“Without change there is no innovation, creativity, or incentive for improvement. Those who initiate change will have a better opportunity to manage the change that is inevitable.” - William Pollard

Company Overview

In 1902, British American Tobacco was formed as a joint venture between UK-based Imperial Tobacco Company and U.S.-based American Tobacco Company. Not too clever with the names back then, were they? Experiencing massive changes in both ownership structure and operations, including a reorganization in 1976 to form a new holding company, and more recently, its 2017 acquisition of Reynolds American, the company has turned into a multinational dynamo.

Presently, British American Tobacco (BAT) owns an impressive portfolio of tobacco and nicotine products, including:

Legacy Categories

Combustible brands, such as Lucky Strike, Pall Mall, Dunhill, Kent, Rothmans, Camel, Natural American Spirits, and Newport. The company also has less prominent brands including Vogue, Viceroy, Kool, Peper Stuyvesant, Craven A, State Express 555, and Shuang Xi.

Traditional Oral including moist snuff tobacco brands of Grizzly, Mocca, Granit, and Kodiak, and snus products (including Camel snus).

New Categories

Vapour (ENDS) - Vuse

Tobacco Heating (HTP) - Glo

Modern Oral (TFNP) - Velo

Championing its “A Better Tomorrow” strategy, BAT has seen rapid, accelerating growth in its New Category segments. Complimenting these New Categories, the company is moving Beyond Nicotine by actively investing in health and wellness R&D, bolt-on M&A, and strategic collaborations. These initiatives fit into the company’s overall “Faster Transformation” objective, in which, along with growing new consumer product brands, BAT is simplifying its organizational structure through rationalizing combustible SKUs and reducing related business units. These programs, paired with its ability to generate substantial operating cash flow, have allowed the company to meaningfully deleverage since 2017 while remaining committed to returning significant capital to shareholders.

The company’s corporate headquarters are in London, England. Shares trade on the LSE under the ticker BATS and on the NYSE under the ticker BTI. Shares are also available on the JSE and the KN. Presently, the company holds the following credit ratings and outlooks:

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Investment Thesis

Since fully acquiring Reynolds American, British American Tobacco has steadily deleveraged while paying an increasing dividend while also engaging in significant R&D and M&A, and now, the company’s transformation is reaching a powerful inflection point.

Despite macro headwinds, BAT is seeing sustained and significant growth across New Categories, which are now contributing significantly to sales. Continued scaling will enhance operational leverage that will generate substantial long-term value. BAT is trading at a depressed multiple, and management has signaled its intentions to prioritize share repurchases to further drive shareholder returns.

Industry Overview

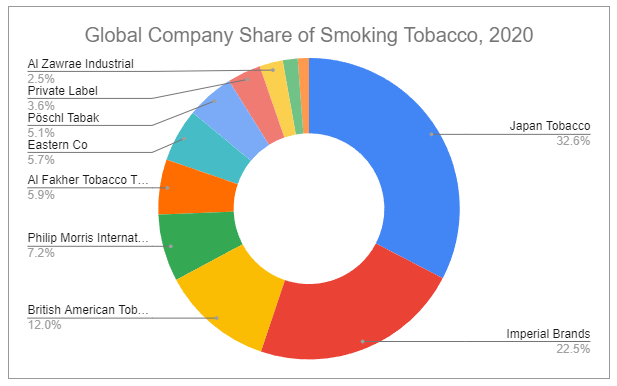

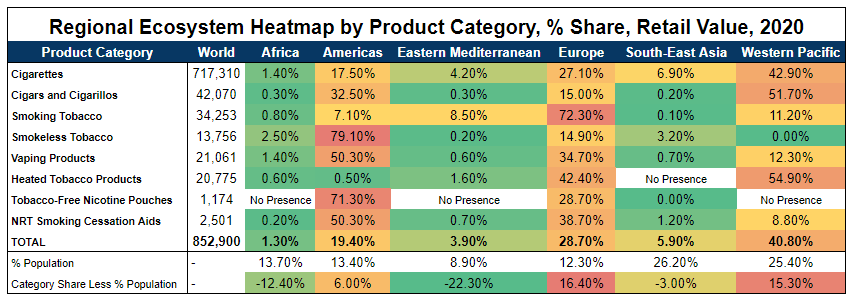

The global tobacco industry is quickly transforming into a space offering a wide variety of nicotine products. Aiming to substantiate reduced risk claims, major manufacturers have sunk billions into R&D to stay ahead of the curve. This has led major manufacturers to pull further ahead - though they have already held a lead due to historically significant regulation.

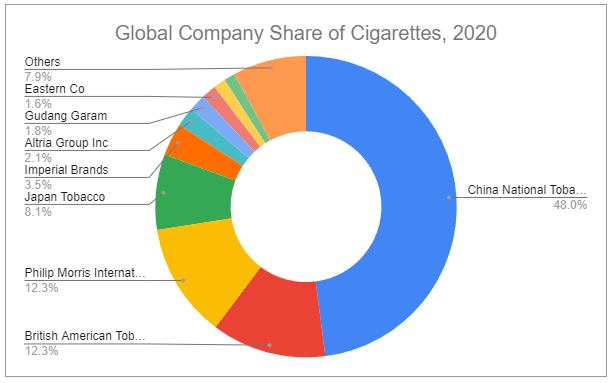

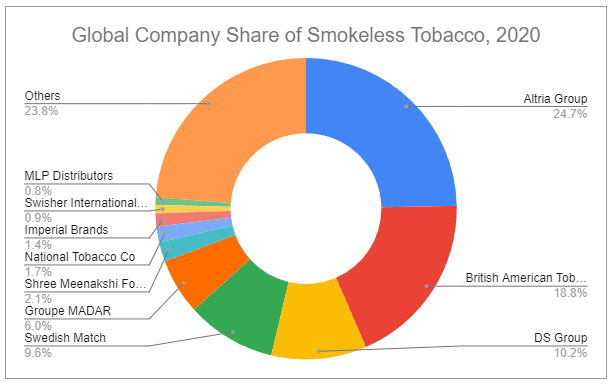

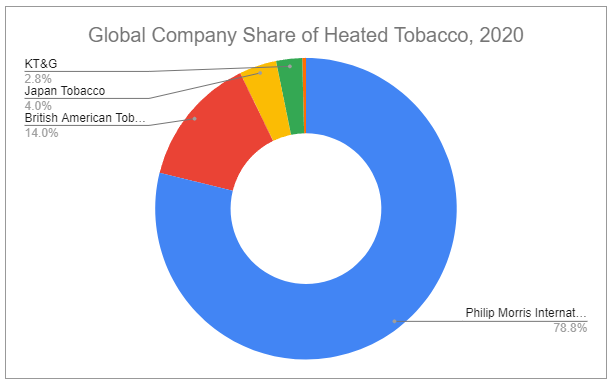

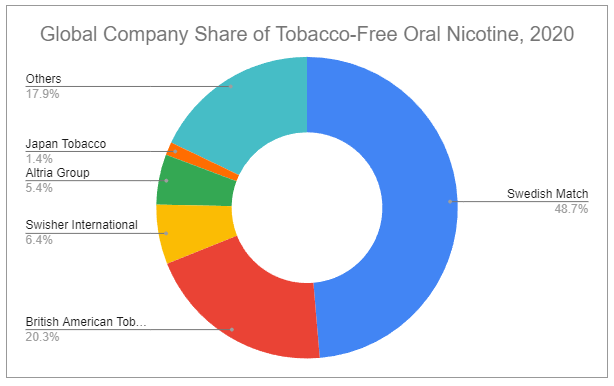

The consolidation of market share is rather clear, as per recent global data:

Industry Outlook

The future of the nicotine industry can be condensed into several key points:

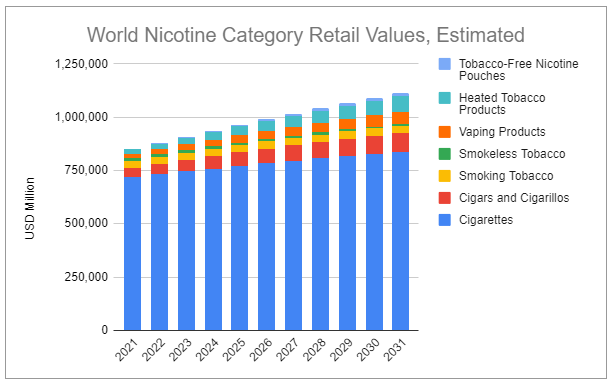

Cigarettes account for most retail value globally, and while volumes are slowly declining, retail value incrementally increases due to pricing.

