“I was taught that the way of progress was neither swift nor easy.” - Marie Curie

The past half-decade has been bumpy for British American Tobacco. Following its acquisition of Reynolds, the company found itself with acute exposure to the whims of the U.S. FDA, legacy volumes challenged by new product categories, and considerably more debt. On top of this was BAT’s questionable approach to new nicotine categories—a 3-pronged strategy, in which it was a laggard in each.

From the outside, the company has largely appeared to be stuck pushing a boulder uphill. But when you look at operations piece by piece, it becomes evident that some parts have not only reached the top of the mountain but are now rolling down the other side. Reconstituted, the picture may not have the same outstanding momentum as Philip Morris International - BAT’s often-compared counterpart, but progress continues toward a powerful inflection.

In H1 2023, British American Tobacco’s reported group net revenues increased 4.4%. On an adjusted constant currency basis, group net revenues increased by 2.6% and operating income increased by 3.6%. These numbers are a result of continued but easing challenges for the group’s cigarette business and mixed performance across new categories.

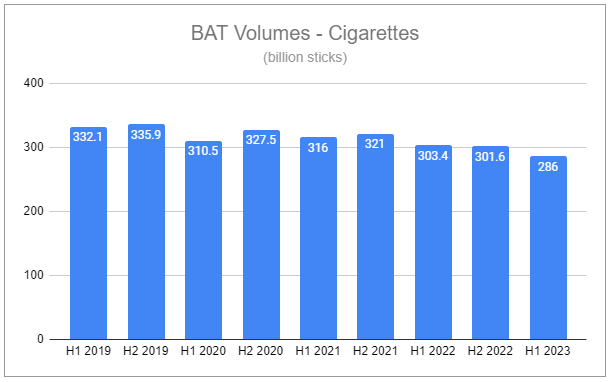

Combustibles performance

In H1 2023, BAT’s total cigarette volumes declined by 5.7% y/y, largely due to continued weakness in the United States, where volumes dropped by 12.4% y/y for the period. An estimated 8.4% decrease in industry volumes was amplified for BAT by a 2.7% share loss, a 0.7% decrease from inventory reductions related to the SAP roll-out, and a 0.6% decrease from the California flavor ban. The company, having a 45% volume exposure to the flavor ban, saw a >85% retention in combustibles following. Strong performance in its premium share looks favorable for the company to continue to drive value.

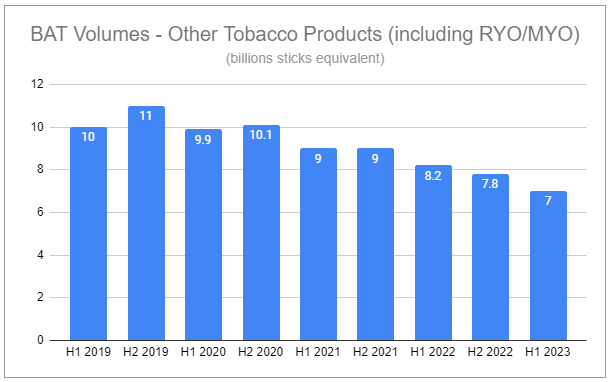

Other tobacco products (pipe, cigarillos, RYO, MYO) continued to see sustained weakness. Despite such headwinds, the group saw combustible price/mix improvement of +6%, leading to total combustible revenues increasing by 0.2%. Lapping the inventory reductions related to the SAP roll-out and gaining greater revenue growth management abilities should allow aggregate value to remain robust provided macro pressures continue to ease.

Non-Combustibles

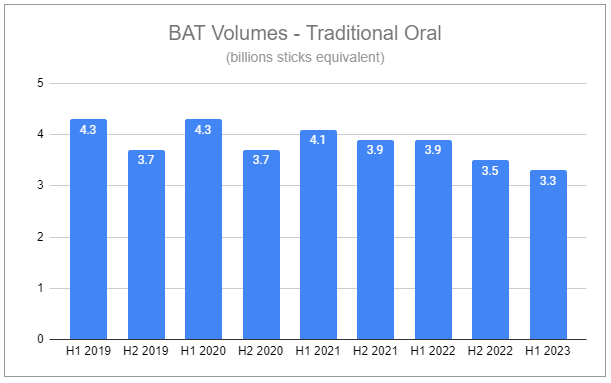

Traditional oral volumes saw a 15.38% decrease y/y in H1, driven additionally by the growing success of modern oral taking share. Nonetheless, pricing - while insufficient to offset volume declines - remained strong, leading to a -4.52% reduction in revenues. This trend will continue, and potentially even accelerate, following the continued growth of modern oral.

