Altria: Rorschach

“Illusions commend themselves to us because they save us pain and allow us to enjoy pleasure instead. We must therefore accept it without complaint when they sometimes collide with a bit of reality against which they are dashed to pieces.” - Sigmund Freud

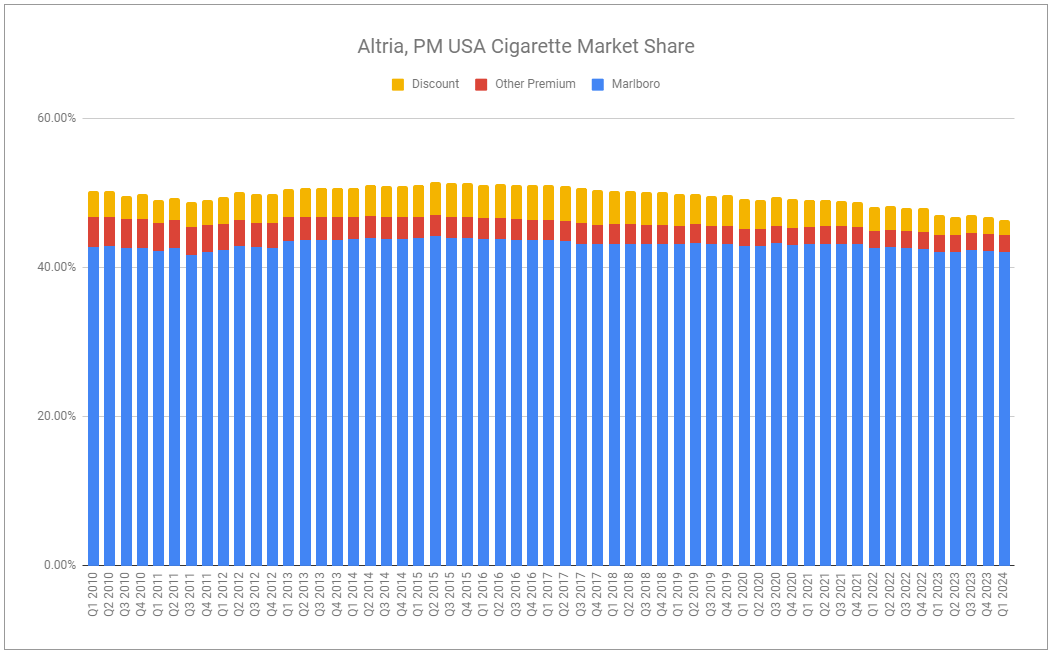

Charted Altria figures, like the ink blots of a Rorschach test, can be administered to assess an investor's psyche. Volumes. Market share. What do you see? Feel?

