“It was luxuries like air conditioning that brought down the Roman Empire. With air conditioning their windows were shut, they couldn’t hear the barbarians coming.” - Garrison Keillor

Company Overview

It was the summer of 1902. William Carrier, while working at a publishing company in Brooklyn, New York, became irritated as the poor air quality and high humidity continued to result in bad prints. Channeling his frustrations, he created schematics for a new device: the modern air conditioner. In 1915, with a patent and extensive scientific knowledge, William partnered up with a team of engineers to found the Carrier Engineering Corporation.

But the air conditioner, which many take for granted and view merely as a convenience, is actually one of the most critically important modern marvels. Along with heating and ventilation systems, AC has allowed humans to flourish in parts of the world that would otherwise remain inhospitable. Additionally, these inventions (paired with reliable energy sources) are largely to thank for the precipitous fall in extreme weather-related deaths over the last century.

Carrier, along with spreading this critical technology worldwide, has expanded its reach and currently operates in 3 segments:

HVAC

Refrigeration

Fire & Security

Carrier became a subsidiary of United Technologies in 1980 and, like Otis Worldwide, was spun off as a separate publicly traded company in 2020. Its headquarters are located in Palm Beach Gardens, Florida, United States, and its shares trade on the NYSE under the ticker CARR. The company currently holds the following credit ratings and outlooks:

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Investment Thesis

Carrier operates in critical markets that are growing from multiple secular tailwinds. Through industry-leading products, digitization, strict cost management, and a shift to higher-margin recurring revenues, the company is positioned to create substantial long-term value. At current levels, the company can produce this value while returning significant capital to shareholders via dividends and buybacks on the back of an undemanding growth scenario.

Industry Overview

Carrier may be an OG and is certainly one of the largest in the segments it operates in, but it faces serious competition, especially in applied HVAC from Johnson Controls and Trane Technologies. Nonetheless, these segments are experiencing several secular tailwinds that will continue to drive growth far into the future:

Ventilation and IAQ (indoor air quality) have seen a massive spike in prioritization over the last several years, especially driven by COVID. (Residential HVAC has seen slowing growth recently as new home starts have lagged in the U.S.) Additionally, working from home is driving new positive trends: From Carrier CEO David Gitlin at the 2022 Morgan Stanley Laguna Conference:

People in the Northwest buying air conditioning when in the past, 45% of people in Seattle have air conditioning. We see people, as you said, Josh, spending more time at home. We see the units running hotter and faster so probably the average life has come down. Maybe it used to be 17.5 years, now it's closer to 15. So a lot of the underlying factors still exist.

HVAC systems account for ~40% of a building’s energy consumption, on average. Building operators continue to aim for products and systems that improve occupancy experience while reducing ongoing costs. This is especially true when energy costs are elevated - system upgrades are easily rationalized by shorter payback periods.

A lack of refrigeration is attributed to ~13% of food waste worldwide. Supply chains require more advanced resources to safeguard high-value and temperature-sensitive cargo.

Regulations focused on efficiency and environmental considerations force buildings to adopt newer, modern systems to comply with overarching climate goals. Carrier CEO David Gitlin, again, at the 2022 Morgan Stanley Laguna Conference:

Look at the European Union, Fit for 55, REPowerEU is aimed at doubling the adoption of heat pumps and is looking to be adding 30 million heat pumps in the EU between now and 2030. And for us, because we're not a major boiler commercial provider, that is all upside.

In the United States, you know about the $370 billion Inflation Reduction Act, stimulating heat pump and higher-efficiency air-conditioning systems for homes and buildings. We launched an EcoHome initiative. We've established our Tennessee facility as our heat pump center of excellence. And we're going to lean into that opportunity, to not only drive increased margins and increased sales, but of course, do right by the planet.

