“I guess I can go anywhere I want. If only I knew where to go.” - Layne Staley

22nd Century Group, Inc. (Nasdaq: XXII) has previously described itself as a revolutionary company. It was founded in 1998, became publicly traded in 2011, and, at times, has been the primary focus of various groups of excited investors. Too excited. Over the last decade, the company has experienced several meteoric rises in its stock price, largely a function of exuberant storytelling rather than sound fundamentals. Several bouts of excitement have been related to the company’s interests within the cannabis space—a haven for fanciful narratives. But a more recent driving force has been the company’s patented intellectual property related to the cultivation of specialized tobacco, granting it the ability to produce very low nicotine (VLN) cigarettes, with nicotine contents ~95% lower than traditional brands.

In December of 2021, 22nd Century Group received authorization for its novel products through the FDA’s Modified Risk Tobacco Product (MRTP) application process. The MRTP process is far more burdensome than the PMTA process, which is already woefully difficult for novel products to pass through unscathed. Only a few products have successfully gone through the MRTP process, and 22nd Century Group’s authorizations mark the first and only cigarettes to receive such a designation, providing the company with the privilege (and requirement) to display an exact message on the packaging of its cigarettes:

HELPS YOU SMOKE LESS

With MRTP designation, the prevailing narrative was that 22nd Century Group was optimally positioned to benefit from future regulatory changes to be pushed forth by the FDA. For years, the administration has slowly worked towards a product standard that would drastically reduce the maximum allowable level of nicotine within cigarettes. It was theorized that if such a standard were enacted, sales of XXII’s cigarettes would balloon, and other companies in the space would have to either buy tobacco directly from XXII or license its intellectual property—an immense windfall for the company. It was further argued that regulatory change barring menthol as a characterizing flavor in cigarettes would be an additional benefit to the company. XXII painted a theoretical scenario in which it receives an exemption for its VLN menthol cigarette, priming it to take over the entire submarket.

The straightforward benefit of VLN cigarettes is that, with a substantially lower level of nicotine, users would smoke less and thus be harmed less. That’s the theory, at least. At the bottom of slide five of XXII’s Q2’23 presentation, there is a quote that reads:

VLN allows consumers to literally stare smoke in the face and say, “I don’t need you.”

But if consumers can say “I don’t need you” to smoke, and VLN is a smokeable product, wouldn’t that suggest that consumers don’t need VLN? This hints at where the true problems are.

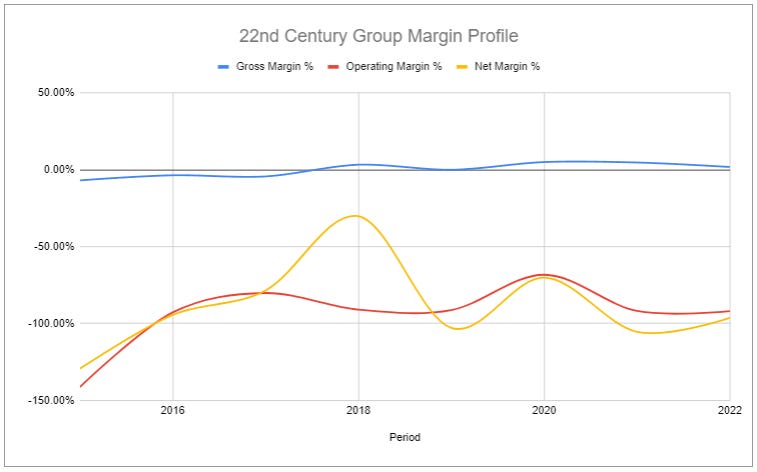

22nd Century Group has been perpetually unprofitable. For years, the company poured millions into developing its intellectual property and creating its product. It then spent large sums to successfully go through the MRTP authorization process. Then, once authorization was granted, the company spent even more to ramp production and solidify agreements with distributors and merchants. Losses have accelerated in recent years.

In February of last year, I was asked for my thoughts on 22nd Century Group since its MRTPs make it rather unique. I responded with a one-sentence thesis:

Speculative, rough road to profitability, and imo is tackling the market from the wrong side of the equation.

