“Time is a circus, always packing up and moving away.” - Ben Hecht

Throughout 2022, headlines were dominated by a circus of fears. Geopolitical strife. Supply chain woes. Persistent inflation. Altria, the U.S.-based holding company responsible for Marlboro and a range of other smokeable and smokeless products, was not entirely unscathed. However, even center stage, spotlights on, shackled by regulation as if impersonating Houdini, and caged in with lion-like legislatures, the only thing circus-like about the company has been its uncanny ability to walk the tightrope: managing its ever-growing pool of profits against an ever-shrinking pool of smokers - the same gravity-defying feat it has performed for decades.

On February 1st, 2023, Altria reported its Q4 2022 and Full-Year results.

Let’s dig in.

Firstly, if you aren’t already deeply familiar with Altria, I recommend reading my comprehensive analysis, valuation, and pricing published last year. While there have been plenty of new developments, its foundation and conclusions remain intact:

Altria’s Q4 2022 & Full-Year Numbers

For Q4 2022, Altria’s headline numbers were:

Net revenues of $6.111 billion, down 2.3% y/y

Revenues net of excise taxes of $5.083 billion, down .1% y/y

A reported tax rate of .5%, 28.3pp below last year

An adjusted tax rate of 25%, 0.5pp below last year

Reported diluted EPS of $1.50, up 70.5% y/y

Adjusted diluted EPS of $1.18, up 8.3% y/y

Once again, as if fooled by a magician’s sleight of hand, headlines have led investors to focus on the wrong numbers. Net revenues for Q4 were down 2.3%! But revenues net of excise taxes were near break-even. Despite the lackluster topline, adjusted diluted EPS was up 8.3% y/y.

The numbers are more dramatic when looking at Full-Year results:

Net revenues of $25.096 billion, down 3.5% y/y

Revenues net of excise taxes of $20.668 billion, down 2% y/y

A reported tax rate of 22%, 13.3pp below last year

An adjusted tax rate of 24.9%, 0.2pp below last year

Reported diluted EPS of $3.19, up over 100% y/y

Adjusted diluted EPS of $4.84, up 5% y/y

Not only were full-year revenues down 3.5% y/y, but even revenues net of excise taxes were down remarkably! However, as I mentioned after Q3, Altria sold its Ste. Michelle wine business in October 2021. Accounting for divested revenues that would have occurred in the first 9 months results in FY revenues net of excise taxes performing in line with Q4, that is, nearly unchanged. All things considered, this, along with growing adjusted diluted EPS firmly within the previously guided range of $4.81-4.89, is commendable considering the backdrop. The year presented an environment mired by macro pressures in the form of inflation and gas prices reducing total purchase trips, as well as consumers downtrading to discount brands.