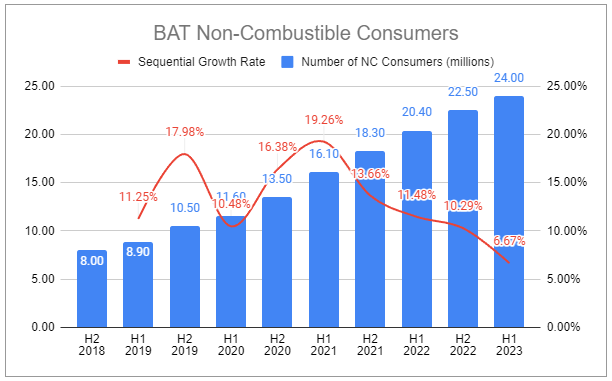

Despite continued declines in traditional oral volumes, BAT’s total number of non-combustible consumers continues to grow in lock-step fashion, thanks to New Categories.

New Categories

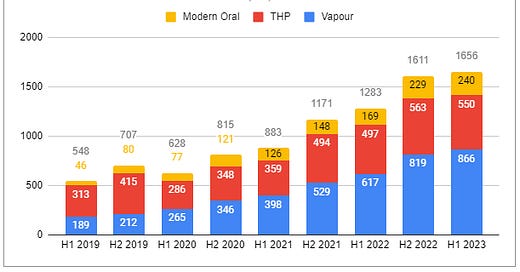

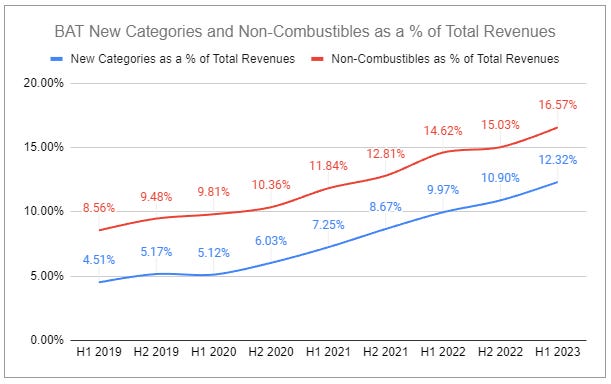

In H1 2023, British American Tobacco’s New Categories each experienced varying degrees of volume growth and pricing and in the aggregate continued an impressive trend, with revenues up 29.07% y/y (26.6% at constant currency).

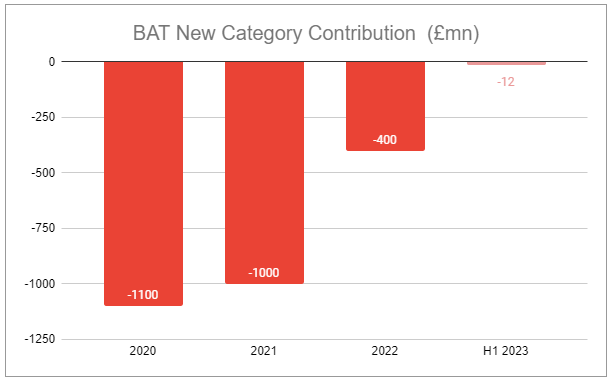

When the company first proposed reaching £5 billion in New Category revenues and profitability in 2025, it sounded beyond ambitious—almost impossible. Yet it appears the company is positioned to reach both—with profitability ahead of schedule, as previously assumed.

New Categories continue to close their negative contribution to operating earnings, being just shy of flat in H1 2023. However, the language used by management has stressed that continued improvement will not be linear, as growth and reinvestment rates will fluctuate—and rightfully so. Looking at each independently highlights a number of unique tailwinds and threats.

