“I’ll tell you why I like the cigarette business. It cost a penny to make. Sell it for a dollar. It’s addictive. And there’s a fantastic brand loyalty.” - Warren Buffett

At first glance, Warren Buffett’s track record regarding tobacco appears somewhat incongruent. On one hand, he has praised the unit economics of tobacco, while on the other, appeared to publicly shun the industry as an investment. Yet, his track record includes a handful of tobacco-related investments. Not only that, but Berkshire Hathaway actually owns a direct economic interest in the tobacco supply chain.

Let’s dust off the filings and archives and look at what the Oracle of Omaha has been up to.

R. J. Renolds Equity - 1980

Inflation in the U.S. had peaked at 14.8% in March 1980. While the Chairman of the Federal Reserve, Paul Volcker, aggressively raised the federal funds rate, many market participants remained cautious - including Warren Buffett. Beginning in 1980, Berkshire Hathaway began to accumulate shares of R. J. Reynolds (now part of BAT), which can easily be found in Warren’s Letters to Berkshire Shareholders:

1980

1981

1982

1983

Buffett would go on to sell the RJR stake, recognizing a ~27% gain on the shares, excluding dividends received over the several years of ownership. Then, in 1985, Berkshire more than x3’d its investment in General Foods Corporation when it was purchased by tobacco giant Philip Morris.

Bayuk - 1982

On December 21, 1981, Bayuk Cigar shareholders approved a plan to completely liquidate the company within one year, including the planned sale of its cigar business assets to Swisher (then a subsidiary of American Maize). The very next day the federal government filed against the sale, stating that it would substantially lessen competition in the manufacture and sale of cigars, a clear violation of the Clayton Antitrust Act of 1914, as highlighted in the archived competitive impact statement.

In March 1982, to avoid the wrath of the government while still proceeding with the liquidation plan, Bayuk instead sold its Garcia y Vega cigar brand and related assets to Culbro Corp (General Cigar). That same month, Buffett began buying shares of Bayuk, which had sold off following the government’s initial opposition, ultimately building a 5.7% stake by the end of April. In September of that year, American Maize sued Bayuk for breaching their original agreement and sought over $6 million for fees, expenses, and punitive and nonspecific damages. Despite the legal overhang, Bayuk sold its remaining operations and assets and made a series of distributions over the next 4 years, with the liquidation netting Buffett and Berkshire shareholders a >x2.5 return on the initial investment.

RJR Nabisco Bonds - 1989

In 1985, R. J. Reynolds acquired Nabisco for $4.9 billion, forming RJR Nabisco. Three years later, KKR engaged in the infamous leveraged buyout. Despite high cash conversion and low capital intensity, RJR Nabisco was saddled with enormous debt, and in 1989, the company’s bonds were trading at deeply depressed levels, which Buffett happily began to accumulate. Within a year, Buffett had deployed $440 million to acquire bonds yielding 14.4%, and in his 1990 Annual Letter to Shareholders, wrote:

Wall Street cared little for such distinctions. As usual, the Street's enthusiasm for an idea was proportional not to its merit, but rather to the revenue it would produce. Mountains of junk bonds were sold by those who didn't care to those who didn't think - and there was no shortage of either.

Junk bonds remain a mine field, even at prices that today are often a small fraction of issue price. As we said last year, we have never bought a new issue of a junk bond. (The only time to buy these is on a day with no "y" in it.) We are, however, willing to look at the field, now that it is in disarray.

In the case of RJR Nabisco, we feel the Company's credit is considerably better than was generally perceived for a while and that the yield we receive, as well as the potential for capital gain, more than compensates for the risk we incur (though that is far from nil). RJR has made asset sales at favorable prices, has added major amounts of equity, and in general is being run well.

While he wouldn’t have minded sitting on the bonds, RJR Nabisco redeemed all of its junk bonds at face value the following year, netting Berkshire a ~$150 million profit.

