Haypp Group: Skyward

“Big ideas are usually simple ideas.” – David Ogilvy

Haypp Group’s Q2’25 results offered plenty of data points to scour over. Additional context was provided concerning US state closures, winding down the US legacy oral tobacco business, and the ZYN outage. When factoring such, the story becomes less noisy. Underlying like-for-like growth was robust across the board, with nicotine pouches proving fierce. There is a fervent demand for Media and Insights. Margins received a meaningful uplift.

From what I see, there was little in the way of surprise. So instead of being a regular quarterly update, this piece offers something different. It revisits many points raised when I first wrote about Haypp last year. It further investigates ideas around value, nicotine usage prevalence, consumer behaviors, and much more, underpinned by data from a vast assortment of sources. Most importantly, it uses that data as fundamental building blocks to present an alternative approach concerning Haypp’s growth prospects, specifically in the United States. As uncomfortable as it was, I even suspended my traditional approach and distilled factors down into a true ‘Blue Sky’ scenario.

Let’s explore.

Value versus Price

A value far exceeding the price is a strong precursor for the success of a product or service. Cigarettes were incredibly cheap when they began to be mass-produced at the end of the 19th century, or at least in terms of their monetary cost. Value was provided through the swift delivery of nicotine to the user. However, well-understood today, the sustained usage of cigarettes is associated with a significant cost to one’s health. That cost was largely hidden until the second half of the 20th century. Regulators ran the math and began to enact a continual stream of regulations to curb usage. Consumers crunched the numbers as well, and many began to conclude that the actual total cost was not worth the value of the nicotine.

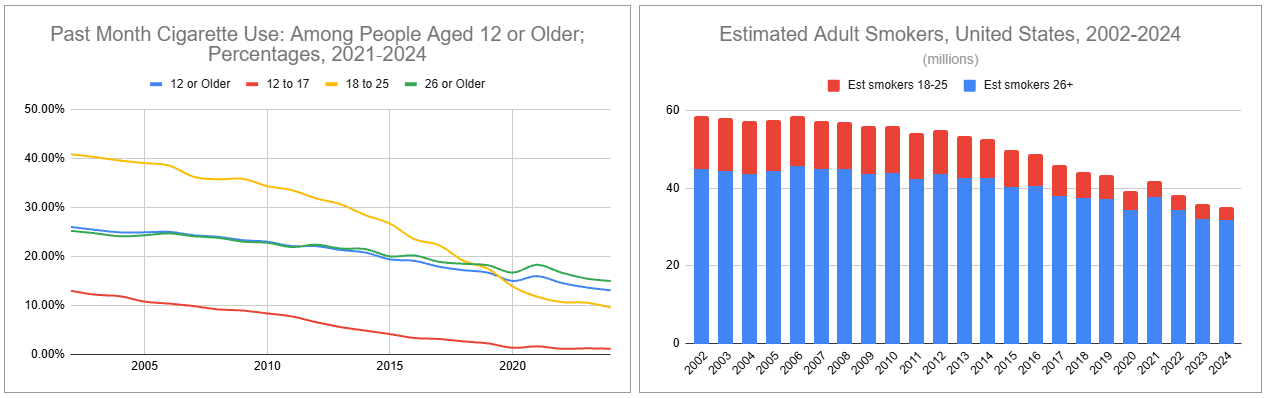

For roughly sixty years, cigarette usage prevalence has been on the decline in the United States. The recent continuance is well-illustrated by data (below, left) from the Substance Abuse and Mental Health Services Administration (SAMHSA). Yet, while the number of adult smokers (below, right) has also fallen, it has not done so as fast. Explaining this is the denominator effect of a growing population.