New categories, like Vaping, Heated Tobacco (HTP), and Modern Oral (Tobacco-Free Nicotine Pouches), are fast-growing, though are currently still small pieces of overall volumes and retail value.

The retail value for all nicotine categories has been continually growing.

For comprehensive data illustrating the industry’s outlook, you will best be served by reading The New Era of Nicotine.

Regulation

Regulation has been one of the greatest value drivers for the nicotine industry. Since nicotine and regulation will forever be intertwined, understanding the related dynamics is absolutely essential.

To understand past, present, and potential future U.S. regulations, read this.

For a broad look at global regulation and taxation, read here.

Condensed thesis:

Governments, consumers, and manufacturers all benefit by aligning:

Regulation will continue to insulate incumbents (major manufacturers) from new competition. This includes market share for legacy products, such as cigarettes, as well as new category products which will be protected from incredibly high scientific standards and associated costs as a barrier to entry.

Government objectives will shift towards tobacco harm reduction policies, which will include incentivizing consumers to switch to RRP products by taxing related products at substantially lower rates than combustibles.

Healthier consumers that live longer, paired with higher profitability of RRPs, will substantially increase CLV for manufacturers.

***If you are unfamiliar with the regulatory dynamics and skipped the above two links, go back and check them out. Seriously.***

Operations and Segment Specifics

British American Tobacco’s operations are split into two primary segments:

Combustibles, comprised of cigarettes and OTPs.

Non-Combustibles, including Traditional Oral, as well as New Categories such as Vapour, THP (they refer to as Tobacco Heating Products, also known as HTP/heated tobacco products), and Modern Oral (Tobacco-Free Nicotine Pouches).

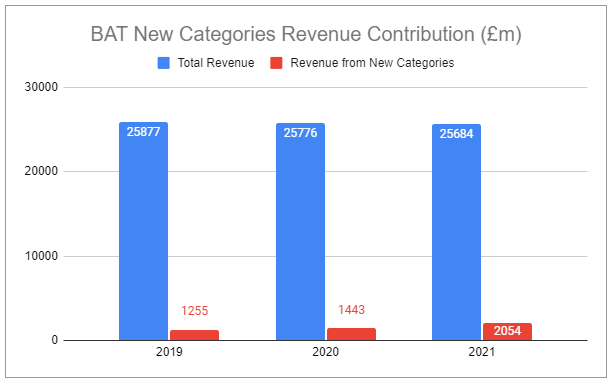

Prioritizing strategic brands and new category products, British American Tobacco is transitioning from cigarette-focused operations with net-declining volumes and growing value to multi-category-focused operations that will grow both overall volumes and value. The company has ambitious goals, including £5bn in New Category revenue by 2025 and 50 million consumers of Non-Combustible products by 2030.

To achieve this, the BAT is not only focusing on new categories but geographic expansion—which represents a massive opportunity.

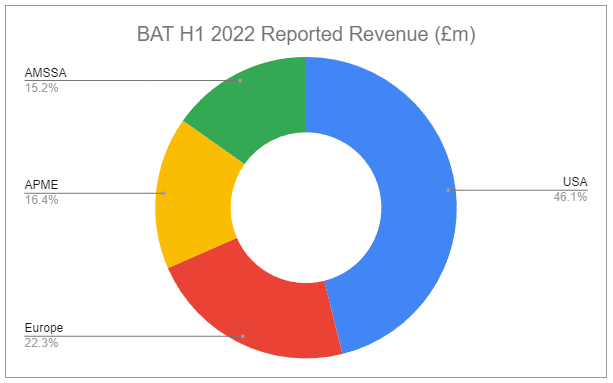

BAT has a unique global footprint. While Philip Morris International operates globally, ex-U.S. and ex-China, and Altria operates exclusively in the U.S., BAT overlaps the two, operating all across the globe, ex-China. BAT geopolitically categorizes its operations into four areas:

Europe

USA

APME (Asia-Pacific and the Middle East)

AMSSA (Americas and Sub-Saharan Africa)

BAT’s H1 2022 financial performance was mixed. Reported diluted EPS was down significantly, -42.9%, due to charges related to Russia, DOJ and OFAC investigations, and Egypt. However, group revenue was up 3.7%, and adjusted diluted EPS was up 5.7% at constant currency.

Combustibles

British American Tobacco’s Combustibles segment is comprised of Cigarettes and OTPs such as make-your-own and roll-your-own products. Brands include Lucky Strike, Pall Mall, Dunhill, Kent, Rothmans, Camel, Natural American Spirits, and Newport. The company also has less prominent brands including Vogue, Viceroy, Kool, Peper Stuyvesant, Craven A, State Express 555, and Shuang Xi.

In H1 2022, BAT’s Combustibles accounted for 83.7% of revenue. Value share gained +10 bps while Combustibles volume share decreased -10 bps. Paired with +4.8% price/mix, this lead to 0.6% revenue growth for the period.

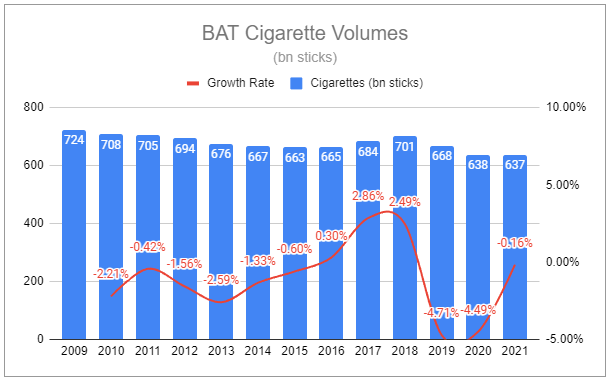

Cigarettes

Global tobacco volumes are expected to decline ~3% for FY 2022 due to the U.S., Turkey, and uncertainty over Russia / Ukraine. I expect pricing to more than offset that for the period. From 2018-2021, BAT experienced >3% CAGR Combustible revenue growth and +20bps Combustibles value share growth per annum on avg. There is no guarantee that BAT’s pricing power in the U.S. will be able to continue to offset volume declines as it has in the past. However, BAT brands span a wide portion of the value spectrum, and with analytics, automation, and strict COGS control, management is confident they have the tools necessary to maintain overall profitability trends. Additionally, as other BAT products take total nicotine market share in the U.S., the company gains more flexibility in the tactics it uses to balance share, volume, and value. With all that said, BAT’s Combustible volumes in the U.S. were down 13.4% in H1 2022. The company cited macro factors and specifically higher fuel prices for the weak performance. While fuel prices have come down since, continued weakness in the U.S. could massively dampen BAT’s profitability.

OTP - MYO/RYO

British American Tobacco’s OTP category primarily consists of make-your-own and roll-your-own products. In H1 2022, OTP volumes were ~8.2 billion, down ~11% y/y. Pricing power can offset losses in revenue and bolster profitability but ultimately will amplify future declines. I expect this trend to continue, especially as New Categories gain popularity.