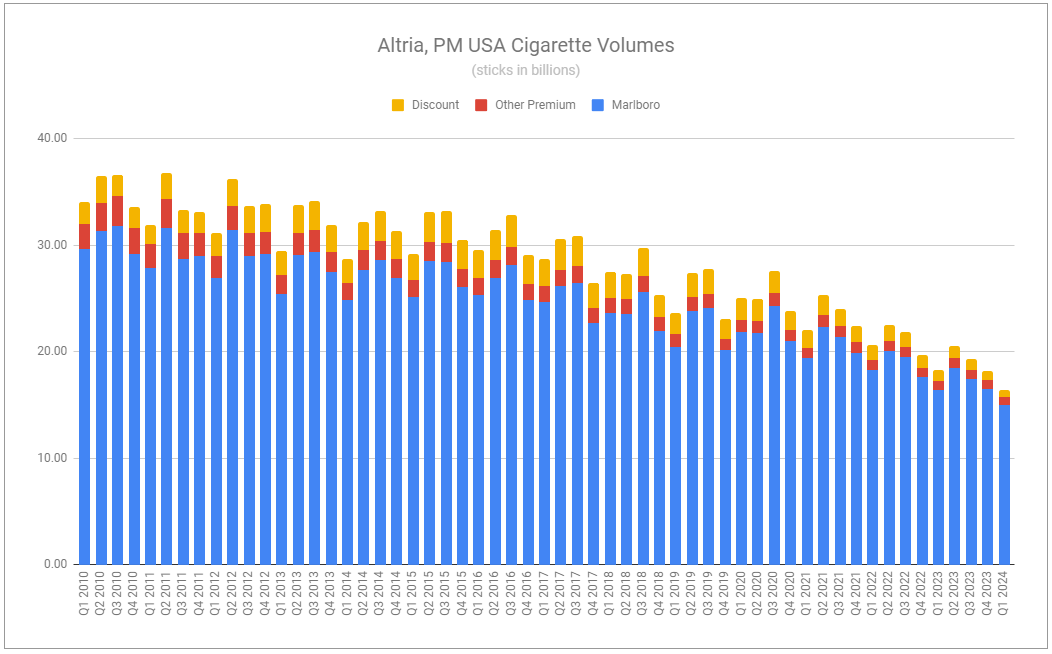

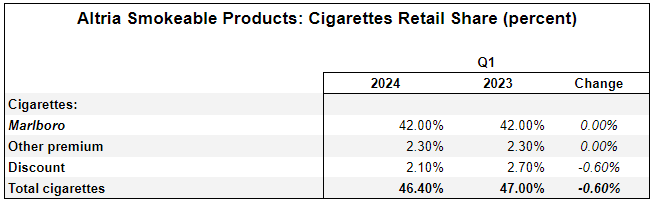

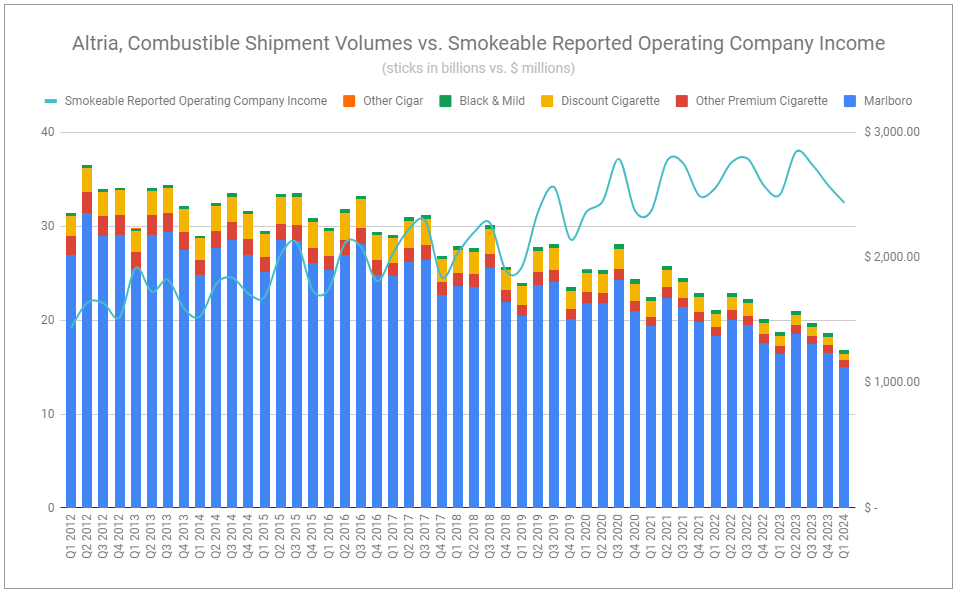

Helplessness? Desperation? Doom? With trends unmistakably heading down and to the right, it is no surprise that that’s how most answer. Oddly, these are the figures that continue to be fixated on despite not being the whole picture. What does an isolated volume or market share figure tell you of value? Nothing. Further, Altria’s management has continually expressed the goal not to prioritize either of these but rather to balance these two figures alongside price and cost, maximizing value over the long term.

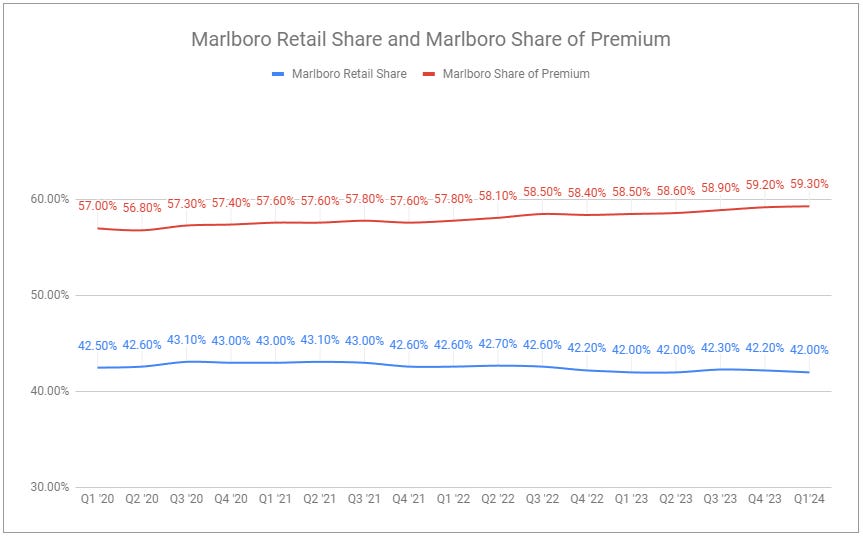

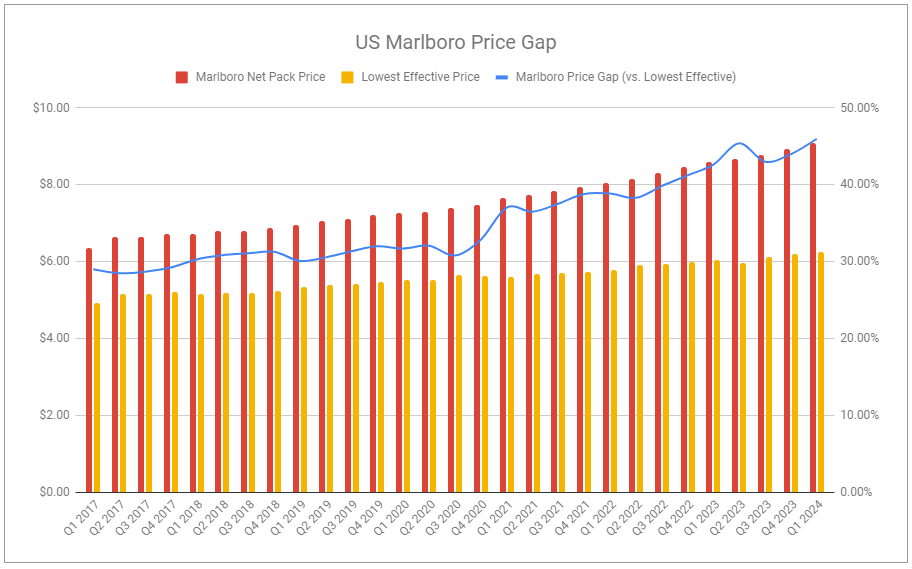

Combustible pricing continues to be pushed further, and while Marlboro has continued to premiumize further, the price gap continues to widen.