Modern Oral

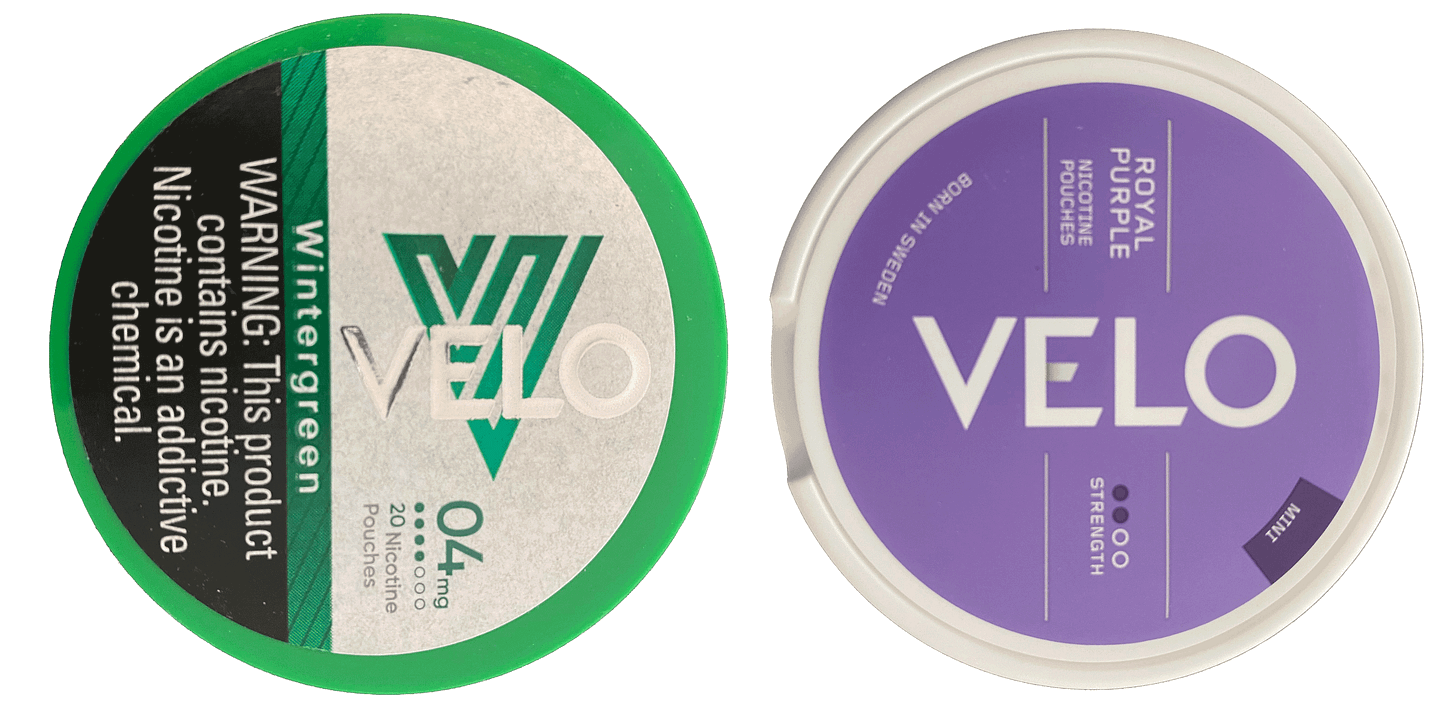

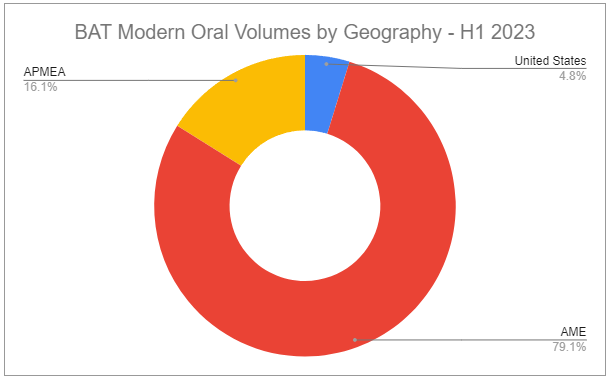

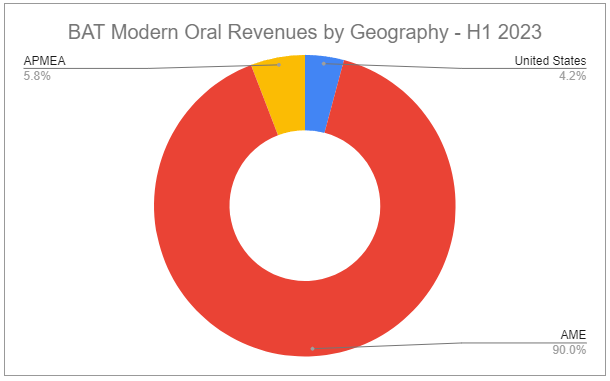

In H1 2023, BAT Modern Oral volumes increased 32.66% y/y, driven by exceptional growth in the AME and APMEA regions of 38.4% and 49.3%, respectively. Category revenues increased at an even greater rate—41.8% y/y for the period. The category’s share of total oral in key markets continued to expand, up to 8.1% in H1 2023, from 7.1% the year prior, and up from 1.5% in H1 2019. It is fair to say that Velo across many parts of the world is the stand-out leader. However, there is one major standout concern: Velo in the United States is currently a total dud.