Non-Combustibles

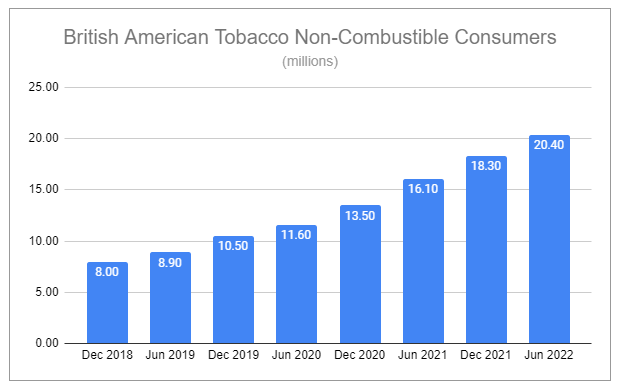

Since 2018, BAT’s consumer base of non-combustibles has experienced a 30% CAGR.

Traditional Oral

British American Tobacco’s Traditional Oral segment includes the moist snuff tobacco brands of Grizzly, Mocca, Granit, and Kodiak, and snus products (including Camel snus). BAT’s traditional oral volumes jumped following its 2017 acquisition of Reynolds American and volumes have hovered around ~8 billion stick-equivalents for each of the last three years.

Camel Snus is currently in a Substantive review of its MRTP application process with the U.S. FDA.

New Categories

British American Tobacco’s transformation largely rests on the continued success of its New Categories. From 2018-2022, New Category revenue experienced a 31% CAGR and has recently accelerated. Not only does BAT boast the most geographically extensive of operations, but it is also the only major manufacturer that wholly owns established products in all three major New Categories, and now, the company is reaching a critical inflection point that is underappreciated.

While in pound sterling terms, BAT’s revenue has been close to flat for the past several years. At face value, flat revenue looks rather unattractive (and it’s even more unattractive in USD terms). That’s fair, but it also masks what’s going on under the hood. In aggregate, New Categories are not yet profitable. In 2021, total New Category losses decreased by a measly 10%; however, in H1 2022, aggregate losses associated with the segment decreased by 50% (£281m), 2/3 of which was driven by scale and operating efficiencies, including 45% New Category revenue growth for the period, as well as marketing optimizations which reduced customer acquisition and retention costs for New Category products by more than 30%. Additionally, in H1 2022, all New Categories grew revenue faster than volume, showcasing BAT’s pricing power and ability to set the pace for the industry. While New Category volumes are still completely dwarfed by cigarettes, non-combustible products (New Categories plus Traditional Oral) now comprise 14.6% of BAT’s total revenue, 2% greater than 2021. Removing Traditional Oral shows BAT’s New Categories are currently ~10% of revenue. This should grow, especially as BAT continues to:

scientifically substantiates reduced-risk claims for New Category products, leading to advantageous regulation and lower taxation relative to legacy products

broaden consumer awareness of the existence and benefits of new products, scale, and enter new markets

see shrinking combustible volumes; accelerated by New Category adoption and prevalence

I expect the continuation of these dynamics will not just lead to sustained net volume and revenue growth but also enhanced profitability driven by incremental margin expansion. Continued expansion into new markets and introductions of new products guarantee this will not happen linearly, but it did take effect in H1 2022:

Vapour (Vaping, ENDS - Electronic Nicotine Delivery Systems) - Vuse

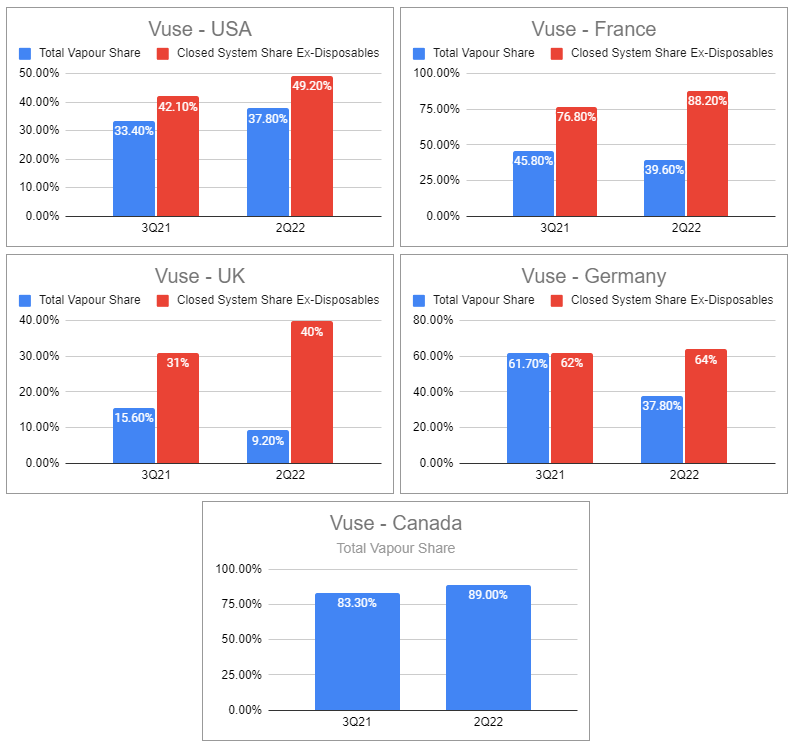

Vuse is the #1 global vaping brand in the world. Recently overtaking JUUL’s #1 position in the United States, it is also the #1 vaping brand in Canada, France, and Germany. In H1 2022, BAT Vapour revenue grew 48% at constant currency, volume was up 19%, and category share increased to 34.7%.

Vuse’s performance to date has been impressive, but it is worth noting that the popularity of disposables is increasing, which should pressure closed system products. Vuse’s trajectory across the top 5 markets, which make up ~80% of industry revenue, shows mixed trends:

BAT Vuse Key Market Performance

With that said, growth has been accelerating as BAT continues to launch improved products:

Vuse Go, BAT’s new disposable, is quickly growing and is close to becoming the #2 vaping product in the UK by retail value, just three months after launch. Offering six flavors at a premium pricing, Vuse Go is BAT’s fastest product launch in history. BAT has noted that there has been very little cannibalization of BAT’s other product offerings from Vuse Go.

Vuse ePod 2+, a Bluetooth-connected vaping device, was launched in Canada in May. It has a dedicated app, allowing for device locking to prevent youth access, as well as cloud control and consumable subscription options. Consumers have been extremely receptive to this device version, and it has quickly become over half of all related device volume sales in Canada since its launch.

BAT’s Vuse Vibe and Vuse Ciro have finished the PMTA process in the U.S. and have both received Marketing Granted Orders (MGO) in their original flavor. Menthol is still under review. Prior product versions, such as Vuse Solo, also successfully gained MGOs, showcasing BAT’s continued ability to successfully navigate extremely challenging regulations. It should be expected for BAT to continually comply and submit PMTAs with all future interactions of products.

Vapour products do not contain tobacco and do not involve combustion. The majority of related products use synthetic nicotine - which may be subject to additional/new and unique regulations in the future.

HTP (Heated Tobacco Products/Tobacco Heating Products) - Glo

HTPs are designed to heat but not burn tobacco, releasing a nicotine-containing vapor. Research shows that this results in a substantial reduction in exposure to Harmful and Potentially Harmful Constituents (HPHCs) relative to cigarette use. The tobacco used in HTP devices is specially formulated into unique, device-specific sticks (heated tobacco products, heated tobacco units/HTUs).

Glo, BAT’s heated tobacco product, is the #2 brand in the world. While far behind Philip Morris International’s IQOS in terms of total share, Glo is quickly gaining traction, with H1 2022 revenue up 44% at constant currency, volume up 30%, and category share reaching 19.6%. While critics will quickly highlight that Glo’s volume share of the total nicotine market is a mere 3.3%, I think it’s important to understand that means Glo’s future runway may be extremely long.