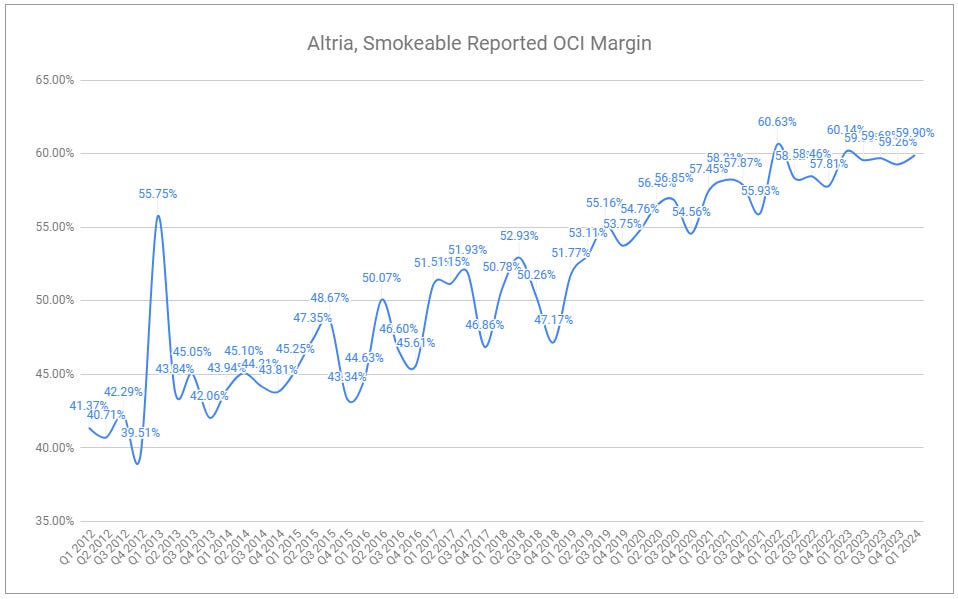

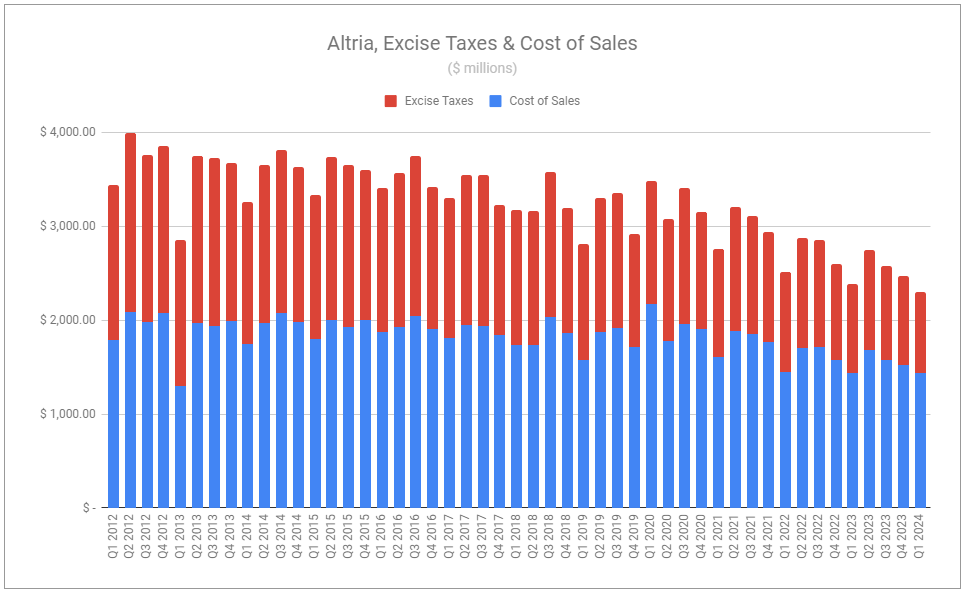

Costs are much more concerning, with Altria’s cost of sales remaining a stubborn total despite legacy volumes declining far above the historical average. Q1’24 reported figures also included a shift in recognized R&D expenditures, moving new category efforts into All Other from the Smokeables segment, quantifying the figure but still leaving numerous unanswered questions about exactly what the company is pursuing in those other categories.

