The Motion of the Ocean

“The roaring of lions, the howling of wolves, the raging of the stormy sea, and the destructive sword, are portions of eternity, too great for the eye of man.” - William Blake

James Cordier had it all. A flawless office towered in downtown Tampa, Florida, the beautiful waterfront home, and his successful business, OptionSellers.com. And then in November 2018, his actions vaporized over $150 million of client money. To make matters worse, the accounts he managed faced massive margin calls, leaving clients on the hook for debts owed. 290 investors, many retired, had lost more than all of their money.

As you might have guessed, OptionSellers.com engaged in selling options. James was an ‘expert’. Such an ‘expert’, in fact, he even wrote a book on it - The Complete Guide to Option Selling, How Selling Options Can Lead to Stellar Returns in Bull and Bear Markets. You can still find it for sale on Amazon.

Options are useful and are conceptually pretty simple. They are really just contractual doohickeys. Each doohickey gives the holder the right, but not the obligation, to buy (Call) or sell (Put) something for a set price (Strike) on or before a set date (Expiration)1. Because these little doohickeys provide a choice to a buyer, and having choices is valuable, a buyer pays (Premium) to a seller for the privilege. And when you think about it, selling options makes plenty of sense: historically, the majority of options are overpriced and many expire worthless. By selling options you can collect premium upfront, either roll the contracts forward or let them expire, rinse and repeat. It almost sounds like free money.

Almost.

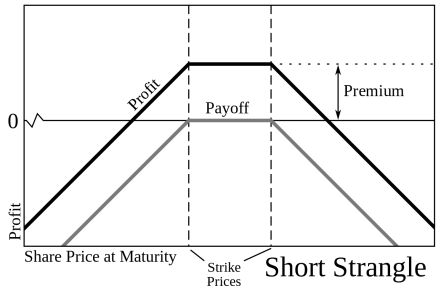

James’s strategy focused on short-strangles, that is, selling both Put and Call options far out of the money (OTM)—strike prices far away from the current price of the underlying asset. If the underlying stays within the range of the two strikes, both contracts expire worthless, and all upfront premium is profit. This is the best-case scenario. If one leg of the trade goes south, it’s usually not the end of the world—an underlying can’t possibly be moving towards strikes in opposite directions at the same time. A trader can roll each leg independently, costing some amount, but allowing for flexibility and the playing of defense.

It’s critical to note that the premium collected upfront from selling an option is a flat amount, and if not hedged, potentially exposes the seller to unlimited loss. Since buying options provides optionality, selling options, innately, provides optionality to someone else while burdening yourself with an obligation. And it’s surprisingly easy to forget that sometimes bad things happen—since far out of the money options often remain out of the money and expire worthless, their obligations rarely seem real or consequential. But what about when the underlying makes a fast move? Well, you better hope you have your sizing correct, otherwise, you might be obligated to take a long walk off a short pier.

In late 2018, forecasts warned of an unusually cold winter, which drove the price of natural gas remarkably higher in a short period of time. James, who had previously claimed to his clients to be diversified across uncorrelated commodities, was highly-concentrated in short strangles on NG futures contracts. Eek. In a matter of two weeks, the damage had been done.

Facing a heap of lawsuits from his (understandably) furious clients, James closed down his business. Many of the suits are still working their way through the legal system today. I’m picturing Mr. Cordier biding his time, sipping something fancy at the edge of his waterfront property. After all, he may have bet the house—but it wasn’t his house. Gross.

