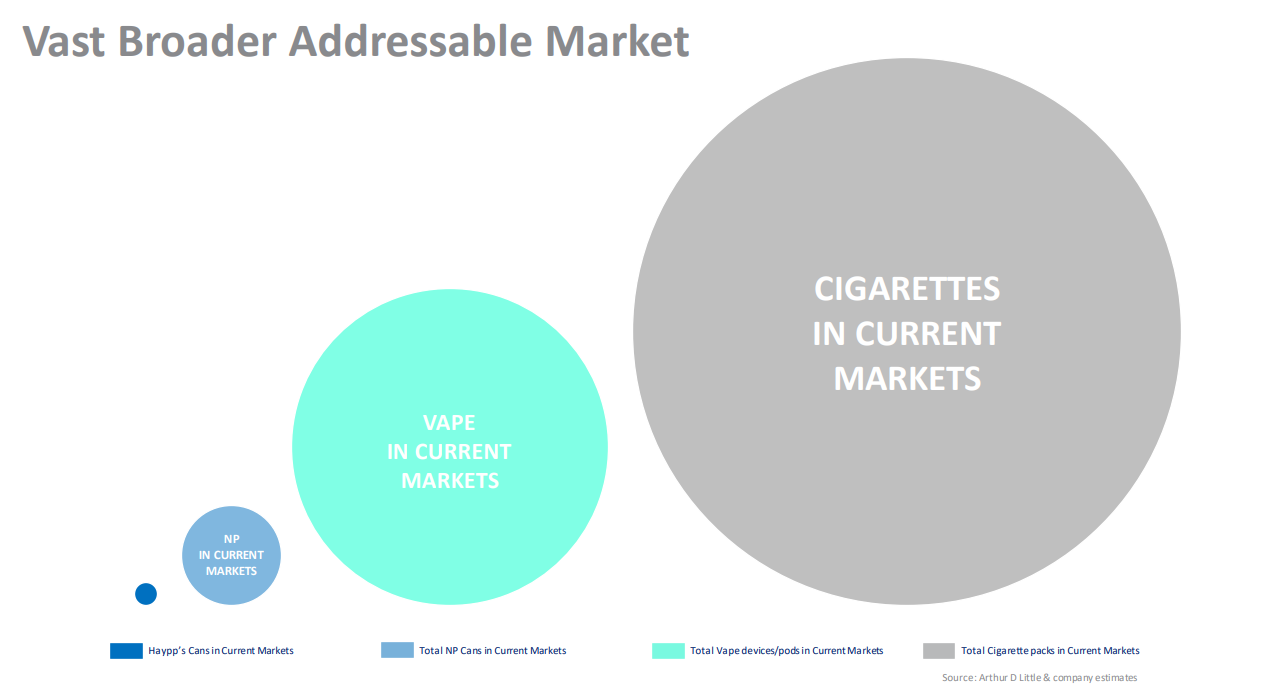

Begininng Q1 2024, the company will report a third operating segment, Emerging Markets. It is difficult to quantify what these opportunities might look like. While I am skeptical of most illustrations of TAM, which often misstate or inflate, slide 75 of Haypp’s 2023 Capital Markets Day presentation helps visualize the relative sizing of categories and where Haypp sits:

Risks

There are undeniable risks pertaining to Haypp Group’s operations and its equity. I will touch on merely a few.

(il)Liquidity

There are only several thousand shareholders of Haypp Group’s equity, with the majority held by the top 10 largest. The number of transactions and the total volume of shares exchanged each day is rather limited. Building a material position proves difficult. Exiting a sizable position may prove even more problematic with potentially wide spreads and an often thin order book.

Currency

Haypp reports and borrows in SEK, has transactional FX exposure primarily to EUR, GBP, and CHF, and has translational FX exposure mainly to NOK and USD. The company does not currently hedge its interest rate risk.

Competition

Fast-growing markets often entice an increasing number of new competitors. While Haypp Group holds numerous distinct advantages that are difficult to replicate, there is no promise that they will endure, nor for how long. Along with concerns of increased competition from specialty retailers, a sensible train of thought is:

Major online retailers, such as Amazon, have ToS prohibiting the sale of certain products because they are addictive.

