“We have increased the buyback by almost 14% to GBP 1.25 billion for fiscal year ‘25. As Stefan said, we are on track to return GBP 10 billion to shareholders since the start of the strategy. Interestingly, this represents 2/3 of our market value at the point when we launched the strategy in January 2021.” - Lukas Paravicini, Imperial Brands CFO, 2024 Remarks

The outcast. The black sheep. The runt of the litter. Doubt has constantly swirled around Imperial Brands regarding its ability to merely survive. Yet, here we are, and 2024 marks four consecutive years demonstrating that the group has a proper strategy and the talent, capabilities, and fortitude to execute upon that strategy consistently. The core business shows stability, balancing volumes, share, and price; distribution continues to provide a solid contribution from tobacco and non-tobacco alike; financing remains palatable, with leverage under target.

While uncertainties remain, it appears that the market has begun to give the group the benefit of the doubt, reflected in the recent run-up in share price. Conventionally, this would market a positive signal; however, in Imperial’s circumstances, and for those with a long-term orientation, it is the opposite:

It is clear, at the rapid pace at which equity is being retired, that a lower share price is capable of having the greatest compounding effect on long-term returns. Conversely, a significant positive rerating would weigh down that exact dynamic; dampening repurchases, slowing the rate of absolute dividend reduction, and to an extent, limiting the group’s flexibility. Returns will be mechanical, and as I’ve said before, this animal feeds on continued pessimism.

