Logista: Succinct

“Endurance is patience concentrated.” - Thomas Carlyle

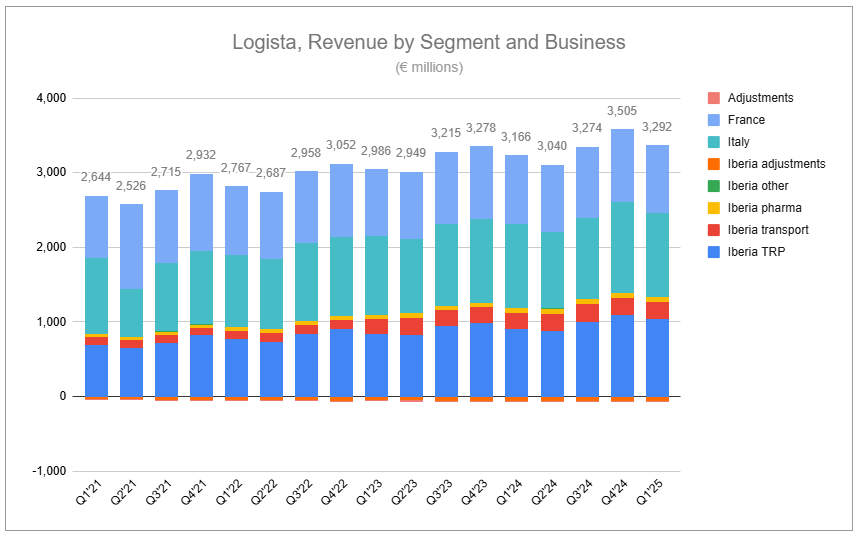

Succinct. That is the only word appropriate to describe Logista’s Q1’25 announcement. There are fewer than two dozen pages, of which many are only half-filled. Excluding the cover page, there is not a single graphic. Add in the fact that the group does not engage in quarterly calls or lengthy Q&A outside of half-year and full-year results, and there is little capable of diverting away from the facts of the business. Despite being aged and lacking flash, it has not struggled to keep up over the centuries, and its consistent financial performance despite low expectations should be enough to suppress the naysayers of its ‘shrinking’ core business of tobacco distribution. Let us keep our thoughts equally brief so as not to distract from another quarter of such financial delivery.

