Defiance

“There is no week nor day nor hour when tyranny may not enter upon this country, if the people lose their roughness and spirit of defiance.” - Walt Whitman

Using words such as Sustained, Steadfast, and Steadied to name recent notes comes off as repetitive, if not dull. But that is precisely the point. Behind all of the doom and gloom and prophesying of the nicotine industry’s demise, there is the actual reality that we live in. Despite all of the headwinds—which there is undoubtedly no shortage of—industry profits have remained not just stable, but robust. The driver? Simply, aggregate demand for and usage of nicotine products continues to march north.

The nicotine industry’s performance acts in defiance of the common narrative that the long-held relationship between humans and nicotine has somehow unraveled. Yet, while such stability is evident, there is a bubbling of potential instability. New US product launches, including Altria’s on! Plus and British American Tobacco’s Vuse One, have been announced.

Why launch these products now? Are these products compliant with current regulations? There is a read-through in which these are not merely new launches but are instead parts of a greater effort for taking the FDA head-on, suggesting far greater implications for the industry’s trajectory.

For years, British American Tobacco decried the surge of illicit vaping products in the United States, which has contributed to the decline in cigarette volumes and has stifled the growth of BAT’s pod-based vapor product Vuse Alto. During the FY’23 call, BAT’s CEO, Tadeu Marroco, stated:

Effective enforcement is critical to the development of functional new category markets. We are deeply concerned by the continued proliferation of illicit single-use vapour products in the U.S., which we estimate represent over 60% of the vapour markets. These are -- there are multiple levers available to the government agencies, state and local authorities to ensure proper regulatory enforcement.

Even with a handful of enforcement actions taken, by the time of the group’s pre-close call in December 2024, it was clear that the level of enforcement was inadequate, with illicit products continuing to take overall share:

We estimate that illicit products are now approaching 70% of the U.S. vapor market, representing approximately GBP 6 billion of manufacturer revenue.

Actions taken both on the federal level and state levels continued to mount, creating a more hostile climate for illicit vapor products. Marroco’s description of the environment was noticeably more upbeat during BAT’s H1’25 call:

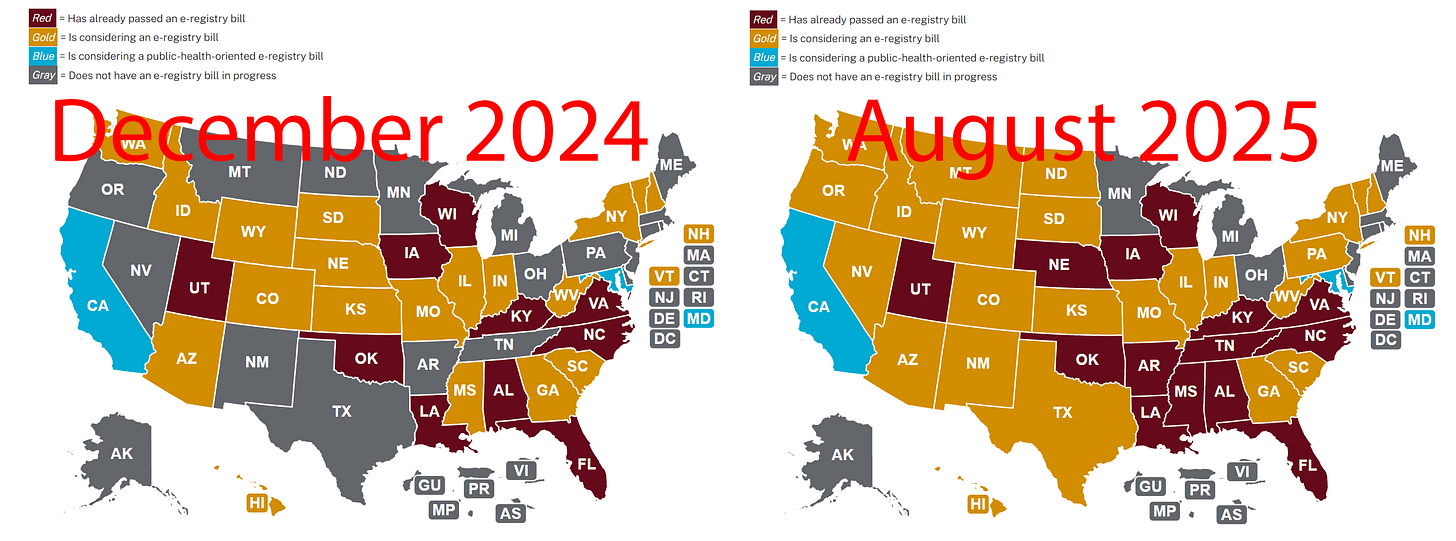

We are encouraged that at the state level, vapour directory and enforcement legislation has now passed in 18 U.S. states and we look forward to do the implementation of these and more robust enforcement. A number of states are now demonstrating that well constructive regulation can be effective in tackling illicit vapour with Vuse volume returning to growth. In addition, we remain cautiously optimistic about a more proactive approach to illicit vapor enforcement at the federal level. The new administration has been clear that tackling illicit vapor is a key priority, and the FDA has already taken some important first steps updating product classifications, closing loop holes for small shipments and seizing illicit products.