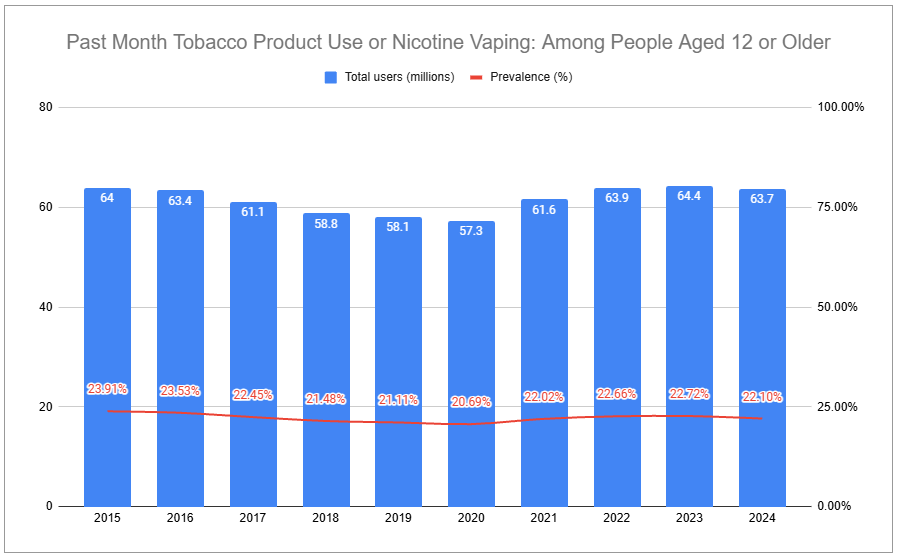

Another factor driving the reduced prevalence of cigarette usage is the fact that cigarettes are only one of many products that deliver nicotine. Below is a composite illustration using SAMHSA’s ‘Results from the National Survey on Drug Use and Health’ (NSDUH) data for the years 2015-2024.

There are some caveats to the above chart. In 2018, SAMHSA acknowledged that nicotine vaping was not included in the survey questions, yet was likely a factor in explaining usage trends, with its annual report stating:

Although cigarette smoking declined, some of this decline may reflect a rise in the use of electronic vaporizing devices (“vaping”), such as e-cigarettes, as a substitute for delivering nicotine.

Things changed in 2020, when the administration began asking specifically about nicotine vaping. Looking backward shows a gap in usage merely because there was a gap in the survey, failing to capture the rapid increase in prevalence of nicotine vaping. Figures became even hazier as the nicotine-vaping-specific question set was modified in 2022. This makes data for 2022 and forward appropriately comparable, while the figures for earlier, included above, are not accurately representative. Nonetheless, when you ignore specific categories and exclusively look in black or white terms of users/non-users, which removes considerations of poly-usage, a different picture emerges. The total number of recent users, i.e, those using tobacco or nicotine vapor, has held relatively stable. While not perfectly quantifiable, it is also intuitively understood that the years where a greater decline of users is visible are due to the surveys not including nicotine vapor usage, thus ignoring individuals who were using that category exclusively.

A key takeaway is that nicotine usage prevalence in the United States has remained quite stable, with the actual rate comfortably above twenty percent. A more critical point is that, just as the administration was late to include questions on nicotine vaping in surveys, it is again late to address nicotine pouches. While other organizations, such as Monitoring the Future, a continuing study of American youth led by the University of Michigan, have begun to include questions about nicotine pouch usage in their youth-focused surveys, even in 2024, SAMHSA’s NSDUH did not include questions specifically about nicotine pouches. Footnotes concerning ‘Smokeless tobacco’ refer to snuff, dip, chewing tobacco, or snus.

Nicotine pouches have proliferated over the last several years, with the majority of users having previously been users of cigarettes or smokeless tobacco products. Nicotine pouch users who remained poly-users would be captured in the above data, but any exclusive users would be omitted. Declines in other categories also do not reflect users switching to pouches. Likewise, new users who would have entered a legacy category but instead adopted nicotine pouches are not reflected. Although without precision, this supports the idea that true total nicotine usage prevalence and the total number of nicotine users in the United States are not just stable, but are actively growing.