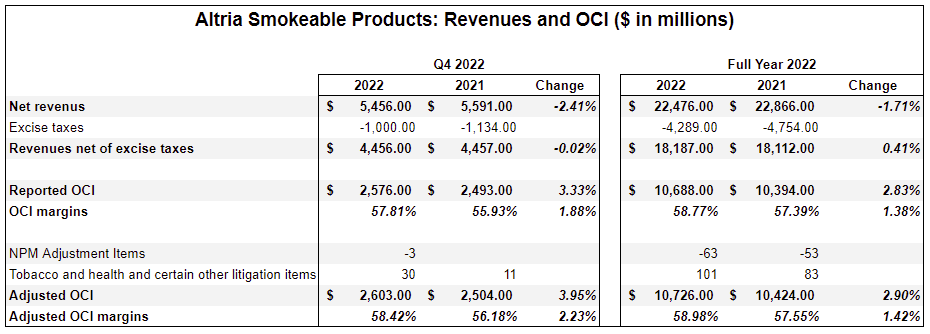

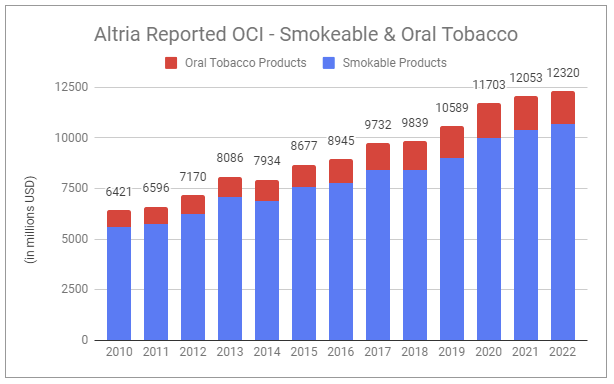

Smokeable Products

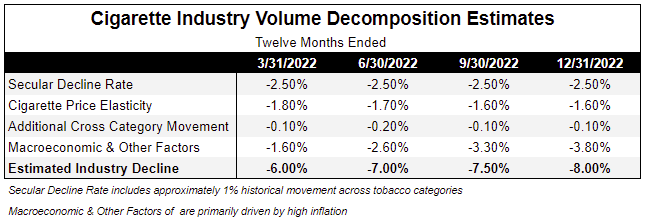

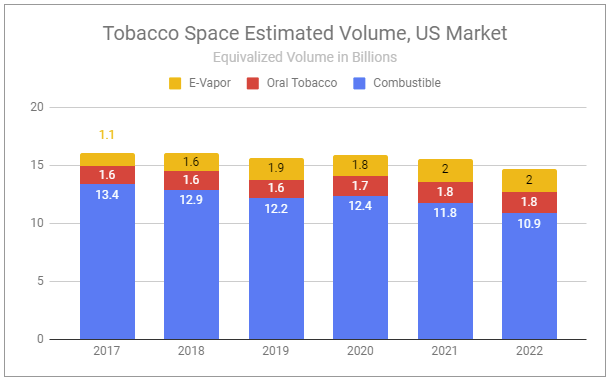

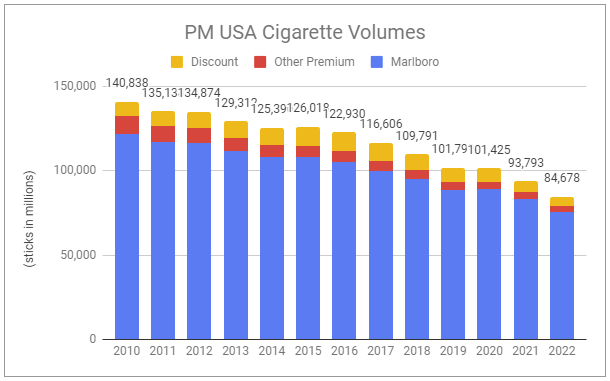

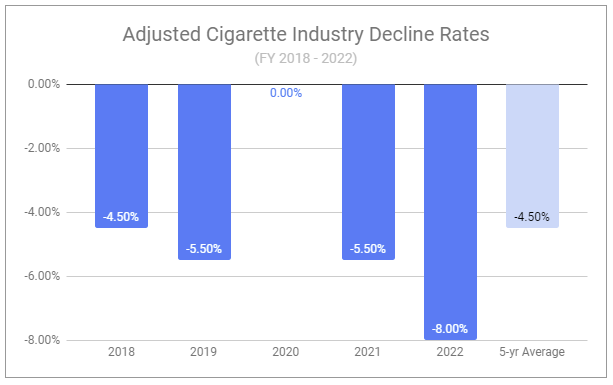

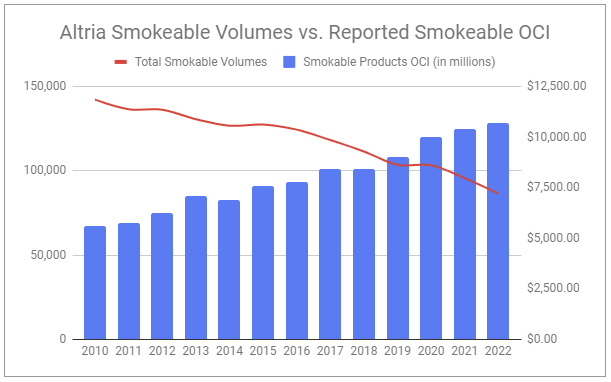

Smokeable products, Altria’s largest segment, saw revenues net of excise taxes grow nearly half a percent. More impressively, reported operating company income grew by 2.83%. I say impressive because this was achieved when smokeable product volumes were down a dreadful 9.61% for the year! Macroeconomic & Other Factors having applied additional pressure beyond the standard secular decline rate:

I stated last quarter:

I believe this period’s volume decline is likely an outlier, opposite to the positive outlier that 2020 ended up being. While it would be unwise to assume that volume declines would revert to the 4.5% range, it is not unreasonable to think that they would continue to come down alongside macro pressures, especially fuel prices. Any reversion and normalization of smokeable product volume declines will provide Altria with more flexibility moving forward. Additionally, this reminds us that while volumes are resilient in periods of economic weakness, they are certainly not immune. Nonetheless, PM USA’s ability to navigate such a steep volume decline and still increase revenues net of excise taxes and OCI is truly remarkable.

This view remains unchanged. These headwinds will persist, though their effects will lessen as gas prices continue to fall and we remain in a period of disinflation.