BAT Glo Key Market Performance

In July, Glo Hyper X2, a smaller, lighter device was launched in Japan, the market with the highest current HTP penetration. Using induction heating technology, heating and taste can be adjusted to consumer preference. Associated consumables were also expanded, providing greater consumer choice.

While Glo’s growth has been impressive, it is key to note that it is currently only available in 26 markets, and critically, BAT recognizes zero HTP sales volumes in the United States. It remains to be seen just how well HTP products will be received in the extremely lucrative market, as PMI’s IQOS had limited penetration prior to being forced to stop sales. In late 2021, an ITC ruling found IQOS infringing on multiple Reynolds patents. An issued injunction continues to prevent IQOS from being imported into the United States, though PMI believes they will have a solution, one way or another, that will allow them to reenter the U.S. sometime in 2023.

Even if HTP begins to gain traction in the U.S., which may fail to materialize as quickly as vaping, there is no knowing exactly if and when BAT will enter the market with its own products.

Modern Oral (TFNP - Tobacco-Free Nicotine Pouches) - Velo

Velo is an alternative to traditional tobacco products and is a tobacco leaf-free nicotine pouch consisting of high-purity nicotine, water, flavorings, and other ingredients. Currently, it is the #1 Modern Oral brand in Sweden, Norway, Denmark, and Switzerland.

However, the situation is a bit complicated.

BAT’s nicotine pouches were initially marketed as Velo in the U.S. and Lyft in the UK (EPOK, prior to a formulation change in which the pouches became tobacco-free). Lyft sales quickly expanded to markets such as the Scandinavian countries, where the product was well received. Following this, BAT decided it was going to unify the brand, shifting Lyft pouches to Velo (except for Sweden, which would retain the use of the Lyft brand).

However, the product in the U.S. is quite different in quality compared to the rest of the world.

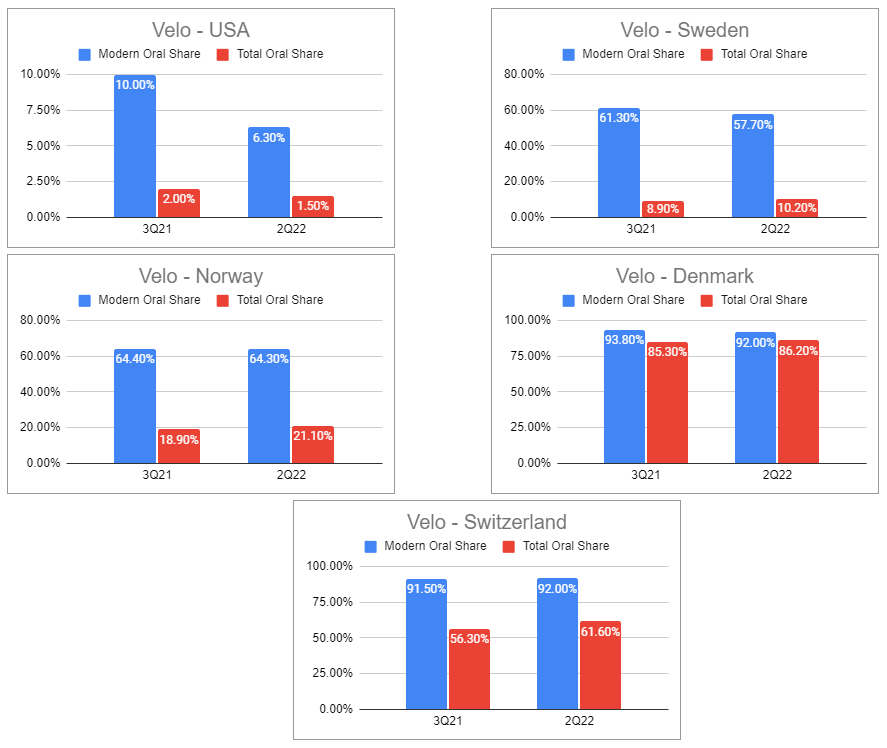

BAT Velo Key Market Performance

The U.S. version has struggled to grow in volumes and market share relative to well-received competing products such as Altria’s on! and Swedish Match’s Zyn tobacco-free nicotine pouches. Velo comes in four strengths in the U.S., including 4mg, 6mg, 10mg, and 11mg pouches. Non-U.S. Velo comes in a wider range of strengths, including stronger versions, which consumers find preferable. Consumer anecdotes regarding U.S. Velo include criticisms:

Flimsy plastic packaging with poorly placed labeling

Lower-quality pouch form factor

Weaker flavors and aftertaste

Excess powder within the container

Despite such weakness in the highly profitable U.S. market, Velo continues to grow rapidly elsewhere. In H1 2022, Modern Oral revenue was up 37% y/y at constant currency.

Furthermore, Velo pilot programs throughout the rest of the world have been going exceedingly well. In South Africa, the brand is achieving a >30% conversion rate to active users. Additional geographic expansion is planned throughout the rest of 2022 which I expect to show similar success. Moving forward, Modern Oral will likely be the single most affordable RRP product available in many markets. This is critical in many parts of SEA and Africa, where costs associated with other products, especially HTP devices, may be prohibitive.

BAT submitted Pre-Market Tobacco Product Applications (PMTAs) for its Velo products in 2020 and are currently under review.

Other + Investments

ITC

British American Tobacco holds a substantial stake in ITC LTD (formerly known as the Imperial Tobacco Company of India). The company has a near-monopoly of the tobacco and nicotine space in India, controlling >75% of the cigarette market. To diversify beyond tobacco, the conglomerate has moved into FMCGs, hotels, software, paper, and agribusiness ventures. While its revenue is seemingly diversified, ITC still generates >80% of its EBIT from cigarettes.

Rising over 30% so far in 2022, the current market cap of ITC is ~$49.37 billion. As of H1 2022, BAT’s stake equated to 29.38%, equalling ~$14.5b. In 2021 BAT’s share of post-tax results from associates and joint ventures (predominantly ITC) was £415 million, down from £455 million the previous year. BAT’s assets of investments in associates and joint ventures totaled £1,948 million at the end of 2021, and dividends from associates totaled £353m in FY 2021.

Vaping in India was completely banned in 2019 by the Prohibition of E-cigarettes Act, however, BAT’s ITC stake could be used to influence policy and allow BAT to enter the market with new products. From the 2022 Deutsche Bank Global Consumer Conference, Tadeu Marroco, Finance and Transformation Director (emphasis added):

…India will be the largest country in terms of population in this decade. So it's not one more country, so start there. ITC is performing well. You see their share price is back to the pre-pandemic levels now. And we believe that in new categories we might have opportunities in India. The oral tobacco size of India is largest than the rest of the world, as big as that. So, if you add all that... So we talk about modern oral in the US, in the Europe, if you add all that across the world, India is still larger than that. So we believe that we might have opportunities there. And that's the strategic reason why being there at this point in time. I don't know if we're going to stay another 15 years or not, but the fact is that you note that there is a ban for foreign direct investment in tobacco in particular. So it's hard to get assets to that market. It's hard to pull out, but we are satisfied with the performance of ITC for the time being. And we are hopeful that these new categories could present towards a strategic opportunity in future.

VST

VST Industries is another India-based conglomerate that manufactures and distributes cigarettes. Initially known as Vazir Sultan Tobacco Company, it is an associate undertaking of BAT. While fully independent and registered in 1983, BAT, through subsidiaries, owns 32.16%. Dwarfed by ITC, VST’s market cap is ~$627m, making BAT’s stake worth ~$201m.

Beyond Nicotine Opportunities

British American Tobacco has closed over 17 investments to accelerate its exploration into target areas such as health and wellness and functional Products for focus, energy, and relaxation.

KBio Holdings Limited

In January 2022, British American Tobacco announced the launch of KBio Holdings Limited (KBio). The role of the subsidiary is to accelerate and leverage the R&D and production of novel treatments.