Various methods of estimation measure 2024 nicotine pouch users somewhere between 5.5 and 7.5 million, with Haypp Group estimating 6.3 million.1 A question I have been asking for years is, “What would happen if people could easily access nicotine while avoiding many of the health concerns as well as social stigma?” Vaping throughout the world, and heat-not-burn products outside of the United States, have suggested an answer. Nicotine pouches have solidified it.

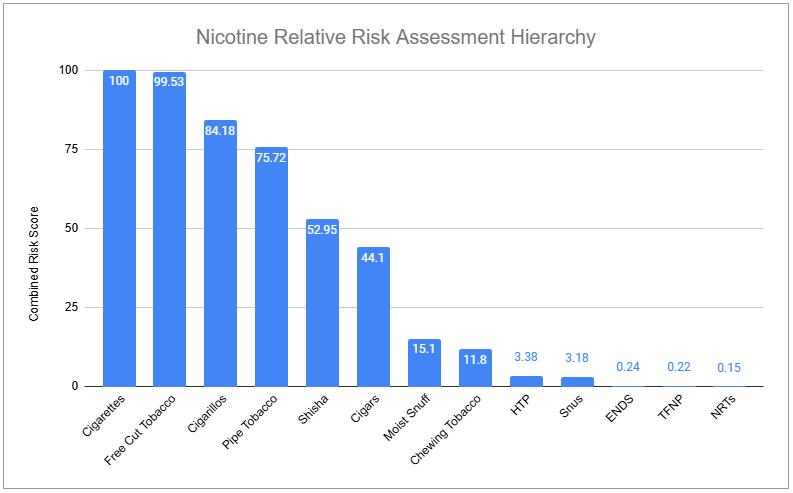

People desire nicotine because it is pleasurable. People value pleasure. But people value their health as well. Even for those who don’t value their health to the same degree as others, they are wise enough to recognize when something is cheap. Nicotine pouches are the most affordable form of recreational nicotine when measured in terms of cost to one’s health.2

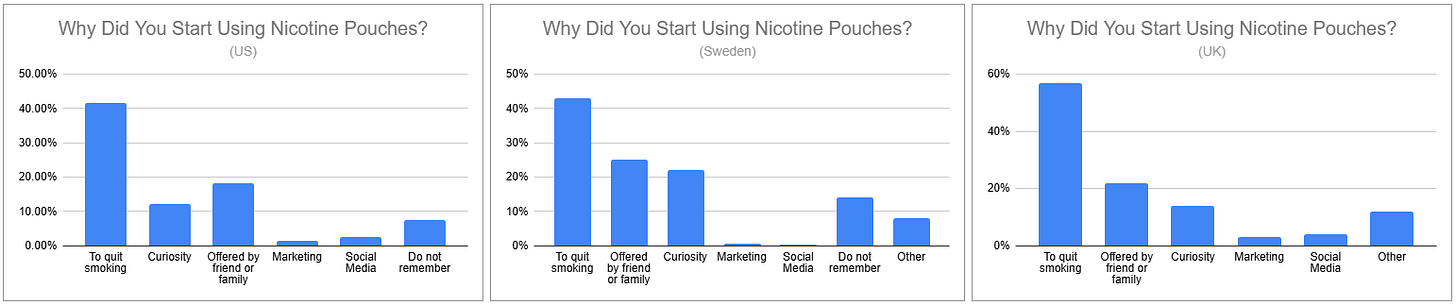

Haypp Group’s 2025 reports on respective markets showed it didn’t matter if it was a country, such as the US or UK, in which nicotine pouches are still nascent, or in a mature market, such as Sweden: by far, the number one reason people start using nicotine pouches is to quit smoking.