UST - 1993

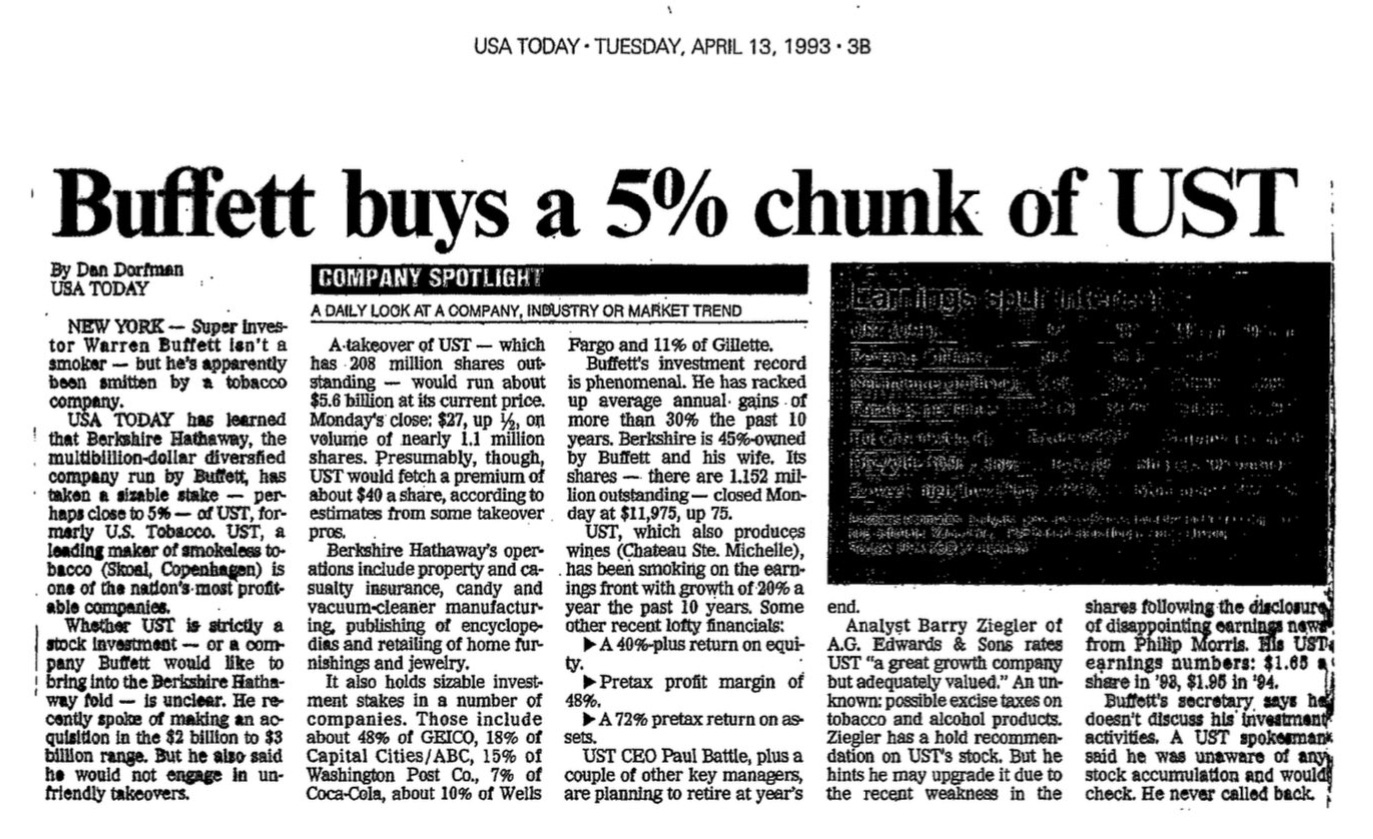

In April 1993, Berkshire took a sizable stake in UST, U.S. Smokeless Tobacco. The specifics of this deal are a bit murky. Initial claims posited Berkshire’s stake could have been near 5%, which, based on where shares were trading, would have made the stake worth ~$290 million.

At the time, UST was the most dominant player in oral tobacco in the United States, was extremely capital-light, and sported one of the highest operating margins amongst any large publicly traded company. But Buffett’s stake likely had less to do with assessing the fundamentals and planning for long-term holding and much more to do with the fact that the timing of the purchase followed Marlboro Friday, in which Philip Morris’s actions caused the entire industry to steeply sell off - even UST, which had no direct exposure to cigarettes. Interestingly, UST was never listed under marketable securities positions in any of Buffett’s Annual Letters to Shareholders, and no specific mention was made of the purchase or subsequent sale, suggesting that the stake was <5% and that it was indeed a short-term opportunity Buffett took on. UST was eventually acquired by Altria in 2009.

Drawing the line

During the 1997 AGM, Buffett and Munger provided some insights into how they think about tobacco (Lightly edited for clarity).

Question:

My name is Michael Hooper. I’m from Grand Island, Nebraska. I applaud Berkshire for starting the Class B shares. My question deals with tobacco stocks, which have been beaten down lately. Does Berkshire own any tobacco stocks, and are some of these stocks attractive now that prices are down on some of them? And in particular, a company called UST. Thank you.

Warren Buffett:

Yeah. We have owned—we won’t comment on what we own now—but we have owned tobacco stocks in the past. We’ve never owned a lot of them, although we may have made a mistake by not owning a lot of them. But we’ve owned tobacco stocks in the past and I’ve had people write me about whether we should do it or not.