From BAT’s website:

KBio will explore new opportunities to develop its plant-based production system, which has the potential to offer greater speed, scale-up opportunity and thermostability. The new company will focus on delivering treatments for rare and infectious diseases by realising and expanding the potential of both the plant-based technology platform, as well as its existing clinical and pre-clinical vaccines and antibody pipeline.

Organigram

In March 2022, British American Tobacco took a 19.9% stake in Canadian medical cannabis maker Organigram, valued at ~£126 million.

From the 2022 Deutsche Bank Global Consumer Conference, Tadeu Marroco, Finance and Transformation Director (emphasis added):

So we have signed development agreement with the Organigram. Organigram is a licensed cannabis producer company, Canadian company. And we want to understand more about this in order to be able to be there in case the regulatory environment evolves. And we are also using our corporate venture capital that we set up in 2019 to be able to explore opportunities in that space of natural written moods enhancement on edibles, on orals and beverage, and trying to see if we can have, you know, leverage on that based in the synergies that we can find the group.

Management and Culture

Executive Leadership

Bowles, Jack, Chief Executive Officer

Marraco, Tadeu, Finance and Transformation Director

Abelman, Jerome, Director, Legal and External Affairs and General Counsel

Comin, Luciano, Comin, Regional Director, Americas and Sub-Saharan Africa

Dijanosic, Michael, Regional Director, Asia-Pacific and Middle East

Vandermeulen, Johan, Regional Director, Europe

Meldrum, Guy, President and CEO, Reynolds American, Inc.

Iqbal, Javeb, Director, Digital and Information

Khan, Zafar, Director, Operations

Kim, In Hae, Director, Talent, Culture and Inclusion

Lageweg, Paul, Director, New Categories

O’Reilly, Dr. David, Director, Scientific Research

Wheaton, Kingsley, Chief Marketing Officer

Leadership

British American Tobacco’s management has long been aware of the health risks that combustible products pose. Along with developing reduced-risk products and actively investing in Beyond Nicotine, the company is focused on delivering value by leveraging its culture and remarkable diversity. From BAT’s website:

Few other companies are as diverse as BAT. We employ people of 140+ different nationalities in management roles across the Group We have 141 different nationalities, from a wide range of ethnic backgrounds, in management roles across the Group. Our target is to achieve at least a 50% spread of distinct nationalities in all our regional and functional leadership teams to better mirror our consumer base. In 2021, this was achieved for 92% of our leadership teams.

We value this kind of diversity because it encourages innovation, creativity and different ways of thinking; it creates a fascinating place to work, with opportunities to collaborate with a wide range of people from various countries, cultures and with different perspectives.

BAT’s headcount has remained relatively stable, with an increase in 2017 reflecting the 5000+ employees absorbed from Reynolds American.

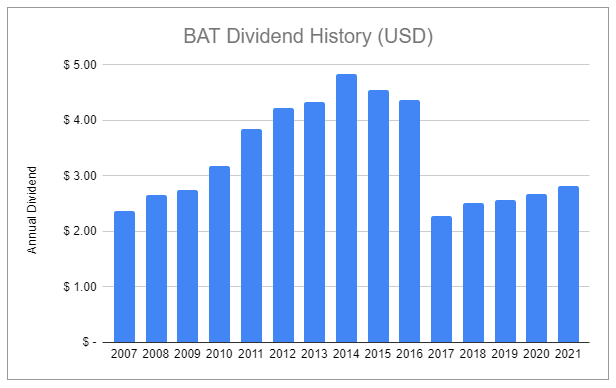

British American Tobacco has remained committed to returning capital to shareholders. The substantial cut to its dividend in 2017 was due to its acquisition of Reynolds American. Nonetheless, the company has resumed dividend hikes while delivering its balance sheet. BAT’s Management has recently stated they are on track to reach FY2022 guidance and have expectations to generate over £40b of FCF over the next 5 years.

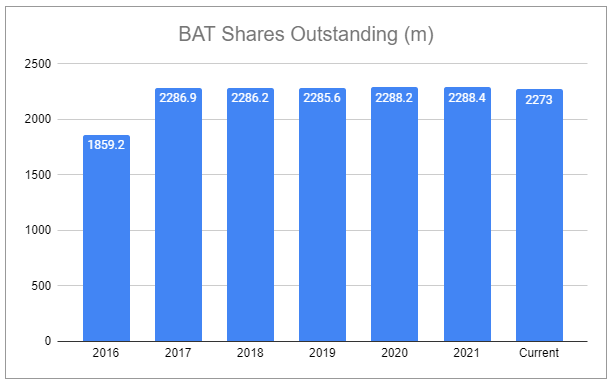

Likewise, shares outstanding increased due to the structural nature of the Reynolds American deal. While share count had stagnated during the deleveraging process, BAT initiated a £2.0 billion share repurchase program in Feb 2022 and has signaled future program expansion.

Additional Risks and Considerations

Future Regulation and Taxation

While past regulation has been a net positive for major tobacco companies, that may not be the case for future regulation. This is especially true in new categories, where rules and frameworks around the world continue to evolve. While I strongly believe many new products are (or will be) scientifically substantiated to be reduced-risk, there is no guarantee that governments will continue to adopt policies centered around tobacco harm reduction. While that would seemingly be boneheaded, it certainly aligns with the natural tendency for governments to muck things up. Along with specific tax treatments for RRPs, other regulations may substantially impact BAT’s overall profitability, including rulings on synthetic nicotine, characterizing flavors, nicotine content limitations, and specific products.

*For the U.S. specifically, there is currently proposed legislation that would ban menthol as a characterizing flavor in cigarettes. Related headlines have caused BAT and other tobacco equities to fall in the past. BAT has a substantial share of the U.S. menthol cigarette market. However, looking at historical precedent in other geographies, it appears such legislation would not materially impact total volumes.

Consumer Preference

An under-discussed risk to the future of BAT and the industry broadly is that while consumer preferences for legacy brands are established, it remains uncertain if New Category products will be able to do the same. If brand loyalty is not as strongly established, profitability will be muted. This would be amplified if regulations ever become more lenient on smaller producers; potentially flooding the markets indefinitely and leading to a race to the bottom in pricing.

