“There's an old saying in Tennessee — I know it's in Texas, probably in Tennessee — that says, fool me once, shame on — shame on you. Fool me — you can't get fooled again.” - George W. Bush

So the thing about crypto is that it has no real utility. That lack of utility gets disguised by financialization schemes, and it usually goes a little something like this:

Person A lends to person B

Person B lends to person C

Person C lends to person D

Person D lends to person E

Everyone pats themselves on the back and eagerly points to the thriving ecosystem they’ve built.

No one questions what person E is up to because they’re all earning a ton of interest on their loans.

Person E loses all the money by putting on a 14-leg parlay, a leveraged crapcoin position, or whatever. Or maybe they get hacked or just run away with all the money.

Everyone is sad and wonders how this could have happened.

Of course, none of this is new. This kind of devious stuff has happened for centuries, albeit with less flashy buzzwords and tech. Still, it should never feel weird when things blow up. Yet people are surprised every single time it happens.

Last week, FTX, one of the largest crypto firms in the world, blew up. Again, not weird, especially since earlier this year FTX’s CEO effectively described its operations as a Ponzi scheme in an interview. Here’s a sequence of events:

2014 - Sam Bankman-Fried (SBF), the son of two Stanford law professors, graduates from MIT with a degree in physics and a minor in mathematics.

2017 - SBF founded Alameda Research, a Hong Kong-based private equity firm that looked to arb trade cryptocurrency between exchanges.

2019 - SBF founded the crypto exchange FTX, which quickly grew to be one of the world’s largest.

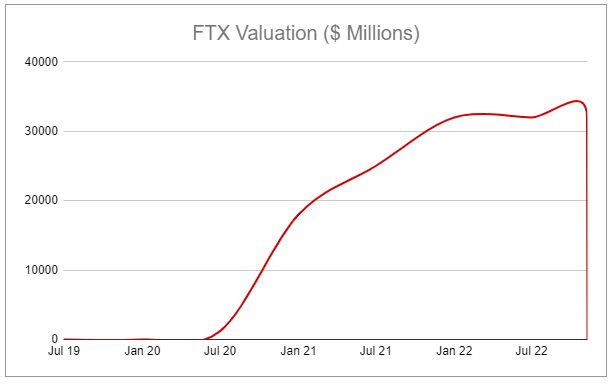

2021 - FTX Raised $900 million at an $18 billion dollar valuation. Investors included Softbank, Sequoia, Thoma Bravo, Third Point, Coinbase Ventures, and other powerhouses. Later in the year, FTX headquarters moved from HK to The Bahamas.

Jan 2022 - FTX announced a venture arm called FTX ventures, which would deploy $2 billion+. FTX then raised an additional $400 million in a series C round at a $32 billion valuation.

Feb 2022 - FTX ran this dumb ad during the Super Bowl, promoting itself as a ‘safe and easy way to get into crypto.’

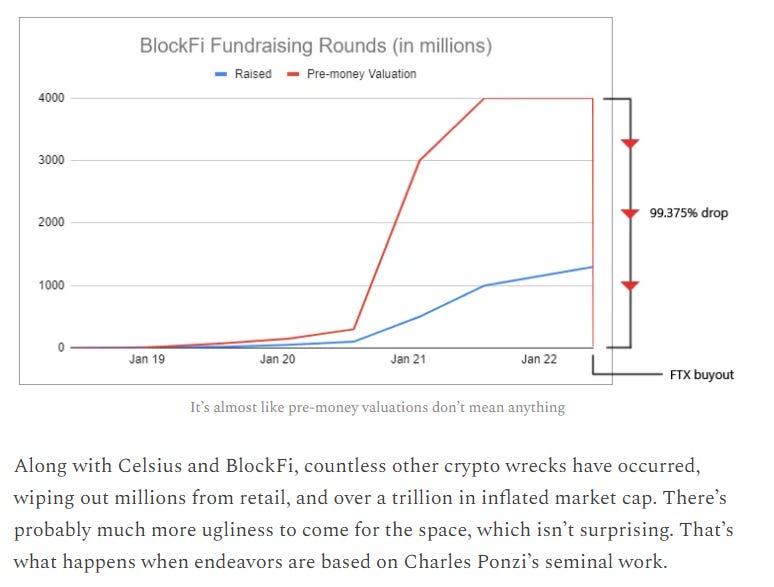

July 2022 - FTX bailed out the flailing crypto company BlockFi, which I wrote about:

And then November came about.

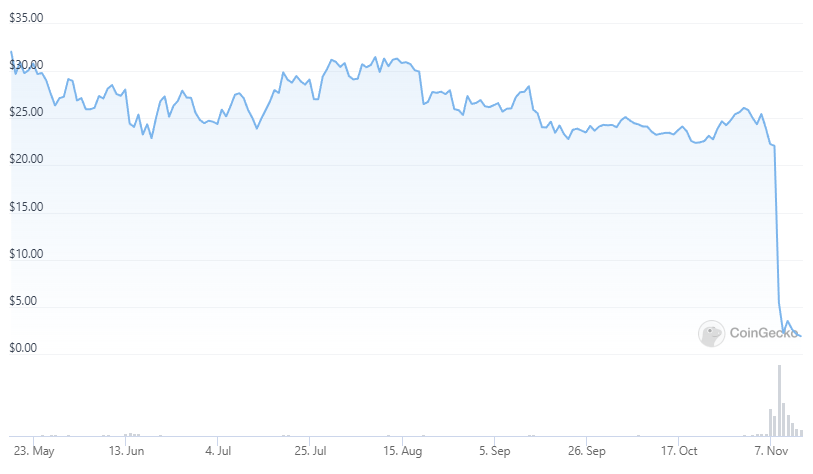

There’s a token that FTX issued on its exchange called FTT, which stands for FTX Token but more appropriately should be called Funny Transaction Token. The token’s value is very clearly tied to the future health and wellness of FTX. A separate, competing exchange, Binance, used to own a stake in FTX, but in 2021, FTX bought back that stake and gave Binance a bunch of FTT. Then, on November 7th, Binance’s CEO said they were going to sell all of their FTT on the open market. As the token was very illiquid and Binance’s stake was very big, everyone knew it would tank the price, so naturally, everyone rushed to sell their FTT before Binance sold. Unsurprisingly, the price of FTT fell substantially.