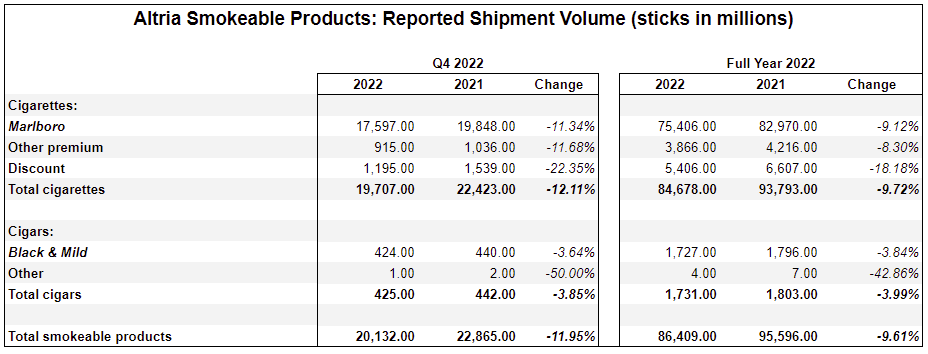

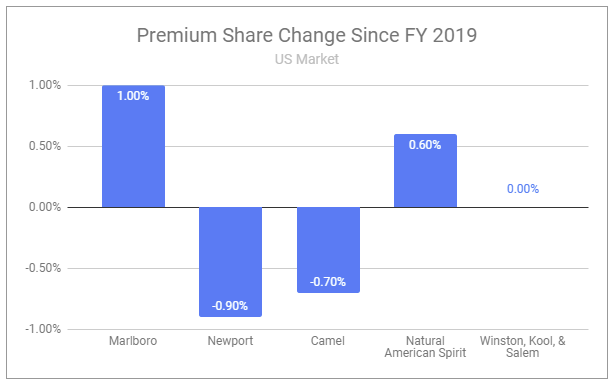

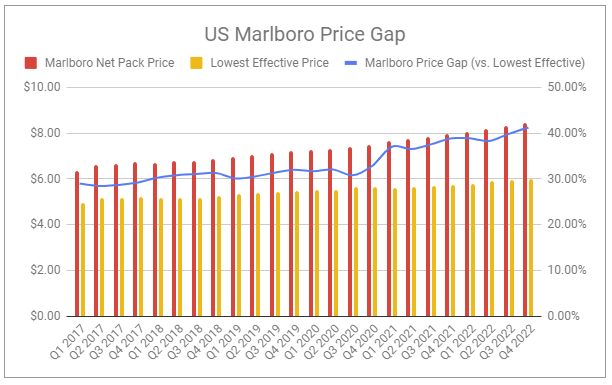

It is vital to look beyond industry volumes in absolute terms and evaluate Altria’s performance on a relative basis. Since 2019, Marlboro has continued to take share in the premium market:

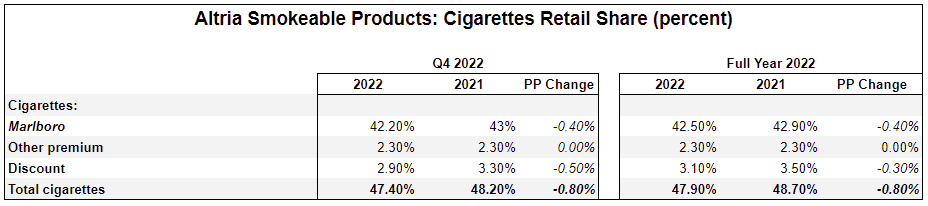

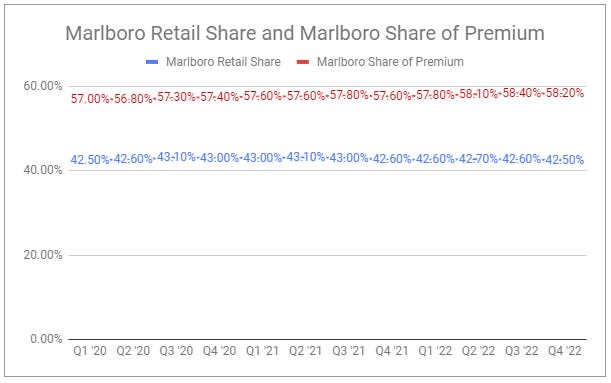

Not only has Marlboro’s share of the premium market grown, but its share of the overall US retail share has remained relatively stable:

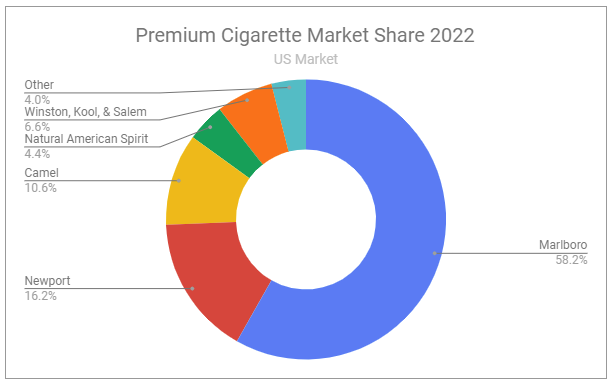

And as always, Marlboro’s share of the US premium market is a sight to behold:

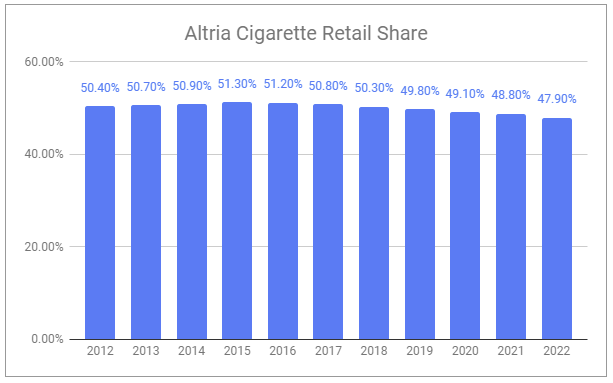

Despite Marlboro’s strength, the company has ceded 2.5% of total share in the last decade due to the poor performance of other premium brands and especially its discount brands:

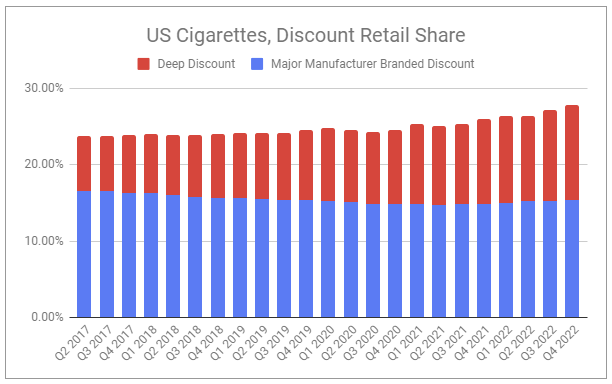

Altria’s discount brand shipment volumes declined by a whopping 18.18% in 2022 - which is especially alarming when discount has been taking share from premium on an overall basis due to consumers downtrading:

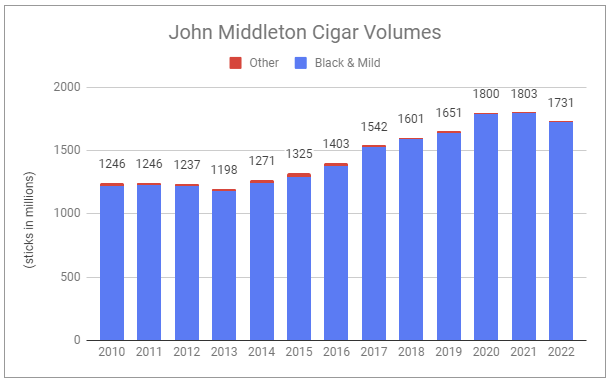

Along with Altria’s cigarettes facing elevated pressures, its cigar volumes declined by 4% in 2022. The company has not cited a specific source of the weakness, which leads me to point toward the same macro factors impacting cigarettes. It is worth noting that this decline could have even been more pronounced: anecdotal channel checks show the company continuing to engage in significant promotional discounting on packs of its FT Black & Milds.

Despite all of this, Altria’s smokeable segment showed remarkable strength and recognized net price realization of 13.5% in Q4 and 11.1% for the full year. Marlboro's net retail price increased by 6.4% in the last quarter of the year.

