“There are plenty of reasons why a company might choose to unload or otherwise separate itself from the fortunes of the business to be spun off. There is only one reason to pay any attention when they do: you can make a pile of money investing in spin-offs.” - Joel Greenblatt

In early 2020, United Technologies merged with the Raytheon Company to form Raytheon Technologies Corp. As part of the merger, United Tech spun off two subsidiaries, Otis Worldwide and Carrier. Neither spin-off received much engagement. Instead, attention went to the large merger, which was still dwarfed by the overall market turmoil and the pandemic sweeping across the globe.

Within 18 months, Otis's shares had doubled in price. And then all came crashing down - fears of prolonged covid lockdowns, high inflation, FX dynamics, and a sluggish China led to shares grinding lower for nearly a year. And then, like much of the market, shares continued to bounce around. Most everything has been noise. Somewhere in the midst of all the chaos, I published my analysis and valuation:

The thesis was simple:

The vertical transportation systems (VMS) space benefits from secular tailwinds including a growing global middle class and urbanization. Complexity, regulation, and safety concerns have created a formidable barrier to entry. Otis, as the largest and most dominant player in the industry, further benefits from:

Superior economies of scale and operational density.

Prioritization of the world’s largest portfolio of serviceable units.

Digitization and enhancing technologies.

These factors allow the company to sustainably increase operational efficiencies of a capital-light business and will create substantial value for equity holders.

On February 7th, 2023, Otis reported its Q4 2022.

Let’s dig in.

Otis Worldwide Q4 2022 & Full-Year Numbers

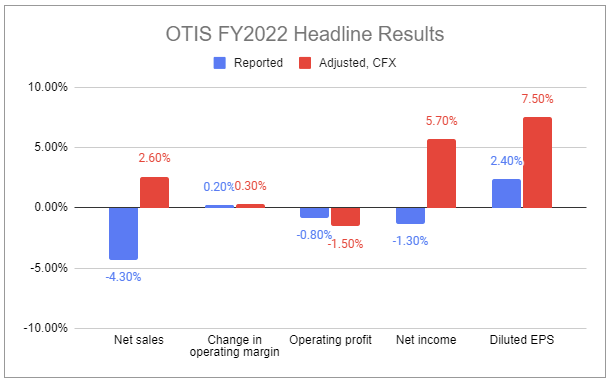

Otis’s Q4 numbers weren’t the prettiest. Net sales were down 3.6%, and operating profit was down 0.8%. But operating margin, net income, and diluted EPS all grew. Full-year was mixed but ultimately positive:

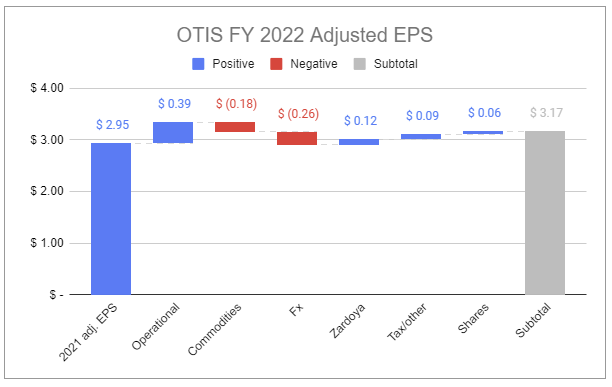

The following chart visualizes the adjustments made:

Baseline adjustments include costs associated with the Zardoya acquisition, costs from Russian-related conflict, and special restructuring-related charges. The FY results include inescapable headwinds such as negative FX dynamics, input inflation, and wage inflation. It may be tempting to ignore the adjustments above, yet, even without adjusting for the acute headwinds, reported EPS was positive for the year. This was driven by strong volume paired with pricing, productivity and cost containment, continued improvement to the company’s effective tax rate, and of course, buybacks. And remember, speaking of adjustments: the direction the wind blows can (and does) change. Headwinds can become tailwinds and vice versa. 2023 will likely see commodities flipping to an operational tailwind, and higher rates will cause interest expense to become a more pronounced drag.

