“There's a hundred-thousand streets in this city. You don't need to know the route. You give me a time and a place, I give you a five-minute window. Anything happens in that five minutes and I'm yours. No matter what. Anything happens a minute either side of that and you're on your own. Do you understand?” - Ryan Gosling, Drive, 2011

If you were looking for cheap thrills, perhaps you’d hop into your car, line up on a straight patch of road, and slam on the gas. Maybe, if you needed an adrenaline fix and had questionable morals, you’d use your car as the getaway vehicle for a robbery. Of course, for those who are averse to the idea of being confined to a prison cell, a viable alternative would be to simply watch a movie like Drive. If you haven’t seen it by now, maybe reevaluate what you’ve been up to for the past 11 years and then set aside some time to watch it - you can thank me later. Ryan Gosling’s gripping performance is paired with an impeccable soundtrack, and the opening scene is guaranteed to get your blood pumping.

So much of our world tries to capture our attention with similar palpitation-inducing tactics. Especially financial journalism. Everything is delivered with a sense of extreme urgency, leaving little room for us to question what we’re presented with. Last week, when Altria reported its Q3 2022 results, was a prime example, as headlines aimed to kick hearts into overdrive and shrieked of falling revenues, accelerating volume declines, and shares selling off in a desperate manner. You’d be led to believe that the company is being driven off a cliff.

Is that true?

Of course not. But it makes for good theatre.

Let’s break it down.

Altria’s Q3 2022 Headline Numbers

Net revenues of $6.55 billion, down 3.5% y/y

Revenues net of excise taxes of $5.412 billion, down 2.2% y/y

A reported tax rate of 45%, 27.4pp above last year

An adjusted tax rate of 24.9%, in-line with last year

Reported diluted EPS of $0.12, up over 100% y/y (last year was negative)

Adjusted diluted EPS of $1.28, up 4.9% y/y

These numbers aren’t what you’d call pretty. The 3.5% decrease in the top line was partly driven by the fact that Altria sold its Ste. Michelle wine business in October 2021. The company also experienced a decline in net revenues in the smokeable products segment. But digging deeper, a different picture emerges.

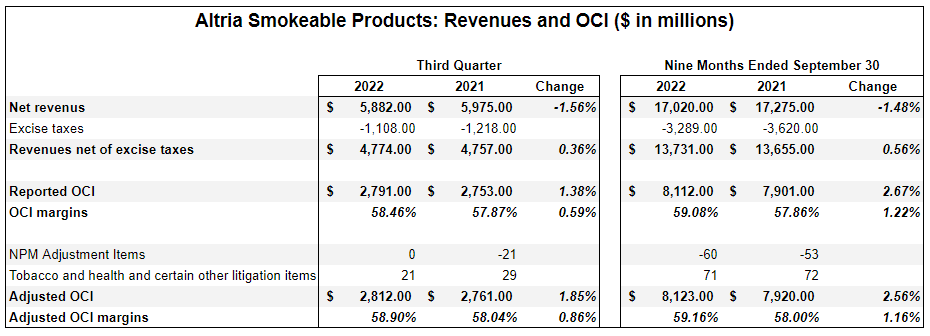

For smokeable products, Altria’s largest segment, net revenues were down 1.56% y/y. However, looking at revenues net of excise taxes (which are of the utmost importance) grew by 0.36%. Along with this, OCI (operating company income, a critical metric for understanding continued operations) grew by 1.38% on a reported basis, with OCI margin expanding 59 bps.

These numbers are the result of the mechanics that too few appreciate. Fewer cigarettes are sold each year, equating to lower costs and excise taxes paid. With pricing power, revenues net of excise increase, as does OCI, and margins expand. In Q3 2022, Altria’s manufacturer net price realization was +10.2% but Marlboro’s retail price per pack increased only 6%, which was less than overall inflation.

