“I think when you see the consumers, they're trying various products, they're looking for products that satisfy their unmet needs and desires. And once they find the satisfying product, it's up to us to build the brand around that.” - William Gifford, Altria CEO, March 6th, 2023 M&A Call

Is Altria acquiring NJOY a good deal?

Good for who?

If the deal closes, Jason Mudrick probably won’t be too unhappy. His hedge fund, Mudrick Capital Management, took over NJOY after the company was successfully restructured in 2017 following its declared Chapter 11 bankruptcy the year prior. With the restructuring, NJOY, Inc. became NJOY, LLC. Since then, the company has developed new products and has captured a sliver of the U.S. market.

Oh, of course! Of course, Altria would want to buy a previously bankrupted brand that currently holds a tiny share of the U.S. e-vapor market. It can sit on the mantle next to JUUL!

Joking aside, it comes as no surprise that people are comparing the deal to JUUL. There are clear similarities. However, it’s also radically different.

Let’s dive in.

What are these numbers?

Altria would be paying $2.75 billion cash at close for a company that is estimated to have cleared ~$150 million in sales in full-year 2022. A staggering EV/sales multiple of x18.33. If you find this ratio alarming, you are in good company.

But one question I have yet to see anyone ask is: $150 million in sales of what?

NJOY sells 3 distinct product types:

NJOY Daily, a ‘cigalike’ disposable e-vapor device

NJOY ACE, a pod-based, rechargeable e-vapor device

ACE PODS, consumable pod cartridges used exclusively with the NJOY ACE

One big issue with trying to judge the headline numbers is that there is minimal granularity into NJOY’s price/mix. We don’t know how much of each of these is actually being sold. We don’t know the exact level of promotional discounting being applied. Additionally, we don’t know the exact geographic footprint of sales, which matters, because different states apply different taxes and use different tax methodologies for certain related products. These factors affect everything from retail price to volumes, revenues, revenues net of excise taxes, market share, retail share, etc. And even if we did have a snapshot of all of these figures, we would need historical comps to understand the velocity of sales. If sales are almost all NJOY Daily, what’s all the fuss about ACE? If sales are almost all ACE PODS and no ACE devices, we might question continued adoption rates. If It’s all ACE devices and very few pods, we might conclude that people are trying the product, hating it, and throwing it away. The list goes on and on. All of this is to say there is a lot that we don’t know. Uncomfortable.

Who is the best owner?

Why would NJOY sell to Altria and why would Altria want to buy NJOY?

In theory, taxation dynamics allow the steady-state unit economics of e-vapor to be even better than cigarettes. But in practice, NJOY is currently subscale and is surely unprofitable beyond a gross level. The company explored options for selling itself last year. With no sale, it would likely otherwise have to raise capital privately, whether equity or debt, or potentially IPO.

Data provided by Altria states ACE pods hold a mere ~3% of retail share. Currently, ACE is only in 33,000 stores, and NJOY has a sales force of fewer than 50 people. Perhaps NJOY as a standalone company could trudge along, slowly taking share. But that takes time, and when you’re burning money, you may not have a ton of time. That path certainly sounds much worse than what Altria is capable of doing, which is leveraging its first-rate distribution and 1,600 salespeople to push ACE into over 200,000 stores nationwide. Not only would this be x6 the stores (and 60% more than the leading competitor), but Altria would be able to improve how ACE is displayed - in an industry largely barred from advertising and marketing, distribution and getting your product in front of would-be consumers is absolutely critical.

Is that enough? Improving brand awareness and availability is one thing, but without true brand recognition, a key factor in driving initial purchase considerations is price. Pod-based e-vapor devices follow the razor/razorblade model - take a loss on the device, and make much more on the consumables. For better or worse, Altria’s deep pockets could easily subsidize accelerated adoption.

Altria could likely be the ‘best owner’ of the NJOY assets. However, best is a relative term, and that alone surely doesn’t mean this deal is good in an absolute sense.

Growth from where?

