Altria: Executing Where It Counts

“The more constraints one imposes, the more one frees one’s self. And the arbitrariness of the constraint serves only to obtain precision of execution.” - Igor Stravinsky

Altria’s Q2 report and conference call were good—not because the numbers were stellar, but because of the absence of distraction. There was no mention of the joint venture with JT, SWIC, or other hazy goals set for the distant future. And while the NJOY acquisition has been completed, there was little new to say, as the company remains rightfully tight-lipped while scaling the brand. But what about the core portfolio—the products that have turned Altria into a cash cow?

The company is executing where it counts.

Smokeable Products

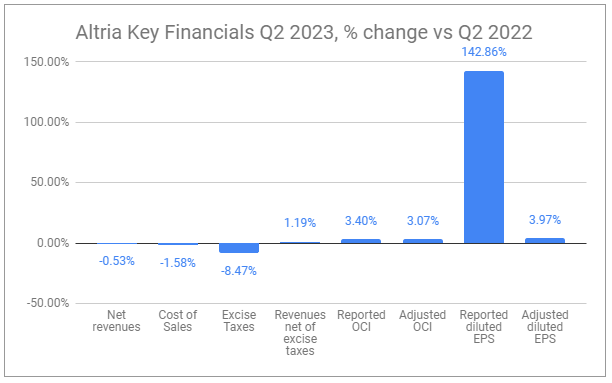

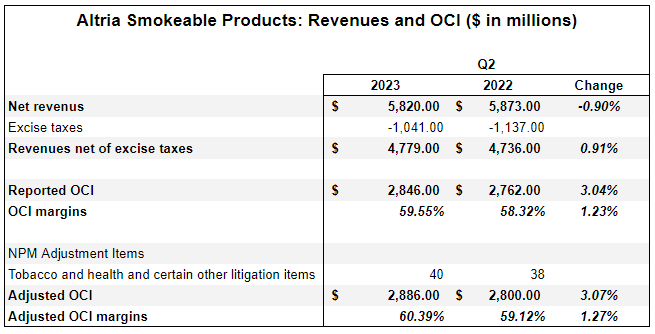

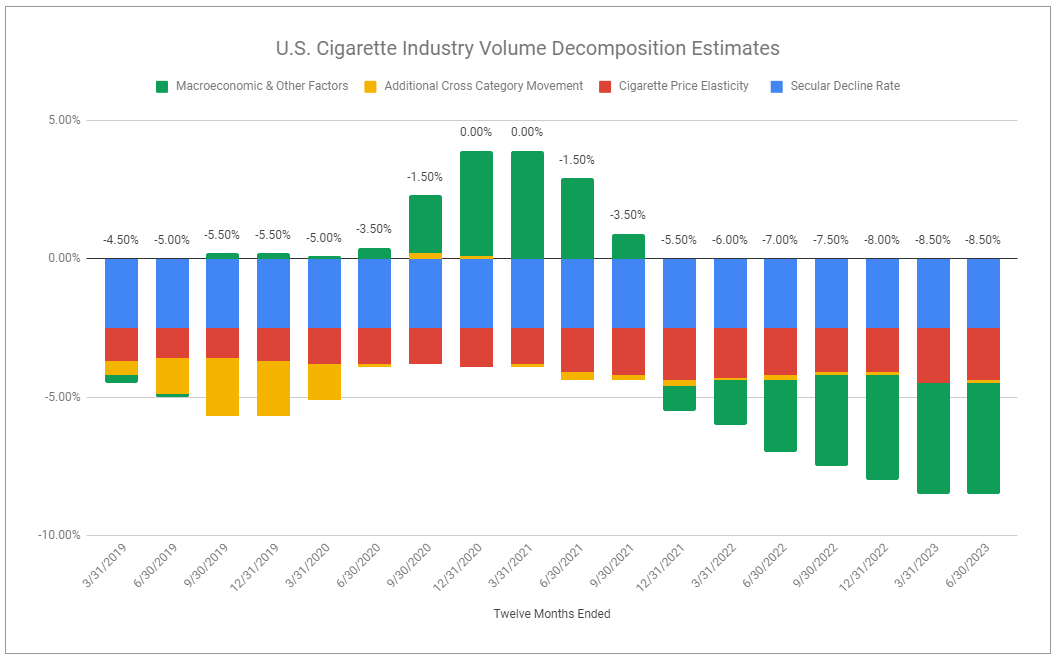

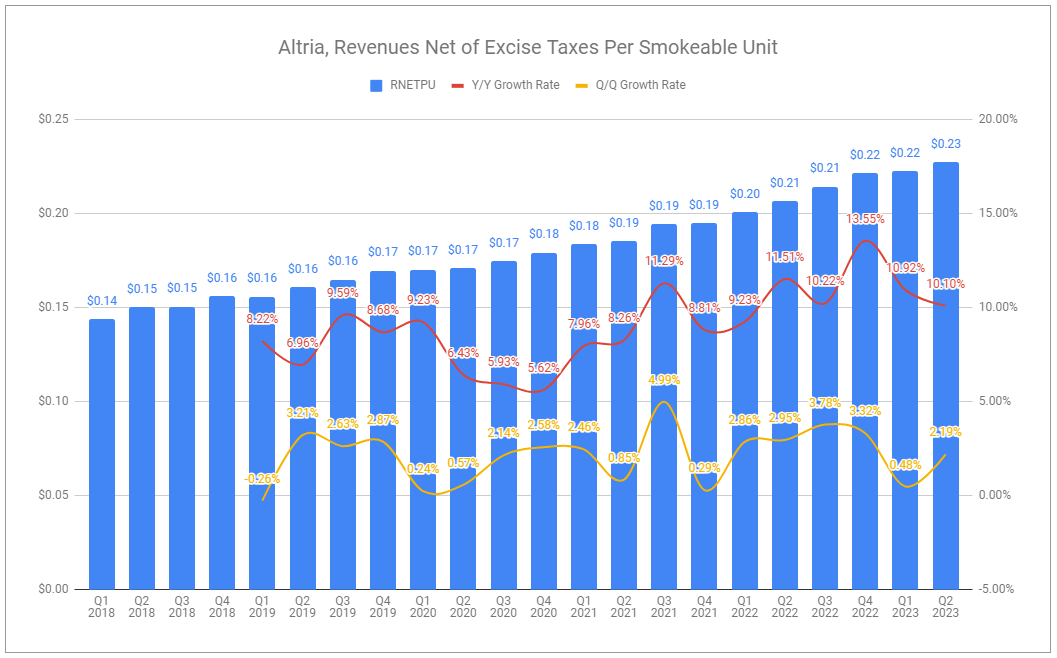

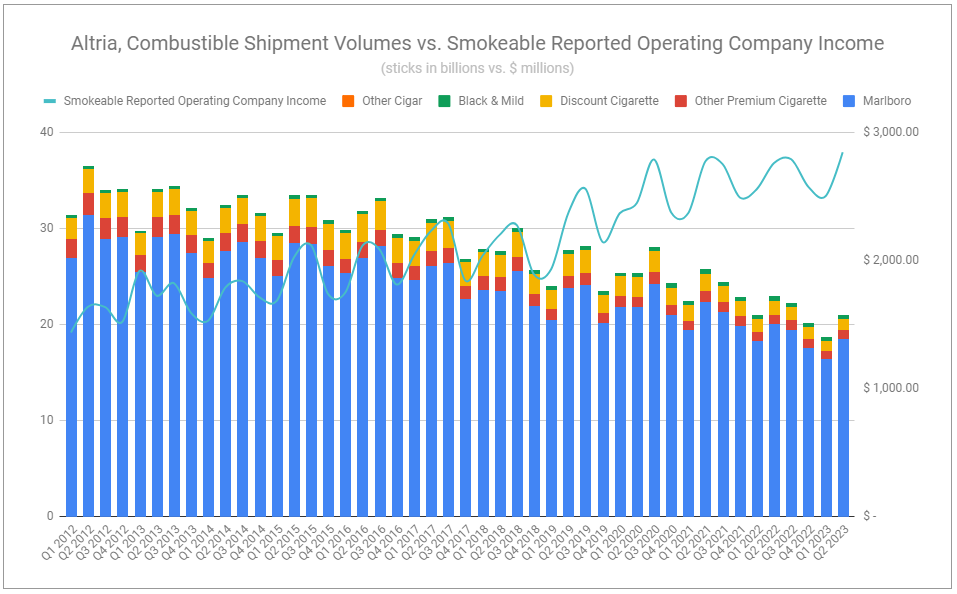

Altria’s total Smokeable volume declines measured -8.35% y/y in Q2, and when adjusted for channel movements, measured -10%. While this remains elevated relative to historical averages, the company continues to exercise considerable pricing power to more than offset volume declines, leading to revenues net of excise taxes and operating company income to increase, and margins continuing to widen.