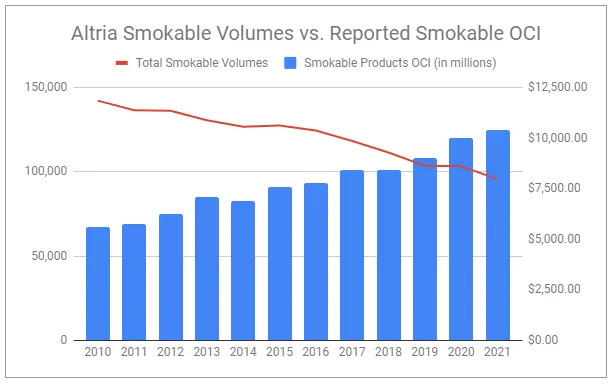

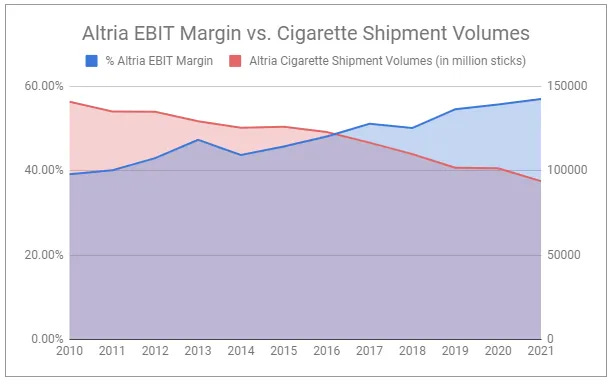

These underlying dynamics are not new:

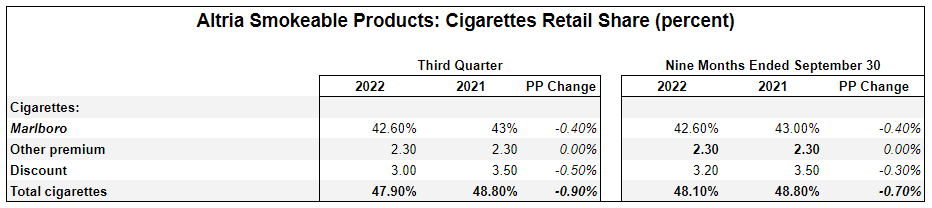

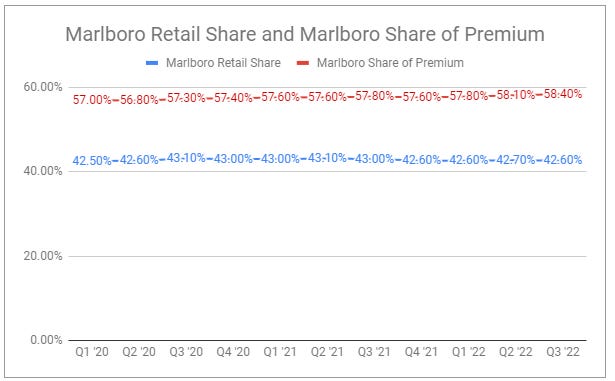

Altria’s PM USA cigarette market share was weaker than the previous year:

However, we can see that Marlboro is holding up quite well relative to history:

While market share isn’t too concerning, the severity of the decline in smokeable volumes was somewhat alarming, with total associated product volumes declining by 8.95% y/y in the quarter. This was driven by falling cigarette volumes, partly offset by the strength of Black & Mild cigars.

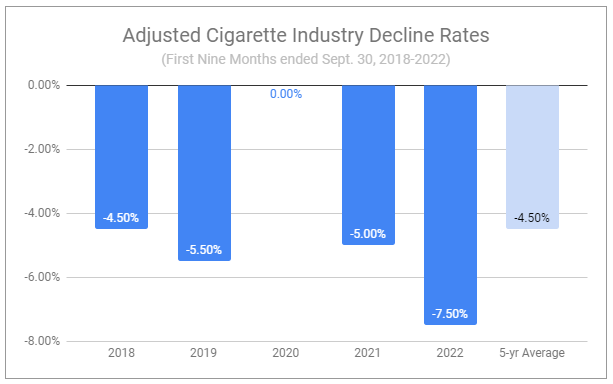

Looking at the following two sets of numbers helps illustrate how severe the cigarette volume decline was:

I believe this period’s volume decline is likely an outlier, opposite to the positive outlier that 2020 ended up being. While it would be unwise to assume that volume declines would revert to the 4.5% range, it is not unreasonable to think that they would continue to come down alongside macro pressures, especially fuel prices. Any reversion and normalization of smokeable product volume declines will provide Altria with more flexibility moving forward. Additionally, this reminds us that while volumes are resilient in periods of economic weakness, they are certainly not immune. Nonetheless, PM USA’s ability to navigate such a steep volume decline and still increase revenues net of excise taxes and OCI is truly remarkable.