As science continually substantiates the reduced-risk properties of novel nicotine products and the concept of tobacco harm reduction gains greater acceptance, these major online retailers may alter their ToS to allow products such as nicotine pouches.

This is a risk, but it is one that is unlikely to materialize anytime soon. While tobacco harm reduction frameworks are gaining broader acceptance globally, total progress is slowed by proponents of prohibitionist policies, the stigma of tobacco extending to reduced-risk products may persist despite wider adoption, and considerable regulatory and liability complexities remain that many major retailers will likely prefer to avoid.

Google/search/discovery

Two front-of-mind risks appear very similar: Either Google changes its algorithm which displaces Haypp-owned sites in search results, or Google is replaced by new discovery engines (something…something…AI).

Google changes its algorithm constantly. New discovery tools are popping up left and right. In all cases, any platform's value and sustained viability is its ability to match users with the parties who can best meet their needs. So long as Haypp remains steadfastly focused on delivering on price, assortment, speed, and ease of use and continues to provide better than the competition for consumers and brand owners, roads will continue to lead to Haypp.

Big brother

Legislative actions are and will continue to reshape the regulation and taxation of tobacco and nicotine products. Certain parts of the world may very well end up banning flavors or specific new product categories or will substantially increase the excise tax rates of new products. However, as described in previous sections covering specific markets, those taking contrasting routes are likely to be more common, and the fact remains that certain legislative actions that appear net negative for the industry as a whole can be incredibly beneficial to Haypp Group. This is especially true due to Haypp's demonstrable commitment to maintaining high integrity and showing that 100% of its transactions are age-verified.

Regarding the taxation of new categories of nicotine products, it is inevitable that more countries and comprising parts will apply new and higher excises—governments always want their cut. However, it is a certainty that legacy tobacco volume declines will be offset by greater price increases, and governments embracing tobacco harm reduction have an interest in keeping excises low on reduced-risk products to incentivize users to switch. The relative affordability of nicotine pouches specifically will likely remain extremely favorable.

Changes in product and adult consumer behavior

One looming risk that is difficult to quantify is the continued evolution of next-gen nicotine products and how consumers will behave in terms of trial, adoption, preference, poly-usage, and usage frequency. Continued innovation within the nicotine pouch category is a definite tailwind for Haypp. But there is no guarantee it will navigate potential new other categories equally well. It may very well underinvest in underestimated opportunities and overinvest in others that fall short. Likewise, the rapid growth of the nicotine pouch category has led to manufacturers needing to continually reinvest in production capability. Haypp’s success is tied to this, and the company must maintain strong relationships with those parties.