Operations and Segment Specifics

Carrier currently operates in 3 segments, HVAC, Refrigeration, and Fire & Security, and envisions a future with software-defined hardware, AI-led optimization, and comprehensive and customizable solutions tailored to the unique needs of all customers. With industry-leading equipment and services, the company promotes the following:

Improved energy efficiency

Maintenance analytics and downtime reduction

Dynamic, load-based, and occupancy-based systems

This ultimately equates to better customer retention and a greater shift to higher-margin recurring revenues. Not to mention, Carrier is executing this playbook on top of its gigantic installed base:

HVAC - 330k commercial, 2m light commercial, 33m residential

Refrigeration - 1.8m units

Fire & Security - 90m+ homes & 400m+ devices

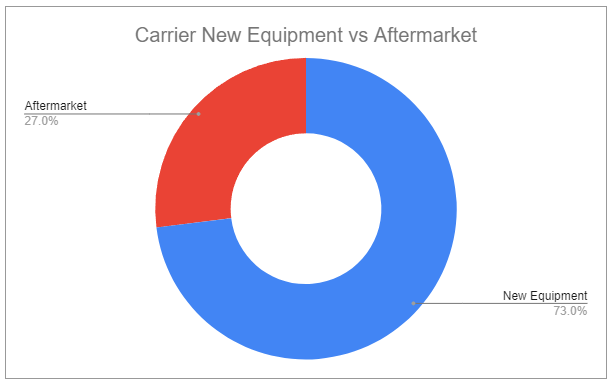

In 2021, Carrier saw ~$4.5 billion in related aftermarket revenues. These have a high recurring mix and are high margin (~10% higher than the Carrier average). Abound is Carrier’s cloud-based platform that provides real-time analysis, making buildings more efficient and responsive. BluEdge, Carrier’s global service platform, has sold over 30k service agreements since its launch in mid-2020 and digital subscriptions doubled in 2021. There is large continued growth potential, driven by service coverage, digital offerings, maintenance, modifications, upgrades, and acquisitions, the company believes it can achieve low double-digit aftermarket growth, leading to related revenues growing to ~$7 billion in 2026 just from its current installed base alone.