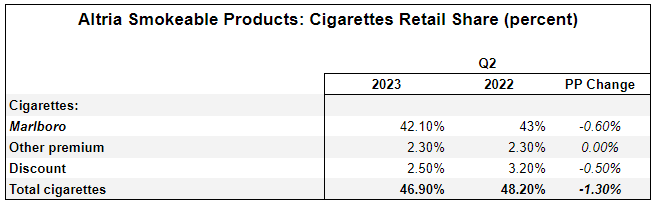

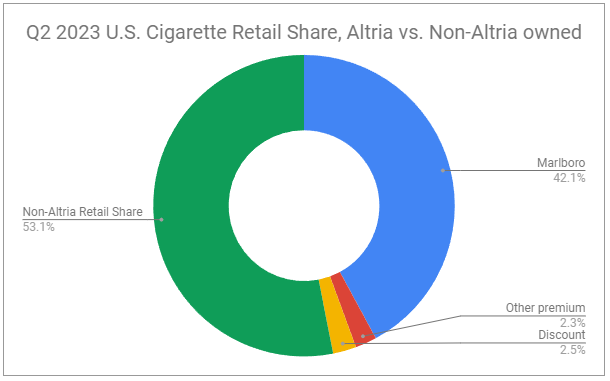

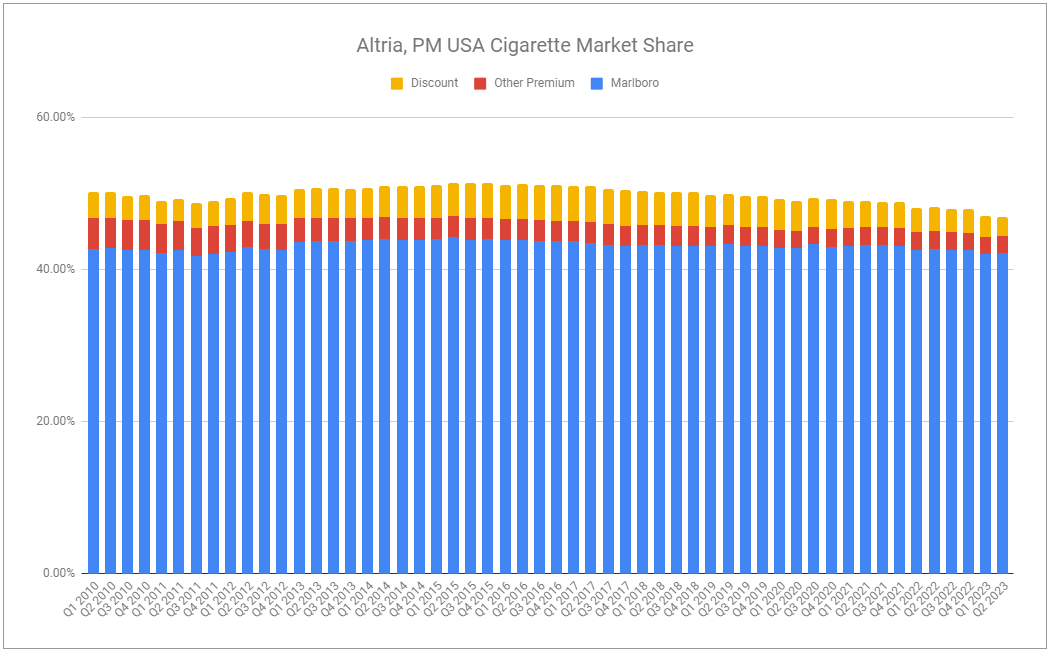

While pricing remains exceptional, Altria experienced a 1.3% y/y decrease in cigarette market share in the quarter. This is unsurprising, as management has stated its intention to focus on total value created and refusing to chase after lower-margin market share.