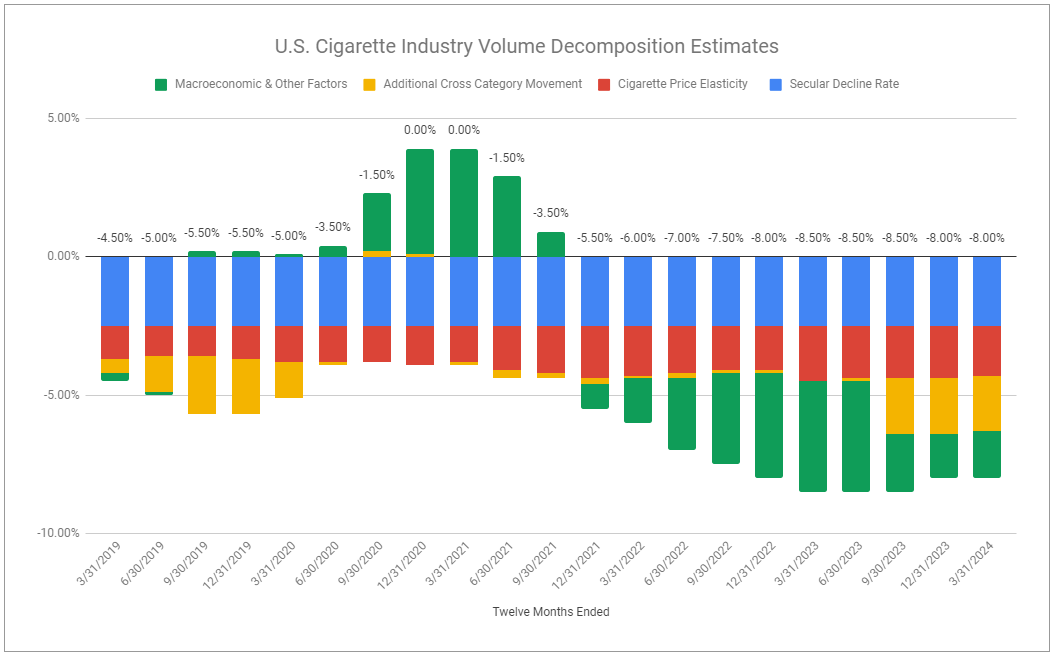

NJOY, while now in more stores, is still falling short. The previously highlighted concerns of pod leakage and device overheating continue to be substantiated by scouring user reviews. Doubt grows about whether this product can compete in the market, especially one overrun by illicit disposables. And even though enforcement actions on both federal and state levels have increased, it remains too little to make a material difference. This extends beyond just going toe-to-toe in vaping and continues to weigh on legacy volumes alike, illustrated by the continued effect of additional cross-category movement within industry volume decomposition estimates.

Heated Tobacco also lacks promise for Altria. While I maintain my doubt about the speed and extent of PMI’s IQOS rollout in the United States, Altria is sure to playing from far behind. SWIC is still in development. The joint venture with Japan Tobacco receives little mention. The IP acquired from Poda is long forgotten. The only saving grace is that when an IQOS ILUMA rollout does eventually occur on a nationwide level, it may struggle to appeal to the millions already leaning toward illicit flavored disposable vapes and may fail to gain momentum against Marlboro.

Despite the challenges, headwinds, and lumpiness of new investments, Altria’s core business continues to produce an astounding amount of cash.

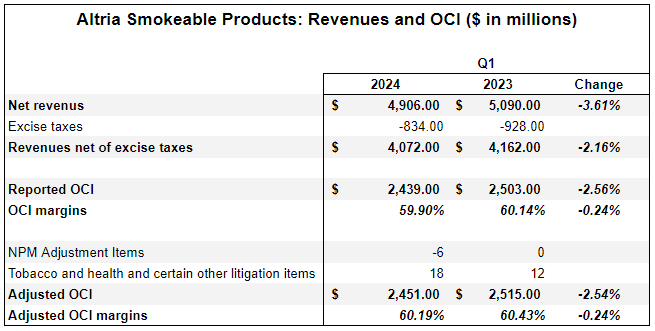

Smokeable Products

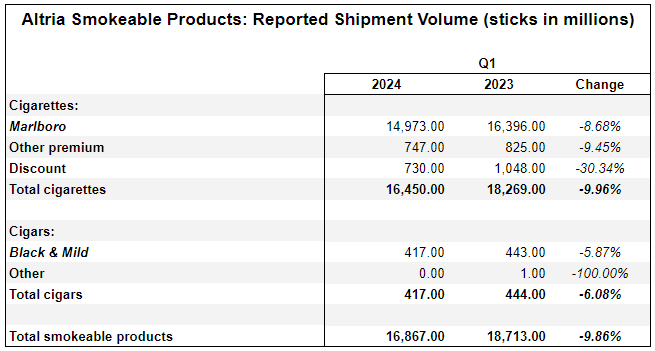

Altria’s nearly 10% combustible volume decline in Q1’24 has alarm bells ringing. However, several points should be noted. Marlboro volumes declined by 8.7%, marginally under the estimated adjusted industry decline rate of 9% for the quarter. The disproportionate decline was associated with Altria’s discount volumes, down by over 30% in the quarter, aligning with the company’s clear Marlboro premiumization focus. This is also well visualized by the trends in share shift for the company:

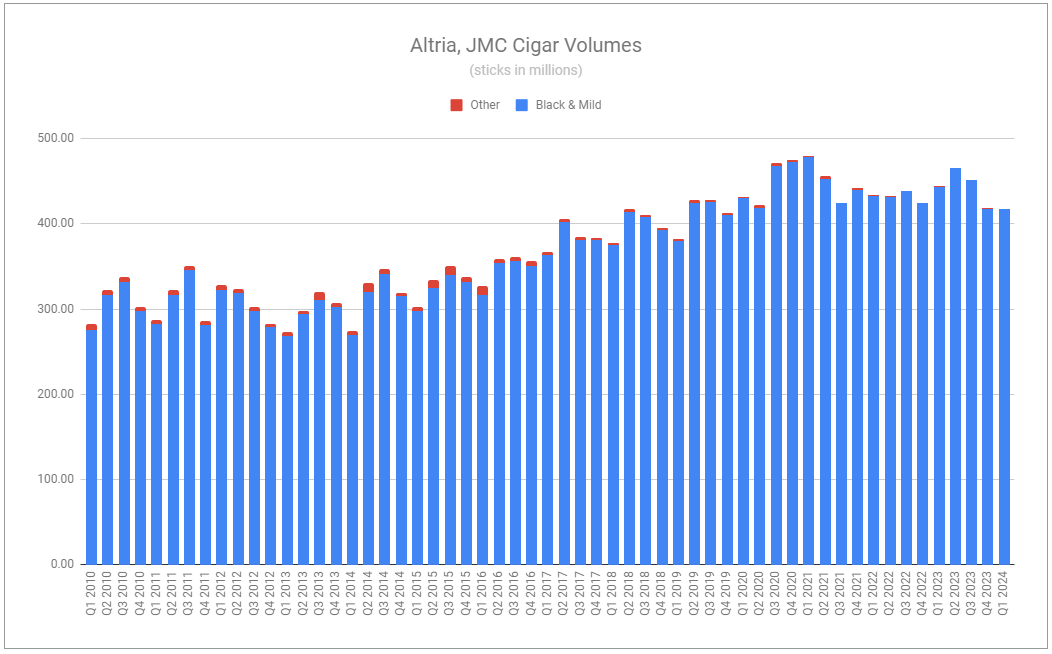

Although down nearly 6% in Q1, John Middleton volumes have remained incredibly robust. The company has continued its nationwide distribution of all flavor assortments and has more recently done the same for filter-tipped versions of all variants, complimenting the brand’s hallmark plastic and birch wood tip versions. As covered in There Aren’t Many John Middlestons, this subsegment may only produce a small total of the category’s financial performance, but its strength is tied to the product and product category's unique qualities and pricing evolution relative to cigarettes. Cigarettes becoming more challenged should be a tailwind for JMC, poised to become a larger part of the Smokeable segment incrementally.

There Aren't Many John Middletons

“Nowadays people know the price of everything and the value of nothing.” - Oscar Wilde Tremendous brand equity can bestow a firm with significant pricing power. If operations also sport low capital intensity, excess profits are unavoidable, and with a long runway, investments into even the most boring companies meeting these criteria can produce immense …

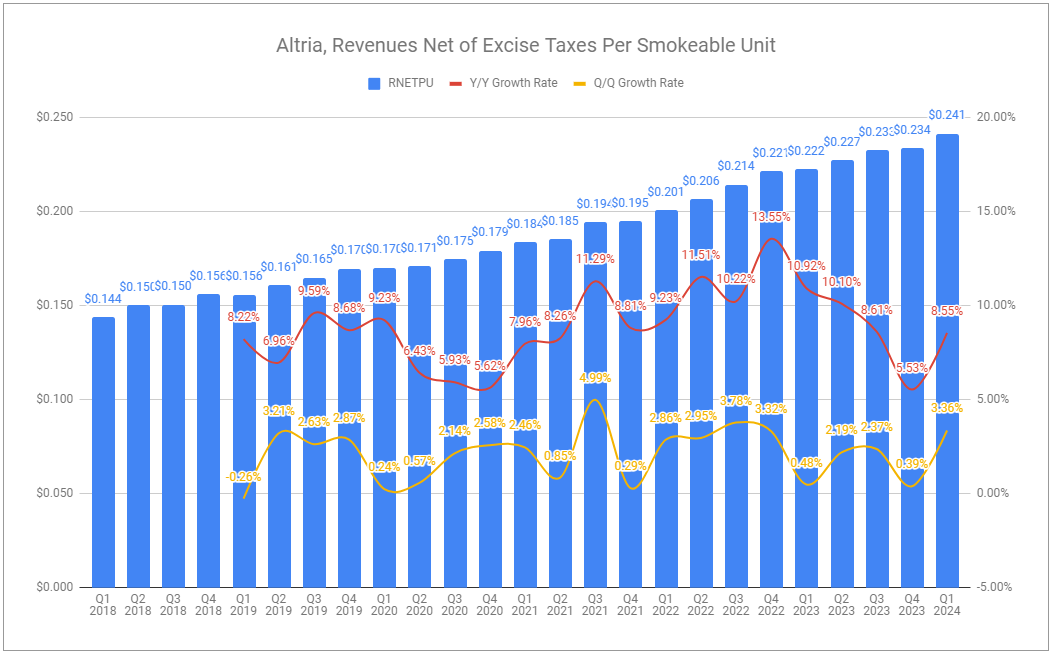

Despite volumes continuing to decline at a rate far above the historical average, price take has continued to drive revenue net of excise per smokeable unit consistently higher. And, although costs remain an elevated headwind, leading margins to compress modestly, the segment still remains ungodly profitable. Q1’s 2.5% decrease in segment operating company income is unlikely to reflect full-year performance and is assuredly not reflective of such on a per-share basis.