While ACE’s total U.S. retail share is 3%, it is 11% in top chain accounts that sport consistent distribution and better visibility. Additionally, Altria stated that in post-trial surveys, adult tobacco consumers generally favor ACE. But if ACE was significantly favored, why doesn’t it have an even higher share? We can suspend our disbelief and attribute this to NJOY’s markedly conservative rollout efforts - demonstrating caution, dutifulness, and perhaps simply not wanting to make the same mistakes as JUUL. For the past several years, JUUL has been dealing with near-endless litigation and regulatory issues, cut its workforce substantially, had to raise additional funding, and has been continually losing share to VUSE. Between all of that, the administrative stay over the JUUL MDOs, and the looming FTC, there should be zero surprises about why Altria decided to wash its hands.

Altria expects e-vapor volumes to grow at a low-single-digit CAGR over the next decade. To become profitable enough to rationalize the purchase price requires NJOY to grow much faster than that. We’re talking x5-x15 as much. Pricing alone won’t do it. So where will that growth come from? The majority of growth has to come from taking share from competitors. To do that, there needs to be significant positive product differentiation.

What actually differentiates NJOY ACE?

I bought the top 3 pod-based products to see.

I will start by saying I did not personally use any of these devices. I am not a cigarette smoker or a vaper. I am, however, someone both interested and experienced in branding and design. Comparatively, there are some things that immediately stand out.

Packaging

VUSE Alto has remarkably poor packaging, plastered in stylized print that reminds me of buying boxed software at Best Buy and Circuit City in the 90s. There is no nice way to open it and the flimsy box tears easily.

JUUL’s packaging is slim and minimalistic. Everything is methodically well-fit yet fairly unremarkable.

NJOY ACE, surprisingly, has beautiful packaging. The box is made of corrugated cardboard and is sturdy enough that it feels like something you need to save. All components align with precision, and it feels akin to opening a new phone.

Device

VUSE Alto is slim and lightweight. There isn’t much to it.

JUUL is even smaller than VUSE Alto and oddly feels easier to hold despite its boxy shape.

NJOY ACE, once again, is surprising. The device is hefty but not burdensome. It distinctly feels high-quality and durable. While both VUSE Alto and JUUL feel relatively insignificant, the form and materials of NJOY ACE immediately give the sense that what you’re holding is valuable.

Usability

At the end of the day, good packaging and device feel matter, but neither is as important as how well the product delivers nicotine. As mentioned, I have not personally used any of these products. Instead, I effectively outsourced my research by collating a huge number of product reviews strewn across the internet. These may be biased or misrepresent these products, but I found them illustrative nonetheless. Here are some insights drawn from the data:

JUUL can’t be used while it’s charging. This is a major UX pain point. Imagine wanting to use your device and having to wait for it to charge. Cigarettes don’t have this issue. Neither does VUSE Alto nor NJOY ACE, which have pass-through charging, allowing them to be used when plugged in. NJOY ACE also has a larger battery than the other two, requiring less-frequent charging - a big plus for more frequent users.

JUUL pods snap into the top of the device and there is less concern about pod leakage, though it can occur. The only reoccurring criticism is that occasional pods will be weak in flavor or the flavor will quickly fade while actively consuming. This contrasts with both VUSE Alto and NJOY ACE pods, which rely on magnets to secure them into their respective devices. While this does not sound consequential, it appears that a mix of weak magnets and condensation build-up during use can cause leakage for both NJOY ACE and VUSE Alto. Such leakage was actually brought up by an analyst during Altria’s business update webcast, which management seemed to brush off. While the most vocal in their reviews across the internet might skew toward negative, the sheer volume of related content suggests that this isn’t a rare occurrence.

In addition to leakage, reviews suggest that both VUSE Alto and NJOY ACE occasionally produce a ‘bad/burnt hit’; or at least more often than JUUL. Furthermore, there are general complaints of discolored/bad-tasting Alto pods, namely the Golden Tobacco variety.