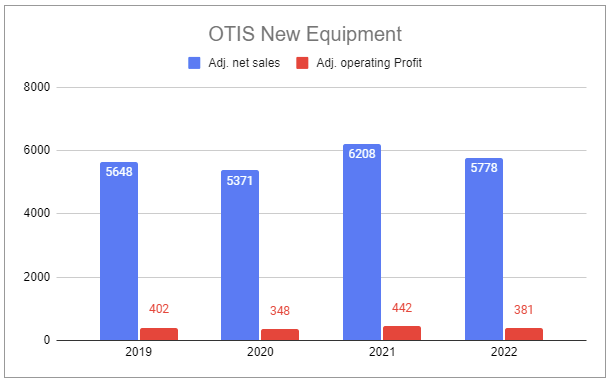

In Q4, New Equipment orders grew 4% at constant currency, and New Equipment share was up 1% for the same period. In total, organic sales were up 5.1%, driven by the Americas (10.7%) and EMEA (12%). Q4’s strength contrasts with the difficulties the segment faced throughout the year. FY organic sales were down 1.7%, though up 7% at constant currency. FY NE sales in China were down ~10% for the year. While the near-term performance of the segment may be lumpy, Otis CEO Judith Marks highlighted opportunity on the FY 2022 call:

I'll actually start with Asia Pacific, where the market, overall, we're really expecting solid growth due to urbanization and infrastructure growth in Korea, in Southeast Asia and in India. And we're not seeing any slowing in that part of the world. It's really accelerating, and expectation should be for solid growth.

Service, including Maintenance & Repair and Modernization, showed incredible resiliency for the full year. In Q4, total maintenance units were up 4.1% y/y, having grown in all regions, and modernization orders were up 13% in constant currency. For the full-year, organic service sales were up 6%, Maintenance & Repair was up 5.6%, and Modernization was up 8.1%. The strength of the segment was the result of growing volumes paired with pricing (3%) and enhanced productivity, which more than offset the segment’s greatest headwind: wage inflation.

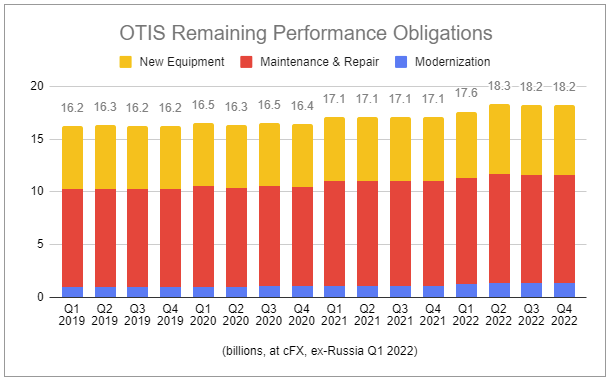

During the year, Otis deployed >100,000 Otis ONE™ units, as well as many other value-add service technologies. As the company continues to offer leading new equipment, as well as improved modernization and digital value-add services, the company will continue to win share, and demand for Otis’s value propositions is well-illustrated in its growing backlog, suggesting years of growth ahead:

Along with a growing maintenance portfolio and backlog, Otis continues to boast a 94% global retention rate and a 64% global conversion rate. Continued strong execution could allow units in the maintenance portfolio to grow by over 15% by 2026, and more critically, margins should expand as the company focuses on its recapture efforts targeting higher-profitability units. But that still fails to fully capture the long-term opportunity.