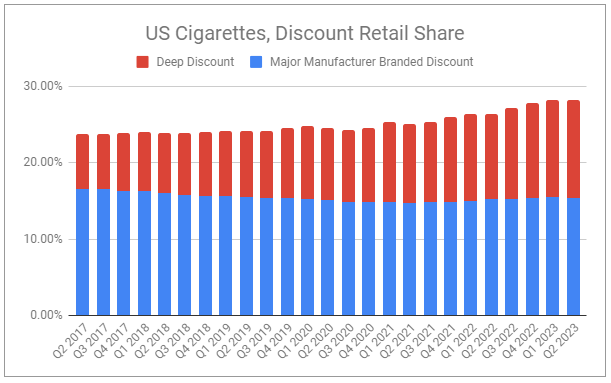

With the Marlboro price gap continuing to widen and showing the most significant spread in recent history, discount brands continue to take retail share.

Despite discount taking share as consumers downgrade, Marlboro took an incremental 0.10% of premium share.

It is also worth noting that these results come after the California flavor ban, which further weighed on volumes and share in the state. This is on top of the headwinds the U.S. industry has been facing—which further highlights how impressive the positive financial performance has been.

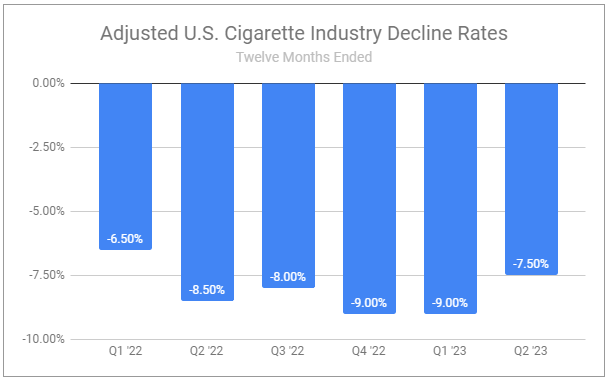

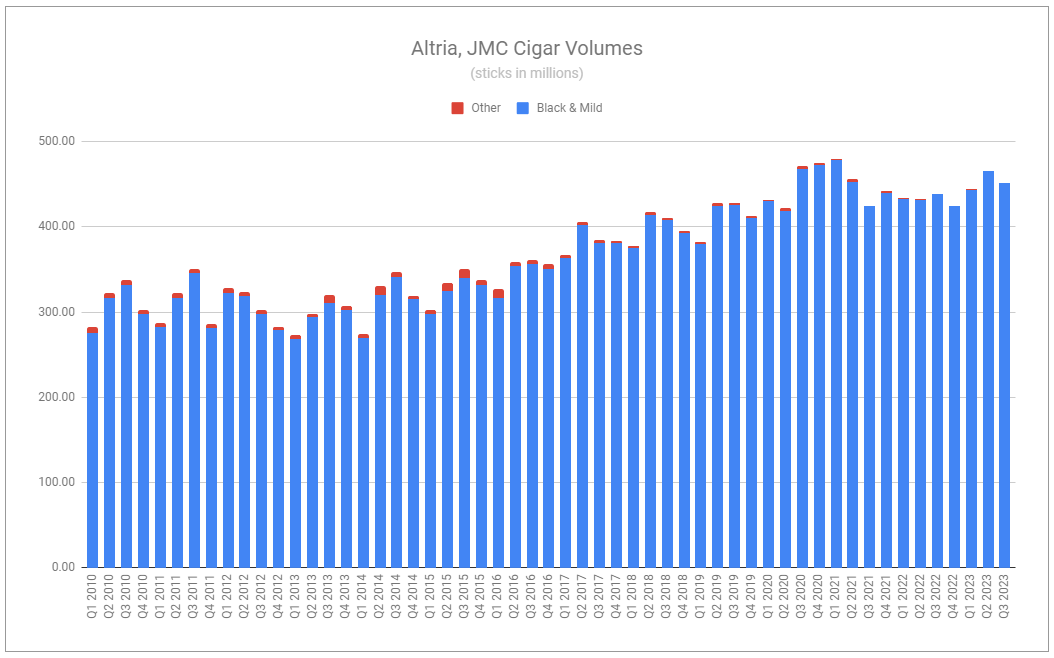

More promising is the change in the estimated adjusted decline rate, which accounts for a variety of channel movements. Should Q4 ‘22 and Q1 ‘23 represent a true bottom, forward easing of volume pressures will provide significantly more room to efficiently manage revenue growth. At the same time, although cigarettes continue to experience elevated volume declines, JMC’s cigar volumes continue to awe, growing by 7.62% y/y in the quarter. I find this additionally remarkable as the company has been even more aggressive with recent related product price increases.

The segment value formula continues to hum along.