Despite packaging appearing remarkably similar, the U.S. and European versions of Velo are very different products, as I’ve forewarned. Along with flimsier plastic, sloppy labeling, reportedly weaker flavors and aftertaste, and excess powder within the containers of the U.S. version, there is one radically different aspect between these two products: moisture content. While the U.S. version is terribly dry, the European version’s higher moisture content allows for a more rapid onset and higher consistency of effect and flavor. This is clearly reflected in the numbers. While the European version of Velo continues to grow rapidly, and ZYN’s U.S. growth recently accelerated, U.S. Velo volumes declined substantially in H1, dropping 37.7%, down to 112 million units—a mere 4.77% of total H1 volumes. Pricing resulted in associated U.S. revenues falling less, down 15.5% y/y in H1 2023.

British American Tobacco’s management is fully aware of how downright terrible this relative performance is. The submitted PMTA for the superior version remains pending, with no clear timeline for determination. Unless a Marketing Granted Order is provided by the U.S. FDA CTP, it’s prudent to assume that BAT’s share of the U.S. total oral market will continue to shrivel.

Heated Tobacco

In May, I noted:

In heated tobacco, BAT’s new devices, namely glo HYPER X2, and heat sticks have received positive responses from consumers, but still trail the success of PMI’s IQOS ILUMA, and now face additional competition of new HTP variants from JT and others, potentially weighing on the company’s ability to take incremental share and exercise positive pricing.

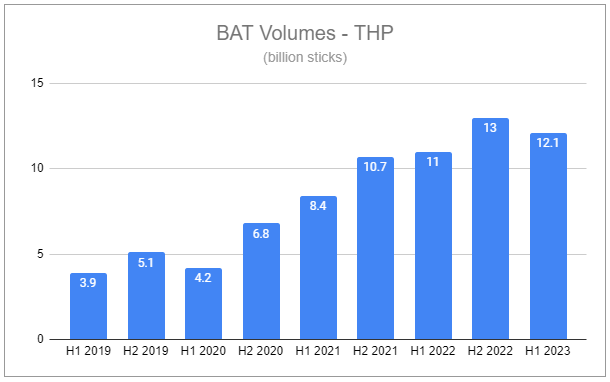

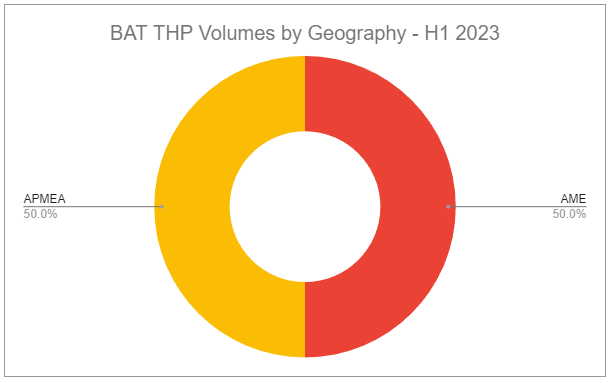

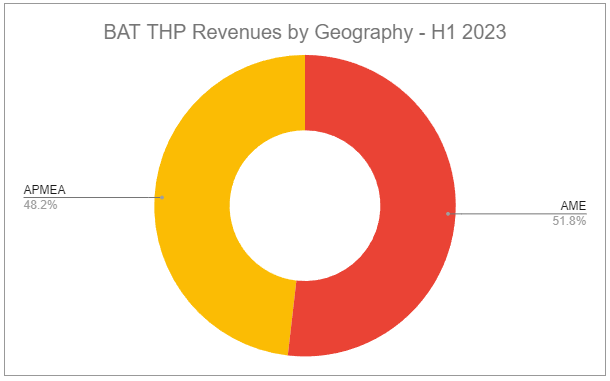

Such competitive pressures are undeniable. While glo’s volume share of combustibles + heated tobacco grew from 3.8% to 4% y/y in H1 2023, its share of heated tobacco volumes as a standalone category decreased from 19.6% to 18.2%. BAT’s heated tobacco unit volumes grew 10% y/y and associated revenues grew at 10.6% y/y in H1 2023, which is unmistakably positive but pales in comparison to the recent growth of PMI’s IQOS HTUs, which in Q2 2023 were up 26.6% y/y on top of positive price take, despite already holding the lion’s share of the heated tobacco market.