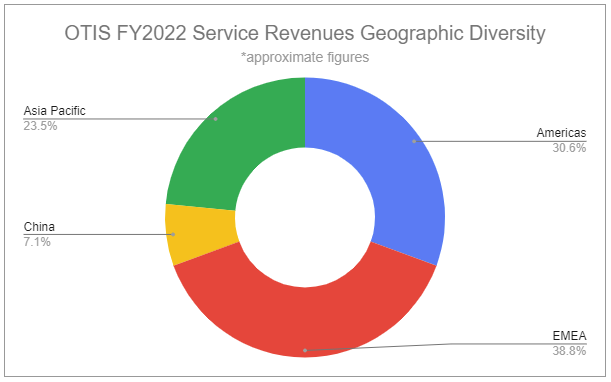

Otis has a wide mix of currency exposure:

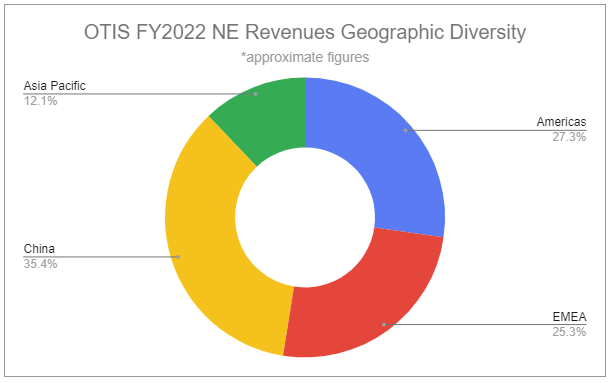

China plays the largest role in New Equipment growth:

But China makes up only a sliver of Service revenues:

This showcases two things:

The Service segment is unphased by near-term uncertainty surrounding China.

China represents an eventual major growth engine for the segment.

This was reinforced by Judith Marks, Otis CEO, on the FY 2022 call (emphasis added):

When I turn to the service business, it's -- the end market is just growing in all regions. It's solid mid-single-digit growth, led by Asia, and low single digit really in the developed markets.

And, recall that the New Equipment market swings really have minimal impact on the Service market. It's going to grow mid-single digit year after year after year.

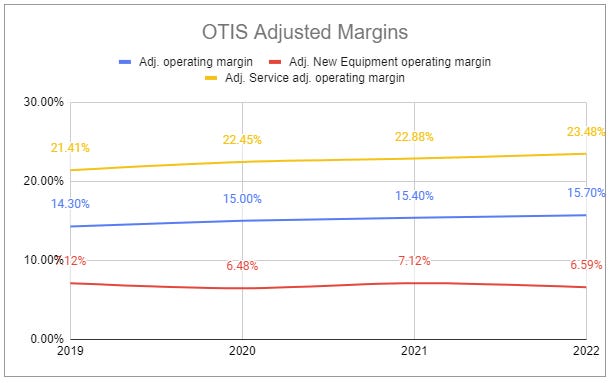

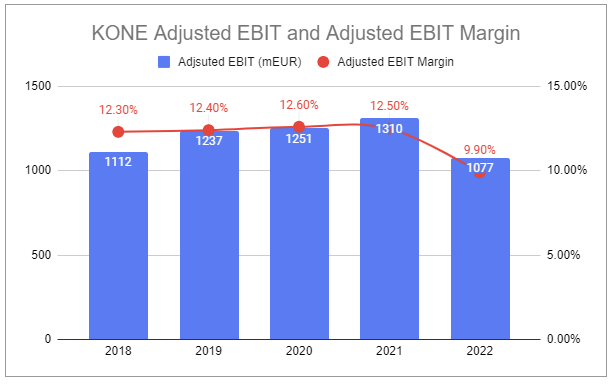

While Otis’ New Equipment segment has struggled to maintain its operating margin, the Service segment has continually expanded its operating margin, which is already substantially higher on a relative basis:

This is in stark contrast to one of Otis’ largest competitors, KONE, who has faced considerable margin pressures:

Mind you, Otis service segment revenues are already larger than NE revenues, and with continually-expanding margins, it will continue to become an even larger part of profits. What will enable this? The flywheel.