JUUL’s initial rise to dominance came by utilizing nicotine salts instead of freebase nicotine, drastically increasing hit intensity while reducing irritation. This method has been widely adopted, including by both VUSE Alto and NJOY ACE. However, the real saving grace of VUSE Alto and NJOY ACE is the even stronger hit they produce through an easier draw and total intake. This is perhaps the most important single aspect of these devices. Conversely, NJOY ACE being potentially the most inconsistent does not bode well. Altria is an expert at refining consumer products, but fixing problems would require management to first acknowledge them, not sweep them under the table.

Looking beyond aggregated reviews and anecdotes shows clearer differences: pod sizes and prices.

The prices above are perhaps less important - as they are local prices in the Chicagoland area. Again, with the razor/razorblade model, promotions are often run on the devices themselves, and the pod packs can fluctuate a few dollars. To give an idea as to the degree of such promotions:

The VUSE Alto device was being sold with a single pod included in the box. Most of the time, pods are sold separately.

On occasion, JUUL will run promos, discounting the device down to $1 with the purchase of a pod pack.

Recently, NJOY promoted ACE, with the device being marked down to $5.99 at retail. Locally, the promotion stopped the same week that the Altria announcement was made.

All 3 of the leading pod-based devices automatically activate when you draw from the device, making them exceptionally easy to use. All associated pods offer 5% nicotine concentrations, but both ACE and Alto pods are significantly larger volumes than JUUL, despite JUUL consistently being the most expensive. When weighed on both total nicotine and price, NJOY ACE pods are by far the most affordable. While ACE may look well-priced relative to its peers, it’s absurd to assume there wouldn’t be more aggressive pricing to compete if it started to take share, potentially upsetting the path toward profitability for all. Again, mind you, prices across markets will vary.

Does NJOY ACE stand out as the best product? Unlikely. But the bright side is that it doesn’t look like any product is definitely the best product. NJOY ACE might simply be differentiated enough to gain a larger slice of the market under Altria’s wing.

Transparency and clarity

Along with the fact that NJOY doesn’t have massive unresolved litigation like JUUL, there are two distinct considerations Altria has quickly highlighted.

First, NJOY would be 100% acquired by Altria, unlike its JUUL investment in which it took a 35% stake. This is important for several reasons. NJOY would be consolidated into operations and Altria would provide greater granularity in reported numbers, unlike simply carrying an equity method investment. No matter whether things go well or not, investors and the public will have a much better understanding of what’s happening under the hood. Additionally, 100% ownership solves a very awkward problem that Altria previously had: if you have a 35% interest in a company that sells a product that steals customers of your 100% owned product, are you not a little apprehensive about helping them succeed? After closing, Altria has stated that NJOY will receive the full support and resources of the company, including its sales force, regulatory team, government affairs team, and so on. There should be no questioning the support Altria will be willing to expend.

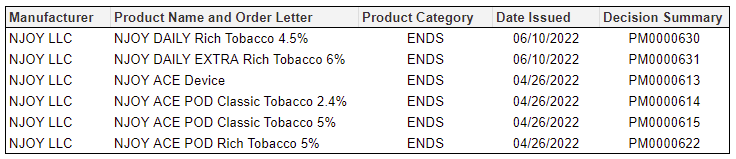

Second is the fact that NJOY has x6 MGOs via the PMTA pathway.

These Marketing Granted Orders place NJOY in rare company - holding 6 of the 23 total MGOs given to e-vapor products, and the only authorized pod-based system. The two leading pod-based systems are not on the list. Last summer, JUUL received Marketing Denial Orders from the FDA, though the FDA has issued a temporary stay. All VUSE Alto PMTAs are still pending with the FDA (VUSE Vibe and VUSE Ciro, much less popular product variants, have MGOs.) This lack of legal limbo is apparently worth quite a bit to Altria. Built into the terms of the acquisition are additional cash payments contingent on attaining additional MGOs:

If the FDA issues an MGO for NJOY ACE POD, menthol flavor, 5.0% nicotine concentration, NJOY will receive $125 million.

If the FDA issues an MGO for NJOY ACE POD, menthol flavor, 2.4% nicotine concentration, NJOY will receive $125 million

NJOY is preparing x2 more PMTAs for 2 non-tobacco non-menthol flavored ACE pods that utilize NJOY’s access-restriction technology (Bluetooth-linked to prevent underage accessibility.) NJOY will receive $125 million for each of these applications that receive MGO authorization.