Burning plenty hot

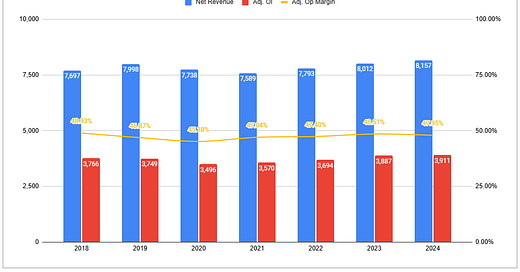

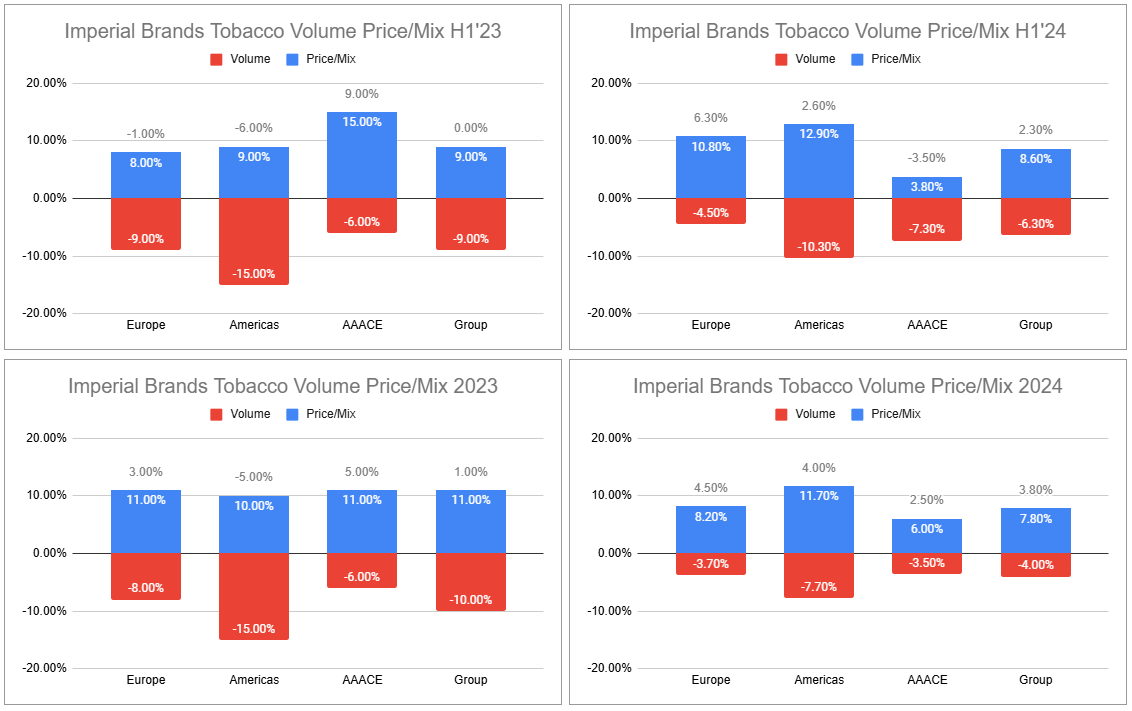

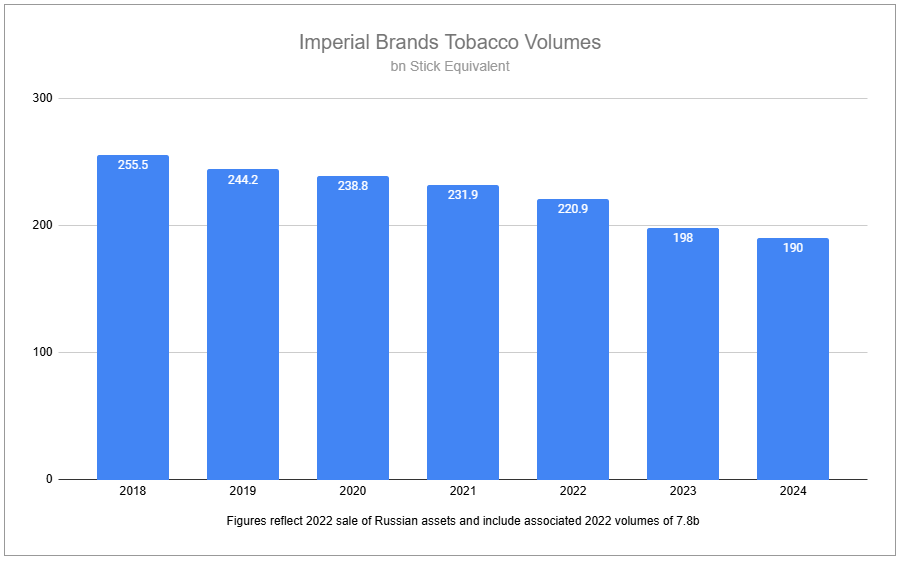

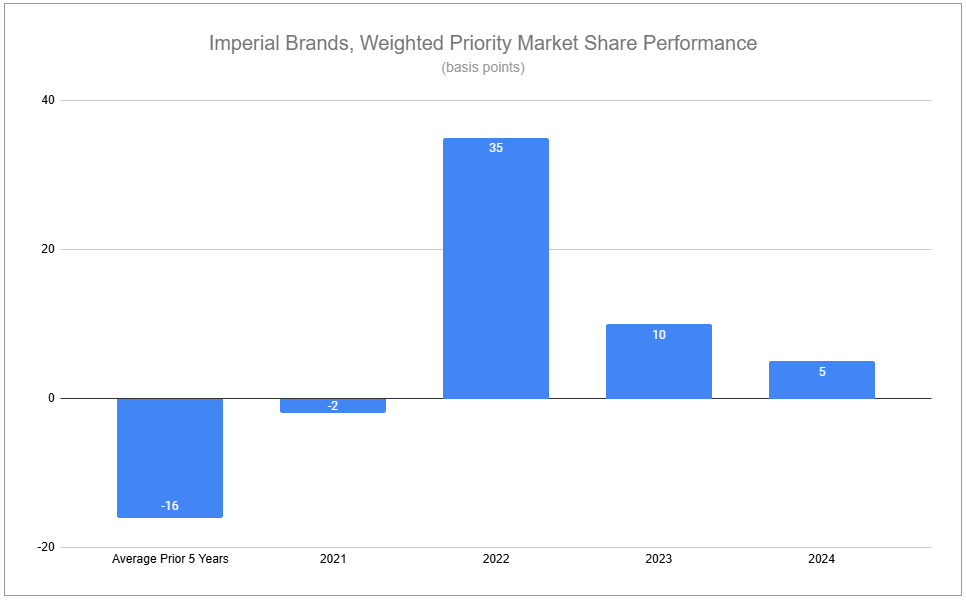

Juggling volumes, share, price, and mix in the face of heightened inflation over the last few years has been no easy task. FY’24 showed improvement relative to H1’24, and to an even grander extent over both periods in 2023. While UK share was down in 2024, the shift was courtesy of more aggressive pricing, which more than offset the impact. Again, the group gained aggregate weighted share across its key markets—a modest 5bps, with Germany significantly improved relative to the struggles faced over the last half-decade. There were no drastic volume or mix movements, such as MMC in previous periods, providing additional breathing room. Pricing has continued to do the heavy lifting, and aggregate performance shows the group’s legacy business is still burning plenty hot to produce robust profits.