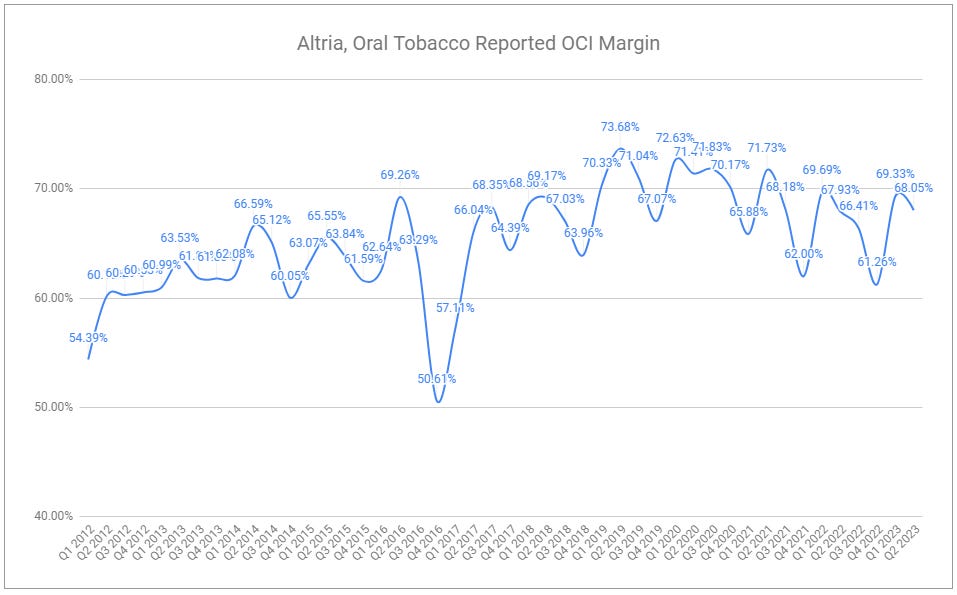

Oral Tobacco Products

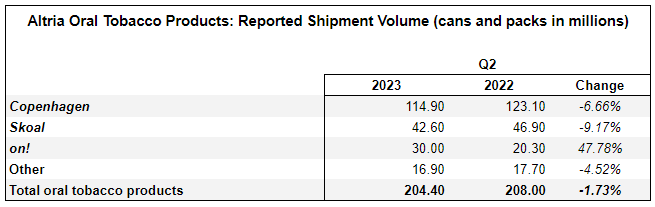

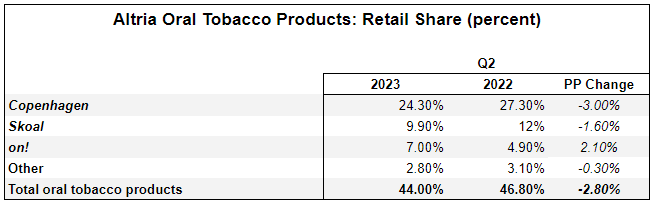

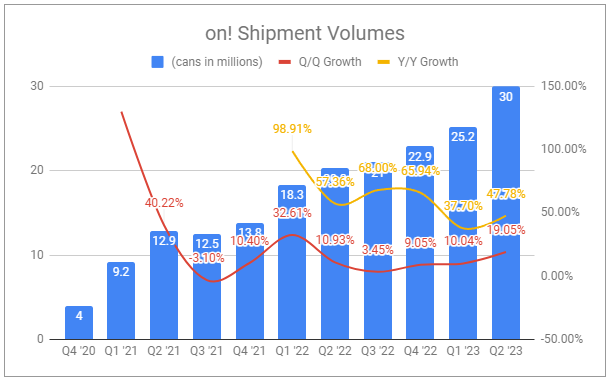

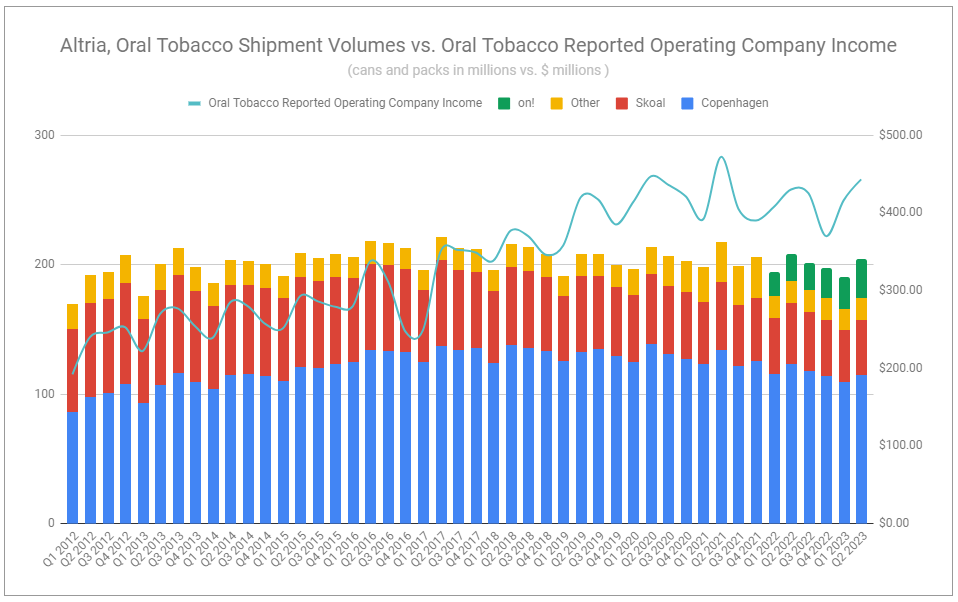

Altria’s Oral Tobacco product segment results look quite a bit different than Smokeables. Flagship Traditional Oral products Copenhagen and Skoal saw sizable y/y volume declines in the quarter of -6.66% and -9.17%, respectively, while at the same time, Modern Oral pouch on! saw a staggering 47.78% volume increase. Aggregated, segment volumes declined by -1.73% y/y.

While the company’s cigarette market share declined by 1.3% y/y in the quarter, Oral Tobacco experienced a loss of more than double—down -2.8% y/y. Despite total share gain by on!, up to 7% from 4.9% in Q2 2022, legacy MST + Snus continued to weaken.

Weakness in Altria’s Traditional Oral share is not solely explained by on! cannibalizing volumes, but by the precipitous growth of Zyn. While seemingly alarming, there are three positive considerations:

Despite Traditional Oral volume declines, UST has consistently taken considerable pricing.

on!, largely grown through promotion and aggressive discounting, is steadily moving toward the 2025 profitability target, with the Q2 2023 average price up 17% y/y.

While Altria’s total oral market share has declined, total volumes are appearing much more stable, as the U.S. segment is continuing to experience growth on absolute volume terms.

When you fully consider volumes, margins, and resulting operating company income, it is difficult to conclude that this segment is anything other than brilliant.

Other developments

E-vapor - NJOY

When evaluating Altria acquiring NJOY, I highlighted an oddity:

Altria has nearly entirely focused on NJOY’s pod-based product, ACE, and the 2 leading pod-based products it competes against. There is very little mention of disposables. This is odd, considering that 2 of NJOY’s MGOs are for its disposable, NJOY Daily, including a 6% nicotine concentration variant, higher than the concentration of any of the noted pods. Odder is that Altria’s supporting data references tracked channels, which may understate the total market by failing to fully recognize the proliferation of illicit disposables.

I am glad I’m not the only one scratching my head. The first point was raised during the Q2 call Q&A:

Gaurav Jain, Analyst:

A couple of questions from me. So one is on the e-cigarette industry growth, clearly disposables are cannibalizing closed and e-cigarettes. So why are you launching the NJOY ACE and not the NJOY Daily product. And in that context, can you also just tell us where you are with the PMTA application of the NextGen product, which is -- which you have mentioned you have filed?