Valuation

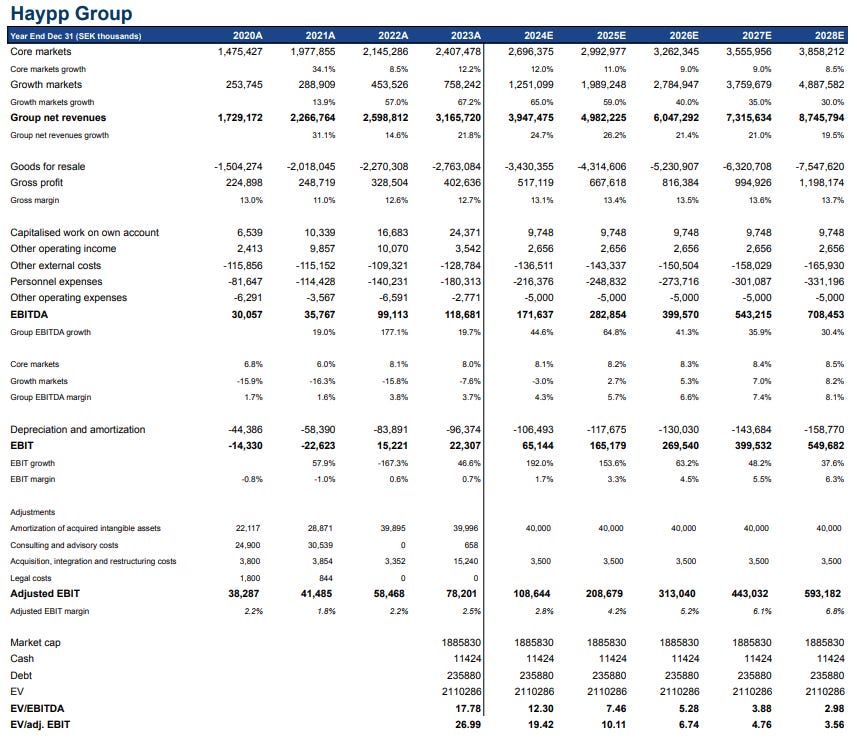

There is considerable difficulty in modeling potential futures for a microcap company focused on a fast-growing nascent category. With that said, we can start by looking at guidance provided by management and then connect that to some key data points. In November of last year, management stated (emphasis added):

We previously said we would reach SEK 5 billion in revenue by 2025, predominantly through organic growth. We now state that we will reach SEK 5 billion in revenue in our current core and growth markets, solely from organic growth. And any revenue we get from the emerging opportunities, which Svante will talk about later on today, will be incremental and above that. We previously guided on profitability that we would reach high single-digit adjusted EBIT in the medium to long term. We are now bringing that forward, and we're stating that we will reach that target in our core and growth markets by 2025. We will reinvest part of that into the opportunities which we're seeing in both adjacent categories and adjacent markets, which we'll talk to a little later also. And on dividend policy, we previously had a very clear statement that we would not, in the foreseeable future, be declaring any dividend. We're now coming back to a position of saying that we see we're going to be generating substantial free cash flow from this business, and it is not highly leveraged and our debt has been coming down.

Management reaffirmed these targets during the Q4’23 call. The guide on the SEK 5 billion top line is quite straightforward. With 2023 net revenues being SEK 3.16 billion, the company needs to grow its top line by ~25% for each of the next two years. This appears quite doable with a 90%+ retention rate on top of steadily growing active consumers, up 19.7% in 2023, considering >~80% of net sales are from returning customers, order frequency increases by >~45% from 1st to 5th purchase, and average order value increases >~10% from 1st to 5th purchase. Core markets could produce fairly stable growth, driven by nicotine pouch volumes partly offset by the cannibalization of snus. Growth Markets have accelerated and, in the last year, contributed near equivalent group growth as Core Markets despite being ~21% of net sales in 2022, becoming ~31% in 2023. The US will be the largest driver moving forward, and even if category growth were to decelerate, a small additional shift to online channels can more than make up the difference.

The ‘high single-digit adjusted EBIT’ is actually defined at 5-7%. Adjusted EBIT margin has steadily expanded following the 2021 acquisitions, but the guide requires a rather pronounced jump considering it was 2.47% in 2023. If margins of Core Markets remain approximately stable, it requires Growth Markets to do something radical. How? A few considerations:

Nicotine pouches were 41% of total 2022 volumes and became >50% in 2023. Not only are Growth Markets growing much faster, but nicotine pouches sport a better gross margin which is even higher in Growth Markets.

Supplier agreements run on calendar years and are based on the size entering the year. With Growth Markets having a much higher base, there is a material step-up from Q4 of one year to Q1 of the next. Further demonstration of this should be shown next quarter.

Ironically, not much granularity is provided for Insights, as its contributions are tucked into the two reporting segments. However, it has previously been disclosed that Insights is a much lower contribution for Growth Markets relative to Core Markets but is rapidly growing. Insights products essentially carry an upfront development cost and subsequent sales are very high margin. Insights sales are predominantly front-loaded at the start of the year with higher rates than the year prior.

Frankly, getting from modest gross margin improvement to a substantial adjusted EBIT margin improvement is a function of scale: massive growth in volumes against operating expenses that are set to grow much slower. For Growth Markets, we already saw a similar radical step up in segment EBITDA margin in FY’23.

By being willing to look rather ridiculous, we can form a paint-by-numbers model, translating the thinking above into enterprise figures. If I am certain of anything, it’s that this does not perfectly capture the future and some of the numbers are bound to be wrong. But precision is never the goal. This act serves to illustrate the company’s direction.