The flywheel

Along with modernization improving the efficiency of legacy units, digitization offers distinct benefits:

Units can contact Otis immediately when issues are presented

Enables remote diagnostics and possible remote maintenance

Immediately dispatches technicians with ready-to-go diagnostics

Automatically facilitates repair sales and contract orders

In-unit displays + mobile apps create a superior user experience for passengers

Allow tracking and transparency for Otis to ensure consistent and high-quality service and the ability to review service protocols

With an industry-leading retention rate, converting units and engaging in M&A increases operational density. Operational density:

Reduces maintenance technician travel times, allowing them to be more productive while also reducing vehicle and fuel usage

Reduced travel times, along with ready-to-go diagnostics provided by digitization, drastically lowers response times and time-to-completion

These dynamics naturally result in a win-win-win-win for key stakeholders:

Client units receive higher-quality service, experience fewer and shorter downtimes, and per-instance maintenance costs can actually decrease due to preventative measures and analytics.

Technicians are able to spend more of their time performing fulfilling work. (This should also allow Otis to attract top-tier skilled talent.)

Reduced travel times and increased productivity reduces the total number of technicians needed on a per-unit basis, reducing one of Otis’ most substantial costs (and wage inflation has been an especially pronounced headwind).

Digital offerings provide Otis’ with multiple streams of predictable recurring incremental revenue that can increase total revenue by 15-20% over the regular service contract.

Better outcomes lead to higher retention and the ability to engage in higher pricing. Both expand margins and increase absolute profitability. Increased profitability and profits allow for more M&A, increasing operational density, providing new units to modernize and digitize, and repeating the cycle. It’s also worth noting that the flywheel has a profound additional effect on competition: as Otis selectively grows and becomes denser in specific geographies, it drastically reduces the options available for competitors within those same geographies. Over time, this will only become harder to compete against.

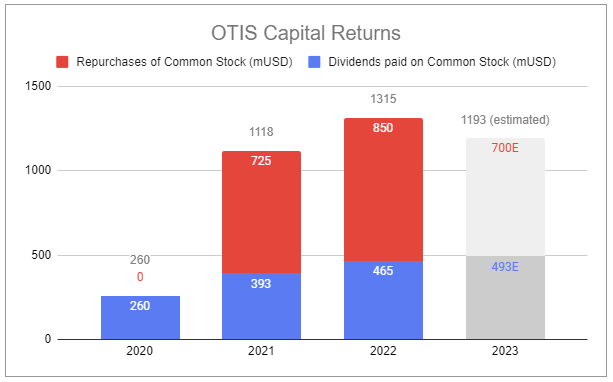

We should expect to see additional bolt-on M&A activity, however, management is likely to remain disciplined, only engaging in the highest-quality opportunities while also returning excess capital to shareholders:

Debt

During 2022, Otis completed a $500M long-term debt repayment. Currently, the company holds:

an interest coverage ratio of 16

a total debt/EBITDA ratio of 3.11

a net debt/EBITDA ratio of 2.59

Otis has continued to deleverage and notes outstanding carry extremely attractive rates:

And the maturity profile of the notes is favorable:

Valuation

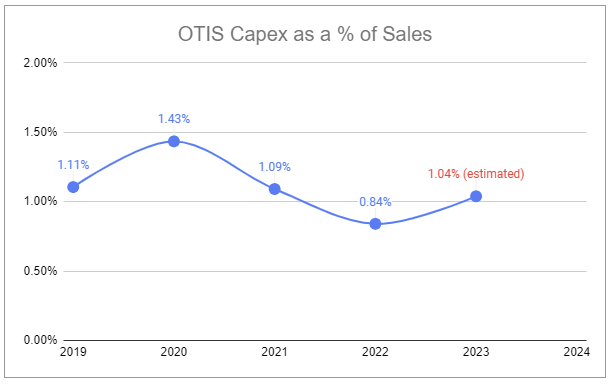

It’s important to recognize just how little Otis needs to reinvest to generate its returns:

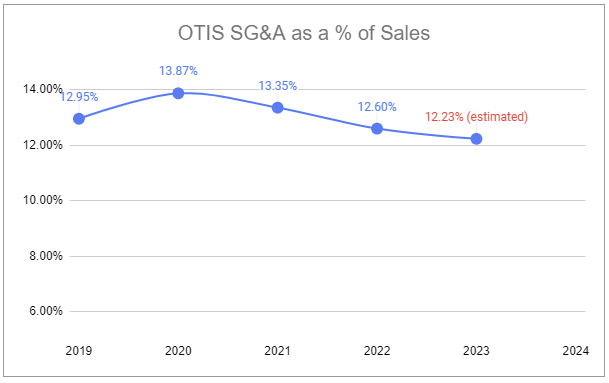

And the firm continues to fiercely rationalize expenses:

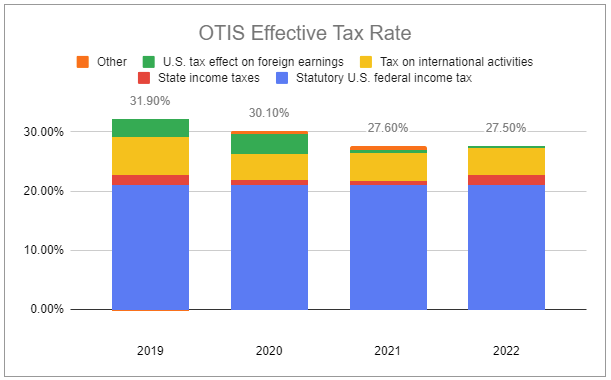

All while its effective tax rate continues to favorably evolve post-spin-off:

I updated my 10-year exit model that backs out equity from an EV/EBITDA multiple and factors in forecasted dividends and share repurchases.

Key assumptions:

Organic NE sales will grow LSD

Organic Service sales will grow MSD, driven by digitization, modernization, and recap

~3% price take per annum

Route optimization and operational density will continue to drive increased productivity

NE Op Margin will remain stable

Service Op Margin will expand by 10-40bps per annum

Continued SG&A rationalization

FX @ CC

Dividends will increase by 6% per annum

Share repurchases will retire 1.7% of shares outstanding per annum

The output of the model suggests OTIS shares are fairly valued.

Additional considerations:

EBITDA growth rate is likely understated for the medium and long-term outlook, considering the additional escalation clauses Otis will be able to exercise in its service contracts.

This model uses the 3-year average multiple instead of the higher current multiple for an exit price.

The buyback rate of 1.7% is softer than the guided levels, reflecting medium-term uncertainty.

Zero bolt-on M&A is included in the model, despite clear accretive opportunities to enhance the ‘flywheel’ and a likelihood of additional deployable capital due to the softness of share repurchases.

This model makes no assumption or illustration of further improvements to the firm’s effective tax rate.

As service growth and operational efficiency continue to outpace New Equipment, Otis will become less cyclical, more predictable, and of higher profitability. If the company is able to maintain a ~115% FCF conversion rate, both RIR and capital returns should be more pronounced.

Therefore, despite the model suggesting OTIS shares are fairly valued, I have no intention of adjusting my position. I believe the company represents an incredibly durable asset that can likely create long-term value above what is modeled. Additionally, there is the old adage “markets take the stairs up and the elevator down.” I would love nothing more than to see OTIS shares partake in a broad selloff with fundamentals intact. Perhaps there’d be an opportunity to take the escalator back up.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Otis Worldwide.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: OTIS 0.00%↑ CARR 0.00%↑

Very interesting article! Thanks for sharing!

Great write-up!

The Raytheon/United Technologies merger and Otis/Carrier spin-off was one of our earliest and greatest successes in the special situation investing space. Since then we’ve been hooked!

Keep up the great work!