We own a newspaper in Buffalo. It carries tobacco advertising. We don’t, well, actually, Charlie’s a director of a sensational warehouse chain called Costco, which used to be called PriceCostco. They sell cigarettes. So we are part of the distribution chain, with a hundred percent-owned subsidiary in the Buffalo News. And so we have felt that if we felt they were attractive as an investment, we would invest in tobacco stocks.

We made a decision some years ago that we didn’t want to be in the manufacturing of chewing tobacco. We were offered the chance to buy a company that has done sensationally well subsequently, and we sat in a hotel in Memphis in the lobby and talked about it, and finally decided we didn’t want to do it.

Charlie Munger:

But it wasn’t because we thought it wouldn’t do well. We knew it was going to do well.

Warren Buffett:

We knew it was going to do well.

But, now why would we take the ads for those companies, or why would we own a supermarket, for example, that sells them, or a 7-Eleven, you know, or a convenience store that sells them or something of the sort, and not want to manufacture them? I really can’t give you the answer to that precisely, but I just know that one bothers me and the other doesn’t bother me, and I’m sure other people would draw the line in a different way.

So the fact that we’ve not been significant holders of tobacco stocks has not been because they’ve been on a boycotted list with us. It just means that overall we were uncomfortable enough about their prospects over time that we did not feel like making a big commitment in them.

Charlie Munger:

Yeah. I think each company, each individual, has to draw its own ethical and moral lines, and personally, I like the messy complexity of having to do that. It makes life interesting.

Warren Buffett:

I hadn’t heard that before. (Laughing)

We’ll make him in charge of this decision.

Charlie Munger:

Yeah, no, no. But I don’t think we can justify our call, particularly. We have to draw the line somewhere between what we’re willing to do and what we’re not, and we draw it by our own lights.

Warren Buffett:

We owned a lot of bonds at one time of RJR Nabisco, for example, some years back.

Should we own the bonds and not own the stocks? Should be willing to own the stock but not be willing to own the business? Those are tough calls. Probably the biggest distributor of—the biggest seller of cigarettes in the United States is probably Walmart, but just because they’re the biggest seller of everything. They’re the biggest seller of Gillette products and they’re huge. And you know, do I find that morally reprehensible? I don’t. If we owned all of Walmart, we’d be selling cigarettes at Walmart. But other people might call it differently, and I wouldn’t disagree with them.

Some may point to the historical context of when this exchange was made. This was the year prior to the finalization of the Master Settlement Agreement, a time when the outlook for the tobacco industry was particularly dark and uncertain. Even so, this offers no satisfactory support to the duo’s stance, which largely looks to be based on an obscurely drawn moral line. Compare this to the additional comments made on the particular company Warren and Charlie knew would do well during the 2005 AGM:

Charlie Munger:

Yeah. I think he’s asking in part, are there some businesses we won’t have as subsidiaries in Berkshire even though they’re wonderful businesses? So, are we rejecting some business opportunities on moral grounds?

Warren Buffett:

Yeah, well we’ve referred in past meetings to one we did on that basis. We will own stocks of companies where we wouldn’t want to own the whole business. I’m not sure that the logic is perfect on that, but we would not have trouble owning stock in a cigarette company. We wouldn’t want to manufacture cigarettes, you know. We might own a retail company that sells cigarettes. I mean, there’s all kinds of gradations.

But we do not—there are things we don’t want to own and be responsible for their businesses, where we have no problem owning their stocks or bonds. And some years back, Charlie and I went down to, where, Memphis?

Charlie Munger:

Yeah.

Warren Buffett:

Yeah, we looked at a—and we were invited down, and we looked at a company that made a product that—perfectly legal—probably one of the best businesses I’ve ever seen, in terms of the economics of it.

Charlie Munger:

Absolutely.

Warren Buffett:

Still doing very well. And we met in the room with—we went to a hotel. We met in the room with the people that had the business. And people were perfectly decent people. And they described the business to us. And we went down in the lobby.

And as I remember, we sat down in the lobby and just decided that we didn’t want to be in that business. And, you know, the lines are not perfect on this sort of thing.

I mean, it—I’m sure that there may be ads in the Buffalo News that are selling some investment service or something that I would cringe at if I knew the people involved or what they were selling.

And it—if you own a big retail establishment, a retailer, general merchandise, you know, you’re probably going to be selling cigarettes when you don’t think that you should smoke yourself or that your children should smoke. And it’s—they’re not perfect.

But we have turned down some—the most dramatic being that one because we went—took us a trip of 1,000 miles or so to finally face up to the fact that we didn’t want to own it.

Charlie, you have anything to add on it?

Charlie Munger:

No, but that was interesting because we were young and poor then by modern standards. And, you know, we’re very human. And we could see it was just, like, putting $100 million in a bushel basket and setting it on fire as we walked away.