The new threat

Perhaps having such legal clarity around NJOY’s existing products will further incentivize Altria to go full-steam ahead. One would think that if the JUUL MDOs are upheld, NJOY would swoop in to fill the void. However, if Vuse Alto receives MDOs, Reynolds is likely to contest, potentially staying on the market for considerably longer. Though this may provide Altria with significant royalties. Additionally, this scenario excludes one of the largest considerations that Altria has largely left out of the discussion.

Altria has nearly entirely focused on NJOY’s pod-based product, ACE, and the 2 leading pod-based products it competes against. There is very little mention of disposables. This is odd, considering that 2 of NJOY’s MGOs are for its disposable, NJOY Daily, including a 6% nicotine concentration variant, higher than the concentration of any of the noted pods.

Odder is that Altria’s supporting data references tracked channels, which may understate the total market by failing to fully recognize the proliferation of illicit disposables.

As an example, for $20-25, consumers can acquire an Elf Bar BC5000 (rebranding to EB design to skirt an injunction over trademark infringement issued by a federal court judge), which contains 13mL of e-liquid at a 5% concentration. This is a greater value than popular pods, and without the need for a separate device. Each disposable simply gets consumed and then tossed. But beyond the clear price differential is the largest differentiating factor: flavors.

The FDA has shunned the majority of characterizing flavors and all major domestic manufacturers have shifted to only selling tobacco flavors and menthol in the United States, and the FDA continues to become more stringent, having issued MDOs to menthol variants of products this past January and even just last week. Foreign producers of various disposables have seemingly cared little. This is simply not a vector that can be competed on.

Altria is massively downplaying the importance of its assumptions regarding U.S. regulation regarding enforcement. There is a House bill that prioritizes the enforcement of disposable ENDS (electronic nicotine delivery system) products, though it is probably dead in the water. Additionally, Reynold’s RAI services, part of BAT, has submitted a citizen petition to the FDA asking it to wield an enforcement policy to target competing disposables. Fortunately, recent FDA activity shows that U.S. tobacco regulation may be changing gears to do exactly what Altria needs, as I covered last week:

For Altria, this deal is positioned to be much less contentious but is still heavily reliant on future FDA actions. Just as the company assumed it could help JUUL successfully navigate regulatory waters and attain MGOs, its assumption that enforcement will increase may be off the mark. If this is the case, the NJOY acquisition may look lousy in hindsight. However, if enforcement efforts ramp up, which is more likely, NJOY may be optimally positioned to capitalize. After all, it’s quite easy to ‘compete’ when you have far fewer competitors.

Looking forward

Let’s remember that this deal isn’t final.

It’s premature to dive into models when there is still such significant information missing. This is doubly true when this coming week will have Altria Investor Day 2023, where we will get the announcements of a new oral product, a new HTP product related to the IP acquired from Poda, and perhaps more details of the joint venture with JT or even information on if Altria management intends to use the deferred tax asset generated from its JUUL exit to offset gains related to its long-held ABI stake.

While Altria faces doubt regarding management’s ability to allocate capital, keep in mind that the total cost of this deal, while not trivial, is small relative to Altria’s total cash flows, which are primarily legacy-derived and have less regulatory uncertainty compared to new product categories. While the spectrum of outcomes is wide, it’s unfair to flatly call this move poorly reasoned. At the very least, even if written to 0, this deal going through removes a possible threat to incumbents, reducing the range of potential futures. The value of that is hard to quantify but is surely greater than 0. Maybe the rest of the oligopoly owes Altria a thank-you card.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Altria and other tobacco companies such as British American Tobacco and Philip Morris International.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑

Deep discount is in Altria’s playbook, as illustrated in its competition against Zyn. British tobacco also tend to utilize price wars in promoting its HNB and Alto products. Given there is little brand or product loyalty among the vapor users, do you think the competition will have a meaningful impact on both company’s book?