While these actions have recently driven more than a 40% reduction in vapour-related shipments to the U.S. due to the long supply chain, we are yet to see any meaningful impact on the ground. As a result, we are not assuming any improvement in the legal vapour market in our 2025 guidance.

For reference, below, left, maps the progress of states enacting ‘PMTA Registry-type’ laws to restrict the availability of non-compliant vapor products as of 12/14/2024, while, below, right, shows an updated map as of 8/21/2025.

After considering such a stance, it may be surprising to learn that BAT intends to begin marketing its own disposable vaping product in select parts of the United States later this year. On the surface, the move appears entirely hypocritical. However, the situation isn’t entirely straightforward.

A deadline of September 9th, 2020, was established for new tobacco products using tobacco-derived nicotine that had been on the market since August 8th, 2016. This deadline did not encompass synthetic nicotine, which is used by the majority of nicotine vaping products. In April 2022, to extend the FDA’s authority to include all nicotine products, irrespective of the type of nicotine used, Congress passed a law that included the regulation of synthetic nicotine. With this, a new PMTA deadline of May 14, 2022, was established for non-tobacco (synthetic) nicotine products.

British American Tobacco’s disposable product, Vuse One, is based on the assets the group’s US subsidiary, R. J. Reynolds Vapor Company, acquired from Charlie’s Holdings. Reynolds was unlikely to be after trademarks related to these products, which were previously marketed under the Pacha brand. Instead, the group specifically sought the IP and related PMTA assets. Charlie’s Holdings’ 8-K, dated 4/17/2025, states:

On April 16, 2025, Charlie's Holdings, Inc. (the "Company") entered into and closed an Asset Purchase Agreement (the “Agreement”) with R. J. Reynolds Vapor Company (the “Buyer”) pursuant to which the Buyer purchased twelve of the Company’s PACHA synthetic products and related assets (the “Assets”) that are covered by a premarket tobacco application (“PMTA”) first submitted by the Company in 2022. The purchase price for the Assets was $5.0 million paid at closing, plus a contingent one-time payment of up to $4.2 million based on product sold by the Buyer during the one year following the first day of commercialization of the Assets.

The company filed another 8-K on 6/3/2025 to disclose amending the purchase agreement:

On May 29, 2025, Charlie's Holdings, Inc. (the "Company") amended the Asset Purchase Agreement (the “Amendment”) with R. J. Reynolds Vapor Company (the “Buyer”) pursuant to which the Buyer purchased three additional PACHA synthetic products and related assets (the “Additional Assets”) that are covered by a premarket tobacco application (“PMTA”) first submitted by the Company in 2022, bringing the total purchased by the Buyer, to date, to fifteen products. The purchase price for the Additional Assets was $1.5 million paid at closing.

On 8/11/2025, CH filed another 8-K, stating:

On August 8, 2025, Charlie's Holdings, Inc. (the "Company") entered into and closed on an Amendment to the Asset Purchase Agreement (the “Amendment”) with R. J. Reynolds Vapor Company (the “Buyer”) pursuant to which the Buyer purchased one additional PACHA synthetic product and related asset (the “Additional Assets”) that are covered by a premarket tobacco application (“PMTA”) first submitted by the Company in 2022, bringing the total purchased by the Buyer to sixteen. The purchase price for the Additional Assets was $1.0 million paid at closing.

The most recent 8-K lists the product variants:

Charlie’s Holdings’ most recent 10-Q reiterates that the PMTA submissions for these products were one day before the deadline:

The Company filed new PMTAs, for its synthetic Pacha products on May 13, 2022, prior to the May 14, 2022 deadline. On November 3, 2022, FDA accepted for scientific review certain of our PMTAs for synthetic nicotine products and, on November 4, 2022, FDA refused to accept certain other PMTAs for these products, rendering the latter products subject to FDA enforcement.

Of course, submitting PMTAs before the deadline is good. Having them accepted for scientific review is good. But it is still far from the end of the race. Even if applications pass scientific review, they then enter substantive review. Substantive review is exhaustive and carries a tremendously high bar to clear, as Brian King’s (former Director of the FDA’s CTP) August 3, 2022, perspective update noted:

Accepted applications then enter further review, which ensures certain criteria are met for applications to proceed forward for further evaluation. For example, required criteria could include information on product formulation, product testing and analysis, and evaluation of the health risks of the product both at the individual and population levels. After this further review, applications that meet the necessary criteria will enter substantive review, including consideration of the impact to the population as a whole, such as risks to youth and potential benefits to adult smokers. The substantive review phase includes evaluation of the scientific information and data in an application, which often results in follow-up questions and conversations with companies, including in situations where elements of an application raise questions needing clarification. It is only after the substantive phase that a company may be granted a marketing order. If no marketing order is granted, it remains illegal to market the product. To date, no non-tobacco nicotine product has received a marketing granted order.

If Reynolds receives MDOs for these products, it is nearly certain that the group will challenge through litigation. You can have an opinion on the odds of MGO versus MDO. You can have an opinion on whether or not this move is hypocritical on Reynold’s part. What is not in opinion is that this approach is nearly identical to many other products currently marketed in the US by major manufacturers. Surely, the fact that ‘others do it too’ is not a strong argument. However, there is far more to consider.