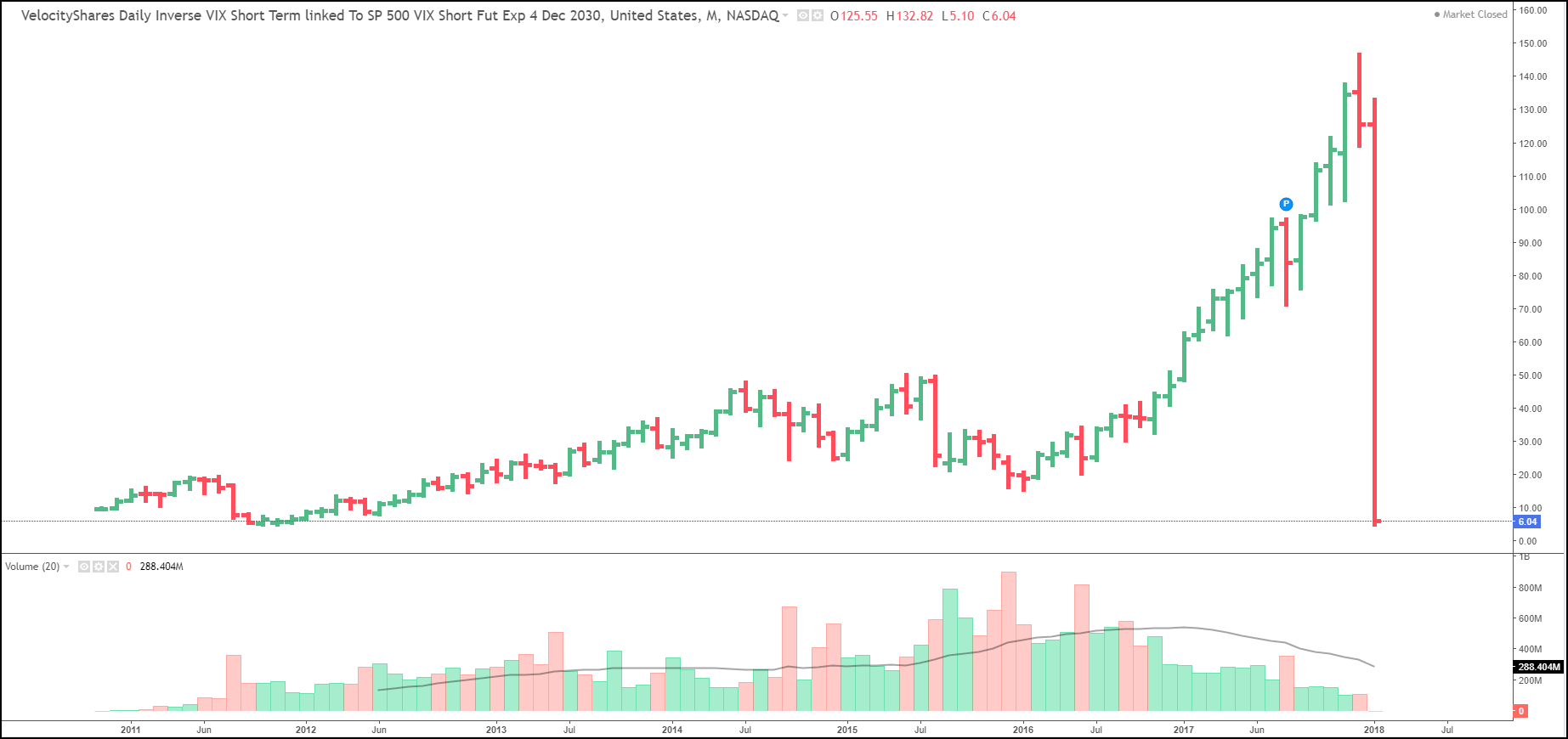

What’s strange is that this obscure story wouldn’t normally have made headlines. In terms of the overall market, $150 million isn’t a particularly large sum of money. And loss headlines were still being dominated by Volmageddon, in which just eight months prior, XIV, the Daily Inverse VIX Short-Term note, imploded, wiping away ~$1.9 billion in a single day2.

James Cordier and OptionSellers.com only made waves across the mediascape because of a bizarre 10-minute video James put out in the aftermath. Sitting at his desk, in a poor attempt to appear solemn, James slowly explained that he had lost his clients everything. Teary-eyed, rambling between cue cards, he went on to inject a super-sized dose of nautical symbolism.

So many of you chose to entrust in us the ability to navigate in the world of investing. Practically every time we spoke of positioning your account the best we could I referred back to my father who used to sail an 800-footer on the Great Lakes. And I always talked about steering your investment like a boat.

This rogue wave that I was unable to navigate has likely cost me my hedge fund.

I promised you every day when I woke up and I would check the markets, I was checking for rogue waves.

You are my family, and I’m sorry that this rogue wave capsized our boat.

Watching the entire video is exceedingly uncomfortable. The original was taken down (likely to appease his lawyers), but copies have sprung up. If you want to see if you can stomach it, you can watch it here.

There’s Always a Calm Before

“Only when the tide goes out do you discover who's been swimming naked.” - Warren Buffett

