Carrier: People Need Our Products

“First is that we're in attractive markets. We realized growth despite broader economic slowdowns, and it's because people need our products. They need heating and cooling and vaccines. They need fresh produce, they need fire detection despite economic cycles. So there's demand for our products, and it's accelerating because of a lot of the secular trends that we talk about, things like sustainability and a shift to electrification and demand for healthy indoor environments. And what we're spending a lot of our time and energy on is driving innovation and differentiation to win more than our fair share of these secular trends. The second theme that we have is a very deliberate shift that we're making at Carrier from selling equipment only to life cycle digitally-enabled solutions.” - Carrier CEO David Gitlin, Stephens Annual Investment Conference, November 15, 2022 (emphasis added)

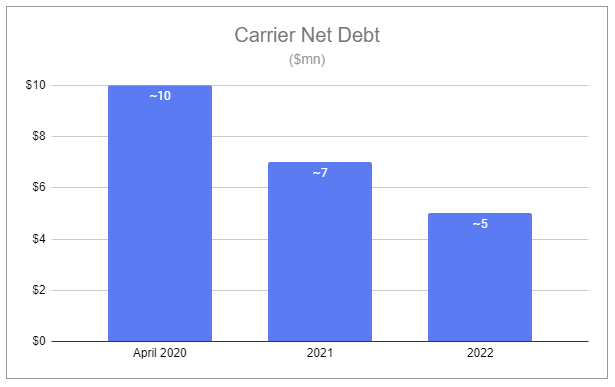

When Carrier was spun off from United Technologies in 2020, it was saddled with over $11 billion in debt and had just $1b in cash. It was clear that the company needed to prioritize deleveraging, and it did. Over the past few years, the company made several sizable divestitures, all while COVID-19 threw a wrench in operations; though also causing a noticeable increase in HVAC demand. All told, net sales look rather choppy:

And both chaos and seasonality are showcased in each segment’s quarterly operating margins:

But when viewed on a yearly basis, adjusted operating margins are quite less noisy, and Carrier as a whole has improved each year post-spin:

Critically, Carrier’s net debt has nearly halved since being spun:

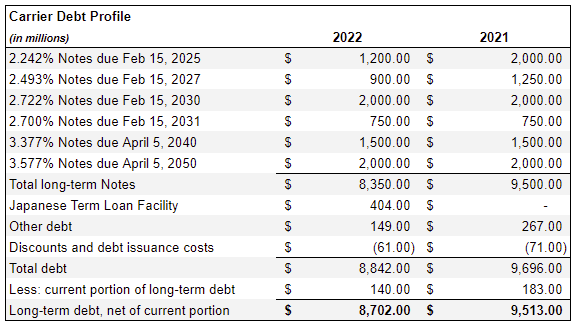

The company has saved itself from a perilous situation in just a few years’ time, and currently holds:

an interest coverage ratio of 9.52

a total debt/EBITDA ratio of 3.02

a net debt/EBITDA ratio of 1.85

Now, with a healthier balance sheet, a backlog that has more than doubled since 2019, and several key acquisitions, Carrier is focused on higher-growth, long-term opportunities.

Ending the year, HVAC continued to show strength in Q4. While NA residential grew LSD, Light Commercial grew over 40%, and Commercial Controls and Commercial HVAC grew at a double-digit rate. Heat pumps were especially strong, with European Commercial sales up 30% and NA residential sales up 35%. With the Inflation Reduction Act increasing the incentives, that will likely carry over into NA Commercial. And on a global level, acquiring the remainder of Toshiba-Carrier Corp (TCC) should allow the company to capture additional opportunities despite potential short-term turbulence. All of this is to say, despite NA residential potentially weakening from coming off a peak, the segment is well-positioned.

Refrigeration saw continued challenges. Container and Commercial Refrigeration were weaker in the quarter, yet, despite supply chain issues, NA and European Truck/Trailer grew double-digits, and Global Truck/Trailer was up ~30% y/y.

Fire & Security became even smaller and saw the most pronounced change. Carrier sold Chubb in 2022, which represented just over a third of segment sales. Yet, Q4 Access Solutions grew over 40% y/y and Commercial Fire Americas grew over 30%. For the full year, organic sales growth of continued operations increased by 7%. While there may be continued pressure from weaker demand in Asia, the Americas continue to look favorable.

But the most important and impressive driver for sales growth has been and will continue to be the aftermarket. While only ~25% of total sales currently, digitization and the shift from product-focused to service-focused represent a fundamental shift, as reinforced by CEO David Gitlin at the Barclays Industrial Select Conference, Feb 23, 2023 (emphasis added):

With our aftermarket growth rates increasing from historical levels prior to our spin at 1% to 3% per year to consistent double-digit aftermarket growth, which we see continuing. And it's really enabled by our two key digital platforms. Abound for buildings. Lynx for cold chain. And what we're doing is providing our customers with sustainable and healthy outcomes throughout the life cycle of our product and service offerings. And all of that results in higher growth, higher margin, more sticky recurring revenues.

These ideas are at the heart of my investment thesis published last year, and closely mirror that of Otis, which was also spun off from United Technologies.

To further drive profitability, Carrier exercises impressive pricing power, having passed broad increases in 2022, which will continue in 2023. Additionally, there is a substantial opportunity for cost savings. Along with the recognition of synergy from the TCC deal, the company aims at several hundred million USD in gross productivity in 2023, with a clear roadmap for more. Two recent statements made by CEO David Gitlin stand out:

Q4 2022 Earnings Call (emphasis added):

Continued takeout of G&A. You'll recall that we used to be 9.5% as a percent of sales. We got down to 7% at the end of last year. More transfers of work to low-cost places like Europe going to Eastern Europe. And all things direct material, which is a big percentage of our direct buy. So we got away from calling it Carrier 700. We said 2% to 3% productivity forever. And we think we're in early phases of what are significant opportunities for cost takeout.