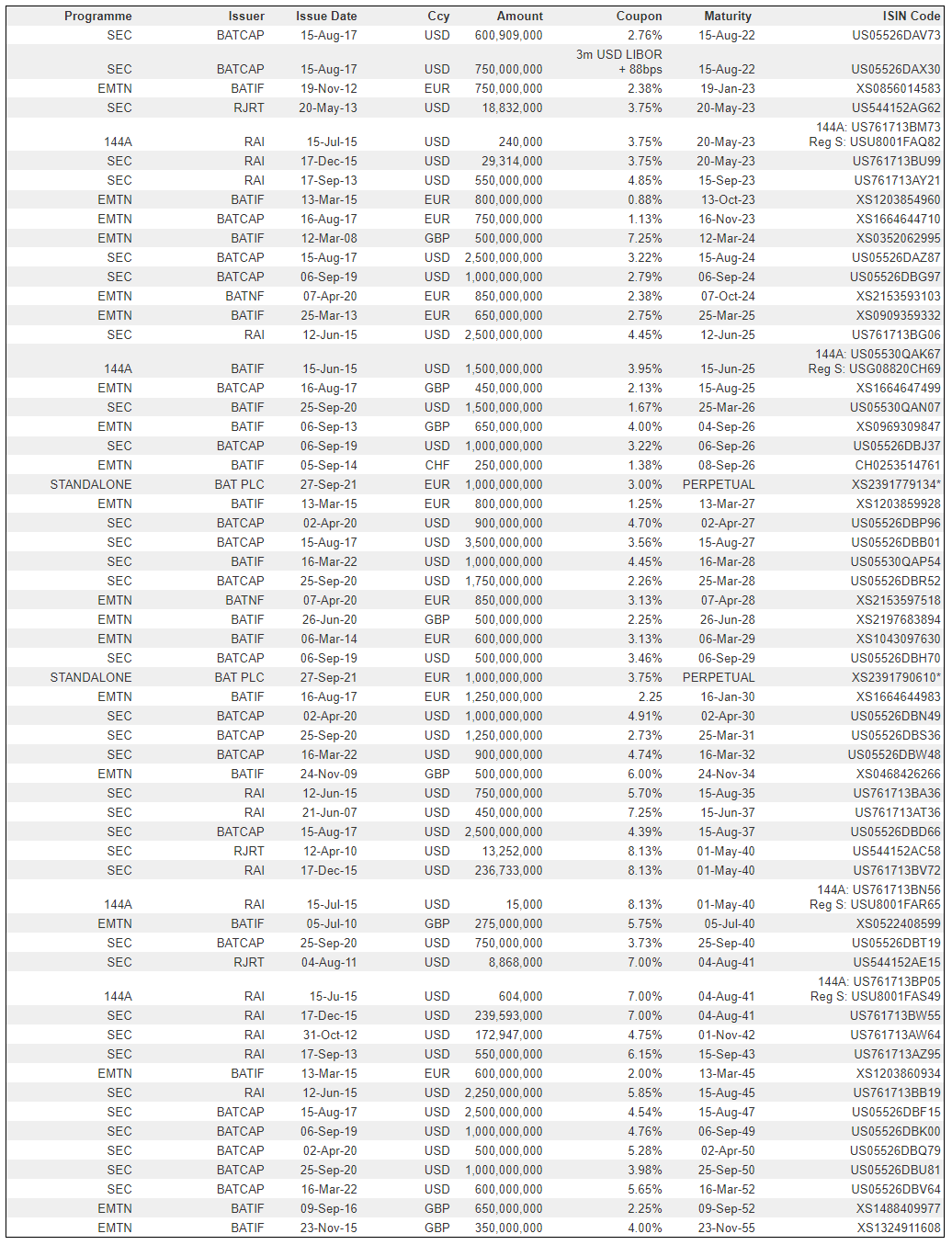

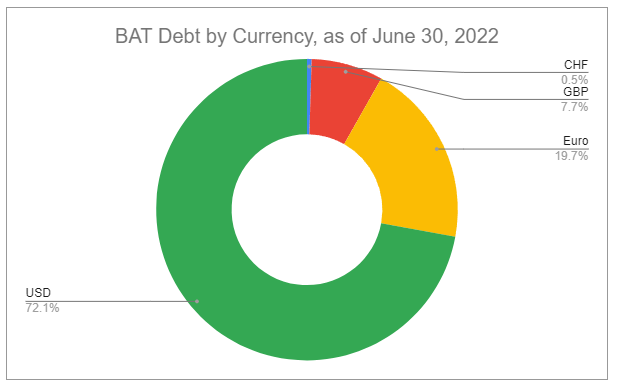

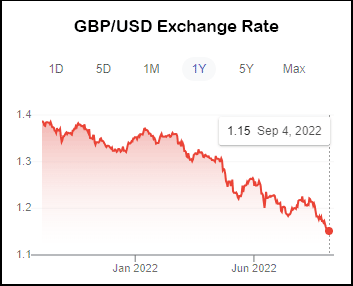

Debt

Over 90% of BAT’s debt is at fixed rates and holds an average maturity of 10 years. However, net financing costs have recently increased. This is driven by rising interest rates and the weakening of the Sterling against other world currencies.

While British American Tobacco substantially increased its debt to acquire Reynolds American in 2017, the company has meaningfully deleveraged since. The company currently has £44.8b in debt, £4.1b in cash, and holds:

an interest coverage ratio of 7.1

a total debt/EBITDA ratio of 3.8

Current guidance and strong cashflow conversion should allow BAT to further bring down its adjusted net debt to adjusted EBITDA and keep it in its 2-3x target range.

Future M&A

While we can hope that management has learned from the past, we should fear any future acquisitions that look like BAT’s historical attempts at fervent diversification. Aware of the terminal risks surrounding the cigarette business, British American Tobacco began to diversify aggressively in the 1960s. The company moved into paper, cosmetics, food, eventually retail, and even insurance. BAT ultimately divested the majority of these other interests. While not all were done at a nominal loss, the opportunity cost was immense.

It does appear that the company’s current Beyond Nicotine initiatives, while not trivial in price, are much more measured so far.

Illicit Trade

Despite global efforts to combat illicit trade, counterfeiting and cross-border sales continually evolve, which is a constant negative headwind for the tobacco and nicotine industry. This results in billions of illegal cigarettes and other unregulated tobacco and nicotine products annually. The illicit market is particularly large in:

Montenegro

South Africa

Malaysia

Libya

Global Supply Chains

Rising costs associated with the manufacturing and distribution of products may impact not only BAT’s profitability but BAT’s ability to service demand for its products. This is especially true for New Category products, which not only are experiencing growing demand but are more complex to produce.

British American Tobacco has thus far navigated the challenging macro environment impressively, especially thanks to pricing power and its cost savings initiatives. In 2021, total recognized savings were £1.3bn. In H1 2021, Bat achieved £1.5bn in annualized cost savings six months earlier than expected and is looking to further increase that amount by end of the year. These savings are largely driven by:

Supply chain optimization

Automation

Digitization

Rationalizing combustible SKUs (since 2017, combustible SKUs have been reduced ~30% and related business units have been reduced by 40%)

Foreign Exchange

As BAT operates globally (ex-China) in many currencies and recognizes earnings in GBP, it is important to consider FX dynamics for future prospects. Volatility in currency exchange rates may drastically impact future results. BAT’s geographically diverse operations somewhat protect it from adverse effects, and FY2022 guidance includes a transactional FX headwind of ~2% and a translational FX tailwind of 6% for adjusted diluted EPS. From the perspective of a U.S.-based investor, FX dynamics present one of the greatest risks for BAT, even though BAT derives a great deal of revenue in USD, which has recently strengthened.

Russia and Ukraine Conflict

On 9 March 2022, British American Tobacco announced that it had suspended all business and manufacturing operations in Ukraine. On 11 March 2022, BAT announced that its ownership of the business in Russia was no longer sustainable in the circumstances. As a result, BAT initiated a process to transfer its Russian business in full compliance with international and local laws. BAT continues to evaluate their options, though the company does not expect the transfer of the business to have a material impact on the remainder of its supply chain. The company has stated its commitment to ensuring the safety of its 2,500 employees in Russia.

As per IFRS, BAT has thus far recognized total impairments totaling ~£1b for the Russian assets it intends to sell once a local buyer is lined up. This recognition led to reported diluted EPS down -42.9% in H1 2022. Please note, while the assets are for sale, there is no discontinuation of operations for these assets, though volumes and revenue will be notably impacted if those operations are eventually sold:

DOJ and OFAC investigations

British American Tobacco is currently being investigated for suspicions of breach of sanctions by the United States Department of Justice (DOJ) and the United States Department of the Treasury’s Office of Foreign Assets Control (“OFAC”). BAT remains highly engaged and compliant in discussions and hopes to find a resolution through settlement.

Due to these ongoing investigations, BAT has recognized a provision of £450 million in H1 2022. There is also no guarantee that these investigations will specifically end in a settlement, and if/when a settlement is reached, a potential settlement sum could vary from this amount.

Litigation

Litigation continues, not just with governments but also as operators clash with one another in highly contested markets. I expect this to continue and for total associated costs to rise as major manufacturers compete over the next generation of products. The following list is not by any means exhaustive and instead illustrates several currently contested issues:

Dryft vs Swedish Match

In late 2020, BAT’s U.S. arm acquired the nicotine pouch assets of Dryft Sciences LLC, giving an estimated valuation of $458 million. BAT rebranded Dryft’s U.S. portfolio under its existing global MON brand. However, Swedish Match (SWMA) brought forth several legal actions against the company. BAT is now alleging that SWMA, having filed suits across multiple venues, was simply trying to overwhelm the competition with meritless legal battles.