The ‘health savings’ of nicotine pouches are significant. This alone is a sufficient driver for continued adoption. However, the nominal purchase price must be considered as well. Average pricing for nicotine pouches remains far under that of legacy products, such as cigarettes and chewing tobacco, with relative retail price differentials ranging anywhere from 15% to 80%, depending on category, federal and state-level excise, and various promotional activity. Naturally, there are adverse developments, such as state-level actions, including a recent significant excise tax increase on nicotine pouches in my home state of Illinois, driven by anti-nicotine ideologies rather than pro-consumer, pro-health, pro-society, and pro-business data. Still, two factors will make this relative affordability differential wider.

The first is increasing promotional activity of nicotine pouch brand owners, aiming to solidify and take incremental share in the fast-growing category as the number of competitors increases. However, even if that lessens as the category matures over time, a second factor is a higher level of price increases of legacy category products set by major manufacturers such as Altria, British American Tobacco, and Imperial Brands, aiming to offset the elevated volume declines brought on by cross-category movement to nicotine pouches, as well as other next-gen products. These two factors can feed into one another, on top of the significant disparity of health costs between product categories, to insulate the affordability of pouches.

One must also take into account the added value provided by other qualitative factors. With nicotine pouches, there is no staining of teeth, foul breath, or need to spit, like in the case of legacy oral tobacco. There is no smoke or vapor to disturb others. Pouches, outside of inserting and extracting them from under the lip, are hands-free. Unmatchably, nicotine pouches are highly discreet, allowing usage anytime, anywhere. Practically undetectable, usage almost entirely escapes the potential of facing social stigma.

Nicotine pouches are valuable because they efficiently and discreetly deliver nicotine, and they are very cheap relative to that value and relative to other nicotine product categories.

Haypp Group prides itself on having even more affordable prices, citing its prices in Core Markets being roughly 20% and 30% cheaper than grocery stores and convenience stores, respectively. This is wider in Growth Markets, where the company offers products 40% cheaper than grocery stores and 50% cheaper than convenience stores. Almost always, when I talk with other investors who are interested in Haypp, they ask a specific question.

Can Haypp raise prices?

The simple answer is yes. But the simple answer is not the correct answer, because it’s answering the wrong question. The right question is, should Haypp raise prices?

The answer is no. Granted, there are fluctuations in price due to various factors. Snus in Core Markets will likely see prices march higher over time, as volumes are cannibalized by nicotine pouches, and manufacturers aim to bolster profits. The pricing of NPs on a brand level can fluctuate as well, contingent on what the brand owner's objectives are at any given time. But Haypp should only be aiming to do one thing.

Serve its customers better.

And once it achieves serving its customers better, the next step is to figure out how to serve its customers better, because it’s never enough.

Never enough

Serving customers better means two things because Haypp has two sets of customers.

For brand owners, it means arming them with more, higher-value data and getting their products in front of more consumers.

There remains a widespread belief that the relationships Haypp has with brand owners are somehow adversarial. It is argued that Haypp is a middleman, siphoning away would-be excess profits from them. Taking that argument further, there is concern that brand owners will establish their own online D2C offerings, cutting out Haypp entirely. This line of thinking can be dispelled.

If you look in Core Markets, major brand owners already have their own online D2C offerings. It hasn’t crippled Haypp, which has increased its share of the total markets over the years. Viewing Haypp as merely a middleman ignores that there are far more parties in between brand owners and consumers at the physical retail level. Wholesalers and store owners each demand their margin. There are also numerous additional costs associated with managing thousands and thousands of points of sale—costs which do not exist in relationships with Haypp.

Getting products in front of more consumers in the most cost-efficient way possible extends to media placement on Haypp’s portfolio of websites. There is ample room to enhance this offer by working towards granular targeting and refining attribution, alongside existing efforts to reduce friction for brand owners by allowing a seamless purchasing of media space.

The thousands of data points collected on consumer behavior which help Haypp refine itself internally, packaged as Insights, also help brand owners understand the category. The myriad of data Haypp collects, and the demand for custom insights solutions, are continually expanding. Ultimately, these relationships aren’t adversarial. They are symbiotic.

It can be argued that if no consumers were shopping for nicotine pouches online, there wouldn’t be much data to package as Insights, nor would there be much demand for Media. Therefore, the consumer must come into focus.

