“Nowadays people know the price of everything and the value of nothing.” - Oscar Wilde

Tremendous brand equity can bestow a firm with significant pricing power. If operations also sport low capital intensity, excess profits are unavoidable, and with a long runway, investments into even the most boring companies meeting these criteria can produce immense windfalls—if acquired at the right price. A prime example of this, already known to many, is See’s Candies. My friend Alex Morris, author of The Science of Hitting, wrote on the specifics nearly a year ago in his piece, “There Aren’t Many See’s Candies.” He wrote:

In the late months of 1971, Warren Buffett and Charlie Munger learned that See’s Candies, a West Coast manufacturer and retailer of boxed-chocolates, was on the selling block. The sellers wanted $30 million for the business (after accounting for $10 million of cash on the company’s balance sheet), and Munger thought that was a reasonable price given its competitive position: “See’s has a name that nobody can get near in California… It’s impossible to compete with that brand without spending all kinds of money.” But despite Munger’s enthusiasm, Buffett concluded that he wasn’t willing to pay a penny more than $25 million for the business, a price that implied a low double digit multiple of See’s after-tax earnings (“three times net tangible assets made me gulp”). Thankfully, the owners were willing to compromise, and the acquisition was completed in January 1972 (See’s was purchased by Blue Chip, which became 100% owned by Berkshire in 1983).

The takeaway is that Buffett and Munger held the view, based on the brand equity See’s had established over half a century with millions of consumers in California, that the company had significant untapped pricing power – and as the chart below shows, they put that belief to the test over the next quarter century. As you can see, revenues per pound of candy sold increased more than four-fold from 1972 to 1997, from $1.85 per pound to $8.80 per pound. (In addition to periodic mentions in Buffett’s shareholder letters, revenue and profitability for See’s Candies was broken out in Berkshire Hathaway’s annual reports until 1999; that ended in 2000, when the company was consolidated into the Manufacturing, Retailing, and Services segment.)

For the period above, volumes of See’s Candies increased by a mere ~2% per year, yet revenues experienced a CAGR of ~9%—a function of mid-single-digit pricing. Pre-tax profits grew by ~11% per year, and with almost zero reinvestment required, what was left post-tax essentially all converted to free cash flow. It would seem preposterous that parallels exist within the tobacco industry today, as dismal sentiment has been led by notably elevated volume declines of the largest product category, cigarettes. Yet, there are a select number of operations that share these same characteristics, and John Middleton has historically done so in a striking fashion.

There Aren't Many John Middletons

In 1856, John Middleton Inc. was founded in Philadelphia, Pennsylvania as a single tobacco store focused on catering to the needs of cigar and pipe smokers alike. Over the following decades, the company expanded its store count and introduced a mail-order tobacco business. Then, in 1950, the company started to produce its own pipe tobacco, and by the end of the decade had sold all of its stores to focus strictly on the manufacturing and sales of its brands. A decade later, in 1968, the company started producing specialty pipe-tobacco cigars with its unique Cherry Blend, which was followed in 1980 by the introduction of Black & Mild, a cigar comprised of a secret blend of air-cured and pipe tobaccos.

Black & Mild cigars hold unique qualities. Rather than using a whole-leaf tobacco wrapper such as handmade cigars or paper like cigarettes, Black & Mild wrappers marry the two: paper made of homogenized tobacco. The secret blend of filler tobaccos produces a bold, yet oddly sweet aroma and flavor. Smooth and rich, the product, often sporting a wood or plastic tip, offers consumers a way to experience the best parts of pipe smoking without added hassle. The small machine-made product is remarkably consistent and has always been attractively priced, making it readily affordable while not requiring an extended period of time to finish. It is a simple luxury.

The widespread success of Black & Mild produced a windfall of profits for the Middleton family for decades. In 2003, John Middleton, the great-great-grandson of the company’s founder, sharing the same name, bought out the stakes of his mother and sisters for ~$200 million. Only four years later, in late 2007, he then sold the company to Altria for $2.9 billion. However, as I previously covered in Altria’s Investment History, the sticker price did not reflect the true price. JMC provided $700 million in present-value tax benefits, driving down the effective net purchase price to $2.2 billion. With the company generating $182 million in EBIT in 2007, this was an approximate multiple of x12.

