“He that can have patience can have what he will.” - Benjamin Franklin

In my comprehensive report published in September, I described United-Guardian as “the smallest, most profitable company you've never heard of” and said:

I’m intrigued by United-Guardian. It has a colorful history and many of the hallmarks that make a great business. However, it’s also been hit hard a number of times over the years, and while never out for the count, I’m not sure if it’s a fighter to bet on. UG’s ‘low capital intensity’ may be more of a bug than a feature and paying out nearly all FCF is more indicative that management has been unable to find effective new ways to reinvest in the business.

I concluded the piece by stating at a certain price, I’d likely be a buyer and that there were particular catalysts that could lead me to action. Along with mixed Q3 2022 results, exact such catalysts are forming.

Let’s dive in.

New President and CEO

On October 25th, United-Guardian announced the appointment of a new president and CEO:

Beatriz Blanco looks to be an exceptional choice to head United-Guardian. While her academic credentials are impressive, including a bachelor’s degree in chemistry and pharmacy, an MBA with a marketing focus, and a master’s in chemical engineering from Carnegie Mellon University, her track record truly shines. Ms. Blanco holds over 21 years of experience specifically focused on specialty cosmetic ingredients and personal and home care products, including nearly 5.5 years at ISP (now Ashland Specialty Chemicals, one of UG’s largest partners). Along with enhancing profitability, her skillset is ideal to both foster growth and navigate an extremely challenging macro environment; especially for UG’s cosmetic ingredients - its most sensitive segment.

While no further announcements have been made, I expect Ms. Blanco to make a more comprehensive statement regarding her vision in the annual shareholder letter, if not earlier.

Q3 2022 Results

United-Guardian’s Q3 results were not pretty at first look:

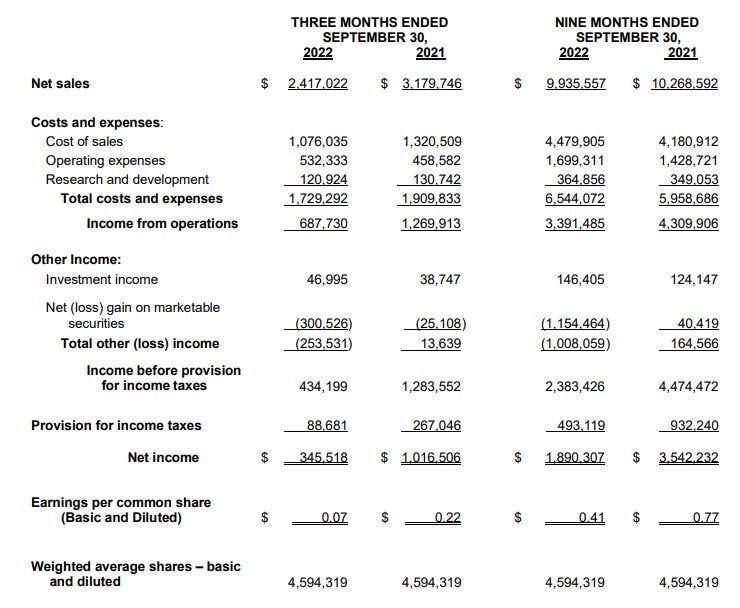

EPS for the quarter fell 68% y/y from $0.22 to $0.07.

Income from operations fell 46%.

Net sales fell by 24% while operating expenses grew by 16%.

All of these numbers are trending opposite of ideal. However, digging a bit deeper provides further consideration. The company experienced a change in the fair value of its marketable securities of -$300,526, equating to a loss per share of $0.065.

Sales for the company’s 4 segments were as follows:

The most glaring change y/y is the drop in cosmetic ingredient sales. However, some relief can be found in the comments of Beatriz Blanco, the new president and CEO, in the Q3 report (emphasis added):

“Our largest marketing partner, Ashland Specialty Ingredients, which is responsible for marketing our products in China, informed us that their sales of our products in the third quarter were adversely affected by the several things, the most significant of which was the continuing impact of the coronavirus pandemic in China. They also indicated that the reduced sales that they experienced in the third quarter was exacerbated by some overstocking issues, especially in connection with one of their major customers switching from one of our Lubrajel formulations to a different one, which resulted in inventory that had to be worked off. They indicated that they are not aware of any significant loss of customers, and anticipate that sales will increase over the coming months, especially as the coronavirus situation improves in China. We remain optimistic that our sales and earnings will improve as the global economy continues to improve, and we are looking forward to a stronger 2023.”

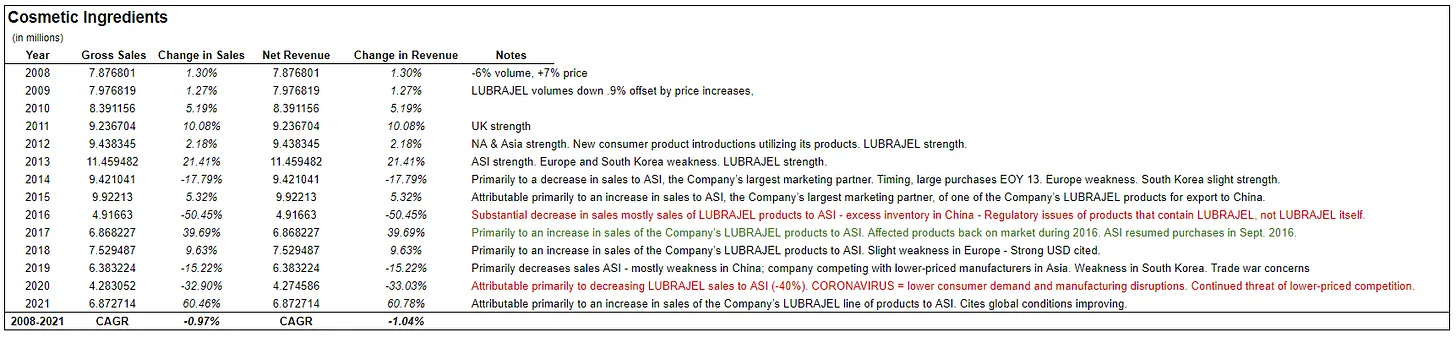

The continued impact of the coronavirus in China was to be expected, though, with recent announcements of reopening, that may begin to subside. The overstocking issue, especially in connection with an Ashland customer switching product types, was not anticipated, but this is not new in the slightest:

Historically, issues with excess inventory have normalized over the following 1-2 years for United-Guardian. When factoring in the fact that there have been no known losses of key customers, I believe it is likely that cosmetic ingredient sales recover over the next 12-18 months.

On the brighter side, medical product sales increased 11.8% y/y to $384,548 for the quarter and are now up 20.4% y/y to $1,904,424 for the first nine months.

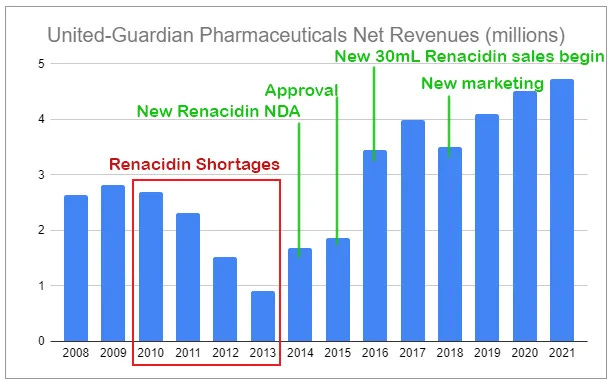

Along with the strength in medical products, pharmaceutical sales were strong, down 4.8% y/y to $1,159,367 for the quarter but growing 3.24% y/y to $3,622,964 for the first nine months. This segment, while still notably smaller than total Lubrajel sales in cosmetic ingredients and medical products, is the one I am most interested in. As I wrote in Mini Monopoly, United-Guardian’s drug Renacidin is surrounded by unique financial and regulatory considerations that thwart competition, allowing the company to generate substantial returns on minimal invested capital.

The setup

When I published my initial analysis on United-Guardian the stock price was $12.48. Last Friday’s close was $12.13. During the interim, the stock has nearly twice reached $11.00.

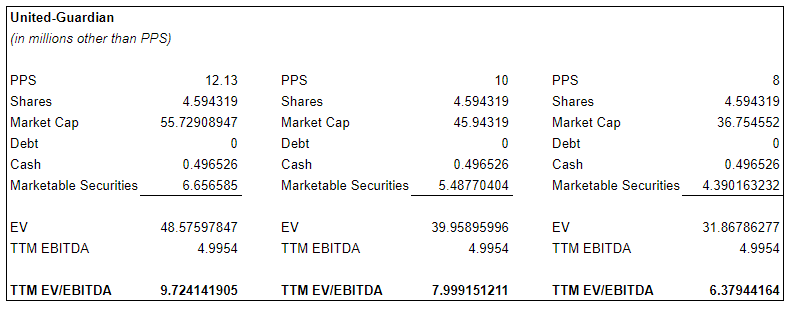

Along with zero debt and $496,526 in cash on the balance sheet, the company holds $6,656,585 in marketable securities. These marketable securities now make up ~12% of the company’s market cap; making it additionally sensitive to fluctuations in the overall market. I’ve stated before that this microcap receives almost zero coverage or analysis, leading me to believe it’s capable of generating substantial overlooked opportunities.

I can envision the company’s new CEO, with the support of the board, potentially announcing a permanently reduced target payout ratio, aiming to shift capital towards growth efforts. Those holding the stock simply for income may quickly sell. I think it’s also likely that while cosmetic ingredient sales should normalize that it will take several additional quarters before we see it in the numbers (especially if China reverses on reopening). Additional weakness in UG’s share price is likely if either of these things happens. If both happen, especially on top of additional broad market weakness, I could see shares falling substantially.

As illustrated in Mini Monopoly, the NPV of Renacidin’s cashflows could be worth over $20 million alone (3% terminal growth rate + UG cost of equity / higher short-term growth + a 10% hurdle rate). Per the above, this would value the remainder of operations (the majority) at only $11-28 million. To boot, with 0 debt, there is no countdown to destruction. There is also no need for the equity to re-rate to its 5-year average EV/EBITDA multiple of 13.85. Even without a recovery, normalizing current TTM EBITDA and FCF conversion could net a double-digit FCF yield. If/when macro pressures ease, recovering EBITDA and improving margins, along with the new CEO ushering in growth, could make for a radically more positive picture.

Having taken aim, I am still not ready to pull the trigger. While I may never shoot and may miss my chance, I much prefer to exercise discipline and patiently wait for the risk/reward to skew even further to the point I feel compelled to act.

Thanks for reading.

Read the full report on United-Guardian here and a valuation of their key pharmaceutical, Renacidin, here.

If you have questions or have something to add, don’t hesitate to comment on this piece or reach out on Twitter.

Ownership Disclaimer

At the time of publishing this piece, I have zero positions in United-Guardian. I may initiate such positions in the future.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: UG 0.00%↑ ASH 0.00%↑

Great article, thanks. I especially admire your patience and the depth of your research and your readiness to easily pass on a company despite all the research already done if the conditions for you to invest do not manifest.

I have been looking at UG on and off for a while , wondering if this is the time to really dive deep