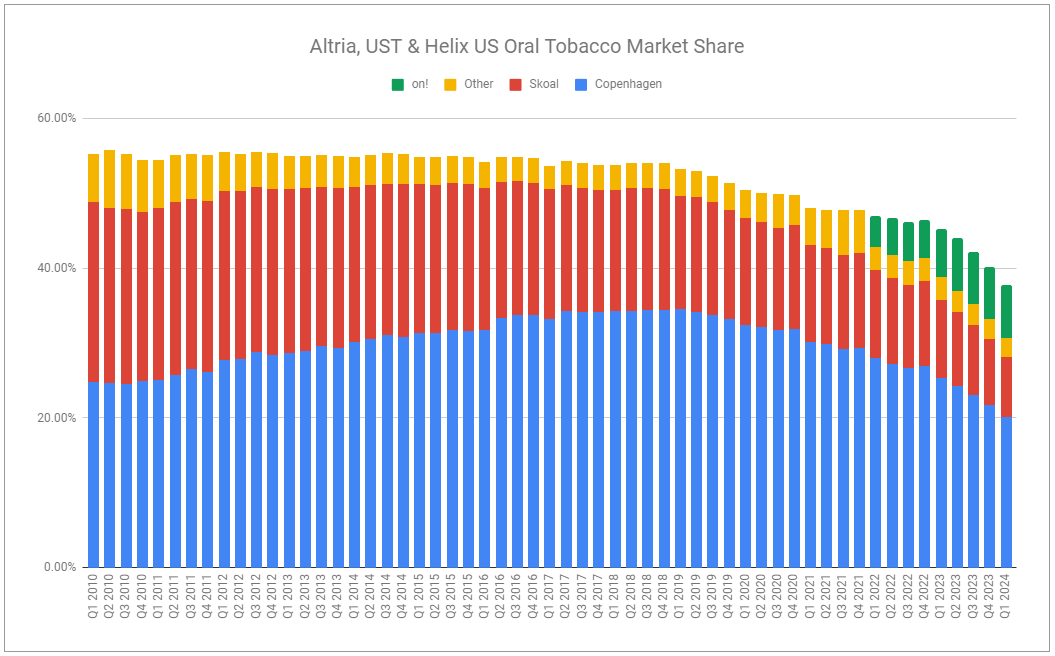

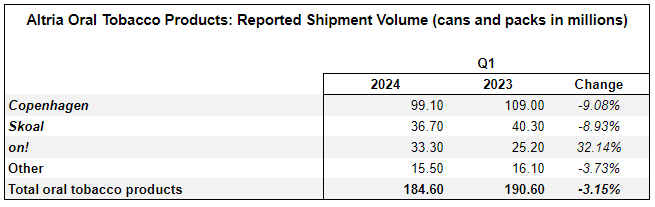

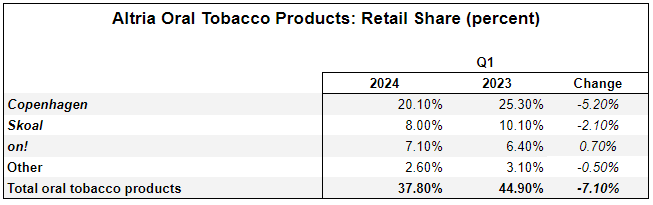

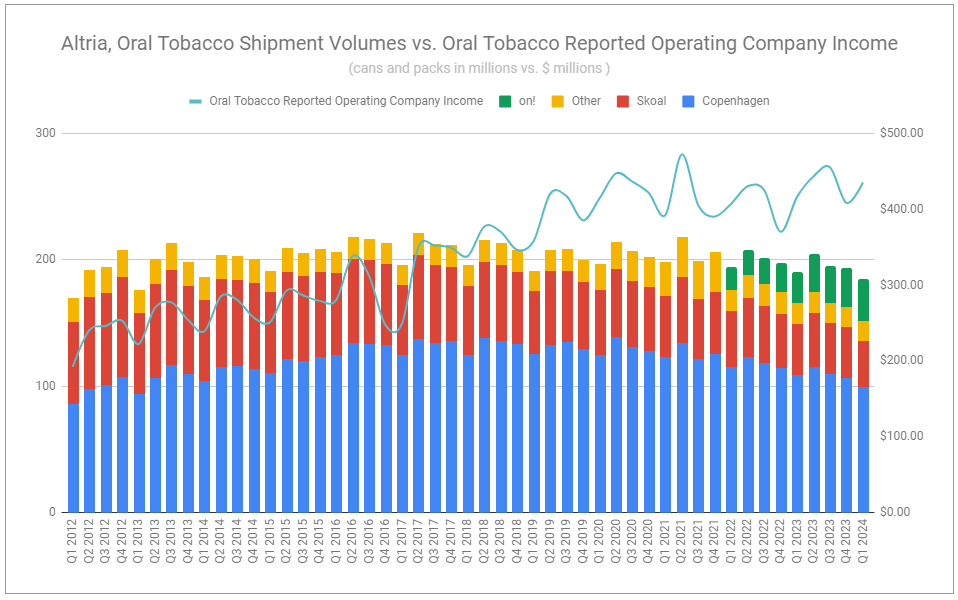

Oral Tobacco Products

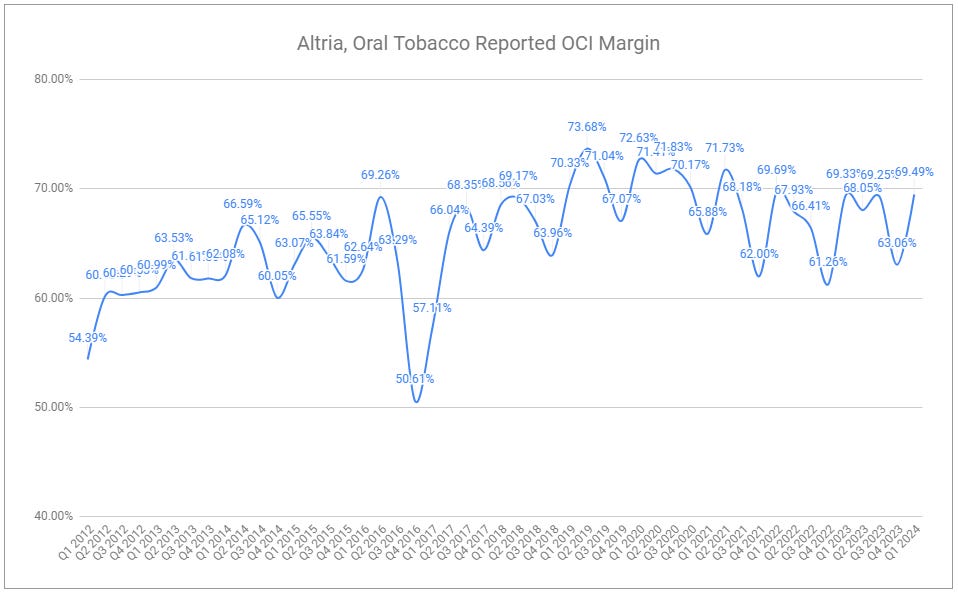

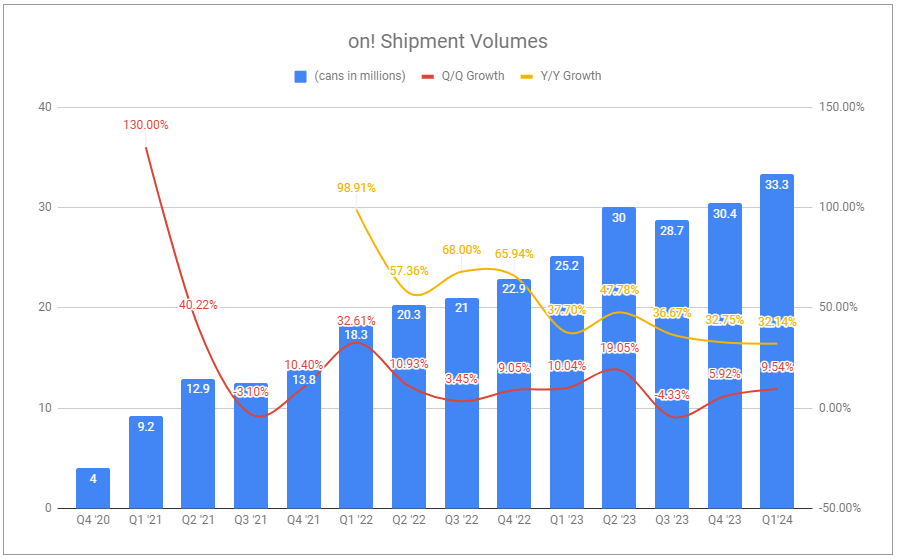

Altria’s share of total US oral tobacco has rapidly declined, falling by 7.1% y/y in Q1’24. As legacy volumes continue to be cannibalized by nicotine pouches, ZYN has shown no signs of slowing or ceding its leading position. These are the same dynamics covered in Q4’23. However, also highlighted is the fact that oral tobacco remains a volume growth category in the United States, with the most recent period showing growth at a substantially elevated rate. While on! does not sport the top position, there is no denying it is a differentiated product that has successfully appealed to a large chunk of adult consumers, with volumes increasing year-over-year by 32% in Q1’24.