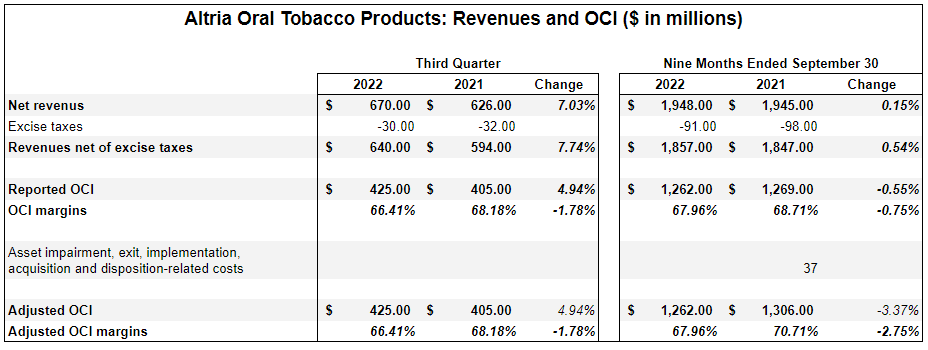

Turning to the oral tobacco products segment, we can see impressive results. Net revenues were up 7%. More importantly, revenues net of excise taxes were up 7.74%, and reported OCI was up nearly 5%, with OCI margin dropping 178 bps. The margin dynamics of this segment may appear less rosy than the smokeable segment, but there are several things occurring under the hood.

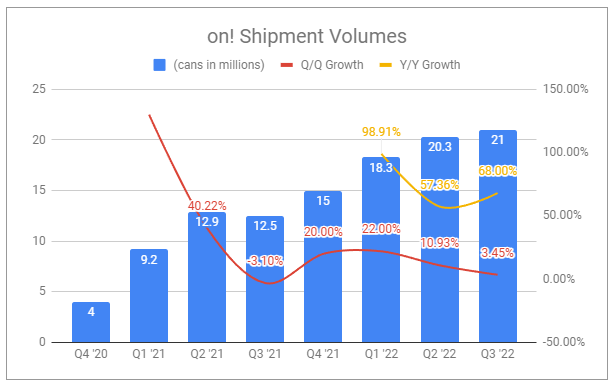

Volumes of legacy products like Copenhagen and Skoal continue to decline. Similarly to cigarettes, pricing power allows Altria to more than offset this. However, the company continues to aggressively promote its newest nicotine pouch, on!, by using extreme pricing deals to drive consumer awareness and adoption.

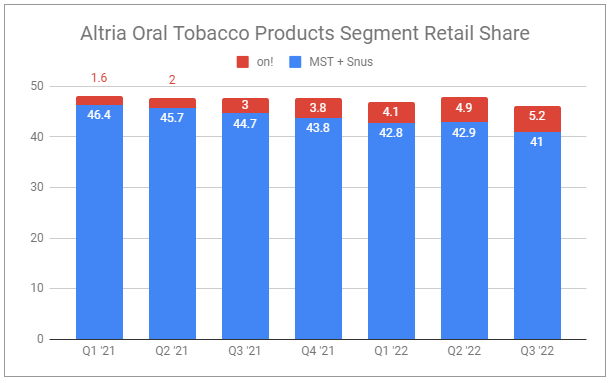

Legacy products continue to lose share, partly driven by the success of on! and other nicotine products winning over consumers:

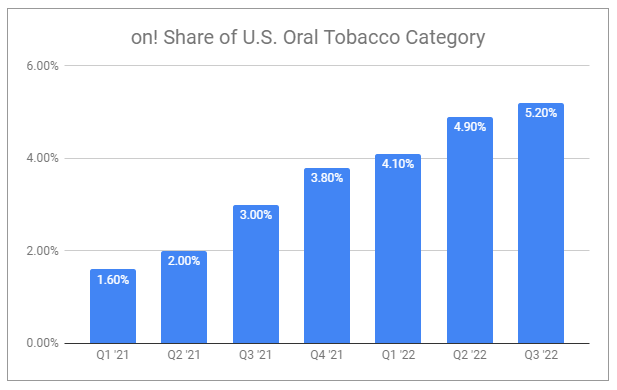

Isolating on!’s market share helps illustrate the rapid growth over the last two years:

It’s not unreasonable to expect on! volume growth to slow, especially as Altria lessens its aggressive pricing discounts. Nonetheless, 68% y/y growth, even if decelerating, is impressive and is showing a path to where on! could become a major contributor to the company. As legacy volumes shrink and on! becomes a larger portion of sales, it’s reasonable to expect segment margins to continue to compress. However, I strongly believe this continues to be the correct path to aggressively take share in a promising nascent market.

Along with these quarterly results, the company repurchased 29.9 million shares at an average price of $48.60, for a total of ~$1.45 billion, leading to shares outstanding being 2.3% less than a year ago, and paid out total dividends of ~$1.6 billion. Additionally, the company retired $1.1 billion of debt at maturity in August. Furthermore, Altria recorded a non-cash, pre-tax impairment charge of approximately $2.5 billion in the quarter related to its equity stake in ABI, stating that the impairment reflects the difference between the fair value and carrying value of the investment and ABI’s share price does not reflect its underlying long-term equity value and that macroeconomic and geopolitical factors may continue to more heavily impact ABI’s financial results. Management also revised guidance, narrowing from $4.79-4.93 adjusted diluted EPS for the year to $4.81-4.89, representing a growth rate of 4-7% over 2021’s adjusted diluted EPS of $4.61.

There have also been several noteworthy developments:

The JUUL Fiasco

In June 2022, the FDA issued marketing denial orders (MDOs) to JUUL for all products currently marketed in the United States. The reasoning for the FDA’s ruling is suspect, and Juul Labs is currently navigating legal pathways to contest but uncertainty remains. Regardless, Altria, seeing further impairment on its stake, recognized an additional $1.2 billion non-cash pre-tax loss in Q2 2022. As of June 30, 2022, the estimated fair value of the company’s investment in JUUL was $450 million, a mere 3.51% of the initial purchase price. Then, on September 30, 2022, Altria announced it had exercised an option to be released from its non-compete agreement with Juul Labs Inc. This move is not surprising, as I covered earlier this year:

Altria’s investment in JUUL has been brutal for shareholders. Since the initial time of investment, Altria has written down the value of its stake multiple times, falling from an initial $12.8 billion to a present $1.6 billion. It’s worth noting that if Altria’s JUUL investment falls below 10% of its initial value ($1.28 billion if you don’t have a calculator handy) or if JUUL is prohibited from selling e-cigarette products in the U.S. for at least a year, Altria is allowed to re-enter the vaping market with MarkTen or other owned brands. There is also a possibility that Altria will move to purchase the remaining 65% of JUUL in the future.

In July 2020, JUUL submitted PTMAs for its JUUL Device and four JUULpod SKUs, which are still pending with the FDA.

By Altria severing the non-compete, Juul Labs is free to sell its remaining 65% to an outside party. Though, with regulatory uncertainty and potential bankruptcy headlines swirling, it remains unseen how exactly the saga will unfold. I’ve long modeled Altria’s JUUL investment as a 0, and the easiest and most appropriate route going forward is continuing to do so.

PMI IQOS Goodbye

On October 20, 2022, Altria announced reaching an agreement with Philip Morris International to end the companies' commercial relationship regarding IQOS in the U.S. as of April 30, 2024. PMI will pay a total cash consideration of $2.7 billion - $1 billion upfront and the remaining by July 2023 at the latest, with interest tacked on. The deal seems reasonable for both parties. It helps solidify PMI’s paths to get IQOS into the U.S., whether through Swedish Match or otherwise. And for Altria, receiving a cash pile equal to ~2.5% of its enterprise value is nothing to scoff at - especially when they were effectively paid to fold on commitments they couldn’t fully execute in the current environment.