This doesn’t get us to the guided range of adjusted EBIT margin, but the above shows operational costs growing at a rate above what is likely for existing business while capitalized work on own account and other operating income have been substantially discounted. Despite management stating they believe Growth Markets will become profitable in early 2024, the illustration would imply a negative segment EBITDA margin for FY’24 if Core Markets remain near stable. Add-backs are light, and considering the significantly lower enterprise multiples just a few years out, there is quite a bit of leeway in what can be tolerated.

Going from enterprise to equity, net financing in FY’23 was unusually high, courtesy of a deeply negative translational adjustment of intercompany loans. Perhaps not sensible, but we can continue a similar net impact for conservatism’s sake. The company’s Net debt/EBITDA rests at 1.7x, with SEK 235mn of debt to which it will continue to pay interest, and along with this is the superficial input showing a quarter of pre-tax profits going to the tax man. There remains continued dilution related to warrants courtesy of the company’s long-term incentive plan. While it could be mapped out more dazzlingly, a rate of 3% per annum is used instead.

Again, results show multiples merely a few years out that are abysmally low for the qualities of the business. Applying an x13 earnings multiple five years out suggests an IRR of nearly 20%—which suggests a significant margin of safety for the current business. However, while the illustration shows what the current business could produce, actual results will differ materially. The company will be investing 1-2% of its top line into new categories and new markets. This will weigh on margins in the interim while pushing the top line faster. Nonetheless, the business model has been demonstrated profitable in Core Markets and as Growth Markets inflect, future growth will be funded by operations without needing to take on additional debt. Further, the business remails capital light, with capex equating to 1.5-2% of sales per annum. Working capital requirements remain favorable, with inventory turnover remaining absurdly high. There was a substantial increase in inventories in Q4’23, but this was completely elective, designed to take advantage of anticipated inbound price increases for specific products in early 2024. Due to the lack of capital intensity, following 2025, management has reiterated the possibility of instating a dividend if opportunities for reinvestment at high returns diminish. Judging upon execution so far, finding more places for reinvestment is far more preferable than capital returns in the medium term.

Wrapping up

Haypp Group, on the surface, is far more speculative than the basket of tobacco names that I hold and routinely cover. However, it is distinctly advantaged and provides unique, concentrated exposure to a secular trend and a separate part of the value chain. Moving forward, regardless of how Haypp’s equity performs, there will be tremendously valuable learnings generated from the company that will help better illustrate the evolution of the industry. You can expect me to cover both in detail.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Haypp Group, as well as positions in tobacco companies such as Altria, Philip Morris International, British American Tobacco, Scandinavian Tobacco Group, and Imperial Brands.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Good article as always,

I ordered a few times from them already. They delivered exactly what ordered and fast (and you get a little candy with it). The problem with the stock is that i don't see the long term moat.

The question i ask myself is: Would i order online if every supermarket or gas station would have a wide array of nicotine pouches to offer? In Germany nicotine pouches are forbidden in retail, but you can order them legally from Sweden, Denmark etc. in normal quantities.

I understand why a German like me orders there (no legal alternative), but not why someone from Denmark, Sweden, Poland etc. orders online (more choices of flavors?).

If they would be sold at every supermarket, corner store, gas station etc. Would i not just simply buy them there while filling up my car?

I don t know one person ordering cigarettes online. Prices are fixed and you get them in every small village via vending machines ( ok, no niche brands. But brands like Marlboro, Lucky Strike, Camel, Pall Mall etc.).

I wish you all a good start to the week :).

Greetings Ulrich

On the Haypp Group website, in the Excel spreadsheet entitled "Selected-KPIs-and-financial-statements-Q120-Q423", in the tab entitled "5_BSheet", under net debt, the line entitled "Bank Overdraft" is relatively large each quarter, with an ending balance on 31 Dec '23 of SEK136Mn. In the same Excel spreadsheet, in the tab entitled "6_CF", under "Cash flow from financing activities", the line entitled "Change bank overdraft" is also quite large, with quarterly amounts [in SEK millions] of -41.9, -43.3, -24.9 and 21.8. Why does Haypp overdraft its account(s)? What are the constraints on such overdrafts and how long may they continue?