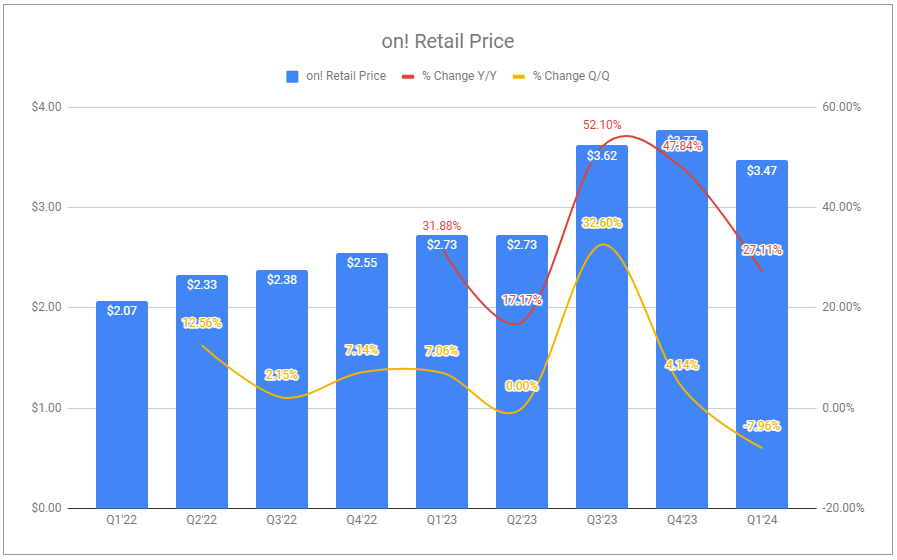

Criticism for the product stems from the fact that on!’s growth rate is less than half of ZYN’s, but that still misses the full picture. While ZYN has taken modest price increases in the last year, on!’s growth has been despite much more significant price take, up $0.74 per can from Q1’23. A second criticism is that from Q4’23 to Q1’24, on!’s retail price decreased, but that too is too narrow of a view. Just like volumes and shares, pricing efforts can not be looked at in isolation. Instead, it must be appreciated that the company will balance these factors, and not just against one another of a single product, but across the entire product portfolio. Maximizing results comes from attracting and retaining adult consumers across both NP and legacy oral.

