“I am paid to look through the noise and look beyond.” - Stefan Bomhard, Imperial Brands CEO, dbAccess Global Consumer Conference 2023

Imperial Brands, the maker of global cigarette labels such as Winston and KOOL, struggled for years as it continually ceded market share and remained dwarfed by its much larger competitors. When its new CEO, Stefan Bomhard, joined the company in 2020, it was clear that much needed to change. Fast forward to today, and Imperial still lacks a dominant premium cigarette position like Altria. It has no market-leading next-gen product like PMI’s IQOS or BAT’s Scandinavian Velo. In fact, at a cursory glance, the company would appear to not be #1 in anything at all. For these reasons, while most investors shun the industry, even tobacco investors have turned a cold shoulder to Imperial. Even my own publicly published analyses have been notably devoid of paying specific focus to Imperial. Yet, having followed the company for years as part of my diligence in tracking the industry as a whole, I have reached a point where I finally find the company’s position compelling. This change in stance has occurred despite the company’s exit from Russia, as well as the materialization of a generational smoking ban in one of Imperial’s key markets, the United Kingdom. While this shift may appear as an affront to investing sensibility, a strong case can be made by peeking into Bomhard’s vision, the company’s subsequent execution, and a bizarre truth: the company not being #1 in any particular product category is exactly where it wants to be.

Shortly after joining Imperial Brands, Bomhard initiated a strategic review of the ailing company. The results were conclusive. The company had neglected the aspects of its business that had made it great. And rather than doubling down in a vain attempt to lead in new products—an approach that many new CEOs would strive for (that would be perhaps ego-driven)—Bomhard decided to refocus the company on its roots, as he expressed during the dbAccess Global Consumer Conference in 2021 (emphasis added):

For me, one of the key principles is start off with the consumer and which consumer are we in the industry serving here? We are serving adult smokers. And the reality is in our business 98 percent of our business comes from our consumers smoking cigarettes or fine-cut tobacco. Two percent of our business comes today from NGP products. The reality is when you apply this lens—as excited as I am, like prior management, about the opportunities that resides on the NGP side—my job is also making sure, looking at all the needs of consumers, and it became very clear that in the past and to decide to build an NGP business, we took our eyes off the ball on looking after our core business. Consistent share declines five years in a row in our top five markets! I'm a marketeer by training. It's, for me, a sign that we weren't doing our job good enough. What is today the bulk of our business is also the bulk of how consumers want to interact with Imperial. Yeah? So it's fair to say with the new strategy there is a refocus on the core business.

Recentering on the notion that a consumer goods company should focus on the demands of the consumer is a radically sensible one. It’s also one that was logical for Bomhard to make. His experience and expertise are rooted in consumer goods—his predecessors had backgrounds in finance and manufacturing. Instead of sharing a desire for empire-building, he further elaborated the company would be taking the approach that had previously served well for decades (emphasis added):

Imperial has been consistently the number three and number four. I mean, in most markets, we’re either number three or number four and sometimes number two. Reality is, when you look at our P&L, that, in the combustible business, is a very comfortable position to actually make some very good money and be a meaningful player in the marketplace. So I think one important change of our strategy on the NGP side is when the NGP segment develops, all our data says that actually, if it's a sizeable market, an individual market, there is clearly room for a number two and the number three and your consumers want a choice and your trade partners even more importantly in some cases. No trade partner out there has an interest of having a monopoly there because it actually devalues the power of the trade. So the reality—what's changed behind our strategy—we're replicating the ambition that we have in our core business also for NGP, which also means from an investment perspective, we're not the market leader. Our ambition is not to become the market leader in NGP. So we will focus on markets where somebody else—like in our core tobacco business—has developed the market, and we come in to offer consumers a choice.

To some, it would appear that this was a tacit admission of failure. After all, how many CEOs want to publicly announce they don’t want their company to be labeled market leader? This would also imply a certain type of impending doom for the company: cigarettes are a product in secular decline!

Such ideas were no bother. Bomhard shook up the management ranks, creating positions and systems specifically focused on the consumer, country by country, brand by brand. Imperial rationalized its portfolio, concentrating resources into key markets: the United States, Germany, the United Kingdom, Spain, and Australia. Operations were simplified and set to become more data-driven and granularly focused. NGP rollouts would only occur as specific new categories became flagged as sizable stand-outs in certain markets. Additionally, there was an expressed resolve to become even more disciplined with regard to its full capital allocation. The company would prioritize reducing its debt burden and promised shareholders that they would not wake up to sudden news that the company had done a massively-priced acquisition, potentially compromising its leverage ratios, introducing greater uncertainty, and quashing the prospects of additional capital returns. There would only be, from time to time, small bolt-on acquisitions that sensibly enhanced core competencies.

Now, several years into the plan, multiple signals point to the strategic overhaul being a success. The company has, in the aggregate, improved its share in key markets, operations have become more efficient through cost rationalization, financials show incremental improvement, and leverage ratios have come down.

Understandably, there are hangups for investors. Could short-term success spilling over into the medium term based largely on legacy products in secular decline be priming the company for full obsolescence? Based on reports I’ve scoured, conversations held with other investors, and a pulse on general market participation, sentiment certainly seems to reflect that is the case. The crux of the thesis against such sentiment rests in several key points.