(Laughter)

Munger provided additional detail during the 2017 DJCO Meeting regarding the company:

Question:

One of the best deals you've ever encountered is the one that you closed with a tobacco manufacturer? Could go into a bit more detail?

Charlie Munger:

That was Conwood. Yeah. It's an addictive product. People are totally hooked. They're the number two person in the market. They all believe in their product, every damn one of them chewed tobacco. The figures were just unbelievable. There was virtually no financial risk. Nothing but money. That cancer's caused by that tobacco, it is maybe 5% of the cancer you get from cigarettes, but it's not zero. You definitely are going to kill people with that product that have no reason to die. It's the best deal we ever saw, we couldn't lose money doing it and we passed. We didn't pay up—Jay Pritzker, who was then head of the trustees or something at the University of Chicago Medical School. Pritzkers are big in Chicago. He just snapped it up so fast, the Pritzkers made two or three billion dollars out of that.

Do we miss the two or three billion we would easily have had? Not an iota. We had a moment's regret? Not an iota. We were way better off not making a killing out of a product we knew going in was a killing product. Why should we do that? On the other hand, if it was just a marketable security, we wouldn't feel that the morality of it was ours, but if it's going to be our subsidiary, we're going to be paying the people that are advertising the tobacco, that's just too much for us. We're not going to do it.

All of these comments make it all the more interesting to look at McLane.

McLane - 2003

In May 2003, Walmart announced selling its subsidiary McLane Company to Berkshire Hathaway. McLane is one of the largest supply chain service companies in the United States, currently employing over 20,000 people and servicing over 110,000 convenience stores, mass merchants, drug stores, and chain restaurants.

As one of the largest suppliers of consumer products for convenience stores in the U.S., McLane is also one of the largest wholesalers of tobacco products. In fact, it is cited in Altria’s filings as one of its single largest sources of net revenues:

In 2022, McLane accounted for ~23% of Altria’s net revenues. Rough math based on Altria’s reported numbers suggests that McLane’s wholesale volumes related to Altria’s operating companies likely make up 11% of total industry volumes alone. While diversified and not entirely reliant on tobacco products, this Berkshire-owned entity is practically a royalty on the tobacco industry.

Squaring the circle

Warren and Charlie shun owning tobacco manufacturing operations outright but are content with non-controlling stakes. That same framework offers no opposition to wholly-owning entities that do not manufacture but do buy and sell tobacco products on a large scale such as McLane. If you find that rationale confusing or even inadequate, you are not alone. But none of this is a critique of the duo or Berkshire specifically; their exceptional track record—including all non-tobacco and tobacco investments alike—speaks for itself. Rather, this poses the question: Where does one draw the line? Owning tobacco product manufacturing outright? Minority interests? Distribution? Retail? What about Grandscape, Berkshire’s mega-development in Texas that houses a Cigars International superstore? What about doing business with tobacco businesses in other facets? What parallels are there with alcohol and sugar? Why not extend that beyond drugs entirely? Perhaps you could extend your goodness and moral superiority to others by fabricating a scoring system comprised of supposed environmental, social, and governance factors - charging a pretty penny. Ha.

Any type of line begins to look absurd. Charlie was spot-on in describing the impossible endeavor of drawing the line. Messy complexity indeed.

Agree? Disagree? Have insights into other obscure tobacco deals or other related details? Please share in the comments section. And as always, if you enjoyed reading, be sure to share this post with others that would enjoy it too!

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Berkshire Hathaway, as well as tobacco companies such as Altria, British American Tobacco, and Philip Morris International.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑

Additional Resources:

Berkshire Hathaway - SEC filings. Source

Berkshire Hathaway, Warren Buffett Annual Letters to Shareholders. Source

Altria - SEC filings. Source

Federal Register, Vol. 47, No. 120, Tuesday, June 22, 1982. Source

DOJ. U.S. V. AMERICAN MAIZE-PRODUCTS COMPANY AND BAYUK CIGARS INC. Source

Competitive Impact Statement: U.S. v. American Maize-Products Company, et al. Source

A fun old Bayuk Cigar ad. Source

DAMN RIGHT! Behind the Scenes With Berkshire Hathaway Billionaire Charlie Munger, page 238. Source

1994 Berkshire Hathaway Annual Meeting, Afternoon Session. Source

2005 Berkshire Hathaway Annual Meeting, Afternoon Session. Source

Timeless Lessons From the 2017 DJCO Meeting. Source

Wal-Mart Announces Sale of McLane Company To Berkshire Hathaway. Source

McLane company website. Source

I wanted to look more into it after the discussion on Twitter. Thank you for doing the work, your writing is a treat

This was a great read. Thanks for doing the research!