William Gifford, Altria CEO:

Yes. So let's break that down. So the first part, I think if you think about the e-vapor category, certainly, there's a large pod base of consumers. And so we certainly see that as an opportunity. And you heard in the remarks, the NJOY ACE is the only pod that has received FDA authorization. When you think about the disposable side, the growth, at least what we're seeing in the marketplace is with the plethora of flavors that are illicitly in the marketplace. So as the FDA certainly steps up enforcement and we see enforcement take place and those illicit products come out of the marketplace, we see the potential, again, because NJOY was able to receive authorization for the disposable, the opportunity for growth in that space. But we feel like the appropriate focus is on that large pod-based, consumer base until they illicit a plethora of flavors and the flavors that are illicitly in the marketplace are cleaned up.

One interpretation of Billy’s response is that the NJOY Daily can’t compete head-to-head with illicit disposables so there is no point in attempting to grow it until substantially more enforcement action is taken. That would be completely reasonable if not for the fact that growth in U.S. vapor is largely coming from disposables and not pod-based systems. Even British American Tobacco’s Vuse Alto - the #1 pod-based vape in the U.S. (PMTA pending) - saw a -6.5% volume decline in the first half of 2023. Ignore NJOY’s other potential future PMTAs, including ones for menthol variants and Bluetooth-linked devices that would prevent underage usage. An endless trove of Marketing Granted Orders won’t save products if the government does not enforce against illicit products. This is largely what I concluded in March.

Leverage

Altria repurchased 0 shares during Q1 2023 due to the pending NJOY deal. Following closing the deal, the company repurchased 10.4 million shares in Q2, totaling $472 million. This leaves $528 million remaining authorized to be deployed by the end of the year. As of June 30, 2023, Altria holds:

an interest coverage ratio of x12.51

a total debt/EBITDA ratio of x2.24

a net debt/EBITDA ratio of x2.17

ABI stake

Following Q1, I wrote:

More recently, Anheuser-Busch has received a spike in publicity, driven by new advertising, public responses to said advertising, and responses to the responses to said advertising. I have no real opinion on the advertising itself, but there seem to be angry people in the world boycotting Bud Light and the company at large. While some claim a permanent impairment to volumes spelling the end of ABI, I think otherwise. If history is any indication, this whole ordeal is likely driven by a small vocal minority who in 6-12 months will be preoccupied with being outraged about something else entirely.

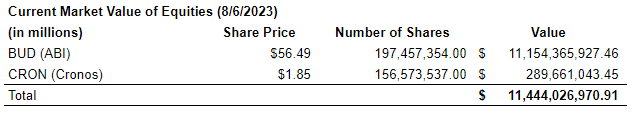

Take a moment to appreciate how terribly wrong I’ve been in anticipating the total extent of the Bud Light boycott. No excuses. Is this reflected in BUD’s share price dropping and the market value of Altria’s stake falling by ~$1.7 billion since last quarter? Perhaps.

However, despite the impact of Bud Light being dethroned in the United States, the ABI thesis remains intact. As the largest-scaled brewer globally, ABI looks to be performing quite well, with global volumes and pricing remaining strong. Continued focused deleveraging is likely to occur alongside producing a growing stream of value shared with Altria. While management has said little in regard to the stake as of late, it’s quite likely they are still focused on holding it as a long-term strategic investment. However, perhaps the stake gets sold sooner, as the company has a deferred tax asset to offset the gains, and, in regards to a sale, I previously said following Q1:

At the same time, perhaps this will be inevitable. Management has announced a shift in dividend policy, from an 80% target payout ratio of adjusted diluted EPS to a ‘progressive dividend goal’ targeting mid-single-digit dividend growth for the next half-decade. I find this concerning. This policy is clearly aimed at bolstering investor confidence but could cause management to perform short-term moves to reach their medium-term goal. A focus on value return is not the same as a focus on value creation, and there is no promise this would align with what is best for the long term. This is especially the case with the company investing in HTP SWIC, on! Plus, NJOY, and who knows what else in the coming years, all of which will face varying durations of unprofitability, further weighing on group results. In this light, maybe this avenue flips from an alluring opportunity to a scary proposition.