Cronos No-nos

On October 24, 2022, the Securities and Exchange Commission (SEC) charged Cronos Group Inc., the Toronto-based Nasdaq-listed company, with accounting fraud. The SEC also charged Cronos’s former Chief Commercial Officer with fraud and aiding and abetting the company’s violations. The SEC determined that the company should not incur a financial penalty, given its timely self-reporting, significant cooperation, and remediation.

Altria owns ~41.7% of CRON, diluted down from the initial 45% it paid $1.8 billion for in 2019.

Japan Tobacco Joint Venture and HTC

JV

On October 27, 2022, in a press release separate from its quarterly results, Altria announced a strategic partnership with JT Group (JT). The joint venture, Horizon, will focus on the U.S. marketing and commercialization of HTS (heated tobacco sticks, also known as heat-not-burn, HNB, or HTP, heated tobacco product). From the agreement:

HTS products are defined in the JV as products that include both (i) a tobacco heating device intended to heat the consumable without combusting and (ii) a consumable that meets the definition of a cigarette under the U.S. Federal Cigarette Labeling and Advertising Act.

Key points on the deal:

The JV is designed to exist in perpetuity and will cover current and future HTS products owned by either company.

PM USA (an Altria subsidiary) will have a 75% economic interest, with JTI having the remaining 25%.

PM USA will contribute an initial $150 million in capital. Continued capital contributions will be made split in accordance with economic interest.

Altria will account for Horizon in its ‘All Other’ financial reporting category.

The two companies will leverage their scientific and regulatory expertise to jointly prepare U.S. FDA filings for the latest JT Group products. There is an expectation for PMTA submissions in H1 2025.

JTI will provide the HTS devices and PM USA will produce the Marlboro HTS consumables for the device.

Horizon will utilize Altria’s significant sales and distribution network, covering over 200,000 retail stores.

The parties will retain independent ownership of respective intellectual property.

My gut reaction to the announcement is cautiously optimistic. While the roadmap illustrates no commercial fruit for several years, there are two key considerations:

JT Group launched its HTS device, Ploom X, in Japan in August 2021 and has already nearly doubled its share of the Japanese HTS market. Japan is notoriously saturated with heated tobacco products and JT Group faces significant competition, including from PMI’s IQOS. Share growth demonstrates a product that is simply winning over consumers, and the data produced will allow the company to iterate and improve leading up to U.S. commercialization.

I see this to be a very measured move on Altria’s part that has a minimal downside and a high upside. JT is responsible for the devices and there are minimal upfront capital costs on Altria’s part, though there will be additional costs that come with commercialization in future years. However, Altria gets to leverage the existing infrastructure that was already in place for their previous agreement with PMI. From Altria CEO William Gifford on the Q3 2022 call (emphasis added):

…remember, our overall strategy, even in the smokeable products categories is to maximize our income through time but to make appropriate investments, both in Marlboro and balancing that with investments in the growth areas. So there are always puts and takes. I don't want you to think all of the investments that we make are completely incremental to the P&L.

We try to leverage and we try to point out some of that in our remarks this morning. So for instance, the manufacturing center, where we expanded our production for on! in that facility. The heat sticks for the JV will be produced by the manufacturing center. So there you have the infrastructure in place.

You have a strong, talented group of employees that are familiar with running those machines. So you leverage some. So yes, there are investments and you have reallocation across the P&L, but it's not all incremental investment.

HTC

In the same announcement concerning the JT JV, Altria announced an update on their own heated tobacco capsule (HTC) product. From the announcement:

We believe HTC products can appeal to U.S. adult smokers who are open to novel smoke-free products but have not yet found a satisfying alternative to cigarettes. This audience includes the millions of U.S. adult smokers who tried, but ultimately rejected, e-vapor products.

The company expects to finalize the design of its HTC platform technology by the end of 2023 and anticipates a PMTA submission to the FDA by the end of 2024, approximately 6 months earlier than the PMTA associated with the joint venture. There is little additional information surrounding Altria’s HTC efforts, though it seems safe to assume it is largely predicated on the company's intellectual property gained from acquiring Poda in May, which I covered previously:

On May 13, 2022, Poda Holdings, INC. announced its entering into a definitive agreement with Altria subsidiary ALCS in which they have agreed to sell ALCS substantially all assets and properties, including associated patents and certain licenses on those patents for an approximate sum of $100.5 million.