More market launches for the newest glo Hyper X2 Air are planned throughout the rest of the year, and the company has stated having an extensive development pipeline including multiple product upgrades. Still firmly #2 in heated tobacco, incremental scale will continue to favorably contribute to group performance, but overall, results are more indicative of how far ahead IQOS remains in the category.

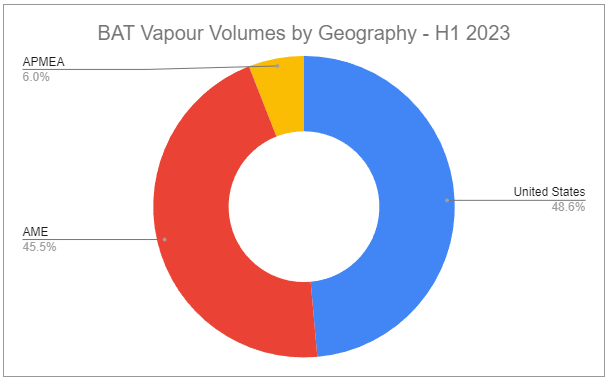

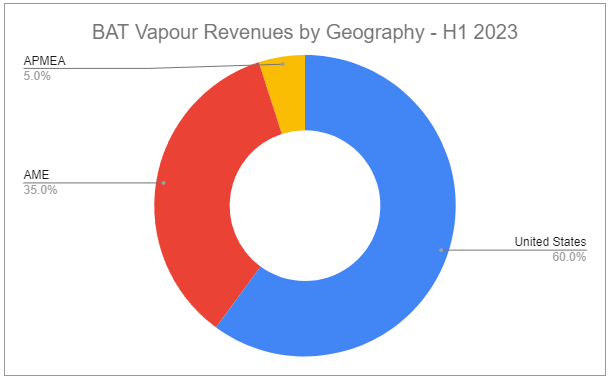

Vapour

In H1 2023, BAT Vapour volumes grew by 9.25% y/y. For the same period, revenues increased by 40.36%—an incredible testament to the level of price take the company has been able to exercise. Interestingly, while a potential menthol ban on a federal level still looms, and would likely not go into effect for several years, it is likely to have a lesser impact on BAT’s Vapour category. While BAT’s combustible exposure to the California menthol ban was 45% of total volumes of which the company retained >85%, 60% of total Vuse volumes were exposed and yet retained 100%.

BAT has stated that its share in key vapour markets is now 38.3%. Additionally, in the U.S., Vuse extended its lead to 47% in tracked channels, a 5.7pp increase y/y. Although these numbers sound promising, there are three major caveats.

While total Vapour volumes grew 9.25% y/y, volumes in the United States actually decreased by 6.5%.

U.S. share stated in tracked channels excludes the continually growing number of disposable vapes which are undeniably taking total share—estimated to be >50% of U.S. total vapour volumes in the United States.

BAT’s Vuse Alto PMTAs are still pending, and a determination is expected by the end of the year. While the science supporting the applications is largely similar to the applications of Ciro and Vibe - which both received Marketing Granted Orders - there is no guarantee Alto PMTAs will share the same fate.

Earlier this year, I touched on the contentious issues surrounding the category in the United States. Since then, the FDA has continued to take actions to tackle illicit volumes, even as recently as this past week. But most actions are merely a drop in the bucket, and a serious step up in enforcement efforts is essential for BAT.

BAT’s continued success in U.S. vapour will acutely rest on a mix of expected future actions by the FDA. The United States currently represents nearly 50% of the company’s Vapour volumes, 60% of Vapour revenues, and category revenues remain larger than BAT’s other two New Categories combined.

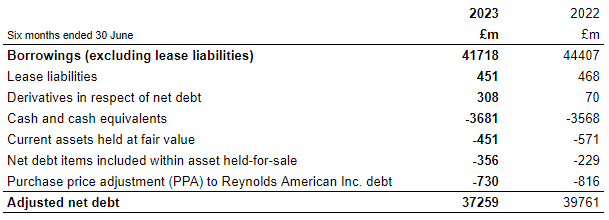

Deleveraging

British American Tobacco has continued to make solid progress in deleveraging its balance sheet toward its goal of x2.5 adjusted net debt/ adjusted EBITDA. At EoY 2021, the multiple rested at x2.99, and at EoY 2022 sat at x2.89. Updated numbers show the multiple now sitting at x2.6. The company’s current average cost of debt is 4.3%, and as maturities come due, rolling debt forward will inevitably increase the company’s interest expense, which for FY 2023 is expected to be £1.9 billion. While this will act as a drag, the company is poised to reach its target ratio by the end of the year. I believe the odds the company reinstates share repurchases by H2 2024 are high.