In May, I brought up my concern about the shift in dividend policy during the Annual Meeting of Shareholders (timestamp 38:15):

Host:

Your next question comes from Devin LaSarre: Could management further rationalize the new ‘progressive’ dividend policy with context on why the previous long-standing policy was insufficient and why buybacks aren’t a preferred route of returning capital to shareholders?

William Gifford, Altria CEO:

Now I’ll answer the dividend question first. We felt like the goals framework that we laid out established better certainty for the shareholder as we’re making the transition from combustible products in pursuit of (?) to smoke-free products, and it gave more certainty and assurance around the dividend.

As far as share buybacks—we’re currently active in a program, as we disclosed in our first quarter. We go through our capital allocation process. We think about how to distribute capital to our shareholders and reinvest in the business. We share that on a regular quarterly basis, updates against that capital allocation, and decisions that have been made, and that’s how we approach our capital allocation decisions.

While I was disappointed in the answer that told very little, I can only blame myself for failing to frame my question much more specifically. If I have another such opportunity, I’ll be sure to do so. Playing devil’s advocate, perhaps the new policy isn’t as concerning as I initially stated. While the company’s earnings will be choppier as they reinvest into new categories, the progressive dividend policy should reign in spending and force management to act most critically and prudently. Or at least one can hope.

Sustained capital returns

While Altria will be undoubtedly challenged by new products, the company still holds the top-performing products, in the most profitable market, priced in the dominant world reserve currency. Volume declines may not revert to historical norms—but they don’t need to in order for Altria to produce outsized returns. Weighing against volume declines are distinct advantages that continue to go unappreciated. Along with leading products, strong pricing power, and best-in-class sales and distribution channels, Altria continues to improve its ability to connect with adult consumers and price products with precision.

My valuation since last published remains largely unchanged. As of Friday’s close at $44.00, Altria sports a market cap of $78.4 billion. Through dividends and share repurchases, Altria has returned $3.8 billion so far this year and is set to return ~11% of its total market cap for the entirety of 2023, with a path to conservatively increase future capital returns at a modest single-digit rate.

If you enjoyed reading, hit “♡ like” and share this piece with someone.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Altria and other tobacco companies such as Philip Morris International, British American Tobacco, and Scandinavian Tobacco Group.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑ BUD 0.00%↑

Hi Devin, appreciate your detailed analysis. May I get your view on these issues please?

1. While MO's data (Source: Circana Info Scan Cigarette 2023) showed that BAT's premium share declined by 0.5 pp from 32.2% in Q2 2022 to 31.7% in Q2 2023, BAT claimed that its share of the premium segment "grew to its highest point in three years". How do you reconcile the difference?

2. While MO has Marlboro Black to mitigate down trading pressure during recession / hyper inflation, BAT's Newport doesn't employ similar strategy to keep their less affluent customers engaged, but rather launched branded discount products such as Lucky Strike in response to the macro environment. When macro improves, do you think there will be a structural shift of market share to MO from BAT in the premium segment? (i.e. converting Marlboro Black customers to mainline Marlboro seems to be more frictionless than converting customers who down-traded to Lucky Strike or other deep discount brands to Newport)

3. Employee review rating and CEO approval rating on Glassdoor showed quite a huge discrepancy between Altria and Reynolds American. Does it concern you that, a corporation with unsettling employees may inevitably lead to weaker execution as compared to competitors? Sometimes I feel quite uncomfortable that BAT keeps parachuting senior executives with almost no U.S. FMCG retail experience to head Reynolds American (Ricardo Oberlander --> Guy Meldrum --> David Waterfield). When the market landscape is stable, it is ok. But when there's paradigm shift, such weakness could be exacerbated. In particular, it seems Altria and Billy know exactly what to do with downtrading as Billy remembered every detail from '08 - '09 and 01' - '02 and he knows which levers to pull in order to emerge stronger after the current hyper inflation period. In comparison, the senior executives of BAT look a bit clueless?

Really fascinating discussion of the dividend policy. I am fan of dividends over buybacks and I think Altria will be a good case study in the distinction.