The long road

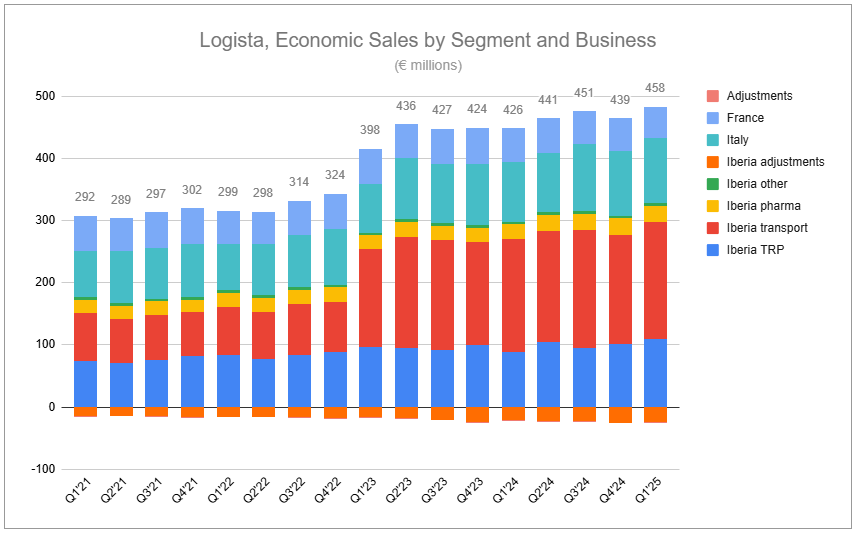

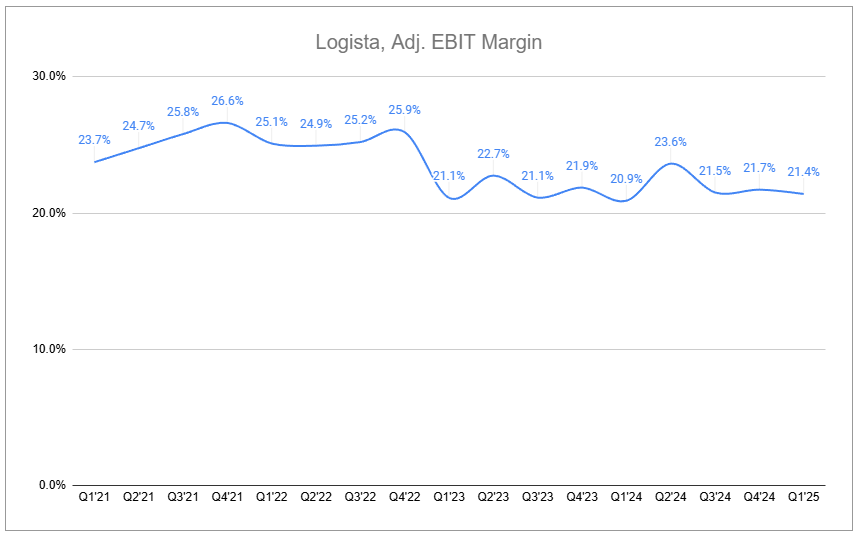

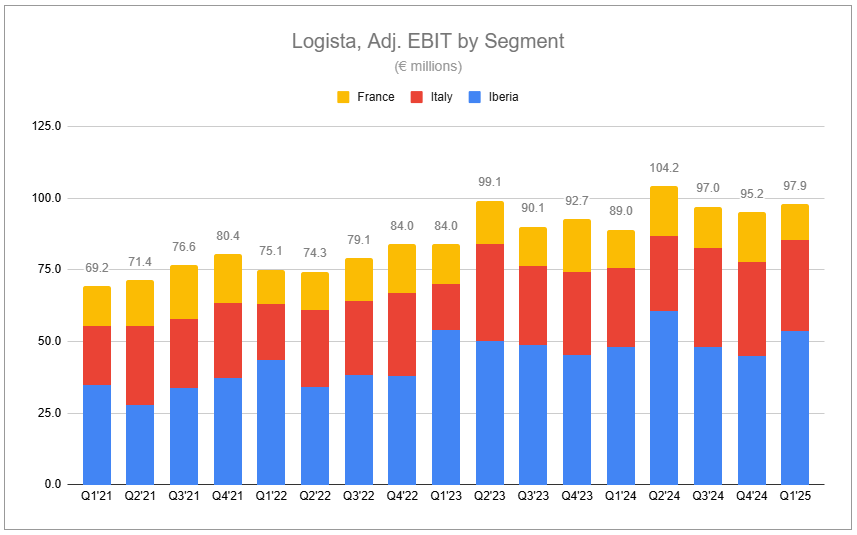

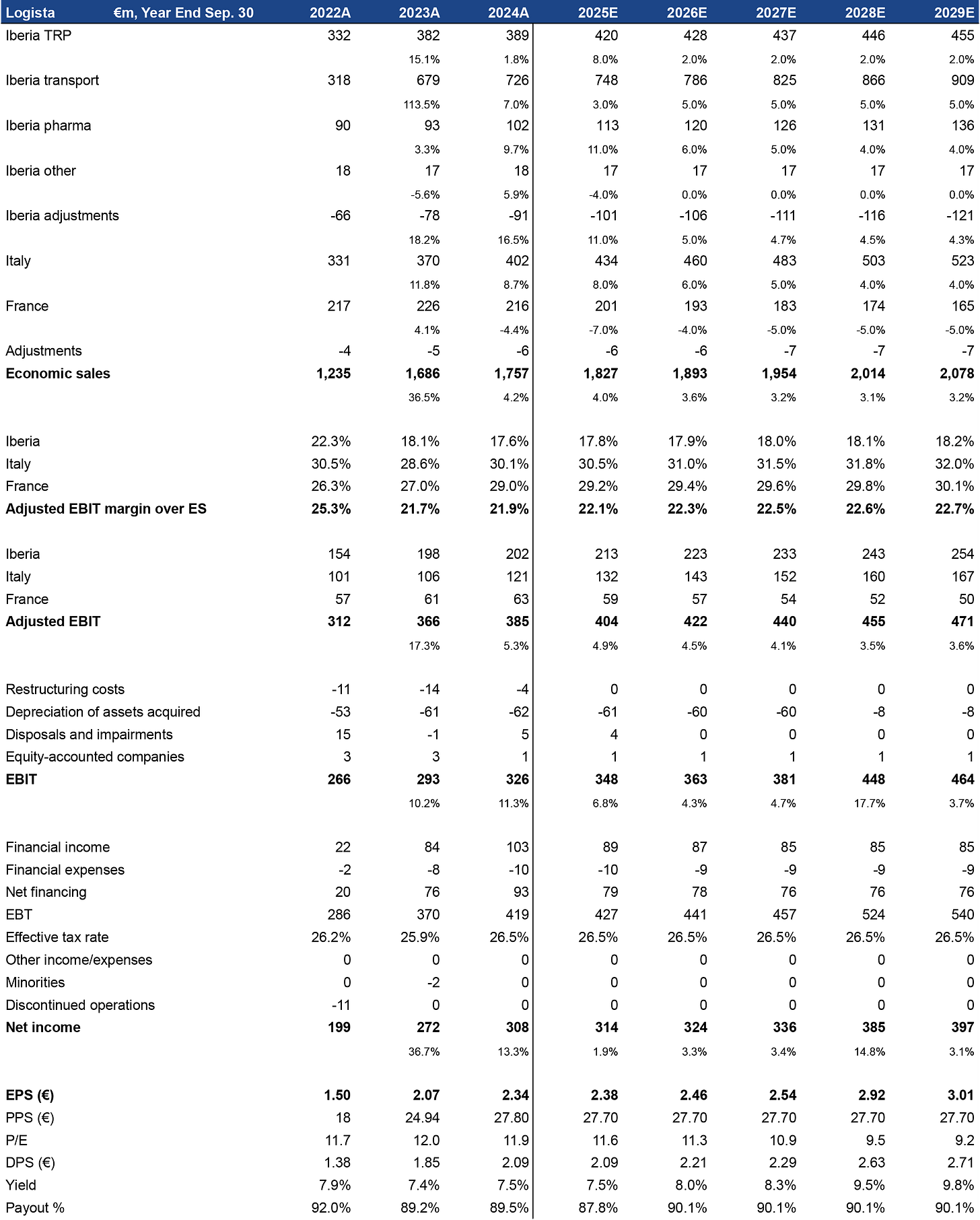

Continued efforts to branch out and diversify lines of business have spread Logista out into long-distance transportation, parcel services, specialty courier services, and beyond. Q1’25 transport revenues came in as a lighter way to start the year compared to the robust growth in 2024. Still, softer expectations for the remainder of 2025 point us back to what has highlighted the quarter prior: These lines of business, along with dampening margins, provide an increasing degree of cyclicality to the group.