Half a year later, the company conducted a 1-for-15 reverse stock split in order to regain compliance with the Nasdaq listing requirement of a $1.00 bid price per share. This was followed in September by the company initiating a process to evaluate strategic alternatives (sale?) of its tobacco assets. In October, in an effort to raise much-needed funds, the company announced a public offering for ten million more common stock shares and warrants for twenty million. Then, just several weeks ago, the company completed the sale of its hemp and cannabis franchise to reduce operating expenses and pay down debt.

In the eleven months since I shared my view, the stock is down 98.7%.

Proponents of the company’s efforts will cite the lack of major regulatory change as the cause of the company’s woes, with the menthol ban being kicked down the road to an undefined future date. But such delays aren’t a surprise, especially since they’ve occurred before. Moreover, the lower nicotine standard is still incredibly unlikely. No. No. The lack of major regulatory change is not the reason the company is struggling. 22nd Century Group is struggling because they’ve been focused on the wrong question—answering whether or not they could produce a very low nicotine cigarette and get it authorized instead of answering if consumers even want the product in the first place.

The narrative that 22nd Century Group has crafted revolves around big opportunities, such as the statement within the letter to shareholders in its 2020 annual report:

The global market opportunity for VLN® is massive.

Expansion has continued into more states and more stores. The company even announced South Korea as VLN’s first international market. How many adult consumers are interested in the product? Very few. Despite the continued expansion, volumes remain challenged. In fact, up until recently, there was really only one party interested in cigarettes sold by 22nd Century Group: the Federal Government of the United States. For more than a decade, the FDA, NIDA, and other agencies have engaged in numerous independent clinical studies utilizing 22nd Century Group’s proprietary tobaccos. For this purpose, the product is sold as SPECTRUM research cigarettes, which come in a number of different nicotine levels and include both menthol and non-menthol varieties. However, more recently, it became apparent to 22nd Century Group that SPECTRUM and VLN were not enough to usher the company to profitability, which led to the company pivoting in the most unexpected way.

In April of 2023, 22nd Century Group announced the launching of a new private label cigarette brand with a large U.S. convenience store chain. The brand, Pinnacle, was described as premium in the press announcement, despite documentation provided by the company stating it was designed for adult smokers seeking lower-cost alternatives. A bit confusing, but the announcement itself wasn’t unexpected. The unexpected part was that this would be a cigarette with a conventional level of nicotine—the exact type of product the company had vilified for years. While it makes sense that the company would attempt to shift focus to products that were actually proven to be profitable, it appears too little too late. Despite sales of Pinnacle being ahead of XXII’s expectations, the company’s cash pile has dwindled, and the clock is ticking.

I’ll remain on the sidelines. It’s hard to be long a company when you don’t believe in the product or see a path to profitability. It’s equally problematic to be short a story stock that could rip north in a blink. Even now, there is no telling how the evaluation of strategic alternatives turns out. Perhaps there is a way to salvage this? Or perhaps one of the major cigarette manufacturers picks up whatever is left for pennies—less than a rounding error for them. Instead, I find value here by recognizing the company’s story as a cautionary tale, further contextualizing the evolution of a contentious and misunderstood industry.

This past Friday, 22nd Century Group announced that it will host a fireside chat event on January 17th. How much smoke will the discussion produce, and which way will the winds blow? We’ll have to wait and see.

If you enjoyed this piece, hit “♡ like” on the site and give it a share.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in tobacco companies such as Altria, Philip Morris International, British American Tobacco, Imperial Brands, and Scandinavian Tobacco Group.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

politicians of most western nations are implicitly in the biz of these products (and alcohol) given the tax:sales ratio. so that means politicans indirectly want volume, and non-nic isnt going to serve.

would also guess the majority of voters are non-smokers that dont really care, as long as 2nd-hand smoke\vapor continues to stay out of their face in public places.

As always you’re spot on -- how can one make a profitable business from selling cigarettes that are not addictive?

IIRC some of the “sales” recorded by XXII come with agreements that XXII will take back their VLN products that a wholesaler or retailer has not sold. Therefore their numerous announcements they were adding more retail locations were always less impressive than they sounded.

Is Pinnacle a relaunch or a brand new cigarette brand?

I also agree there’s almost no possibility that the FDA will reduce nicotine levels to very low levels in our lifetimes. (Congress is another matter.) In addition to the lengthy process you describe, tobacco companies would litigate this for decades. They were able to delay retail corrective statements from 1999 (DoJ lawsuit) / 2006 (court ruling) to 2023.