BAT is seeking $1.2 billion in damages, as well as other relief.

Altria

Still pending, Altria has sued Reynolds, the subsidiary of BAT in North Carolina, for patent infringement over the Vuse line of vaping products.

Philip Morris International

PMI and BAT continue to contest the merits of each other’s patents regarding HTP technologies in areas including the U.S., the UK, Germany, and other parts of Europe. PMI has won many such cases, and while BAT’s Reynolds was favored in 2021, leading to an injunction banning the importation of IQOS in the U.S., PMI succeeded earlier this year in invalidating parts of some related patents.

ESG

While it is clear that ESG proponents have long been outspoken against the tobacco and nicotine industry, BAT continues to actively engage in activities it believes will make the world a better place. Along with developing reduced-risk products, the company has made substantial efforts to curb its environmental impact, including:

Focused elimination on unnecessary single-use plastic in packaging

Reduction in value chain emissions

Focus on working towards carbon neutrality

I’m generally skeptical of most ESG focuses since, along with the fact that globally there is a clear lack of uniform definitions, there is a lack of accountability and provability for voluntary initiatives. Nonetheless, the company remains committed, and paired with promoting RRPs over combustible products, this may cause the company to be eventually seen in a more positive light by investors and regulators.

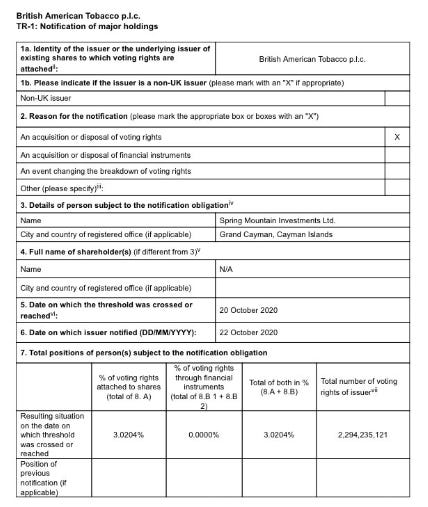

Kenneth Dart

Kenneth Dart is a reclusive billionaire living in the Cayman Islands and was the heir of William F. Dart, who founded the Dart Container Corporation. While his exact net worth is unknown, he seemingly deployed the majority of it into shares of major tobacco companies. In late 2020, Dart took initial stakes in BAT and Imperial Brands. The transactions were made via his Spring Mountain Investments fund, and he has increased his stakes since.

As of earlier this year, it looked like Dart owned >8% of BAT and ~5.2% of Imperial Brands. What’s Kenneth’s end game here? No one can quite know for sure. The last time Dart talked to the media was in 1993. However, he is not known to be a passive investor and is no stranger to coercing other parties to his will. Will he eventually push for BAT to spin off a part of its business or perhaps up its leverage and push capital returns? We’ll have to wait and see.

Valuation and Pricing

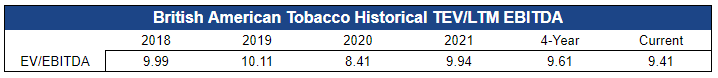

Relative Valuation - Exit Multiple

I valued British American Tobacco using a 10-year exit based on backing out equity from an EV/EBITDA multiple and factoring in forecasted dividends and share repurchases. This approach felt appropriate, as BAT’s operations, like many other names I cover, are incredibly capital-light. CapEx, historically, is rather predictable relative to sales, and other reinvestment needs are minimal.

In 2021, Ukraine and Russia accounted for 3% of revenue and a slightly lower amount of adjusted profit from operations. BAT’s management has stated they intend to keep Russia included in their financial reporting until after the future sale of related assets is finalized. I have proactively removed related contributions from 2022 onward in this model, guaranteeing that these numbers do not line up with reported results or other estimates or models you may see.

Key Assumptions:

Cigarette volumes will maintain decline trend, offset by pricing power, resulting in retail value growing ~1.5% per annum.

BAT cigarette market share will remain relatively stable.

New Category sales volumes will modestly decelerate from recent acceleration and will flip to net profitability in H1 2024, driven by growth, decreasing CAC and retention costs, and price/mix.

Current FX dynamics will persist.

Continued supply chain constraints and input inflation.

Cost savings initiatives will incrementally expand past £1.5bn per annum.

Estimated ~£420m R&D, £1.2b D&A, £715m CapEx, £100m SBC run rates for medium-term outlook.

Operating margins will expand by ~10-20 bps per annum.

Effective tax rate ~25%.

Zero contribution from Beyond Nicotine.

Zero contribution from ITC and VTS.

BAT will extend its current share repurchase program to maintain its current buyback pace.

DPS will increase 2% per annum; less than half the 5Y average.

No significant future M&A.

Results suggest that BAT is significantly underpriced. The easiest bit of criticism to provide is that this model is in USD and not GBP, and actual results may diverge greatly based on prevailing FX dynamics. Nonetheless, the inputs used are far from whimsical, and there are additional considerations that could lead to substantially higher returns:

While I removed Russia from the results, related operations have already contributed to H1 2022 results and in reality, will continue to contribute until related assets are sold. A sale could take longer than others are forecasting.

Excluding ITC and VTS ignores non-trivial post-tax results contribution to the tune of £400m+ and dividends from associates totaling >£325m annually. The exclusion of related equity stakes is also substantial.

Sales could grow faster, and margins could expand more significantly.

Greater capital could be returned via dividends and buybacks.

The exit multiple is a paltry 9.41. This is in line with the company’s multiples post the acquisition of Reynolds. I will never rely on the assumption of multiple expansion for forward returns, but I think there is a reasonable chance for BAT to re-rate as New Categories continue to grow and the company’s prospects become more evident.

These points could ultimately push BAT’s IRR towards mid or high teens. But let’s not forget the stark negatives:

FX dynamics and geopolitical strife continue to negatively impact recognized financial performance.

Glo is far behind IQOS in terms of scale and market share, and has not yet become available in the United States.

Velo is losing share in the U.S. and is seemingly inferior to the overseas version.

Vuse, while gaining closed system share, is losing total vapour share in certain key markets.

BAT New Category products, in aggregate, are not yet profitable and will have many regulatory challenges in the future.

BAT U.S. cigarette volumes have recently declined at an elevated rate relative to historical norms.

This list sounds quite bad—and it is! It leads me to believe British American Tobacco has the widest spectrum of potential future outcomes relative to its peers. However, I also believe it heavily skews to the upside.

Relative Valuation - vs. Peers

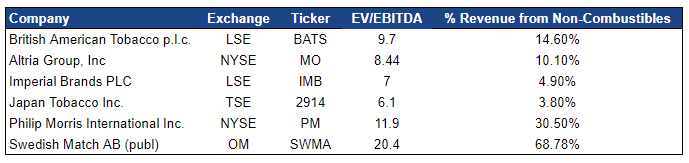

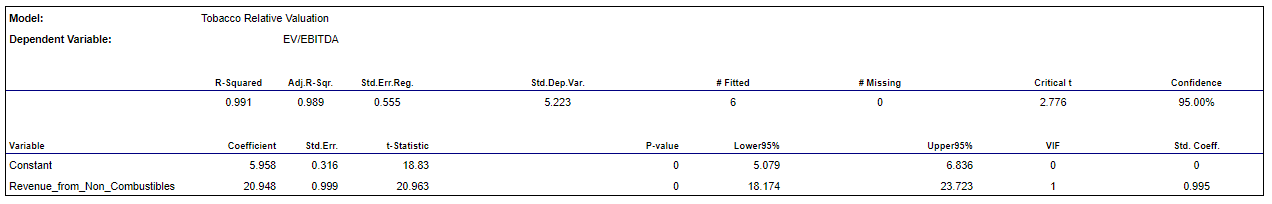

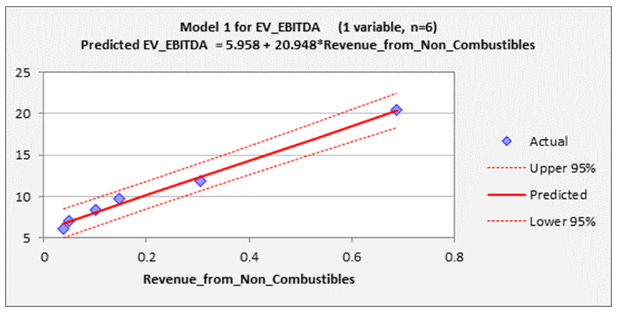

Due to the consolidated nature of the tobacco and nicotine industry, a comparison is limited. This is especially true since many names are either considerably smaller than BAT or are more linked to tobacco as a commodity rather than to marketable consumer goods. Five companies remain to compare directly to British American Tobacco. I ran a simple regression to normalize the EV/EBITDA for each company by weighing the percentage of revenue each derives from non-combustibles as of their most recent quarterly filings.