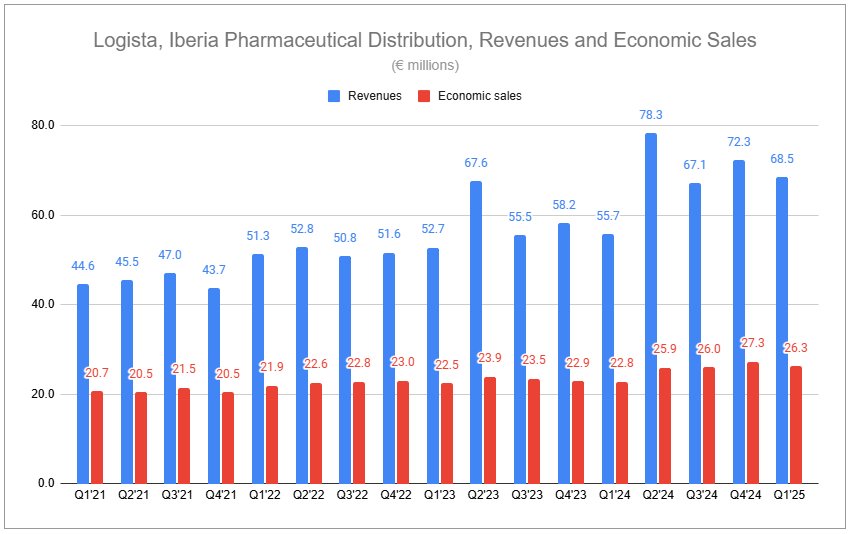

Despite incrementally higher cyclicality, Logista’s pharmaceutical distribution shows excellent strength, segmented separately from the core transportation activities. Q1’25 revenues were up 23.1% from the previous year, with economic sales up 15.1%. While the timing is unknown, this remains where future bolt-ons are most likely, expanding the footprint and suite of services. While also having a lower margin than the core business, rigid regulations produce an environment that’s harder to encroach upon, boosting retention and giving the group ample room to grow as is.