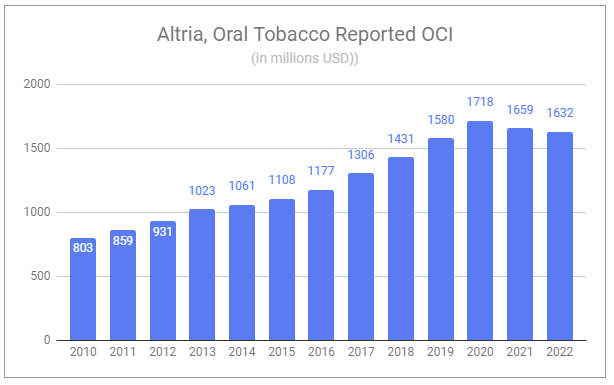

Oral Tobacco Products

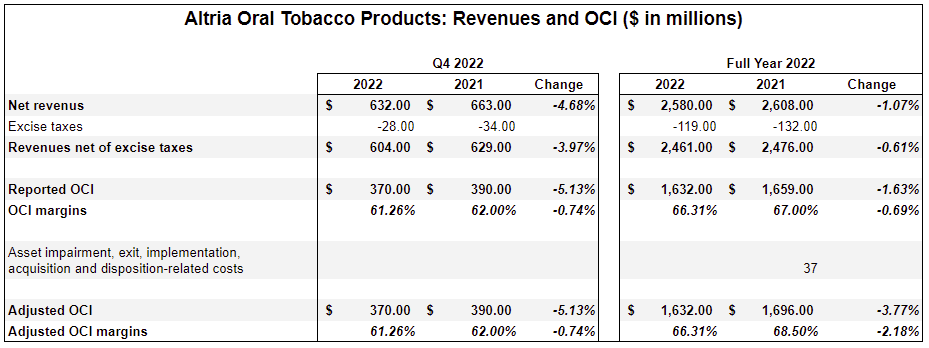

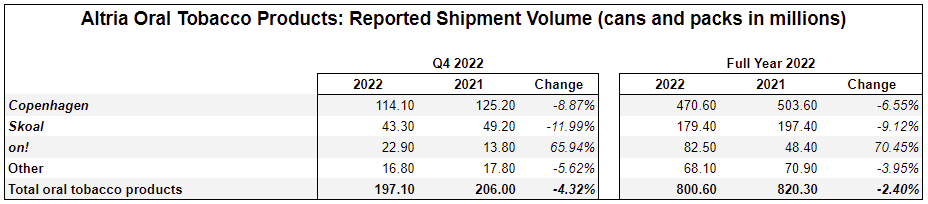

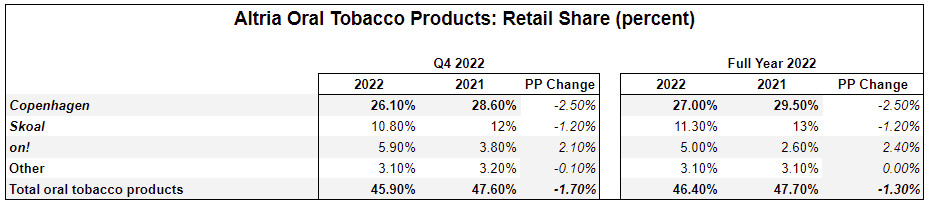

Altria’s Oral Tobacco segment produced mixed results. Volumes of legacy products such as Copenhagen and Skoal continued to decline in Q4 and FY. When normalized for trade inventory movements and calendar differences, FY oral volumes were still down approximately 2%. Price realization was unable to offset the volume declines, both of which were exacerbated by the promotion of on! nicotine pouches. Reported operating company income was down 1.63% for the year after falling 5.13% y/y for Q4.

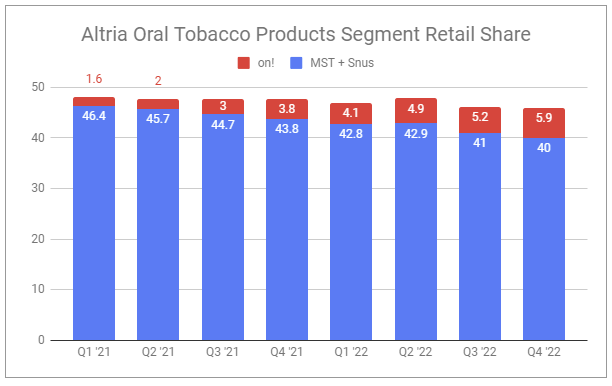

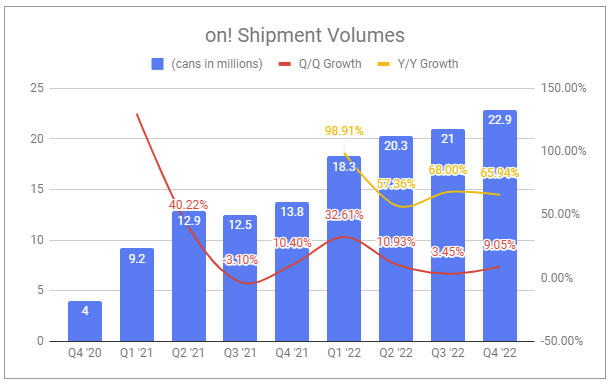

The silver lining for the segment was the performance of on!. While the pouches continued to cannibalize legacy volumes, they grew in total retail share. on! volumes were up nearly 66% y/y in Q4 and up over 70% for the full year. This is doubly promising as the company had reduced its promotional spend per can by approximately 15% between H1 and H2 of the year.

Not only does on! now hold a 5.9% share of the oral tobacco segment, but it now has a 24% share in the nicotine pouch category, up 3.5pp y/y. This category is nascent, with a long runway ahead, barring unforeseen regulatory impacts. While the oral tobacco segment will continue to face pressures, on! continued growth paired with a reduction in those promotions as consumer awareness builds will be a positive for both operating company margins and income. In tandem with macro pressures easing, this may allow the segment to stabilize and OCI to flip to stable LSD growth.

Merging the operating company income of both major segments illustrates a long-term trend that is less concerning:

Other developments

During the prior quarter, we were provided with several interesting developments:

Altria being paid $2.7 billion to nix its commercial relationship with Philip Morris International regarding IQOS in the U.S.

Altria forming a JV with Japan Tobacco.

Altria moving forward with its owned HTC platform, with finalization due 2023 and expectations for PMTA submission by year-end 2024.