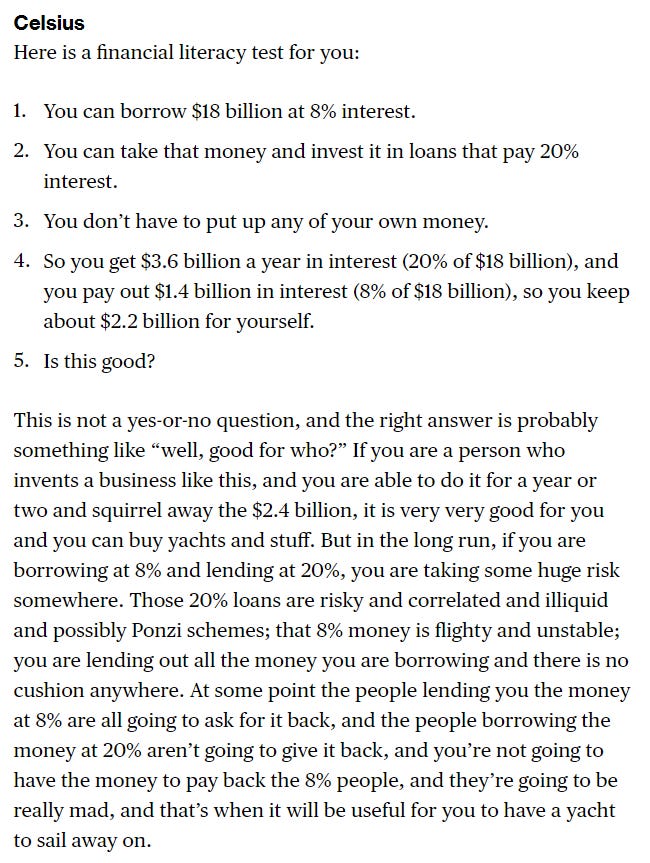

Oceans, boats, waves—I was inspired to revisit the tale of James Cordier and OptionSellers.com after reading a recent piece written by the brilliant Matt Levine in which he mentions sailing. It opens with:

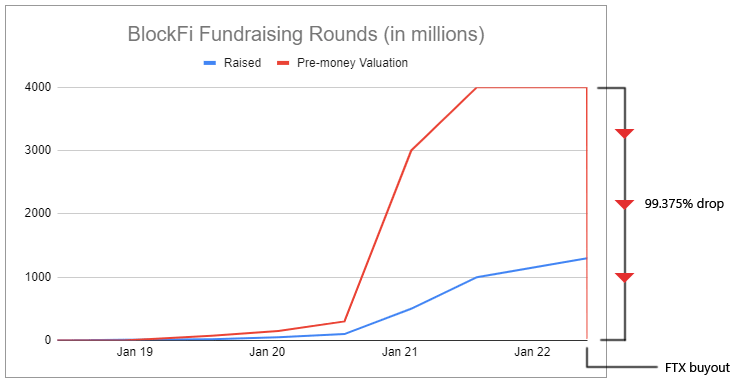

If you’re unfamiliar, Celsius is (was) a crypto lending platform that is only one domino in a long line that has recently fallen. Now exploring bankruptcy, things don’t exactly look pretty for the embattled company. Another domino is BlockFi, a company with a similar business model to Celsius. Having received funding from many hotshot VCs over the last few years, the company’s pre-money valuation ballooned to $4 billion before collapsing when the flailing company accepted a $25 million takeover bid from FTX. The chart beautifully captures the precipitous fall:

Along with Celsius and BlockFi, countless other crypto wrecks have occurred, wiping out millions from retail, and over a trillion in inflated market cap. There’s probably much more ugliness to come for the space, which isn’t surprising. That’s what happens when endeavors are based on Charles Ponzi’s seminal work.

While you might be disappointed to learn there aren’t any more nautical references in the rest of Matt Levine’s article, I recommend going back and reading it anyways. He does an exceptional job covering market dynamics, liquidity, and recent shenanigans such as Bill Hwang using extreme leverage to manipulate markets, which inevitably led to him blowing up his own fund, Archegos Capital Management, and losing his $20 billion fortune in the process.

Rogue Waves

All the stories of poor risk management and faulty mechanics sound unique, but the violent repricings are always the same. People leverage up and pile in, unknowingly accelerating due course to become fish food. Every time someone claims they got taken out by a rogue wave, it’s code for “I didn’t respect the ocean.”

No one should cheer for disaster—It’s not healthy—I always hope that in the aftermath people are able to grab ahold of something buoyant, or are at least really good swimmers, though, in the case of fraudsters, I often find myself cheering for sharks to find them. Rather, I believe we can all learn from these events. They are a reminder that it doesn’t matter how smart you are—Every boat is designed with one goal: not to sink. And yet, new boats keep finding their way to the bottom of the ocean.

You can look over your maps and redraw your routes. Avoid piling on all your cargo for a single trip. Maybe think about investing in ports, drydocks, and lighthouses. Whatever you do, just respect the power of the ocean.

With all that said, I’ll leave you with a short essay I wrote last year:

The Seas of Volatility3

Imagine a busy harbor, several centuries ago.

Each day, ships are loaded with precious cargo and prepare to sail halfway around the world.

The cargo is tied tight, the haul is in good order, and the sails look good.

With limited boats and a growing backlog of cargo, the dockworkers begin to add additional weight to each vessel.

Why not? This seems like a manageable risk and one worth taking. More cargo moved in less time means more profit.

One by one, the ships cast off to their respective destinations, fading unto the horizon.

But the oceans are far from kind. Dark, blinding storms show no mercy.

Violent swells and harsh winds capsize most of the overloaded boats.

No witnesses. No survivors. The realization of their mistake is lost to the sea.

The few boats that make it to their destinations celebrate successful voyages. Confident in their abilities, they reload. Perhaps even adding a bit more weight this time around.

One by one, they set sail.

Back into the seas, they go.

Thanks for Reading

If you liked this piece, please share it with others you think would enjoy it too. And if you haven’t yet, subscribe!

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

This is in regards to American-style options. European-style options can not be exercised early, and assignment must only occur at expiration.

Volmageddon wasn’t totally unforeseen. Christopher Cole of Artemis Capital Management highlighted such risks several years prior.