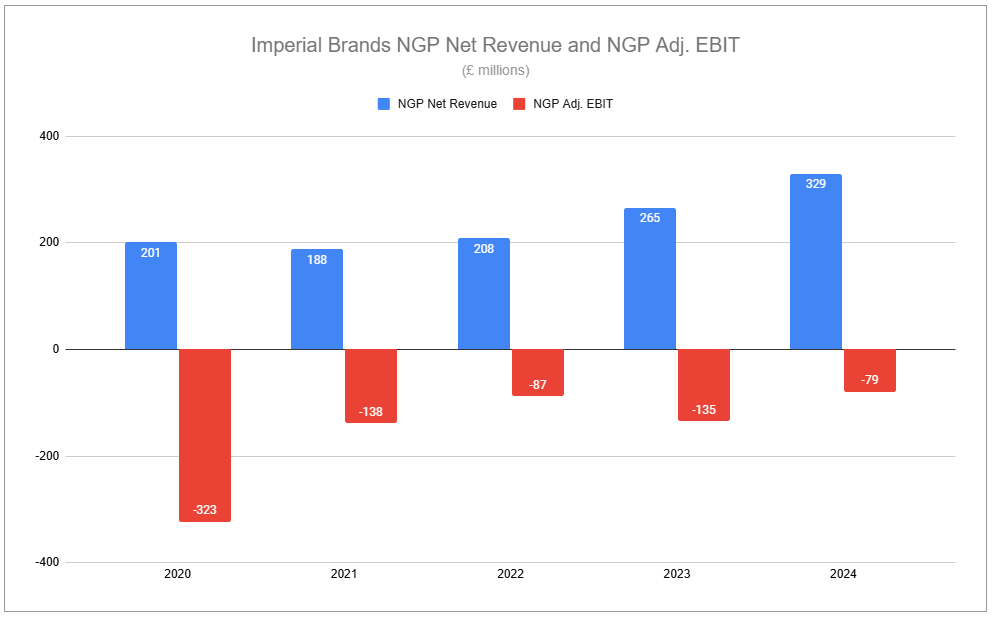

The heat put off by Imperial’s tobacco business was only marginally cooled by losses in next-gen products. Losses shrunk in 2024, driven by scale, despite incremental costs of new market rollouts. Revenues grew in all three geographic segments, with Europe, the Americas, and AAACE sporting NGP growth of 18.20%, 26.50%, and 136.40%, respectively. It is worth recognizing that despite sporting the lowest growth rate of the three geographies, Europe made up the majority of growth in absolute terms, with a £40m increase in NGP net revenues y/y versus a combined £24m increase for the Americas and AAACE combined.

Keep reading with a 7-day free trial

Subscribe to Invariant to keep reading this post and get 7 days of free access to the full post archives.