To add a bit more uncertainty to how the future will unfold, in January of this year, the FDA issued marketing denial orders for two menthol e-cigarette products currently marketed by R.J. Reynolds Vapor Company, a subsidiary of British American Tobacco. Two days later, the FDA issued PMTAs for three varieties of HTP consumables owned by Philip Morris International. This, paired with PMI successfully reaching the acceptance threshold for its Swedish Match offer, suggests additional competition may be coming to the U.S. market.

Debt

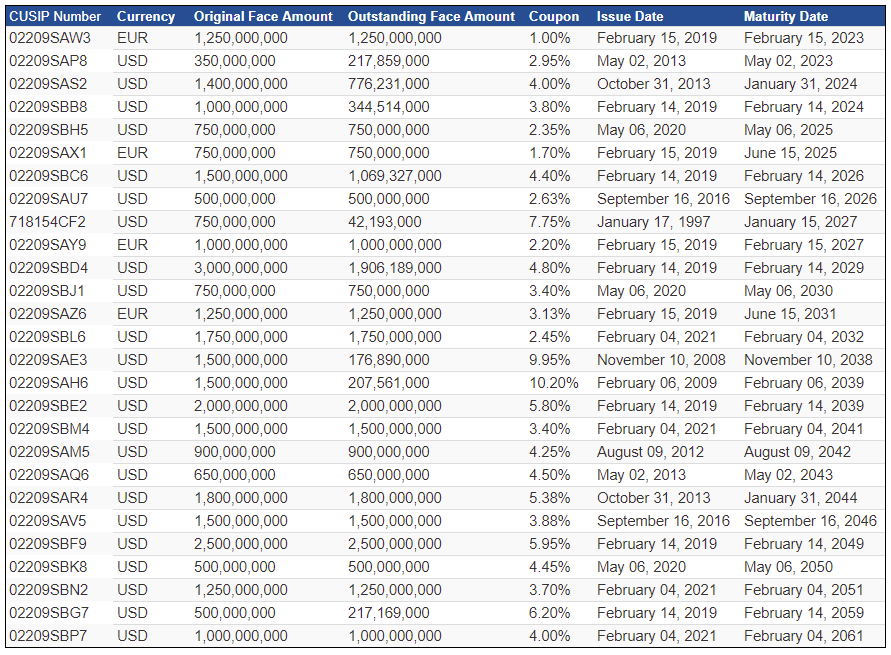

Altria continues to make meaningful progress in deleveraging. As of Dec 31, 2022, the company’s weighted average coupon was 4%.

Currently, the company holds:

an interest coverage ratio of 10.3x

a total debt/EBITDA ratio of ~2.1x

a net debt/EBITDA ratio of ~1.8x

Altria completed repurchasing $1.8 billion of stock during FY 2022, equating to over 38 million shares. The board has authorized a new $1 billion share repurchase program, which will likely be entirely executed during 2023. While the new program is notably smaller in size, the company has set aside the necessary cash to retire ~$1.3 billion of notes (CUSIP 02209SAW3) due later this month. Future repurchase programs will, as always, be at the discretion of the board, and we should expect them to fluctuate, contingent on both operating performance and the maturity dates of other outstanding notes.

New product design

Altria has finalized a new product design that will be revealed during its 2023 investor day later this month. While I had initially expected them to showcase a product leveraging the IP attained from last year’s PODA acquisition, it is unlikely to be an HTP or e-vapor product, as management has stated favorable testing with dippers and nicotine pouch users. Moist pouch? Lozenge? I have no interest in further speculating when all mystery will be shed in a few weeks’ time.

Vuse Alto ruling

In September of last year, a jury found that Reynolds Vapor Company’s (“Reynolds Vapor”) Vuse Alto e-vapor product infringed three patents owned by Altria Client Services. Altria was able to convince the jury to swap its $95m award for past damages through June 30, 2022, for a royalty rate of 5.25%. During continued litigation, the Judge declined to double the royalty rate to 10.5%, though upheld the initial ruling in favor of Altria. Reynolds intends to appeal and weigh all other options.

Equity investments

Juul

While Altria continues to retain its economic stake in Juul, the company once again recognized a non-cash impairment, this time to the tune of $100 million. Juul had finally reached a settlement with nearly 10,000 plaintiffs, removing a great cloud of uncertainty. However, already deeply impaired and continuing to lose market share, primarily by the hands of Reynolds, Juul Labs has been forced to cut costs and even raise fresh funding to stay afloat. For now. I continue to value Altria’s equity stake in the company at $0.00.

Cronos

Altria’s “strategic” investment is valued at approximately $389 million today, down from the $1.8 billion it paid in 2019 to acquire it. Ouch. In Q4 2022, Altria irrevocably abandoned its Cronos warrants.