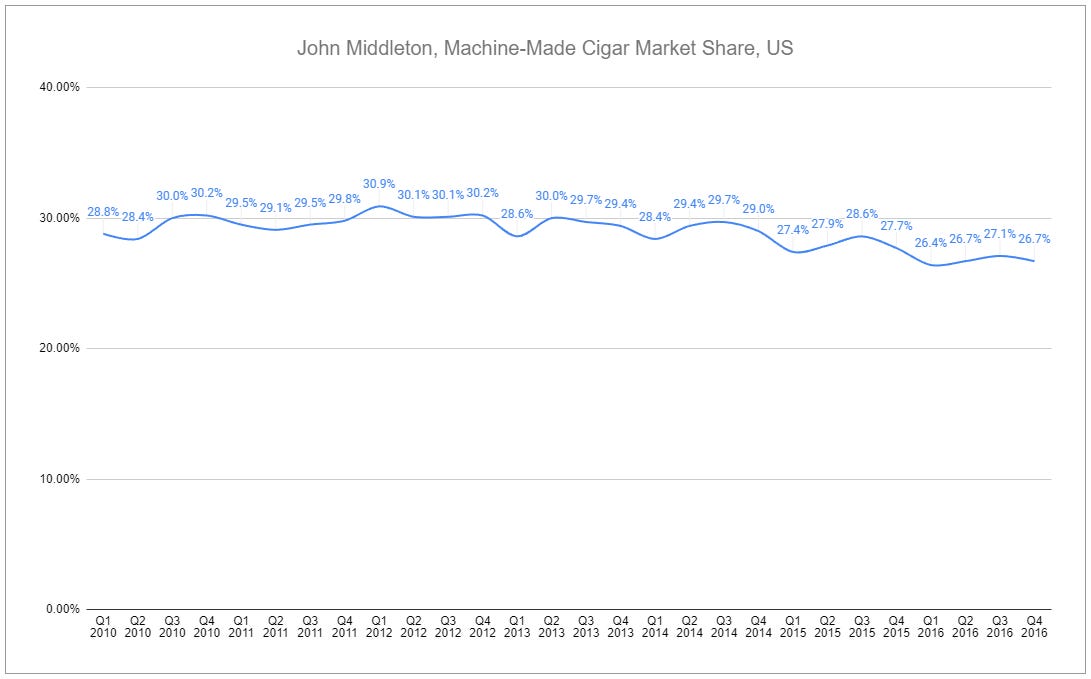

A loftier multiple than the implied low double-digit multiple of after-tax earnings Buffett paid for See’s, certainly. However, there are several distinct parallels and further contrasts. See’s was growing revenues and EBIT at CAGRs of 9% and 11%, respectively. Before being acquired, JMC had compounded revenues at 10% and EBIT at 13% for years. While See’s remained fully autonomous after being acquired, Altria saw a path to reduce JMC’s back-of-house expenses, improve manufacturing efficiency, and, perhaps most importantly, leverage its dominant relationships with distributors and retailers to improve everything from routing to POS placement. In the first several years following the acquisitions, Altria successfully expanded JMC’s market position. However, the environment became mired in pending changes to regulation and product taxation, as well as heightened competitive pressures in the category. Sure enough, JMC’s share of the US market went from stable to challenged, illustrated below:

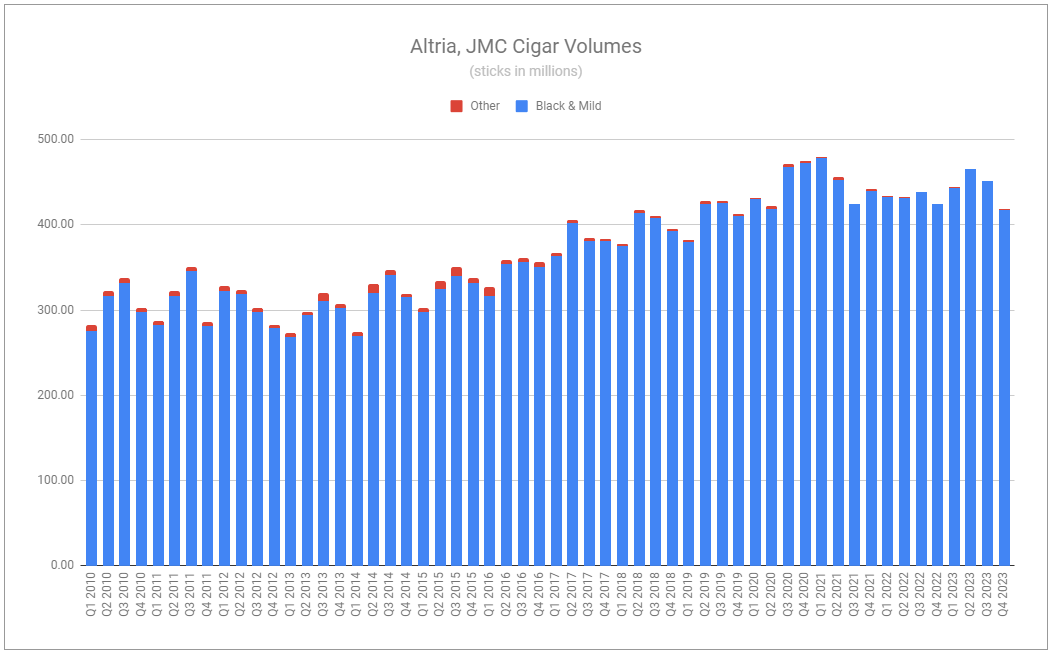

Competitive pressures, paired with an unfortunate excise tax increase several years after the acquisition date, suggest that Altria’s purchase was ill-timed and shortsighted. Such notions were certainly supported by the company's need to engage in promotional spending to defend JMC’s market position, which further weighed on profits. However, several factors helped counter such headwinds, including the fact that the machine-made cigar/cigarillo category has continually grown in the US. Additionally, JMC introduced several new versions of Black & Milds during the challenged period, including Black & Mild Royale in 2010, untipped versions in 2011, untipped Black & Mild Jazz in late 2012, national rollouts of plastic and wood tip variants beginning in 2013, and Black & Mild Casino in 2014. Although Altria stopped publishing exact cigar market share figures after 2016, external data sources have illustrated a subsequent recovery, and when looking at the tipped pipe tobacco cigar subcategory, the company appears to now command more than 85% share. In all, JMC’s volumes went from stagnant to steady growth, with a 2007-2023 CAGR of 2.34%—a similar volume growth rate to See’s following its acquisition. Despite being a legacy combustible product, total volumes are up more than 44% since being acquired.