The resulting regression equation:

5.958 + 20.948 (% Rev from Non-Combustibles)

This gives British American Tobacco an implied EV/EBITDA of 9.02, ~7.5% lower than its current multiple.

With such a small dataset, the luxury of doing a more robust regression isn’t really afforded. I think it’s worth taking the results with a large dose of skepticism, and as always, it’s worth digging into each name individually and weighing the nuances yourself. It won’t take long to uncover plenty of considerations, such as:

While Altria derives 10.1% of revenue from non-combustibles, the majority of segment revenue is from traditional oral and not modern oral products (though on! is fast-growing).

PMI generates 30.5% of its revenue from non-combustibles, but it’s 99.9% from IQOS, meaning the company faces concentrated product risk.

Japan Tobacco experienced 13.6% RRP volume growth in Q2 2022 but only 0.6% RRP-related revenue growth, indicating a lack of pricing power and/or the use of steep discounting to drive growth.

This extends far beyond just RRP and non-combustibles considerations. Each company holds different market and value shares, products, brands, geographical operations, debt levels, management, capital allocation track record, etc. The list goes on and on.

As I’ve mentioned in previous writings, the historically low multiples for the tobacco industry as a whole pose an interesting question. Are these companies fast-melting ice cubes that ESG proponents smartly avoid? Or are they relatively cheap cashflow machines bolstering their terminal value via next-generation products that help consumers switch away from combustibles? While not all companies listed are equal, and uncertainties remain, I’m inclined to side with the latter.

Simplified Pricing

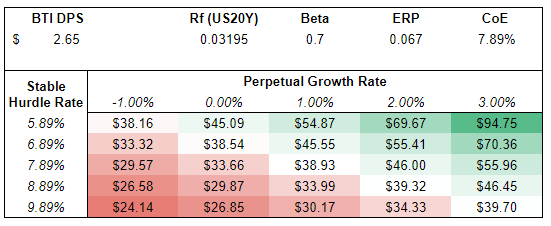

Gordon Growth Model (GGM)

British American Tobacco has a long history of paying and increasing its dividend. I would argue that BAT, thanks to New Categories, is entering a period of moderate growth and that the GGM may be inappropriate to use, as it would undoubtedly over-discount. Nonetheless, it’s one more tool to use to take a quick snapshot.

g = Perpetual growth rate

r = Stable cost of equity (hurdle rate)

D1 = Value of next year’s dividends

P = Current stock price

British American Tobacco targets a ~65% payout ratio of adjusted diluted EPS. Historically, its earnings and dividend have grown considerably more than what is illustrated in the chart below. But, to be cautious and to assume that perpetual growth can never be above the growth of the economy broadly, the PGR is capped at 3%.

The results suggest BAT’s equity is close to fair value if growth from this point forward remains at 1%. While the company’s growth may decelerate to such a level in the future, BAT could realistically achieve considerably higher than that in the next several years, suggesting that BAT’s equity is attractive at current levels. However, it must be noted that BAT’s target payout ratio is based on adjusted EPS denominated in sterling terms. Substantial changes in FX rates vs USD would clearly impact USD payouts, for better or worse. I’ve adjusted the GGM using current spot rates to crudely modify the TTM dividend per share:

Predictably, implied values were knocked down. However, if BAT can grow adjusted diluted EPS >3% annually for the foreseeable future, this still implies a reasonable margin of safety. Nearly all that is required to reach that hurdle is tepid positive results if the company maintains its current rate of share repurchases. And again, FX dynamics could turn this headwind into a tailwind at some point in the future.

Closing Thoughts

Conclusion

British American Tobacco is trading at a very depressed multiple, despite remaining incredibly profitable and having substantially deleveraged while beginning its transformation over the past few years. While headwinds may dampen results, I don’t think the company has to do anything radical to produce rather impressive returns. With BAT, there’s plenty to keep up with, but I’ll keep my eyes on the three loaded bases:

A company that has unique, geographically diverse operations.

The only major company that wholly owns fast-growing products in all 3 next-gen nicotine categories (Vaping, HTP, Modern Oral).

Unique investments that provide substantial minority ownership of an effective monopoly on tobacco in India (and a chance to influence policy to enter the said market with New Category products.)

Thank you for reading!

Could you do me a favor? If you enjoyed reading this article, please take a moment to share it with a friend or online somewhere. Sharing is caring—and helps me connect with more curious minds.

And make sure you’re subscribed to get future articles sent straight to your inbox!

If you have questions or have something to add, don’t hesitate to comment on this piece or reach out on Twitter.

Ownership Disclaimer

I currently hold positions in British American Tobacco as well as other tobacco companies such as Altria and Philip Morris International.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: BTI 0.00%↑ MO 0.00%↑ PM 0.00%↑

Additional Resources:

British American Tobacco - public filings and investor presentations. Reference Source

Philip Morris International - public filings and investor presentations. Reference Source

Altria - public filings and investor presentations. Reference Source

Swedish Match - public filings and investor presentations. Reference Source

Japan Tobacco - public filings and investor presentations. Reference Source

Imperial Brands - public filings and investor presentations. Reference Source

Nicotine Products Relative Risk Assessment: A Systematic Review and Meta-analysis. Reference Source

WHO global report on trends in prevalence of tobacco use 2000-2025, third edition. Reference Source

World Health Organization: WHO Report on the Global Tobacco Epidemic. Geneva. 2019. Reference Source

Global Trends in Nicotine Report December 2021. Reference Source

An approach for the extract generation and toxicological assessment of tobacco-free ‘modern’ oral nicotine pouches. Reference Source

Toxicological evaluation of novel heat-not-burn tobacco products – non-technical summary. Reference Source

Wonderful write-up! A quick question on the valuation methodology used in your DDM with Exit Multiple. I noticed that you strip out adjusting items from terminal EV then discount to PV whereas, to my knowledge, common consensus is discount terminal EV THEN strip our adjusting items to get PV of Equity (otherwise you would be double discounting the debt and cash). Perhaps I'm just naive to this specific modeling technique as my DDMs typically gets capped by a perpetuity TV and, truthfully, I'm partial to FCFF models where I'm significantly more comfortable. I notice that were you to compare FMV using these two TV methods you end up with a near $20 intrinsic valuation differential due to the significance of debt on the valuation. It would be extremely helpful to understand your thought process in deriving PV of Equity!

Thanks for the detailed article. All is not well between BAT and ITC ( Indian associate). BAT is against to unrelated diversification whereas ITC is going ahead with it. BAT infact stopped ITC to issue new ESOPs so as to stop diluting its stake in ITC. So your assumption that BAT can influence policy in India through ITC is something to take a conservative view on unless BAT explicitly mentioned the same with solid backing.