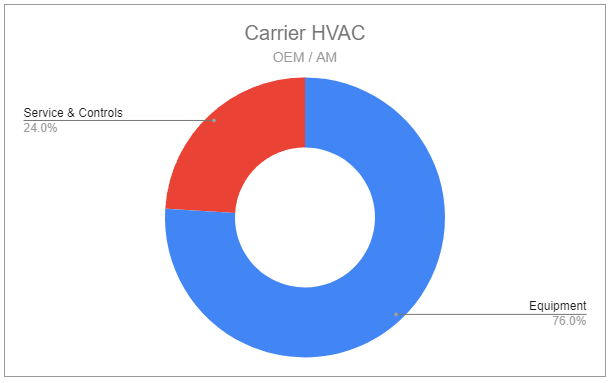

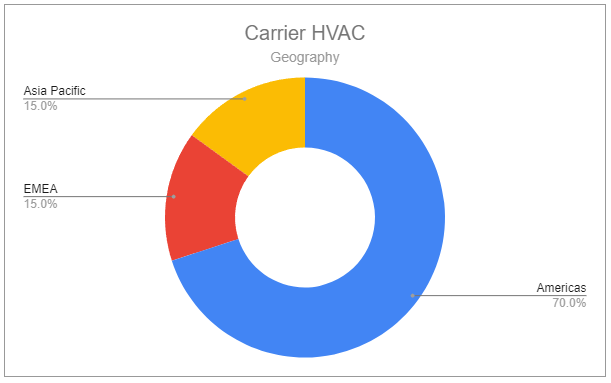

HVAC

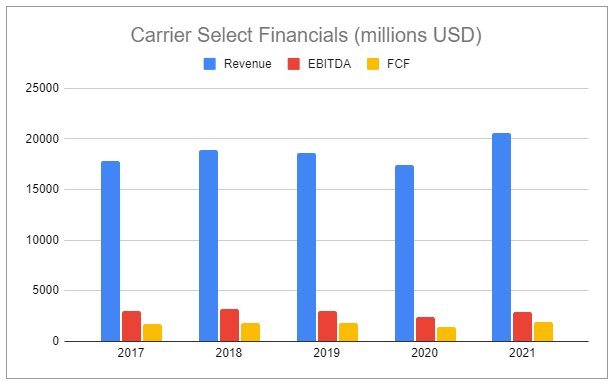

2021: $11.4 billion net sales, 15.6% adj. operating margin, MSD organic growth

Carrier’s industry-leading HVAC solutions focus on comfort, productivity, and efficiency. The company covers both commercial HVAC, including design, installation, and maintenance, as well as residential, including quiet, consistent, and energy-efficient systems. As a leading global brand, the company has recently continued to take share in this growing market.

Carrier’s heating and cooling brands include Carrier, Arcoaire, Beretta, Bryant, Carlyle, CIAT, Comfortmaker, Day & Night, Heil, Keeprite, Paynem Riello, SLD Pumps & Power, Spot Coolers, Tempstar, Toshiba-Carrier (JV), and Totaline.

Carrier’s building automation and control brands include Carrier, Automated Logic, EcoEnergy Insights, and Norescro.

Carrier’s ALC controls business has heavily driven growth in this segment, with Commercial HVAC sales up double-digits for 6 quarters in a row. Residential has recently been near flat, though the company believes there is still considerable room on pricing.

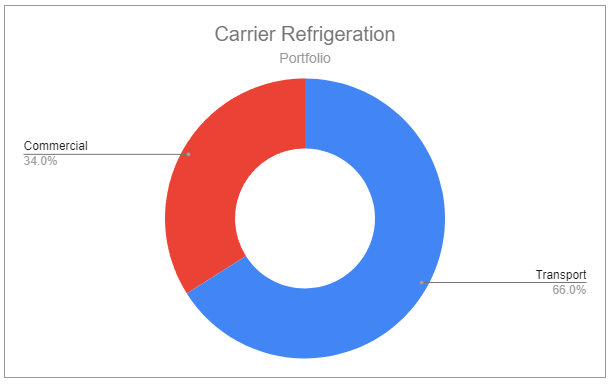

Refrigeration

2021: $4.1 billion net sales, 12.1% adj. operating margin, MSD-HSD organic growth

Carrier, using industry-leading technologies, offers a wide swath of solutions for both transport and commercial refrigeration. Brands include Carrier, Carrier Transicold, Sensitech, Profroid, Celsior, and Green & Cool.

Lynx, Carrier’s intelligent cold-chain technology, helps reduce food and medicine loss, optimize logistics, and reduce disruptions. Monetized via analytics, fleet management, and cargo monitoring, the value it provides leads it to become entrenched in customer operations. To provide perspective on how critical this technology is, each year, there are ~$200 billion in food losses and ~$35 billion in pharmaceutical losses related to temperature. Additionally, there is a continuous demand for these solutions worldwide since countries such as China and India only spend a fraction of what the U.S. does on cold-chain technologies, ensuring a long runway ahead.