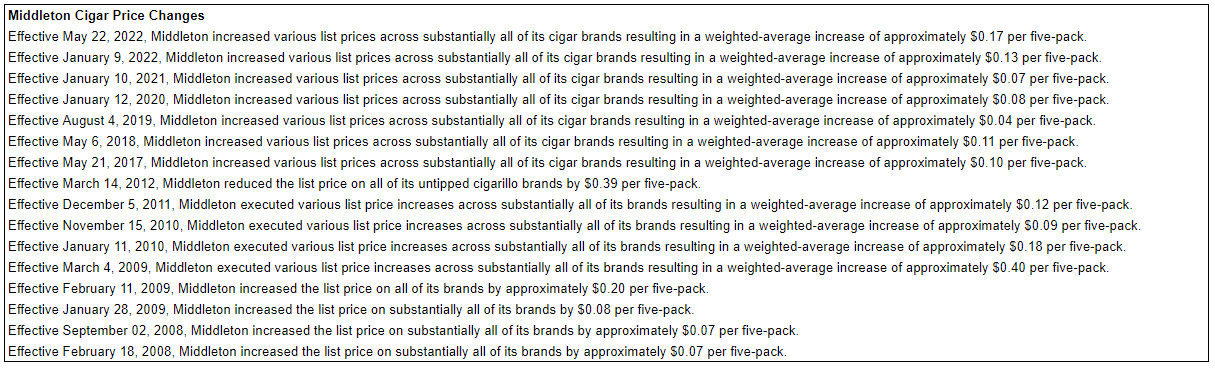

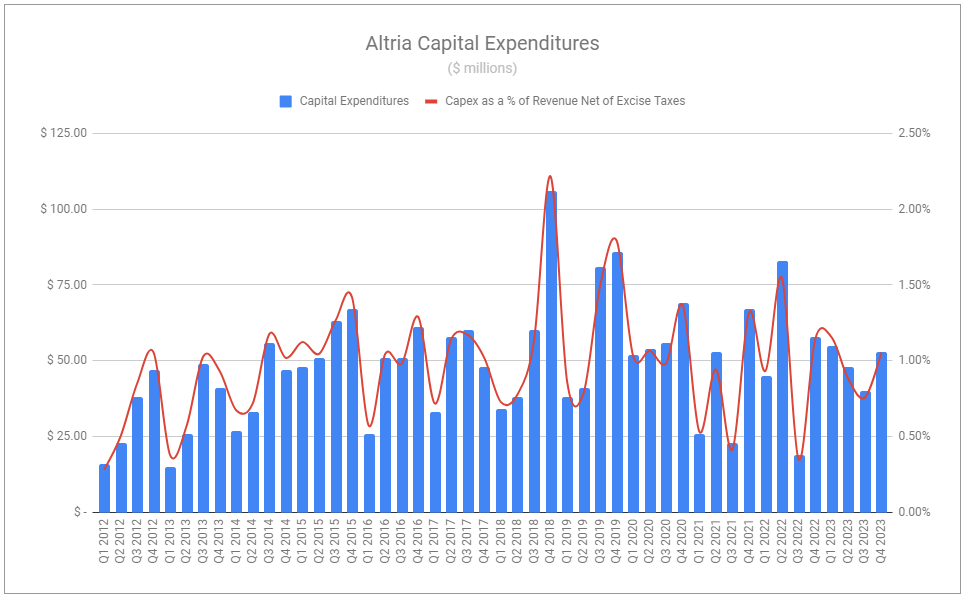

In 2016, efforts were made to recognize efficiencies by moving Middleton’s Limerick, Pennsylvania operations to Altria’s major manufacturing center in Richmond, Virginia. Causing the company to recognize asset impairment, exit, and implementation costs begining in 2016, the consolidation of operations was set to finalize in 2018 and led to considerable savings. How exactly these effects translated into profitability is harder to pinpoint. Just as Altria stopped disclosing cigar market share figures after 2016, it stopped providing cigar-specific figures for revenues, excise taxes, and EBIT after 2011, instead tucking such numbers into smokeable figures with cigarettes. However, we do have some numbers to help us illustrate how this part of the business evolved. JMC’s cigars, despite their relatively small size and appearance, more closely resembling cigarettes than handmade cigars, are defined by the Internal Revenue Code as ‘large cigars’ for excise tax purposes. Aggregated across states and factoring in the federal level, this is a positive for the manufacturer despite higher per-stick input costs—especially true since cigar volumes also skirt MSA per-pack payments that are forced upon cigarettes, as well as minimum pricing laws. Additionally, like See’s, JMC has a long history of leveraging its brand into continued pricing power, continued through the years since being acquired by Altria:

From 2008 to 2011, reported net revenues increased from $387 million to $567 million, and revenues net of excise taxes increased from $326 million to $360 million. The largest contributor explaining the enormous differential in the growth of the two numbers is the massive step up in associated excise taxes per cigar, equating to $0.05 per unit in 2008 and $0.13 in 2009 for JMC. This was due to the introduction of The Children’s Health Insurance Program Reauthorization Act (CHIPRA) of 2009, which increased the federal excise tax on little cigars by $0.97 to $1.01 per pack of 20, in line with cigarettes, and increased the excise tax on large cigars from 20.719% of the manufacturer’s price (capped at $0.05) per unit to 52.75% of the manufacturer’s price (capped at $0.40) per unit. The higher promotional spend over the next several years, alongside the massive step-up in excise taxes muted EBIT, leading 2011’s to be near flat compared to 2008 at $163 million. However, a reduction in subsequent promotional spending paired with continued price increases suggests that the revenue net of excise taxes per unit has likely compounded at an MSD rate, and sustained volume growth has led to EBIT growth outpacing both. Altria’s entire business is the poster child of low capital intensity, and JMC likely requires even less maintenance capex than the rest, allowing the majority of profits to convert to free cash flow.

While JMC has continually grown its volumes and produced considerable profits in doing so, the question now is, will it continue? There is a straightforward thesis supporting those who believe it will. First, it’s critical to note two major headwinds. We have the rise of next-gen nicotine products, which are assuredly taking total share from legacy tobacco products. However, these poorly emulate the nuanced qualities of Black & Milds and the ritual of enjoying them, which should lessen the relative impact of cross-category movement. More pronounced is an undeniable aspect that mass-market cigars and cigarillos have weaker demand inelasticity relative to cigarettes, causing continued price hikes to have a more prominent effect on volumes. However, despite cigarettes being substantially more affordable in the United States than in other countries, elevated volume declines have led to higher rates of manufacturer price take, further shifting the affordability differential between cigarettes and mass-market small cigars and cigarillos. It stands to reason that so long as the current cigarette volume/price dynamics remain in place and cigarette pricing outpaces Black & Mild, a tailwind will be provided to JMC. This is supported by usage prevalence figures, in which cigar prevalence has slowly declined at a snail’s pace, which purely reflects the denominator effect of a growing population. On a nominal basis, cigar usage has remained remarkably steady, and while comprehensive data on cigarillo and tipped cigars is less readily available, historical trends show the subsegments remaining even stronger.

Further considerations suggest Black & Mild will outpace the category in volumes and earnings growth. First is Altria’s trade programs and granular pricing ability, which allow for maximizing the balance of volumes and net price realization. Aiding this, along with retailing app rewards programs, Black & Mild has also more heavily pushed its own ‘Aroma Rewards’ program on its standalone website:

Additionally, JMC has continued introducing additional flavors—something permitted for Black & Mild’s product classification, but prohibited for cigarettes:

While plenty of parallels exist, we can safely say that the acquisition of John Middleton pales in comparison to that of See’s Candies. A loftier purchase price and unique challenges have led to less impressive results. Nonetheless, the company has still produced considerable and growing profits despite almost zero reinvestment. Neither JMC nor Black & Mild were mentioned during Altria’s Q4 2023 earnings call. Yet, with the primary value drivers intact, these operations are positioned to produce considerable value for Altria and its shareholders well into the future.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Altria and other tobacco companies such as Philip Morris International, British American Tobacco, Scandinavian Tobacco Group, and Imperial Brands. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑

Additional Resources:

Altria - SEC filings. Source

Altria - Press releases. Source

Black and Mild. Source

Single Cigar Price and Availability in Communities With and Without a Cigar Packaging and Pricing Regulation. Source

Associations between Black and Mild Cigar Pack Size and Demographics and Tobacco Use Behaviors among US Adults. Source

Tobacco Fact Sheet- Cigars, Cigarillos, and Little Cigars. Source

Not Your Grandfather’s Cigar. Source

National Survey on Drug Use and Health, United States, 2002–2019. Source

2022 NSDUH Detailed Tables. Source

"They're Pretty Much Made for Blunts": Product Features That Facilitate Marijuana Use Among Young Adult Cigarillo Users in the United States. Source

Effect of price changes in little cigars and cigarettes on little cigar sales: USA, Q4 2011-Q4 2013. Source

Enjoyed this - and thanks for the shout out Devin!

Always look forward to your column on Sunday's! Appreciate the insights.