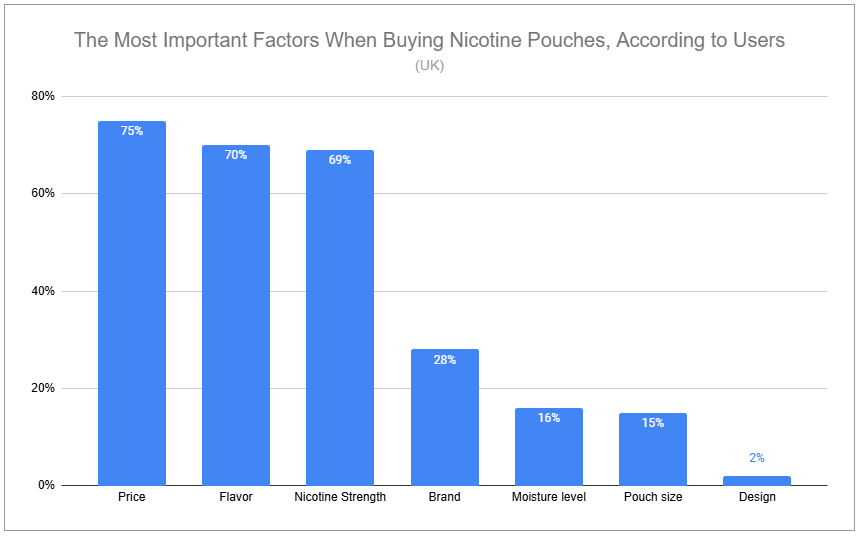

Similar to there being no difference across markets when consumers are asked why they adopted nicotine pouches, there is little difference in what factors equate to serving consumers better. Above all else, consumers value convenient access to a greater assortment at cheaper prices. The requirements of physical retail assure that online D2C activities can be (and in Haypp’s care, are) more cost-effective. But the limitations of physical retail further solidify the proposition. Consumers also want comprehensive information on the products they are considering. Limited shelf space assures a lesser assortment at the physical level, and limitations to the extent of information and how it is provided at the physical level point to the online channel being the best channel for making informed decisions.

Fortunately, serving consumers better and serving brand owners better are not mutually exclusive objectives. They can be achieved at the same time, and more promising, each can be reinforced by the other.

Media isn’t just about generating sales. It aids brand owners in testing and refining messaging. M&I growth is outpacing product sales growth and also carries radically high (>90%) incremental margins. But brand owners are eager to pay, because the cost is far outweighed by the value provided in accelerated learnings and reducing the odds of failure.

Haypp does not need to shove these dollars to the bottom line, and it shouldn’t want to if this can be invested in more resources to help brand owners succeed, lower product prices further, and make the shopping experience better. The group has exceptional retention, and once a consumer is retained, the company sees a significant uplift in order frequency and average order value.3

There is also the consideration that there is actually a third set of customers Haypp serves. Regulators. Enhanced regulation of next-gen nicotine products in Western countries, including the US, is practically inevitable. While some approaches will go against common sense and be driven by anti-nicotine ideologies, others will make sound decision-making by looking at the science. A key part of that science is looking at consumer behavior in the grander ecosystem, and Haypp’s data is a prime resource. Additionally, in the US, that same data is integral for brand owners looking to receive or maintain Marketing Granted Orders for their products through the PMTA pathway. Further, regulators should view online as a preferred channel for nicotine pouches. Proper regulatory frameworks and appropriate enforcement mechanisms provide a high degree of accountability via complete digital records and are best-suited to restrict underage access through strict age verification measures. Data supplied by Haypp’s Snusbolaget Snusrapporten 2025 captures this:

Nicotine pouches, sold online, by Haypp, is a win-win-win-win situation for consumers, brand owners, regulators, and Haypp. The outstanding value produced is a strong positive feedback loop. But it is never enough, and rather than figuring out how to boost short-term profits, Haypp’s team demonstrates its long-term focus by continually investing in ways to widen the value-to-price gap for all.