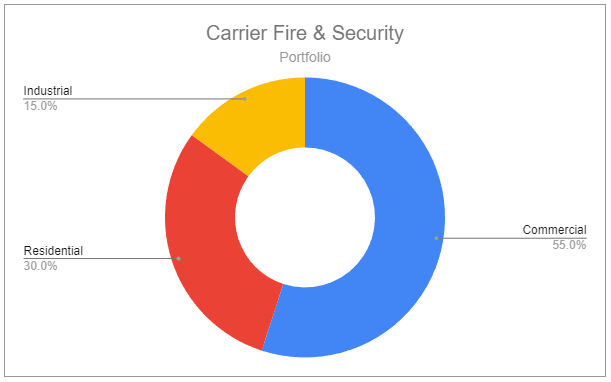

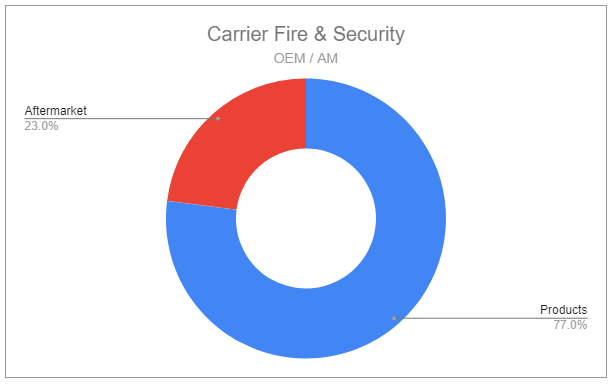

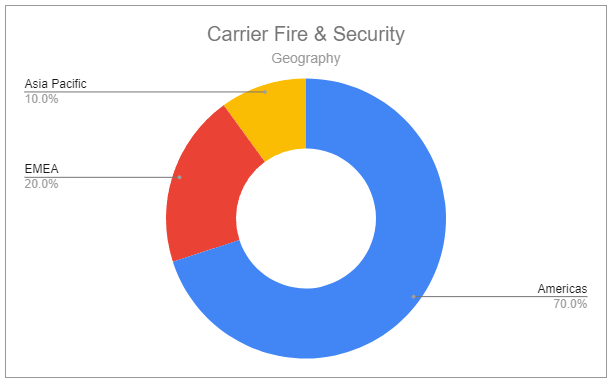

Fire & Security

2021: $5.5 billion net sales, 13% adj. operating margin, LSD organic growth

*~$3.4 billion net sales, ~15.6% adj. operating margin post divestiture of Chubb

Carrier’s Fire & Security offerings cover residential, commercial, and industrial needs, including fire and carbon monoxide detection, alarms, incident management and monitoring, evacuation, gas and water mist suppression, and fire and gas safety controls, as well as remote access and analytics. Brands include Kidde, Edwards, GST, Marioff, Det-Tronics, Autronica, LenelS2, Aritech, Supra, Onity, UTEC, Fenwal Controls, and Fireye.

Growth in this segment has come from Carrier expanding from its initial offerings focused on fire and carbon monoxide detection into all types of detection and safety focuses, including total air quality monitoring. The company believes there is a substantial runway ahead by prioritizing digitizing its installed base and integrating it into smart home systems, along with cross-selling HVAC solutions. This is especially true when accounting for the fact that in the United States the majority of homes fail to meet the minimum recommended detection threshold. An additional small but impressive growth driver is the success of mobile credentialing, using systems like Supra, BrokerBay, Onity, and Lenel S2 to create personalized digital access keys via mobile devices for uses in hotels, storage units, commercial buildings, and more.

Acquisitions and Divestitures

Acquisitions

Carrier has stated that strategic M&A will be a key focus in driving:

enhanced cold-chain ecosystems.

acceleration in digital and aftermarket growth.

further differentiation with new technology.

expanded adjacencies and geographic coverage.

Toshiba-Carrier

Carrier recently signed an agreement to acquire substantially all of Toshiba’s stake in Toshiba-Carrier Corp (TCC). This gives the company greater exposure to the fast-growing variable refrigerator flow (VRF) and heat pump markets and will present an opportunity to recognize ~$100 million in synergies.

Nlyte

In late 2021, Carrier announced acquiring Nlyte, a leading provider of data center infrastructure management (DCIM) software, and would make it part of Automated Logic Corporation, Carrier’s building automation and controls business.

Cavius

In late 2021, Carrier announced acquiring Cavius, a Danish residential alarm company focused on smoke, heat, flood, and carbon monoxide alarms.

Giwee

In mid-2021, Carrier announced acquiring Guangdong Giwee Group to strengthen its position in the variable refrigerator flow (VRF) and light commercial market.

BrokerBay

In Sept. 2021, Carrier announced its acquisition of BrokerBay, a pioneering company focused on developing a streamlined and user-friendly real estate management cloud ecosystem. This acquisition would support Carrier’s mobile credentialing and security offerings.