InBev

Altria’s investment in ABI is approximately valued at $11.68 billion. Altria recorded $571 million of adjusted equity earnings for the full year of 2022. There has been increasing questioning surrounding the stake and what management’s intentions are. Naturally, the response has been that the focus is long-term value creation, and the stake will continually be evaluated. Having originated from Altria’s (then Philip Morris) stake in Miller Brewing Company more than 50 years ago, I don’t see them rushing to sell, especially with tax implications present. Nonetheless, it’s not farfetched to envision such opportunities in the future. Any notable divergence in the relative performance of MO and BUD equity, contingent on fundamentals, could be used as a rationale for selling the stake to further delever or to simply retire a substantial portion of Altria's common equity.

Valuation model

It’s easy to get stuck on past management’s poor capital allocation decisions, speculate on the possibilities of new products and new competitors alike, and fixate on declining unit volumes. But what really matters? As always: the ability to generate cash. In Q3’s note, I concluded:

Most spectacularly, the company will likely generate ~$12 billion in operating income this year while only deploying $175-225 million on CapEx. That’s worth keeping in mind as other companies attempt to race away from the fact they’ve been overspending with little to show for it.

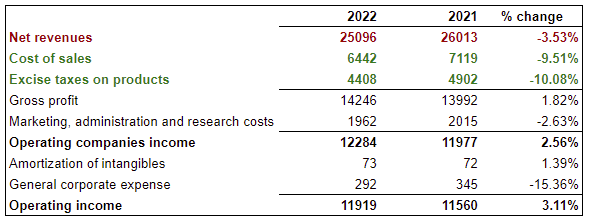

Altria remains able to generate obscene amounts of cash while being entirely self-funded and needing to reinvest minimal amounts. FY CapEx came in at $205 million. D&A $226 million. The company generated $11.919 billion in operating income, a 3.11% increase y/y. At the heat was the usual dance of declining sales volumes driving costs of sales and excise taxes down:

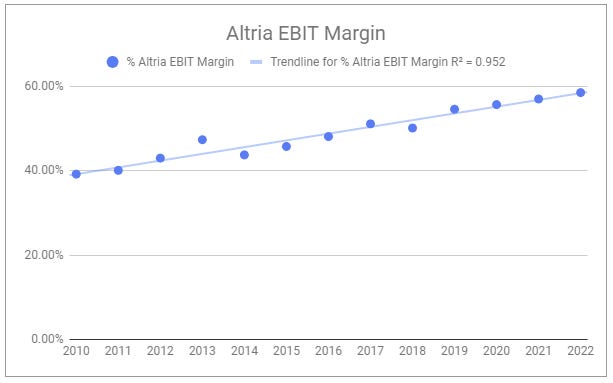

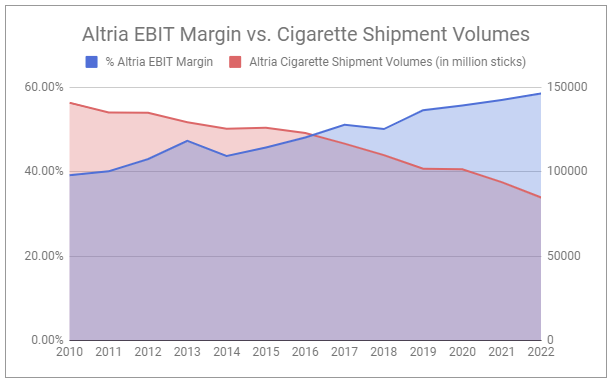

With exercising tremendous pricing power, Altria can walk the tightrope for quite some time:

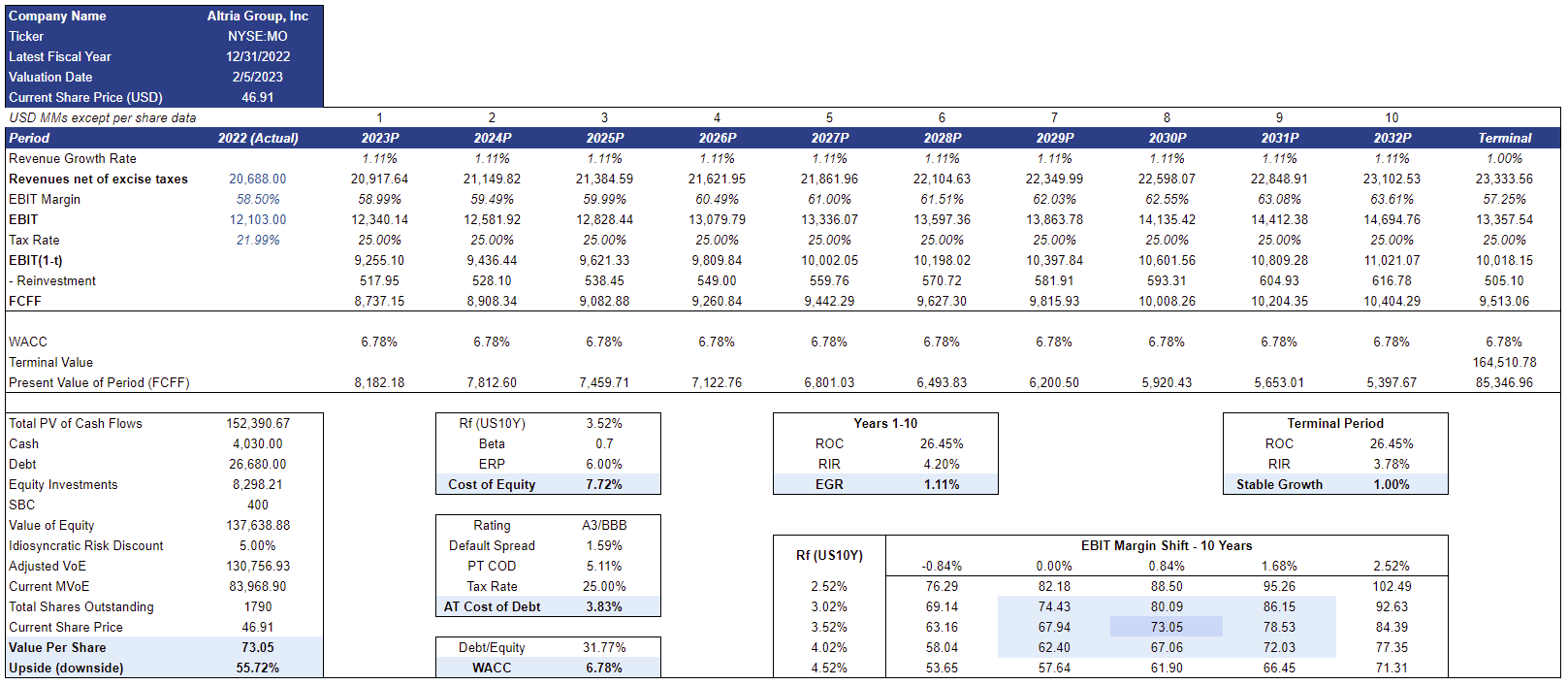

An update to my two-stage unlevered discounted cash flow model.

Key assumptions:

PM USA cigarette market share will remain relatively stable as consumer spending narrowly fluctuates between premium and discount brands throughout economic cycles.

Price hikes and cost savings will offset legacy volume declines for the foreseeable future.

Margins will expand steadily.

These are expressed via the following inputs:

ROC and WACC will remain stable.

Minimal reinvestment will be made to maintain low growth.

During the ten-year period, net revenue will grow at the 12-year average of 1.11%. It will drop to 1% in the terminal period.

EBIT Margin will expand by a relative .84% each year for ten years before contracting in the terminal period.

The company’s tax rate will be normalized at 25%.

The DCF model:

Applies zero value regarding marijuana, despite Altria's multiple patents concerning the use and vaporization of THC and CBD and the company’s growing lobbying efforts to legalize recreational marijuana at the federal level.

Assigns zero value to Altria’s JUUL investment.

Applies no specific values to potential or anticipated future regulation.

Assigns zero value to Poda IP.

No expected value calculation for ruling regarding Vuse Alto royalty.

The simplified inputs of this model are intended to be conservative and thoughtful. The output suggests that Altria’s equity is considerably underpriced with a substantial margin of safety. There is nothing off-limits to criticize, but there are additional considerations:

EBIT and FCFF, while stable, are shown to grow at just 1.96% per annum, well under the historical average.

Along with Altria’s equity stake in JUUL being written down to 0 (unchanged from my initially published valuation), Altria’s CRON stake has been marked down 70%, and the company’s BUD stake has been marked down 30%.

Altria’s pre-tax cost of debt was synthetically calculated using the Rf rate and the company’s default spread, presenting a PT COD of 5.11%, well over the company’s weighted average coupon of 4%.

A 5% idiosyncratic risk discount was applied to the equity to proxy uncertainty around the U.S. market, mainly competitive dynamics.

Out of all the inputs, the 5% idiosyncratic risk discount may turn out to be the most foolish. After all, Altria represents the strongest and most profitable brand in the most profitable market - and one that is largely insulated from competition thanks to the company’s partner, the U.S. federal government. Of course, with minimal investment, perhaps eventually, competition will find its way to reverse Altria’s long-term value engine. Time will tell. But for now, it will continue to fire away. For the full year of 2022, Altria returned $6.6 billion as dividends to shareholders along with the previously mentioned $1.8 billion in share buybacks. The total, $8.4 billion, is equal to 10% of the company’s current market cap.

The ultimate balancing act goes on.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Altria and other tobacco companies such as British American Tobacco and Philip Morris International.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑

Great work as usual, Devin. Thank you!

"the company’s partner, the U.S. federal government"

"The ultimate balancing act goes on"

;-)

There is one difference to the balancing act now, though, from times before. Now we have revenues declining. If this is a trend, the balancing act will need to be done on a thinner rope than before.