The smallest of three

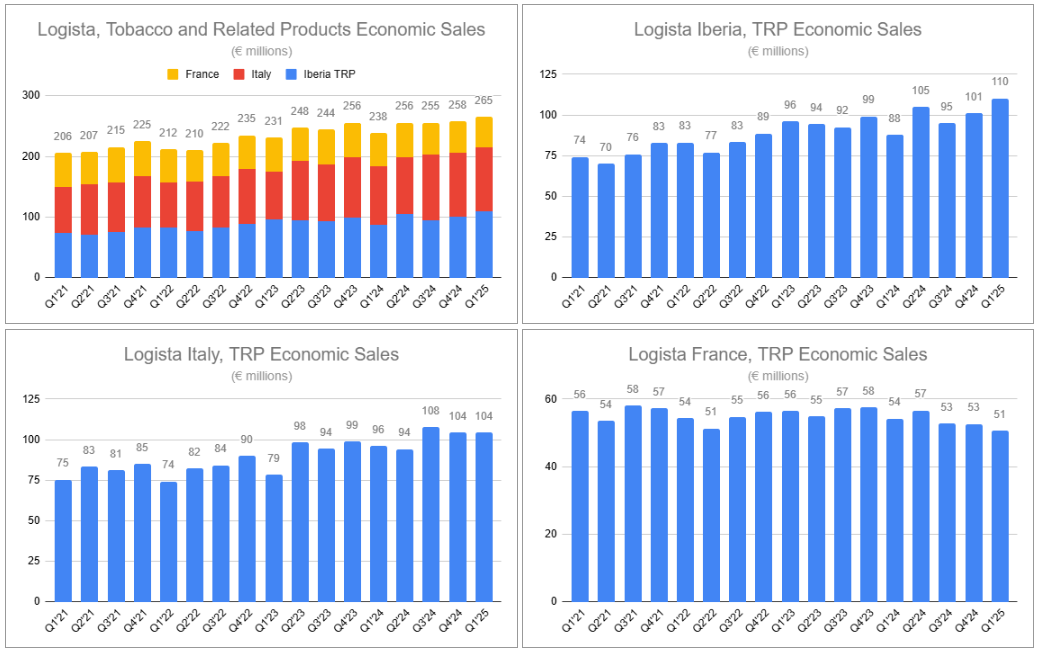

Logista’s tobacco distribution business in France continues to feel the crunch from substantially elevated decline rates in legacy products. At the same time, the country remains averse to embracing NGPs—now planning to ban nicotine pouches firmly. Q1’25 revenues were down by 1.8%, with economic sales down by 6.4%—a pronounced drop relative to Q1’24’s of -4%. Fortunately for the group, when looking at other parts of tobacco distribution, relief is provided in knowing France is, by a wide margin, the smallest of three.

In Q1’25, the group’s distribution of tobacco and related products in Iberia saw revenues grow by 14.8%, with economic sales jumping by 25.5%. Such a strong output was unquestionably due partly to the lousy performance a year prior. Another aspect was manufacturer price take and excise increases, wholly anticipated, which led to a profit on inventory of €14 million for the period—a phenomenon set to repeat. Volumes of legacy products, including cigarettes and RYO, grew by nearly 4%, and the growth of NGPs, namely vapor doubling, supported volumes further.

Tobacco distribution in Italy for the period was far from lackluster as well. Revenues were down by only a sliver, with the market facing the impact of the flavor ban affecting HTP. However, a minimal drop of legacy product volumes, paired with rapid growth within vapor, supported economic sales growth of 8.8%. Although nowhere near as pronounced as the POI in Iberia, the segment recognized a positive swing from last year. Philip Morris International’s launch of NPs in the country is a new development with uncertain benefits. Historically, there has not been a high degree of oral use in the country, but the resources to steer the market are readily available.

Succinct

There is little to say that has not been repeated. Diversification has introduced bits of cyclicality while also pressing down on margins. Logista’s efforts to spread itself out have not been poor, but it would be easy to conclude such when comparing to the mighty profitability of the core tobacco business. Below, one of the infinite potential futures for 2025 has been illustrated. Minor adjustments have been made to segment economic sales and margins. The payout to shareholders in the coming year has been kept flat. The most prominent change is a notable decline in financial income from the group’s credit agreement with majority holder Imperial Brands. All together, estimates are roughly unchanged, with a share price providing a bar to be stepped over without much struggle.

Thanks for reading. Enjoy this piece? Hit “♡ like” on the site and share it.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own no direct position in Logista (Compañía de Distribución Integral Logista Holdings, S.A). I own an indirect stake in Logista via positions in Imperial Brands. I own positions in other tobacco companies such as Altria, Philip Morris International, British American Tobacco, and Scandinavian Tobacco Group. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

great post!

Thank you for the update. Logista is known for its “bolt on” acquisitions. Have they made any or discussed any plans?