Divestitures

Since being spun off from United Technologies, Carrier has focused operations and divested non-core assets, generating ~$3.7 billion in net proceeds, improving its balance sheet, and allowing greater flexibility moving forward.

Chubb

At the start of 2022, Carrier announced the sales of Chubb, a component of its Fire & Security segment, for ~$3.1 billion.

Beijer Ref

In late 2020, Carrier announced entering a definitive agreement to sell its remaining stake in Beijer Ref AB, one of the world’s largest refrigeration wholesalers.

Management and Culture

Executive Leadership

Gitlin, David, Chairman & Chief Executive Officer

Agrawal, Ajay, Senior Vice President, Global Services, Healthy Buildings & Chief Strategy Officer

Anderson, Jennifer, Senior Vice President, Strategy, Business Development & Chief Sustainability Officer

George, Bobby, Senior Vice President & Chief Digital Officer

Goris, Patrick, Senior Vice President & Chief Financial Officer

Milmoe, Mary, Vice President, Communications & Marketing

Nelson, Chris, President, HVAC

O’Connor, Kevin, Senior Vice President & Chief Legal Officer

Timperman, Jurgen, President, Fire & Security

Villeneuve, Nadia, Senior Vice President & Chief Human Resources Officer

White, Timothy N., President, Refrigeration

Yilmaz, Hakan, Senior Vice President & Chief Technology Officer

Leadership

Carrier’s commitment to stakeholders is clear. Through providing critically-important products and services, the company helps other companies operate, improves the lives of millions, and reduces food, pharmaceutical, and energy waste, all while becoming incrementally more profitable.

While still nascent as an independent publicly traded company, Carrier has committed to returning capital to shareholders. Along with instituting a dividend that it aims to grow over time, the company also has a $2 billion share repurchase program in place. Along with strategic M&A to foster growth, Carrier aims to continue focusing on share repurchases to return capital to shareholders.

Risks and Considerations

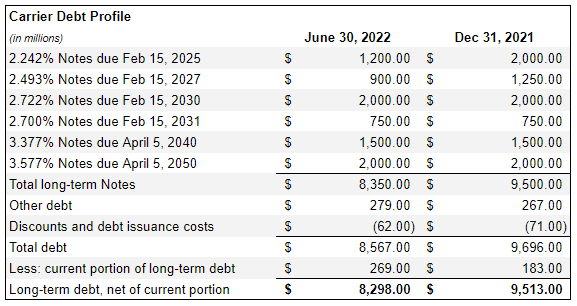

Debt and Leverage

Carrier has significantly deleveraged since being spun from United Technologies in 2020 and is now targeting a Baa2 / BBB rating and net debt/adj. EBITDA of ~2x.

Currently, the company holds:

an interest coverage ratio of 8.5x

a total debt/EBITDA ratio of ~3.1x

a net debt/EBITDA ratio of ~2.1x

Also, perhaps most impressively, is the fact that the weighted average coupon of their debt is <3%. Moving forward, this will provide enhanced financial flexibility, allowing the company to pursue larger, accretive M&A targets.

Future Acquisitions

Carrier has stated that strategic M&A will be a key driver of value creation moving forward. Acquisition targets will prioritize building and cold-chain ecosystems, accelerate digital and aftermarket growth, and assist in further differentiating Carrier from the industry. Each deal will be measured on FCF yield, ability to become EPS accretive by year 2, and must be margin accretive.

Competition

Carrier faces notable competition, especially in the applied HVAC segment from Johnson Controls and Trane Technologies. However, Carrier is dominant in many respects:

#1 in North American residential HVAC

#1 in North American commercial HVAC

#1 in global transport refrigeration

#1 in European commercial refrigeration

#1 in global residential fire

#1 in global access software

#2 in global commercial fire

#3 in global applied HVAC

Over the last few years, along with the strategic acquisitions noted, Carrier’s R&D spending has been slowly growing, increasing from 2.2% of sales in 2019 to an expected 2.7% in 2022. The company’s sales force has also expanded from ~4,900 in 2019 to an expected ~5,800 in 2022. While other large competitors may apply pressure, I think it is most likely that Carrier grows faster than the markets it operates in by taking share from smaller participants, driven by differentiated technology, better service offerings, and geographic reach.