Barclays Industrial Select Conference 2023 (emphasis added):

There's going to be parts of the portfolio that see some volume pressure. There's going to be some high-margin businesses like Commercial that are seeing volume tailwind. And then this cost reduction opportunity, remember, we're coming off a couple of years of significant inflation, $1.5 billion last year, $500 million or so the year before. There's $2 billion of inflation that's our god-given right to go back and get.

And on a relative basis, Carrier’s capital intensity remains extremely low:

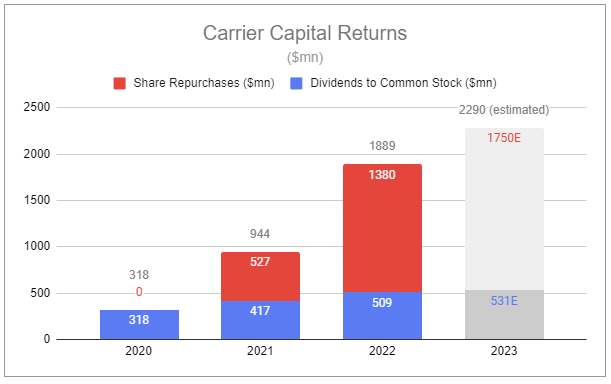

These dynamics have allowed the company to engage in material M&A, in addition to returning significant capital to shareholders:

Valuation

Setting aside some of the tailwinds such as NA and EU regulation - which will undoubtedly enhance Carrier’s growth for years ahead, and resting any notions concerning the virtues ESG, there is a very simple factor explaining Carrier’s runway:

Carrier’s brands save customers money.

Each year, more of the world becomes reliant on heating and air conditioning. The importance of security and monitoring grows. More buildings are built. More sensitive goods are transported and stored. Carrier’s leading offerings produce better outcomes by raising efficiency; putting more dollars back into the pockets of clients over time. With low capital intensity and a clear plan to reduce costs, Carrier can grow in profitability alongside its customers. The company produced ~$1.4 billion in free cash flow in 2022 and has guided to $1.9 billion in free cash flow in 2023, though this year’s jump is non-normalized and is partly due to reduced inventory.

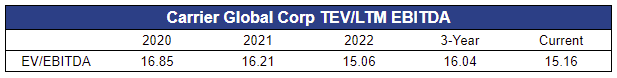

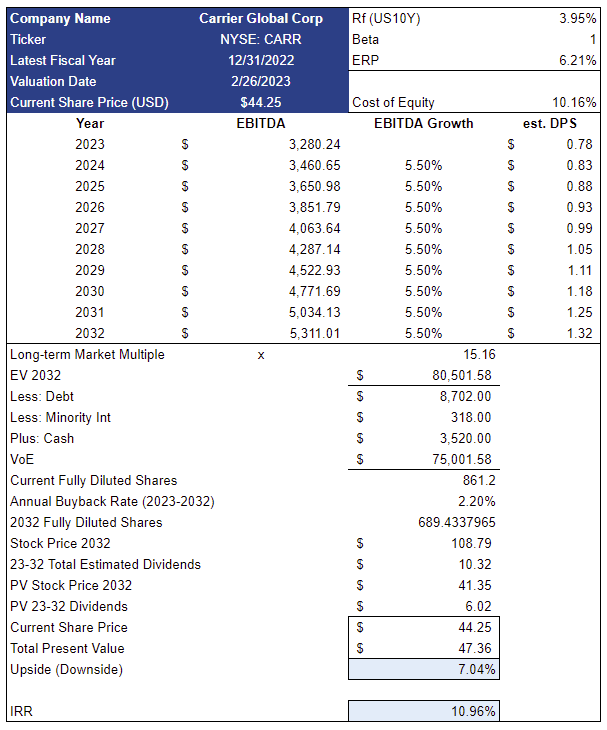

Here is an updated 10-year exit model, backing equity out from an EV/EBITDA multiple and including forecasted dividends and share repurchases.

Key assumptions:

HVAC Organic growth remains MSD, Refrigeration stalls for several years before returning to LSD, and Fire & Security remain at LSD growth. Aftermarket continued to grow at an LDD rate.

2023 EBITDA is estimated based on the growth of ongoing operations, a margin headwind related to TCC, acquisitions, productivity, and pricing

organic volumes, pricing, and productivity will drive ~5.5% EBITDA growth per annum thereafter

The company will increase its dividend at a rate of 6% per annum

The company will retire 2.2% of shares outstanding per annum

Maintains current EV/EBITDA multiple

Factors in zero additional M&A

The output of the model suggests CARR shares are slightly undervalued.

You can surely make fun of the smooth growth plugged into the model - there will be bumps and natural cyclicality. You can also protest using the current EV/EBITDA multiple as the exit multiple, even though it is lower than the 3-year average. After all, it was just a few quarters ago that the company was priced at x12.5 EV/EBITDA. While I can’t speak for the market, the expansion may reflect confidence in business prospects, especially the opportunities related to TCC, aftermarket, and a stronger balance sheet. Regardless, all else equal, compression of the multiple would allow management to repurchase more shares. It’s far more important to me to find the inputs conservative, with pricing and cost rationalization potentially contributing to a greater degree. If that is correct, there will simply be more value created, and more capital to deploy or return. Along with share repurchases, we can expect continued M&A as the company refines its operating portfolio, further advancing its competitive position.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Carrier Global.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: CARR 0.00%↑ OTIS 0.00%↑