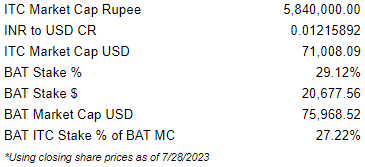

ITC

Due to ITC’s stock-based compensation, BAT’s stake decreased from 29.19% to 29.12%. Nonetheless, ITC shares have tracked higher, and the stake’s market value is now over 27% of BAT’s market cap. I previously wrote why focusing on the market value of BAT’s stake was perhaps non-ideal. However, just last week, ITC announced a proposal to spin out its hotel business (you can view the investor presentation covering the proposal here). The segment was responsible for a mere 4% of ITC’s total revenues and just over 2% of profit last year, but the business holds over 120 hotels and a spin would create a pure-play stake for BAT. Not only would this be a smaller stake, but it would be unbound by some of the additionally stringent regulations affecting investment into Indian tobacco companies, potentially allowing BAT a clear path to sell the new stake to unlock value for shareholders.

The big picture

My view remains unchanged that British American Tobacco has the widest spectrum of potential future outcomes relative to its peers. Although exposed to a considerable number of competitive and regulatory challenges, British American Tobacco’s uniquely-advantaged assets reinforce my belief that the forward spectrum skews heavily to the upside. Despite combustible volume weakness, pricing and brand management have allowed the company to produce substantial value, continue to deleverage, and return substantial sums of capital to shareholders while aggressively reinvesting into all 3 of its new categories.

While New Categories as a percentage of total revenues continue to grow, more impressive is the potential impact on group margins. Combustible gross margins are currently at 68%. Heated tobacco has reached parity, and Modern Oral is 4pp above. Vapour - widely criticized as questions of brand loyalty, heightened competition, and future regulation mount - sports a gross margin of 58%, up from 49% last year and 40% in FY 2021. As British American Tobacco continues to scale these categories and continually focuses on efficiency, the contribution should shift down to the operating margin and below.

Some have theorized that continued success in New Categories will lead to a positive re-rating. I remain unconvinced. This is an unloved company in an unloved industry with its primary listing in an unpopular market. Pessimism may continue to mount—especially on the back of looming regulatory actions. If share repurchases resume, growing negative sentiment may be ideal for long-term shareholders who are best served by focusing on continued execution. Even when subtracting out Russia and Belarus, growing reinvestment into new categories, and increasing interest expense, forward returns are supported by a hefty double-digit free cash flow yield. Trading at under x7 EV/EBITDA, with a conceivable path of low to mid-single-digit growth, this company does not need to do anything extreme for the equity to produce outsized returns.

If you enjoyed reading, hit “♡ like” and give this piece a share.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in British American Tobacco and other tobacco companies such as Altria, Philip Morris International, and Scandinavian Tobacco Group.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: BTI 0.00%↑ PM 0.00%↑ MO 0.00%↑

> My view remains unchanged that British American Tobacco has the widest spectrum of potential future outcomes relative to its peers.

I think that’s a fair conclusion.

Part of the difficulty (and the fun!) of being an investor is figuring out long term trends. Will one of the three NGP categories manage not only to take a large share from combustibles, but also be adopted by people who have never smoked?

In the US, the FDA has been pretty adamant, especially with vaping, that users should be current or former smokers. But when I look at modern oral, I see the possibility that it might be adopted more widely. I think it was Six Bravo who shared videos of Peter Attia explaining why he takes modern oral. Many financial analysts I read on Twitter sometimes offhandedly mention how they use Zyn. And modern oral is invisible in a way that vaping and HNB are not, reducing stigma and IMO reducing the political pressure on the FDA to reduce its use among adults.

Have you seen clear evidence the FDA are implementing on taking the illegal vapes off the retail selfs in the USA. The uk are having a similar problem if illegal vapes but there are constant news reports of actual shops being raiding by enforcement agency’s and closed or fines. The uk are taking this problem seriously. I’m concerned FDA are not enforcing it enough.