Macro

Persistent inflation is at the forefront of most minds. Carrier, through strict cost discipline, believes it can navigate such an environment while still delivering sustained margin expansion. The company has designed components and systems with this in mind, shifting away from copper reliance and other more volatile inputs. Additionally, despite labor headwinds, the focus on growing aftermarket service revenues will be margin accretive in aggregate.

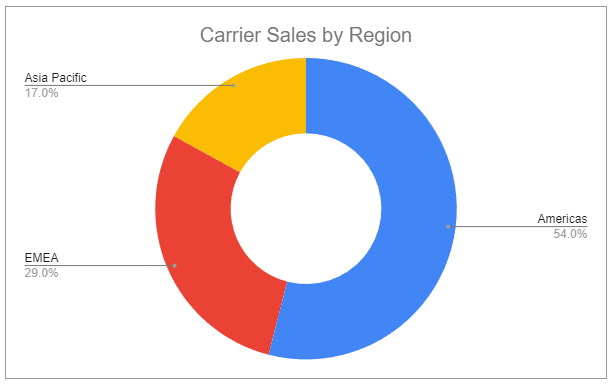

Foreign Exchange

Currency dynamics have been a major headwind for Carrier. In Q2 2022, the company saw the following:

Organic HVAC segment growth of 8%, set back 1% by FX translation.

Organic Refrigeration segment growth of 9%, set back 7% by FX translation.

Organic Fire & Security segment growth of 3%, set back 2% by FX translation.

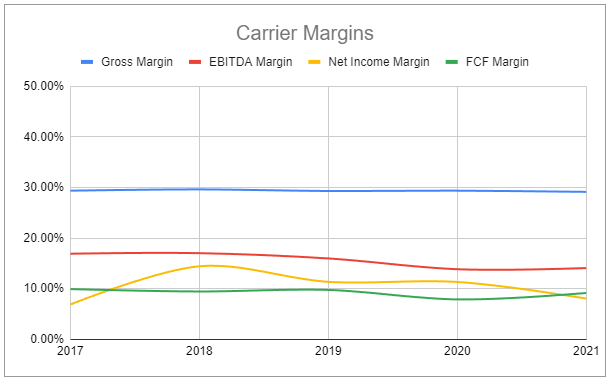

Valuation

Here’s how I’m approaching Carrier’s valuation:

We have a long-established company that is still fairly new to being a standalone publicly traded company, operating in lindy industry segments that can grow at a mid-single to high-single-digit rate.

HVAC - MSD

Refrigeration - MSD-HSD

Fire & Security - LSD

Aftermarket sales, about 1/4 of the company, can grow LDD.

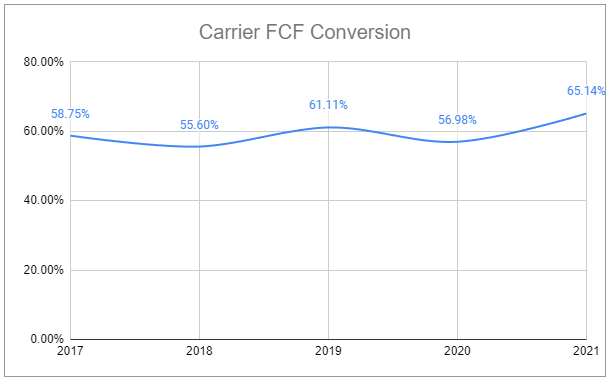

Carrier is guiding medium-term 6-8% organic growth. On top of this, we have an anticipated 2-3% y/y gross productivity improvement, driven by dual-sourcing critical components in the supply chain, factory/footprint optimization, and G&A rationalization. Layering digitization on top of this, we can see incremental adj. operating margin expansion every year for the foreseeable future. The company has also shown disciplined management of working capital, with it remaining at a stable ~$2.5 billion over the last several years as the company has grown; becoming a small % of sales. If Carrier can continue to improve its working capital efficiency, it could free up $100-200 million in additional cash.