Maybe somewhat surprisingly, Alameda Research owned a ton of FTT (most of its balance sheet.) Now, it looks like FTX loaned Alameda a bunch of customers’ assets to trade or do whatever with (whoops). FTT goes down, which leaves a bit of a hole in FTX’s balance sheet, which makes their outlook more questionable, which makes FTT go down, and that all continues until everything goes dark.

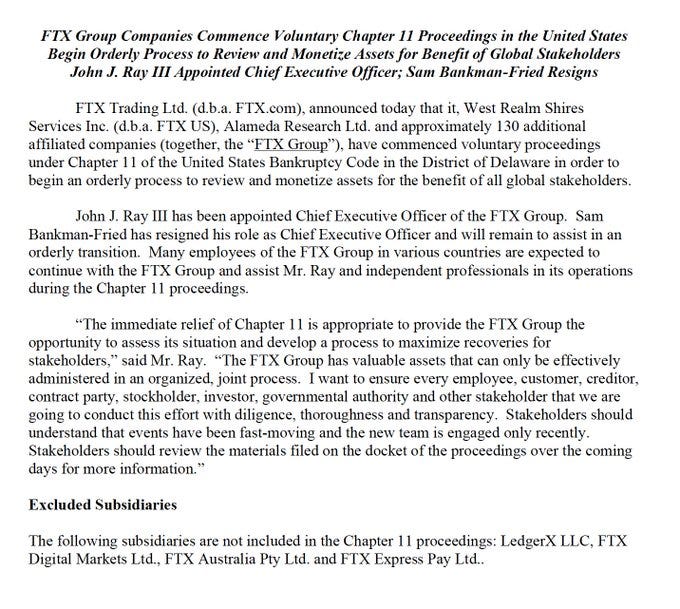

Of course, SBF tweeted a bunch during the last week assuring people that everything was fine. Then he claimed things weren’t so fine. And then it was all over:

SBF stepped down from his role as CEO and is replaced by John J. Ray III, who was the lawyer tasked with untangling Enron’s collapse a decade and a half prior. I suppose that’s good because it will free up a lot of time for SBF to work with his lawyers and prepare his legal defense. What is not good is that we don’t know the true size of the hole in FTX’s balance sheet and who else is affected, though I suppose that makes it easier to estimate FTX’s current value, which is assuredly much closer to zero.

There are also all kinds of looming questions. Was Alameda trading profitably, or was it a money-losing operation that generated tremendous transactional volume on FTX that allowed FTX to raise more money from investors? How much of it was simply pumping and unloading alt tokens? Was SBF using customer funds to finance FTX’s venture investments and other endeavors? Isn’t it clear that FTX was bailing out other failed participants to buy itself more time? Isn’t it actually insane that FTX’s former Chief Regulatory Officer, Dan Friedberg, was the lawyer front and center in the 2008 Ultimate Bet online poker cheating scandal?

If all of this wasn’t enough, it’s worth noting that SBF and FTX were the leading political donors in the U.S., seemingly working hard to push forth enough legislation that they’d appear legitimate enough to drum up institutional money. And now, there are two additional major developments:

Post declaration of voluntary bankruptcy proceedings, it looks like a lot of FTX funds (>$600 million) are on the move. Supposedly a hack; it’s not going to surprise anyone to learn it was an inside job.

Supposedly there are a bunch of FTX employees fleeing to countries with no extradition to the U.S.

Maybe one clear positive is that this whole FTX ordeal will likely get turned into a big movie. I really hope Jonah Hill plays SBF - I think he’d nail it.

I really don’t care all that much about crypto. If it's your cup of tea, check out

and her website web3isgoinggreat, which chronicles the continued follies and misdeeds throughout the cryptosphere. Also see Crypto Critic’s Corner, which does some of the best investigative research in the space.I suppose the related big headlines act as good reminders that there is no real value creation occurring in the crypto space. Most activity is merely value transfer, primarily into the coffers of conmen. As long as the people lauding self-sovereignty, trustless systems, and decentralization keep throwing their money into centralized schemes run by shady people to chase the promise of low-effort riches, I suspect those reminders will keep coming at a steady pace.

Thanks for reading.

Questions or thoughts to add? Comment here or message me on Twitter.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

As a filmmaker with a degree in Marketing, I must say that commercial was amazing. From a production/creative stand point it was very well done but also from a marketing stand point. It literally addressed the skepticism that nay sayers would have had. The commercial was obviously not to convince the nay sayers to believe, but to empower the naive to ignore the nay sayers doubts. Brilliant marketing.

What a day to be alive. Thanks for sharing this great article, Devin.

It would be interesting to see (first and foremost the movie :)) but also how he managed to mislead so many institutional investors Who were their advisors? What DD did they undertake? What was the role of the auditor? Was the going concern properly assessed by auditors? So many questions that we can think of that could shake the industry once again.