Migrating online

If you believe that brand owners will raise awareness and promote the nicotine pouch category, nicotine pouches are an advantaged product that will incrementally take a greater share of total nicotine consumption, and the consumption frequency of the average user will increase; it is difficult to dismiss the idea that more consumers will migrate to the online channel.

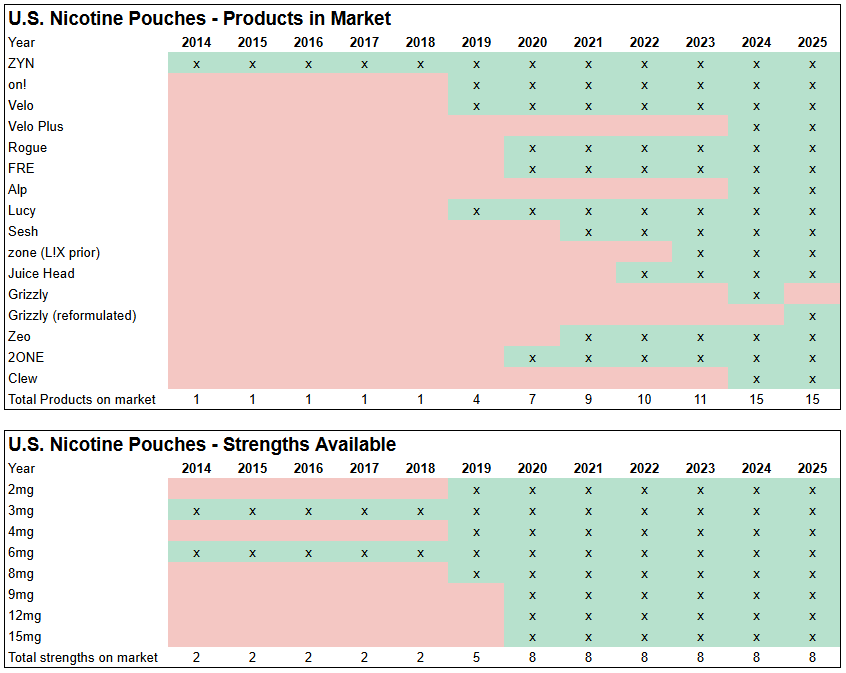

The number of product offerings in the United States market has meaningfully increased since ZYN’s introduction in 2014.

There are several underlying developments regarding the number of products on the market. How fiercely brand owners compete is a function of how fast the category can grow, which is heavily contingent on the total degree of consumer appeal. Appeal does not just come from the categorical relative risk profile or the monetary cost of the products in absolute or relative terms, although those are essential drivers. It is not just about how many products are named differently. It comes from the rapidly expanding qualities of the products on the market. As showcased above, the number of strengths available has grown significantly. On top of this, we have gone from one to a wide variety of packaging, designs, pouch forms, moisture levels, flavors, delivery speeds, and durations. Some products, such as Velo Plus, launched late last year, measure more favorably on nearly every qualitative factor compared to what was on the market just a few years ago. Each qualitative difference increases the odds of consumer trial and adoption, because preferences at the individual level are incredibly diverse. More brands equals more competitiveness, which also makes partners, like Haypp, more important, while making partners less reliant on any one brand.

Haypp Group has provided an estimate that in 2028, the number of nicotine pouch users in the US will grow to 11.5 million, representing 5.2 million new users and a 16.24% CAGR from 2024. This aligns with the growth rates articulated by major manufacturers, and the factors outlined in this piece lead me to believe that those estimates are not far off. Increasing assortment, which can best be provided in the online channel, along with lower prices, are contributors to why users will migrate. But they are an incomplete answer, and a far more critical driver overshadows them.

Keep reading with a 7-day free trial

Subscribe to Invariant to keep reading this post and get 7 days of free access to the full post archives.