Volumes do not equate to value. Yes, volumes are unquestionably part of the equation, but operational efficiency, managing share, and optimal pricing have been and are likely to remain effective counterweights.

While cigarettes are in secular decline, the rate varies greatly across countries. I’ve largely favored premium brands as they have held higher relative pricing power and stand to benefit from minimum pricing laws; however, Imperial’s portfolio is comprised of a wider variety of brands across the value spectrum, further increasing resilience throughout cycles. Additionally, other products sport more unique trends, such as fine-cut tobacco in parts of Europe and mass-market machine-made cigars in the United States, of which Imperial has well-positioned brands.

Next-gen product categories hold great promise, and I’ve written extensively on them, but there is still uncertainty around how regulation will develop throughout the world, as well as long-term excise tax implications for related product classes. Conversely, the regulatory and tax environments for legacy products are, broadly, much more rigid. Governments and special interest groups around the world rely on the immense tax revenues produced by tobacco products. While these groups aim for a smokeless future, many such targets equate to reaching a 5% smoking rate, and ultimately, there will always be some baseline population of adult consumers who choose to smoke cigarettes, regardless of how well-informed they are and regardless of what product alternatives exist. The same regulatory frameworks that make up the spectrum of future outcomes for legacy products also largely insulate incumbents from new competition. You do not see many people rushing out to create cigarette start-ups. To add, pricing behavior across insulated legacy incumbents remains remarkably rational, further reinforcing the predictability of related cash flows. With this context, Imperial can also be viewed as an imperfect hedge against uncertainty tied to the NGP trajectories of its larger competitors.

Investors as a whole seem to reject the points above, especially as of late, pointing to the previously mentioned generational smoking ban to occur in the United Kingdom. That’s worth putting into context. The ban, which would kick into effect in Jan 2027, would then affect adults born after Jan 2009 from legally purchasing cigarettes. This is one of the few levers the government has left to pull after having tugged on all the rest over many previous decades. But it won’t stop current adult smokers from choosing to continue to smoke—many will, and many will continue to prefer the offerings of Imperial Brands. This will not be a knife quickly twisted into the core business, of which the U.K., referenced as a key market, makes up ~10% of all operating profit.

Granted, such types of generational bans could, and are likely to, occur in other countries. Perhaps some will reverse when the illicit markets they foster and the loss of tax revenues become unbearable. If not, perhaps competing next-gen products will lead to more aggressive legacy volume declines—they unquestionably already have done so to a degree. If so, what will be left? Even entirely setting aside the group’s distribution business—which was added to via bolt-on acquisitions and benefits from tobacco and non-tobacco products alike, what remains would be a business that is ungodly disciplined. The very profitable legacy products, as it happens, require very little reinvestment. With extremely measured investment into new products, which are still growing quickly, albeit off of a small base, Imperial Brands produces a staggering amount of free cash. Now, having improved its leverage ratios, the company has started to return capital to shareholders beyond its sizable but timidly growing dividend.

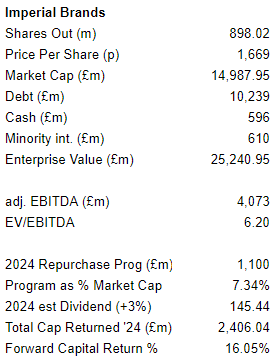

Imperial Brands has begun to buy and retire its own shares hand over fist. The share repurchase program for 2023 measured £1.0bn. Next year it is aimed to increase to £1.1bn, as per its most recent pre-close trading update. These programs are gigantic relative to the size of the company.

Can this lofty rate of capital returns continue? Net financing costs are guaranteed to increase as the company’s bonds mature and are to be rolled forward over the next several years, with rates well above the company’s current all-in cost of debt of just over 4.1%.

However, even accounting for increasing financing costs, required reinvestment, associates, minorities, and taxes, the resulting cash available should exceed the capital outlays for these programs. This is before considering further cost savings and improvement to operating profits—both of which management intends to achieve. Not to mention, these share repurchases further reduce the absolute dividend payment, providing the company flexibility to further target debt, incrementally reinvest, raise payouts to remaining shares, and conceivably increase future repurchase programs.

Of course, the strategy of focusing on legacy business and riding the coattails of competitors who spend considerably more developing next-gen categories across the world is unlikely to score points with a wider set of investors. As the consensus outlook for the industry remains bleak, Imperial Brands has welcomed its shares to re-rate further south if concerns mount. As it continues to cannibalize its share capital, that may not be the worst thing for those patient—a dynamic not strictly exclusive to Imperial. Should pronounced headwinds begin to shrink the core business, it largely becomes a matter of whether share count shrinks faster and by what rate. Ultimately, this is a thesis tied to pessimism—something there certainly is no shortage of.

If you enjoyed this piece, hit “♡ like” and give it a share.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Imperial Brands and other tobacco companies such as Altria, Philip Morris International, British American Tobacco, and Scandinavian Tobacco Group.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑

Interesting read and look into the future of tobacco regulation. Follow the money, governments say one thing but like to collect the taxes.

Very interesting. Merits further DD. Many thanks for the idea.