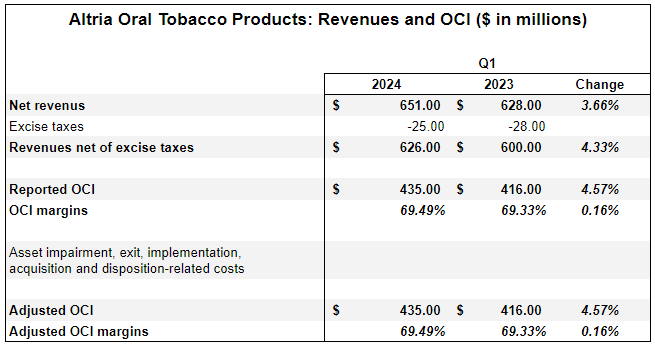

In Q1’24, Oral Tobacco revenues net of excise taxes and operating company income increased by 4.33% and 4.57%, respectively, with margins widening by 16 bps. Just as JMC is set to partly offset further cigarette weakness in the Smokeables segment, the continued strength of Altria’s oral tobacco operations is poised to do so even more, provided the NP environment remains somewhat static. A leading position in a steadily declining legacy paired with a firm second-place NP is a fine spot to be in while room for further pricing exists.

Ask, and ye shall receive

I wrote on a potential sale of Altria’s Anheuser-Busch stake a year ago:

Naturally, this comes with hesitation. While it deleverages the company, the company’s present debt levels aren’t all too concerning, and the performance of the remaining entity would be further concentrated on the core business. If the core business degrades, this type of maneuver would look foolish in hindsight. If the core business degrades while ABI flourishes after Altria were to sell its stake, it would look downright asinine. Nonetheless, the above exercise illustrates the mechanics at play. A substantial increase in the differential between MO and BUD shares leads to a substantial increase in the odds of a sale.

At the same time, perhaps this will be inevitable. Management has announced a shift in dividend policy, from an 80% target payout ratio of adjusted diluted EPS to a ‘progressive dividend goal’ targeting mid-single-digit dividend growth for the next half-decade. I find this concerning. This policy is clearly aimed at bolstering investor confidence but could cause management to perform short-term moves to reach their medium-term goal. A focus on value return is not the same as a focus on value creation, and there is no promise this would align with what is best for the long term. This is especially the case with the company investing in HTP SWIC, on! Plus, NJOY, and who knows what else in the coming years, all of which will face varying durations of unprofitability, further weighing on group results. In this light, maybe this avenue flips from an alluring opportunity to a scary proposition.

Having continually revisited the stake, last quarter’s note concluded by stating:

The investing community continues to fixate on the race for next-gen products while simultaneously overlooking the exceptional profitability of legacy operations. The great race that Altria should be partaking in is seeing how fast it can continually return capital to shareholders. One must wonder what relative multiples it would take for management to consider selling down the BUD stake to accelerate share repurchases. A $1 billion deployed to share repurchases retires ~24.1 million shares at the current price—1.37% of share capital. Along with increasing EPS, this incremental $1 billion repurchase would also cut the total annual dividend paid by $94.8 million.

Ask, and ye shall receive.

On March 13, 2024, Altria announced its intent to sell part of its stake in Anheuser-Busch and, on March 19th, entered accelerated share repurchase transactions totaling $2.4 billion. The math works out to be strikingly close to the described above, at a factor of double. For a total of $2.04 billion, Altria repurchased 46.5 million shares in Q1, approximately 2.6% of total share capital. This is ~85% of the accelerated share repurchase, leaving 15% to be recognized in Q2 and a further $1 billion remaining from the authorized share repurchase program to be utilized throughout the rest of the year. This will represent over 4% of total share capital, after which the company will save approximately $300 million per year in absolute dividend payments. Even accounting for the relative loss of income associated with the paring of the BUD stake, this will provide substantial opportunity over time to further retire share capital or debt, both of which will drive value on a per-share basis all the much further. Altria’s partial sale of its BUD stake represented only 19.3% of its total investment. Still holding 125 million restricted and 34 million common shares, the company can sell the position further and retire equity more aggressively. Should the price and value of BUD and MO diverge to a greater extent, I will be sure to welcome it.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Altria and other tobacco companies such as Philip Morris International, British American Tobacco, Scandinavian Tobacco Group, and Imperial Brands. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑ BUD 0.00%↑

Dont get me wrong. My tobacco position of my portfolio is massiv near 50%. But altrias numbers are very bad. -10% volume decline is massive and now the ocf is dropping too. Njoy is getting beaten by Bats and On! Is getting beaten by PM. Mo with 100% us and combustible premium products is the least favorable tobacco stock imo at this valuation.

Excellent piece