Poda develops, manufactures, and markets multisubstrate heated capsule technology. ‘Beyond Burn’ Poda Pods are tobacco-free and contain a mix of pelletized tea leaves infused with synthetic nicotine. The pods are inserted into a device that heats the contents without burning them, creating an aerosol, providing a sensory experience similar to traditional cigarettes but without smoke or ash. The capsules are propriety, single-use, biodegradable, and are designed to eliminate cross-contamination and cleaning requirements of the heating device (a common pain point expressed by users of other HTP products). The underlying technology is fully patented in Canada and is patent pending in over 60 other countries.

Altria has also stated that it expected to partner with JT to launch the HTC device in an international test market in late 2024 or early 2025 using JT’s sales and distribution network. With that in mind, it’s important to recognize that the HTC product is wholly owned by Altria, and any additional agreements with JT would be independent of the announced joint venture.

Completely Consumer-Driven

The best exchange during the Q&A portion of the Q3 call (and the inspiration for this piece’s title) was between Morgan Stanley’s Pamela Kaufman and Altria CEO William Gifford (emphasis added):

Pamela Kaufman (Analyst):

“I wanted to follow up on Bonnie's question and ask about how you're thinking about the evolution of the U.S. tobacco market over the next 5 to 10 years? How do you think about the relative size of the e-vapor versus heat-not-burn category over time? And now that you have greater flexibility to invest in e-vapor, given the noncompete termination with JUUL and the partnership with JT, how are you going to prioritize your investment between heat not burn and e-vapor?”

William Gifford (Altria CEO):

“Yes, it's a great question, Pamela. I think it's important to remember as you step back, and that's why we tried to highlight in the remarks that the reduced harm in the U.S. is really undeveloped. And the reason I say that is from an authorization standpoint, take the 2 that exists today, e-vapor and novel oral.

A very low percentage has been authorized by the FDA in e-vapor, and we believe that's going to go through a period of transition as those authorizations come out and some make it and some get denied. When you move to the novel oral, really no authorizations have been received in that space. And so that, again, depending on how the regulatory body goes about assessing and authorizing those, there could be a bit of a transition there.

And then in the heated tobacco space, it's really nonexistent. I think when you think about those 3 categories, we believe the extent of those 3 categories will really be shaped by 3 factors: So one, I mentioned, is the regulatory decisions that are taken in each of the individual categories. It will be legislative in tax policy. How does that develop through time related to the individual categories? And then really through time is the innovation in the spaces that best address the consumer preferences based on what they desire.

So that's really what's going to shape the size of the 3 individual categories. We believe those are the 3 categories that will grow through time as consumers continue to move away from cigarettes to the smoke-free products. As far as prioritizing, we're going to prioritize based on where we see the consumer moving and how we see the consumer moving. It's going to be completely consumer-driven, and that's why we're excited to be able to leverage the sales force to get the products in the right stores as well as the amount of data we receive and the insights that we can garner from that.”

Billy’s response is notable for several reasons. Firstly, it affirms that Altria’s leadership is focused on the changes coming to the industry, which I’ve covered previously concerning Altria, BAT, PMI, and the industry broadly. Secondly, Altria seems to have learned from its past mistakes, such as massively overpaying for its JUUL stake, and is now committed to making more thoughtful and measured investments.

I expect Altria to continue to leverage its superior distribution and data capabilities to manage the secular decline of its legacy business as it invests in new opportunities, all while returning significant capital to shareholders. So far this year, the company has returned $6.4 billion to shareholders via dividends and buybacks. Most spectacularly, the company will likely generate ~$12 billion in operating income this year while only deploying $175-225 million on CapEx. That’s worth keeping in mind as other companies attempt to race away from the fact they’ve been overspending with little to show for it.

Thanks for reading.

If you haven’t read it, check out my comprehensive report on Altria.

Questions or thoughts to add? Comment here or shoot me a message on Twitter.

Ownership Disclaimer

I own positions in Altria and other tobacco companies such as British American Tobacco and Philip Morris International.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑

Heated tobacco capsule seems like a pipe dream or there be significant market penetration in 5 years?

That was a fantastic and thorough write-up. Much appreciated!