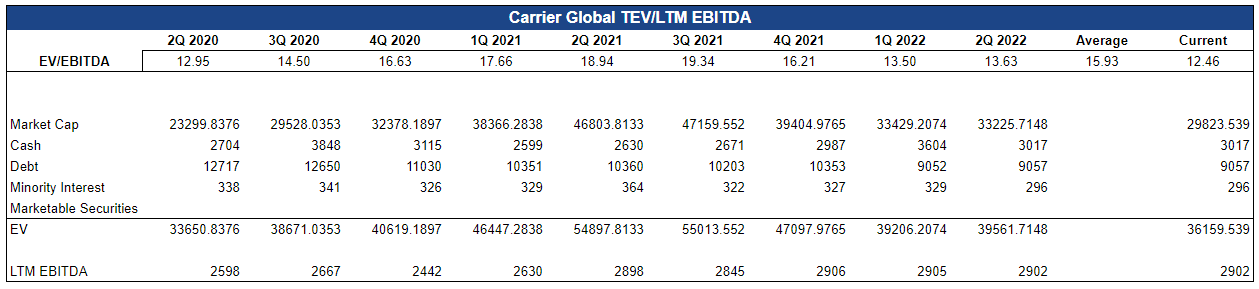

I valued Carrier using a 10-year exit based on backing out equity from an EV/EBITDA multiple and factoring in forecasted dividends and share repurchases.

Key assumptions:

CapEx and R&D spending remains stable at current levels, at 1.75% and 2.7% of sales, respectively.

22% ETR.

60% FCF conversion rate, close to the 5-year average.

EBITDA growth of 5% per year.

Aiming to hold a ~30% payout ratio as of 2023.

Buyback rate of 3% per annum.

Maintains current EV/EBITDA multiple.

The output may not look all that impressive, considering the IRR is a mere 1% above CoE, and the implied upside is 7%, however, there are several major considerations to factor:

The 5% EBITDA growth rate is far under the guided 6-8% topline growth + productivity improvement leading to incremental margin expansion.

Only about 68% of the theoretically generated FCF would be deployed to dividends and buybacks, leaving a good chunk available for further increases or to grow inorganically through M&A.

Factoring in fully deploying available free cash could push the IRR toward the low teens. If growth and margin expansion aligns with management’s guidance, the IRR gets pushed into the mid-teens. I prefer to paint a more conservative picture, but if reality were to unfold in that way, the NPV could be in the $45-57 range. Granted, that’s also contingent on the multiple staying where it’s at, though, at x12.46, well under the average across the last 9 quarters of x15.93, I’m not terribly concerned. This is especially true since any additional compression to the multiple will likely cause management to prioritize buybacks, amplifying their effectiveness and possibly substantially enhancing long-term owners’ earnings.

However, multiple compression is far from the greatest concern moving forward. Many factors could cause the company to fail to capture share of the growing market or cause margins to shrink. Tracking growth from a volume/pricing mix, as well as gauging how well the company can sustain productivity improvements, will be essential.

Is Carrier the flashiest company? Not by most people’s standards. But I find it to be an above-average company trading at a below-average multiple with other qualitative factors that make for an attractive valuation.

Thanks for reading

Ownership Disclaimer

At the time of publishing this piece, I own positions in Carrier.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: CARR 0.00%↑ JCI 0.00%↑ OTIS 0.00%↑

FWIW - unfiltered comments from a PM at one of the top PE shops in London whom I've sent this piece to:

"Still has some more way down IMO, but good company! They will do aggressive M&A, super cash rich and market demanding growth."